Weekly Recap | October - W2

Weekly Watchlist, Trump is Addicted to Social Medias, The AI Bubble, PayPal Advertising, Duolingo's Marketing & Transmedics' New Plane.

If you guys are interested by a 15% reduction on all FiscalAI subscription plans, click the link below!

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs and honestly the best platform on the market to follow companies’ fundamentals. If interested, feel free to use my link!

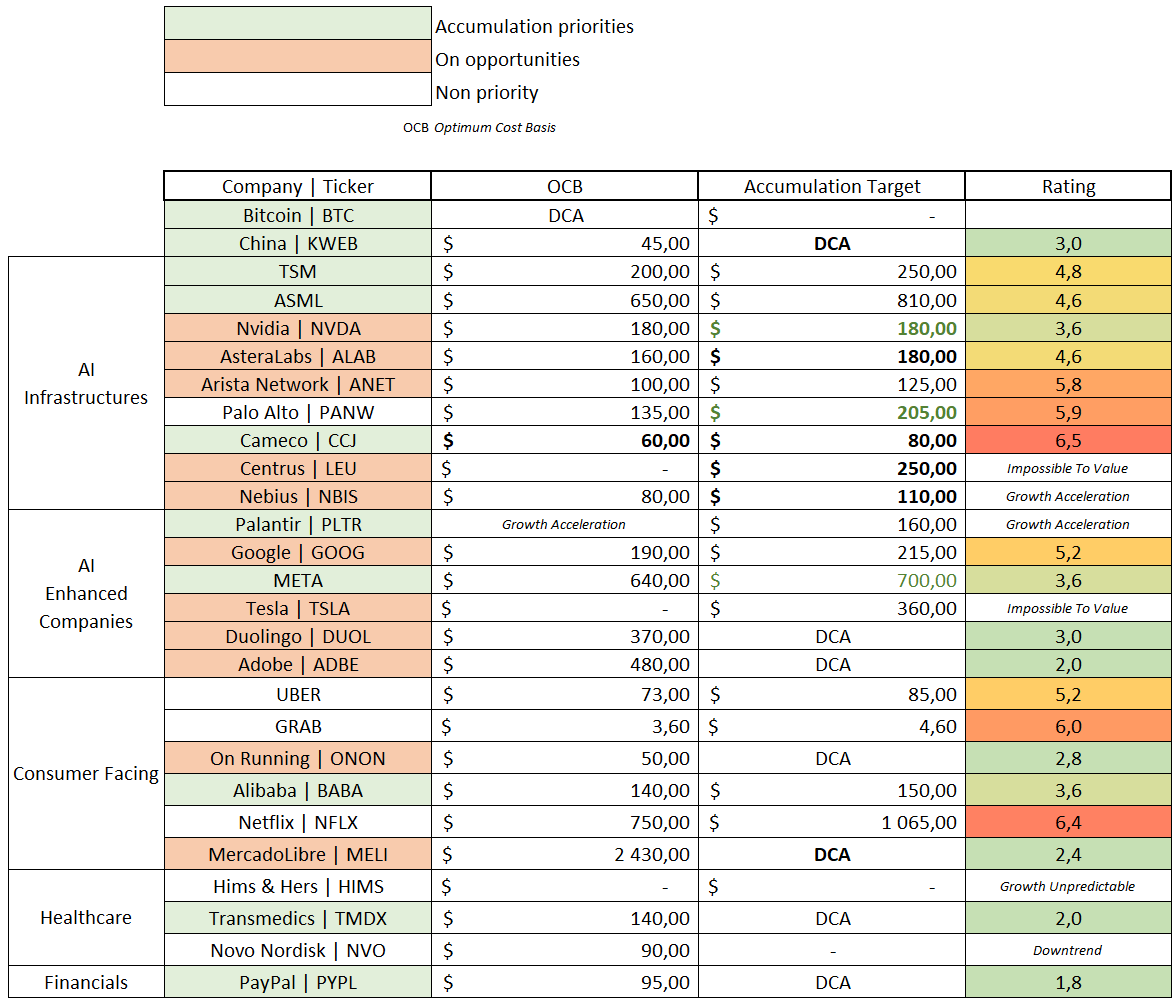

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold are updates compared to last week and green are targets reached.

I keep improving this graph to bring more value - in my opinion. As always, feedback is appreciated!

Macro & Markets.

I shared everything yesterday about the situation and the new Trade War 2.0, which began a few days ago and is probable already over.

Here’s what I shared then.

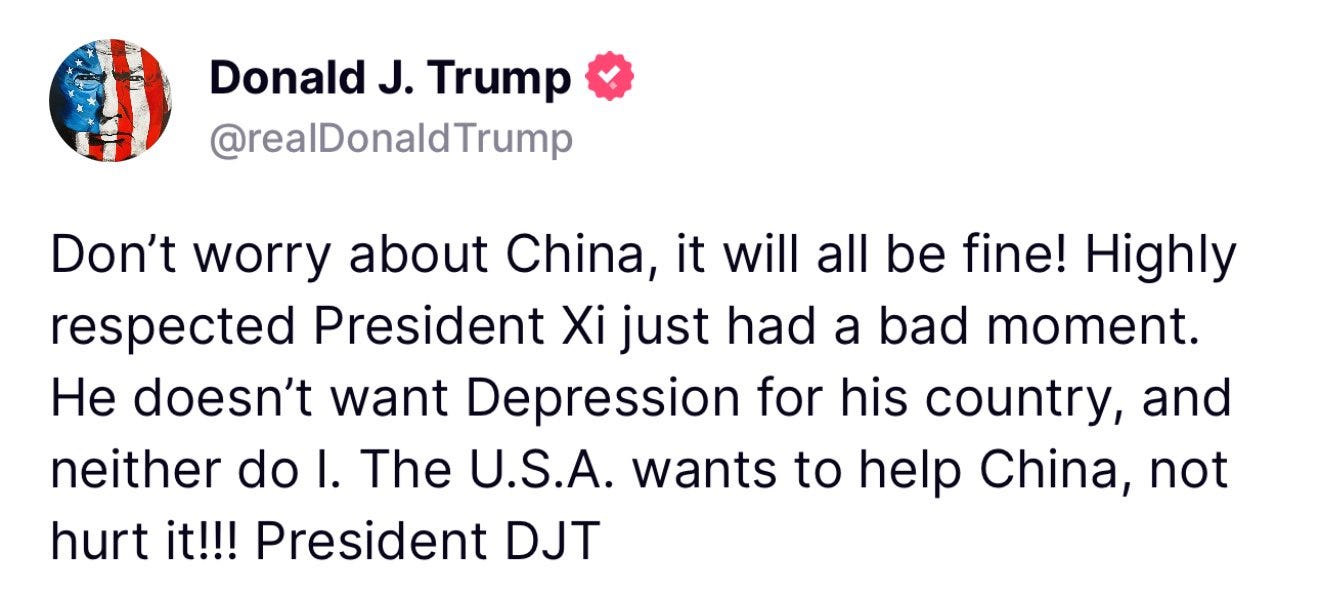

Keep in mind that after everything I said, it is entirely possible for Trump to post on a social media a selfie of him and Xi eating pasta, and the market rallies to new all-time highs in hours by Monday. I do not invest my money on “maybes” and would rather have a risk-averse approach than an all-in casino one. But it could happen.

And here what was posted few hours ago.

There are no pastas but you get the idea. Millions got wiped out during the last days and lost years of hard work. But that’s how the world work, two posts from Trump on social medias can change your life if you aren’t careful.

So even if the market goes back up tomorrow, maybe even to new time highs now that leverage was flushed and many got scared, my post shouldn’t be dissmissed. It isn’t about a specific situation but how to think about risk in general.

It is about having a system with clear signals. Do not underestimate this.

We should be green Monday, cryptos already are but I will need more confirmations. I’ll turn bullish and aggressive again if the S&P reclaim its daily 21, until then, I don’t see any reasons to overdo it while I already am more than enough involved in the market. That’s my system.

Watched Stocks and Portfolio.

The AI bubble 2.0

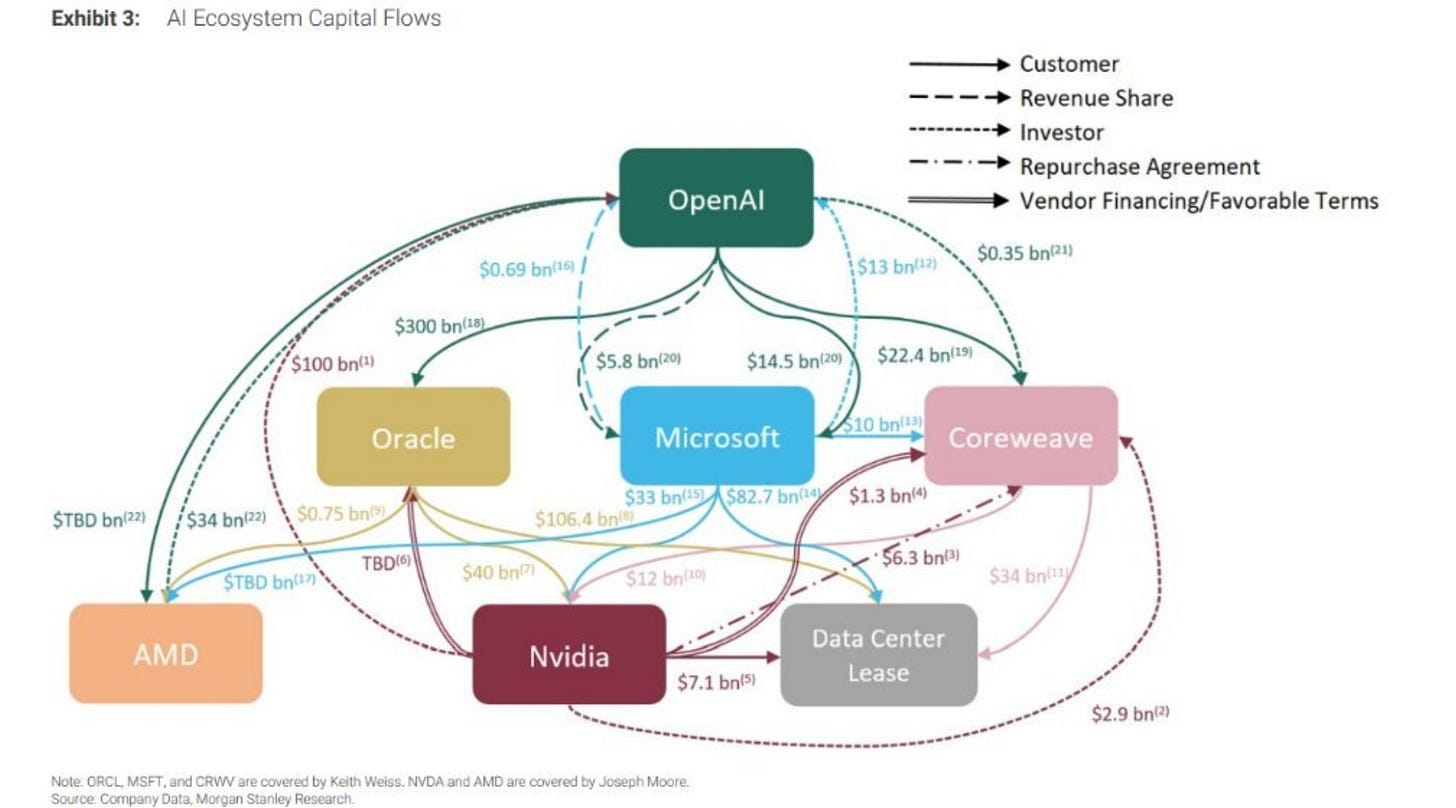

Debates continue about AI stock valuations & the recent deals between companies. We’ve already covered this - I wasn’t surprised by most of those partnerships since they were meant to create win-win financing deals.

But this week brought a new odd one between OpenAI and AMD. OpenAI promised to buy about 6GW of compute over 5 years and, in exchange, receive AMD’s equity.

Today, we’re announcing a multi-year, multi generation strategic partnership with OpenAI that puts AMD compute at the center of the global AI infrastructure buildout.

A normal deal would give AMD OpenAI’s equity, not the other way around, just like Nvidia’s deal which receive OpenAI’s equity plus promises of GPUs purchases in exchange for cash. To me, AMD knows it’s behind and made a move to push its infrastructure by giving up equity to leverage OpenAI’s influence.

The deal feels like a “take my equity, use your position to influence others to buy my GPUs and you’ll make money through your stake in our company.” This doesn’t seem to be the healthiest deal ever, but that is only my opinion, feel free to disagree.

Many now worry about the increasing cross-involvement among AI companies. I see it as an “AI economy” - companies with cash and cash flow fund the next step of AI in exchange of equity.

When you sell GPUs or infrastructure, your incentive is for final AI services demand to grow. Helping those who provide that service benefits everyone - especially Nvidia which has taken equity stakes in many AI firms. Who would need GPUs if AI services aren’t demanded or don’t generate cash flow?

But as companies become interlinked, systemic risk grows.

The key concern: financing isn’t free. It demands ROI and collateral. If AI services don’t produce cash flow soon, how will OpenAI & co justify and repay these partnerships?

Rumors about Oracle’s compute margins also raised concerns, a report suggested its AI server leasing isn’t yet profitable - weighed down by high costs and competition.

The data indicates that its AI server leasing operations are not yet profitable, despite the surge in demand for compute power driven by artificial intelligence workloads. This suggests that Oracle’s rapid expansion into AI infrastructure is burdened by high upfront costs, intense competition, and heavy investment requirements.

Those information aren’t official and other papers denied the claims, but the concerns remains valid. I shared a note few days ago an excellent write up from UncoverAlphagoing through those concerns better than I would. Bear or bull, this is a must read with valid concerns and arguments.

My opinion remains that he might be wrong only if AI services become profitable really soon - by 2026 or so, which seems unlikely. If not, optimism will fade once markets realize the cash flow story may take longer to materialize.

I agree with his conclusion: AI will be one of our history’s most transformative technology, but this takes time. The market isn’t pricing any delay.

That being said, as long as funding flows and deals continue without any clear sign for a lack of cash flow generation, optimism can hold and stocks can keep rising. It’s all about risk management. Richard believes today’s risks outweigh potential rewards. Many share that view. I fundamentally agree but I continue to play the market, who doesn’t.

PayPal Advertising.

PayPal continues to expand into new high-margin businesses, including its growing advertising arm.

Meanwhile, large investors keep buying calls with increasingly higher strike prices, up to $100 this week. The market is turning bullish.

Duolingo's Marketing.

Duolingo, known for edgy marketing, went all in with a five-episode YouTube TV series. I’d assume you can expect something bold and provocative.

I personally love it and am all for it.

Reports also show Duolingo among the top OpenAI token consumers, a great sign that management embraces AI, which is what investors want as it is the way to create personalized learning and to expand to other verticals.

Transmedics New Plane.

The company just bought its 22nd plane, expected to be the final one in its first NOP expansion plan.

Flight data is slow to pick up but seasonality should be over now and I continue to believe it is just a matter of time.

Thanks for a balanced view on the AI situation. I also wanna ride the bull wave, but gotta be cautious because this thing can unwind quickly once it becomes clear ROI on the capex is below expectations and additional spending will stop.

On the Rihard Jarc tweet - he's saying 1GW of GPUs requires 60B USD spend, whereas NBIS revenue per MW is around 10-13 mil USD if I remember correctly which is 10-13B per GW. Assuming they will have 50-60% gross margin (my estimation for the sake of this analysis), the cost to build 1GW would be around 5-6B USD. Didn't he count one 'zero' too much?