Trash, Dirt & Guns: Unsexy Stocks With Large Upside

Wall Street hates them. Management is guiding growth. Clear catalysts. Here's the setup.

Like my last write-up, this one might not be received as well as a growth name would. Yet, once again, returns are the only thing that matters and safer returns are what any investor should look for. Those exist outside of growth names.

A system capable of compounding is more important than the feeling of finding the growth gem that could return 100x. In that spirit, let’s look at three names no one is talking about; mostly because they aren’t that sexy, and many focus only on sexy.

I’ll talk about options; if you are new or do not know what they are, click here.

The Food Industry

We’ll start here, as what is more defensive than necessary food products? Even if AI goes south, tariffs escalate or consumers lose all buying power, the companies responsible for any vertical related to food will continue their business.

For long, the market ignored them as tech was booming and the market shifted from defensive names to risk assets. But as we’ve seen, the contrary rotation is clear now, and these stocks were left behind for years, sold down to attractive valuations.

Darling Ingredients

I’ll let AI explain what the company does as I still need to consume compute - doing my part to push AI stocks higher.

Darling Ingredients is the world’s largest renderer - it collects and processes animal byproducts (fats, bones, grease, used cooking oil) from slaughterhouses, restaurants, and food processors, then converts them into usable products.

Revenue comes from three segments: Feed (animal feed ingredients like protein meals), Food (collagen, gelatin for food/pharma), and Fuel (renewable diesel feedstocks). The company also owns 50% of Diamond Green Diesel, a joint venture with Valero that produces renewable diesel.

Essentially, Darling turns waste into value across the food-to-fuel chain.

The use cases and products sold by Darling are manifold, and you can understand that most of them - if not all, will be in demand in any kind of market & economic conditions: they are necessary for the functioning of a society.

This is defensive investing 101.

As for why the stock could push higher? There is more to it than just a defensive asset at a low valuation - although that’s what Darling is at the moment.

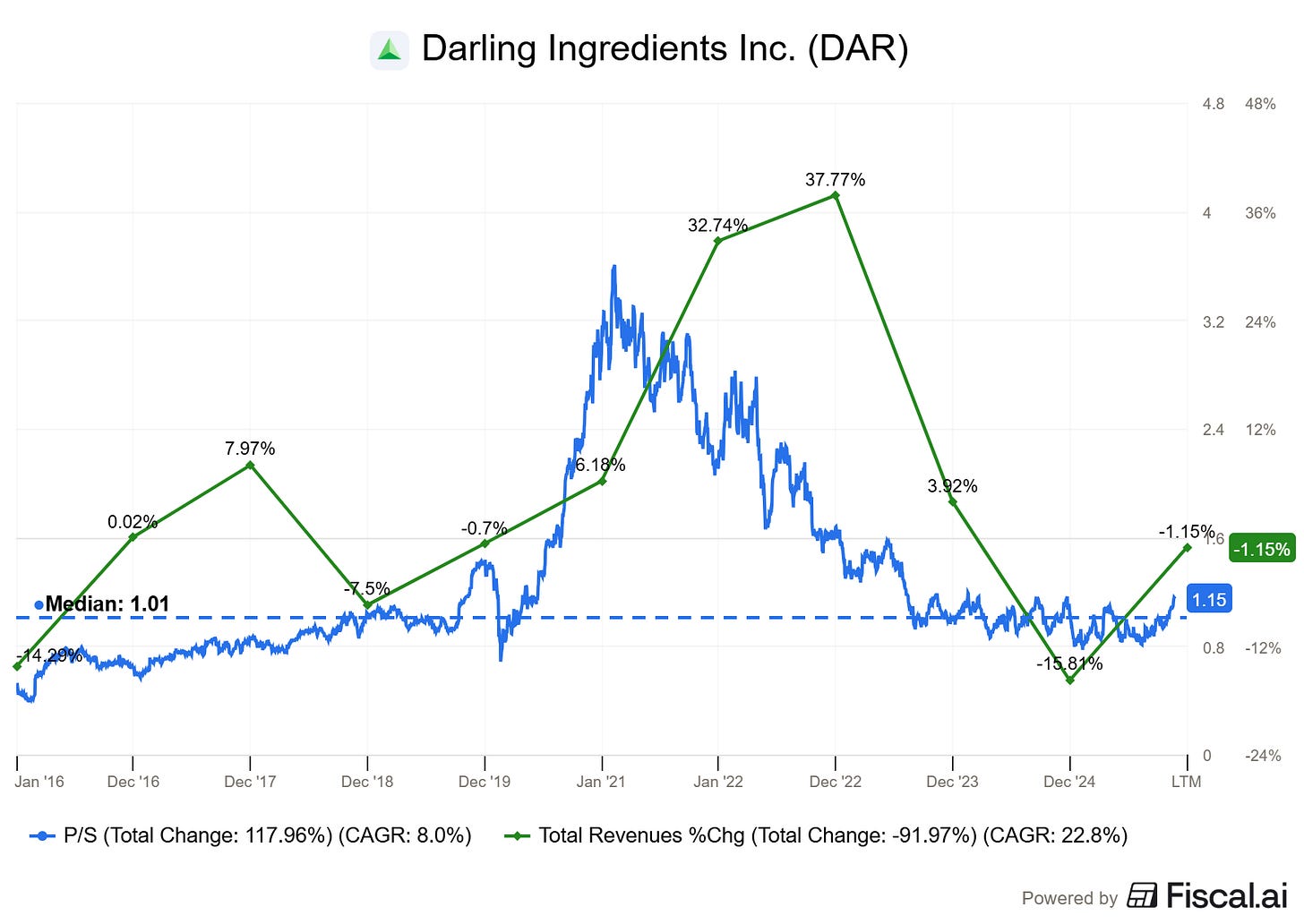

It could look like we are already above average, but when you bring growth into the mix - which is clearly accelerating and has reasons to continue, you see that if this trend persists, Darling has room to run.

It could deserve a higher multiple for two reasons:

Being a defensive asset actually in demand

Accelerating growth with clear tailwinds

The clearest tailwind is regulatory changes around biofuels; The government is about to force oil companies to buy a lot more green fuel credits and Darling is one of the biggest producers of those credits.

Using biofuels earns them credits (called RINs), and companies have a requirement of credits per year to avoid penalties. Until the end of 2025, regulation on the amount and the implementation of penalties & ratios was unclear. That changes early 2026.

That will benefit Darling twofold.

First, they produce and sell biofuels themselves, which some companies will be forced to buy. Between their own business and Diamond Green Diesel, this represents ~30% of their revenues.

Second, they also sell credits which they get from collecting and transforming wastes directly. Their core business model earns them credits which they can sell on a market where demand is only growing, pushed by regulatory frameworks.

As you can see from the screenshot above, revenue acceleration can push the stock to a 1.5x–2x sales, which would be a ~30% to ~70% increase from today’s price; more from my buying target.

Investing Playbook

You should be used to my charts and the patterns I look for by now! So no surprise to see that Darling fits perfectly.

An almost four-year-long downtrend that ends in higher low, weekly average reclaim, and earlier high breakout. We’re still fresh here; the retest hasn’t happened yet, and this will be the target. I’d look to buy around ~$40, while the averages are a bit lower at ~$36. This is the range to buy.

As for the plan, it is up to each of us as usual. For me, this would be an option play, as we are talking about a cheap defensive name in today’s market conditions, a perfect price action and clear narrative. It’s hard to imagine the stock break its lows, and as Darling doesn’t pay dividends, holding common shares is a bit less interesting.

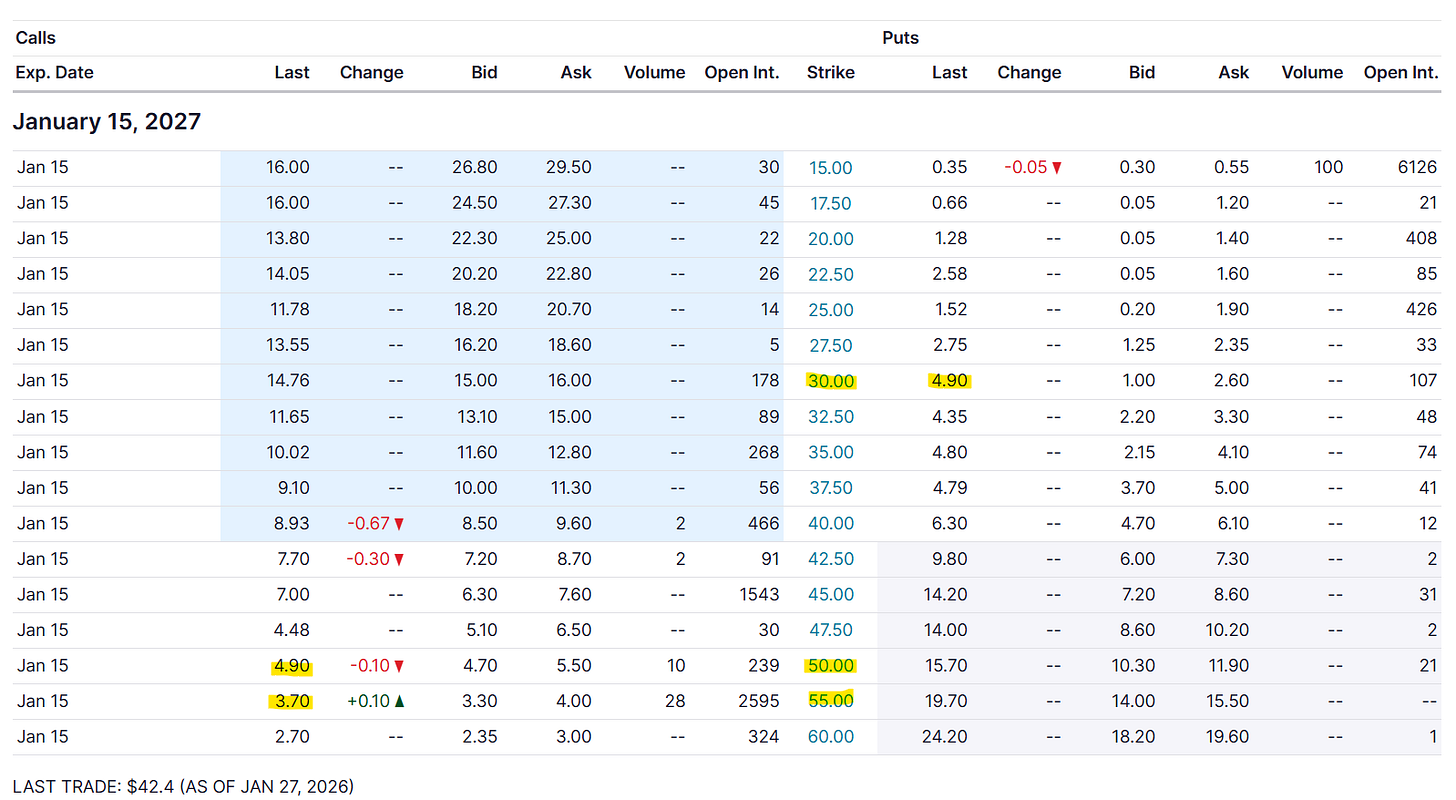

With the regulations changing, we’ll need to give companies time to adapt and start their new credit purchases & workflows. A year out seems to be the minimum. With our lows at ~$30 and our target of 1.5x sales at ~$55, this gives us our plan for our reversal options trade.

At today’s price, we’d already be in a good position to get paid for taking the trade. Puts sold at $30 would pay us $4.90 per contract; calls bought at $50 would cost us exactly the same. Being a bit more optimistic would with a $55 strike pays $1.20 and require $3,000 of collateral per contract without margin - which I would use with a year to go minimum on those contracts.

This looks like a great trade for the next year, although it relies on some regulations which should pass but could bring volatility if things were to be changed or reviewed. It isn’t my first choice nor my priority, UPS or Novo are, but it is a trade I would take if my other options were not possible.

Nutrien

We’re still in the food sector, with one of the biggest fertilizer companies.

Nutrien is the world’s largest fertilizer company by capacity, formed from the 2018 merger of PotashCorp and Agrium.

Revenue comes from four segments: Potash (potassium-based fertilizer - they’re the #1 global producer), Nitrogen (ammonia, urea), Phosphate, and Retail (Nutrien Ag Solutions with over 1,500 farm retail locations selling seeds, crop protection and agronomic services directly to farmers).

The vertically integrated model spans from mining fertilizer raw materials to selling directly to the end customer.

This is a comparable thesis to Darling in some respects, although the growth story isn’t tied to regulations, it’s organic from growing demand for their products while supply remains stable at best, which means pricing power.

Through the first nine months of 2025, Nutrien delivered structural earnings growth through record upstream fertilizer sales volumes, improved reliability, and higher retail earnings. We raised our 2025 potash sales volumes guidance range for the second time this year.

Our positive outlook is formed by strong potash affordability, large soil nutrient removal from a record crop, and low channel inventories in most major markets. This is most evident in China, where reported port inventories are down by more than 1 million tons year over year.

We anticipate limited new global capacity additions in 2026 with announced project delays and remain constructive on supply and demand fundamentals. Global nitrogen supply challenges are expected to support a tight supply and demand balance going into 2026.

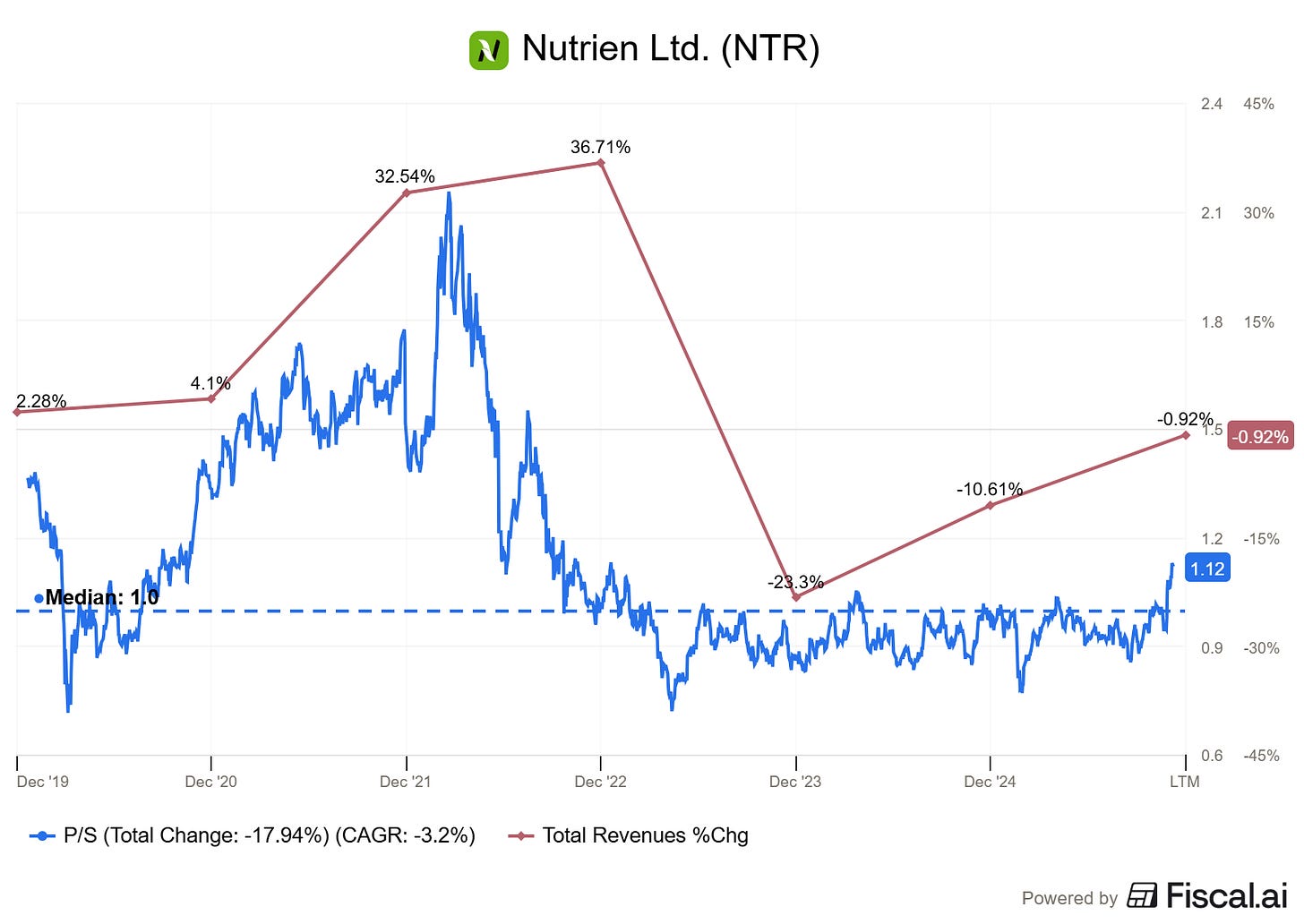

And this also comes at a pretty low valuation due to declining revenues and no love for defensive assets for years.

As you can see, the last time growth accelerated, it pushed the P/S from 1x to 2.1x which, combined with a ~30% revenue increase, yielded ~140% returns. I am not saying the same will happen over the next two years, but it is a possibility with the actual state of the market and demand/supply dynamic.

Investing Playbook

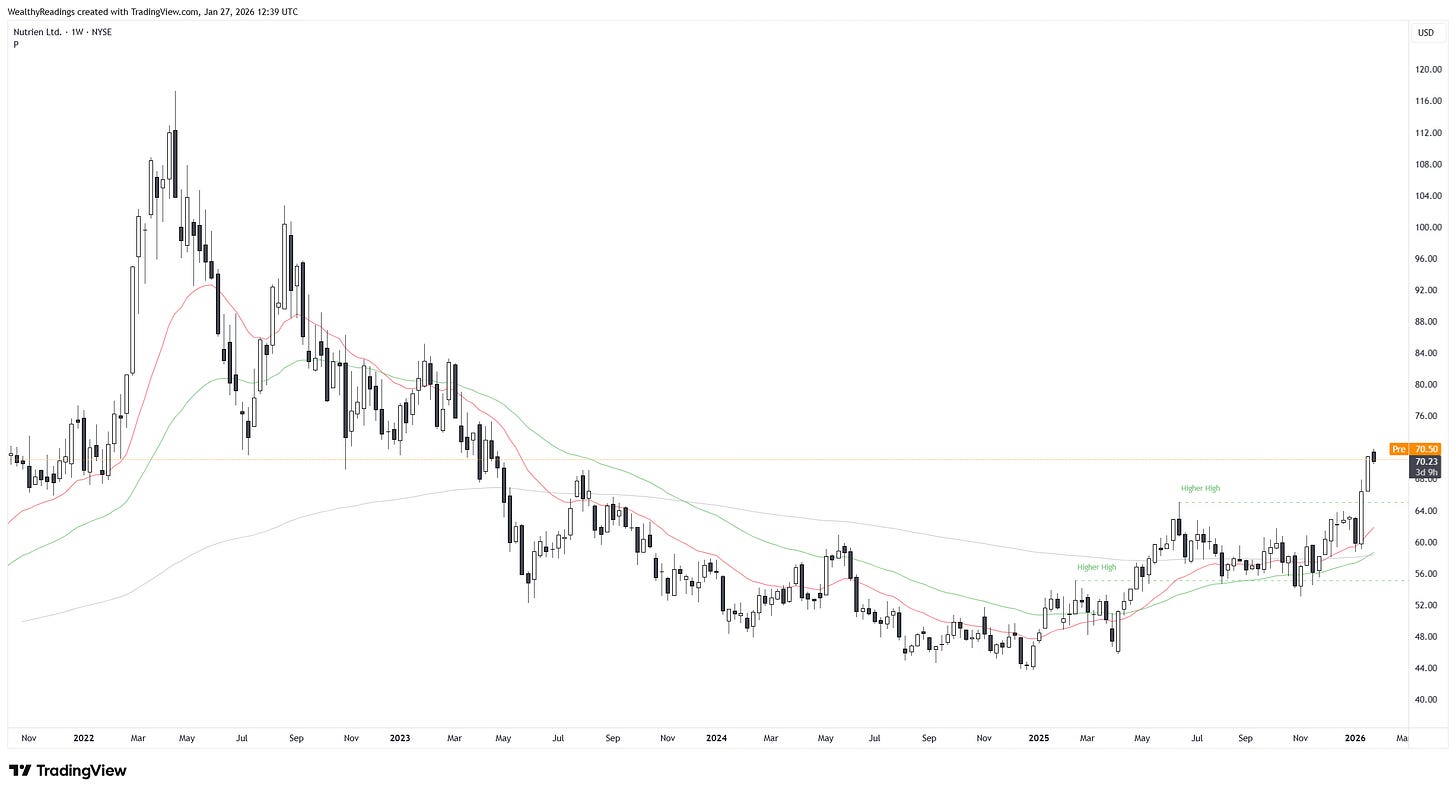

In terms of price action, we are a bit late to the party, as the great entry was on the $50 retest after a clear breakout and reclaim of the weekly averages, a purchase already up ~25%.

But as shown above, we are still at a fair value - undervalued if growth does continue to accelerate. The retest around ~$65 would still be a great entry, with a potential 30%+ return in a stable growth scenario. Anything above expectations - which aren’t that high, could bring the stock close to its old 2x sales peak. That wouldn’t be my base case, but it could happen, yielding 70%+ returns from the ~$65 retest.

Nutrien pays a ~4% dividend yield, which makes it a better candidate for commons and sitting on them, waiting for time to do its work. They also do buybacks, which would benefit both common and options holders, worth noting.

With the same options playbook, we’d be looking at puts sold around ~$55 - current low, and calls bought around ~$85 - 1.5x sales. We’d need to see growth acceleration confirmations to justify higher multiples. As of today, both contracts are at $3.50, so a free setup for $5,500 of collateral without margin.

This is the least interesting trade of the three, in my opinion, because we are a bit late to the party and the trade should have been taken on the previous retest. But we are still talking about ~30% returns on a base case using common shares, more with the options trade, and more depending on growth acceleration, which management is confident about, at a very comfortable valuation which makes risk vey tolerable.

We’re still looking at a defensive asset.

Smith & Wesson Brands

Let’s be polarizing and talk about the firearms industry. As usual, I am not here to talk ethics. I am here to present investment setups. I’ll let you manage your own ethics and do as you wish. So, here goes.

Smith & Wesson is America’s oldest and most recognizable firearms manufacturers, founded in 1852. Revenue is almost entirely from selling handguns (~72%), long guns/rifles (~20%), and accessories/suppressors (~8%) to consumers, retailers, and law enforcement.

The business model is straightforward manufacturing & wholesale distribution, they design and produce firearms at their Tennessee facility and sell through dealers, distributors, and sporting goods retailers.

Demand is driven by self-defense, sport shooting, and collecting, with notable sensitivity to political cycles and regulatory sentiment.

This could be seen as a cyclical industry based on political climate. Dare I say that the political climate is tense in the U.S.? Not here to discuss politics neither so again, have your own opinion, but in mine, last year’s news speaks for itself.

Second, this is also about regulation. Trump’s administration has been pro-firearms, reducing export controls internationally and loosening local regulations. Add to this the combination of the two previous companies: potential growth acceleration, low valuation, and a defensive, ignored asset.

Management is expecting healthy growth moving forward, and that growth is driven by new products, so this isn’t about catching up, it is a clear new trend supported by real demand.

After inventory fluctuation adjustments, our total firearm unit shipment into the sporting good category were up 3.3% versus the market being down 2.7%.

We expect our third quarter sales will be 8% to 10% over our Q3 fiscal 2025 sales. Q4 is always our strongest quarter... this year, I don’t think it’s gonna be any different. I think you can expect somewhere high single digit, low double digit growth in Q4 over Q3 this year.

Our new products continue to be a significant catalyst accounting for nearly 40% of sales in the quarter.

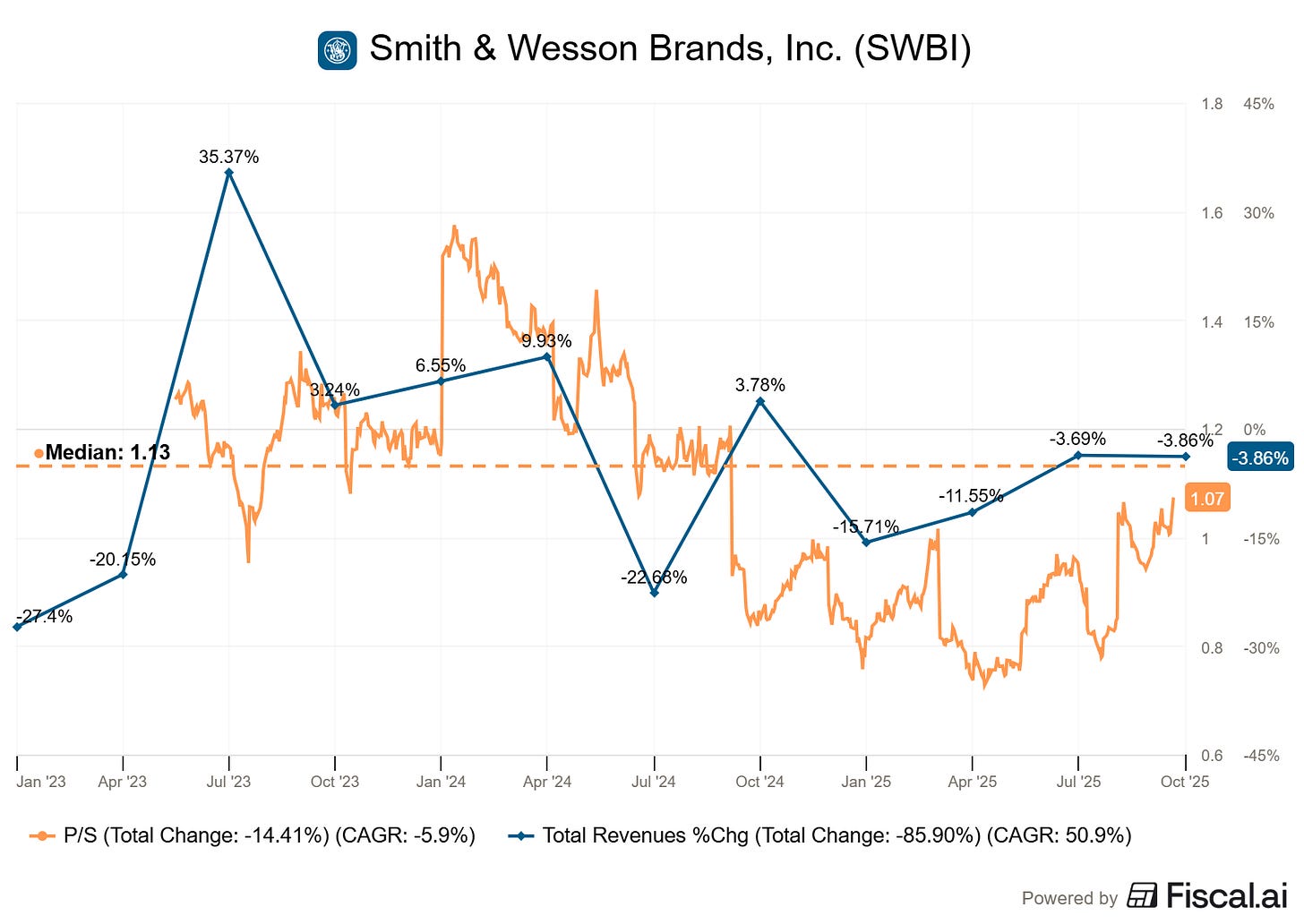

The last year that closed with double-digit growth was rewarded with 1.5x sales. We are very far from that happening, but with positive comments for the next quarters, a clear trend and healthy inventory - which means what is sent to wholesalers is being bought, stocks have been cleared. This was a problem in recent quarters not to worry about anymore.

Seems like a lot of positive news.

Investment Playbook

But just like Nutrien, we are a bit late to the party. The breakout, average reclaim, and retest already happened around ~$10.

We haven’t yet cleared another higher high, meaning price could still range between the current higher her and the earlier one - between $10 and $11.50. Any retest in the $10 area would be a great purchase. If that doesn’t happen, it means we’d need to buy the next breakout retest around $11, which remains healthy but of course less interesting.

I wouldn’t make my base case a 1.5x sales as growth is hard to predict and a double-digit growth year still seems far-fetched today, but if the trend continues we’d be looking at a higher multiple than today’s and easily a 20% - 30% push from my $10 target.

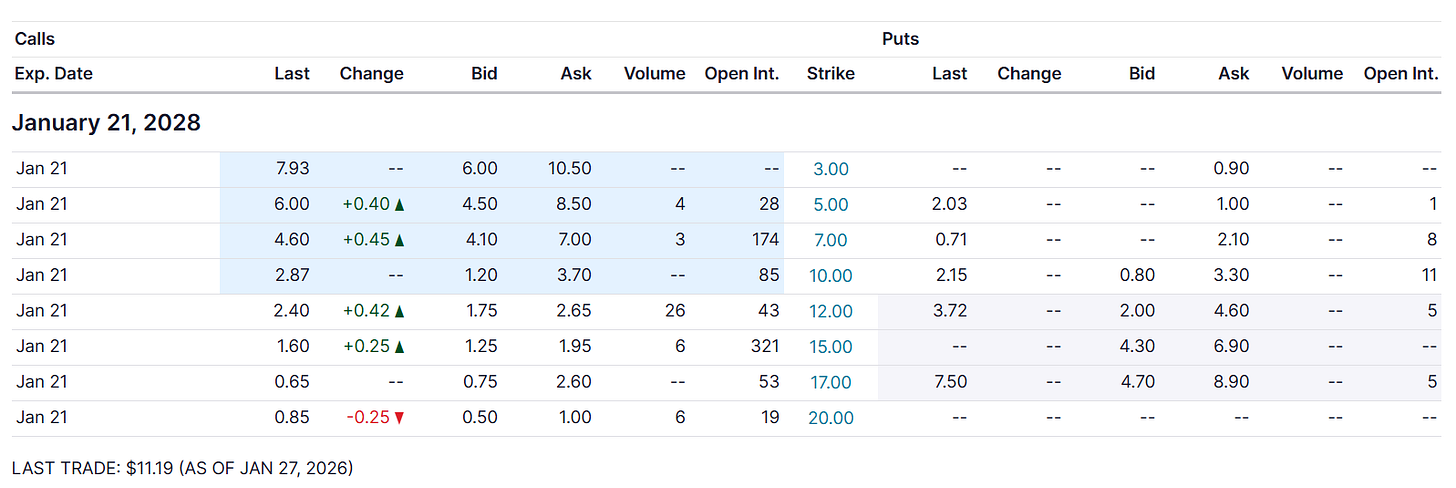

Any options trade would require you to go further than January 2027, as regulations shouldn’t change - except if Trump were to be removed in the midterms, & demand or the climate shouldn’t improve during the period - that’s only a personal opinion, but the long term growth acceleration remains unconfirmed yet, even if Q3 was a beat and Q4 guidance came above expectations.

Pushing to January 2028, which wouldn’t be impacted by the November presidential elections yet, with a floor at $10 and a target at $15, you’d be paid $0.90 to take that trade for $1,000 of collateral - much less considering the two-year timeframe, which gives room for a margin positions. Prices would be even better if we were to retest that $10 region, but the trade already seems great today.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.