Weekly Recap | October - W3

Watchlist Update, Market Overview, China Consumption, Alibaba's Expansion, Microsoft's Rental Deals, OpenAI & Broadcom, AI Networking Shift, Weekly Planning & More.

If you guys are interested by a 15% reduction on all FiscalAI subscription plans, click the link below!

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs and honestly the best platform on the market to follow companies’ fundamentals. If interested, feel free to use my link!

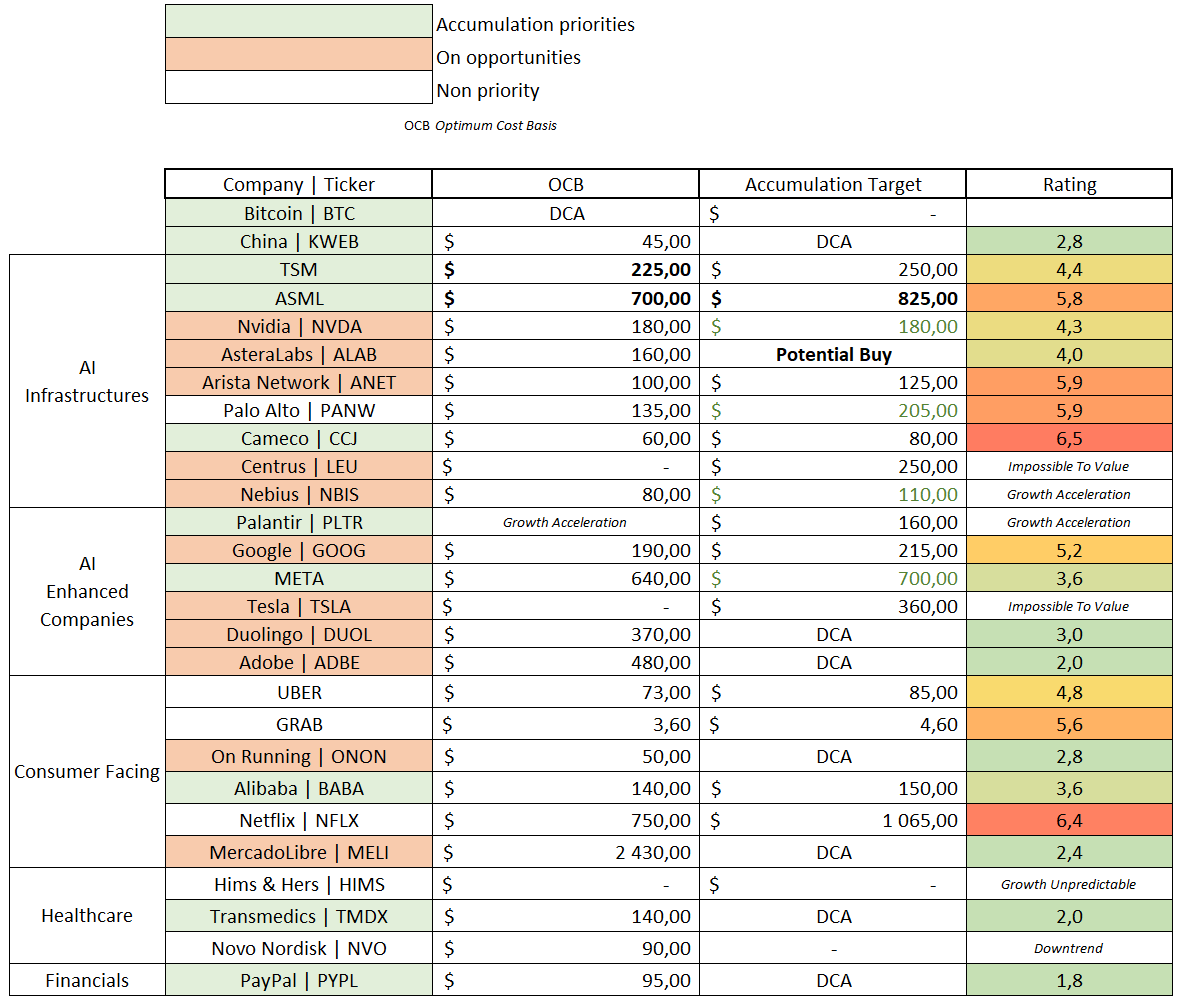

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold - updates compared to last week.

Green - trading at accumulation target.

Some words on AsteraLabs. We’re talking about a growth stock and a young company whose bull case relies on the adoption of its products. We’re close to an interesting price but this remains a very high-risk, high-reward play.

Something to keep in mind if you choose to go for it. I personally haven’t pressed the button yet and would prefer a bit lower to reduce risk.

Market Overview & Macro.

The S&P Danse.

The market was a mess this week, swinging north and south on every new, comment, or post on any topic - mostly China. This is a very emotional market, focused on risks and narratives rather than data and fundamentals.

Many are scared and would rather get out than take risks.

My view remains the same. There are no changes in the data: ASML and TSM reported great and solid quarters respectively; banks did well & aren’t worried about the global financial health of the economy or consumers.

The economy is what it is but the government is in shutdown, we don’t have updated data on inflation or employment, although Powell mentioned “more softness” in an interview this week.

While the unemployment rate remained low through August, payroll gains have slowed sharply, likely in part due to a decline in labor force growth due to lower immigration and labor force participation. In this less dynamic and somewhat softer labor market, the downside risks to employment appear to have risen

The market liked that, as it means more rate cuts are coming - which is seen as a positive. No signs of overheat in terms of valuations, in my opinion - at least on serious companies.

With a confirmed rate-cut cycle, controlled inflation, strong bank earnings, massive demand for semiconductors, I see nothing fundamental to worry about short term.

Yet, the market swings and stays emotional, one day reacting to China headlines, the next to potential bad loans from small regional banks. It’s focusing on narratives and perceived risks, not on data. Which is understandable in a game where leaving just a bit too late can cost you a lot.

I personally don’t see any issues yet. I continue to believe they will come, especially with inflation due to tariffs, but until I see concrete data, I’ll stick to my system. As investors, there’s nothing to do but accumulate great names at good prices. For traders, under these conditions, it’s not the time to be a hero.

We’ve rejected the earlier bull trend twice and are barely closing above the daily 21. It’s not the time to increase leverage or take speculative positions, it is time to sit tight and wait for confirmations, especially with catalysts ahead.

U.S./China negotiation meeting this week

Tariffs & export controls deadline: November 1st

Government still in shutdown

Earnings season

As I mentioned last week, I closed my SBET calls to increase liquidity and am now waiting for confirmations before spending it. I am holding the rest as I remain confident on the positions. More details below for the full picture.

Once again - I’ll never repeat this enough, each book is different, and each position must be adapted to your original plan and portfolio. What I share here is mine: my system, signals, and actions.

It’s important that you find yours.

Watched Stocks and Portfolio.

China’s Consumption.

As you know, my bull case on China relies on growing demand for AI and tech, rising consumption, and government incentives pushing citizens to consume & invest more, driving a more dynamic economy and fewer savings.

We’ve had many proofs this year that they’re pushing in that direction, including one this week as the central bank encouraged institutions to support consumption.

This will, over time, translate into direct revenues for many companies - Alibaba first but also JD and other e-commerce platforms, reinforcing my long-term investment and the trade idea on JD shared a few weeks ago.

Chinese equities are taking a breather now, but I remain very bullish on the country.

Alibaba’s Geographical Expansion.

Alibaba confirmed the construction of a second data center in the Emirates.

I remain skeptic on international expansion but the Emirates is certainly the better option for Alibaba, much better than western countries.

Microsoft Continues to Rent Compute.

This is the fourth or fifth deal in recent weeks for Microsoft, which now clearly relies on external providers for its compute load instead of building its own data centers; the complete opposite of Meta, which announced a new gigawatt-sized one in Texas planned for 2028, along with a new $30B private financing package for its other data centers.

There still are two possible conclusions for Microsoft:

They do not want to take risks.

They do not find the infrastructures or ressources to build more data centers.

I still bet on prudence, but who knows.

Meta accelerates its infrastructure plans leveraging debt, while Microsoft slows them and prefers to rent compute with its cash flow. Two very different strategies & no way to know which one will be the right one. Only thing we know for now is that there is a need for compute.

OpenAI & Broadcom.

There isn’t a week where OpenAI doesn’t announce plans to spend more billions. With Broadcom this week, from whom the AI company committed to buying custom chips to meet specific needs.

The company is now going directly to chipmakers instead of buying packaged semis from Nvidia and AMD - though it still does that too.

The million dollars question remains: how will OpenAI pay for all this?

Potential Shift in Datacenter Networking.

Arista Networks has been Meta’s main networking provider for the past few years, but Meta just announced it would buy Nvidia’s Spectrum-X for its new data centers.

Meanwhile, Oracle confirmed its continued use of Arista for a new cloud computing service relying on its systems.

I wouldn’t worry yet, Meta is probably dual-sourcing and testing new configurations but this is something to keep an eye on for shareholders or anyone considering investing in it.

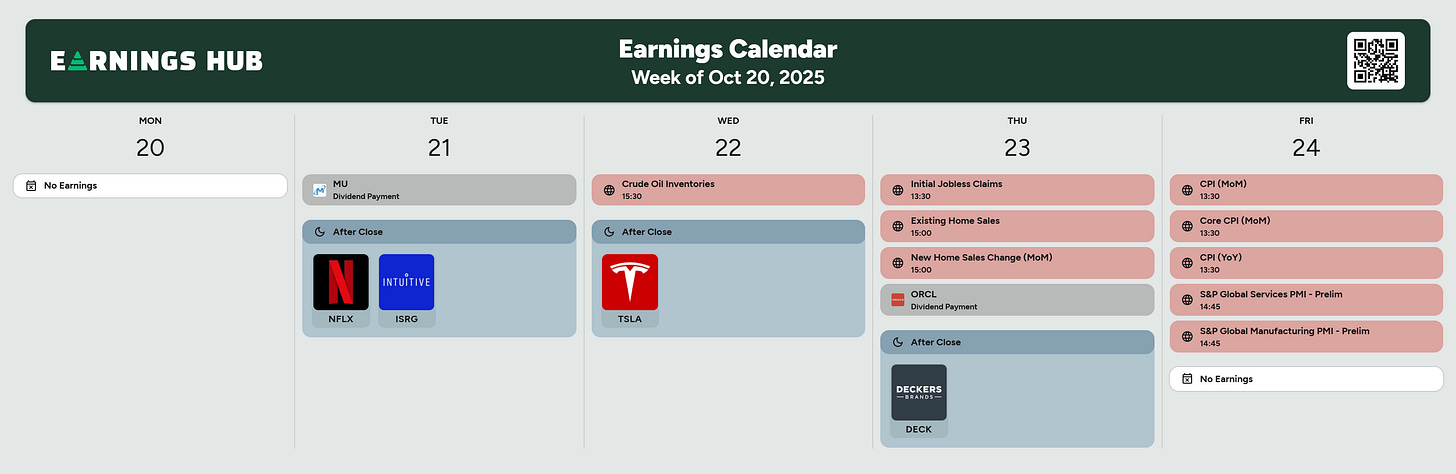

Earnings.

As shared above, both ASML and TSM reported strong numbers and confident commentary overall, very positive for the AI sector.

This week, you’ll receive detailed reviews of Netflix and Tesla.

I’ll also look closely at Intuitive Surgical whose stock is down 30% ish from its highs. I still think it’s a bit expensive, but it’s time to review the data and start planning.

Decker is only a proxy for On Running with its Hoka brand, so I won’t comment on it.

The Sub Nanometer Machines.

I also wanted to share this video showcasing ASML’s technology TSMC’s Arizona fab.

This is one of the most advanced technology humans ever reached. Pretty impressive and nice to have an inside video on how ASML’s hardware actually works in production.

It's interesting how you approach the high-risk, high-reward plays like AsteraLabs. What if the current AI boom accellerates their product adoption even faster then expected?

Thanks for the eye-opening video, it’s really something!