Transmedics Q2-25 | Earning & Call

The thesis is stronger than ever.

Everything you need to understand TransMedics’ bull thesis is here.

Our first half results reflect disciplined execution, continued gains in operating efficiency and meaningful progress in our clinical and innovation programs.

Business.

It is very hard not to be overly optimistic about TransMedics after this quarter. Growth is organic and comes from all verticals – OCS & NOP usage, in an industry which is dreaming of evolving, innovating to save more lives.

Organ transplant therapy is experiencing a renaissance globally due to the growing recognition of the life saving and cost effective outcomes when treating end stage organ failure. In The U.S, federal agencies and Congress are driving a national initiative to modernize The U. S. Transplant system to enable greater utilization of donor organs to meet the growing demand for more and better organ transplantation.

The European Society of Organ Transplantation or ESOT published a call for action paper in The Lancet, highlighting the global importance of organ transplantation. Specifically, the paper reinforced the urgent need for healthcare systems to prioritize investments in organ transplantation as a critical healthcare strategy given the significant impact on health and cost efficiency of organ transplants.

Management also confirmed during the call that they will continue to use their cash & income to focus on growth & growth only, through different verticals - international expansion, R&D for hardware or improved logistics.

Everything was positive.

OCS Hardware.

The product growth is as usual led by livers although there is an uptick in revenues from heart, which is a good indication of the trust given to the company.

Not only growth is very healthy but market shares are also growing.

We continue to take market share both DBD and DCD in heart and lung and liver.

My assumption is that after months of usage, the quality of the liver’s OCS convinced many practitioners to move forward & try for hearts. This is only an assumption but it would not surprise me as the industry is led by trust, and this is a very good indication of what could come as TransMedics received FDA’s approval to start its lungs next-gen OCS clinical trials – no updates on hearts yet.

We are pleased to report that we have received FDA conditional approval for the OCS Lung IDE in July. We’re continuing to collaboratively engage with FDA’s leadership to address their final questions and are planning to begin the trial initiation activities after the summer vacation season. On the OCS Heart IDE, we feel we are very close to reaching similar agreement with the FDA leadership to enable the near term launch of our clinical program. Based on the progress achieved with FDA, we feel we remain on track to launch both programs before year end.

The trust TransMedics is building with its actual OCS will go a long way when next-gens will be approved, as practitioners won’t hesitate to use them. As you can see above, lungs are less than 3% of total revenues and the trial will generate a small growth – nothing significant. But final approvals could open a massive new growth vertical to TransMedics.

A vertical with no real competition as other products' did not meet practitioners’ expectations, something TransMedics took in consideration while engineering its hardware.

Also, specific to the lung market, we have been very transparent in our view that the poor and equivocal clinical results associated with the non portable and non blood based perfusion technologies have contributed heavily to the current apathy for lung perfusion in the U. S. Therefore, we see the recent competitive commentary on U. S. Trends in lung transplant as a validation of our thesis.

We will have more data at the end of the year, after more practitioners use this OCS & give feedback.

Recent Controversies.

We had lots of noise over the last months about the transplant industry & some tried to pinpoint mistakes or fundamental issues on TransMedics. The results speak for themselves but Waleed made some comments during the call.

On the OPO controversy first – the stories about “alive” patients being harvested during DCD procedure covered by the NYT.

Waleed confirmed that first those concerns were not new to the industry, maybe to the press but not to them and that this would not change the decision to do DCD harvests, while TransMedics was either way respecting all rules – as detailed on the NYT article.

Please remember that while this is a complex market dynamic, there are clear and established protocols in place and that TransMedics NOP surgical procurement team strictly adheres to these established protocols.

He also confirmed that this could require more oversight or stricter rules in OPOs, which would be a good thing & a tailwind for TransMedics, not the contrary.

I think some level of organization and organizational structure and oversight will actually benefit the transplant market, especially in DCD. So we see this as just one example that some level of oversight is actually -- could potentially be beneficial, not detrimental. As I tried to highlight in my script, we feel confident that the unique attributes of our business allows us to operate in the current system or any system in the future, and we stand by that statement.

We also had some comments on the state of the lungs market, following XVivo’s quarterly debacle, confirming that competition’s weakness did not mean sector weakness.

While we hold all companies operating in the field of organ preservation in very high regards, I want to be crystal clear that our expectation is that as TransMedics continue to execute and gain more market share, the results of our peers with smaller footprints in the market could be negatively impacted.

If you want me to translate: others don’t succeed because we are eating their lunch.

And lastly, some words on OrganOx whose hardware has been authorized by the FDA to be air transported which the market saw as a massive potential competition.

This device is so large and so wide and so tall, based on our knowledge of the configuration of aircrafts in The United States or charter flight, they would require a large jet to be able to fly and not any large jet have that configuration. It's going to be too expensive to fly and ultimately the device doesn't have the battery capability. I think this is another unwarranted noise in the system that we see it at all.

Pretty clear: everything isn’t about FDA approval, you also need your hardware to be built for efficiency.

NOP Services.

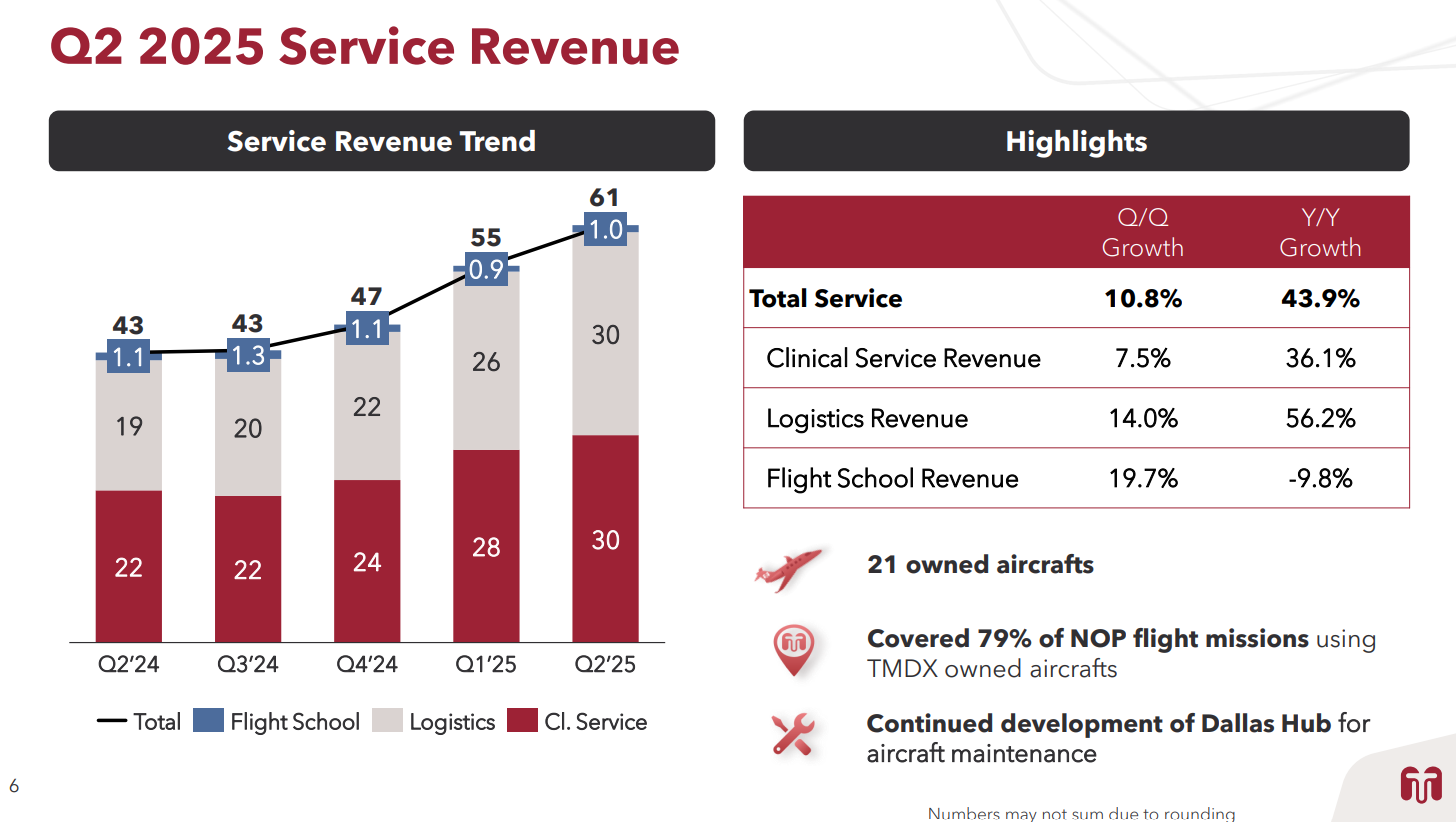

Not much to comment on here despite the fact that clinical service revenues are growing well which means more healthcare systems rely on TransMedics’ medical teams and on their end-to-end service - once again illustrating trust in their services.

Logistics continue to grow rapidly while only covering 79% of total flights, confirming a high demand for their OCS – which they cannot fulfill with their own fleet.

In Q2, we covered 79% of our NOP emission requiring air transport compared to 78% in Q1, So we're nearly at ourtarget of covering 80% to 85% of our NOP missions requiring air transport

As shared earlier, management confirmed their focus on growth & this means more jets in the future to reach their target, with no immediate plans to acquire any.

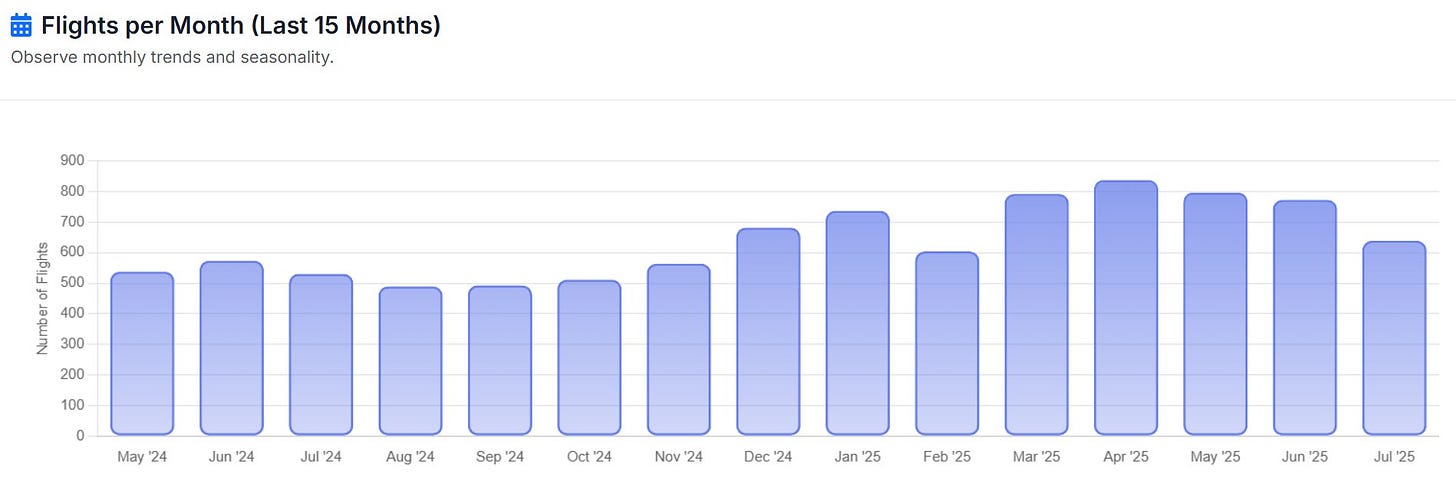

Seasonality

As surprising as it can be, there is a seasonality in the transplant industry and it hit the company hard last year, but the market is now understanding that - I hope, and won’t overreact if it happen this year - at least management tried to educate them.

First, I'll remind you all that we are in Q3, which includes summer vacation season for our users in The U. S. And outside of The U. S. We fully expect to see some minor and transient seasonality in our 3Q performance similar to what we saw last year.

We already have seen a slowdown in July’s flights which could continue in August.

So let’s not be surprised if we see it materialize.

Expansion.

As shared above, management intends to focus on growth through different verticals. Expansion being one of them with Europe as their first target.

We are also actively exploring options of expanding our NOP model internationally. This will enable TransMedics to potentially nearly double our total addressable market as Europe represents 45% of the global transplant numbers. This entails evaluating the potential for replicating the successful OCS NOP across several European countries.

They already shared some comments about a potential NOP in Italy but we had no news yet. It will happen, remains to see when.

Financials.

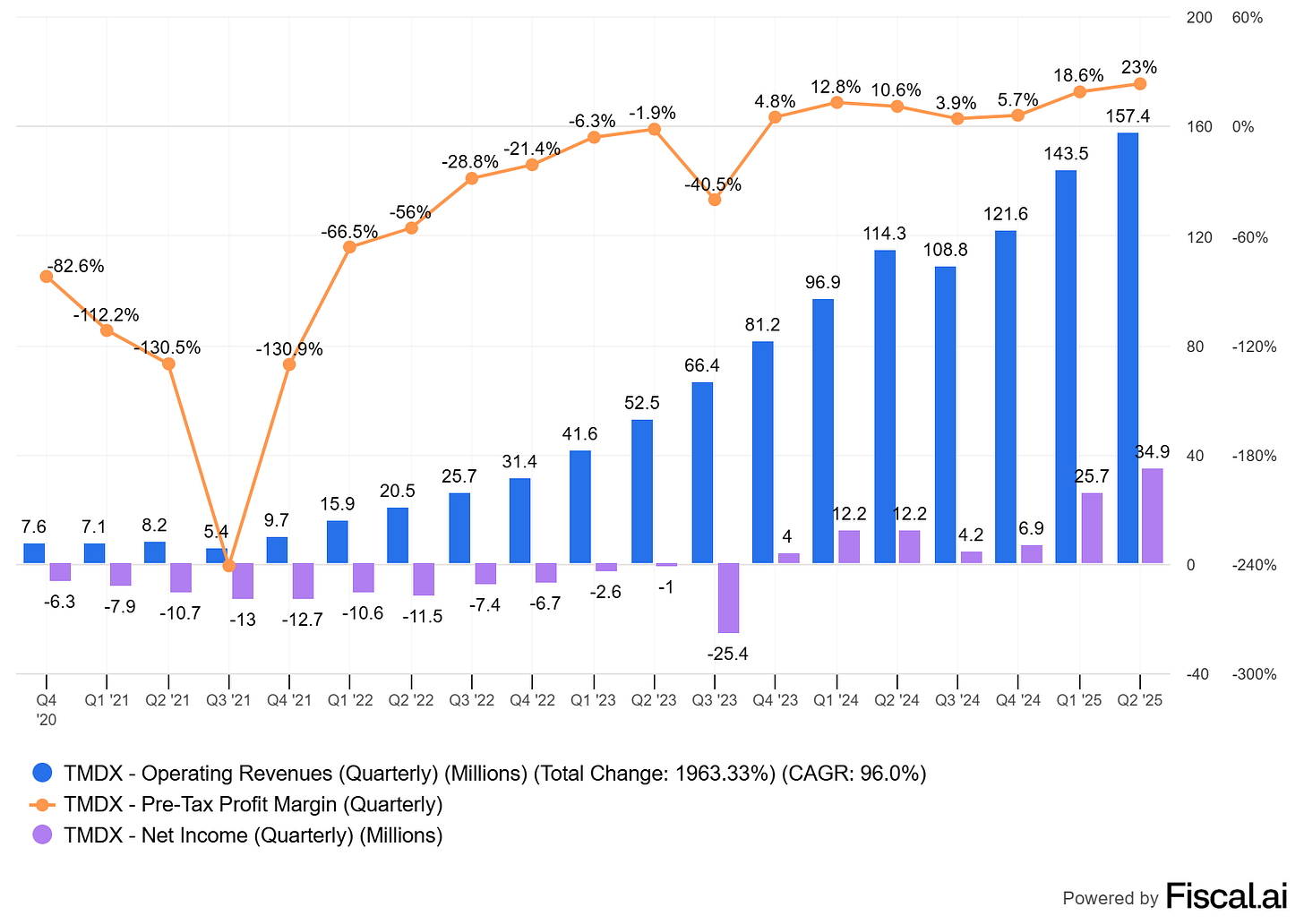

Fundamentals were great but financials are even better as we had real surprises there.

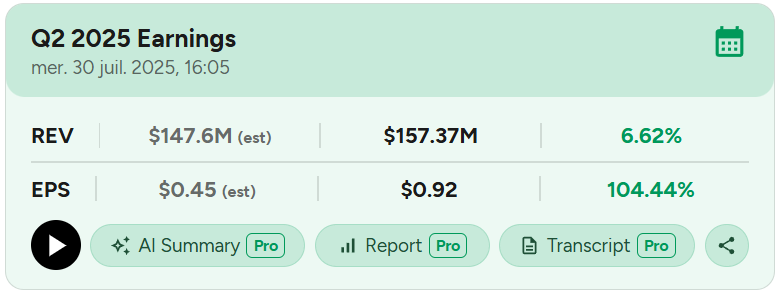

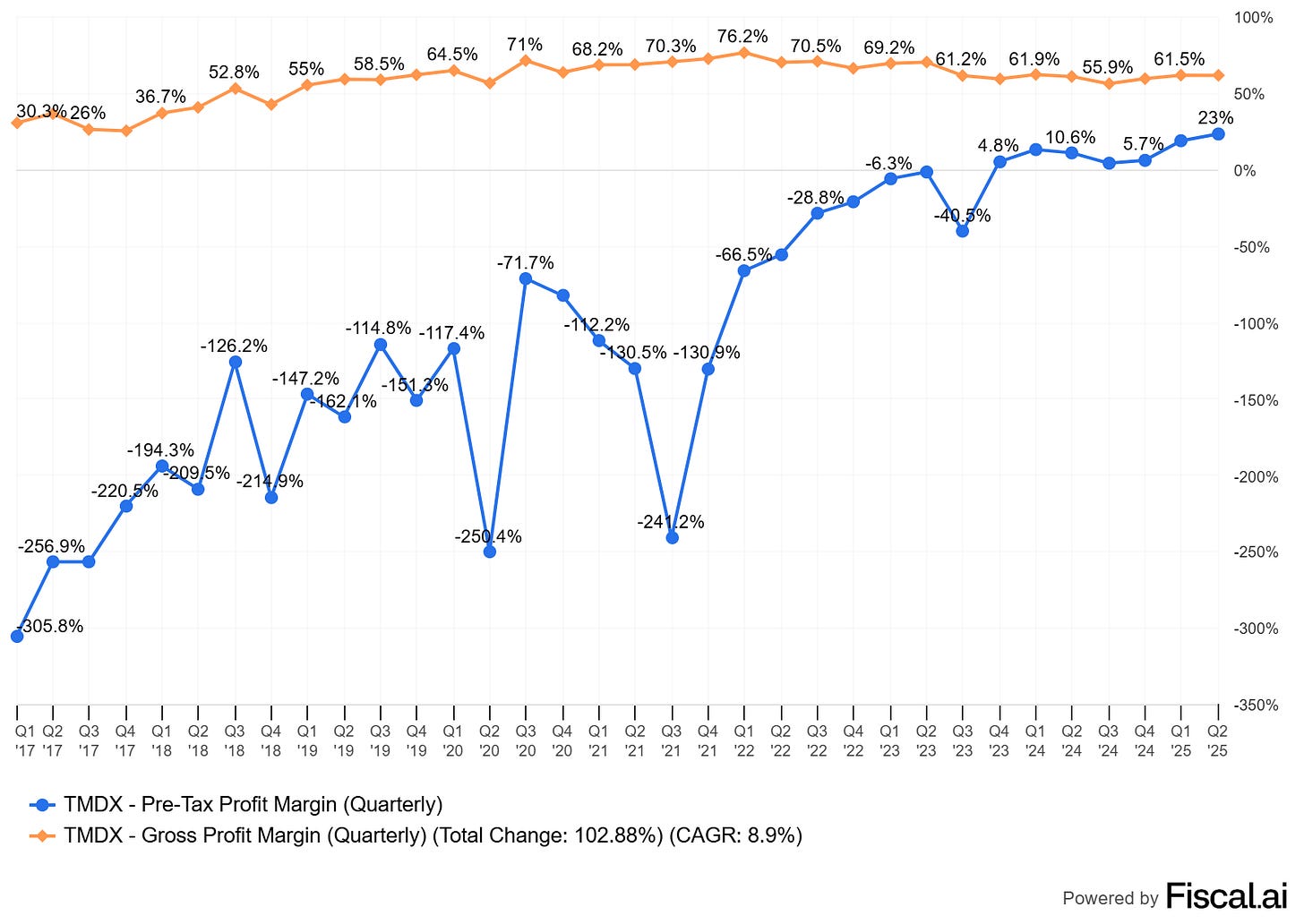

Revenue grew 37.8% YoY & 9.7% sequentially which is really strong but isn’t the most impressive data. Margins are.

TransMedics is succeeding on its bet to own the entire chain of a transplant system which required massive investment to get there, now finally yielding results in the form of operating leverage.

The Yoy increase was primarily driven by four thirty one basis point improvement in service margin, reflecting higher TransMedics fleet utilization and cost efficiencies in logistics operations.

And this played a big role in growing net margins with flatish gross margins - at least since the integration of NOP which is a lower margins service.

Those margins will continue to fluctuate depending on fleet maintenances & other metrics, but the bottom line remains that TransMedics proved two quarters in a row that it had what it takes to generate cash. Lots.

We are talking about $82.5M of FCF for $400M of cash & $60M of long-term debt - plus $451M of convertible notes.

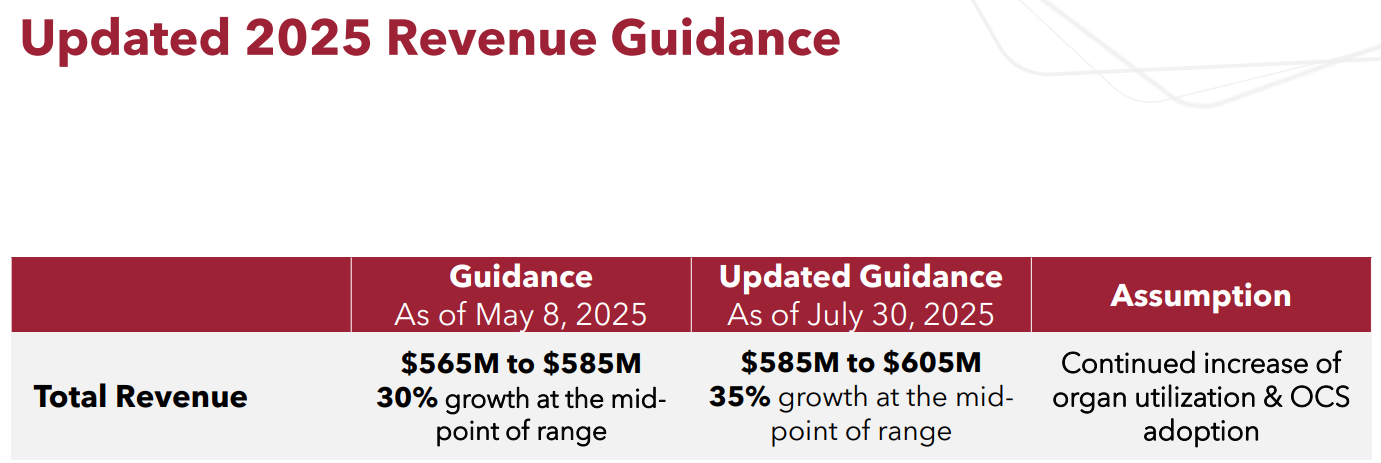

Guidance.

Fundamentals are really strong & financials are improving above most expectations. Logically, guidance was raised, even expecting a potential slow down in Q3-25.

That being said, our exceptional first half performance and strong overall trajectory gives us the confidence to raise our full year 2025 revenue guidance to between $585,000,000 and $605,000,000 representing approximately 35% growth over full year 2024 at the midpoint.

Looking. Good.

Investment Execution.

This quarter was nothing but excellent, confirming that the industry was healthy, that Tranmedics was one of its leader and putting to cross on the T for the different gossip running around.

Yes, TransMedics delivers quality & yes practitioners in the U.S. rely on them more & more for their end-to-end service and hopefully soon enough, also for their lungs OCS. Fundamentals are as strong as any bull could expect and financials are even better as we now see a clear cash generation potential with higher than expected margins.

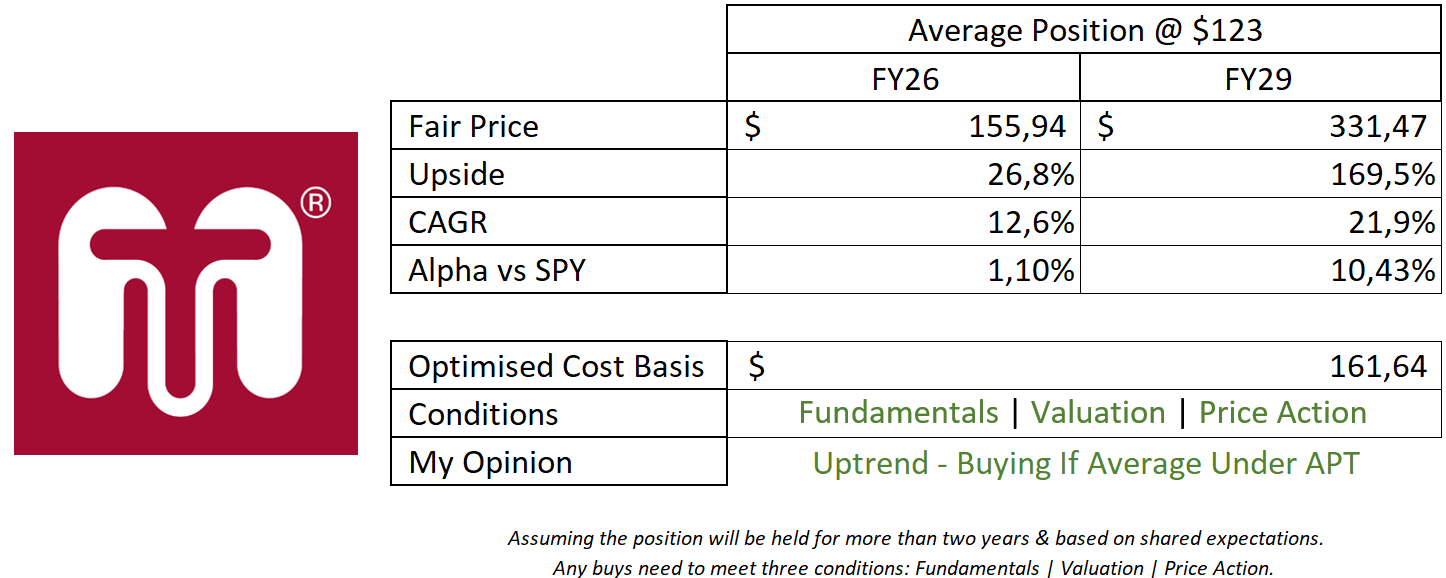

This was a dominant quarter from a dominant player & it allows me to raise my target with higher assumptions in terms of growth & margins.

This model assumes a 35% & 25% CAGR growth until FY26 & FY29 respectively, 21.5% net margins, 1% of dilution & P/S & P/E at 35x & 7x respectively.

Some assumption remains conservative notably FY29 growth as we could assume that lungs & heart OCS plus international expansion would yield a pretty strong growth long term - with kidneys on the pipes for post 2029. I also kept what I consider fair multiples but TransMedics could deserve higher ones.

This assumption is fair to my opinion, leaning more towards conservative than overly bullish. Better to lean that way than get burnt.

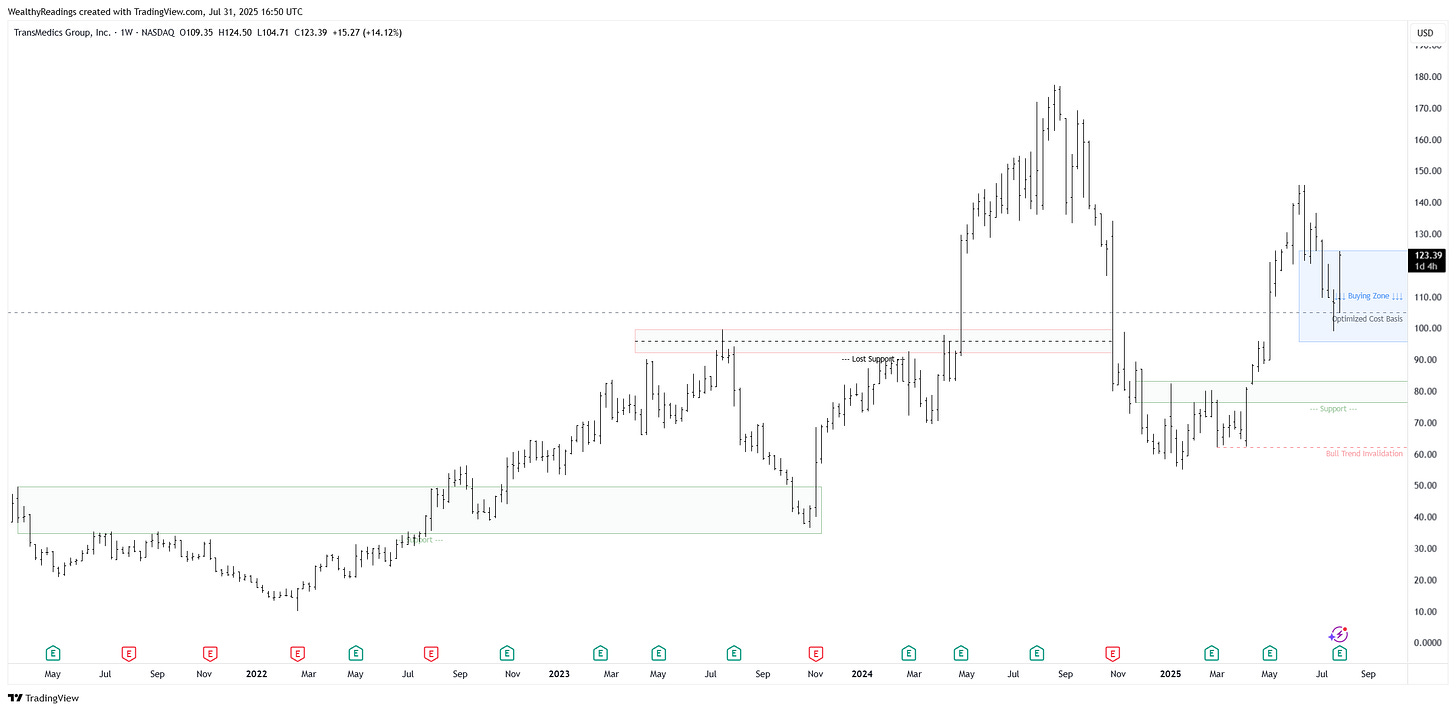

In terms of price action, there is nothing to comment. We had a wonderful breather which I - and hopefully some of you, bought massively, and are probably back to a bull trend from there.

Waiting patiently for the next step now, sitting on both shares & calls.

Appreciate your focus on TMDX, what a journey it’s been! Co. is slowdown proof as well.