Everyone's Buying These But Me. Here's Why.

Six stocks everyone is buying but me, and why I decide not to.

Before we dive in, let’s frame the context.

You know I am a concentrated investor. I believe concentration is the only real way to create wealth; diversification is for when you’ve reached 8 digits and preservation becomes the priority. Until then, concentration makes wealth.

Concentration only happens if you filter for the best opportunities and leave the rest behind. No hard feelings. Buy & hold or DCA does not fit my system because at any given time, there are too many excellent companies trading below “fair value”. If you do not filter, you lose the concentration that creates outperformance.

My system uses two main filters:

Price Action: I don’t buy downtrends. None negotiable. This erases dozens of names immediately.

Potential & Narrative: For every asset, I build a thesis; a fundamental valuation “target” and a specific price entry based on price action, which gives me return expectations. Subjective, but that’ what investing is about.

I only buy the handful of names with the best subjective upside. If a new opportunity doesn’t offer better potential than my current holdings, I don’t touch it. This means I will be wrong sometimes, and I will miss big moves. That’s why I do not all in in one but buy a handful, to compensate for potential slow ones or losers. It also makes me data-reliant rather than emotion-reliant. I don’t own the companies I want to own; I own the ones that fit my system.

Today, we’ll talk about several great companies that I believe are below fair value, but that I don’t own and don’t plan to. And most importantly, why so.

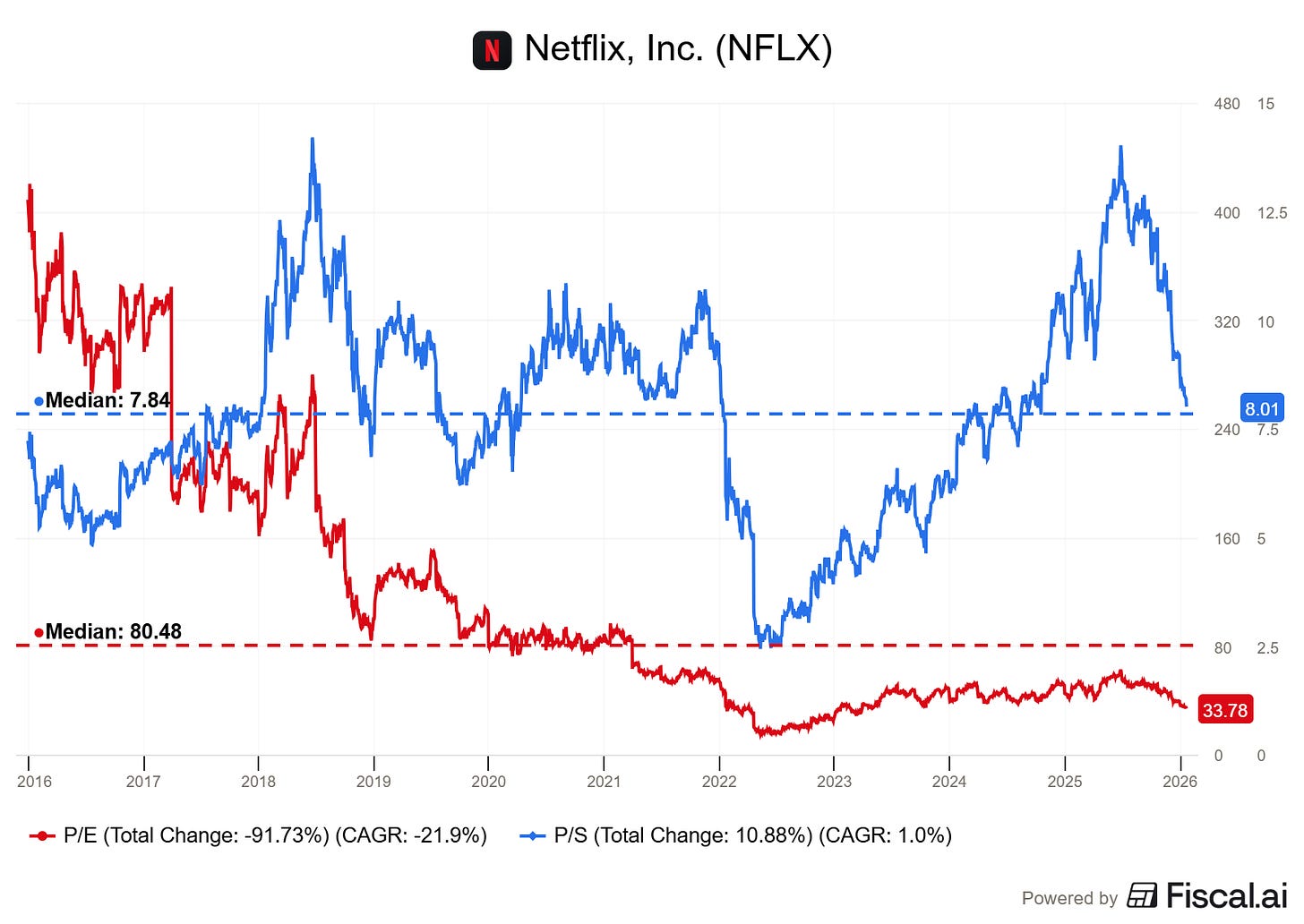

Netflix

Netflix is on everyone’s lips following their actuality and the publication of their Q4 yesterday which was nothing but strong. But the market is in a zero-tolerance mode for anything less than perfection for a company eyeing an acquisition for ~$70B all-cash for Warner Bros. There was nothing a strong guidance could help with, even if they delivered it.

Revenue: 12% growth floor.

Operating margin: expanding to 31.5%.

Ad Business: Expected to double YoY.

This isn’t what a failing company looks like. But the market rewards clean, predictable cash generation with a premium multiple. So when you talk about an acquisition for roughly ~13% of their market cap, that premium vanishes. With ~$50B in debt and 100% of cash & FCF used for that acquisition, the expectations of 45x earnings or 8x sales no longer apply.

I’d judge Netflix fair price ~$80 after reducing my multiples due to that new leverage. Management has and will probably continue to work wonders with these new IPs, but it will take time to show, to generate cash and to prove investors that the ROI will be worth the spending.

Is it buyable? Yes.

Am I buying? No.

Why? Because I could be wrong. My opinion is only an opinion. And buying today is assuming I’ll be right, while the market is being cautious. What is the upside? Is the pain over? How long if not? Will it even be over one day?

So many questions I, nor anyone, can answer. And the market is not optimistic, which means I have no reasons to be optimistic. Yet. I believe I will have reasons to. Until then, patience is the right move.

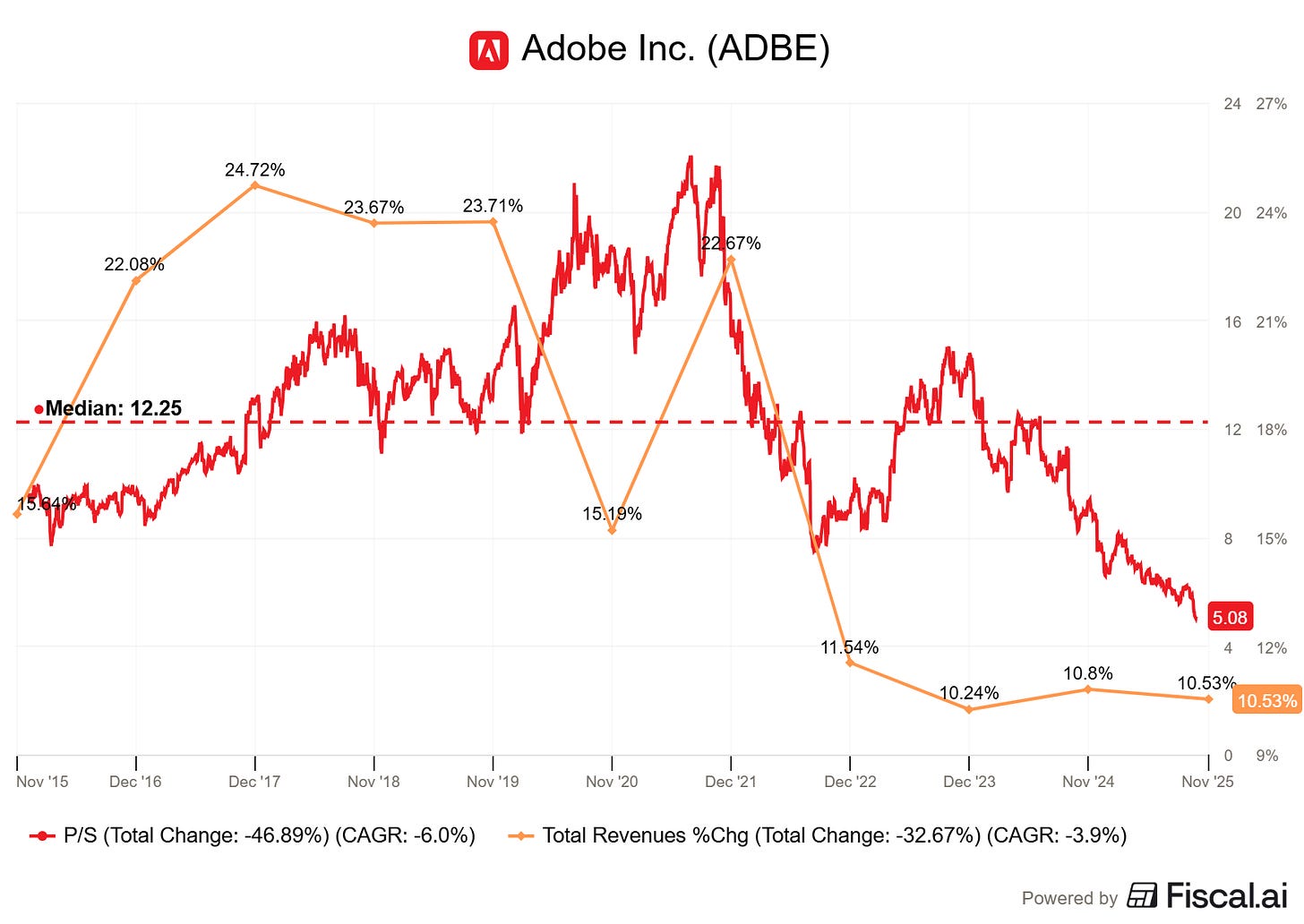

Adobe

Adobe is a social media favorite with an easy bear case to frame: AI disruption. I don’t buy the “Adobe is dead” narrative, but I understand why the stock is falling. On the situation first.

Adobe is a creative, marketing and analytic professional service. Its retail business is ~30% of their creative cloud revenues, ~22% of total revenues. It is significant but it highlights the importance of fitting enterprises’ needs, and the lower importance of taking consideration of retails complaints. Enterprises are the bread & butter of the company so their new services, importantly their AI services, have to fit those needs, not the need of the one who wants to remove the dog from its holiday’s picture. And Adobe isn’t late on its AI services, far from it.

But from the market’s perspective, it doesn't just want to see Adobe survive; it wants to see them thrive, be an AI leader. Without clear growth from AI products, the market will continue to fear disruption. At the moment, enterprise creative is growing at ~8%, not enough to justify an AI growth leader premium no trust.

The stock certainly looks cheap at its lowest multiple ever while guiding ~10% growth FY26. Software companies typically trade higher than 5x sales for double digit growth, based on pre-AI averages. But the market is trying to figure out where this is going.

Will Adobe remain a leader? Will their AI growth speed up? Will competition eat their lunch? Will they retain their clients?…

So many questions unanswered, so many uncertainties, that the market sells first. My opinion? Adobe will at worst do very well in the AI era. But I’ll buy when the market confirms my opinion is the right one. Until then, I’ll be patient.

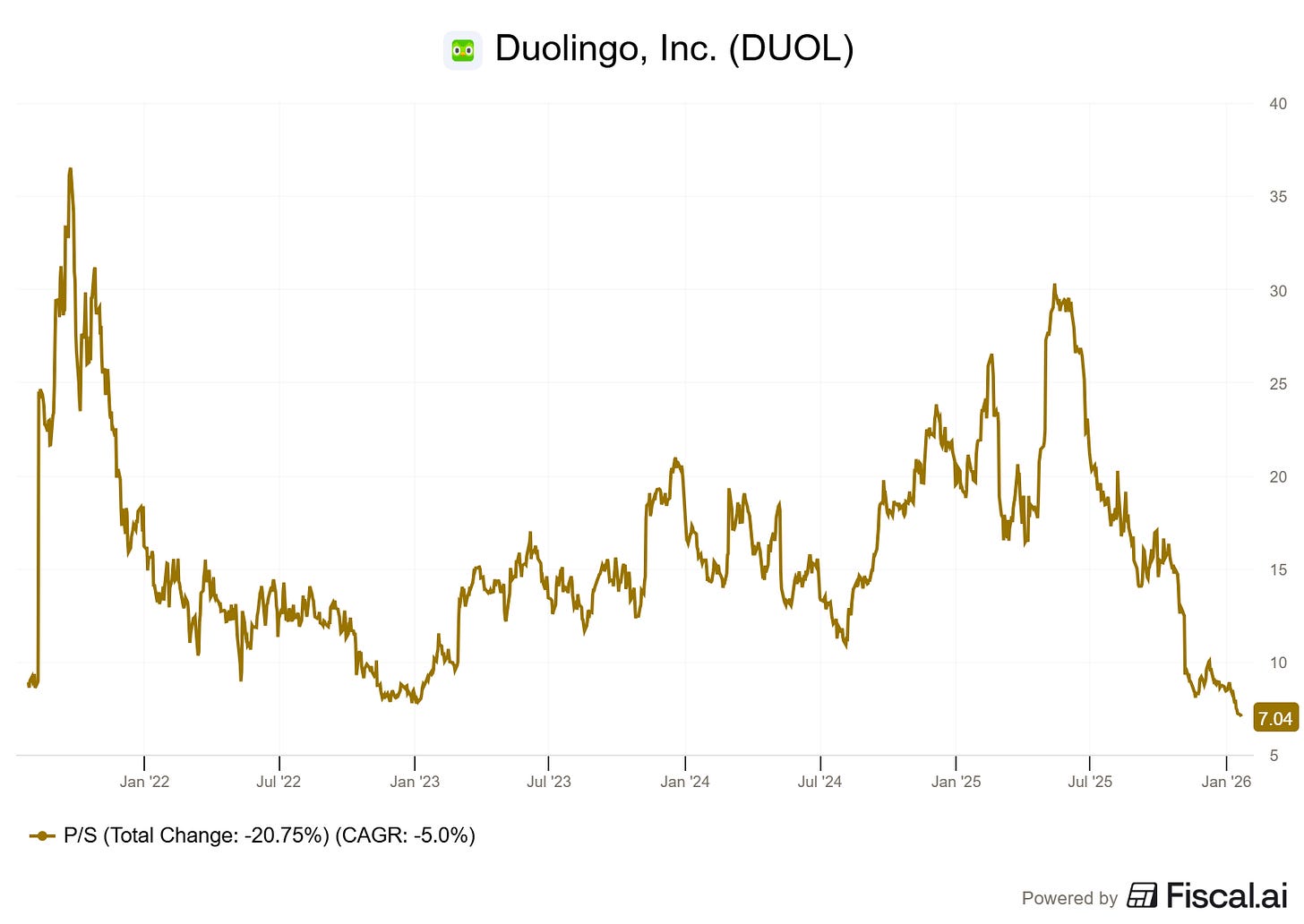

Duolingo.

Let’s go over the owl since we’re talking about software. The story here is different: everything is a question mark.

My opinion is similar to Adobe, the owl will do great because speaking more than one language will always be necessary & its power isn’t language only but a gamified and addictive learning system. The market however isn’t sure about their cash generation. Management announced they’d focus on long term value creation, which could be a sign of weakness on their cash generation capacities, and said they would prioritize it over near-term cash. And we know the market prices everything on cash generation.

From today, growth could range from 15% to 35%. You saw Adobe trading at 5x sales for 10% growth just above. Duolingo’s 7x sales for 30%+ growth would be ridiculous, but as the market has no idea what real growth will be moving forward - and it could be ugly since Q4 guidance talked about no sequential growth, it won’t price anything yet.

Buying Duolingo today is a gamble that they guide to 25%+ growth for FY26. It might happen. It might not. Just like you might get rich putting your net worth on red at the roulette in your hometown casino at 4AM after five gin tonics.

The downside at 7x sales isn’t losing it all, I’ll give you that. But the upside is a massive question mark, and that’s not what I buy. The market is about probabilities, go big on high chances of winning.

That’s not Duolingo, not today at least.

MercadoLibre.

This is an entirely different case. I am bullish on every aspect of MercadoLibre: LatAm and local buying power, regional politics, the company’s verticals, its cash generation capacities, its market, its shares. There isn’t much I am not bullish with this company.

This is a matter of selectivity, one of the examples where concentration limits yourself - and a price action issue. My fair price for the stock is around ~$2,430, roughly 10% higher than today’s price. The stock has ranged between ~4x and ~5x sales for the past three years with stable growth I’d expect to continue. That means the upside would push the stock to ~$2,650, less than 30% higher than today.

Excellent returns for such a compounder.

But that’s assuming growth doesn’t slow an inch - lower growth = lower multiples, & margins remain stable. Entirely possible, nothing pointing to the contrary. Not yet.

From here, I still wouldn’t be a buyer. Why? Because I own 7 assets today, and all my positions have a potential return > 50%. I am better off accumulating than opening a new position, based on my assumptions - which could be wrong but it’s the only thing we have in the markets.

Then comes price action.

A three-year uptrend without any significant close below the weekly 50, now broken. Not only was the average broken, but sellers show up constantly on any retest. This shows clear intent to sell any pump while buyers don’t step up because they don’t consider the stock worth that price - not enough of them at least.

Maybe they’re wrong. Maybe they aren’t. But even if I were to like everything - and I do not with that price action, this stock doesn’t have better potential than my other ones… So I’m better off accumulating those.

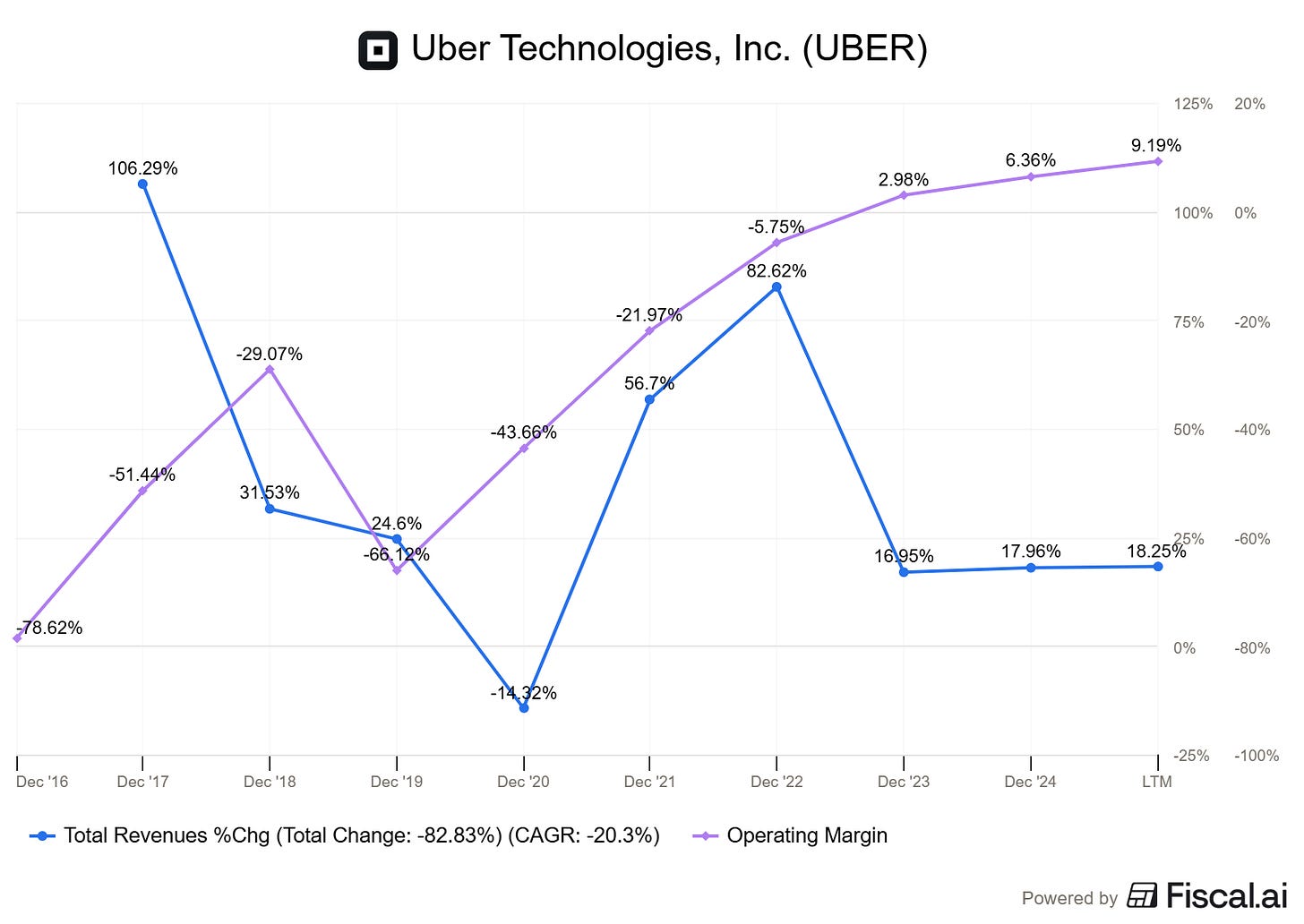

Uber.

Another interesting case; a mesmerizing one. My perception of Uber is very simple: Tesla exists. And yes, this sounds stupid, and I believe it is too. Yet…

Autonomy will be a massive market. Tesla will be part of it but won’t monopolize it & Uber owns the users. Any player has to pass through them or they won’t have clients otherwise. They are the gatekeeper for any player without a fanbase - everyone but Tesla.

How do we justify a company growing 15%+ consistently without any sign of slowing down, expanding to new & very demanded services, a massive & constantly growing (and satisfied) user base, impressive operating margins, massive opportunities with autonomy to expand them further, constant, growing cash generation... trading at only 3x sales?

I personally don’t justify it. And I believe that for the exact same reason Tesla has a “dreamer” premium, Uber has a “Tesla” discount.

Everything doesn’t have to make sense. Maybe one day the market will wake up to Uber’s user base and quasi-monopoly on demand, maybe Tesla will partner with them. But until then, isn’t Uber doomed to be discounted?

I’d love to be wrong. But I’m better off with my own assets, even though I’d love to be a shareholder of such a company.

Meta.

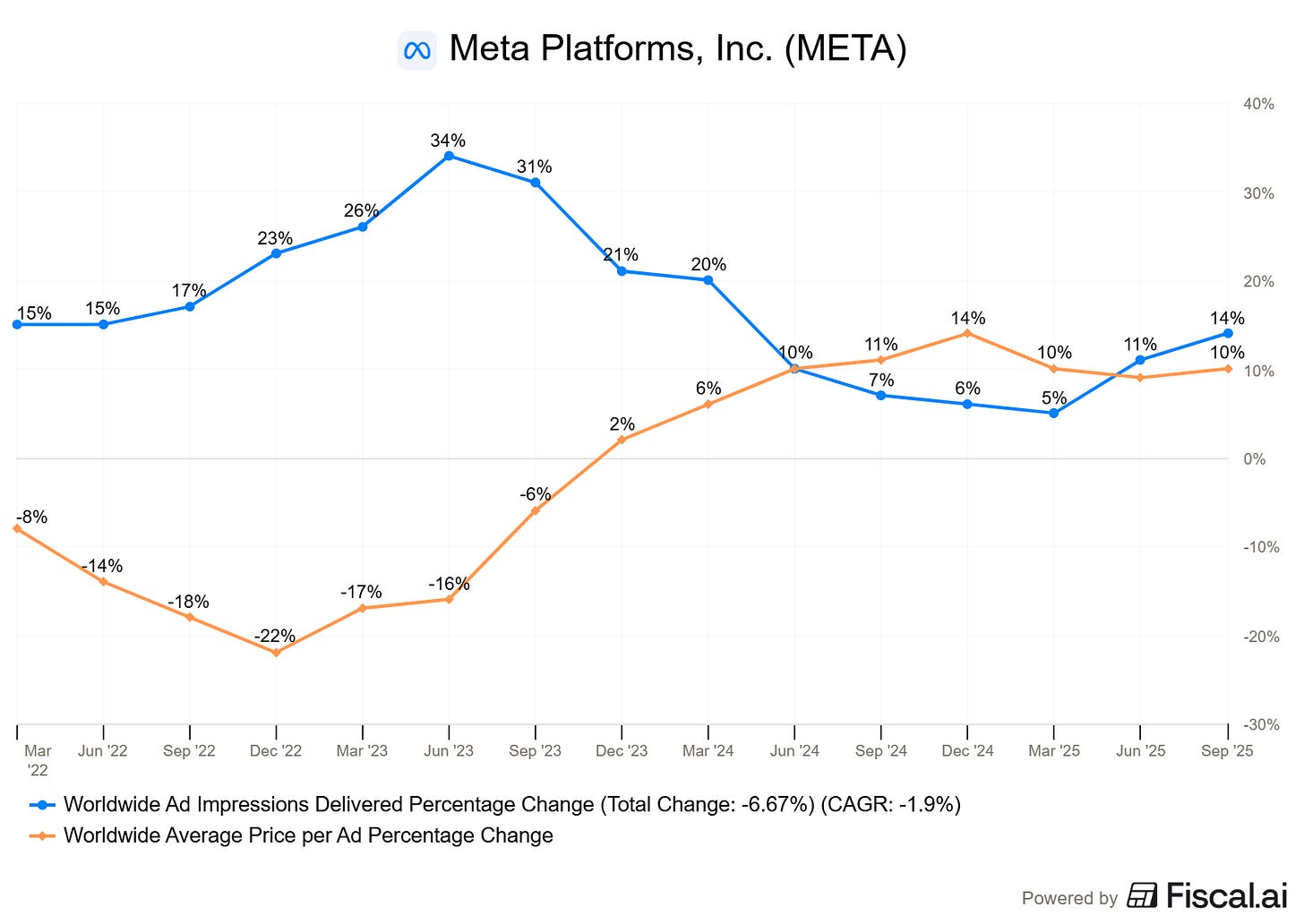

One of my favorite companies, with what I consider to be the best management one could find. There is nothing to say against Meta. One could disagree with some of their choices and methods, but the facts are they own the best advertising business in the world and have been managing it perfectly, taking risks that have often paid. Now they are taking even bigger ones.

AI CapEx. What if all that spending turns out to be worthless, all those data centers without demand, AI without use cases?

As of today, it’s hard to quantify the ROI for such spending. I’d argue the spending has already paid off in a more efficient advertising service, but can improvements continue? And are they worth the spending acceleration?

With Zuck screaming all around that they will continue and increase that spending... the market doesn’t like it.

So execution risk is worry #1.

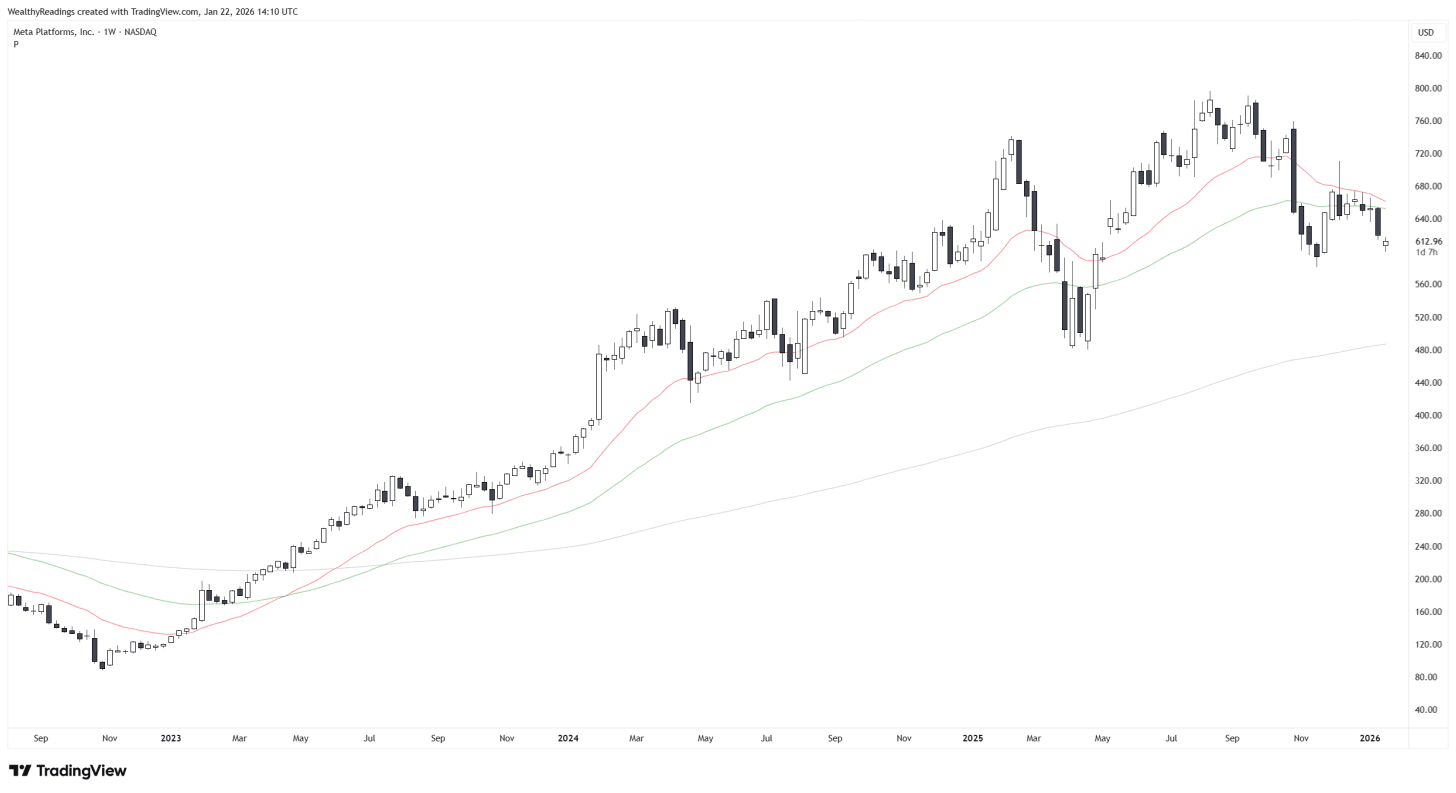

The second is the same as MercadoLibre. I believe Meta’s fair price is around ~$600, where we’re trading today. Many are happy to buy this stock and I understand why; this is probably my favorite company in the entire market so you understand I’d love to own it. But buying at my fair price means the upside is limited, based on today’s expectations. Meanwhile all my assets are expected to deliver >50% within a year.

Then comes price action, which looks exactly like MercadoLibre: clear selling at key levels, something that did not happen since the start of the bull run in late 2022.

Excellent company, correct returns to be expected, clear and well-identified risks that are growing as management doubles down, and unfavorable price action.

Meta will be the first stock I buy once the opportunity is crystal clear. But it isn’t today.

Others.

I could add many names to this list but I’ve already covered them elsewhere, including Hims and PayPal. Investing isn’t playing Pokémon; the goal isn’t to catch them all. It is to catch the great ones, the ones that can make a difference. I’d rather own names I love, but if it isn’t where the money is... Why would I?

Investing has to be treated like a rigorous job. The goal remains to make money, not to be pleased with our Pokedex.