Weekly Recap | December - W2

Potfolio Update, FED Rate Cuts, QE or Not QE, Nvidia's H200, Alibaba Cloud Demand, China Regulation, SpaceX IPO & More.

You’ll find my portfolio, watchlist, and action updates at the end of the write‑up from now on!

Before we dive into the news: no AI talk today. I’ve got a detailed write‑up coming that covers the situation, the market’s reaction, Oracle and Broadcom earnings this week, and why I keep buying Astera Labs. That piece will have all the AI updates you need and will be out next week.

The FED Cut Rates.

No surprise here. Bit sad to be in Europe as I would’ve made decent money on Kalshi in November betting on that obvious 25bps cut.

More importantly, the FED announced they’ll restart balance sheet expansion with a $40B buy of short‑term bills. There’s debate online about whether this counts as QE, since the textbook definition is buying long‑dated treasuries, not short‑term.

Semantics aside, bottom line is this boosts short‑term debt accessibility and pleases most market players. It will not fix real estate’s weakness as long‑term rates are still market‑driven, but from the government’s perspective, short‑term debt is the priority as the fiscal dominance forces them to always emit more debt.

This is good news for markets. Short‑term treasuries will keep printing, liquidity won’t slow, and now there’s a new buyer. From a stock investor’s angle, this is even better than “real” QE: more liquidity, easier short‑term borrowing for companies, and real estate stays unattractive with high rates - so liquidity flows into equities instead of diversifying away.

So far, so good.

China, Alibaba & Nvidia.

Okay, a bit of AI talk, but only in the China context. Another twist in the H200 saga: we discussed during Nvidia’s Q3 the possibility of those chips being sold in China. It has been validated this week - again, though it’s been approved and canceled multiple times before.

I’ve always said sales would eventually go through as China won’t strike a deal without access to the U.S.’s most valuable tech, and the U.S. needs a deal. So here we are.

This is huge for Nvidia. They stopped including China in guidance and order books, while western demand was already insane.

We currently have visibility to $500 billion in Blackwell and Rubin revenue from the start of this year through the end of Calendar Year 2026.

Add Jensen’s estimate of a $50B market in China… And that’s Nvidia’s potential FY26.

But the Chinese government is adding restrictions to imports, something I flagged could happen in my Alibaba bull case: the government will favor local companies.

Reports say purchases of U.S. GPUs will be limited. Only established cloud providers and some neo‑clouds can buy H200s. Enterprises building their own infra won’t be allowed, they’ll have to contract compute to providers.

This isn’t just about controlling compute or boosting chosen winners. It’s also about forcing local firms to invest in R&D, eventually producing competitive hardware instead of relying on Nvidia.

If those regulations go through, a “Meta‑like” company in China couldn’t buy Nvidia GPUs directly. They’d either use local hardware or rely on providers.

For us, as Alibaba investors, this is a net gain. Last quarter proved Alibaba was the best provider in terms of quality in China, due to its vertical integration - something we already saw to be an advantage even in the west.

SpaceX IPO.

Nothing official yet, but Bloomberg reported SpaceX is eyeing an IPO in 2026, aiming to raise billions at a ~$1.5T valuation. Massive. The space sector hit new highs this week after this new.

This will be fun to watch, as we also have many other massive potential IPO next year.

Weekly Watchlist Update.

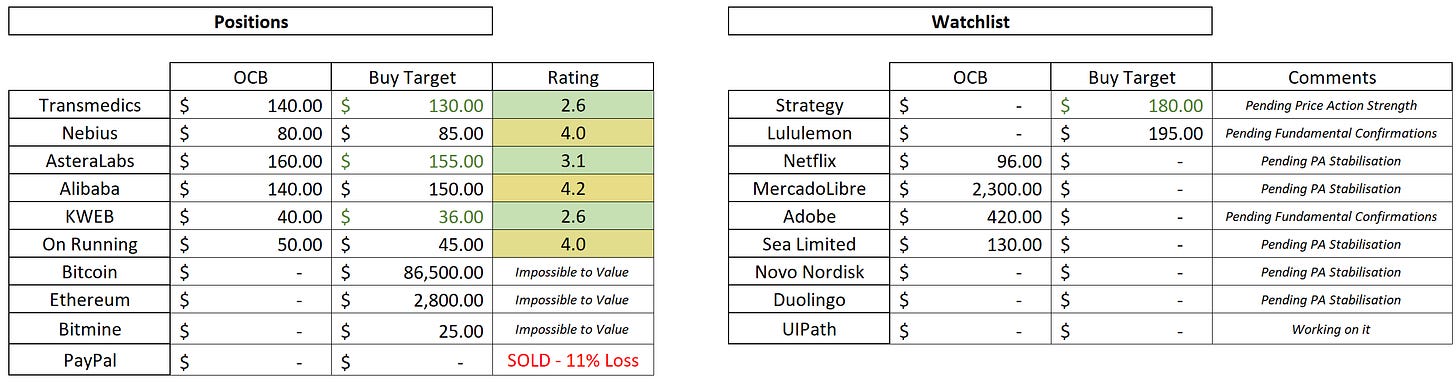

Here’s my watchlist and buying plan - both current positions and watchlist names. As always, buys & sells are free to access in my public portfolio:

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Rating - Buy < 3.5 < Hold < 7 < Trim.

Bold - updates compared to last week.

Green - Potential buy/accumulation.

Transmedics behaved opposite of what I expected. I thought it could go back within its range but that wasn’t my base case. But here we are now, down 20% in two weeks. I said I’d buy again below $130. That’s the plan now. Fundamentals and potential remain strong.

I closed PayPal this week, as I said I would if opportunities came up. That happened with On Running, which adds some diversification. Sportswear has been bouncing lately, which helps since most of my owned sectors have been struggling.

I commented on Lululemon and Adobe earnings this week - check those write‑ups if you feel FOMO after their stock reactions. Even though the market rewarded them, struggles aren’t over. Neither stock is going to rocket in a few days. Stay rational. The potential is here but I wouldn’t be a buyer just yet - although many disagree with me.

On crypto: Ethereum behaved better than expected, breaking its bear trendline, and I bought a bit more. I expect more strength than I initially thought. Still, the “more pain before gains” thesis is alive, and I’m ready to buy more if that pain shows up. Same goes for Strategy and Bitmine - I already sold some puts there, following the plan.

No AI stock talk today, full write‑up coming this week on why I keep buying Astera Labs, my plan for the stock, and why I think the AI fear is overblown. Stay tuned.

Weekly Planning

Nothing I am particularly looking at this week, although we will have some important macro data including inflation, unemployment and retail sales which could move a bit the markets.

I’ll see you for that AI situation & AsteraLabs detailed review, wishing you a wonderful week in the meantime!

Regarding the FED's moves, your liquidity explanation is super clear. It's smart how you highlight market flow, but I'm still pondering housing affordability. Eager for the AI piece!