Weekly Recap | August - W1

Weekly Watchlist Update, GDP is Useless, Tariffs, FOMC & Unemployement, The Importance of Having a Plan, Novo Freefall, Hims GLP-1, Tesla's Robotaxi, Figma IPO & Earning Review plus planning.

I joined FiscalAI affiliate program this week and will regularly share my referal link for you guys to have a 15% reduction on all subscription plans.

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs & honestly the best platform on the market to follow companies. So if ever you’re interested, feel free to use my link!

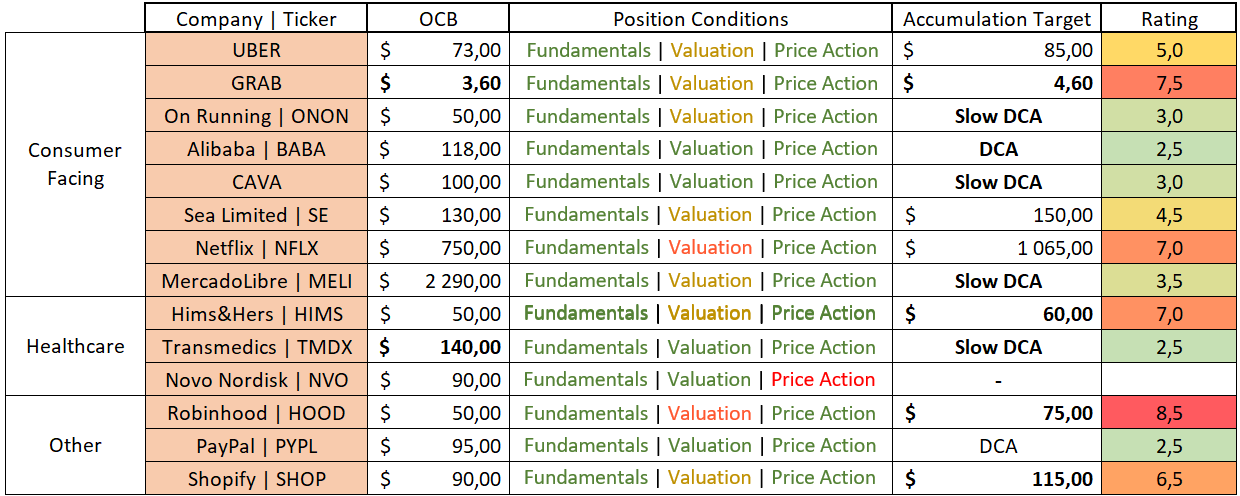

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold cells are updates compared to last week.

I tried to update with a score representing my view on each, investing-wise. Feedback is always appreciated!

Macro.

If last weeks’ were quiet, this one will make up for it as we have a lot to unpack.

GDP.

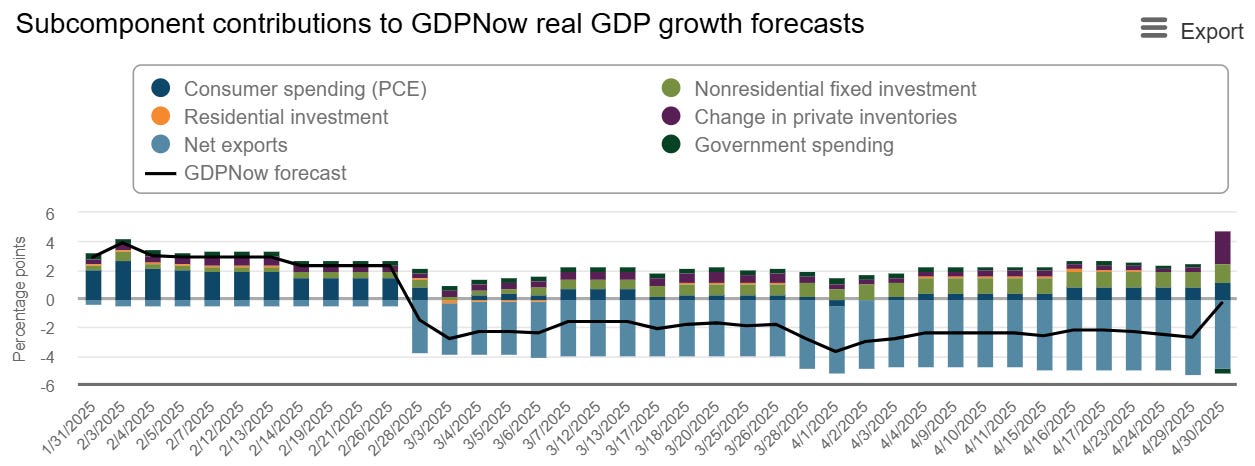

U.S. Q2-25 GDP came at 3%, above consensus of 2.4% & everyone went screaming about how healthy the economy was, but many miss the big picture.

In Q1, I often talked about the front run of tariffs and companies building inventories, which grew massively the U.S. net export deficit as imports increased while exports remained around usuals, impacting negatively GDP.

This quarter, logically, the opposite happened. Companies built massive inventories & did not need to import those materials anymore, so net exports turned out positive, boosting GDP, while the net change in inventories went down as companies consume their stocks.

If you buy 5,000 bananas between January & March & do not buy any between April & June, you did not spend less money on buying bananas; you simply optimized your spending by shifting its timing.

In brief, GDP is not really usable as a metric since tariffs, but the truth is that Q1 was better than it looked & Q2 was worse, with a probable in-between showing a stagnant economy.

Thursday, Friday & Market Reactions.

I will group the other metrics together - PCE, rates, tariffs & unemployment, as they all impact each other & the market in an interesting dynamic.

Before diving, let’s remember that the market is hoping for the FED to cut rates - even if it doesn’t matter at all & would actually be a bad thing for returns. I explained this many, many times, the latest here.

The bottom line being that liquidity is created by the government through its fiscal policies & we do not need private-led liquidity creation to boost the markets. One more proof of this was the latest treasuries issuance which, now that the debt ceiling has been lifted, is going at it real strong with more $1.6T of debt for the next two quarters - with $500B to refill their accounts, everything won’t go to the economy.

But that’s what the market wants & the FED will cut rates only under two conditions: a weak labour market or inflation back at 2%.

On Wednesday, core PCE came at 2.8% above consensus of 2.7%, which is not good news for future inflation data.

On Wednesday as well, the FED decided to keep rates unchanged, a logical decision from an economy perspective, despite what people on social media say or even what Trump says.

Why? Because tariffs are inflationary and the only reason why it doesn’t show yet is because of the inventory we talked about just before. Most companies still have the materials they need, bought at a usual price. But they’ll eventually need to replenish those inventories and will pay tariff prices this time, wihout a choice but to transfer those additional costs to consumers. Powell said the same during his speech.

“American businesses have been absorbing Trump’s tariffs so far, but eventually the burden will be shifted on to American consumers.”

We’ve not seen it yet because it is too early. But we will.

On Thursday, Trump went to add more tariffs on countries he had no deals with as his deadline of August 1st was reached. I won’t list them all because it doesn’t matter, not the specifics at least. What matters is the market’s reactions and as expected, it dumped on the announcement. Trump went even further saying he would apply tariffs on India because they were buying Russian oil and tariffs on others just because they do things which don’t please him - including on Europe, because why not. This isn’t a negotiating tactic anymore; this is trying to get everyone to do what he wants, but this won’t happen… India already told him that they didn’t care much about his opinion & will continue to do their lives.

This is probably the best summary of the tariffs situation.

Nevertheless, the market went red, not comparable to April but still harshly.

On Friday, we had the nonfarm payroll data which represents the monthly number of jobs added during the month in the U.S. The data came at 73,000 below consensus of 106,000 but most importantly, we had a massive revision of the two previous months. And what was supposed to be a May & June with 291,000 new jobs turned out to be only 23,000. A massive revision which shows weakness in the labour market, and this weakness is exactly what the FED needs to cut rates which is why the market rapidly bought the dip on Friday after the data was released: because it might force the FED to move. The market still closed red but the dynamic is interesting to understand.

I might need to write another macro detailed review soon as things change fast. Even if some details changed - notably as Trump came back from his April tariffs, the conclusions of this write-up are still on point & my view didn’t change.

I’ll share an update after the earning season as nothing should change until then. But to be clear: I will be a buyer of this breather, in the long-term & active portfolio, as I do not believe the uptrend is over.

The Importance of Having a Plan.

I shared three times over the last 10 days or less that the market was probably due for a correction or at least a breather, which finally came. You will find all the details in the different write-ups, especially in the trimming Palantir one.

I’ve seen some panic already, some people starting buying too early, others trimming too late… The difference between beating the market & taking the saloon’s doors is having a plan.

My goal with this substack is to share information, arguments & my personal actions, methods. I shared why I believed we would have a downtrend & what I planned to do to ensure that I wouldn’t feel emotional if it happened. I chose to hold some stocks & accept the drawdown, to trim others to raise cash and to close most of my swings on the active portfolio to lower the risk.

What I am trying to share is that I had a clear plan. I knew after that I would feel good if we continued higher or if we went lower. I knew my emotions would be controlled, in every possible situation.

I didn’t react to the market; I anticipated. It doesn’t mean I will anticipate it every time, but that’s what I try to achieve. But what matters is to always have a plan. Otherwise emotions take over and we make mistakes.

Watched Stocks and Portfolio.

Hims, Another Drama & Trimming.

First of all, let’s start with the positive for Hims, who released a recap of the first year of its GLP-1 service which is pretty positive if not in terms of results, at least in terms of price/results ratio.

As for the drama, it all started after Novo’s quarterly results where the company had to review its guidance downwards due to a much lower performance than expected for its branded GLP-1 - Wegovy & Ozempic. Management doesn’t blame Hims nor other compounders but clearly states that those propose alternatives which should not be legally accepted and that they will take actions against them.

In brief, the GLP-1 dramas will continue and Novo now looks like a mad dog while its stock price is falling always lower… Really low, which gives me another great example on why we shouldn’t buy downtrends, with more details here.

Back to Hims, I decided to trim the position on Wednesday as the stock was back on a pretty big resistance, with daily & weekly bearish divergence. The stock ended up breaking out the next day & gave back all the gains the day after… I will probably trim a bit more on Monday pre-earnings as I am not really certain about what could come from them & how the market could react.

I struggle to see the company execute well enough to print a new ATH but either way, I will only trim, not close the position - my second biggest position at the moment below Transmedics. I’ll gladly buy back if they beat & raise.

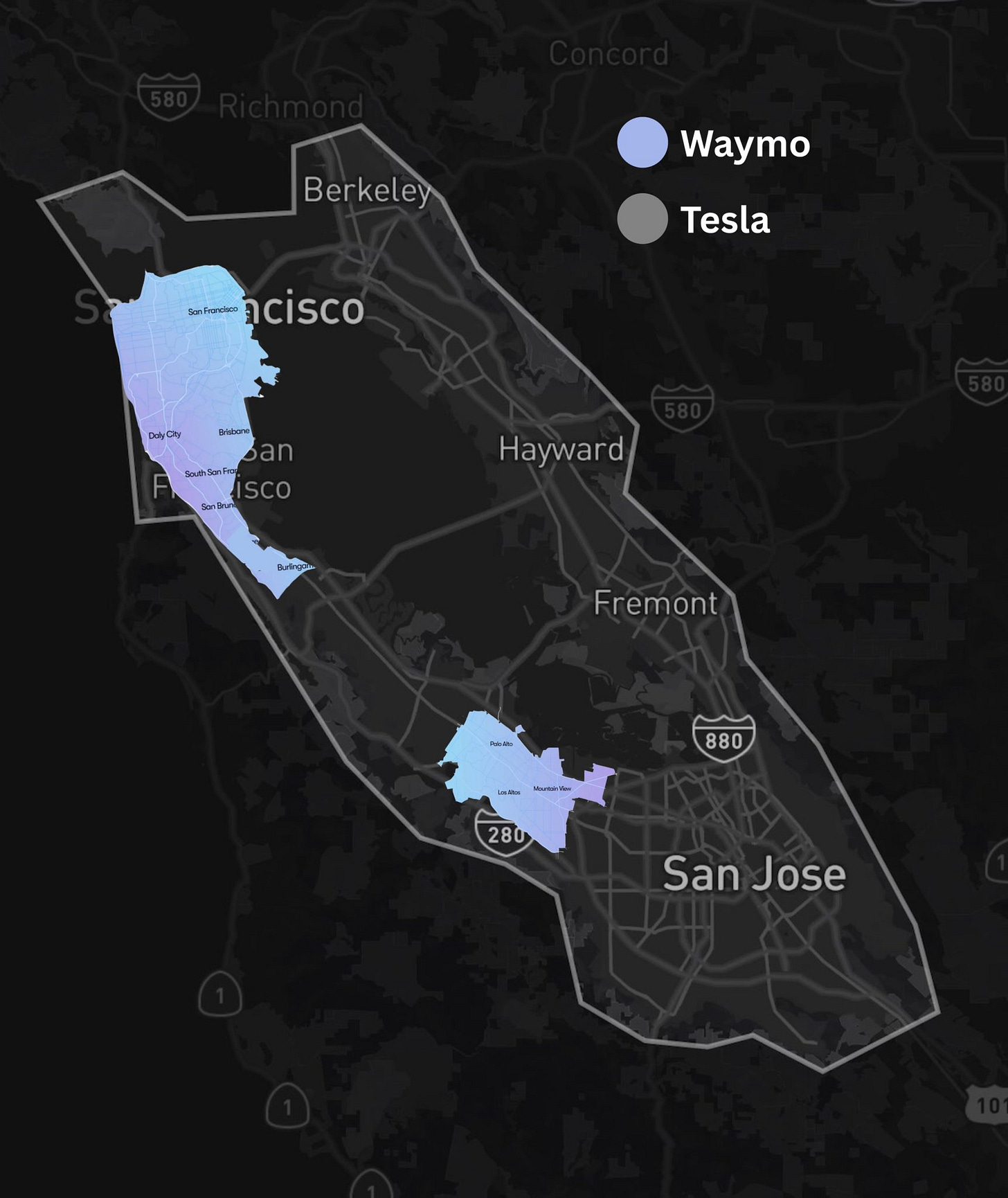

Tesla Robotaxi.

The service is still in a pilot phase without much cars available, but Tesla is already showing why its tech is better in terms of scaling as a month after its release, the company is now opening its service in San Francisco with an operative zone something like… Five times Waymo’s?

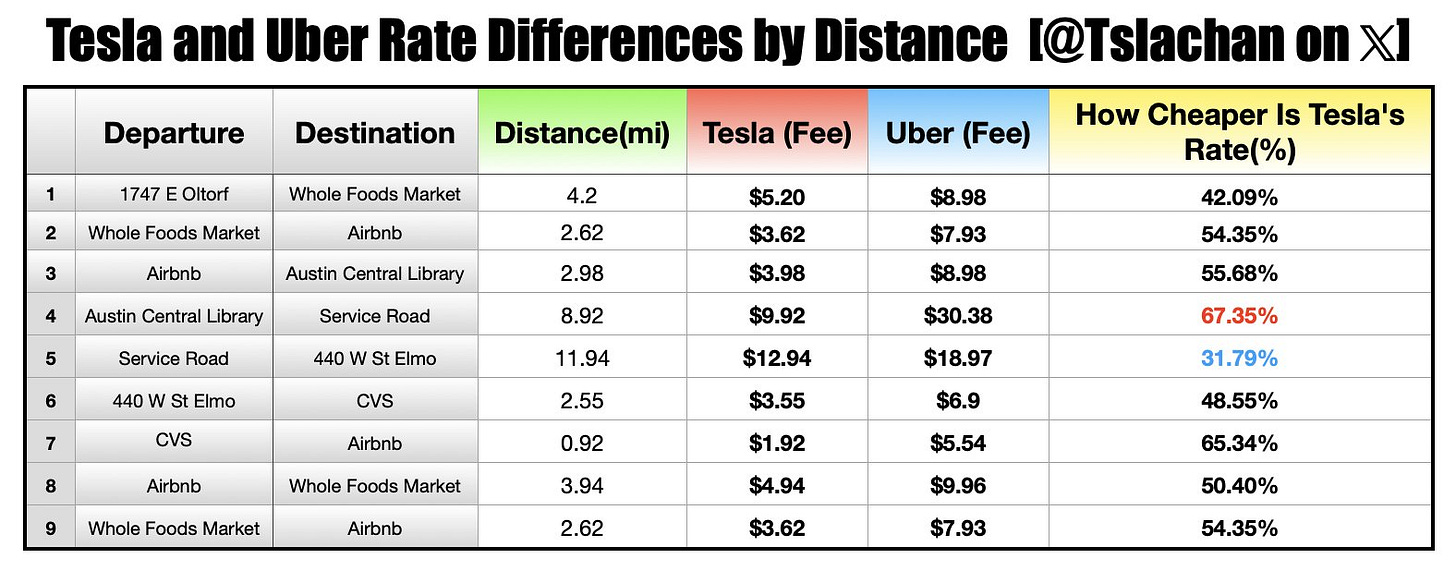

I know lots of people - even reading these lines, do not like Tesla but their technology is simply better & can scale much, much faster. Plus, Tesla manufactures its hardware which gives it another massive advantage above competition: vertical integration, and allows them to propose lower prices than competition - which has always been the bull case for robotaxis, that its price competitiveness would bring most users on its platform, stealing market shares.

Robotaxis are only on tests - which means prices are not final, but what was a fixed rate on the first day is now dependent on time & length… And are more than twice cheaper than Uber for the same trip.

The data is not from me but from Tslachan as you can see, who is documenting the difference between both ride-hailing platforms transparently.

https://x.com/Tslachan/status/1951467818806829235

Figma & Adobe.

Figma IPO this week & closed it with a $60B capitalization on $751M revenues FY24, while Adobe has a $147.5B capitalization for $21.5B FY24 revenues. If you needed proof on the market’s inefficiency, you have it here.

If you do not know Figma, it is an online collaborative interface design tool, mostly for web designers. And as a reminder, Adobe is being sold by the market due to the risk that AI apparently poses to its business.

My question would be, how is Figma not at risk by AI but Adobe is? Because that’s what the market is telling us, pumping one to 80x sales while the other one is being sold to less than 7x sales.

I am being a bit ironic here as I know the market short term is all about speculation, especially with IPOs, but I continue to believe that Adobe will be an opportunity. Once price action gets better.

Weekly Planning.

Next week is going to be the busiest week… Maybe of the year. You guys will receive a detailed review on Palantir, Hims, MercadoLibre, Uber & Duolingo. Detailed comment on AMD, Arista, Shopify and Airbnb, with some words for the rest eventually - nothing certain as they are not on my watchlist.

Small reminder that Olo was acquired a few months ago. I am not sure how it works but don’t think we will have earnings; earnings hub is probably not updated yet.

Earnings.

Closing on a very busy earning week, here’s a recap of all write-ups.