Various Earnings & Market in Turmoil

Portfolio modifications, Google, Amazon, Iren, Palantir & More

Portfolio Update

Let’s start with a rapid update of my situation as things changed over the last months and even if I said I would wait for my asset’s earnings before taking decisions, the market forced me to change my mind.

As of today, I own five assets: Transmedics, AsteraLabs, Alibaba, Uipath, Lululemon & UPS. I closed Novo Nordisk this week as shared with you on the earnings review for a ~10% loss on a small position, and I closed Nebius after Google’s report after ~220% of total gains and a first purchase ~$30 back in January 2025.

Nebius is one of my favorite company and one with a very large potential long term; I hope they get to fulfill it but as I’ll share below, I do not see short term strength in the cloud sector and would rather be out of risks, as I shared many times. I do not fall in love with my stocks, and I do not hold a weak one. Many will call me - and did call me, a trader for this and that’s fine by me.

If you believe being an investor means having a portfolio down 70% while the S&P500 is ~1.5% below ATH - and many are in this situation today on social medias, I am very fine being called trader as my portfolio is down ~3% YTD and is enjoying a large gain today - up ~8%, thanks to reinforcing AsteraLabs at key levels.

The liquidity taken out of Novo Nordisk and Nebius was spread into AsteraLabs and Alibaba mostly - I’ll detail why below, with a bit of cash kept aside for opportunities.

Google & Amazon

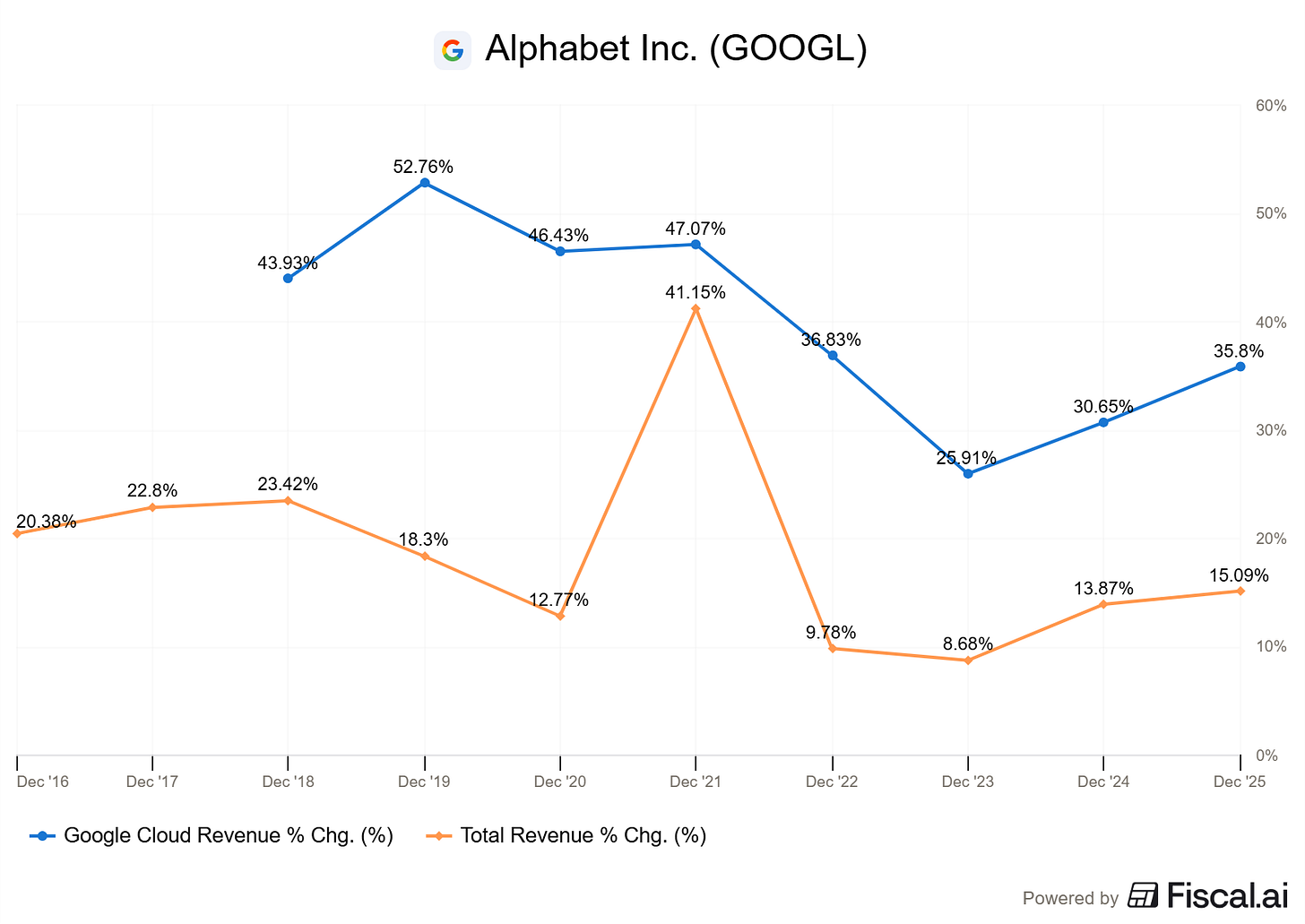

I won’t go over each one by one as what is interesting is the market’s reaction, not just the numbers as they are either way excellent - which is ironic. Google showed continuous acceleration in cloud, search, YouTube and global revenues.

Can you believe the stock was down 6% after exploding analysts assumptions and a growth profile looking like this?

That is why I say the earnings didn’t really matter. What matters is the market reaction which has been negative for all tech, all week, regardless of their results, fundamentals and guidance - although the bounce is real as I write those lines on Friday.

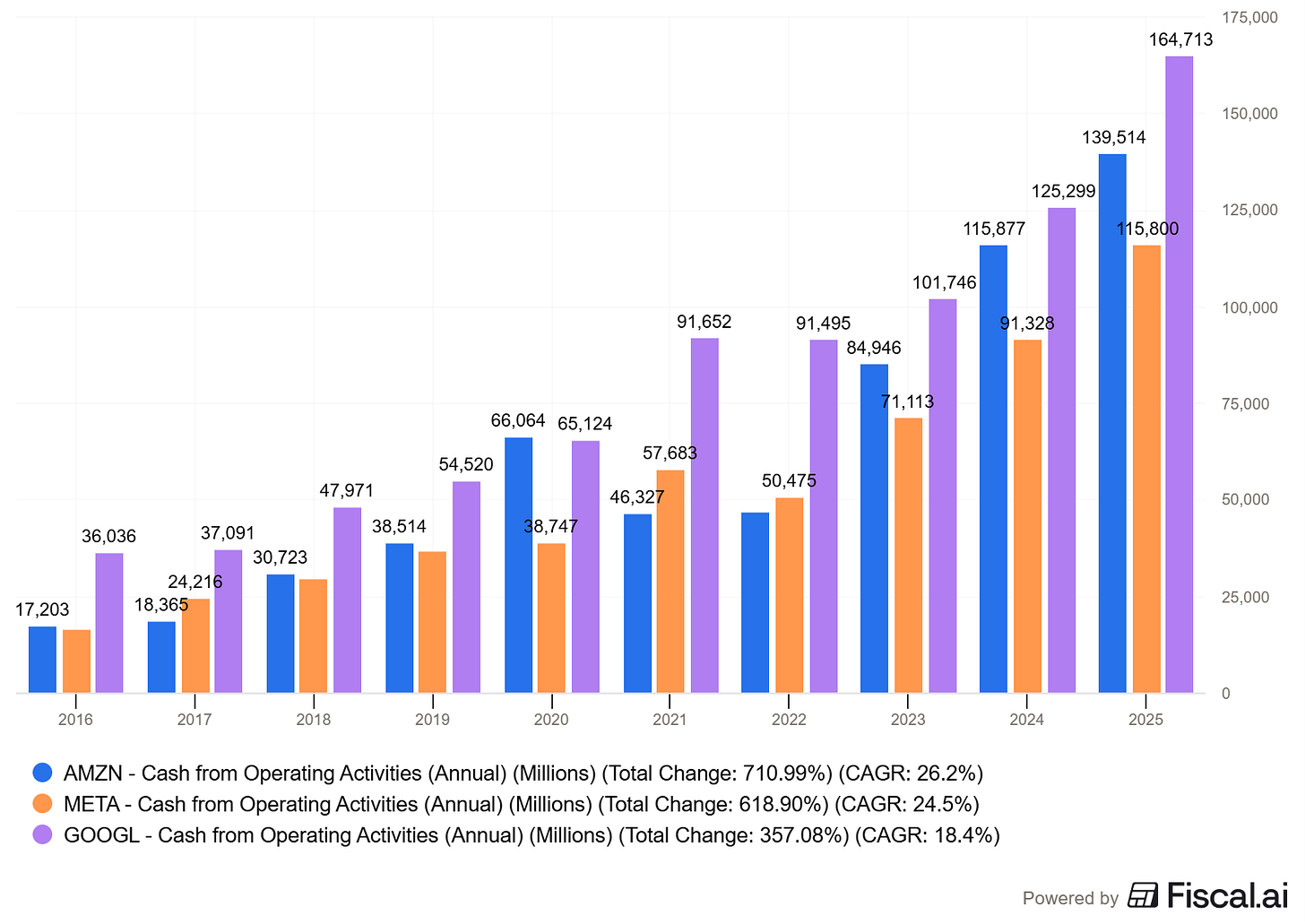

But the situation remains the same to me, bounce or no bounce. The matters is tired and it doesn’t want to reward spending anymore, refocusing on cash generation and pricing risk more harshly than before. Nothing matters more than safe & predictable cash generation for the market. And that isn’t the case anymore as all hyperscalers guided to massive CapEx increase, once again.

Google guided to ~$180B vs $119B est, Meta to ~$125B vs $110B est, Tesla to $20B vs $11B and Amazon to ~$200B vs $145B est, Microsoft didn’t give a clear guidance but had a similar tone - more spending than expected. If those value don’t mean much to you, tell yourself that all CapEx guidance are exceeded the comapnies’ FY25 cash generation from their business.

This means everything that went into the bank this year and more will be spent next year. The hyperscalers are going all in on AI and while you think this should be bullish, the market doesn’t care about opinions, it cares about one thing.

Safe and predictable cash generation.

This is why I closed my Nebius position. If the market does not reward Google’s above expectations results while expectations were sky high, with stellar growth due to AI & their previous spending, because they intend to spend more to generate more in the future, why would the market reward Nebius for the exact same behavior?

When leaders fall, second-hand companies usually don’t rise. We could have a bounce - which we are having today while I wrote this line yesterday, which many would call a V-shape recovery. it could also only be short covering. Who knows. But I won’t be part of it, the risk reward is simply not worth it considering other opportunities are shaping up in the market, some even within tech.

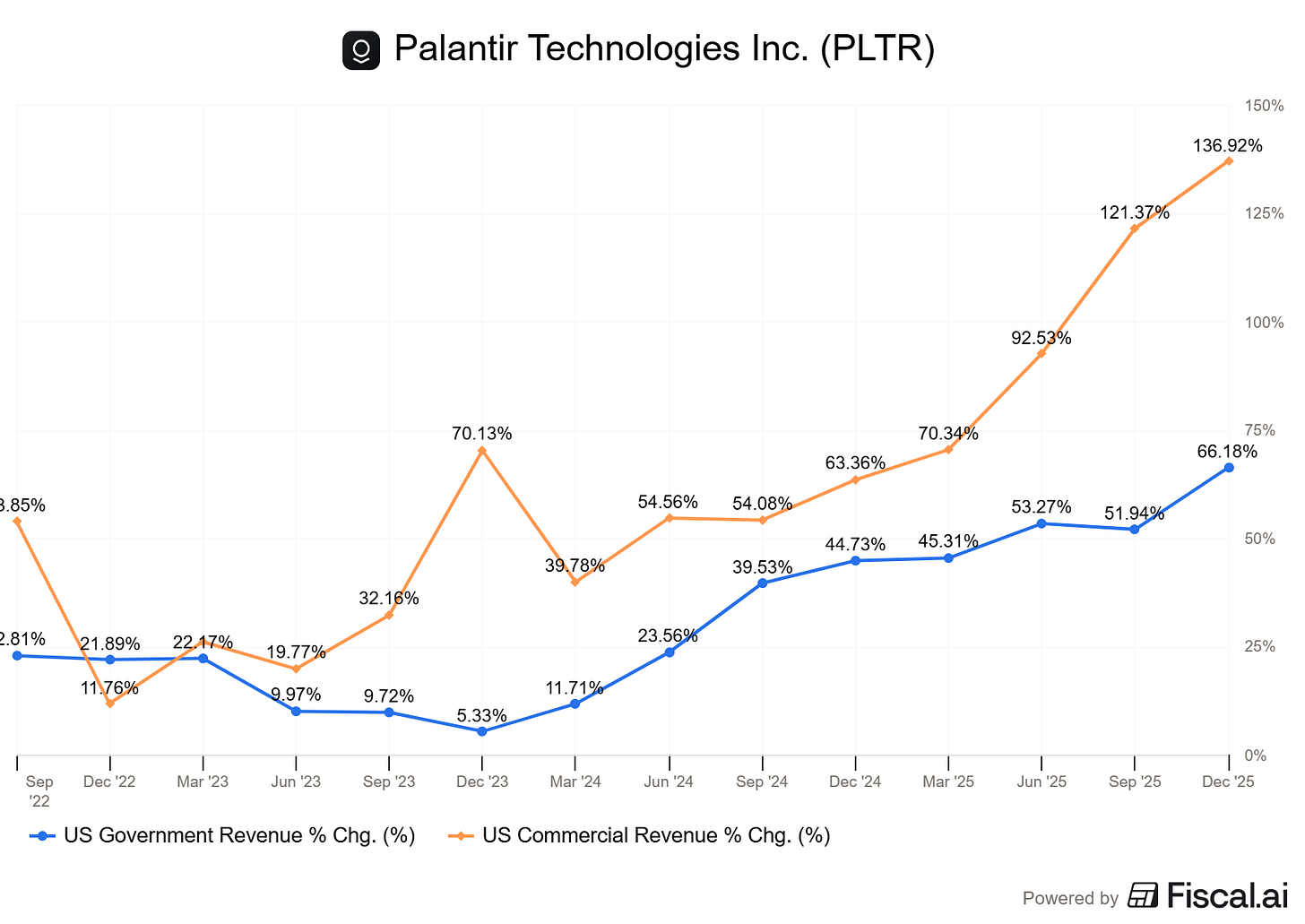

Palantir

If you want another example, let’s look at the undisputable leader of the AI cycle, the software king which was once trading at 100x sales and more. I have no other words but to say that they, once again, crushed earnings. If anything, each quarter is even better than the previous one as they continue to push their ceiling higher, which is pretty hard to do considering where they are.

And yet…

I don’t even know what to say when I see such numbers, they are just out of this world and I wonder if any companies have ever done comparable things, outside of fraud & the actual AI sector.

And yet, after delivering those earnings, Palantir is down 18% and 35% since its ATH.

Yes, social medias will quote Buffett and tell you that valuation matter and they aren’t wrong - I have a write up ready on that for you this week end, be ready. What they do not share is that valuation is the representation of market’s appetite for risk. When fundamentals keep improving and leaders fall, it means the market does not wish to put more of its liquidity on this name, even if fundamentals look like the screenshot above. That means they are scared.

And when it translates to price action like this, with crumbling volume except during selling, lost averages, lost support, and below nothing but emptiness…

That’s not something I want to buy while, keep in mind: we are talking about one of the best companies of the world at the moment in term of growth and fundamentals, beaten maybe by Nvidia only and that is arguable. Why sell?

I talk about Palantir because I follow the company closely. But it isn’t the only leader in free fall. Robinhood, Bitcoin, Uber, Netflix, Palo Alto… Strong fundamentals, pump and dump, complete speculation, it doesn’t matter. Many leaders are falling regardless of their fundamentals, potential and earnings.

All… Or almost all.

Hardwares & Alibaba

I only own two tech stock today: AsteraLabs and Alibaba, for very clear reasons.

AsteraLabs generates real cash today. As long as CapEx keeps rising - hyperscalers confirmed it will, semis will keep printing. Those companies are different, they do not require trust nor execution, they build a product which is sold for cash, right now.

Companies like TSM, ASML, Sandisk & co have been doing very well, because of this very important dissociation. AMD did terrible this week but I personally never had any hope for them while SMCI is flat after good earnings compared to a disaster for cloud companies; hardware isn’t in the same situation than the rest of tech.

They have a safe and predictable cash generation.

That said, AsteraLabs reports earnings next week and is sitting on a key support level at $140. If the stock were to lose that level like Nebius did before earnings, I’d close the position without looking back. The rest will depend on numbers and market’s reaction post earnings on Tuesday, although today’s bounce could be the start of a real and stronger one which I’d be pleased with.

Alibaba is the only hyperscaler holding up while markets fall. I’d assume two reasons for this strength.

Ownership is largely non-US → US tech pressure doesn’t apply while the sell off has other reasons, mostly liquidity/macro

China is in a different economic situation, healthier to some extend with more control and potential

Valuation is incomparable to US hyperscalers, with safe cash-generating assets outside of tech

There is no saying that Alibaba will continue to outperform but I have been bullish on China and Asia at large for long and it seems like international assets are behaving pretty well lately while tech sells off. If that rotation is meant to happen, it might finally be the case.

Market’s in Turmoil

Today’s reaction was overdue after weeks of selling, but I wouldn’t trust it too much, I would even consider it false hope. The market is a rotation of liquidity and while this could be genuine buying at key levels - like Nebius weekly 50 ~$77, it would also be short covering and some classic liquidity rotation that happen during downtrend. So far, what I see is lower lows and violent selling volume.

And going back to Nebius, after Google and Amazon got punished, the key AI cloud provider of this cycle is down ~60% from its ATH, another -28% since we last talked about it in December.

Over the last months, I have not shared any new position in tech & have talked about that famous rotation repeatedly, repeating that the market will be harsher and that some tech names will work, but not everything together anymore.

My moto nowadays is: why take risks? You do not need to know if this is a bounce during a downtrend or a healthy re-accumulation before another high. You can simply walk away and look for performance elsewhere, because it exists elsewhere. There are no rules saying that money made on Nebius is worth more than on UPS.

There is no point forcing anything. We’re here to make money not write fantasy. If the market doesn’t like tech I don’t like tech. If the market loves trash companies I will love trash companies. Right now the market loves defensives and all names I shared over the last months have largely outperformed tech and the S&P 500.

It’s just time to accept it.

Tech won’t die, AI won’t die, softwares certainly won’t die. Tomorrow’s opportunities lie in those sectors, but we’ll need cash to buy them when they materialize. We will not have that cash available then if we continue to buy falling knifes trading at 25x sales, a multiple we have been biased to judge “fair” or even “cheap” due to the last three years of massive bull market and optimism.

Let’s give time to the market to correct.

The AI revolution will continue even if the markets do not rewards companies’ stocks, it is a mistake to believe that both go hand in hand. It will again once appetite for risk, liquidity and clarity comes back. AI really is the new innovative revolution, possibly the mot important one of our century and it will yield to massive improvements, services, products and cash generation for companies. There are no doubts of this.

And the markets will reward AI stocks again.

Let’s be patient until then.

——————————————————

Disclaimer: I am not a licensed financial advisor, analyst, or broker. This content reflects my personal opinions and investment decisions for informational and educational purposes only. I hold positions in securities discussed and may buy or sell without notice. Nothing here constitutes a recommendation to buy, sell, or hold any security. Past performance does not guarantee future results.

Always conduct your own research and consult a qualified professional before making investment decisions. I accept no responsibility for any financial losses.

Might that be six stocks?? Or is one of these no longer valid? "As of today, I own five assets: Transmedics, AsteraLabs, Alibaba, Uipath, Lululemon & UPS."