Alibaba & China Thesis Update

My Alibaba position, update on the situation and my next moves

I shared my first article on Alibaba on June 5th, 2024, when the stock was trading at $78. We’re ~100% higher today, 18 months later.

I believe we can see comparable performance over the next 18 months while the rest of Chinese equities deserve to be on our watchlist.

My original bull case relied on Chinese consumption and buybacks. Consumption remains part of my thesis today, but I’ve learned that “undervalued” is just a fancy word that means nothing since, and that buybacks aren’t a bull case.

Today’s bull case, which I shared quarters ago on earnings, is much stronger.

China & The New World.

I shared another write-up on China’s challenges and objectives in March 2025. Not much changed since. I’d recommend starting there to understand the country’s situation, especially to understand inflation and innovation, the CCP’s main goals starting 2026.

China’s challenges today are the same as a year ago:

Geopolitical tensions

Lack of consumption

Behind in high-end tech

But two important things have changed.

Western Relations

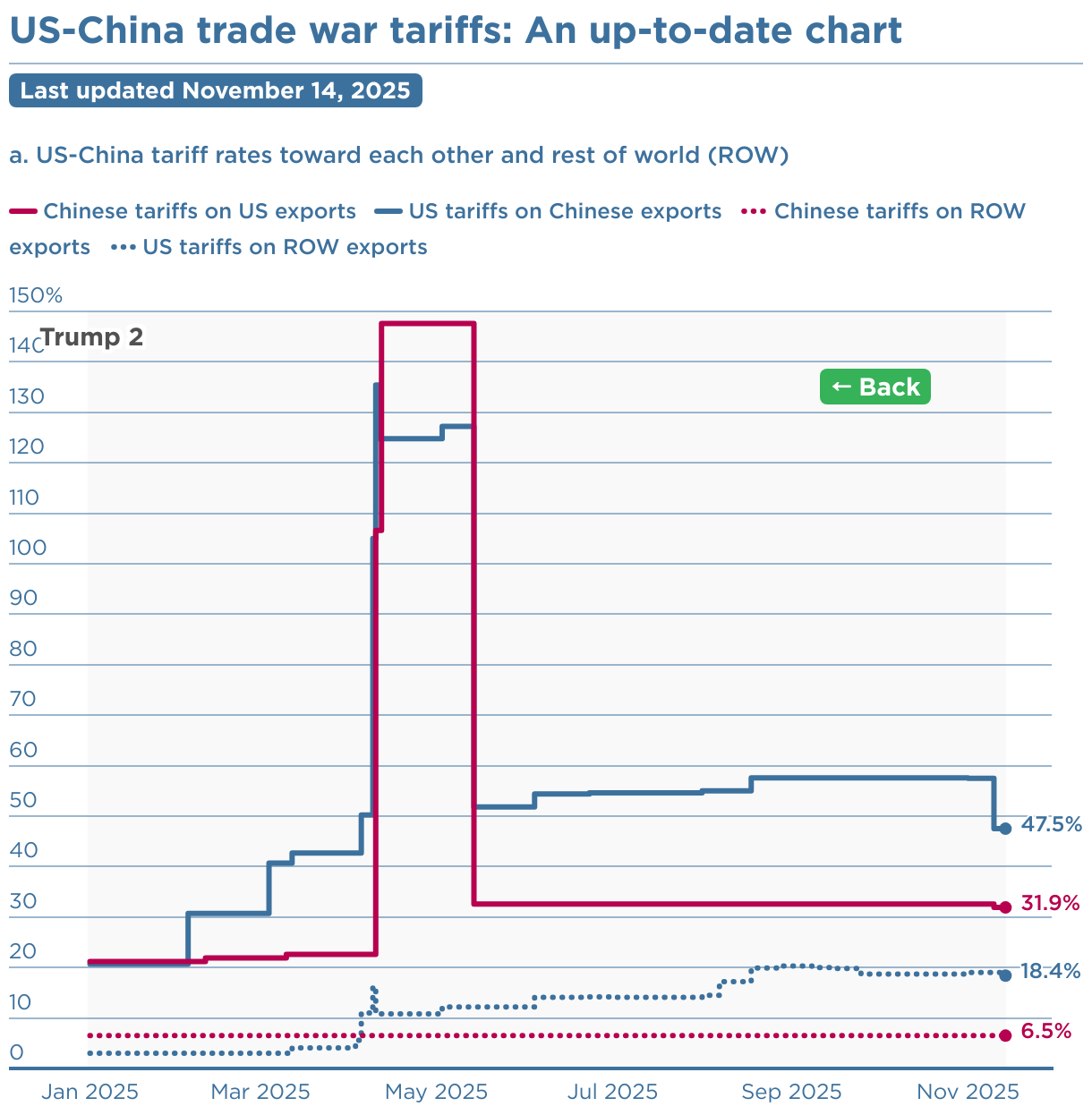

This is probably the biggest change since the U.S. tariffs announcement followed by months of messy negotiations. That period has mostly resolved, with communication channels opened between both governments, concessions made, and more… Long months which brought us to today’s situation, not perfect, but stable enough.

This chart is meant to illustrate the earlier situation and today’s “stability”, it isn’t very factual on the applied tariffs - no one really is as it has so many exceptions… Every import isn’t tariffed at 47.5%, but it gives you an idea.

The real win isn’t in tariffs though. I’m not even sure either country truly cares about import tariffs; they’re negotiation tools for what really matters:

Rare earths and GPUs.

This is where China won, to some extent. They didn’t crack under pressure. They kept their cool, went to the negotiation table, and got what they wanted: access to Nvidia’s GPUs - something Trump declared many times would be impossible.

Turns out China had cards.

Don’t misread me: both countries would have lost in a standoff, and China didn’t hold all the cards. They both had what the other wanted and what matters is they found an agreement and stability - tariffs on imports, rare earth deals, GPUs accessible again.

For once, the U.S. didn’t win it all. They had to make concessions. That’s a shift and it is for the best as it allows both countries to continue on a “healthy” relation - as healthy as a relation between two superpowers can be.

Government Priorities

The CCP made clear they have two priorities for their next 15-year plan:

Technology; develop local high-end technology: lithography, semiconductors, space systems. Everything the U.S. still leads in.

Consumption; through incentives, not direct stimulus. China doesn’t throw money around. They incentivize consumption through healthcare benefits, childcare subsidies, a unified social security system... The goal isn’t to throw money but to create a system where the population feels safe, erasing the trauma of Mao’s famines and the need to save “in case”. That system would increase consumption naturally.

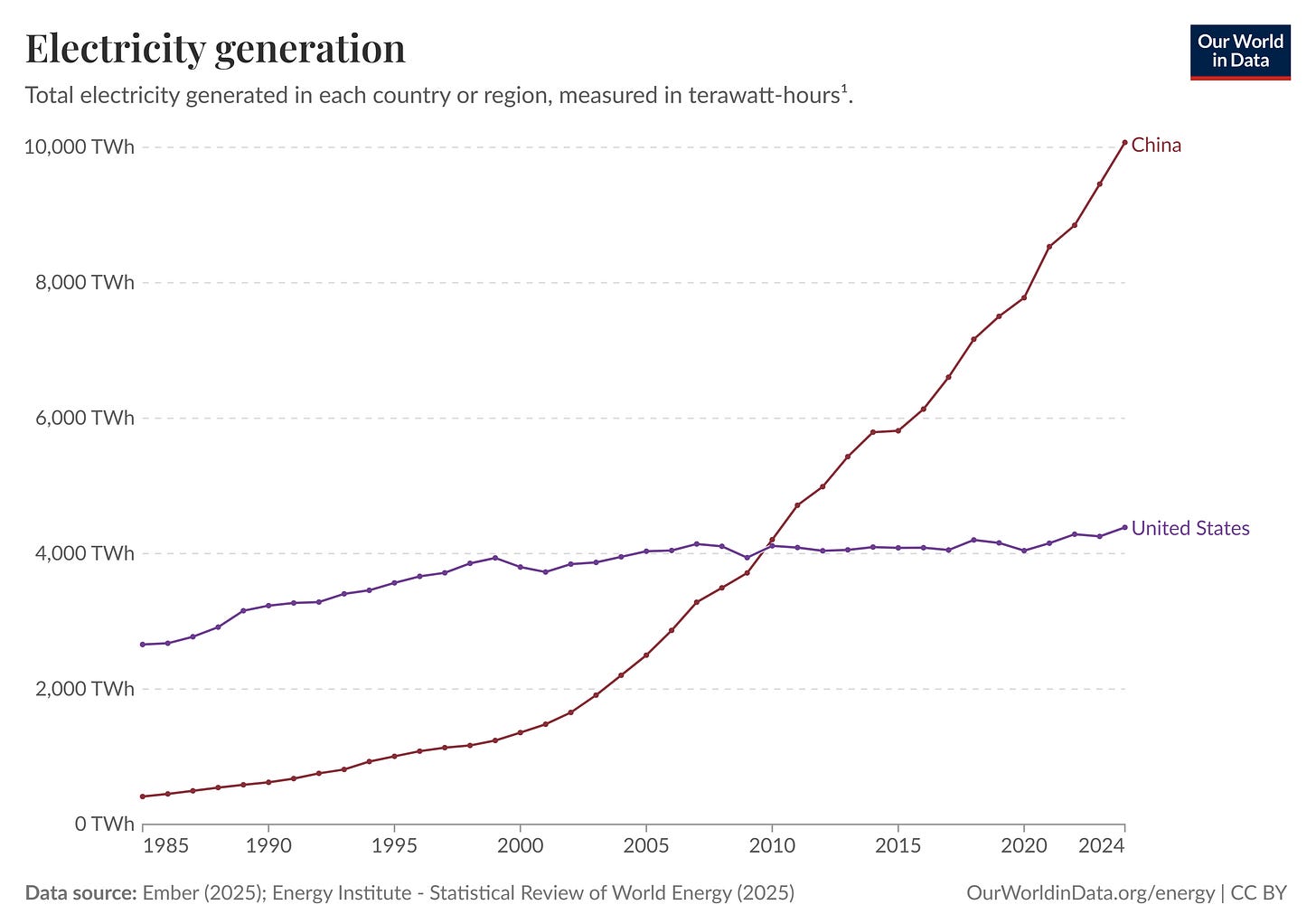

They already started some programs in 2025 but those are now official priorities and will only accelerate. Other priorities exist - notably energy development with a focus on nuclear, a key vertical for AI and the actual bottleneck in the U.S. right now, which may be less of an issue for China due to this anticipation.

Chinese infrastructure is on another level. The next question will be how many flops per energy unit can China bring online? Cause having energy is only half the problem, the second is having performant enough compute hardware.

That’s why technology is priority #1, to catch up with the U.S., become independent, especially on chips. The government pushed and helped companies to innovate, and will continue to do so partly by restricting Nvidia’s imports, which seems stupid but will force innovation - which happens when you desperately need something with no alternative.

Is that the only reason why the Chinese government is restricting hardware imports? Maybe not. But forcing local companies to innovate is likely part of it. I cannot guess the other reasons.

It already worked. Not for hardware, but it forced optimization of software and model training/inference to levels the U.S. only dreamed of. When you can throw money at problems, you usually do - it’s easier and faster than research. But as Chinese had no alternative, they built DeepSeek, which was highly optimized. And western companies rapidly replicated this open sourced technology for their own training.

They were forced to adapt. And they did.

For now, GPUs import delays seem more about regulation than forced innovation. The government is now filtering who can buy Nvidia’s GPUs with purchases restricted to companies with clear commercial purposes - supposedly:

If you want to do inference, or you’re a traditional enterprise looking for local private deployment, or you’re a hardware supplier wanting to buy GPUs locally to run DeepSeek - don’t buy for now. Prioritize Huawei or Cambricon products, or buy APIs directly from big LLM companies instead of private deployments.

Authorization would apparently go only to companies that can train models (Alibaba, Tencent, ByteDance, DeepSeek, some neoclouds). They’d be the only ones with H200 and would sell compute to others who need it.

I covered consumption in my previous write-up:

The Chinese now have very strong local buying power; they simply don’t spend much due to habits. If this mentality were to change, we’d see real growth in consumption, as well as in innovation and investment, since holding onto their cash piles wouldn’t be enough anymore - or better opportunities could arise. Growing buying power, inflation & consumerism: isn’t this the perfect environment for any investor?

Just to be very clear: this isn’t where China is today but this is where they want to be soon enough, and markets are here to anticipate success or failure. It’s only that today, the risk reward is very compelling to bet on China’s success.

The challenge is political and cultural. They need to change mentalities & behaviors, which isn’t an easy thing to do.

But China is an autocratic regime and thinks in decades, not electoral cycles. Policies are easier to set up when you know what party will run for the next decade. This is why their choice isn’t stimulus, but slow and controlled policies to create a safe environment. Longer to set up, but healthier.

This is why I believe the bull run is just starting. Structural shifts take time.

China’s Determination

Let me back my conviction with some facts. China has had many long-term plans over decades, and they achieved nearly all of them, often exceeding targets:

They moved 800M people out of poverty over the last 40 years.

Built or upgraded 716,000 km of rural roads since 2021.

Built 50,400 km high-speed rails in 5 years.

Deployed 3.5 million 5G base stations.

Tripled solar’s electricity generation in 5 years.

Landed robots in the moon.

Impressive for a country where millions starved just 60 years ago.

I guess what I’m saying is: Don’t underestimate China.

Alibaba

Introduction is done, and now we can talk about Alibaba.

Involved in both tech and consumption

#1 e-commerce platform in China

#1 cloud & AI provider in China

Favored by the Chinese government

Underestimated by markets

Pretty great setup.

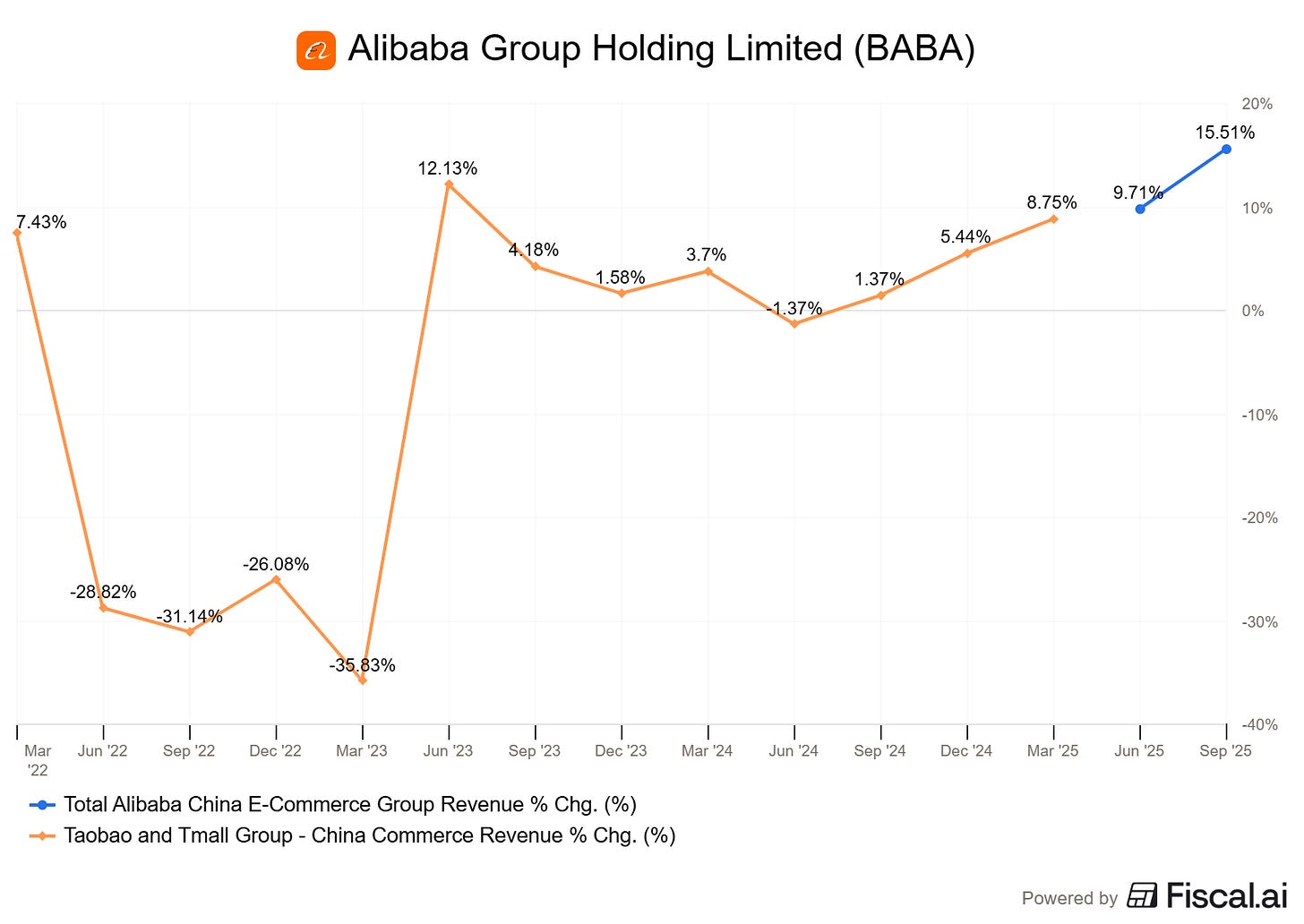

Taobao, Tmall & Local Services

This is Alibaba’s cash engine, source of funding for its heavy AI investment. We need to see continuation here. It’s growing slowly at the moment, but any growth is a bonus as it generates more cash to spend on infrastructure.

Numbers were a bit boosted the last two quarters as Alibaba integrated other revenue sources beyond just Taobao and Tmall & doesn’t report those two separately anymore.

Plus, most growth on those two platform - which they still comment on, came from AI and services optimization (merchant fees, advertising…), not growing consumption.

For China e-commerce business, customer management revenue rose 10% YoY to RMB89.3 billion (US$12.5 billion), primarily driven by improved take rate which benefitted from the software service fees introduced in September last year and the growing adoption of the AI-powered marketing tool Quanzhantui.

With already 900M active users in China, the only organic growth lever is accelerating household consumption, but it takes time. It’s hard to give a timeline for the reasons detailed above, but I believe it is coming and in the meantime, slow growth due to this kind of optimization is enough to generate cash. Growth from consumption would be the perfect case scenario, obviously, and we’ll need to control the numbers to see if it happens.

But until then, Alibaba is a tech company, and has to leverage its assets. They have applications, millions of users and thousands of services, so they optimize advertising, take rate, merchant fees, etc…

And they’re pushing tech further: a few months ago they released an AI super-app combining e-commerce with other apps from their ecosystem (social media, banking, entertainment…).

One app to rule them all.

This means new fees, AI-enhanced services, new monetization sources for advertisers, merchants, partners... E-commerce remains Alibaba’s profit source & they’re smartly leveraging all parts of it, not just consumption. And when/if household consumption picks up, Alibaba wins manyfold. Merchants increase usage of higher-priced services, GMV rises along with fees, and we start a really bullish flywheel which yields growth and more cash generation to fuel AI infrastructures.

We’ll hopefully watch this in the coming quarters.

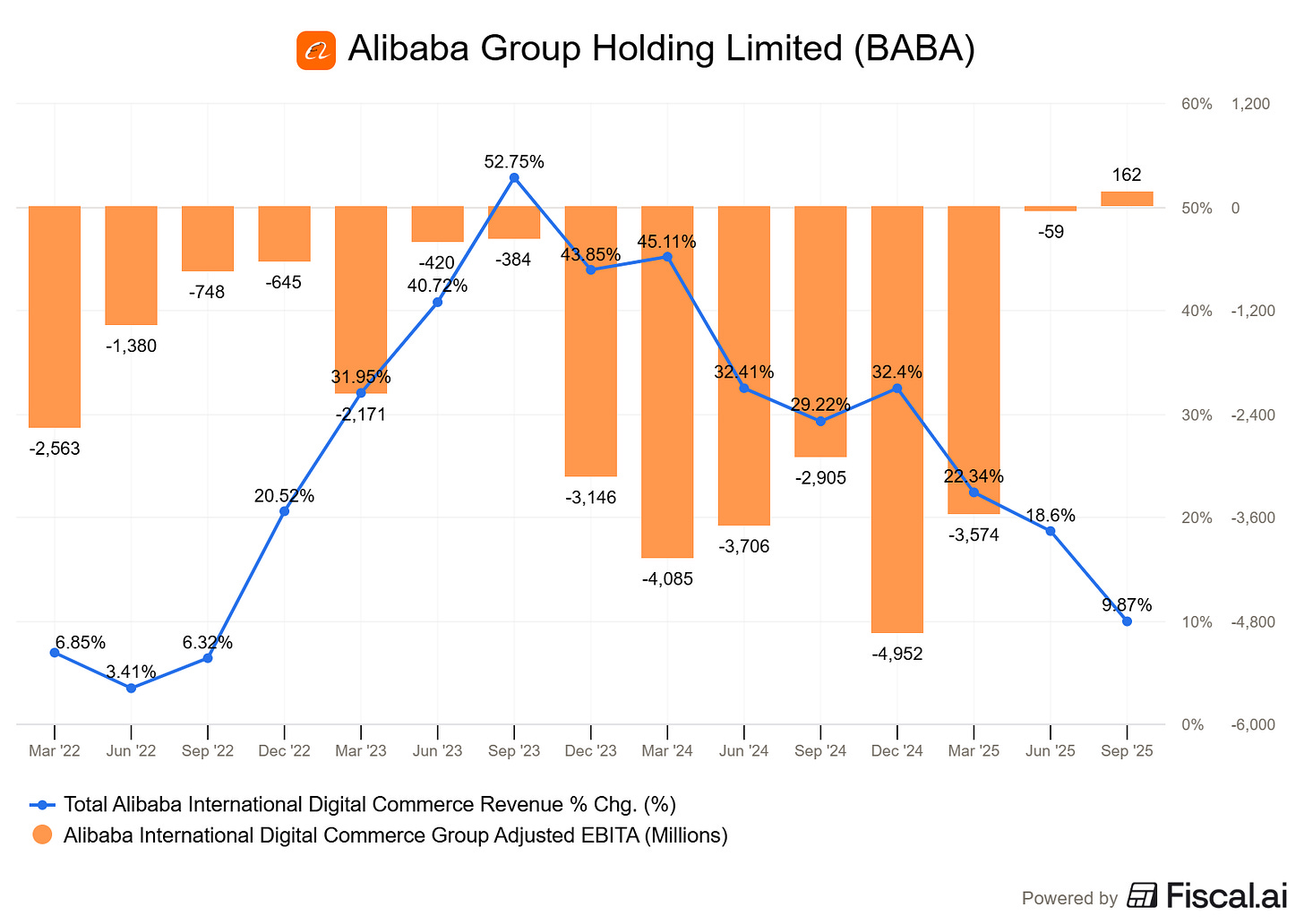

International E-commerce.

Not the most exciting, nor central to my bull case, but it’s ~15% of revenue and slowly turning profitable so it is an important part of the company.

AliExpress, Lazada, Trendyol, etc… are growing healthily & diversify away from China’s consumption, which if turned profitable, become really interesting assets to generate even more cash.

I’d prefer heavier AI commitment & less focus here, but that won’t happen. Best case, this vertical turns profitable so it stops draining cash that should go to infrastructure.

AI & Clouds.

The most important vertical. Markets only care about growth, and growth comes from innovation or competitive advantage.

Alibaba has both.

One of its massive advantage is vertical integration.

They own infrastructure and design their own inference chips - with comparable perf to Nvidia’s H20. Less powerful than the H200 they now have access to, but usable for optimized inference.

If you wonder who started doing this, the answer’s simple: Google. Every Mag7 now does the same because it's the logical next step for optimizing compute.

Moving up the stack: Alibaba owns Qwen, one of the best open source LLM - which proves Chinese engineering talent. Developing your own LLM lets you customize its training for specific needs, which is advantageous compared to using another one - which can also be costly.

One layer higher: Alibaba owns the applications, hundreds of applications for many different usage, which they can optimize for AI services. They do not just own the app, they own the users, the merchants, the partners… Everything.

Owning the entire stack allows Alibaba to optimize every step of the way, which isn’t possible for many companies and will allow them not only to optimize but also to unlock monetizable services which cannot be set up by companies who do not own the entire stack.

It’s hard to find a Western comparison. Alibaba is a mix of Google and Amazon. But they also own social and entertainment platforms with hundreds of millions of users, are deeply tied to Ant Group’s fintech ecosystem, and own the entire stack for all these services. The data flywheel, optimization potential, and monetization surface area is… unmatched.

Add to this Alibaba’s privileged position in China allowing early and privileged GPU access - critical for offering superior performance, plus political capital as a major domestic company aligned with the government’s 5Y tech priorities.

Not bad.

Other Verticals & The Hidden Growth Story

The market misunderstands Alibaba for one reason: Intime and Sun Art sale, end of 2024. Two companies which used to be part of Alibaba’s revenues, generating RMB ~20B combined per quarter. As they aren’t part of the group anymore, the quarters continue to be compared to revenues when they were, and as the market only cares about growth, having a small one is an issue, whatever the reasons for it.

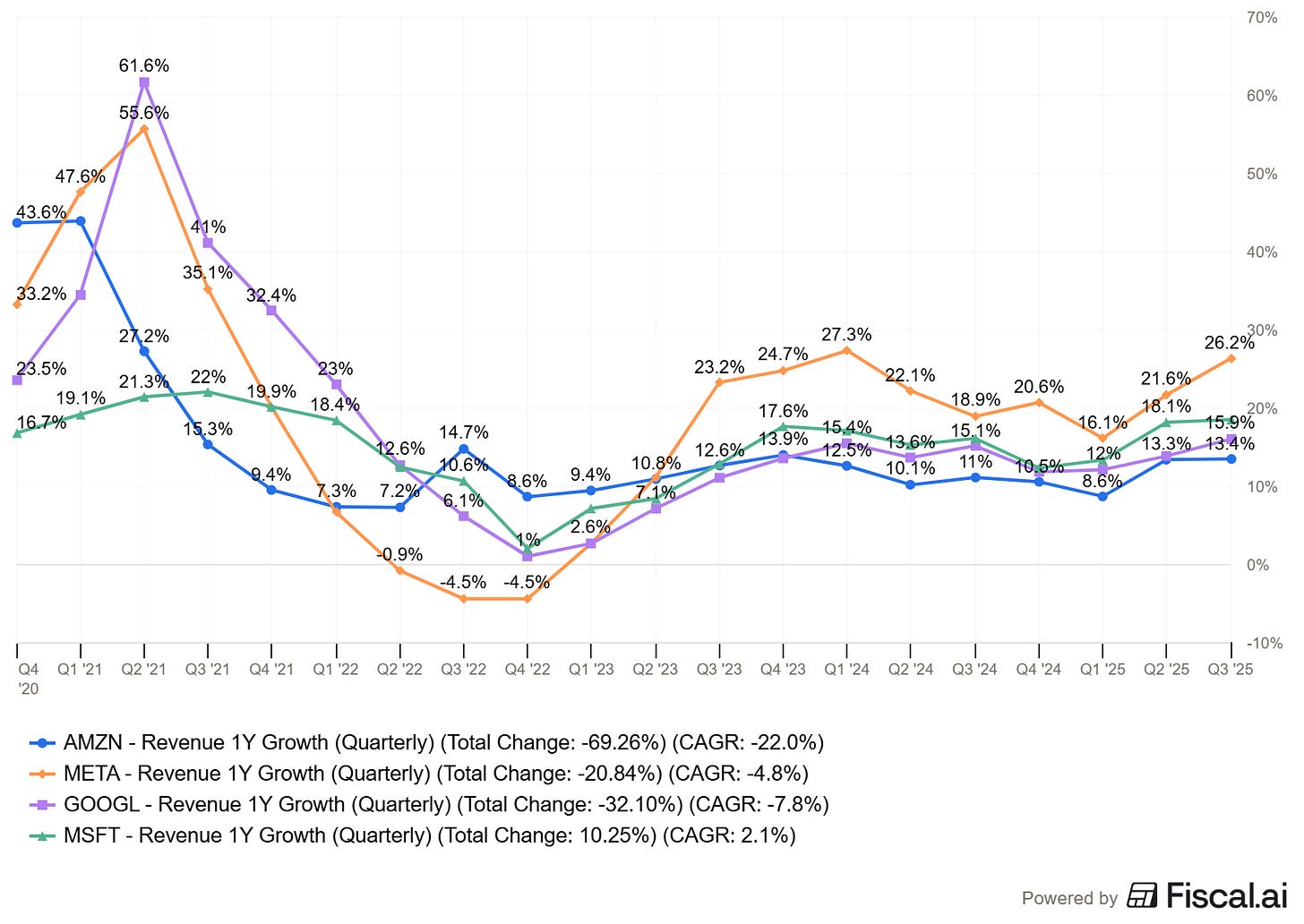

Excluding their revenues, Alibaba grows ~15% YoY with AI/cloud accelerating.

Many know because management shares this number in their report. But markets run on momentum and data, everyone doesn’t read every reports. What most know is that Alibaba is a slow growing Chinese giant. Not a double digit and accelerating high end tech giant. It shows up on no ones radars because of that “small” growth.

In Q1-26, Alibaba will become a double digit growth high-end tech giant, because the comps will be done without Sun Art and Intime revenues for the first time. This brings the company in line with our AI related Mag7.

Yet markets treat it very differently.

I know most of the bear case and the reasons why those multiples are “justified”, so I’ll address the common ones.

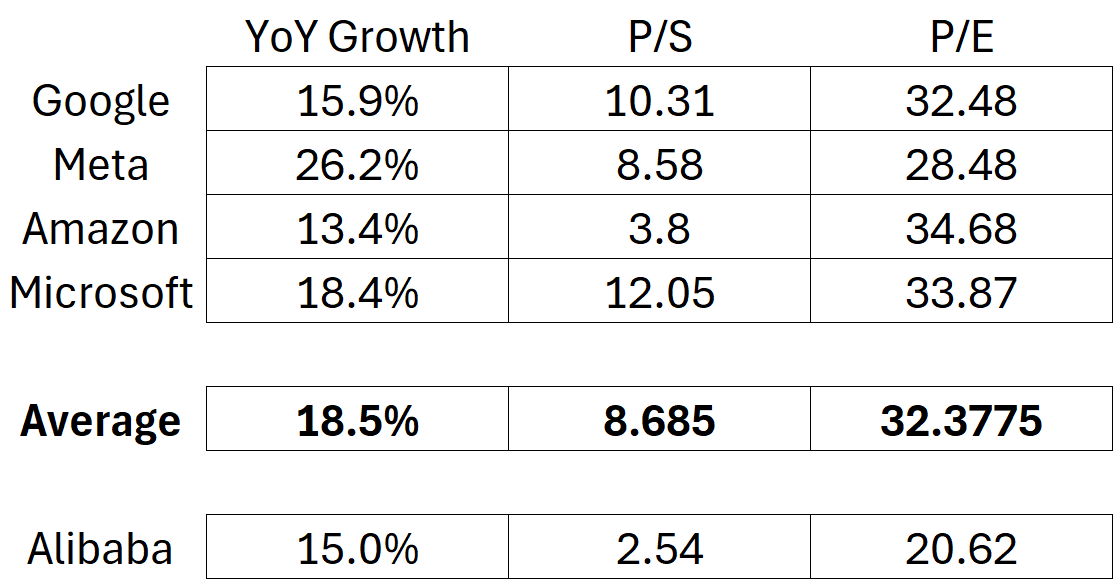

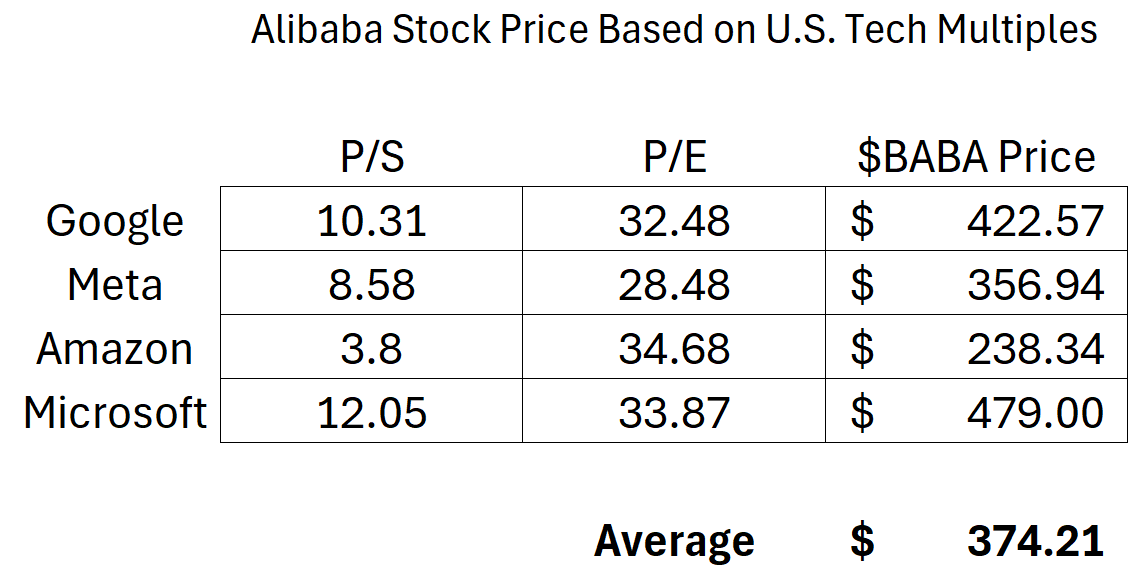

Slower growth. True, even excluding Intime and Sun Art. But Alibaba is early in its AI growth acceleration, easily a year behind the U.S. & its potential is massive. Plus, Amazon has slower growth yet lower multiples. At comparable multiple, the stock would trade at $238, a 58.6% from today. Why the gap?

China is dangerous. Geopolitical risk? What about potential frozen accounts? The ADR structure and lack of ownership? Potential Taiwan invasion? Trade war escalation or new episodes in the actual one?

We have to weigh probability in each. Will they invade Taiwan? Very unlikely. Will they break their relation with the U.S.? It would be mutually destructive and who wants to destroy its country. Freezing accounts and investments is not realistic as they0d break trust with the most powerful economy of the world (and the one which invests the most).

Is it 100% safe? No. But it isn’t remotely as risky as many make it look like, and no investments are risk free.

Ethics. If you've followed me for some time, you know my take: it's a fancy word for “personal opinion”. This Substack covers economics, markets and making money. I'll leave ethics to others (and you can disagree with me here, I’ll have no problem with that).

Markets run on momentum and greed. Eventually U.S. stocks will stagnate, excitement will slow down, or other markets will run harder and returns will be found elsewhere. Not just returns, but also excitement, thrills. This is what the markets are about.

Chinese stocks are clearly in a bull trend. It’s been happening for months in Tencent, Alibaba, Baidu... The Hang Seng rose 32.7% last year, outperforming the S&P 500. Investors are moving into China, most of it comes from Asia as Honk Hong’s volume has been increasing for months, but there is a point where American’s liquidity will also be part of the game.

Eventually, even those with ethics will bend. Greed always wins. That will signals the bull market top, but we’re far from it.

Execution.

As you know, I focus on Alibaba. I have a Chinese stocks watchlist, but I’m not buying other names yet. Bull markets start with leaders so let’s focus on the #1 first.

My directional bias was shared above, I believe Alibaba compares to U.S. tech names and should trade comparable to them. Why not? They offer comparable services in very large geographies with very high demand. The actual lower multiples are due, to my opinion, to distrust from Americans in China and this “lower growth” illusion. And you understood I expect both to disappear in the next quarters, while AI demand is clearly booming everywhere, Asia included. The challenge for Alibaba is to monetize its services to the level U.S. techs did, which is harder to do in a less consumption focused economy, but can be done nonetheless as mentalities change.

There are conditions for Alibaba to succeed, but there always are. In any investment.

Realistically, even in a Chinese bull run, I don’t expect Alibaba to trade at U.S. level multiples. So this $350+ isn’t my expectation, it is only to illustrate. Apply a growth adjustment and a China discount - which will always exist, and you’d have a target.

In my optimistic base case - consumption flat at worst and AI demand accelerating, which indicators suggest, Alibaba above $250 seems plausible. Maybe near $300, if only because of the growth perception which will shift, boosted by AI acceleration.

This is my expectation. From $150 today, that’s a 65%+.

The bear case? Volatility. Chinese stocks trade on geopolitical headlines. Bad news means downside. But I see it as temporary; Xi and Trump know their economies are interdependent for years to come and both need concessions to thrive. Both have made it clear they can work together. And both want to thrive. I don’t see a point of no return between these administrations. I could be wrong.

On price action, we’re in a sweet spot today

Alibaba has shown a clear pattern since the bull trend started.

Violent pump to new highs

Respected downtrend

20+ weeks consolidation

Return to weekly 50 MA

Repeat

Yes, only twice so far. And the weekly 50 sits ~11% below current price, and we’re only at 14 weeks of consolidation. Nothing guarantees repetition, but it gives indications.

Bull trend is intact

Weekly 50 is ideal entry

Decisions will be different for each investor. Some won’t care. Some have no position and want in; better to wait for the weekly 50 retest - which may never come, or buy now already? Some have a position? Maybe DCA makes sense. There are no perfect answer, it all depends on you, your style and objectives. Make YOUR plan.

I have a position averaged below $100. My plan.

Stock hits weekly 50 (green line) → I buy

Stock breaks trendline & retests on daily → I buy (like the orange circles)

That’s my plan. You gys have to build your own based on you, and stick to it.

In the optimistic scenario, Alibaba is just the start. Other names will follow as China ramps up consumption - namely JD.com and PDD which sit massively “undervalued” on my watchlist. Both could return multiples, not percentages, in short time.

But for now, focus on the #1.

This closes my Alibaba and China update. If things go to plan, you’ll hear much more about Chinese stocks. We should hope so, as there’d be plenty of massive opportunities if it were the case.

In the meantime, I wish you an excellent day and week end, and will see you soon!

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.

I’ve been frothing over Chinese stocks for the last few years wondering how valuations could stay so cheap. Not just the big names like BABA, TCEHY, NTES, BIDU, and JD, but smaller names with massive upside like QFIN, FINZ, JFIN, ZTO, ATAT, and XYF. I’m slowly accumulating several positions, building them up while they’re undervalued. Most pay a dividend and whatever I’ve accumulated will pay off nicely when the market catches up.

So you're implying that once US funds move into Chinese investments, the top for US such is in? What % of their holdings would that need be, in your projection? Thanks.