Various Earning Reviews

ASML, Meta, Microsoft & Tesla

ASML

Without much surprise, ASML delivered a massive quarter and gave reassurances that the coming quarters and years will be equally strong.

It was a record quarter in terms of revenue. It was a record quarter in terms of order intake. It was a record quarter in terms of free cash flow generation.

The stock moves on two metrics. As the company sells only a few units per quarter which take months to manufacture, bookings are more important than quarterly revenues. Cash generation and usage is the second important variable.

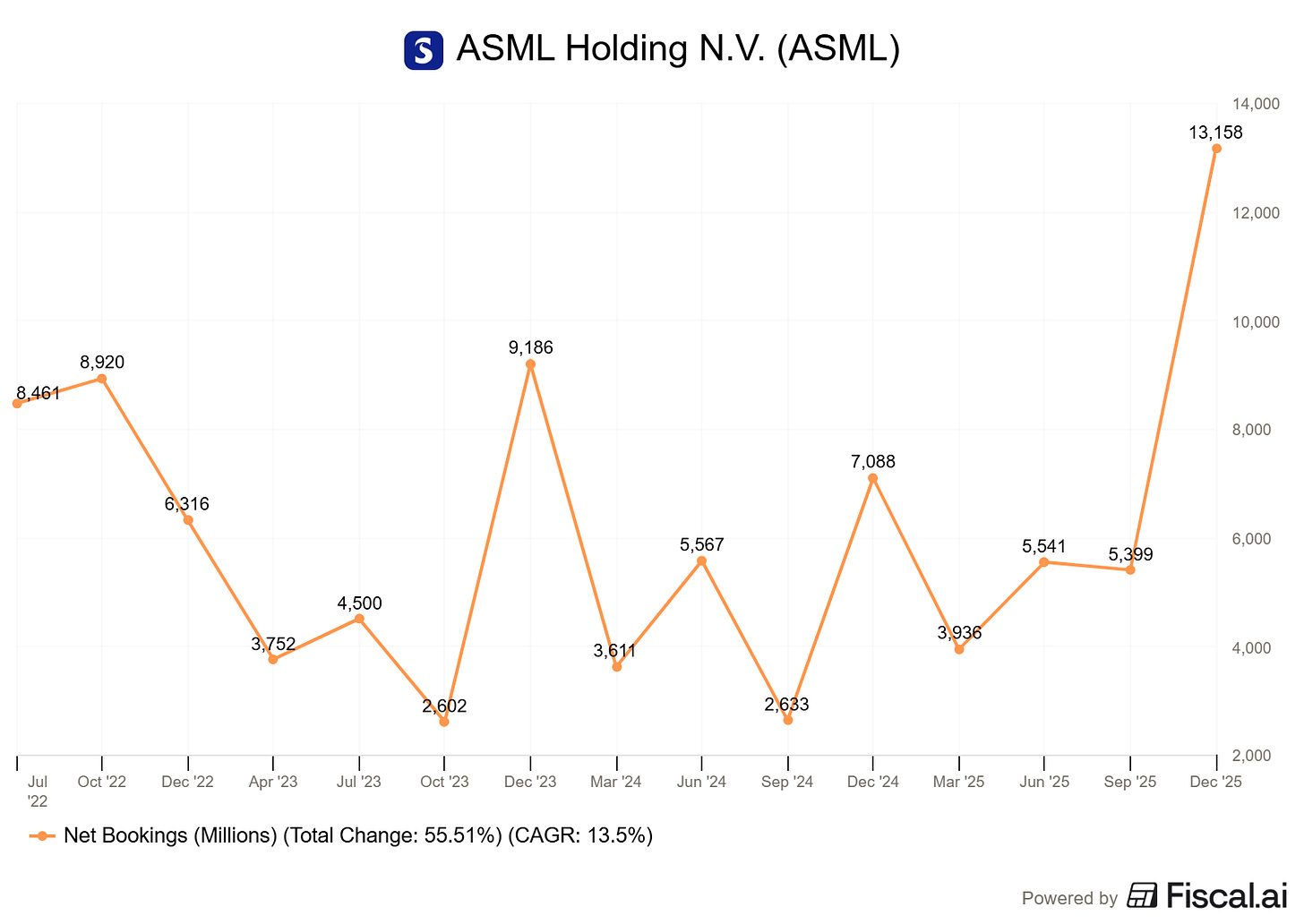

Bookings & Demand Cycles

The company crushed expectations with net bookings above €13B and a backlog of €38.8B confirming the bullish demand trend for lithography hardware.

We knew data would be great as TSMC and other fabs said they will expand their infrastructures, which means they’ll need more lithography hardware.

The market outlook has improved notably over the last months specifically as related to the continued build-out of data centers and AI-related infrastructure. This buildup is now translating into additional capacity needs at our advanced logic and DRAM customers.

But logic demand was only part of the bull case as we’ve also seen that memory demand was through the roof. And of course… they also sell those.

Memory is most probably the bottleneck for AI today... DRAM prices had risen significantly in the last few weeks, pushing memory customers to move very aggressively on capacity expansion because capacity is also market share.

The first part of the cycle - demand for logic lithography hardware, isn’t over. And the second cycle - memory, is only starting.

Cherry on top, management shared that these numbers came with China reducing as a proportion of sales from 35%+ to ~20% FY26. Less uncertainty.

Cash Generation & Management

Not only will revenues grow, but margins should also expand for a few reasons:

EUV is growing as a proportion of sales and their latest system was sold for the fist time this quarter - those have higher margins

Guidance between €34B and €39B with gross margin between 51% and 53%, expanding up to 60% by FY30

1,700 job cuts or ~4% of workforce, not touching engineering and key verticals

I’ll say it again: the market rewards predictable cash generation. And that is what ASML is about.

Massive MOAT - and I don’t use this word lightly

Years of dominance past and more in the future

Different growth lever with massive demand

Increased margins due to pricing power and efficiency

Each point deserves a multiple premium and ASML has all of them.

The stock was an easy buy at ~$700 and it looks like an easy hold today, despite short-term moves. Nothing indicates a top. Maybe a small consolidation as the stock ran hot in anticipation of earnings, but those delivered and more, so…

Nothing to be worried about here in my opinion.

Another cherry on top for Nebius and Astera Labs from management’s comments:

In the last months, many of our customers have shared a notably more positive assessment of the medium-term market situation, primarily based on more robust expectations of the sustainability of AI-related demand. This is reflected in a marked step-up in their medium-term capacity plans and in our record order intake.

I think it’s primarily on the basis of the more robust view that they have when it comes to demand for AI, which seems to be more sustainable from their vantage point. That recognition has led some of our customers to really invest in capacity and gear up their plans for medium-term capacity expansion.

Meta

Without much surprise, the company is doing great. Weirdly though, the market was positive this quarter on everything it punished last quarter: growing CapEx and shrinking margins. Kind of curious to me, although there is more to it.

Maybe the market is finally understanding that Meta is one of the best company, with one of the best management and business models on the market, and as the team continues to deliver, we see some appreciation and trust.

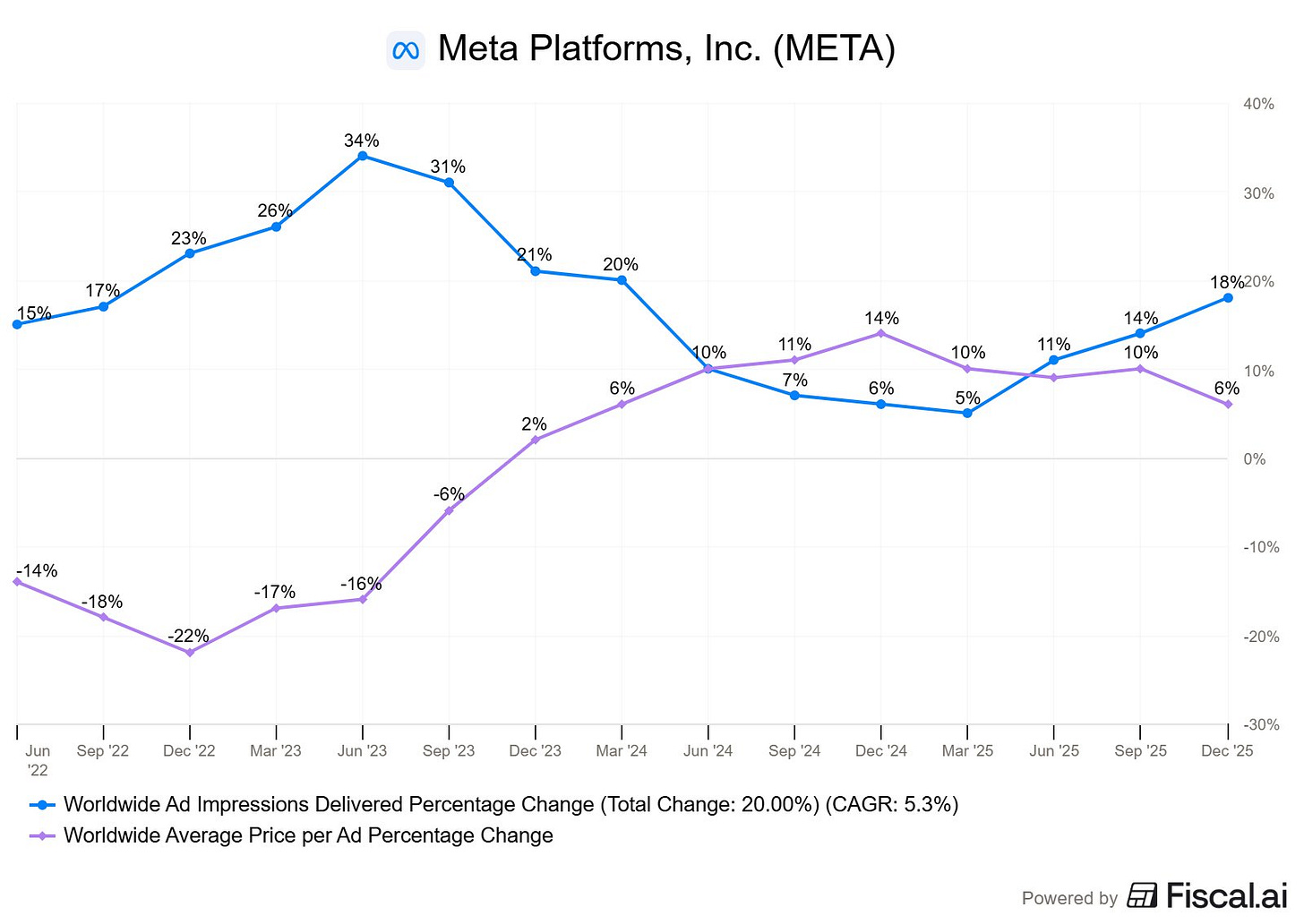

Revenues and earnings beat analyst estimates and proved that AI continues to deliver impression expansion and higher ad prices while also driving increased time spent on their platforms.

In the second half of 2025, Facebook initiatives to redistribute ads across users and sessions delivered a nearly four-times larger revenue impact than Facebook ad load increases.

It is hard to be bearish when the company shows no ceiling in AI optimization and guides to more of it with Q1-26 revenues at a ~20% growth between $53.5B & $56.5B, largely above analysts’ expectations of $51.4B.

So that should be the story of Meta and of this quarters: trust management and trust the business model. But the flaws are still the same, and still present.

CapEx guidance came at $115B–$135B versus $110B expected. This is almost double what was spent FY25, but it happens because management sees an opportunity, and Mark was very clear and vocal about it.

We are now seeing a major AI acceleration. I expect 2026 to be a year where this wave accelerates even further on several fronts.

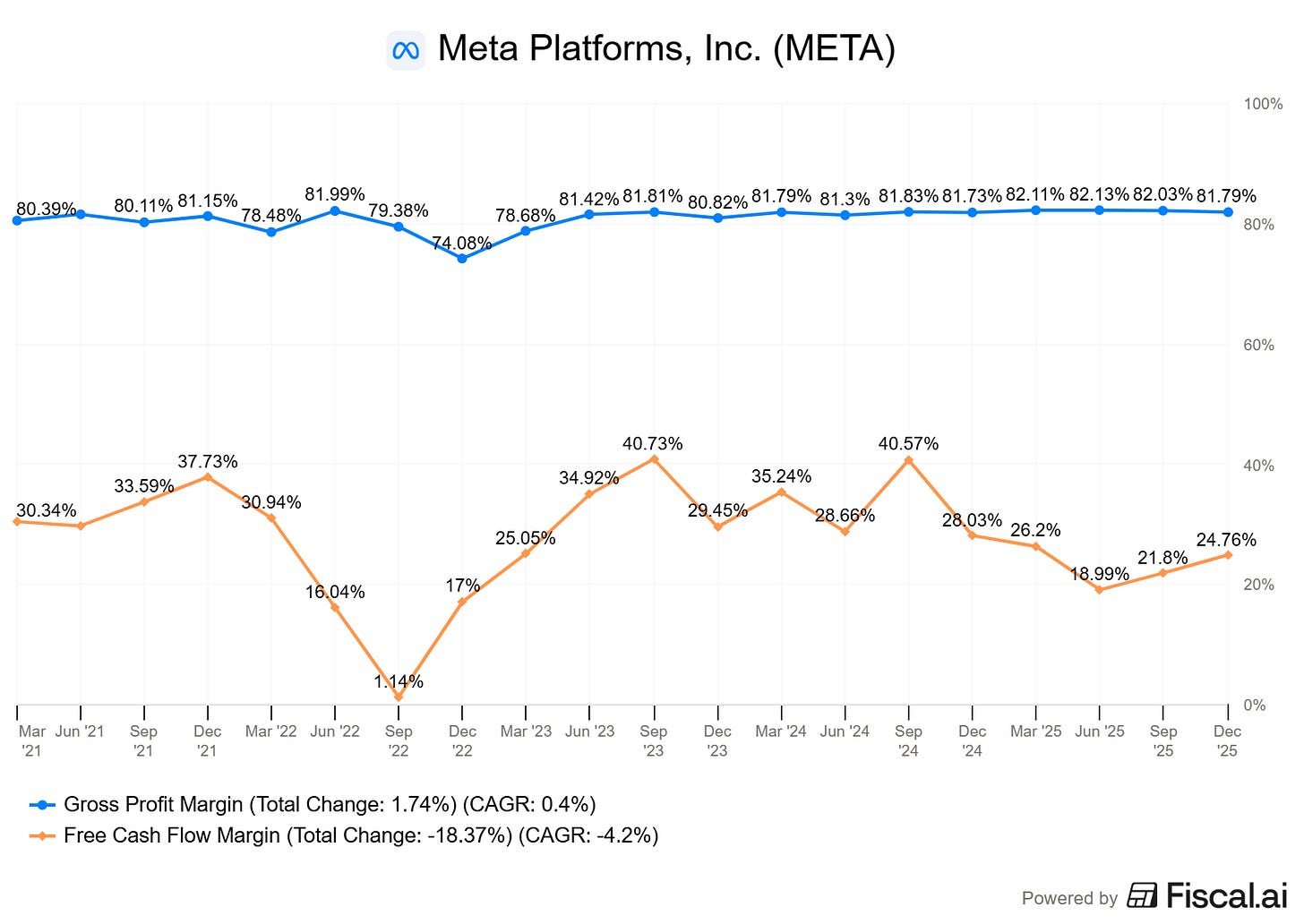

Secondly, margins continue to shrink which is normal as expenses - which should increase to $162B - $169B for the year or ~37% YoY, include depreciation and amortization. Meta will still make more money FY26, but it will look differently.

Despite the meaningful step up in infrastructure investment, in 2026 we expect to deliver operating income that is above 2025 operating income.

Understanding the D&A Dynamic

We need to understand D&A to follow Meta and the hyperscalers in 2026.

When a company spends on CapEx for infrastructure, cash leaves their bank account immediately. Using that hardware means its value diminishes, and this is displayed as depreciation and amortization. But the cash was already spent, this has no financial impact when D&A hits the income statement. It is an accounting method to display the hardware’s loss of value, which shows in earnings but has no impact on cash flows since the cash was already spent.

From now on, the capacity of hyperscalers to generate cash cannot be measured on the earnings report. It has to be seen on the cash flow statement, and Meta has no issues there as even with shrinking gross & net margins, FCF margins are expanding as D&A are added again when computing FCF - as they aren’t cash expenses.

The difference is very important to understand for the coming quarters. Those looking only at earnings and not cash flow will conclude that Meta is struggling with shrinking margins; but this is only a visualization, not a reality in terms of cash in the bank.

Bottom Line

Meta delivered a monster quarter and I am not surprised one bit. Market’s reaction is positive due to the clear proof that their CapEx and expenses is yielding results in the form of engagement, ads pricing and cash flow, combined with a positive guidance. AI’s ceiling hasn’t been reached, shouldn’t be reached in 2026, and demand for AI is still growing. They could still use more capacity.

We would be able to put more capacity towards good use... not only would the MSL team appreciate having more capacity, but we’d be able to put it towards good and ROI positive use in the core business as well.

One day the market is happy and the other it isn’t while nothing really changes for those who follow the company; ROI was almost guaranteed from Meta.

This is a very healthy report for AI bulls who understand and believe that AI will yield ROI in the future, justifying the spending. So the discussion remains the same: is AI real and driving real improvement, or not? Today, the market said yes for Meta.

Last words on the smart glasses, which tripled in sales in FY25 & forced management to order more to meet demand. This is the perfect wearable.

On other subjects, Meta also confirmed that AI agents are finally starting to show real use cases. This took time as tools were being developed, but they’re showing up, which is great for UiPath as even if Meta isn’t naming or using them, it proves that those services are starting to bring real added value to companies.

We're starting to see agents work. This will unlock the ability to build completely new products and transform how we work.

Microsoft

Ironically, Microsoft is being punished with a ~6% drop for what Meta was punished for last quarter and rewarded for this quarter: growing CapEx and expenses.

Worth noting is the small Azure growth miss, with a slowing trend from 40% to a 38% guide. But we need to add context here: Microsoft has to allocate its compute across different priorities. Management confirmed that if everything went to Azure, growth wouldn’t be slowing. But in a supply-constrained market, choices have to be made…

When the market decides to be picky, nothing can change its mind. Not the bullish comments on the actual massive demand:

We continue to see strong demand across workloads, customer segments and geographic regions, and demand continues to exceed available supply.

And on the GPU contracts that we've talked about, including for some of our largest customers, those are sold for the entire useful life of the GPU. And so there's not the risk to which I think you may be referring. Hopefully that's helpful.

We now expect to be capacity constrained through at least June 2026.

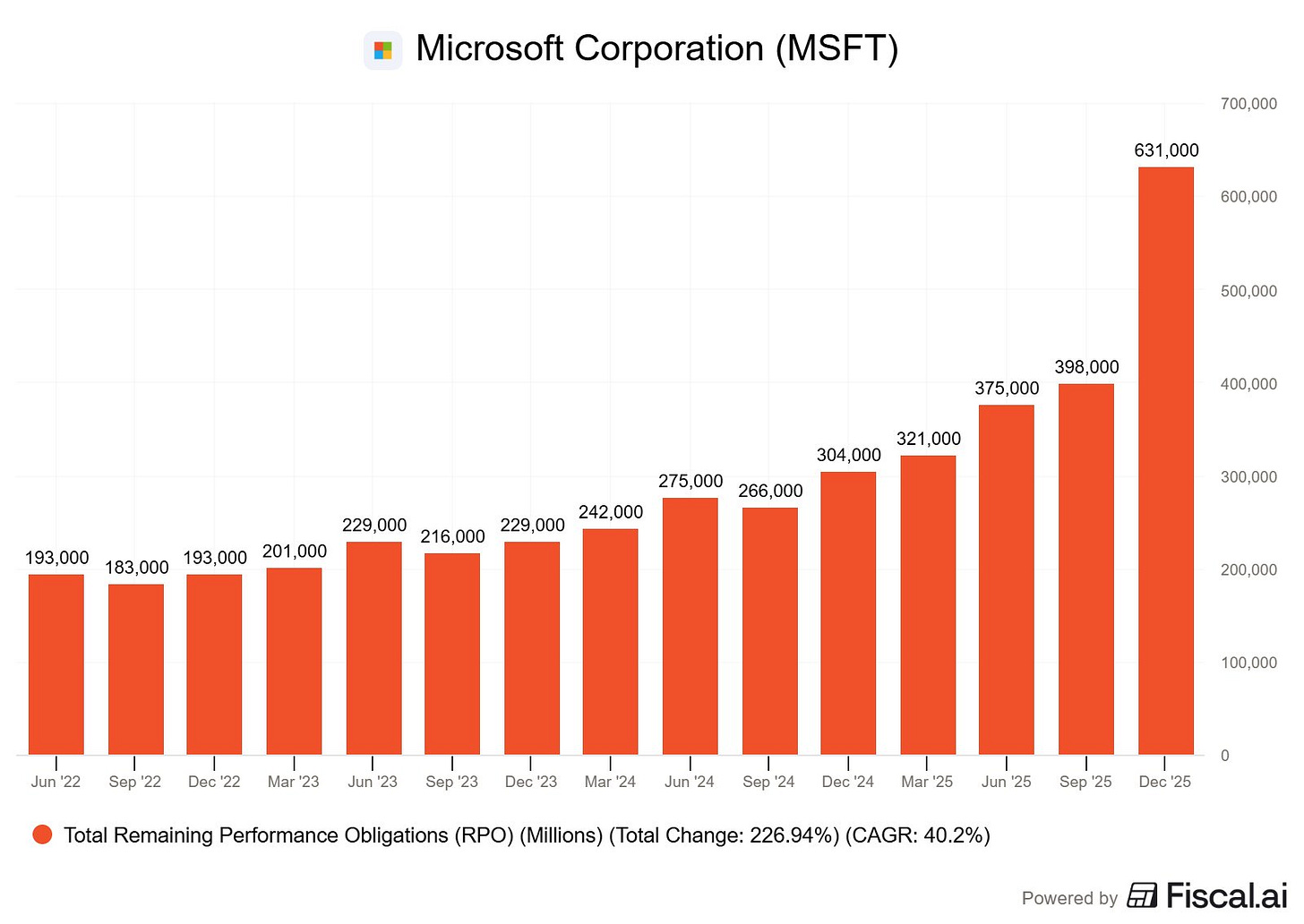

Nor the visualization of this demand in massive RPOs, comparable to Oracle’s.

Although just like Oracle, the problem starts with an “O” and ends with “penAI,” as 45% of those commitments come from them - who is rumored to be seeking a $50B investment in Middle East and is pushing every monetization system they can, which is what they should do and should be seen as positives. Somehow, investors still show up and give money to OpenAI so things are probably not as bad as thought…

This concentration risk, combined with higher CapEx and shrinking margins due to depreciation and amortization, explains the market’s reaction. As with many other cloud providers, growth will be dictated by infrastructure buildout speed. As long as we don’t see new capacity come online, growth could slow despite massive demand. This is the hard reality of the situation although I wouldn’t worry about it short term. If Microsoft wanted to please the market, it could.

The bottom line remains: massive demand, supply constraints, longer hardware lifetime while AI starts to deliver real-world use cases. Not bearish.

Tesla

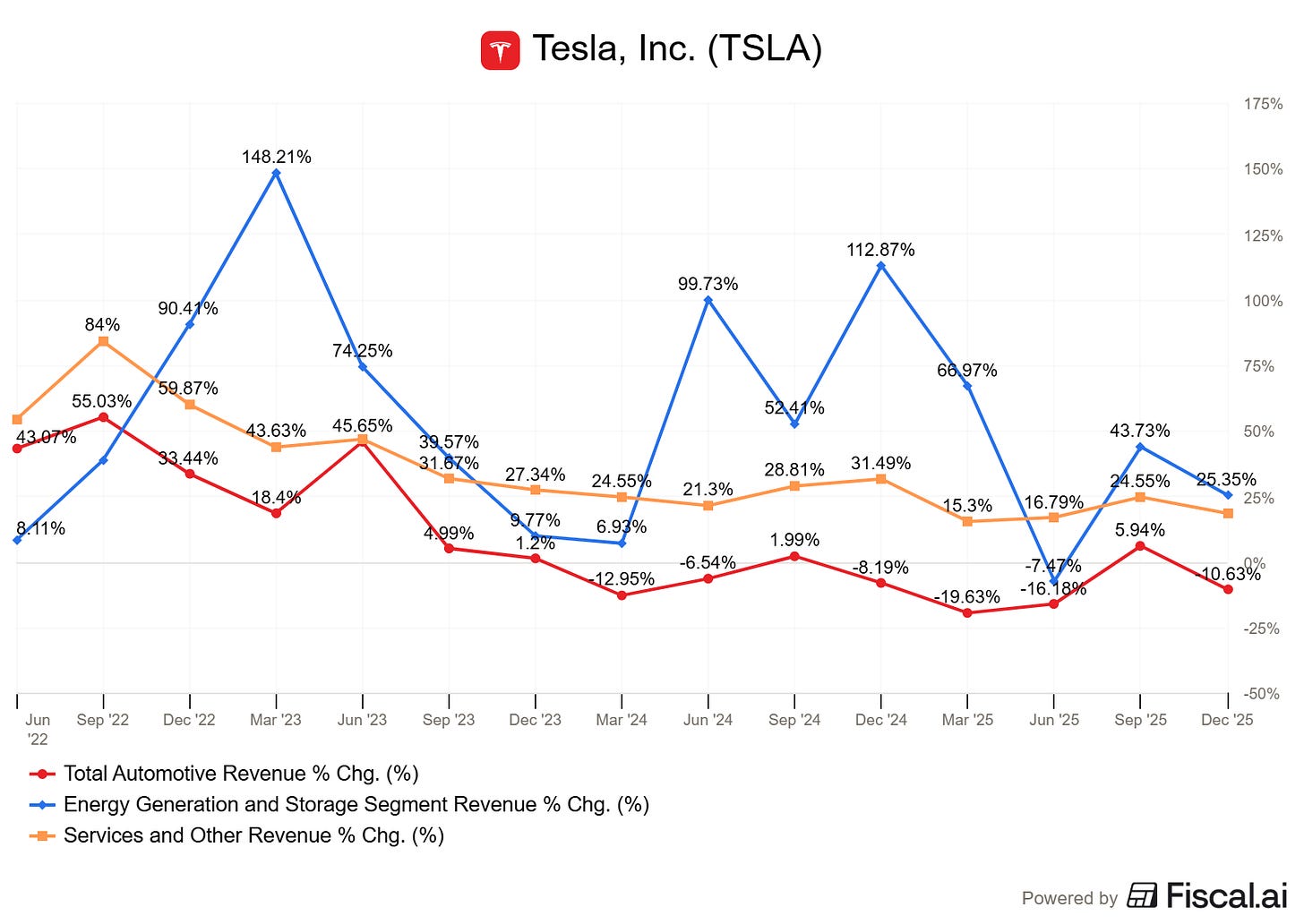

Looking at the verticals, the dynamic is the same as in past quarters: EVs sales down, everything else up.

I think it might be time to face the fact that demand for their EVs has slowed. It might be due to very high penetration in key markets, or other reasons, it doesn’t matter. Demand is slowing, or normalizing I’d say after strong years, even if management mentioned a bigger backlog starting 2026.

EVs became more mainstream and other brands are taking market share. But as I said, Tesla’s bull story is not about EV growth or margins anymore.

It is physical AI - Optimus and FSD.

Management not only knows it but is clearly moving forward. They plan to redirect an entire Gigafactory toward Optimus production.

It's slightly sad, but it is time to bring the S and X program to an end. It's part of our overall shift to an autonomous future.

This is risky, ambitious, and… how rare to see a car company accept that demand for its products is slowing and redirect its capacity to another product entirely - not another model, but an entirely different product category.

That said, this is a logical, first-principles decision as could be expected from Musk. The Model S and X are not the most demanded ones, so… Better to reuse the infrastructures. Left to see what this robot can and will be able to do, if demand will exist for it, and if AI progress is fast enough to justify commercialization and pricing.

I wouldn’t bet against Musk, but I’ll watch this from the sidelines.

On Full Self-Driving and Robotaxi

It’s hard to deny the technology now, with data proving its safety, at least compared to human driving, but it still isn’t perfect. The deployments are going well and results are positive, with a 100% increase in take rate and 1.1M FSD users now (excluding robotaxis), with 70% being upfront purchases.

We are well over 500 robotaxi vehicles at this point between the Bay Area and Austin... doubling every month.

FSD is already 100% unsupervised in Austin. We are being more cautious with the rollout for customers.

Energy Segment

The energy sector is still doing extremely well, without much surprise given the actual demand for energy in the US and globally - demand which should only accelerate. Batteries are a very cost-efficient system.

Tesla Energy achieved yet another gross profit record during the fourth quarter. There's insane demand for the Megapack and Powerwall. Backlogs for these products are healthy this 2026.

As this vertical and the services segment continue to grow as a proportion of Tesla’s revenue, margins are also expanding - although to be fair their EV business had expanding margins by itself this quarter.

CapEx

Lastly, CapEx is, as expected, massive with ~$20B planned for their AI services, meaning another big spender for compute. How surprising.

We're really moving into a future that is based on autonomy. Investors should expect some $20B in capex this year, with investments in new factories, Optimus and artificial intelligence computing resources.

There isn’t much more to comment. Tesla is an amazing company to own if you believe in the future and physical AI. I do, but then, everything has a price and I believe there are better opportunities out there.

But I’ll always happily follow and cheer for the company.