January Investing Plan & Yearly Review

Yearly review, Successes & failures, Improvements to come, Portfolio & positions review, Buying plans, Watchlist and More.

As the year comes to a close, it's time for a recap; what went well, what went wrong, and what I'll be improving next year. Here's a review of my positions, plans, and watchlist.

Portfolio & Performance

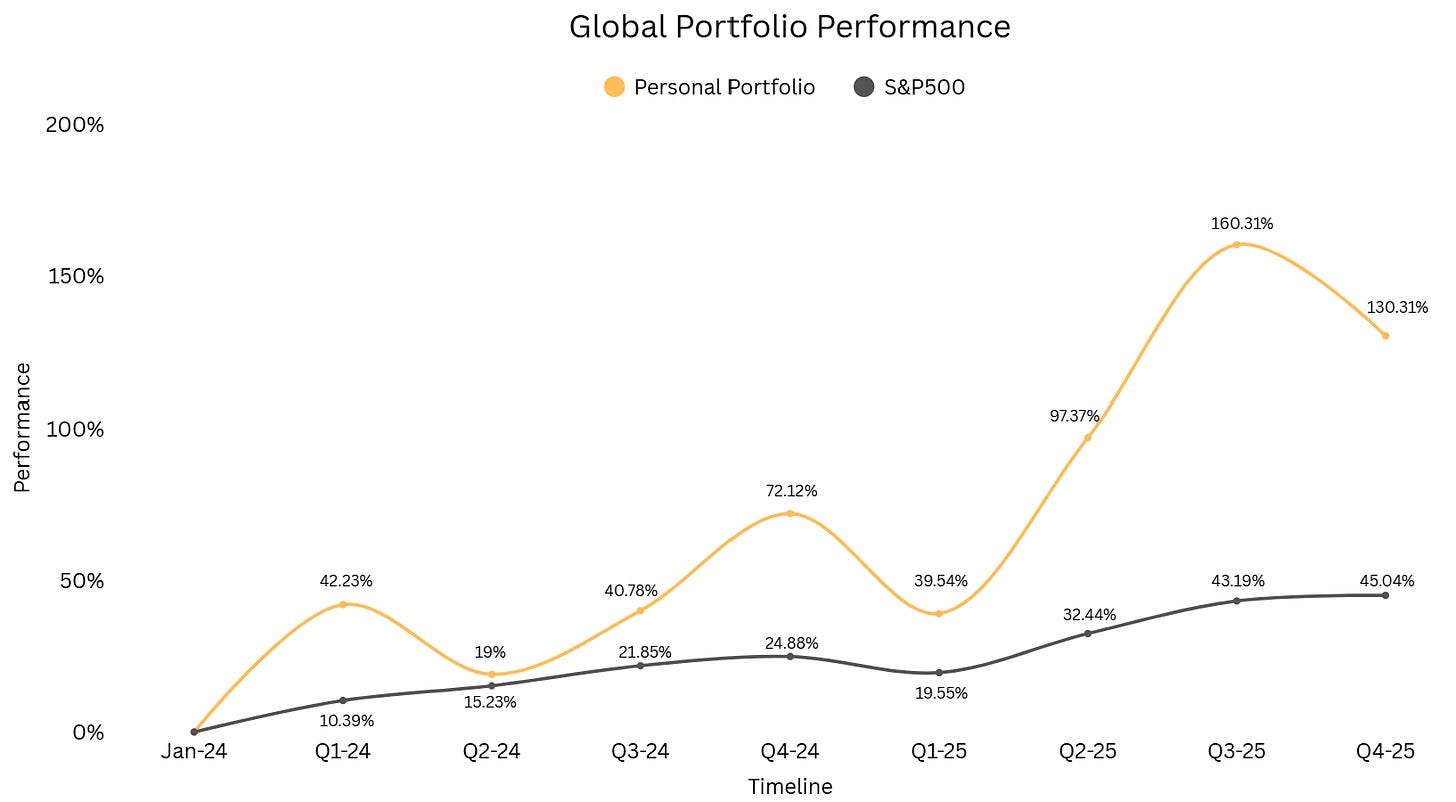

I'm closing the year with a 33.9% YTD return, compared to 13.76% S&P 500's. That's a 20.14% alpha for the year and an 85.27% alpha over the past two years.

To be honest, this year's performance feels a bit disappointing. It's still strong, and the main goal is to beat the S&P 500, which I did, by a wide margin. But considering the number of opportunities out there and the stocks I picked, this year should have been much, much better.

The last quarter clearly underperformed both the market and my own expectations. This was due to some big, costly mistakes that I won't be repeating anytime soon.

Ironically, the biggest mistake of the quarter was Transmedics. It wasn't that the pick or the stock's performance was wrong, but my aggressive calls expiring in January at $150 ended up being very costly when the stock pulled back lower and longer than I expected. Without those calls, my performance would be ~60% YTD.

I also made some mistakes in my analysis of PayPal, which wasn't too costly but could have been easily avoided. There was a painful trade on Duolingo that was hard to see coming - almost no one did, a lot of overtrading on names I wasn't familiar enough with, and some silly losses here and there.

I've mentioned before that I had a tendency to overdo it, and I've been working on that. I was overdiversified, impatient and not sticking strictly enough to my system, which has proven to be effective with the picks I made this year.

I was in on Palantir from under $15 - and sold too early, Hims below $10 - I perfectly sold it at the top above $60, Nebius below $20, and Alibaba below $80. I was one of the last standing bulls on Google at $150 and Meta below $500. That kind of stock picking deserves a much better performance in a year like 2025. It confirms that the ability to consistently and significantly outperform is there. What's left is to focus on execution and eliminate the excess; not the easiest part, but it can be achieved with rigor and perseverance.

And that’s what I’ll be working on in 2026. Less noise, more signal & a laser focus on the few names that will deliver performance, leaving the rest behind. As I shared, the content will change, as will the methods and execution compared to early 2025, and I hope you’ll be there. Everything is about to get much better and my objectives for the years to come are sky-high.

This year was excellent in every aspect, and I am really grateful for you; for the time you spend & the interest you have in what I have to say. I hope my words can help you achieve better returns, or provide value any other way.

There’s no magic recipe in the market, only learning and hard work. I promise you that I’ll keep on learning, working hard, and sharing it all. I’ll continue to do my best to develop and transparently share the best system possible to create wealth and reach our targets, however high they may be.

This year will be better than the last. And the next, better than the one to come.

My Views & Watchlist

Not much has changed since my December plan, just a few specifics.

I still expect the next few months to show that the AI trade isn’t over and could even push it into a real bubble, not just the suspicions we’ve had for a few months. I don’t expect a crash or a correction right now, not with the constant flow of positive news, strong earnings and global demand for AI.

We’ve seen Meta acquire Manus for $2B+, OpenAI rumors of new deals pushing its valuation to ~$800B, and Softbank completing its $40B funding round. Nvidia also got the right to sell in China again, and there’s more positives... It is hard to remain bearish AI at the moment despites some fears around funding. Even though, we’re very far from a bubble to my opinion - and for now.

Bubble or stable continuation, I continue to believe returns will shift to new verticals:

Accelerators allowing for better, more efficient compute.

AI-enhanced services.

But. We’ve seen clear signs of a rotation. The question is, will this rotation continue in a healthy way while tech slows down? Or will we push tech much higher, create a bubble, and then have a massive correction? And what are the timeframes for that?

The million dollars question.

If we have the bubble scenario, I will be part of it and the challenge will be to time the market and exit properly. If we have the steady rotation scenario, some AI names will continue to perform even if the broader tech market doesn’t, and I believe I own some of the best name and therefore will also profit, while my watchlist has lots of none AI names to be part of that rotation as well.

My only losing scenario today is if the tech/AI rally is indeed over. And I attribute to this scenario the lowest probabilities.

But again, the rotation is happening. We saw it in precious metals last month, which shows a lack of trust in other assets. We saw it in beaten-down defensive sectors now coming back to life, like energy (Halliburton and Schlumberger), consumer staples (Dollar General and Dollar Tree), and healthcare (Johnson & Johnson and Merck & Co). Things are brewing.

But we don’t have clear signals yet on the direction. For January, I’m confident in AI, in the broader market, and in almost all of my positions.

Positions & Investing Plans

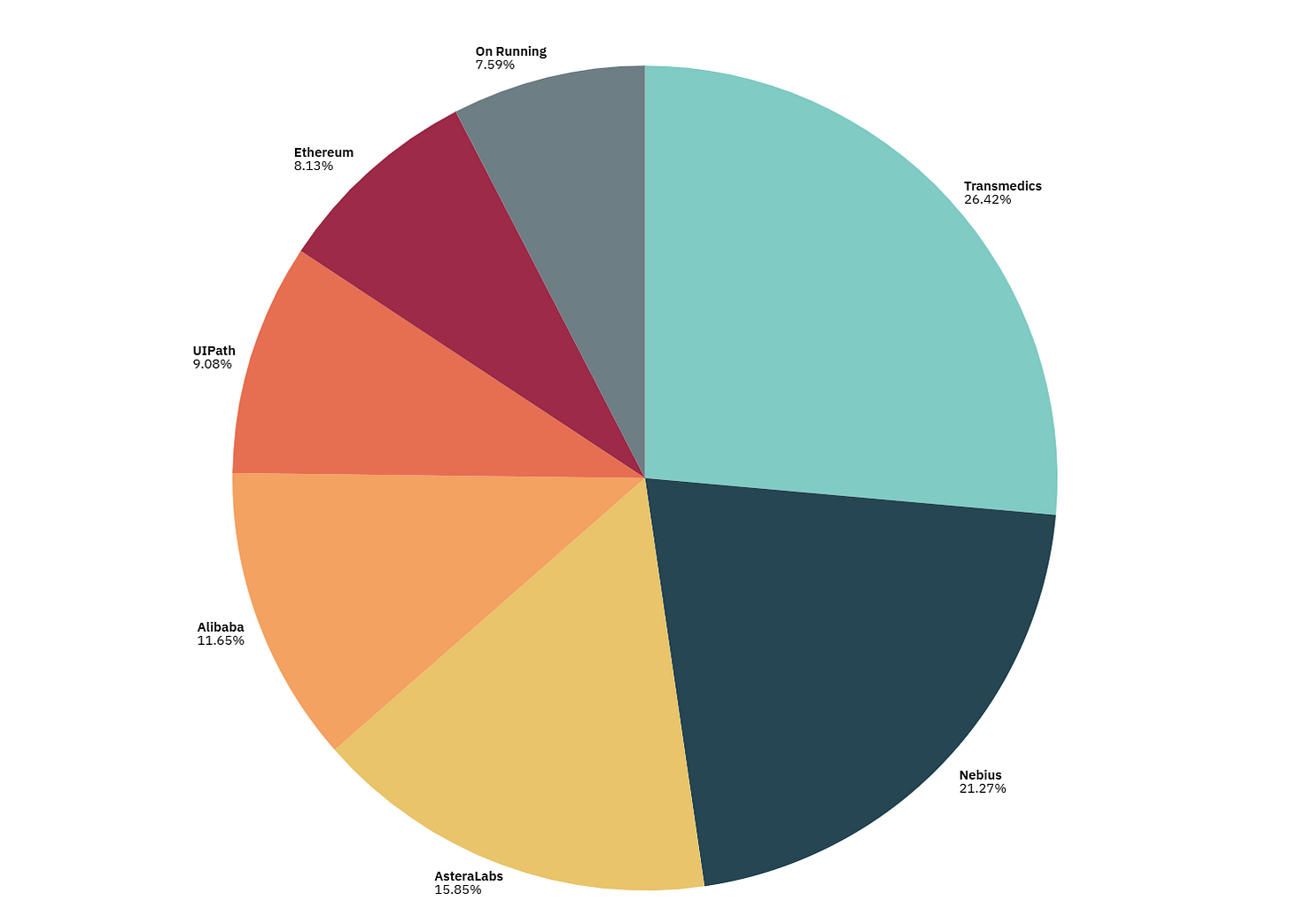

The portfolio hasn't changed much since the last review; when I write Ethereum, I mean crypto - Strategy + Ethereum at time of writting.

The only modifications this month were selling PayPal and buying UiPath. The bottom line, before I go over each position, is this:

High confidence and buying at the right price: Alibaba and UiPath in priority, with Transmedics third if liquidity is available.

Second priority: Astera Labs and Nebius - because the positions are already large.

Lower confidence: Crypto. Last month’s price action was weird, so I’m considering a potential trim to reduce risk and wait for healthier signals.

On Running should be rebalanced to meet my strict conditions.

Transmedics remains my favorite & biggest position heading into 2026. A healthcare name, which gives us some defensive positioning even though the stock has behaved like an AI name during Q4 - which is a bit of a question mark for me and a reason for the lower-than-expected performance.

But I'm very confident for the next few years; my thesis and targets haven't changed. If the market needs six more months to realize this stock should be trading ~$200, fine. I'll wait and accumulate as long as the stock bounces on its weekly 50, now sitting around $115.

I will share a note with my expectations for Q4 and FY25, but I expect Q4 revenues to have a floor at ~$155M. This would meet the midpoint of their guidance, with only 22 flight less than my expectations for the quarter. The revenues will then depend on the mix of DBD and DCD, of services used and of heart and lungs trials. I remain optimistic for the company and its future.

Nebius and Astera Labs are my AI positions. They're pretty high-risk considering the current market skepticism, but they are two great names that have been stabilizing healthily over the last month. I'm accumulating below $80 and $155, respectively, assuming both names hold their recent lower lows at $75 and $140.

I personally am optimistic, but I would listen to the market if it were to disagree.

Alibaba is also one of my favorite names for 2026 and I have many Chinese names on my watchlist. The country is focused on consumption and innovation, ready to spend always more to achieve its goals. We know how efficient this government can be when they decide to focus on something.

Price action has repeated the same pattern twice already, to perfection, and we could be seeing the third one now.

It has always taken more than 20 weeks to push to new highs and has always retested the weekly 50 before doing so, which now sits at ~$140. Stocks move in stairs, and that's exactly what Alibaba is doing.

I personally continue to accumulate as my average remains largely below my OCB of $140, but the perfect purchase is on the green line, at $136 to be precise today.

UiPath should be at least 15% of my portfolio, as I'm really, really optimistic about my thesis. The acceleration I expect isn't guaranteed - nothing is in the market, but if I'm right, we won't be talking in percentages of returns, but in multiples.

The problem with this stock is that the perfect entry/accumulation is on the weekly average below $15, which is 10% to 15% lower than today's price - a big fall.

It's hard to know if we'll get there, which means growing the position might require buying at a higher price. I'll slowly DCA on this one & will be aggressive if I get the opportunity, with the objective of growing this position to at least 15% of portfolio.

My crypto position is the one that's been making me doubt lately. A lot. Bitcoin and Ethereum are behaving as one might expect. It's December, and risk-on assets aren't very hyped, so those two are in a no-man's land. Nothing is happening.

But Strategy continues to be sold, and that's strange. It's now trading at 0.739x NAV, which has rarely happened. The last time was during peak pessimism of 2022’s bear market, and even then, it only reached that multiple a few times & rarely went below. And yet, the market continues to sell.

I always say that we have to respect price action; it's the market's way to tell us what we don't know. Ignoring it would be stupid, so I'll be ready to cut this position until we have a bit more clarity and will gladly buy back in then. It's possible the market is wrong, but I don't want to take that risk. I'll continue to monitor the name closely and could buy back in a few days, but until I see some positivity, I'd rather avoid risk.

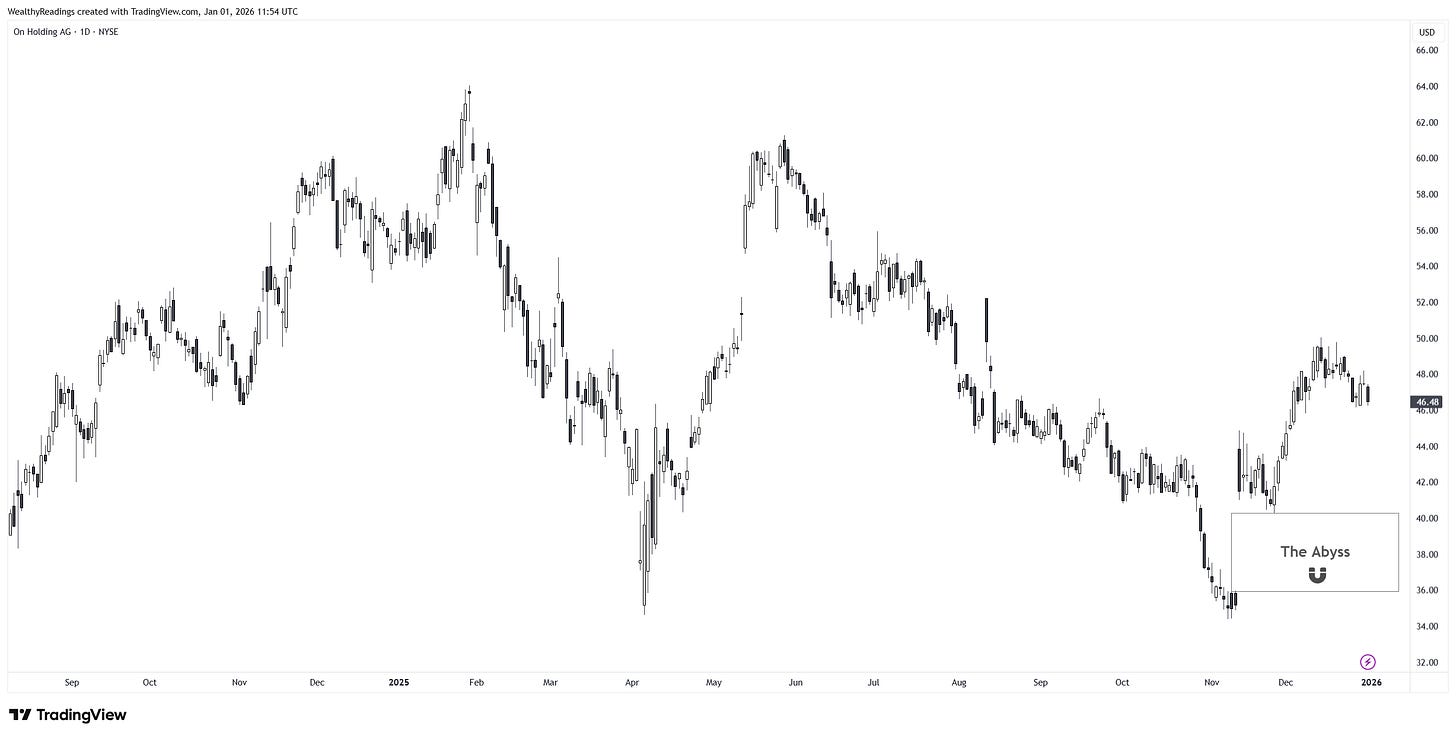

On Running is a long-term position without much headache. The product is great and in high demand, the retail sector is apparently healthy as wealthy people spend more than ever, and I've said many times that I expect the Christmas period to be great thanks to debt and the Western ego, where families would rather spend on credit than not have a great, gift-filled holiday season.

That said, there is still a large daily gap between $36 and $40 which might act like a magnet. This would yield a wonderful opportunity to grow the position if it were to happen, right at the bottom of a massive range.

This’d be maximum opportunity, so I’ll change my strategy and wait for it to happen.

Watchlist

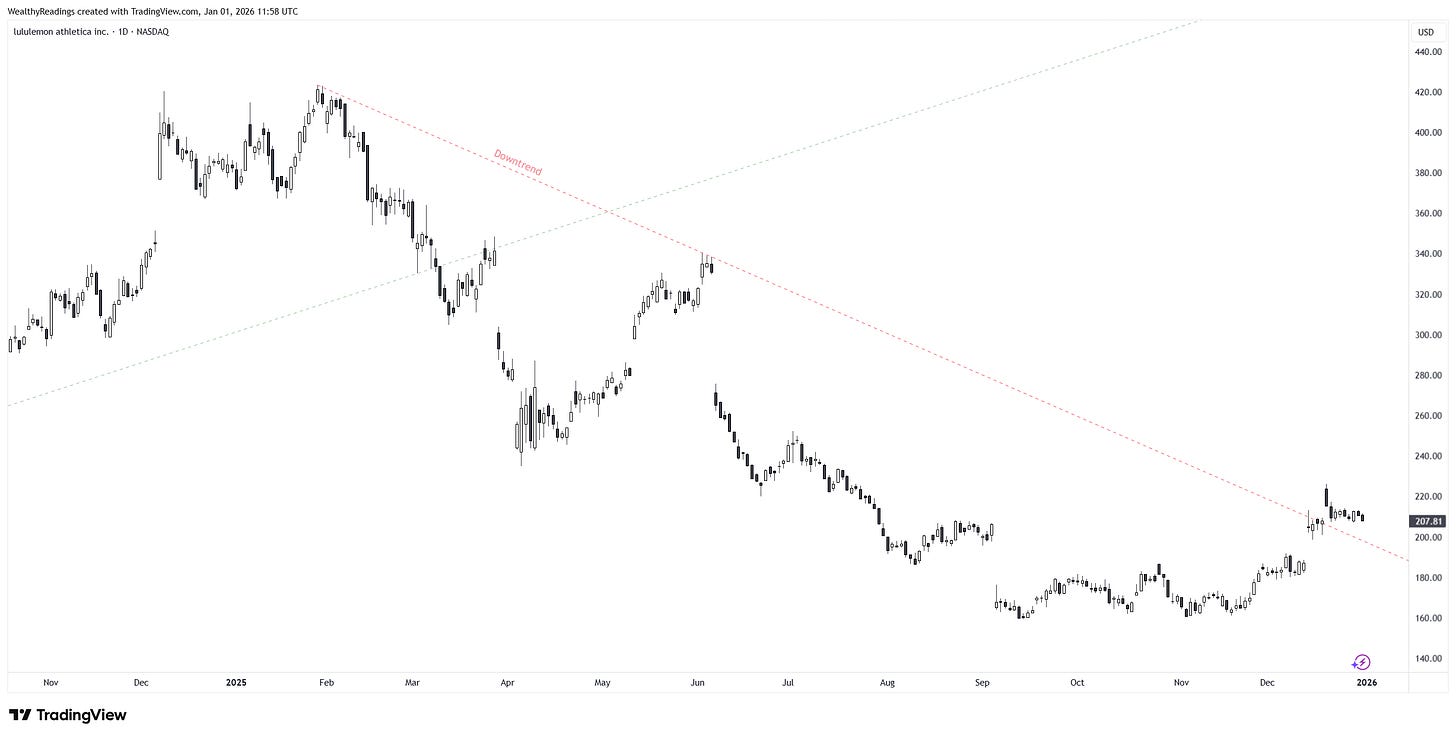

Of the stocks I'm keeping a very close eye on, Lululemon is at the top of the list. I've shared that the quarter was 'meh', especially in the West, but the market was very optimistic about the change in management and the actions in place to bring back growth there.

The facts remain that we have broken a year-long downtrend and have broken out with a clear higher high.

As usual, price action speaks before fundamentals. The market is expecting the issues to be resolved, but it anticipates they will; if not, they won’t get worse. The sub-$200 region is very probably a buy. I wouldn't take a massive position, as the risk of the West not catching up is real, but a pilot position is worth it. The market's optimism is what any stock picker is looking for, as long as the fundamental potential is there - and it is for Lululemon.

I'm still keeping a close eye on Adobe and Novo Nordisk, but those two aren't ready to push into new highs yet to my opinion; they're ready to consolidate. I also added Target and Pfizer to the list - I told you we were going defensive.

And I’ve started looking into three promising companies.

Twilio, which provides a platform for businesses to build AI agents that manage customer service calls, texts and are capable of taking decisions. Perfect for the AI enhanced SaaS narrative like UIPath, although the name is a bit expensive today so we’ll need a bit of patience.

Genius Sports, which captures and sells detailed and exclusive sports metadata to betting places, advertisers, and interactive media broadcasts. I’ll need to dig more but we’re in a promising sector for the next years as betting is exploding.

Upstart, an AI-powered marketplace that uses non-traditional data to predict borrower risk with better accuracy than a FICO score, a beaten down name that seems to yield some interest lately, and provides above average service with AI.

I’m still at the start of my research and even if they all look promising, my portfolio’s positions look better. I’ll share a detailed investment plan IF I judge one to be a great opportunity, but I wanted to share the names with you as you can do your research and buy in already if they fall into your criteria.

That is it for my January plan. Priority to UIPath and Alibaba, potential risk reduction with my crypto positions, and close eyes on Lululemon while I dig onto those three names to decide if they are worth a spot in the portfolio, or not.

We are now officially starting a new year. But it is only another day in our journey of overperforming. The work continues just like yesterday, only wiser and with more knowledge. More work and success ahead of us.

For all other aspects of life, I wish you the best and only the best.

Keep up the great work, love to read your posts!

The defensive sector rotation thesis you're outlining with Dollar Tree and Dollar General feels particularly timely given how stretched valuations got in tech. One thing that's often overlooked in the discount retail space is how these stores effectively became the last-mile logistics hubs for lower-income consumers during the past few years,especially as inflation pressures budgets. I've noticed in my own neighborhood that the Dollar Tree has basically replaced convenience stores for a lot of quick trips. The challenge is whether their margin structure can actually handle the inventory management needed to capitalize on this shift, particularly if the AI-driven efficiency plays start moving into value retail. That operational question might be what separates the winners from the laggards in this rotatoin.