Weekly Recap | November - W1

If you guys are interested by a 15% reduction on all FiscalAI subscription plans, click the link below!

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs and honestly the best platform on the market to follow companies’ fundamentals. If interested, feel free to use my link!

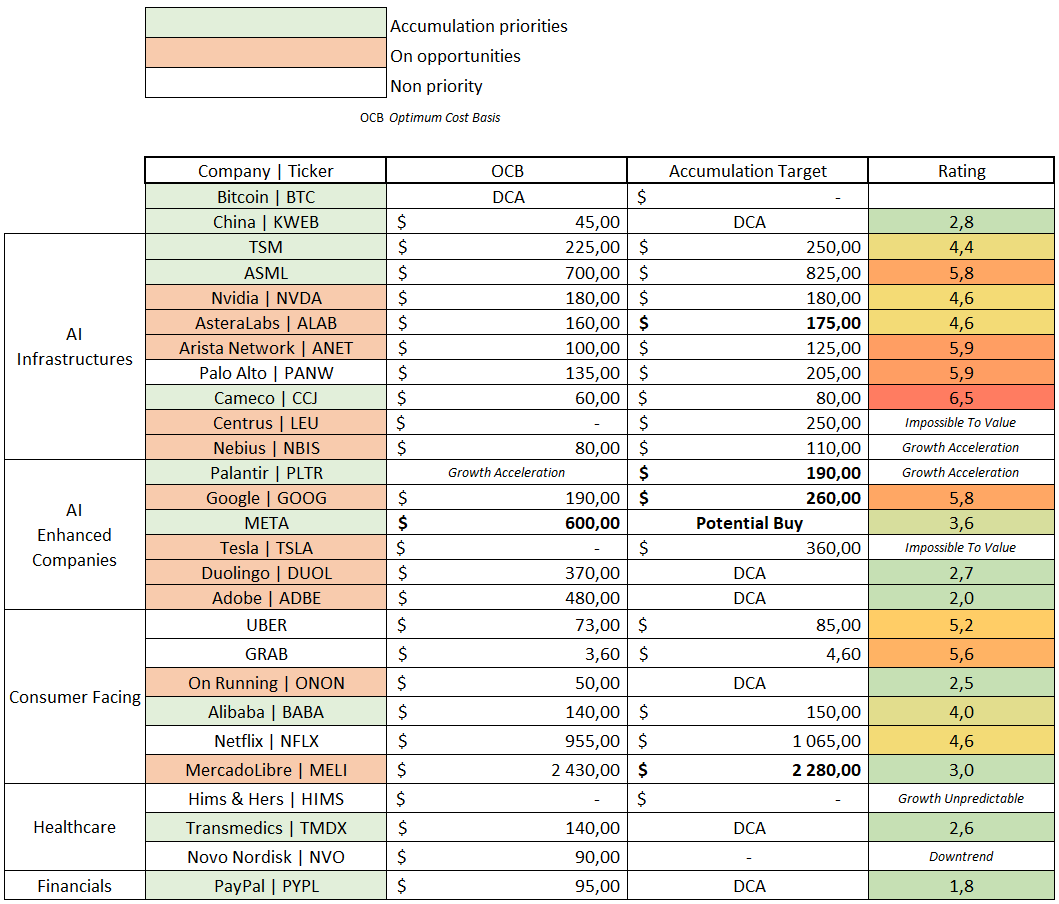

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold - updates compared to last week.

Green - trading at accumulation target.

Meta is still slightly above a perfect price and margins raise some concerns, but this is one of the bluest chips out there so anyone with a 5Y plus timeframe should be able to slowly buy in, as long as they understand the possible outcomes I described on the quaterly review this week.

AsteraLab bounced hard after touching my target, up 23% in two weeks for those who took the trade. High risks high rewards, as advertised.

Market & Macro.

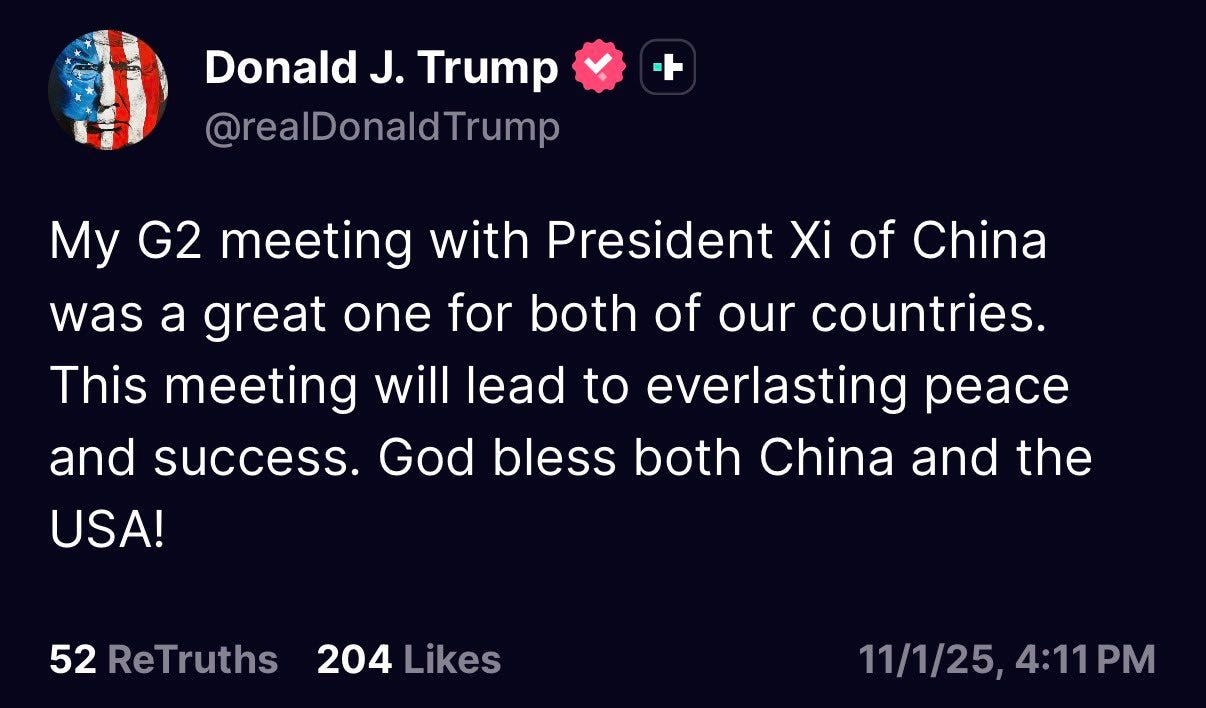

Friends, without much surprise: we have a deal & Xi and Trump are now best friends.

The news broke yesterday after their meeting in Korea - the one that “shouldn’t have happened”. The same playbook, over and over again; plenty of noise & volatility for nothing. The market should appreciate this deal.

Here are the key points.

Chinese actions.

Suspend new export controls on rare earths announced Oct 9, 2025 and issue general export licenses for rare earths, gallium, germanium, antimony, and graphite.

Tighten fentanyl-related chemicals export controls.

Suspend all retaliatory tariffs since March 4, 2025 and remove non-tariff countermeasures targeting U.S. firms.

End all investigations into U.S. semiconductor companies (antitrust, anti-dumping, etc.).

Resume importing divers U.S. products including soybeans.

American actions.

Cut tariffs on Chinese imports by 10% effective Nov 10, 2025.

Suspend reciprocal tariffs until Nov 10, 2026.

Suspend for one year the Section 301 actions on China’s maritime and shipbuilding sectors.

In short, we’re more or less back to where we were early this year, before Trump took office except for a ~30% tariff on Chinese imports which is manageable and unlikely to hurt China’s competitiveness meaningfully.

I’m surprised there was no mention of semiconductor imports, likely still discussed behind closed doors.

Overall, this is good news and I’ll need to revise my medium-term bearish bias as inflationary pressures from tariffs were a big concern for me. Companies can likely absorb a 30% tariff now that they have more clarity, although things can change again fast with those two.

Some damage is already done and will show in 2026, but if this resolution holds, the next few years should be better than I expected.

This hurts my Energy Fuels position as there’s less urgency for government support on rare earths, though long-term the U.S. will need to work on this. It should boost sentiment for my Chinese stocks, which was exactly how my book was built: to win no matter what.

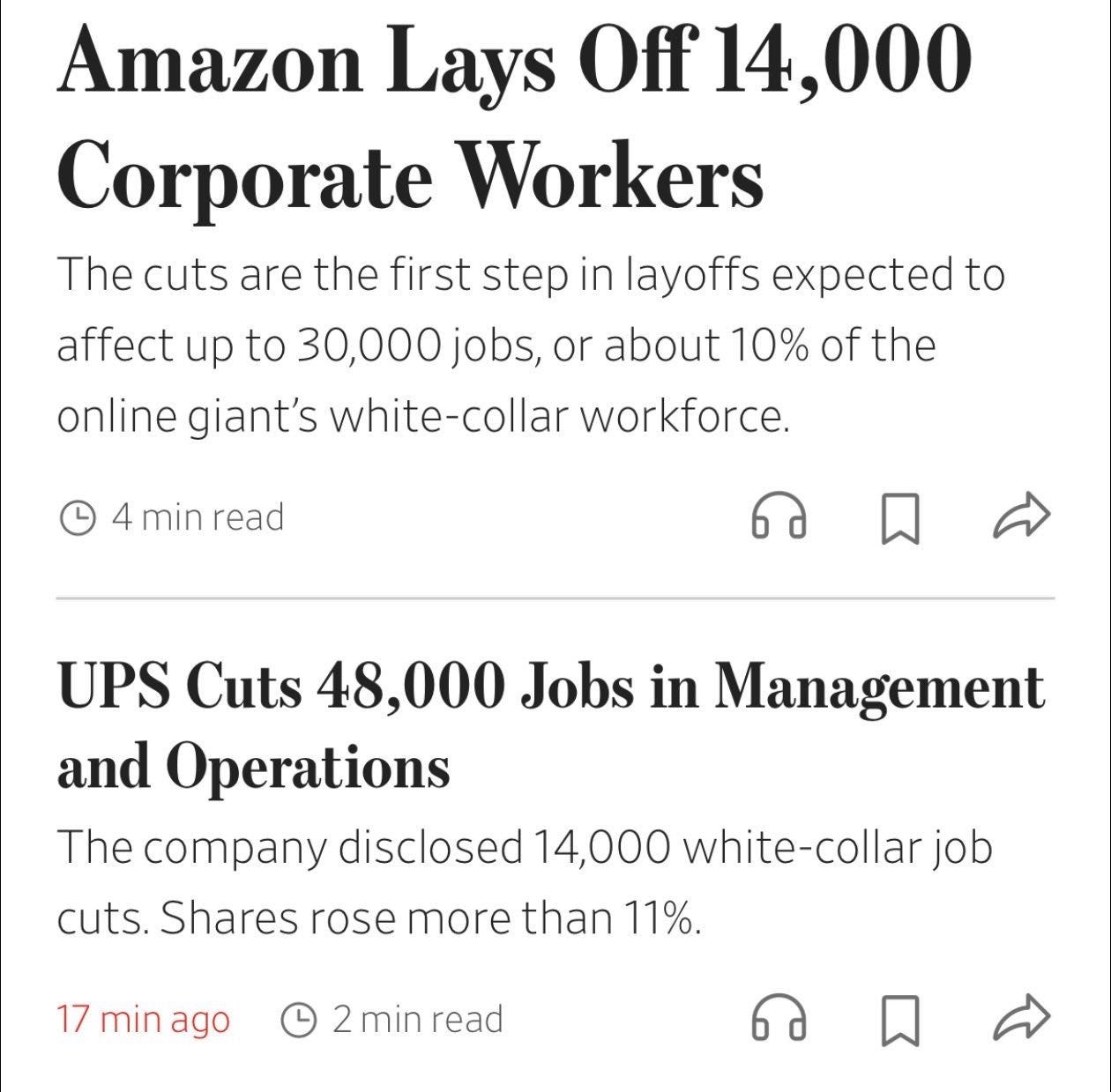

The main short-term concern now is layoffs as Amazon & UPS both announced large cuts this week.

Macro data isn’t released during the shurtdown but unemployment should be ticking up. That’s why the FED keeps cutting rates, as they did again this week, as expected.

Job cuts boost margins and please the market in the short term but if those workers don’t find jobs quickly, consumption will drop, and that’s not what we want. We’re clearly not out of the woods and I remain bearish 2026, but this deal with China is encouraging for further in time.

The S&P was already back above its trendlines & paused a little bit those last days.

Earnings season will now be the focus as short term macro concerns are resolved, or giving more clarity at least, and we do not have meaningful catalysts except earnings during the next weeks. The only important subject left is the government shutdown which will hopefully be resolved soon, with positive news.

Until then, we are in a bit of a blur where everything is possible, but we enter it with a positive position, trading above key average and trendlines.

China’s 5Y Plan.

China released its new 5-Year Plan this week, and it’s very bullish.

The focus: boosting consumption through tax optimization, social aid and incentives while also ramping up investments & innovation in high-end hardware & software.

The most important being.

Optimize birth-support policies and incentives.

Children are the ultimate consumer, China knows it & needs more. They’re addressing their demographic issue head-on.

This plan is a Christmas gift for anyone investing, or planning to invest, in China.

Watched Stocks and Portfolio.

Adobe Max.

The key event of the week, aside from earnings, was Adobe MAX. You know I’m bullish on Adobe and think the market is wildly wrong here, for a few reasons.

First, after years of model deployments now, studies continue to show that the clear winners in enterprise AI are specialized models, models trained for one specific task.

This was confirmed by this MIT study and by Meta’s quarter where Mark explained that the company now operates over 200 specialized models, each focused on a single function for better efficiency and cost structure.

This supports my thesis that ChatGPT & co cannot compete with Adobe, whose AI are built for content creation and marketing. Adobe’s models will always deliver better results because of this specialization. And enterprises don’t look for average.

This is what you can do with Adobe’s softwares.

ChatGPT simply can’t. Even if it could, Adobe provides access to the latest models - Flux, Gemini, ChatGPT and co, directly inside its applications.

Adobe also announced a partnership with YouTube, allowing users to upload content to the platform directly from its software, simplifying the entire workflow. As we saw in Google’s earnings, YouTube continues to grow rapidly, especially through Shorts, so this is very interesting for most content creators.

I remain very bullish on Adobe, especially as the stock is consolidating with a solid low around $330 on which buyers clearly step up. If that level breaks, I’ll change my opinion, but until then, I’m accumulating.

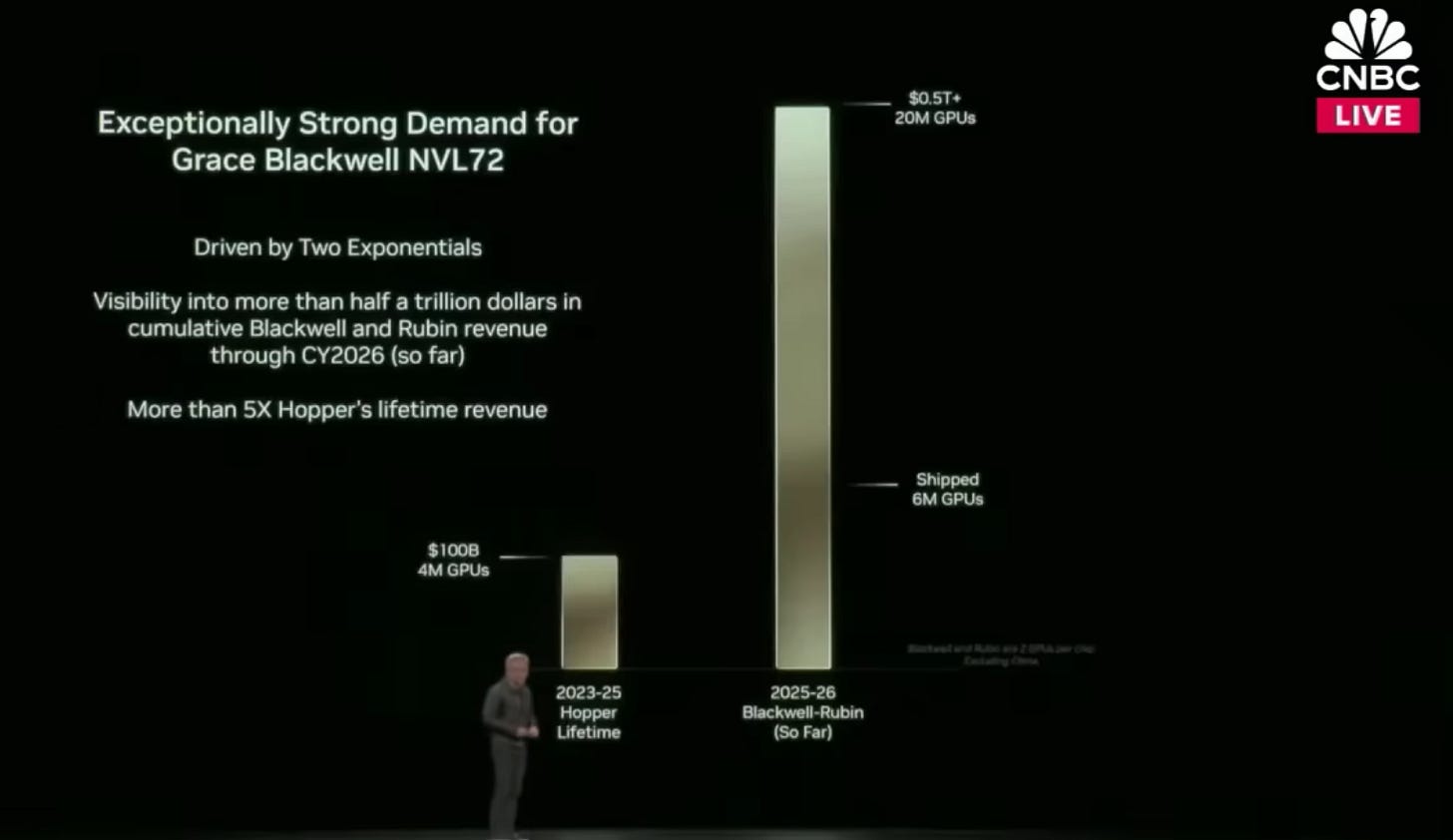

Nvidia’s Roadmap.

We had the GTC this week, NVIDIA’s annual conference, where they presented their roadmap and outlook. Nothing different was shared except for one quote from Jensen that set the stock on fire.

We have visibility into half a trillion dollars of cumulative blackwell and early ramps of rubin through 2026. This is how much business is on the books.

That number is much, much higher than analysts expected. It would be massive it this reflects actual signed contracts and not simply intends but as Jenssen talked about backlog, I would assume those are indeed orders.

It seems possible as both Google and Meta announced plans to significantly increase CapEx in 2026, and many others will follow - notably neoclouds.

And this excludes China which still doesn’t have access to Blackwell or Rubin chips.

The CapEx cycle is far from over and this is very important for the market.

Cameco, Uranium & the U.S. Government.

One of my bull cases for Energy Fuels was a governmental contract or equity purchase for “national interest”. That didn’t happen, but the U.S. government did announce a contract to accelerate the construction of nuclear reactors, which sent Cameco’s stock much higher as they will be the biggest provider of enriched uranium.

I expect something similar for Energy Fuels, as the company operates in both uranium and rare earth refining - even more strategic. No clue when, but the timeline says before 2026 as this is the date limit for China and its export controls.

OpenAI IPO.

This has to be the most ironic news of the week: a non-profit organization IPO.

Not much to add, but if you’re looking to time the market, pay attention to this one. If the IPO happens in 2026, it’ll be the perfect top signal to take profits and get the hell out of this market which will hopefully have bubbled by then.

Would be the perfect playbook.

Don’t Buy Losers.

I shared this on X which made noise, but I stand by it.

You know I focus on ranging or climbing stocks. That’s where the money is. When you long, you only make money if your stock go up so anything going down doesn’t interest me, not to buy at least, doesn’t matter how cheap they look.

They’re “cheap” for a reason.

This is why I never buy negative price action. My confirmation is always price strength, I buy only when the market shows that my thesis can be rewarded. But that’s my way of doing and everyone doesn’t need/want to do the same.

But there are still two very simple rules to beat the market consistently.

Buy winners. Avoid FOMO.

If you have more money to invest? Accumulate your winners and wait for the losers on your watchlist to become winners. If they’re as good as you think they are, they will. Until then, focus on your winners.

Those two rules will largely improve your returns.

Earnings Review and Weekly Planning.

We’re closing a big week for my portfolio and I’m globally happy with the results.

I want to talk a bit more about Google and Meta for those who didn’t read the reports - you honestly should if you didn’t as the market relies on their data.

Both confirmed increased CapEx in 2026, materially, focused on AI infrastructure. This explains Nvidia’s $500B target. This spending is vital not only for the market but also for the U.S. economy and GDP overall, so it was important to have confirmations.

On the downside, Meta showed signs of margin compression due to AI spending, which the market didn’t like. Over time, the same will happen to Google and every other AI-heavy company, it’s unavoidable. CapEx returns take time to yield returns.

The key question is whether Meta continues to be punished or not, and we should expect similar reactions for others soon.

PayPal delivered excellent earnings and not owning it at this price, in my opinion, is a mistake. Everything points to a strong future so I’m still building my position and staying aggressive.

Transmedics also reported a great quarter, though the market reaction was strange. I couldn’t find anything negative in the data and continue to believe the stock will be higher before year ends.

And MercadoLibre remains a must-own for anyone interested in Latin America; a steady compounder and an easy stock to hold long term.

Overall, great results all around in terms of business performance. Meta had a small hiccup, but nothing alarming. The market remains moody, but the data points to higher value for my portfolio before year-end, so I’m not worried.

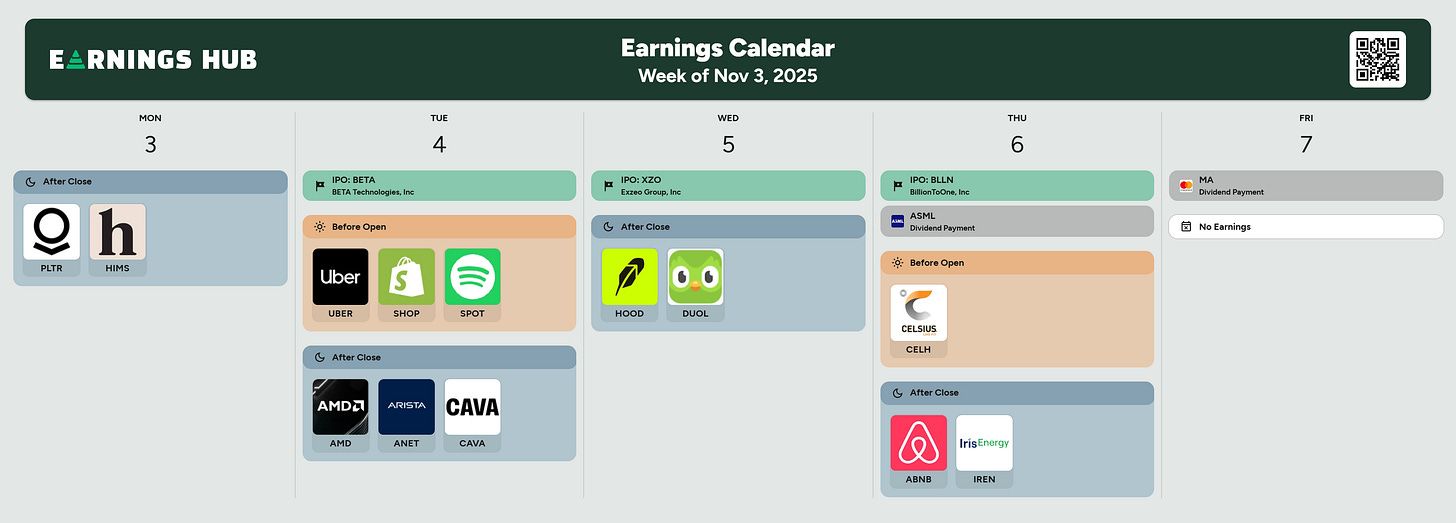

Another big week coming and you guys will received a detailed review write up on Palantir, Uber, Arista Network and Duolingo.

I could one on Hims & Airbnb depending on my bandwith and if there are important data to share about the quarters. The rest is by personal interest but if you guys have specific requests, feel free to ask.

That’s about it for this week, I’ll see you very soon!

Thanks for all the great reviews last week!

Good luck with incentivizing people to have kids - smart people know one’s life quality is exponentially better without them :p