Weekly Recap | November - W2

Watchlist Update, Government Shutdown, Market Price Action, Meta & Google Financing, AI Bubble v.28759423, Nebius New Datacenter & Token Factory, Weekly Planning.

If you guys are interested by a 15% reduction on all FiscalAI subscription plans, click the link below!

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs and honestly the best platform on the market to follow companies’ fundamentals. If interested, feel free to use my link!

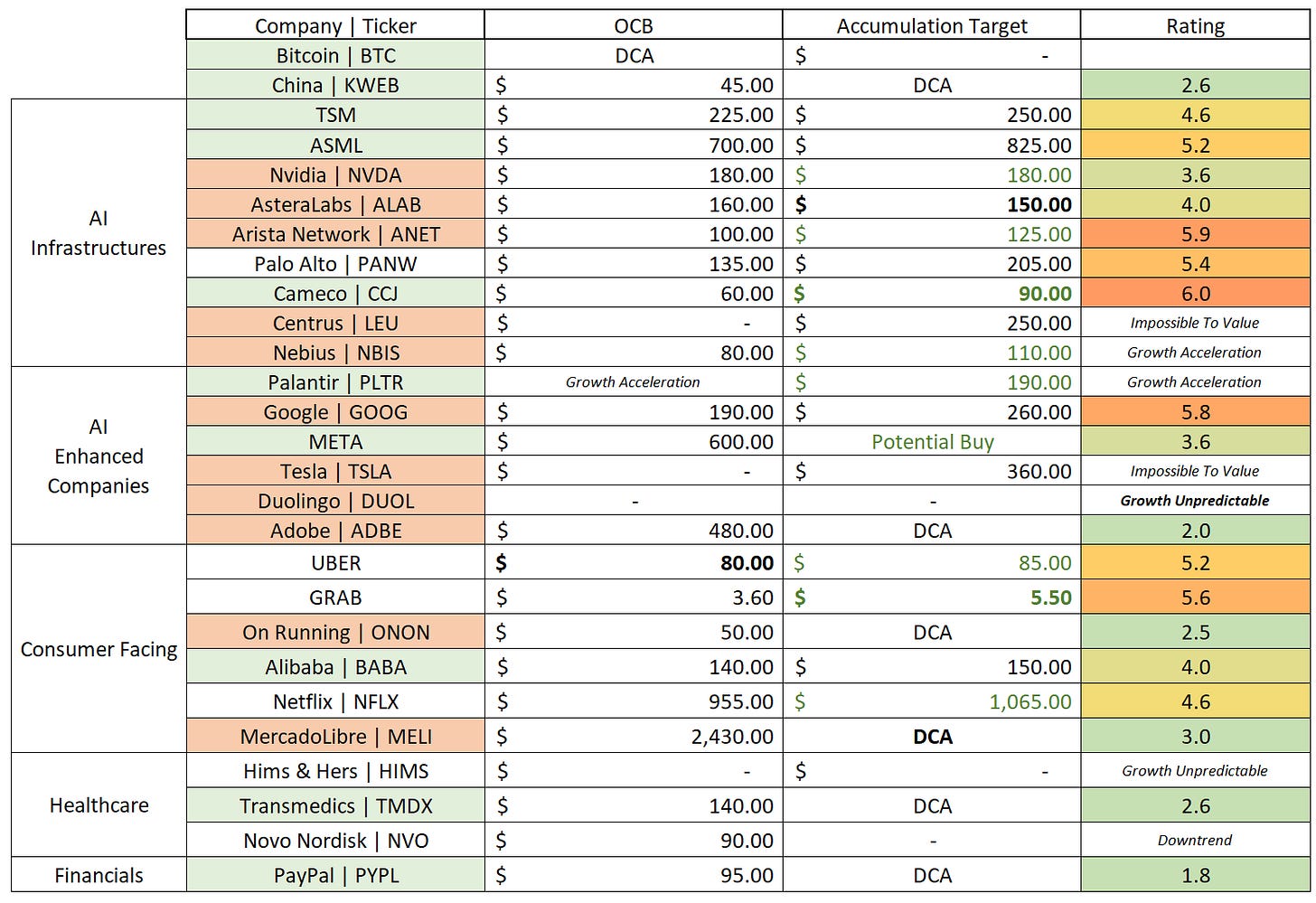

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold - updates compared to last week.

Green - trading at accumulation target.

I bought AsteraLabs this week as my price target was reached after what I considerd good earnings with positive information. You can read my argumentation here.

On Duolingo, I removed the DCA rating. Management will prioritize user growth over monetization which will reduce near-term growth. I still believe in the bull thesis but liquidity will go elsewhere short term - probably Adobe as other majo position are fully built by now. I’ll buy Duolingo again soon, fundamentals are strong and price is attractive for the next decade. Just waiting for some stabilization.

Meta continues to fall as the narrative is about margin pressure. Like Duolingo, Meta will be fine in five to ten years. Depending on your investing profile, it could be a good buy today. Full breakdown here.

MercadoLibre is also down despite a great quarter. If you’re looking for exposure outside the U.S. and want to avoid China, this is one of the strongest candidates at today’s price.

As the table shows, there’s value in this market for long-term investors. Tech is expensive but many sectors aren’t. I also recommend to check out my write-ups on Schlumberger and Halliburton; energy is underrated with real value.

We still need to respect the market, but there are reasons to nibble on long term names. Plenty of attractive prices out there.

Market & Macro.

The market’s been moving fast. Here’s what I said last week.

Earnings season will now be the focus as short term macro concerns are resolved, or giving more clarity at least, and we do not have meaningful catalysts except earnings during the next weeks. The only important subject left is the government shutdown which will hopefully be resolved soon, with positive news.

Until then, we are in a bit of a blur where everything is possible, but we enter it with a positive position, trading above key average and trendlines.

Seven days later, the S&P lost its daily 21 and bounced nicely off the daily 50, a critical level. Losing it would mean pain for longer, no fast recovery.

Last month wasn’t great. Even with the S&P up, most stocks declined. Only megacaps had positive returns and earnings reactions were kinda extreme both ways. Anything less than great was heavily punished.

In short, not much optimism despite a deal with China which I thought would lift the market. But it wasn’t enough with the latest catalyst: the government shutdown, now the longest… ever. It’s starting to hurt the economy with massive delays at airports and other services closed due to absent workers.

The main blocking point remains healthcare spending with other disagreements on nuclear for example. Both parties keep proposing solutions only to see them rejected immediately. This is the reason for market’s biggest concern right now: consumption slowdown, service sector drag, and rising unemployment risk.

My view hasn’t changed. The China deal should’ve been the highlight and once the government reopens - and it will as public pressure will force one side to give up, paychecks and pensions will resume and the market will celebrate this.

That’s why I keep buying. Short-term pain, but I don’t see a bearish end to the year, although as usual, I am often wrong and could be once again so what matters is to have plans, not to invest because “I think that…”

Plans. Systems. That’s what works.

Watched Stocks and Portfolio.

This week was all about earnings. You should read the ones I covered and check out others you’re interested in. We saw a lot of overreactions and exaggerated moves which created great long term opportunities. I shared some I focus on but you might have other focus.

The AI Bubble v.IDon’tKnowAnymore.

Once again: read my Meta earning report to understand CapEx impact on the stock.

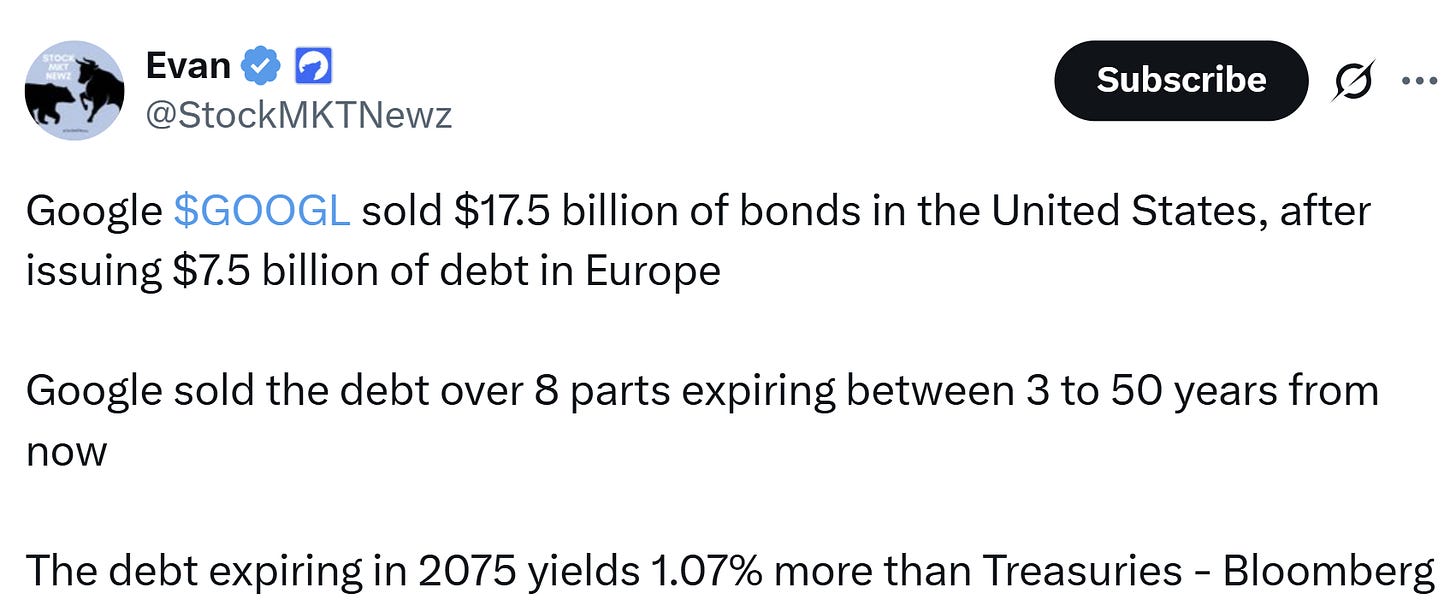

Spending is acceleratin - again. Meta completed a $30B bond sale this year. These won’t appear on the balance sheet, which is not normal in my opinion. But no one’s asking it, so. No point complaining about things we can’t control.

More spending means more GPUs, depreciation, expenses & lower margins. That can hurt the stock again - hence the importance of reading my report to understand the dynamics and why.

And Meta’s not alone. Google raised $25.5B in bonds across Europe and the U.S. for the same purpose: AI buildouts.

And as I said in my Google review last week, what’s happening to Meta - shrinking margins and rising expenses, will happen to Google next.

As for the risks, I don’t think anything changed. Both companies generate massive cash, are highly profitable with an healthy business even in a recession. These are corporate bonds, not high-rate shady bank loans. I don’t believe this leverage will cause problems and am not part of the “2008-style bubble” narrative.

But I do think the market will get frosty if AI services don’t deliver meaningful growth to justify the spending. It did help both business until today, but we need more improvements, not stepbacks. And the market will see shrinking margins as stepbacks.

I don’t see a debt bubble. But I do see punishments for continuous spending without ever better results, short term.

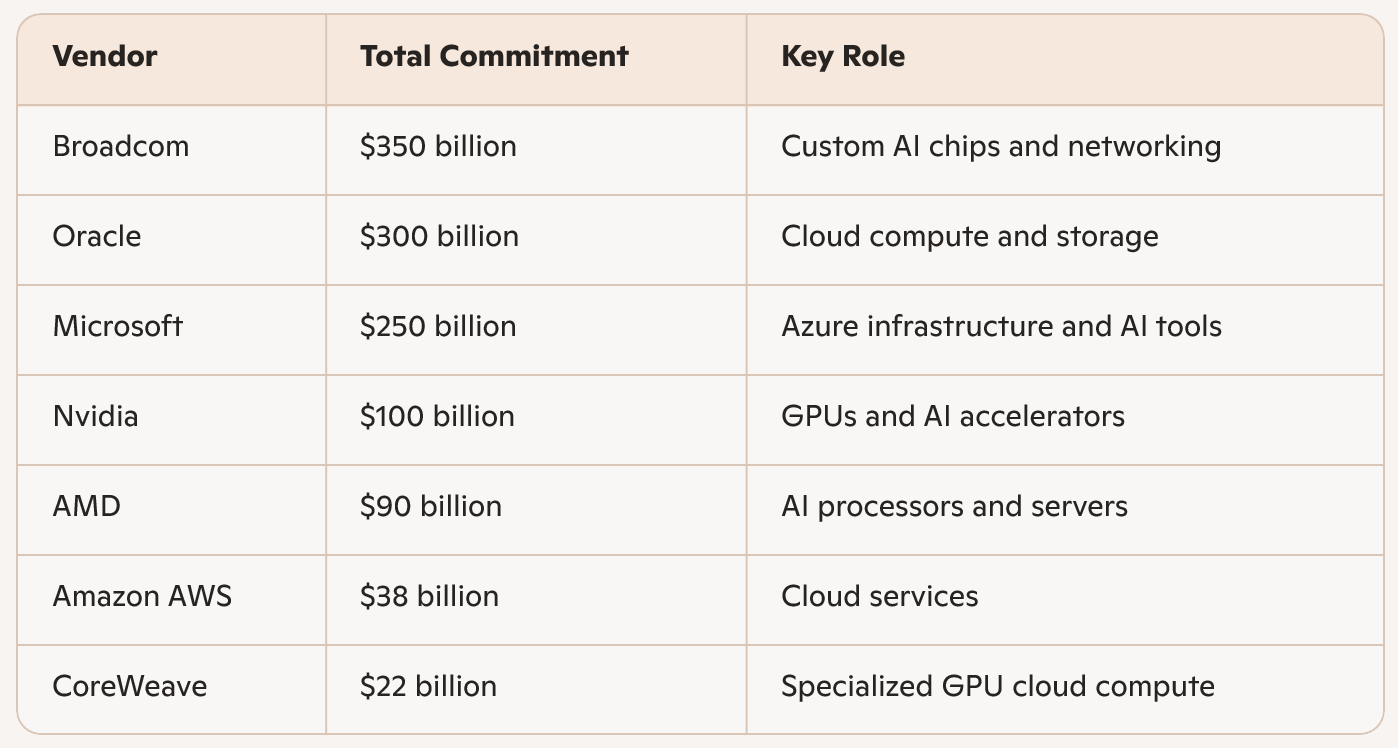

We also saw another OpenAI deal with Amazon this time. Same story: I’m confident in Meta and Google, but not in OpenAI, which now has $1.15T in cumulative commitments for hardware, cloud and compute.

OpenAI expects $13B in revenue this year and $125B by 2030. The math is clear, no one knows how they’ll pay for this. If there’s a bubble, it’s here. And if those commitments aren’t met, it’ll hurt the entire industry in term of revenues and the entire stock market.

This is the real concern, not Google or Meta’s bond sales, which are independent of OpenAI by the way. The last two standing and if ever this situation were to blow up, the two obvious stocks to pick up.

Nebius News.

Two very important development for Nebius’ future.

Their UK datacenter is now live, with 4,000 Nvidia HGX B300 GPUs across 126 racks. Another 3,000 GPUs will be added this quarter. The company was already at full capacity, so these will generate revenue immediately.

Second, the company launched Token Factory; a compute service for enterprises directly competing with hyperscalers.

These neoclouds keep delivering. Plus, we’ve had great feedback and business news from ClickHouse, in which Nebius holds a 28% stake.

Weekly Planning.

We’re wrapping up the biggest week of the season. You’ve received tons of write-ups already, with more coming.

I didn’t comment on Hims; this quarter had nothing new to offer. I’m out of the name, and what I said last quarter here is playing out slowly and should continue through year-end.

Next week, I’ll cover two earnings with a dedicated write up: Nebius and On Running, with possibly some words on JD.com in Sunday’s weekly as I hold an option position.

Others are either watchlist or personal interests.

Have a wonderful week, see you then!