Weekly Recap 1 - January 11th

New position, Supreme court judgement on tariffs, Venezuela update, Amazon compute pricing, Transmedics flight data, New GLP-1 pill & Weekly planning.

Hello everyone!

Quick reminder: the database is live and updated! You can check it out here.

I’ve updated everything after the weekly close and I’m doing regularly, so you can check it up whenever you feel like for updates.

Buying Lululemon

I’m making a small change to my portfolio. I decided to buy Lululemon despite saying I’d be waiting on my quarterly review.

I’ve only opened a pilot (small) position to get started without being aggressive. My perfect entry price is still around $190 and I’ll only size up if we see confirmations.

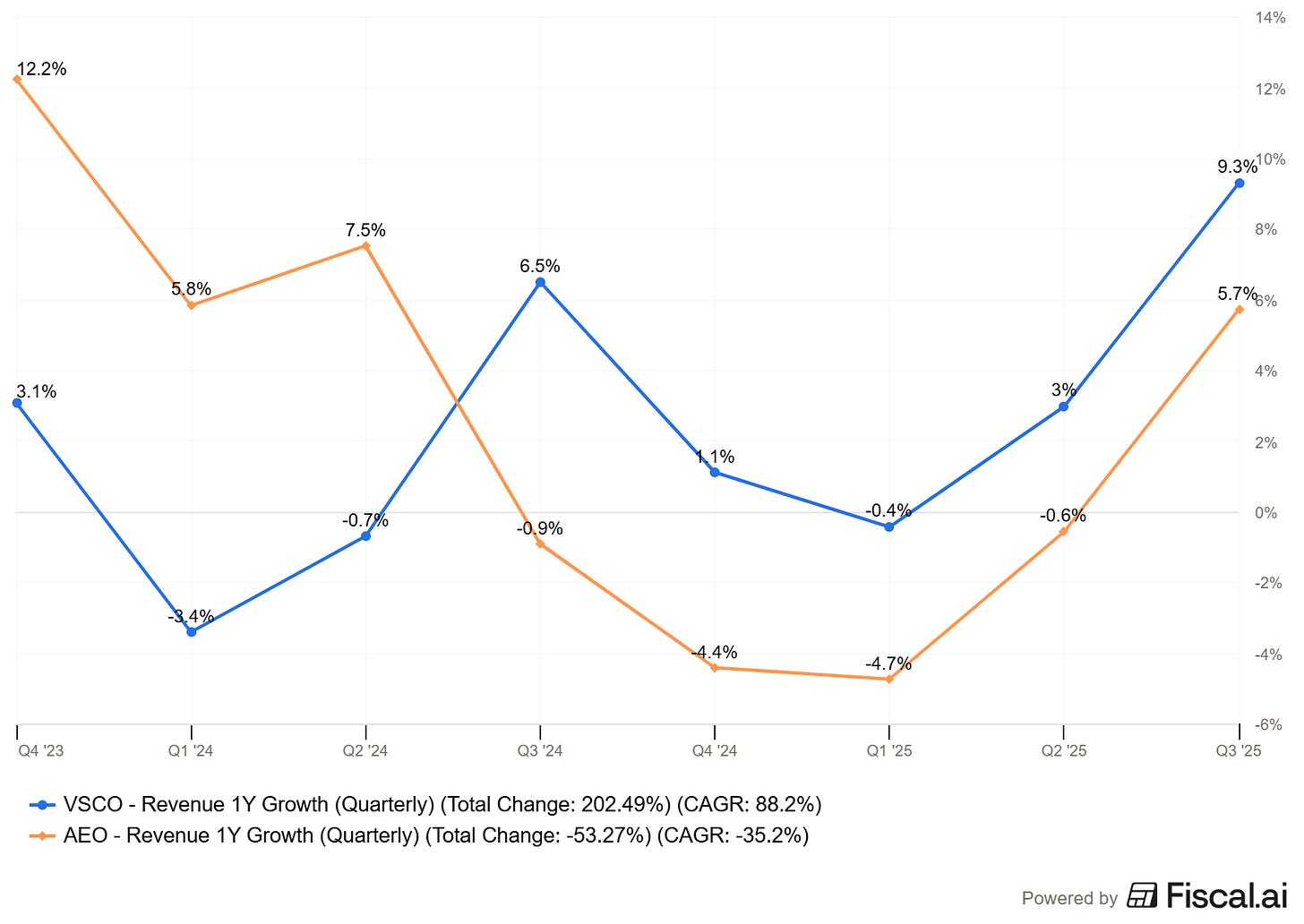

Why the change of heart? Because of peers. American Eagle and Victoria’s Secret are up 122% and 197% in just 20 weeks. Are they better companies than Lululemon?

Nop.

They had problems - comparable to Lululemon, and fixed them with a clear strategy. The market anticipated the recovery, earnings confirmed it, and the stocks are up big time. Chart-wise, they followed a classic pattern, something we are familiar with.

Breakout → Retest → Breakout → Retest.

And Lululemon is setting up exactly like that. They have a plan to fix Western growth, easier YoY comps and a booming international business. We’ve had the breakout and we’re close enough to the perfect retest - at $190.

This is why I changed my mind. The similarities are real. I think early 2026 could be the start of a massive comeback, assuming earnings confirm that their plan is working.

Pilot position now, and let’s see where Q4 & price action goes to be more aggressive.

Supreme Court & Tariffs

This was supposed to be the big news this week, but we’re still waiting for a ruling. It’s been pushed to next Wednesday, without guarantees. I’ve seen many “expert” takes on the ruling and on market’s reaction, but the truth is none is predictable. Not even remotely. There’s a bullish and bearish case for both outcomes:

If ruled illegal: Will companies get refunds? If the government pays them back via stimulus, the market will love it. If not, finding the money will be hard and the market won’t like that.

If ruled legal: Nothing changes. The market likes stability so short term, great, but it means tariffs can be used and therefore, will be used once again as negation tools and put pressure on lower-income households.

There’s no telling the ruling, the reaction nor when we’ll have the ruling, so I wouldn’t overthink it. Things will happen, what matters is to have a plan and stick to it. We will not be able to anticipate anything here, even though I personally think any decision will please the market for sportswear names - On Running & Lululemon, as they either see their tariffs removed, or finally have a stable framework to move forward.

Will Venezuela Open?

As usual, I won’t talk about politics or ethics, only the business consequences of what happens around the world. Venezuela was an authoritarian country under Maduro & the state had a tight control on… Everything.

And After Maduro’s “removal”, the market is anticipating a new leadership - probably more opened to free market than Maduro was.

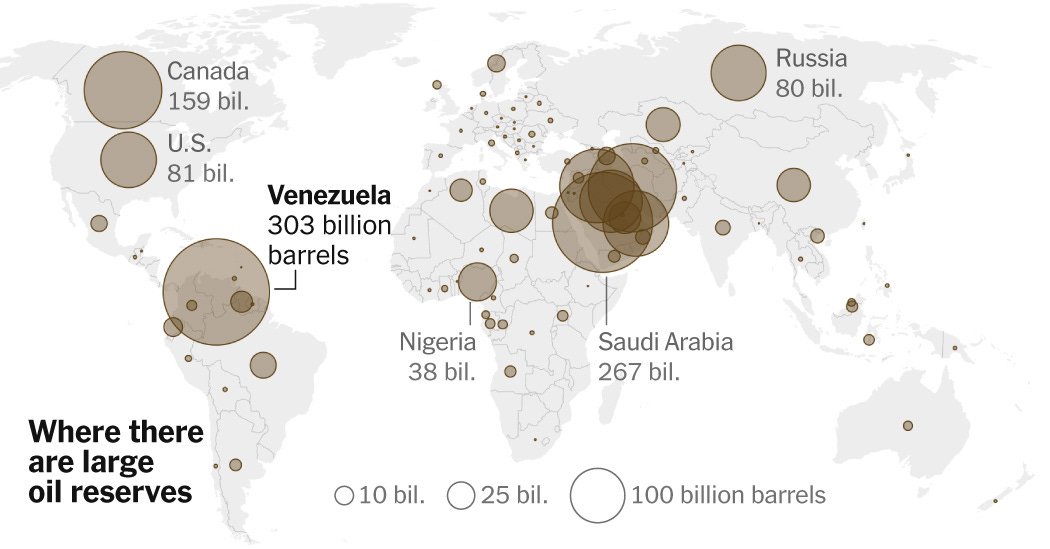

Now, the country has massive oil reserves but isn’t even a top 10 exporter, for many reasons not all tied to politics - sanctions & poor infrastructure being some.

With Maduro taking some vacations in the U.S., a new leadership could change things up there and open the country to the rest of the world.

This would be a massive opportunity for many, but oil companies would be the bigger winners as everything is to be done, starting with infrastructures. Halliburton and Schlumberger are the obvious choices here as they could help redefining everything in the country’s oil exploitation. Both are already up massively since I mentioned them - over 1,000% with my option play.

MercadoLibre could also benefit as a new market opens for their fintech products first, as the country as been miserably poor due to its currency’s management over the last years, and for its e-commerce platform later.

The market is already pricing in this “reopening”. but if it were to happen, it would take years to see real results. But the market is a machine of anticipation.

Amazon Compute Pricing

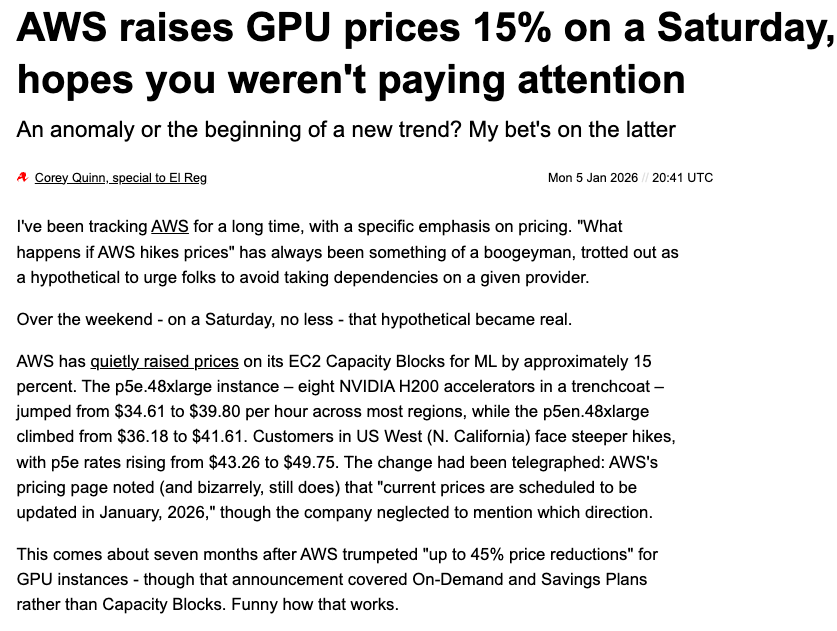

Amazon just raised its cloud compute prices by 15%.

This includes H200 clusters and long-term, locked packages. If clients want to have a dedicated compute for a defined period of time, they’ll have to pay more, on all GPU generations.

You don’t raise prices on all generations for the most demanded compute package without a clear and rising demand. This is a method to filter demand by those who can pay the most.

This should be a clear sign for the market that AI demand is very healthy.

Transmedics Flights & Conference

Their jets are flying non-stop. They are averaging ~33 flights/day despite only having 22 jets. Not sure if the double shifting is the reason for this, or if demand has surged, but this is a first in Transmedics’ history.

Luckily, we have the J.P. Morgan Healthcare Conference tomorrow for more details. I’ll do a detailed recap if the content is worth it.

Novo Nordisk GLP-1 Pill

Novo officially launched its weight-loss pill this January. This means Q1 will give a real look at the revenue it generates.

I have no doubt the pill will be popular - many avoided GLP-1 because of needles, and those will now jump in. But it’s still unclear what it means for Novo in term of growth. The pills are priced between $149 and $299, much lower than the ~$350 price tag for injections, and Eli Lilly’s pill is also coming, soon enough.

I’m not yet convinced that Novo’s growth is back on the menu. I still believe the stock will be a great buy eventually, but I am waiting for the price action to prove it, or clear numbers showing growth.

And price action is getting better, but we’re far from an uptrend compared to what X is telling you. Don’t let the recent 35% gain make you think you’re too late. Most have been buying heavy since ~$100 and those are still underwater even if parading on X due to that small pump.

As I’ve said, and proved before: there is no rush. I’ll wait for a great setup.

Weekly Planning

Earnings season kicks off this week with the big banks. Nothing interesting for me until next week.

Content wise, I’m working on some alternative ideas, a write-up on stocks I don’t usually discuss with a great setup right now & potentially Transmedics’ conference commentary, depending on the data.

Until then, the database is updated and ready, and I always appreciate your feedback.

Have a great week, guys!

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.

Love the content. Regarding HAL and SLB, thoughts on the counter-argument that Venezuelan oil can only feasibly be produced with brent pushing $80s, which seems quite a bit away?

New live graph is amazing. So detailed. Love the little write ups when you click and buy prices! 👏🏼