Investing in Uncertain Times

The trade war is back; Portfolio & market review, mental framework & swing strategy.

Hello everyone,

I’ll need an unplaned post today to talk about yesterday. It’s important when you do what I do to follow up in those situations as investing is about planning, not reacting. So I will go over the situation, my long term and swing portfolio, each position & my vision for them.

If you want the short version:

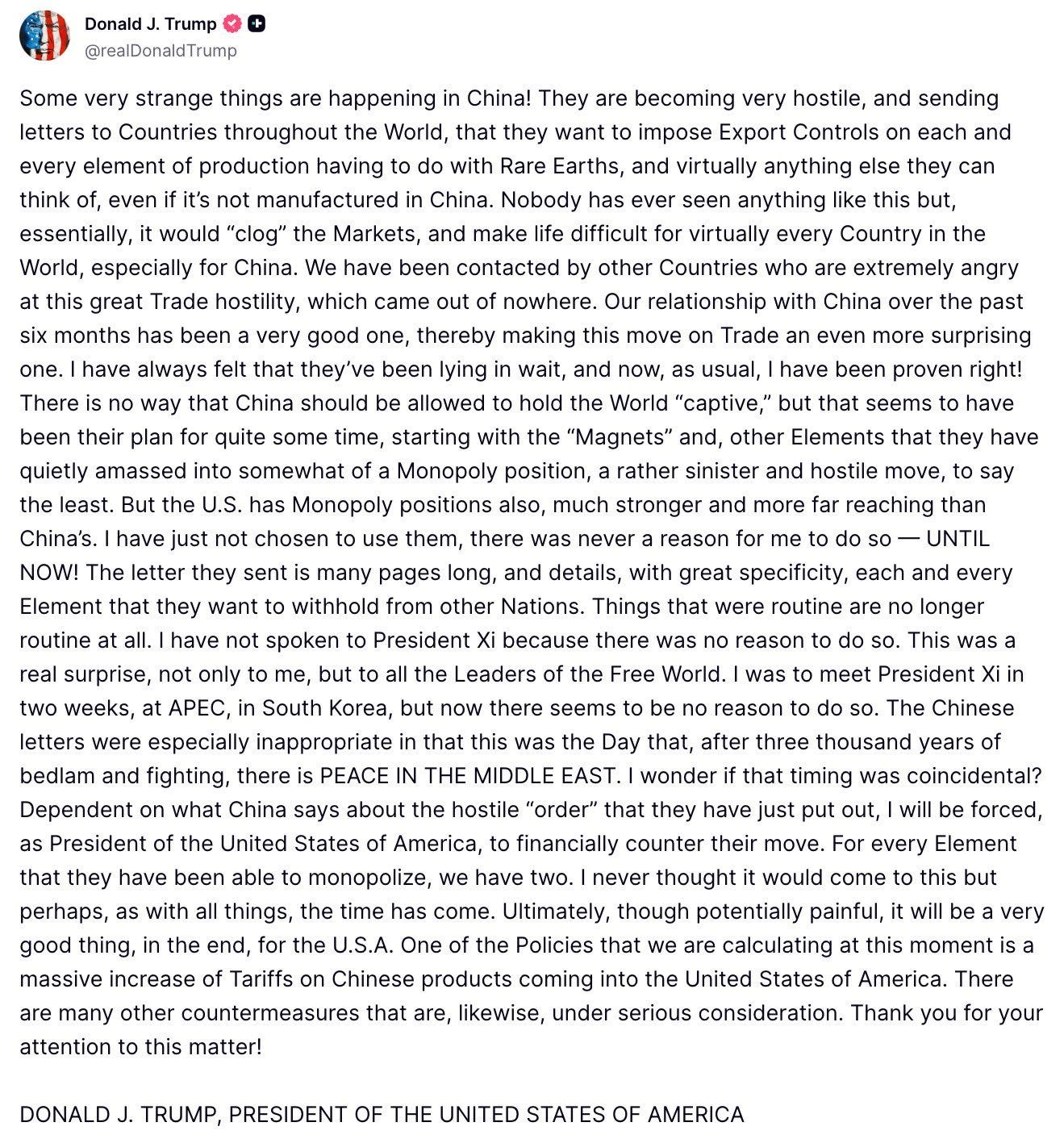

Trade war is back; China set export controls on rare earths & Trump replied with 100% more tariffs on all goods from China, both effective November 1st.

The S&P500 tanked on the news, losing its bull trend, daily 21 & struggling with its 50 post-market. Those are signs of short term weakness & uncertainty is back on the menu.

We’ve seen this game before. Threats end up in a big ball of nothing while Trump has shown his limits: a declining stock market and a rising bonds market.

For long-term positions, it’s probably just another nothing burger & a good setup for accumulation. I intend to accumulate the names I want at my target prices.

For swings/options, it’s time to adjust. Capital preservation is rule #1 and when the S&P loses key trends, we need to reassess some positions. I’m not holding weak convictions on this environment.

I will go over my situation, share my process and my thinking, not advices. We all have different portfolios with different assets, objectives and timeframe. Outperforming the market comes with a system. Build yours and stick with it.

Here’s mine.

Tariffs War 2.0.

Bottom line: we’re back to where we were at the start of the year, with Trump posting on social medias without any PR checks and large volumes of insider trading - on-chain data and option flow always tell the real story.

Somebody always knows.

But we’re not here to cry about how unfair the world is, that brings nothing. We’re here to work on leveraging this to our advantage. So here what happened.

China has a quasi-monopoly on rare earth refinement - not mining. Those are mostly used for technological manufacturing (missiles, radar systems, aerial vehicles, naval warfare platforms, jet engines and aircraft, high-powered lasers, night vision, secure communications, satellite & space systems, semiconductors, microelectronics, energy infrastructure…).

We live in an ironic world: the U.S. know how to build the best tech hardware, but only China can refine the materials. Both rely heavily on each other on this matter & many other but still use their leverage in negotiations.

China’s threat to cut off rare earth exports is its golden card, many expected it back in April, but it didn’t happen. Why now? No idea, but Chinese moves are never irrational nor impulsive. They usually push only when they know they can win. Trump answered by a new 100% additive tariffs on Chinese goods but China already showed it wasn’t impressed by those while the GPU export controls are already in place.

This lattest move shows that negotiations the market thought over are nowhere close to finished. But both measures - tariffs and export control, are supposed to start on November 1st and we’ve already seen those situation play out. Seems like a classic U.S. admin chaos with a high probability of not happening but the market hates uncertainty.

It was impossible to guess what would happen and when, but the market has been hot for weeks now and I’ve shared since early September that we were due for a breather and should look out to weakness signs.

There are no reasons to be bearish as long as the market doesn’t give clear signs, but it’s important to keep this in the back of our mind and to react when signs arrive for swing traders or to be aware of the possibility of a breather for long term investors. It’s all about risk/cash management.

That’s very probably where we’re at.

The Stock Market.

The S&P500 dropped immediatly after Trump’s posts, lost the daily 21 during the session and the 50 post-market, we’ll see Monday if we hold it.

Short-term bull trends stick above the daily 21 - red line. We’ve had quick excess since April but never stayed more than a session below it. Depending on what happens this week-end, we could reclaim it; the market has been strong enough to buy it back and restore the uptrend but I wouldn’t bet on this.

I won’t base my performance on maybes, but it is possible. We’ll see soon enough. In the meantime, here is my view from my two perspectives.

As an investor, if we indeed have a few weeks of weakness, this is the signal to make plans for the cash you set aside - as you should have & we talked about many times. It is time to look at our watchlist, price targets and start to deploy it, slowly. Probably another nothing burger, soon to be forgotten, as markets are designed to trend up over the long run and Trump loves to reminds us of that.

As a swing trader, it is different; this is a signal for short-term weakness. No need for leverage or theta decay right now. It’s important to stay liquid and wait for strength confirmations. Preserving capital comes first and too many already got burned this week. When the S&P shows weakness, it’s better to respect it.

The Crypto Market.

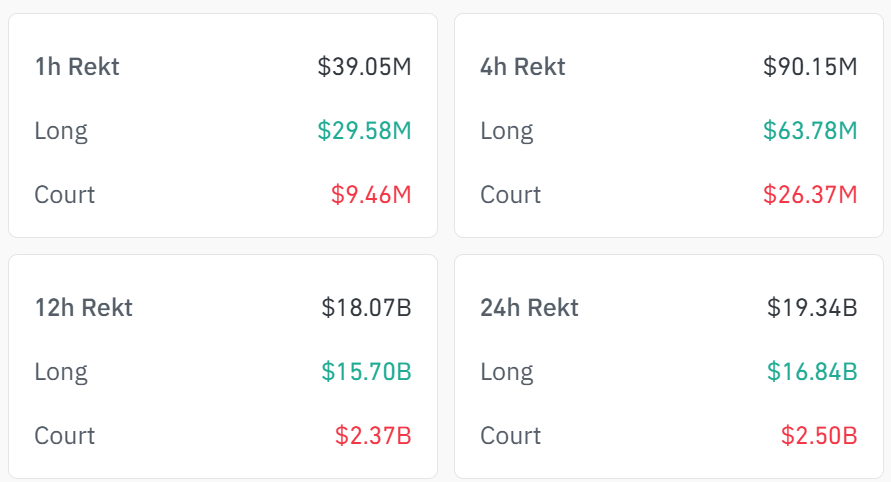

I’ve been involved in this market for years, but never saw anything like Friday. Even the FTX crash was mild in comparison. Friday saw the biggest liquidation event ever, close to two million accounts were liquidated for $19.34B. Insane numbers.

Many altcoins went down 90% before rallying back to close only -20% or so, and the order book was wiped clean. I’ve never seen anything like it, and I hope none of you were affected.

Last week I said I felt confident using leverage again.

I’ll continue to accumulate Ethereum & BMNR on red days as I expect Q4 to be good for cryptos in general. I also started using leverage again on some altcoins although I don’t share those trades here, the bottom line is that I am confident enough to use leverage - reasonably and as long as the S&P is healthy.

I’m always reasonable with leverage, and only with large names, so no margin calls for me, but that timing wasn’t the best for sure.

My Opinion.

This feels like March and April all over again. Trump is back with public threats, China remains quiet with effective moves. Both sides can keep pushing until someone hits their limit while the end game is hidden and probably lies in discussions we are not aware about.

I’m no geopolitical expert, but it’s clear nothing changed; China & the U.S. need each other, but they can keep escalating until one’s backed in the wall. For Trump, that wall is the market and he showed it in April, he won’t let it crash too long and won’t let the US10Y spike. This is his limit and China knows that.

We could see the S&P hit its daily 200 around 610, even lower, but at some point the administration will intervene. Bond yields - US10Y, are stuck near 4% and already saw a rate cut, so there’s little room for more pain here.

Bottom line: Trump loves his market too much and always circles back to it. He might hurt it briefly, but he always returns. It might take weeks to months, but I believe the playbook only repeats which means we only need to be patient.

My Positions & Book.

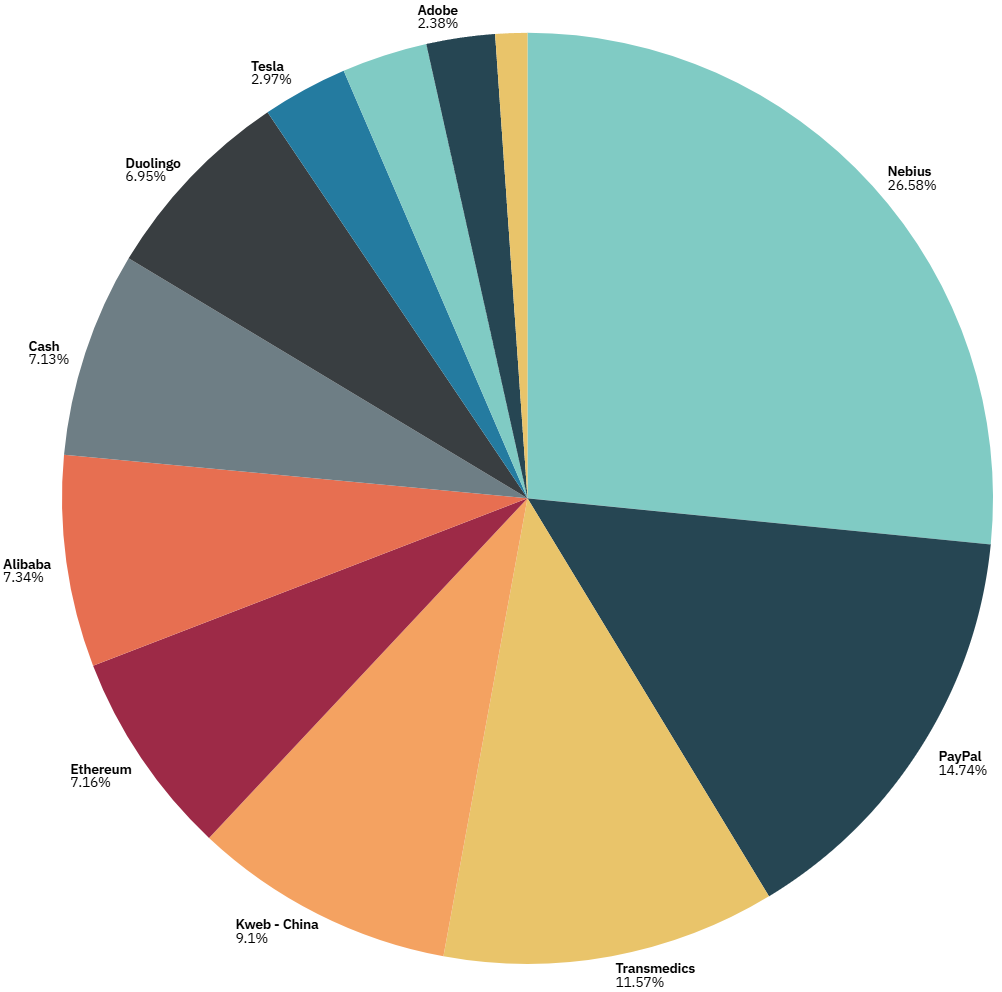

Here’s my portfolio as of Sunday - On Running & JD.com are the positions not shown.

Two perspectives as usual.

As a long-term investor, I’m not making any changes. I own companies I believe in at good prices. I’ll slowly deploy cash without any rush and will be more aggressive as/if we go lower.

As for price action: Alibaba’s retesting daily 50 - my buying zone; KWEB is in a similar spot. TransMedics is holding the daily 200, Duolingo is healthy, PayPal is bouncing at the daily 50, Nebius is strong, Adobe holds its bottom but is the only name I might rotate for stronger conviction. I see no reason to panic, even if all those names go lower.

Have conviction, own your stocks at a comfortable price, and then just wait. If you are uncomfortable, your convictions aren’t strong enough, or you bought at the wrong price. In any case, there is work to do, moves to analyse.

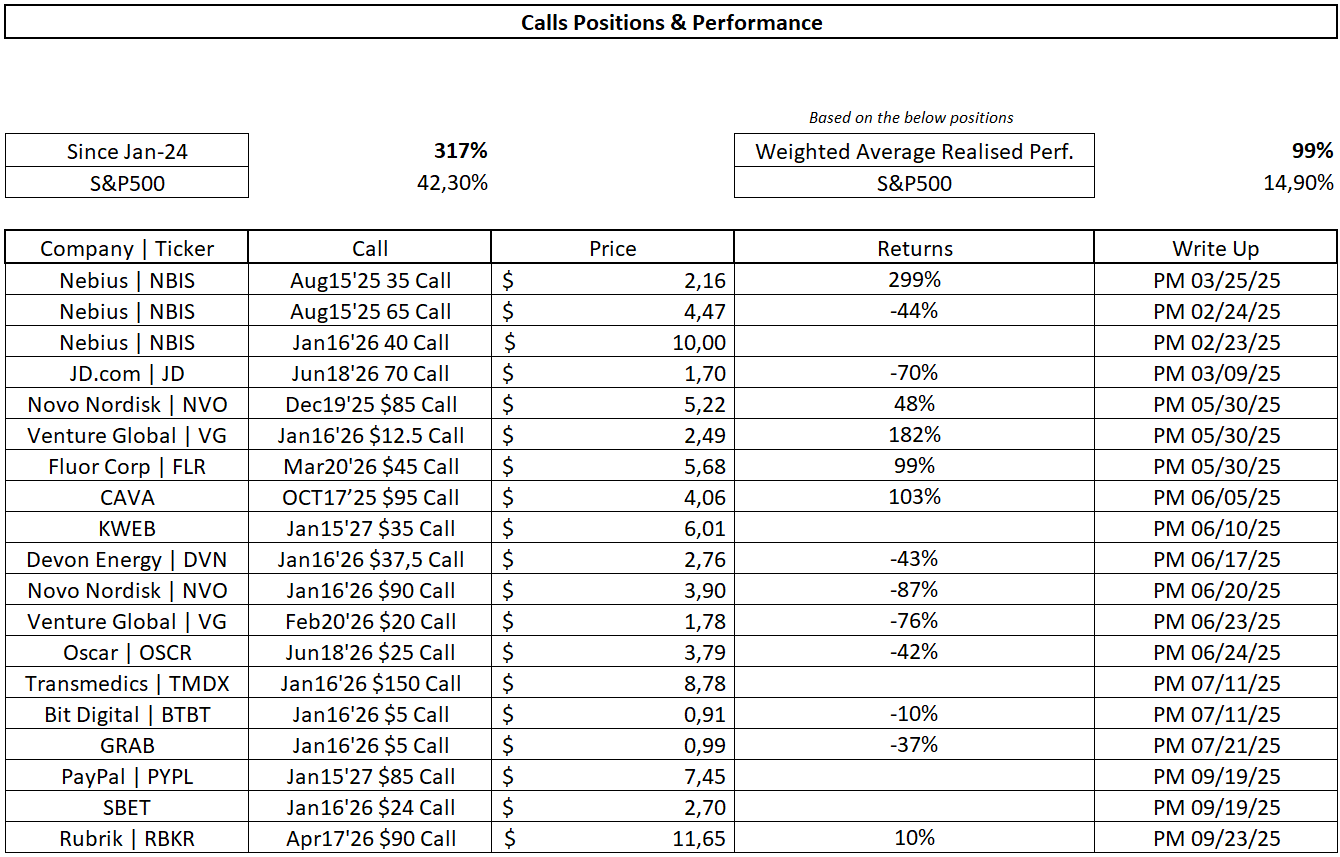

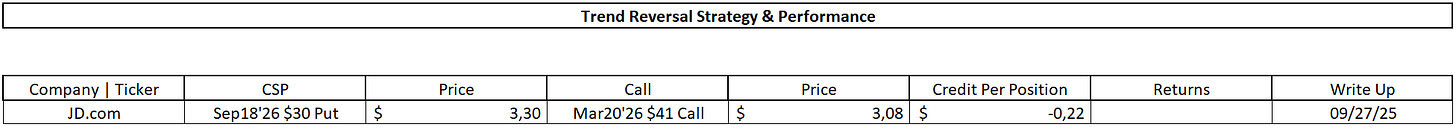

As a swing trader, my book is balanced. I remain confident on most names: KWEB, PayPal, JD.com, TransMedics, Nebius. I closed out VG for a loss after bad pre-earnings plus I wanted more liquidity in this environment.

In summary: VG is gone. I am holding Nebius, PayPal, KWEB, and JD puts confidently. I might close SBET, JD calls & TransMedics to raise liquidity if the dip accelerates. Once again, no issues with the thesis, but capital preservation is more important than anything else.

Nebius is an obvious hold to me, I will talk about the sector more tomorrow but my calls are in the money and my plan is to hold them until expiration. By then, I will sell or convert into shares depending on the market.

PayPal is my highest conviction and millions of dollars pour daily into options with strikes at $80, $90 and $100. My calls expire in January 2027 with a strike at $80 so between strong convictions and time until expiration… I remain confident.

TransMedics. The calls expire in January, which is a bit short. The name is unaffected by geopolitical issues except for global liquidity. I believe it undervalued & the market is not rewarding it because flight data remains weakish. Price action has been very stable with buying pressure below $110, which seems to act as a strong floor. As long as the name holds its daily 200, I will hold my calls but would sell them otherwise, as liquidity is more important.

KWEB and JD.com are both impacted by geopolitics, although the bottom line is always the same question: how was the trade setup?

Long-term for both, based on China’s consumption acceleration, liquidity package, reforms toward their equity market and acceleration from their tech industry and demand.

What changed? Nothing.

KWEB ran hot and is breathing, reaching my buying zone. I won’t press the trigger just yet but will once we have more clarity. The calls expire in 2027 and are close to the money. Do I expect China’s bull market to stop now? And not come back until 2027? I don’t.

JD.com is a bit trickier, as the stock lost its daily 21 and 50, not a great look. The asset is more impacted by additional tariffs than Chinese tech. The trade expires mid-2026, and I remain confident for the puts, less for the calls, which I would sell if the situation worsens, but I was paid to buy them.

Even if the calls go to $0, I’d still close that trade at a profit as long as JD closes above $30 in a year. Once again, do I expect Chinese equities to do nothing while data points to a pickup in consumption and growing interest in its stock market?

I would close the calls to reduce the risks, grow my liquidity, but I remain confident in those puts and the overall narratives. Once again: precautions.

On the fear that U.S. platforms could delist Chinese ADRs: it's technically possible. It happened for Russia, but we should keep in mind that this kind of escalation would have massive proportions. It would be a next-step punishment and would require much more than just some trade talks.

Lastly, on SBET. This is a position I would close even if my view of Q4 didn’t change. I expect the crypto to rip higher, but this is a better-safe-than-sorry situation.

The asset is toying with its daily 200 at Friday’s close. If we don’t it and print a new low, I will close the position, preserve my capital, and live to fight another day.

The way I see the crypto market, Ethereum is holding its daily 200, which remains the grail in such a volatile environment.

We’ve lived a very comparable event in 2021, ended up in a long month of chopping followed by a massive run to new all-time highs. This is my base case as of today.

We had a massive liquidation event, and the order book is empty. Those who weren’t liquidated will get cocky and probably get liquidated as they play “the obvious trade.” As I’ve said often, wicks are always retested, and Ethereum’s wick sits at $3,441 or so. This is my next buying price, and I will remain positive for Q4 as long as we chop around this price.

I still have leverage on and will be more aggressive if this happens on confirmations; a daily breakout after a healthy consolidation around that price. I’ll get out if we lose the daily 200.

Some notes on Halliburton, the swing trade on the energy sector I shared a few days ago. The fears of a new trade war reignited fears of a recession and therefore fears for lower energy consumption, which pushed oil prices lower. Once again, the HAL trade relies on the need for energy more than energy itself, and nothing changed there fundamentally.

But if you went in with the option trade and not the shares, and if your plan is focused on short-term dates, keep in mind that the asset lost its daily EMAs, which makes it look like a failed breakout.

If you bought shares of a great company at a low valuation long term, the situation is different. I did not pull the trigger but if you did, ask yourself: what is my time frame? What are my expectations? What was the plan?

There is a case to hold those shares. There is another one to sell them. And I cannot answer that for you.

Closing Remarks.

Keep in mind that after everything I said, it is entirely possible for Trump to post on a social media a selfie of him and Xi eating pasta, and the market rallies to new all-time highs in hours by Monday. I do not invest my money on “maybes” and would rather have a risk-averse approach than an all-in casino one. But it could happen.

The S&P 500 is giving clear signs of weakness. We have to listen to it. If it rips back up, so be it, my long-term portfolio will print & I will find new opportunities for my option portfolio once confirmations are given.

We might enter a red period for weeks or months but as usual, what matters is cash management to preserve long-term performance.

You can never predict the trigger nor the outcome, but when the market runs hot, it’ll pull back. I didn’t know Trump would tweet yesterday, but I knew the importance of having cash aside in this market, and I shared it countless times.

If you have cash, patience, convictions, and a clear plan for your positions, there is nothing to worry about. Follow your system, deploy your capital slowly at key prices on your watchlist, manage your cash wisely if you have leverage; there are no reasons to blow up your accounts during uncertain times while certain ones will come back. We just have to wait for them. Markets are designed to go higher. Wait patiently for confirmations before being aggressive again.

If you don't have any or miss one, it might be time to look back at what was done and identify your mistakes. Improve your system. This substrack is the platform I use to share mine, my convictions and trades, so it can be used as example, not blindly followed.

Find your system. Follow it. I will continue to share mine and we will continue to outperform the markets. This is nothing but an expected bump during a long marathon.

Interesting that you have almost 30% of portfolio in NBIS. Did you noticed that NBIS and IREN barely dropped on Friday?