Tesla | Investment Thesis

The one who wants to change the world.

Tesla is a very complicated topic and I'll do my best to simplify it as clearly as I can. I'll start this write-up with the conclusion, to change a bit.

Tesla's goal is to help the world transition to cleaner energy sources, and that is what they've been doing with their EVs and energy branch since the beginning, against all criticism. And it has become a pretty healthy and growing company. They are now pivoting to focus on new markets, new potential disruptions, namely self-driving cars and robotics.

This is the only viable investment thesis on Tesla: that they will succeed in those disruptions. It is to believe in the future, to believe their engineers can pull off the impossible and to wish to be part of this adventure. There's no other reason to buy into this ticker but to be an overly optimistic person, wishing for innovation to happen and for Tesla to be the one bringing it.

And if they do, the company will be the most valuable one on earth.

[Company]

Everyone knows Tesla and everyone has seen their cars on our roads by now, but I'll close the debate in these first lines: Tesla isn't just an automaker. I'll make my case. You can disagree, but this is the perspective used in this write-up. Keep an open mind going further.

EVs. Everyone told them it couldn't be done and that EVs were only a dream. Tesla made it happen and made it its first and biggest business.

The company now sells five different models: the Model S, 3, Y, X, and the Cybertruck. I won't dive into the cars' details, different designs, capacities, prices, etc. That is even more true for the Cybertruck, which also has a very specific clientele. There's not much competition to their products; you can of course talk about BYD or other EVs from traditional constructors, but... No. I am not even talking about tastes here; I am simply talking about quality.

I don't live in a cave and know BYD overtook Tesla in term of deliveries in Q4-23 and that they are growing rapidely but their products are different. I'll go through why Tesla's cars are better and how the Model Y became the most sold car around the globe later on.

I try not to be biased though, everything isn't perfect and things need to get better in order to really scale their business and make EVs the first choice for clients - especially those batteries/chargers.

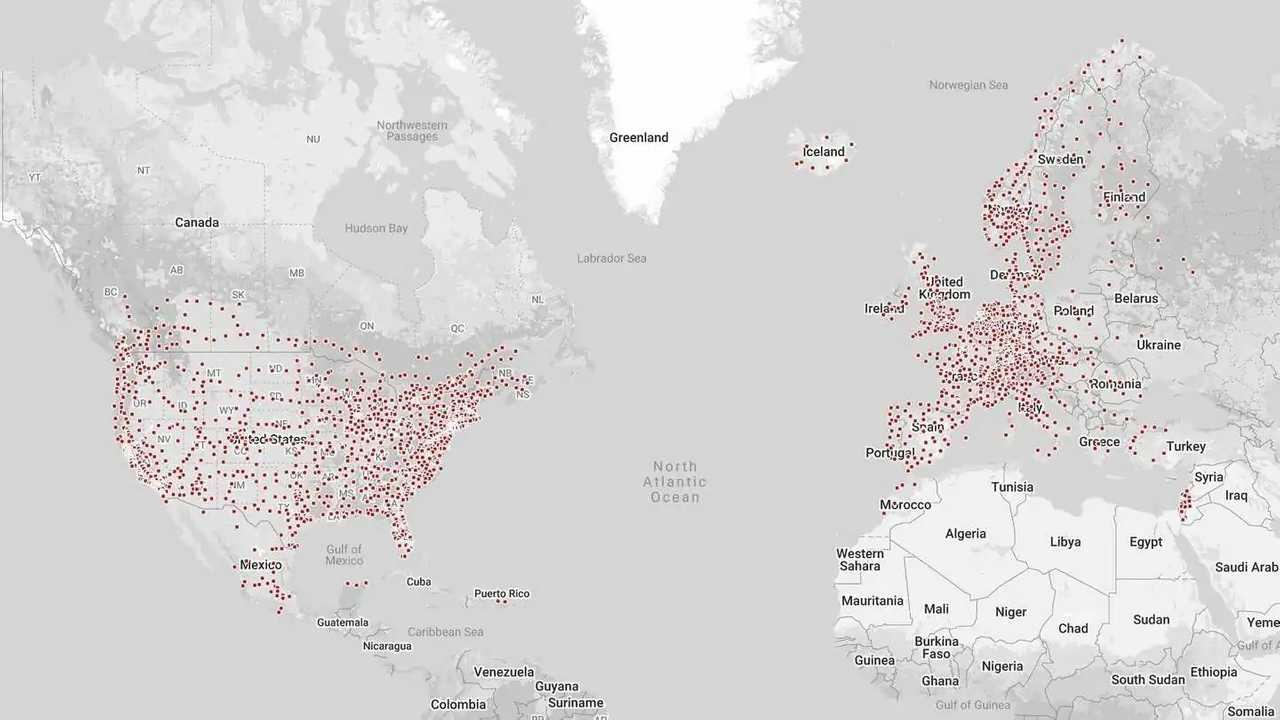

Chargers. This logically became one of Tesla's businesses, whether directly sold to their clients so they can install it on their house or via its superchargers infrastructures. Those are comparable to classic gas stations, a public source of energy to charge your car while the owner takes a fee.

The entire EV market adapted its plugs to their standard so you can now charge almost any EVs via those superchargers, while Tesla takes its fee.

There are more and more of those but it's still not enough.

Batteries. One rapid word about the batteries because Tesla produces some of them. The Model Y already integrates the 2170 cells and Tesla is working on its 4680 cells, which will power the Model Y and the Cybertruck in the future. They're also used in their power walls which we'll talk about just after.

The company also relies on a few third parties such as Panasonic or BYD. I think this brings Tesla above the status of "car company" already, but it goes further.

Solar products. The company already works on batteries and its mission is to help the world transition to clean energy. The logical next step was to provide opportunities to homeowners, they called these the Solar Roof and the Powerwall.

The Solar Roof is supposed to be a more efficient and stylish alternative to solar panels with smaller tiles capable of covering the entire surface, providing better performance. The Powerwall is the name given to the batteries charged from the solar energy.

The system is meant to power any electrical need, whether directly from the sun or from the batteries when our flaming ball isn't available. Full autonomy.

For more information: http://tesla.com/solarroof

Those products obviously go together but that's a theme with Tesla, we'll talk about this later.

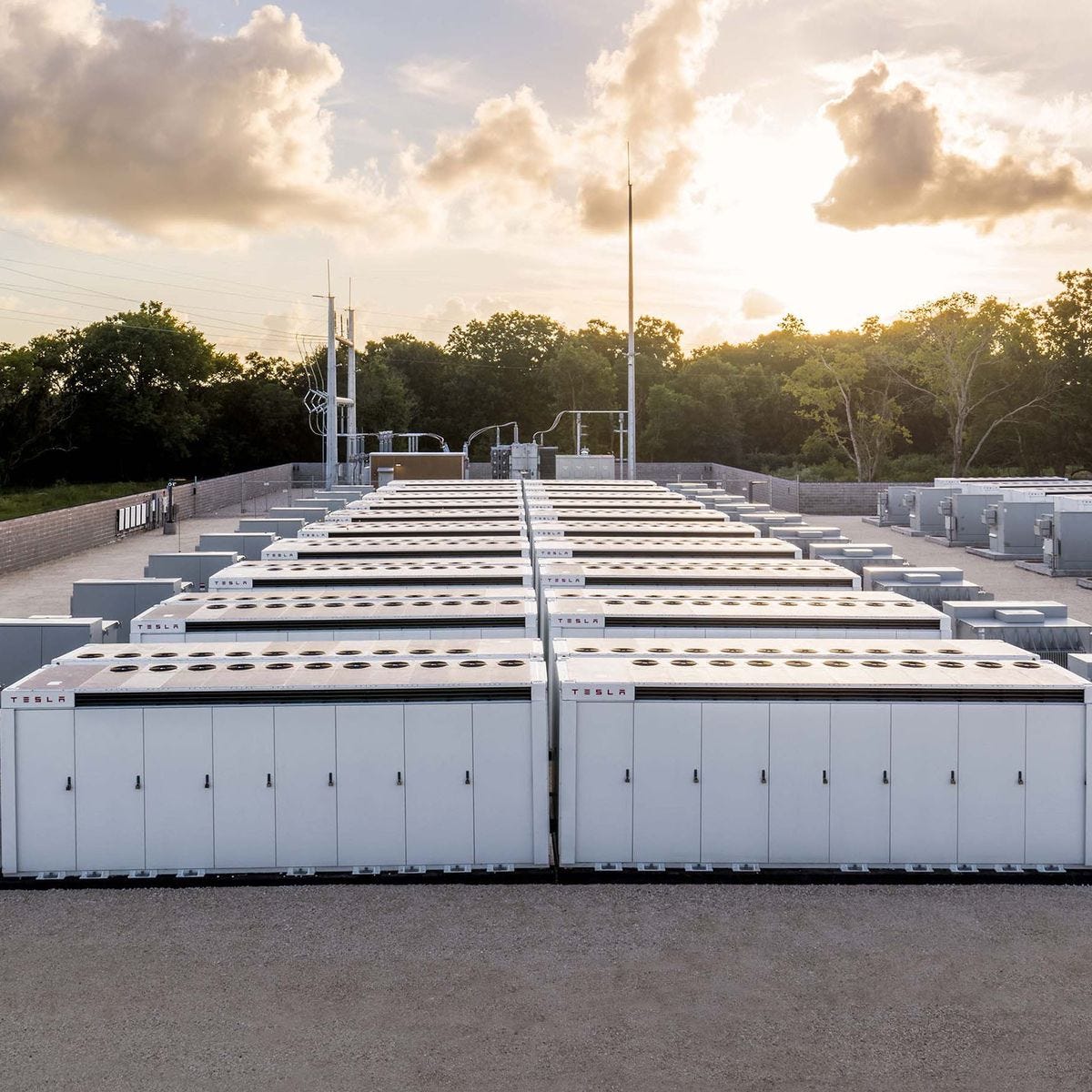

Megapacks. Powering houses with solar energy isn't done only by Tesla; many other companies are on the market - notably Enphase - but the competition reduces when we're talking about powering entire companies or small cities.

You can see the Megapack as boosted Powerwalls, a solution for storing various types of energy on a very large scale. Each unit can store 3MWh – enough to power 3,600 homes for an hour, according to their advertising.

For more information: http://tesla.com/megapack

These are most often charged with solar panel farms. The first product from Tesla not really directed to retail.

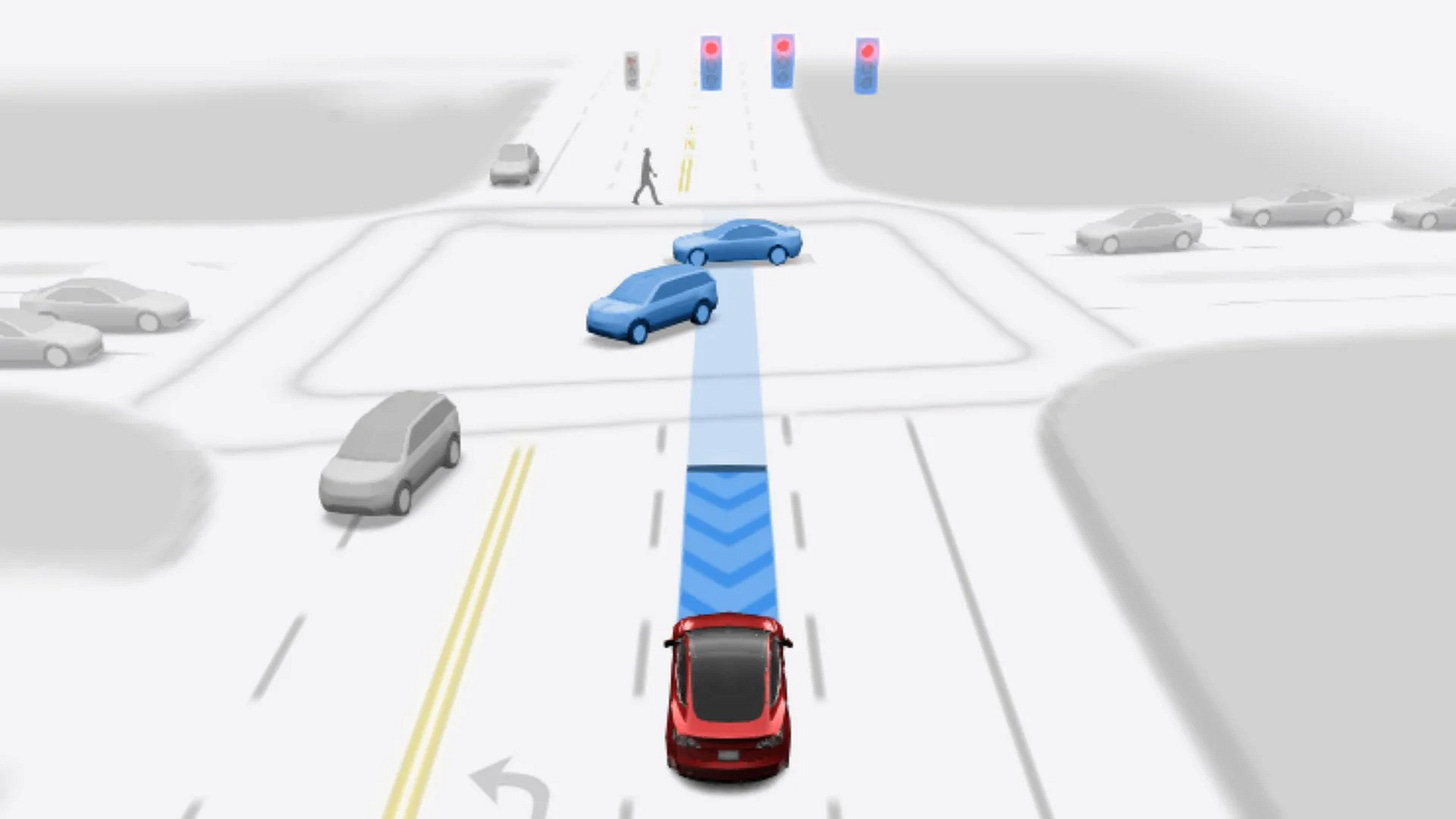

FSD. The Full-Self Driving software. I won't add it to the R&D section because it already exists - in a supervised form. The product is sold as a subscription for some Tesla owners and you probably already know about it; it's meant to give your car the ability to drive itself.

It's not ready yet, I won't argue, but there's nothing close to it out there. Saying the contrary is being unfair, undocumented, or straightforward dishonest... I'm not saying it will remain above competition, but as of today, it is.

Other companies can show things that look like FSD (under perfect conditions), but they're not. Google for example took a very different approach with Waymo in terms of software - and seems to not be working so perfectly. As of today, Tesla is the only one taking the bet on making its cars intelligent and autonomous, trained on an AI model and not based on code lines and hundreds of cameras.

Tesla chose to make their cars autonomous while the competition is controlling them, and there's a big difference. One allows them to make decisions based on their learning of what is the best thing to do. The other one is simply responding to orders on how to behave in a specific situation.

Tesla's tech is the only one really working on autonomy. And the only one that can scale.

R&D - Robotaxi, Optimus, Roadster & Semis. Now, I presented the products that already exist and are sold by the "car company" but there's more to it as their R&D clearly puts them on the podium of the most innovative (and interesting) companies - maybe even in history.

We could talk about FSD here as well; the software is far from complete and will require lots of resources and probably some years before deserving its name. But there's more.

First, Tesla works on new EVs, new models but also semis.

It isn't commercialized yet, but it is something Tesla's engineers are working on. As to when we'll have it? Not for a long time, and I honestly hope other innovations will become reality before the semis, but it's worth talking about it.

For more information: https://www.tesla.com/semi

Now the R&D part I'm really interested in is Optimus, the Tesla humanoid robot.

This is a focus point for Tesla and we receive regular updates on how things are going in terms of engineering or AI training, and things are moving - not as fast as many would like, but these things take time. Musk talked about selling it externally for 2026, but who trusts Musk for release dates? It will be ready when it is ready.

What's interesting with Optimus and puts Tesla in front of others (namely Figure) is its training. The company takes the same approach as for FSD and believes AI is the answer, training their robots on tons of data sets. Two products, same resources as after all, their EVs simply are robots on wheels.

This concludes the presentation of what Tesla does. Long, I know, but there's lots to say about one of the most interesting companies in the world.

[How do they make money?]

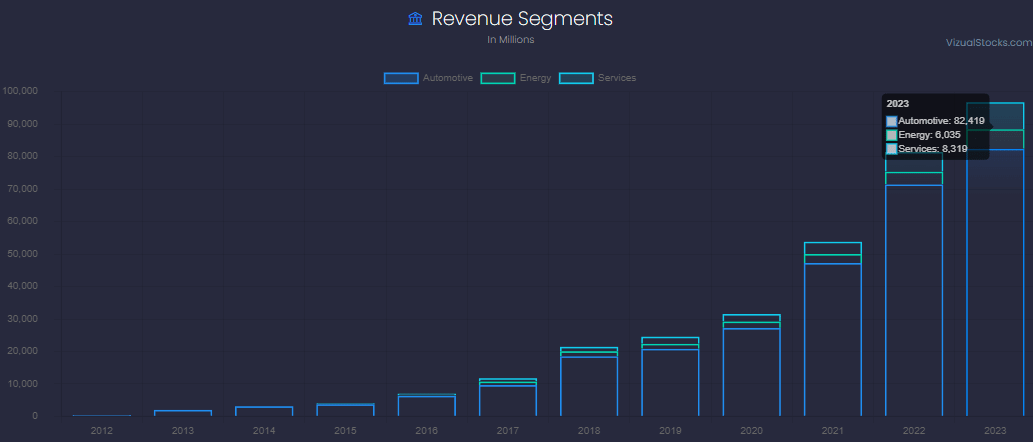

This is an easier question to answer and that is why many argue that Tesla is only a car company because most of its revenues come from... selling EVs. Hard to deny that logic, although it is the tree that hides the forest in my opinion. But let's not argue more: revenues come from their EVs.

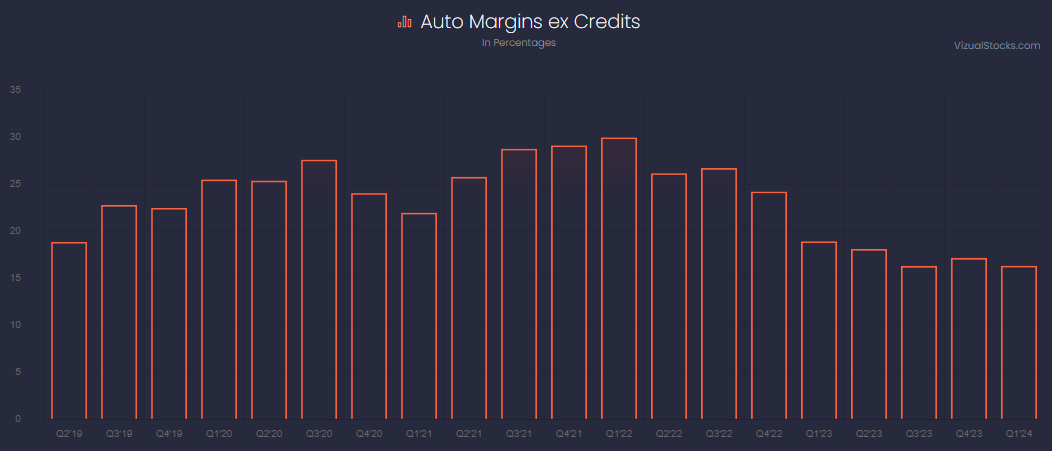

To be precise, 85% of them. I think the process is self-explanatory, but I can talk a bit about the margins as this is a discussion that divided investors a lot during the last year into two categories - or that's my take, feel free to disagree.

High magins. Some investors want Tesla to be a premium brand, and premium brands sell to premium users at a premium price. That is how Tesla began, with more expensive cars, but most importantly for investors, higher margins. But that isn't what Musk wanted, and it seems that investors didn't understand it. You don't help the world transition to clean energy with premium products.

Low margins. Their objectif meant giving the opportunity to every (or most) drivers to buy a Tesla. I believe the misunderstanding was that Tesla would still sell a high-margin EV model and would develop a lower-cost/lower-margin one. But management chose another option.

They chose to reduce their margins on all their models - setting them slightly above 16% as of today.

Tesla is all-in on this strategy, which displeased tons of investors. Although it has been an entire process for the company, which focused on cost optimization. Reducing costs and lowering margins meant reducing the end price of the product.

Competition. Low prices for a high-quality product mean destroying competition. No EV maker can compete with Tesla's price and quality, and that is solely because of this strategy. I did a more complete dive into this myself, but you can have a peek here.

https://x.com/WealthyReadings/status/1760689006558482721

No western EV maker can compete with Tesla, and all of them are bleeding money because consumers can have better, cheaper. Reducing margins put Tesla in this situation, with the potential of owning the entire EV market, at least in the west.

The only possible competition comes from Chinese brands, who can compete with Tesla's pricing - although probably not with its quality. They are still focused on hybrid cars and not fully EVs, so statistics are hard to really compare... But there's no denial that those companies are a true competition to Tesla. The only one.

Back to revenues. We saw most of the company's revenues come from their EVs but not all. Their energy and services branches are growing - we're talking about Solar Roof, solar panels, Megapacks and Powerwalls, superchargers, FSD subscriptions... These are all part of the investment thesis, but naysayers are right to say that they aren't significant.

Yet.

[Market]

I think you understand that it will be very, very hard to corner Tesla into a single market. We can put them in the solar market at large, but that wouldn't include FSD nor Optimus. We can, of course, compare it with the EV market, and I will, but it still won't be enough as we'd forget about Optimus, FSD, and the entire solar branch... There's no way to value Tesla properly.

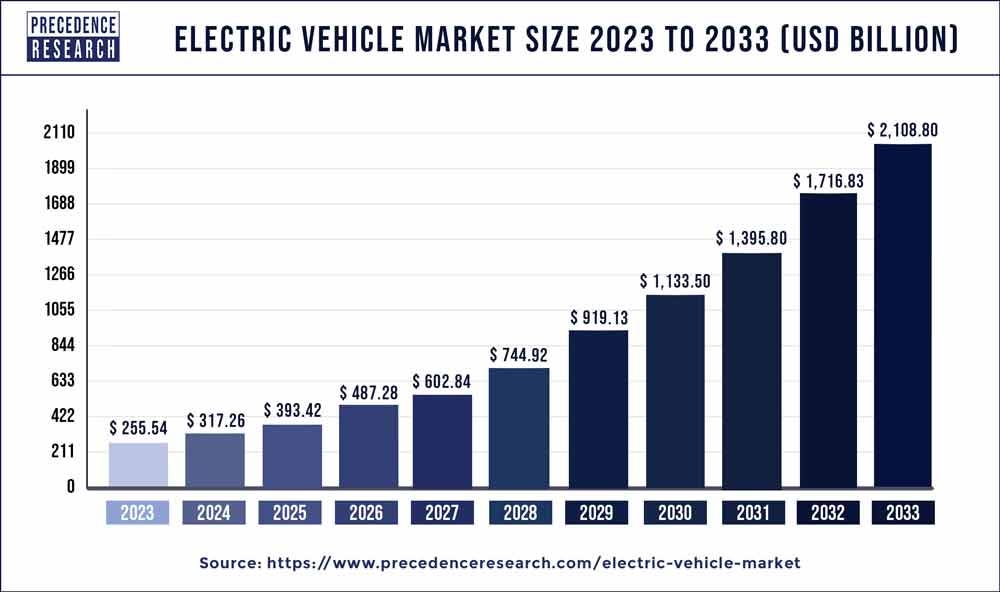

EV market. Let's start with the most obvious one and, of course, one of the biggest, as consensus talks about a market breaking the trillion-dollar mark by 2030 and almost doubling by 2033.

To be a bit more precise, those numbers include hybrids for around 30%.

"Battery Electric Vehicles (BEV) led the global market and accounted for more than 67.7% of the overall revenue share in 2023."

With only 70% of those numbers being BEVs, Tesla would own more than 45% of the market in 2023. It's hard to know if the brand will grow from there, but it clearly shows dominance and I am really not sure any western competitors will eat their market before long - all eyes on Chinese brands, again. I wouldn't be surprised if Tesla were to keep 40% of the entire market until 2030 - but I'll use more conservative assumptions.

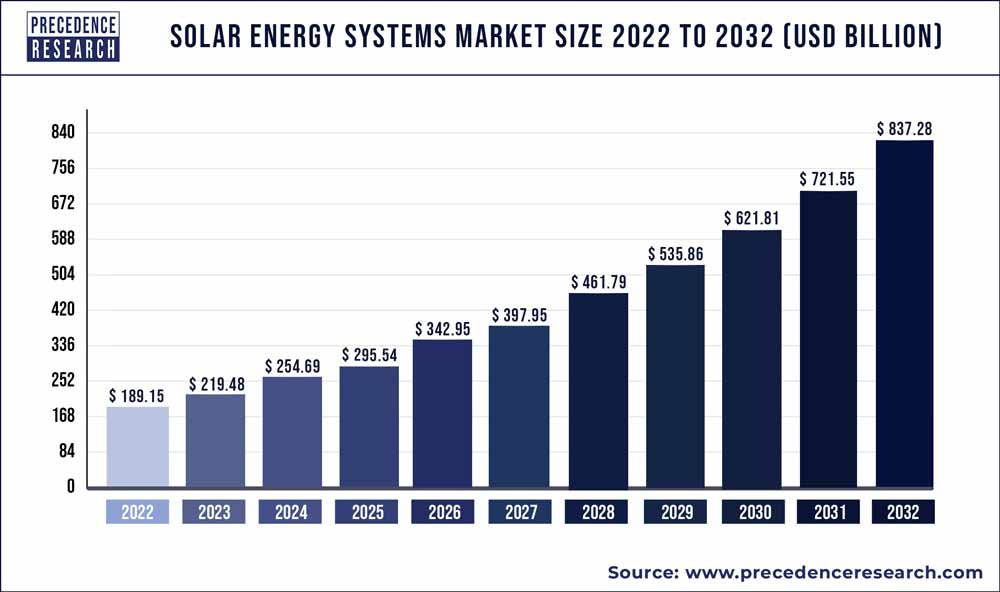

Solar energy market. Another rapidly growing market in which Tesla is involved - one of many.

This is a pretty "new" industry that has been growing very rapidly, helped by environmental regulations in every western country. Tesla is a very small player (approximately 3% of the market) in this field but is also playing a different game with the Megapacks and has been growing faster than the market. This part of their business could grow to more than $15B, assuming the company holds on to its market shares.

The potential for the supercharger won't be included in those numbers, though, and will be very hard to quantify.

Other markets. We have FSD, which is a market estimated to be around $100B by 2030, but honestly impossible to forecast - even by the best analysts, if those exist. This is just to give a number here.

The same goes for Optimus, as analysts clearly don't agree on where this is going, but most of the numbers are between $30B and $75B by 2035 - which is already a large range. My personal take is that we'll be able to talk about it only once the first is commercialized. Until then... there's, of course, potential but not quantifiable.

[Moats]

Now we start the most important part of my write-up, what is important to understand for Tesla and before investing in it. Tesla has numerous competitive advantages over the competition.

I'll try to give my opinion on most.

Cohesion. As I have said above, Tesla's mission is to help the world transition to cleaner energy - mainly solar. Some will believe it, others will call it bullsh*t but no one can deny that they have been focused on it and have developed everything to do so. This is the future Tesla imagines.

I personally like it, and this is now a reality for some. You can live in an electrically autonomous house thanks to their solar roof and Powerwall and drive an EV, which you'd of course, charge at home with your charger. All powered and sold by Tesla.

But the cohesion doesn't stop at the end-user level; it also applies to the engineering, development, manufacturing, and many other aspects of each of their products and processes. Think about the batteries. Those are used in the Powerwall as well as in the EVs, and the same goes for all the wiring. Tesla's FSD is trained with the same AI capacities that are now training Optimus, and this humanoid robot will be manufactured by the same gigafactories that produce the cars.

Everything is optimized; everything goes together.

Gigafactories. I'm sure many would disagree with me, that this shouldn't be considered an advantage over the competition, but... It is. Because there aren't many factories like these ones.

There are five of them: three in the U.S. (Nevada, New York, and Texas), one in Europe (Berlin), and one in China (Shanghai). Another one will be built over the next few years in Mexico, and rumors suggest we could expect one in India - though these are only rumors for now.

These factories are meant to manufacture everything Tesla sells, for its energy branch as well as for the EVs, and everything inside has been optimized. So much so that, again, the company should be able to produce Optimus at scale on the same lines as its EVs.

Cost optimization & Vertical integration. These go together and are due to the synergy of Tesla's products and its gigafactories. Having products with similar parts, technologies, or manufacturing processes reduces costs and facilitates operations. But Tesla has taken things further with an obsession for optimization.

Vertical integration is something no one in the car industry tried to do; they used parts from left and right and glued them together to make new models. But it wasn't possible for Tesla for two reasons: the fact that they were building EVs which don't have the same requirements or architecture and didn't exist back then, and Elon's obsession to have the toy he wants and not just something close to it.

These two reasons made Tesla's teams focus on creating exactly the product they wanted and forced them to rethink everything. And when you need new things, it's often faster to do it all yourself, and so that is what they did - rethinking and rebuilding what they needed from scratch. This is true for lots of Elon's project, SpaceX for example.

Vertical integration makes your products better because you do not have to make any concessions. It also makes it harder to build and more expensive (at least at the beginning). But you can ask Apple; if you succeed... no one comes close to your quality & users' experience.

Brand. And that's what creates your story. In Tesla's case (and Apple's), a brand that almost died at birth before becoming widely known for different reasons - two of them being an eccentric and perfectionist founder and a qualitative product.

I think honest people recognize it, and those who don't have never been inside a Tesla. You can dislike it, though, but you can't call those cars garbage - like me, I don't like Apple, but I have to recognize that their products are nothing but great. It creates trust between the end user and the brand, a trust that is proven by the brand's retention.

"87% of U.S. Tesla drivers say they’ll buy another Tesla."

Besides EVs, this trust also accelerates the clients' tendency to buy another product Tesla can provide, mostly their chargers as a first step and likely the entire solar infrastructure later on—panels and batteries.

AI capacities. We also have to talk about Tesla's AI capabilities, which are close to the other 6 magnificent. Not many have reached this level and that will give Tesla a big advantage when it comes to training Optimus and FSD. Who else would have enough power to do so?

[Finances]

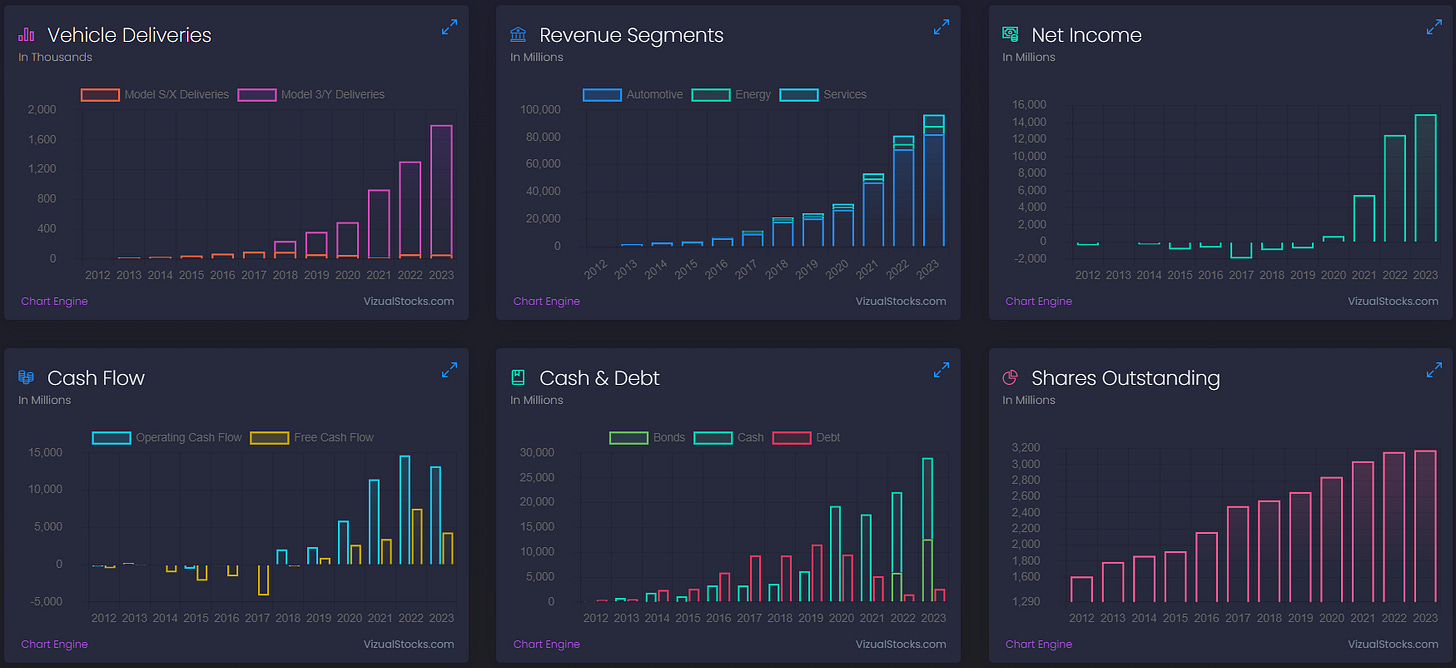

Tesla's history is fascinating. Very few believed in its potential but it ended up being an American success story - now profitable and very healthy. It wasn't always the case.

The company struggled to make consumers understand that EVs were the future and that their products were as good as any gasoline cars (they weren't, but now they are). It took the Model Y for Tesla to be widely accepted. Things changed from there.

Tesla became the example, the only truly usable EVs out there. Revenues started to flow in and continued as consumer appetite for their cars didn't wane. The company grew at a 46% CAGR over the last ten years. With growing acceptance and demand, Tesla shifted focus to profitability, achieving a net margin of 14% today, and investing in its future.

Tesla is now in a very healthy and profitable position. After facing near bankruptcy, management built a very strong balance sheet, maintaining a net debt of $27 billion today. Profits are now being poured into R&D and Capex to drive the company towards its next growth trajectory, be it FSD, Optimus, or its robotaxi fantasy.

Create a profitable business. Reinvest the cash on R&D. Disrupt another industry. Repeat.

[Risks]

Elon Musk. We can start with the most obvious topic and the one many naysayers like to discuss: Elon Musk. A phenomenon, a rock star to some and an ass to many. But let's leave personal opinions aside and focus on facts.

He has collaborated with people like Peter Thiel all his life, built Tesla when many, including Charlie Munger, doubted the viability of EVs. He founded SpaceX despite being told reusable rockets weren't doable. He also launched Neuralink, challenging the entire neurosciences. Musk is an idealist who believes he is making a positive impact on the world. Is this a bad ?

Musk's impulsive nature has sometimes caused volatility and short-term issues for his companies. Some accuse him of market manipulation, leading to potential legal concerns. Companies led by their founders often rely heavily on them, and this is true for Tesla.

There's no Tesla without Elon.

EVs demand. Now that these cars exist, they need demand, which seems to be slowing over the last few months amid high interest rates. The key question remains: Is it that people don't want Teslas anymore, or is it that they can't afford them despite price reductions?

While I have my own opinion, I lack concrete evidence - which is also true for naysayers. Yes, sales are slowing, but finding the exact reason is challenging. I believe high interest rates and reduced purchasing power are the main factors, not a lack of demand.

We'll now in a few years. As of today, no one knows for sure.

FSD Regulation. I don't know if it should be considered as a risk but it has to be mentionned. I'm pretty sure it will be years before FSD is working and regulations fully authorize it, especially outside of the U.S - especially in E.U.

Might be faster in Asia and China but things will take time. As for the stock I don't think regulations will be an issue, once FSD works the anticipation of it being accepted everywhere will be enough. Institutions take for ever but what really matters is if the technology is here or not.

Competition. I cannot list all the competition to Tesla as we'd need to talk about BYD for the EV branch, Enphase for the solar branch, Figure for the robotic brand, Google for AI & FSD and probably many other car constructors for other features. Tesla works on so many things that their competition is... Everyone.

That is to be kept in mind.

R&D. As I said in introduction, investing in Tesla is investing in the future, a disrupted future. What if Tesla just never bring its innovations to market? What if they can't solve the problems they work on? This is something to consider as investing in Tesla means believing they will.

They might not, and this is the biggest risk for any investment in Tesla.

[Opportunity]

We've covered almost everything there is to know about Tesla. Now, let's talk about its stock. Many readers know the rollercoaster ride that is Tesla's stock, and this volatility should continue for a long time. This is entirely normal.

The volatility is due to one main factor: investor disagreements. Valuing Tesla is extremely difficult. Everyone has different opinions and when you add emotions in the mix, any announcement can either skyrocket or tank the stock.

So, how to value Tesla?

EVs. Some would say Tesla should be valued solely based on its primary revenue source: EVs. Let's start there. The question is, how much is this really worth? I did a comparison with Toyota which suggests a stocke price well under $100 per share, probably around $60-$70, although both companies don't have the same growth.

https://x.com/WealthyReadings/status/1752357233118109840

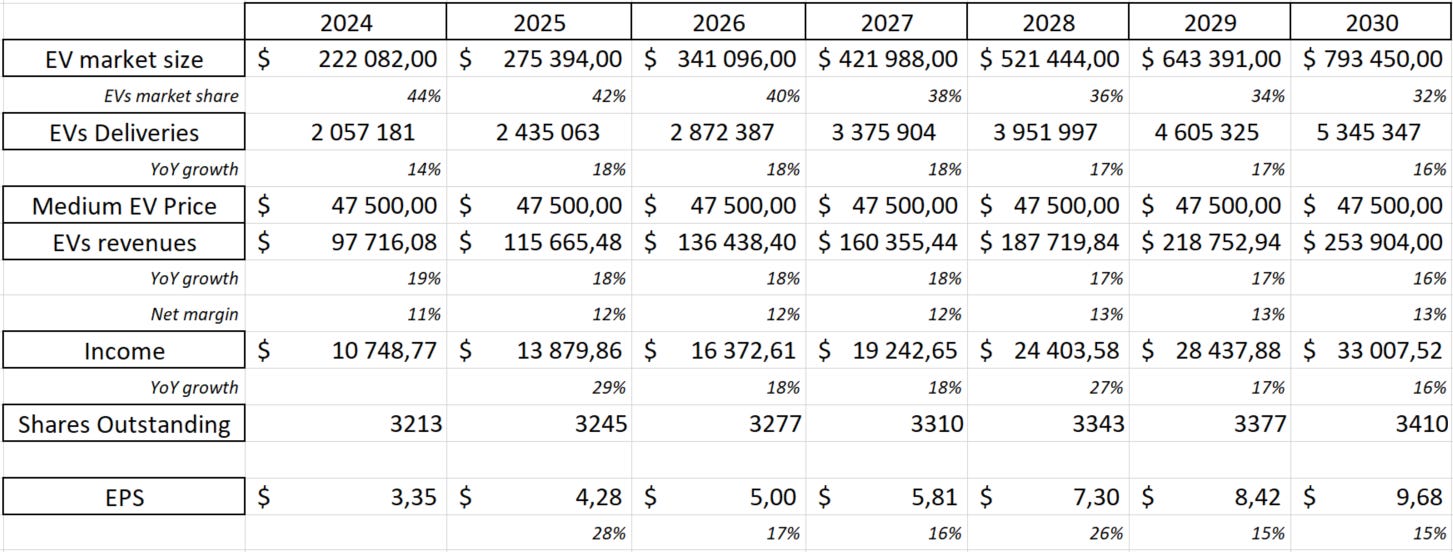

Let's make some assumptions.

Tesla will control 30% of the EV market by 2030.

Net margins will grow from roughly 10% today as Tesla continues to optimize pricing and manufacturing - lower number than in reality as I included costs related to Tesla global in this part of the projection.

The average price per vehicle will be around $47,500 over the next few years.

2024 will surely be more challenging than my projections. But selling 5 million cars by 2030 at a 13% margin doesn't seem overly optimistic - it's less than half of what Toyota sold in 2023.

Feel free to add the ratios you want to the EPS to value the EV business. If I were too, I'd still compare it to Toyota which trades at a PER of x10 - not very bullish right? You could also compare to BYD which trades at x30 - bit better but not crazy.

Car companies generally trade at a P/E ratio of no more than 30, with most trading under 20, depending on their growth rate. Hence my assumption that the stock would surely not trade above $100 if Tesla was only an EV maker - probably much less.

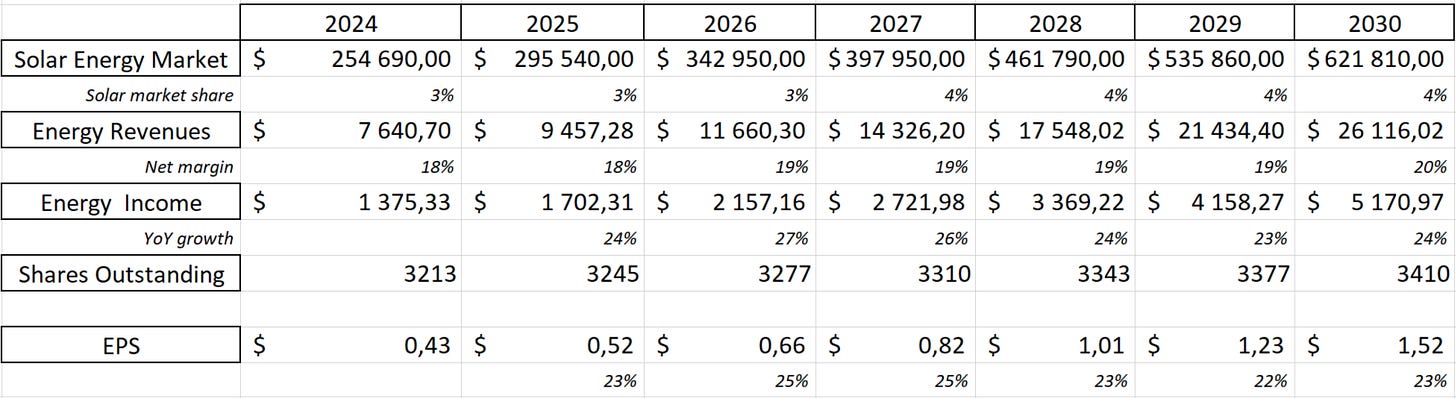

Energy. But Tesla has more up its sleeves, starting by its energy branch growing over 30% CAGR the last five years, above the industry average of roughly 15%, taking shares of the global market so we could expect this trend to continue.

The assumptions are comparable, a market share slowly growing up to 4% and net margin slowly growing up to 20% as the company improves its products & services prices. This would mean more than 20% CAGR growth to 2030, lower than what Tesla did over the last years and slightly above the market's estimates. Again, nothing overly optimistic.

The EPS computation might look silly as those are two businesses inside the same company but I just wanted to add it for the visual and if you want comparisons, Enphase is trading at a PER around x60.

Add this rapidly growing branch of Tesla to its EVs and I think we can agree that the company is easily worth above $100 per share - still not $180 though.

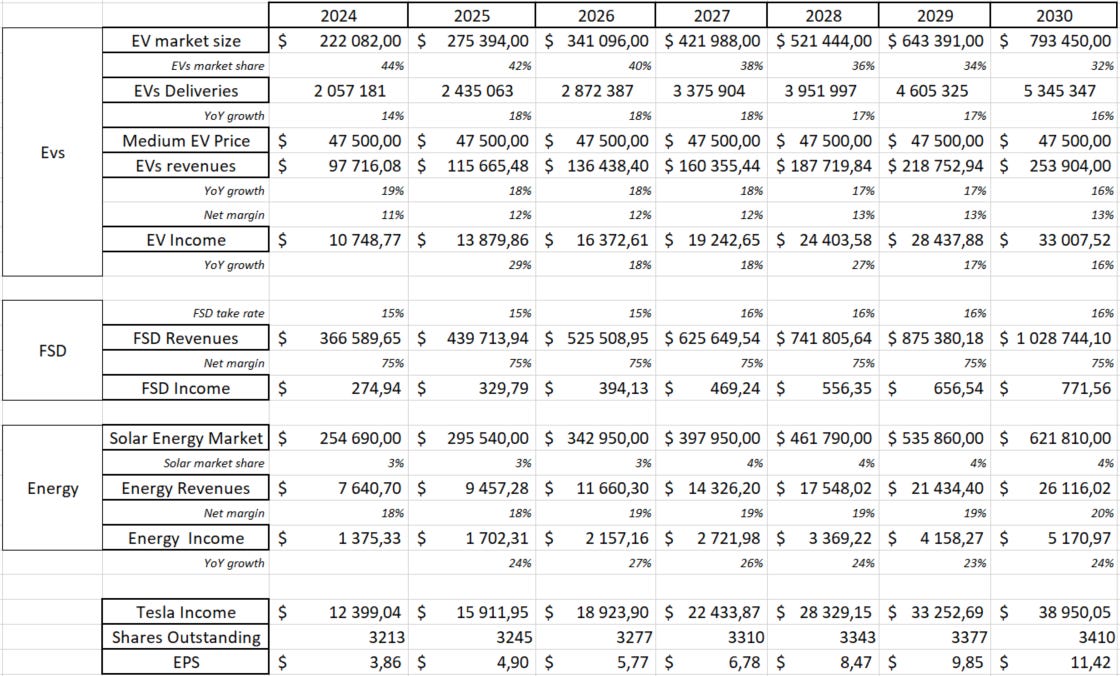

FSD. Now, can we really quantify FSD? No. As of today, the software is sold for $99/month and is deployed to half a million vehicles - according to Barrons' analysts. We could do projections assuming a take rate and a margin and have some numbers.

But it honestly makes no sense in my opinion as FSD will bring meaningful revenues only on the condition that it is what it's advertised to be: a Full-Self Driving software. And once that's what it is, those computations become useless because it'd be one of the most valuable software on earth.

But we'd still have some users even if it isn't perfect, so we could quantify it.

What have the above assumptions taught us? That Tesla is hard to value only taking its actual business but if I were to try, I would have something like this.

I know net income projection is less than FY-23, but those are only assumptions.

Then, if you want to find a fair value for the entire business, you'd have to agree on what multiples to use. Car manufacturer multiples with a P/E ratio around x20? Energy/solar multiples with a P/E ratio around x55? Or AI company maybe, with multiples high above x60?

Is it really overvalued today with a PER of x45, which is kinda in between all of those industries? Serious question. That is the reason why Tesla is so volatile, because everyone has a different answer at this question at a different time. I would personally not buy in for the energy & EVs branch only. Never. And if I had to, I wouldn't feel very comfortable buying above $120/$130.

[Thesis]

But it isn't what Tesla is about. Tesla is an investment in potential disruptions, lots of them, and I honestly think that this section isn't very useful - and you read it all... It's interesting to have a rough idea of what exists & its value, but well... It doesn't really help. This might:

The investment thesis on Tesla relies entirely on its R&D, namely Optimus and FSD. Nothing else, and I do not believe anyone buys Tesla at $175 for its actual business - if some do, I'd really like to meet those strange people...

To my opinion, only one kind of people invest in Tesla. Optimists who love innovation and want to be part of it - even if it's only for a few dollars because this is what investing is about, giving your money to entrepreneurs, capable of taking risks and potentially reaping the rewards for those with your investments in their backpacks.

FSD. The potential for FSD is simply impossible to imagine, and its impact on Tesla is also very hard to quantify. Humans have been dreaming about flying cars for years, but not many imagined those driving themselves, and yet, that's what Tesla is working on - not the flying part of course.

Imagine your cars safely driving you everywhere you'd like to go. It won't replace the train nor the plane, but it will certainly be worth a monthly subscription to many because a world where you don't need to drive is a world where you have much more free time. And safer roads. And unlock revenue streams for Tesla.

First, the direct revenues from the subscription with software margins and a strong demand. Second, they'd sell more cars. If you have the monopoly on self-driving cars, you sell more of them. Third, they'd license the software, easy revenues at very, very high margins and probably overpriced as once more, they have the monopoly and if end users want it at a correct price, well... Vertical integration.

They should buy a Tesla, right?

Robotaxi. Things go even further with what Elon called the robocab on the last earnings call - a specific car designed to drive itself as a taxi.

If you can imagine what Uber does without a chauffeur, you already understood the concept; it's that simple. Add to it the capacity for Tesla owners to add their cars to the pool when they don't drive or during their holidays, and you get another reason to buy a Tesla - it generates revenues when you don't drive it. Again, you sell more EVs.

Sure, it looks like science fiction today. But that's also what investing is.

Optimus. Now the last piece, the humanoid robot. This is estimated by many to grow to a $100B market by 2030, but let's make something clear before estimating revenues: Optimus isn't like what you can see elsewhere. Most robots nowadays are designed to do one thing and do it all day. Optimus is supposed to be trained by AI to behave like a maid. It's not like in the Amazon warehouse, it should be able to understand what you ask from him and execute the tasks.

Again, autonomy versus control.

This one will need years to be close to finished but I do believe if someone can pull this off it'll be Tesla. But they're not alone in the market.

There's no way to quantify those innovations if they hit the market in the next five years, but I'm sure you understand this would disrupt many industries and would easily lead Tesla to be the most valuable company on earth, as one of those would also generate more demand for the rest of their products. A virtous circle, for the company, for investors & for the world.

[Conclusion]

You can start from the top again as the conclusion and the introduction were meant to communicate the same message. Investing in Tesla is being optimistic about innovation, believing that they can bring those innovations into our world in the next 10 years. If they do, Tesla will be greatness.

I'll be fine if they don't.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!