Weekly Recap | November - W3

Watchlist update, Consummers weakness, Rate cut anxiety, Liquidity rotation, Portfolio Review, Alibaba super-app, Hims At-Home lab, AsterLabs acquisition & Weekly planning

If you guys are interested by a 15% reduction on all FiscalAI subscription plans, click the link below!

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs and honestly the best platform on the market to follow companies’ fundamentals. If interested, feel free to use my link!

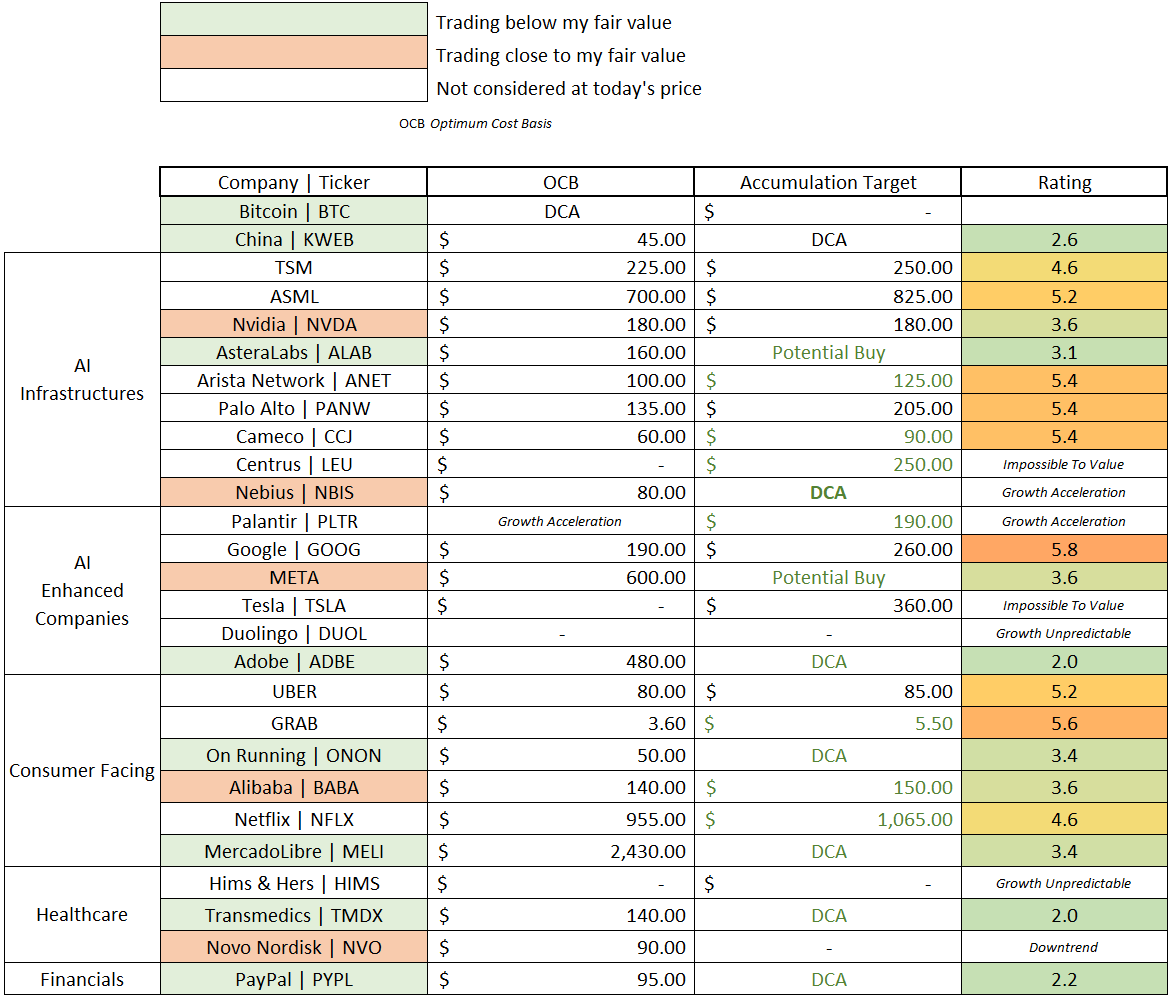

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

Bold - updates compared to last week.

Green - Potential buy/accumulation.

Note that I’ve updated the color code in the company column, now reflecting the current price relative to my OCB.

Lots of green in the accumulation column this week. The market took its breather and is offering long-term opportunities on many names.

I increased my weekly Bitcoin accumulation as we’re now trading below $100,000.

KWEB is perfectly retesting its earlier breakout and is a top pick at today’s price for exposure to China’s tech growth.

Astera Labs filled the daily gap from a quarter ago and is now bouncing off its 200 daily, a great entry point though risks remain as it’s a growth stock, as detailed here.

Nebius was heavily punished. I’ve shared my accumulation strategy in my full review. I’ve started buying, but we could still dip to close the Microsoft deal gap and test the 200 daily - both around $75, similar to Astera Labs.

Meta is now around $600, my revised OCB, very probably a great long-term buy for those aware of the potential downtrend detailed in my review.

On Running had a stellar quarter, up 18% this week, yet remains cheap as the market worries about consumer health - with reason.

Alibaba is back in an averaging-up zone, right at the confluence of its weekly 21 and the breakout of its 3-year range.

MercadoLibre continues to be punished for unclear reasons. It remains one of the best opportunities to diversify outside the U.S. for those avoiding China - detailed review here.

TransMedics just completed a textbook retest of its bearish trendline breakout and 200 daily. Fundamentals are strong, flight volumes are reaccelerating & I’ve added both calls & shares. This is the best setup in the market right now to my opinion. If this doesn’t work, nothing will…

Novo Nordisk is showing signs of a bottom. If we hold around $45 a bit longer, it could become one of the most attractive names in the market.

I’ll try to include a short note for each stock on the watchlist - those with something interesting to share, like done above focused on investment and price action going forward. Hope it’ll be useful.

Market & Macro.

Plenty to unpack as the market grows worried.

I won’t speculate too much, but we’re clearly entering a phase with fewer tailwinds. The government has reopened, we have a deal with China, we’re in a rate-cut cycle, the Fed plans to end QT by year-end & resume Treasury purchases in 2026. Many good news are now behind us, with less to look forward to.

AI CapEx fears are at peak though no hard data supports them yet. And we do have clear signs of consumer weakness, especially among lower-income households, as I anticipated a year ago in my macro review.

Here’s a quote from Chipotle’s earnings call that sums it up:

Now, I want to spend a minute addressing a few of the consumer headwinds we have experienced. Earlier this year, as consumer sentiment declined sharply, we saw a broad-based pullback in frequency across all income cohorts. Since then, the gap has widened, with low to middle-income guests further reducing frequency.

We believe that this guest, with household income below $100,000, represents about 40% of our total sales, and based on our data, is dining out less often due to concerns about the economy and inflation. A particularly challenged cohort is the 25 - 35 year old age group. We believe that this trend is not unique to Chipotle and is occurring across all restaurants, as well as many discretionary categories.

No surprise here. Inflation has crushed many households, and that’s not something that resolves quickly. I expect continued weakness in this kind of sectors.

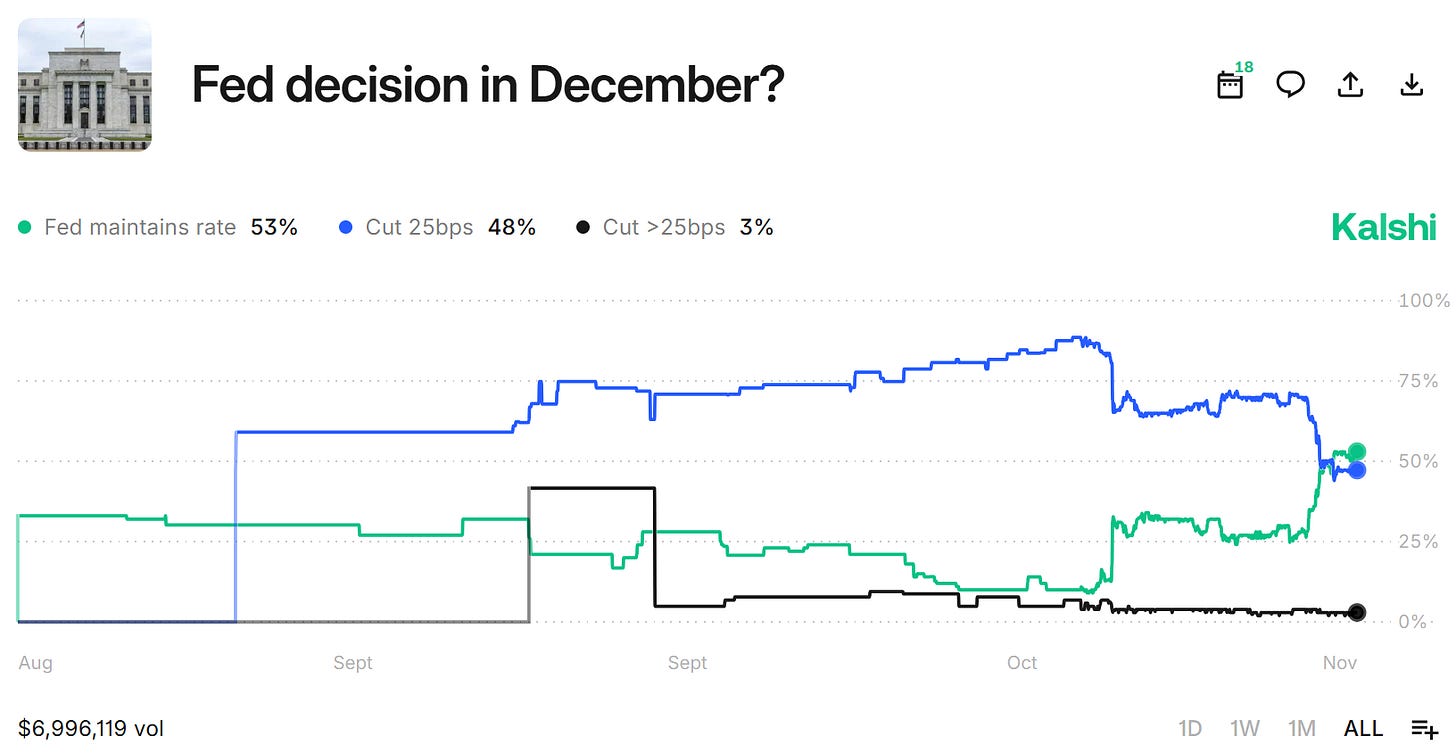

To top it off, we had some hawkish comments from members of the FED this week, which spooked the market about December rate cut. What was a certainty is now a question mark, and markets hate question marks.

That being said, the broader setup hasn’t changed. Even without fresh macro data, thanks to the shutdown, the FED remains stuck between inflation and a weakening labor market and right now, the latter is hurting more, so cuts are still likely. If not December, then early next year. If the market’s weakness is indeed due to this, it’ll be forgotten rapidly.

Liquidity Rotation.

The S&P has been volatile this week. While it’s only 2% off all-time highs, most stocks have been hit hard and many growth names are down 50% plus already. If you’re not in tech blue chips or diversified into key sectors, your portfolio hurt.

And there are only two key sectors: energy and healthcare.

This is the first real rotation we’ve seen in quarters. It doesn’t mean the tech bull run is over, but it does raise questions about its remaining length. Liquidity doesn’t shift to defensive sectors without reason.

That said, I’m not changing my positioning. The market needed a breather - I’ve said this many times, and we’re getting it. It could last days or weeks, though I’d expect a strong end to the year. The only concern in the data is the health of U.S. low-income households and I’m not exposed to that, only slightly through PayPal.

I don’t believe this is the end of the AI trade. It’s just a pause as the market prices in some risk and macro concerns. The long-term thesis is intact, although Nvidia’s report next week will need to confirm this.

My portfolio took a hit, but convictions haven’t. My macro view is unchanged: fiscal spending and liquidity injections won’t slow down. I own great companies at great prices and will keep buying them. Volatility is a feature, not a bug.

Sure, it’s tough to stomach, especially with options, but it’s part of the game. And if you’re only playing with shares, this breather is a chance to reinforce positions or start new ones you’ve been patiently watching.

Nothing changed since last month, as long as we focus on buying great companies are great prices, overperformance will happen naturally.

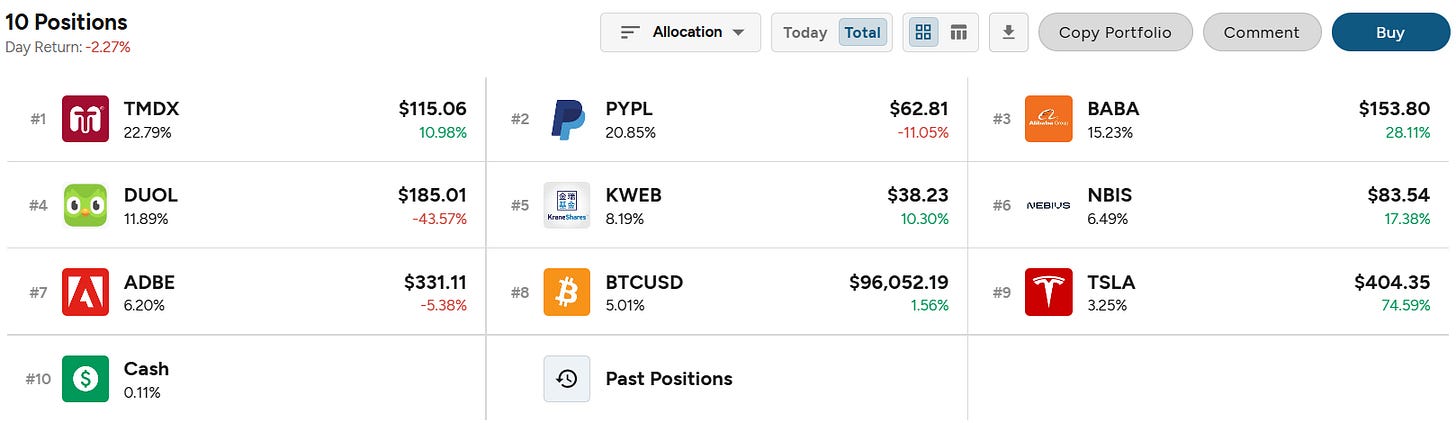

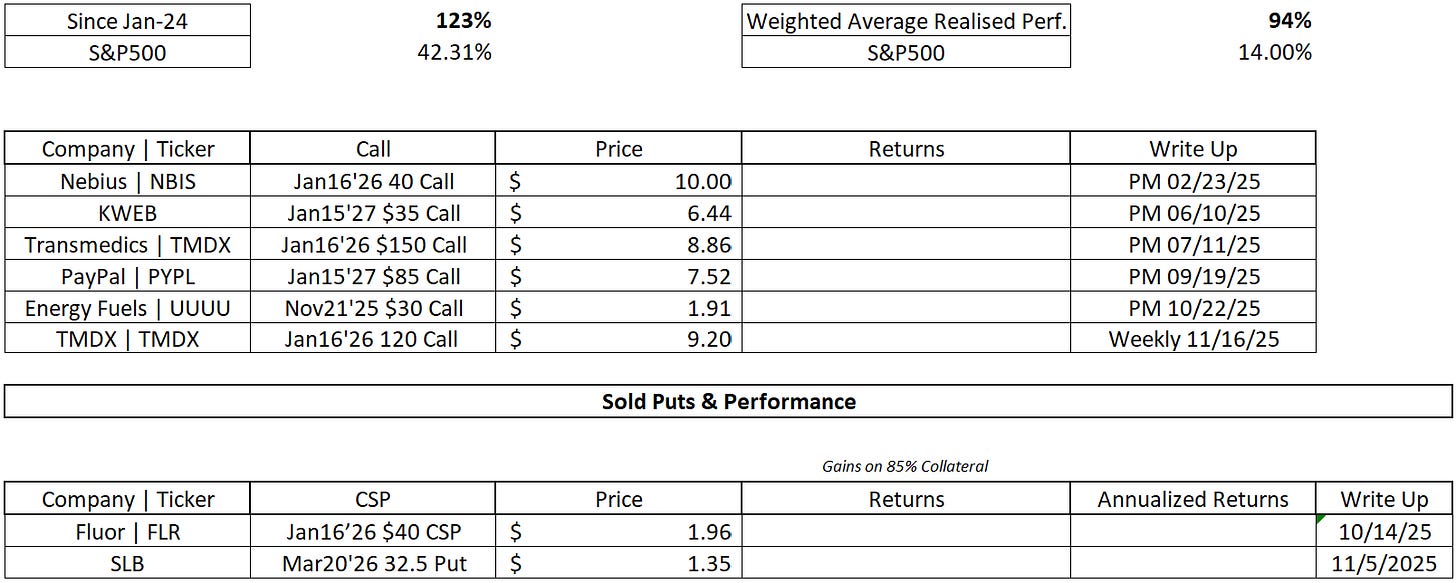

Portfolio Review.

As you guessed: my portfolio took a hit. What was a strong YTD outperformance a month ago is now a slight one - a few percentage points, for a few reasons.

Duolingo: Hard to call this a mistake, no one saw management’s shift coming. My error was being too optimistic and making it a core position too early.

Energy Fuels: This one was a mistake. It hurt my options portfolio badly. I chased a narrative, which will certainly be proven true but wasn’t necessary. Expensive but necessary lesson.

Options Portfolio: Implied volatility crushed this week. I’m concentrated in three names - TransMedics Nebius & PayPal, who got smashed despite strong earnings. Their options got crushed and this badly impacted my overall portfolio. I see this as a temporary setback, we’re talking about three quality assets and expirations are far enough for them to rebound, assuming my view of the market is right and we’re only in a breather, not a structural shift in narratives.

Here is my portfolio and my option account. I’ve made some adjustments: closed my Astera Labs shares to buy more Nebius, exited my JD.com puts/calls to free margin and add to TransMedics.

On the bright side, I shared two energy trades a month ago which are doing well. If you followed me into even one of them, you’ve got a nice edge. If you missed them, we are talking about Halliburton and Schlumberger, both are still buyable today.

Watched Stocks and Portfolio.

Alibaba Super App.

Alibaba is working on integrating AI into its super app.

Hims At-Home Lab Testing.

Hims has finally launched its lab testing service, which is pretty interesting.

AsteraLabs Acquisition.

Astera Labs confirmed the acquisition of aXScale Photonics, as discussed in their earnings review.

Weekly Planning.

Earnings season is slowing down, with only Nvidia and Palo Alto reporting this week. Both will be covered in detailed write-ups.

Nvidia is crucial to the market, it needs to restore trust in the AI CapEx cycle and its value added/long-term viability. We had great data during GTC but we need to see it in the numbers now. The contrary would be worrying.

Have a wonderful week, I’ll see you later!