TSM Q3-25 Detailed Earning Review

A pure display of domination.

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand TMS thesis is here.

This will be concise as there isn’t much to say. This quarter is a demonstration of strength and dominance.

Business.

The million-dollar question today is about the AI bubble: does it exist, and if so, are we near the end? I’ve presented arguments on both sides with some indicators - notably Microsoft slowing expansion and relying more on external providers to manage risk. That’s the story for global AI datacenters.

But when it comes to semiconductors demand, I believe we’re nowhere near a bubble nor at the top. Demand is very strong.

The explosive growth in token volume demonstrates increasing consumer AI model adoption, which means more and more computation is needed, leading to more leading-edge silicon demand.

Companies such as TSMC are leveraging AI internally to drive greater productivity and efficiency to create more value. As such, enterprise AI is another source of demand. In addition, we continue to observe the rising emergence of sovereign AI. We are also happy to see continued strong outlook from our customers. In addition, we directly receive very strong signals from our customers’ customers, requesting the capacity to support their business. Thus, our conviction in the AI megatrend is strengthening, and we believe the demand for semiconductors will continue to be very fundamental.

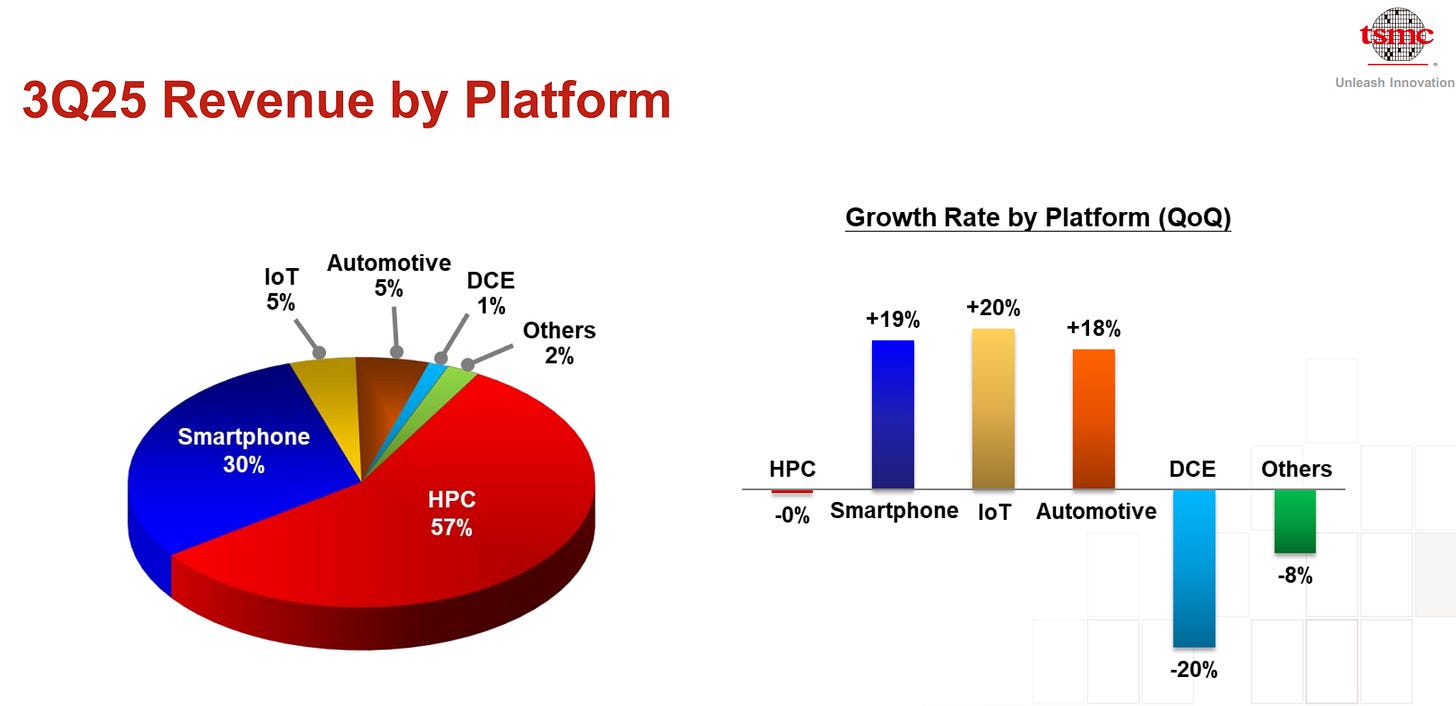

There is a constant need for the most advanced chips which unlock better compute & energy efficiency. The 2nm and 7nm combined accounted for 74% of revenues and is shared between more than 500 customers.

Our 2 nm and S16 technologies lead the industry in addressing insatiable demand for energy-efficient computing, and almost all innovators are working with TSMC. N2 is well on track for volume production later this quarter.

The 2nm are ready for volume production with a stronger demand that expected by management just a quarter ago. Demand isn’t only for those advanced chips but comes from every vertical.

Semiconductors aren’t just used in high-performance computing but in all electronics globally, smartphones, etc, and soon, millions more robots on our roads and cities.

We continue to observe robust AI-related demand throughout 2025, while the non-AI end market segment has patterned out and is seeing a mild recovery. Supported by our strong technology differentiation and broad customer base […] we have not observed any change in our customers’ behavior so far.

As I said, this quarter is a clear display of dominance and management is already planning its next steps with high R&D expenses remain to answer clients’ needs.

In addition, we are preparing to upgrade our technologies faster to end-to-end and more advanced process technologies in Arizona, given the strong AI-related demand from our customers.

This directly relates to ASML’s report yesterday as it means adopting their newest lithography hardware.

And with fab expansions to grow volume. The U.S. Arizona fab first, already expanding to focus on the most advanced semiconductors with further expansion possible, a new fab in Kumamoto, Japan, another under construction in Dresden, Germany, expansion plans for their Taiwan fabs...

All these spaces to be filled with ASML’s newest lithography equipment and answer their clients need in term of products and proximity.

If you thought it couldn’t get better, it did. Management raised guidance after this quarter, stating they could meet growth targets even if geopolitics with China strengthen and more export controls are imposed.

Analyst: Even with a limited opportunity from China for the time being, you are still confident that a 40% CAGR or even higher can be achieved in the coming years?

Che-Chia Wei: You are right.

TSMC’s business is that strong.

Financials.

As strong as you’d expect.

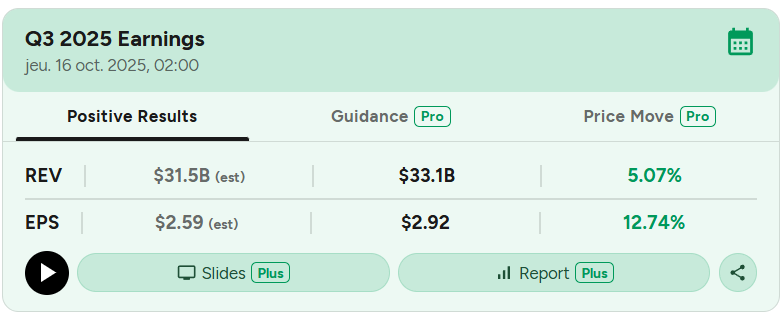

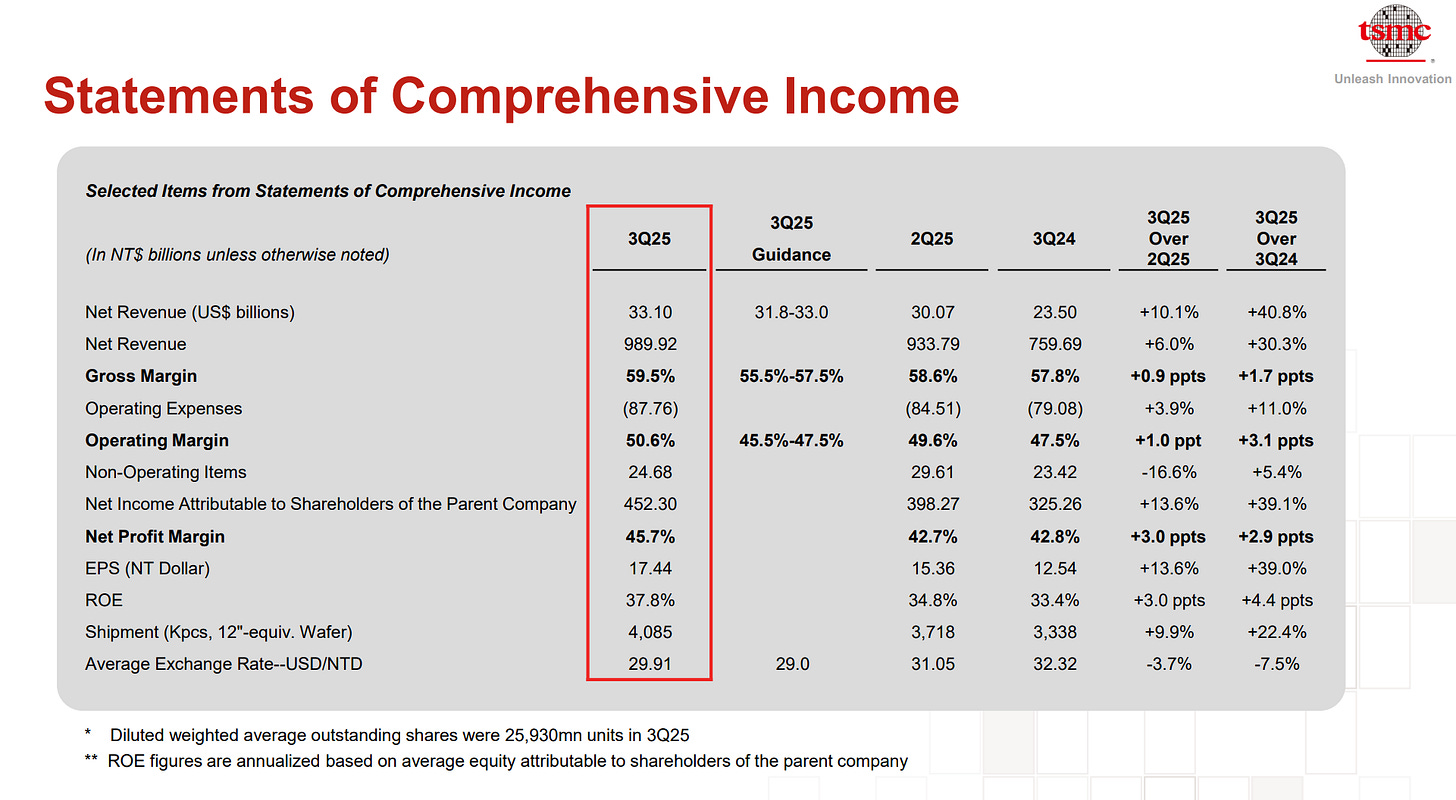

A 40% YoY growth with rising gross, operating & net margins as demand concentrates on the most advanced hardware. Companies need time to ramp production, so YoY comparison may understate the actual growth and results would have been even better without FX effects.

Compared to the second quarter, our third quarter gross margin increased by 90 basis points sequentially to 59.5%, primarily due to cost improvement efforts and a higher overall capacity utilization rate, partially offset by margin dilution from our overseas fabs and an unfavorable foreign exchange rate.

In term of cash, TSMC holds nearly $60B in net cash with $4.3B in free cash flow, and returned $3.6B to shareholders in dividends.

Guidance.

As I shared, the company raised its FY25 guidance.

we now expect our full-year 2025 revenue to increase by close to mid-30% year-over-year in U.S. dollar terms.

Investment Execution.

It’s hard not to be bullish on the AI market after this report, especially as TSM has a broad overview of the market thanks to its backlog. Some may argue they wouldn’t talk if they saw weakness but the tone on the call was clear and bullish, not trying to avoid questions.

The only takeaway is that demand for efficient hardware is growing, and TSM continues to expand to meet it. No ceiling is in sight.

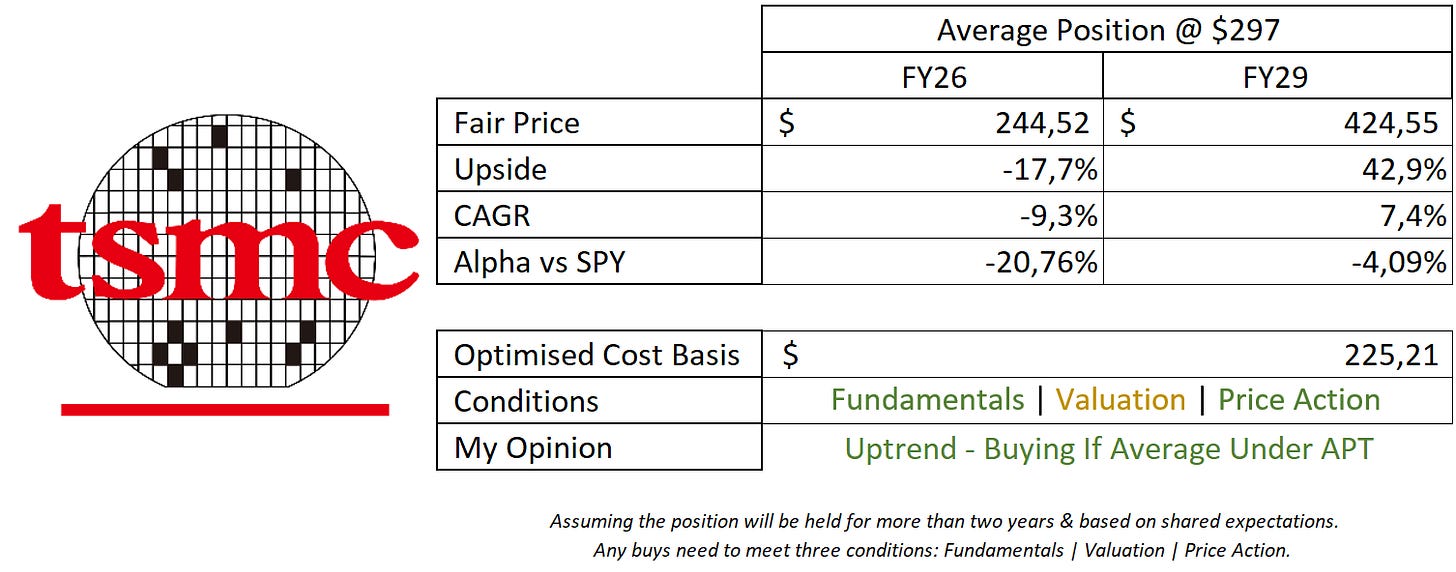

This model assumes a 35% & 25% CAGR growth until FY26 & FY29 respectively, 30% net margins, 1.2% return to shareholders, and a P/S & P/E at x9 & x23 respectively.

Management is more optimistic about its five-year growth expecting 40%+ growth for the HPC vertical and 30% for its global business, but I remain conservative in forecasts to include risk.

I raised my optimum average target to $200 and accumulation target to $220 for TSM July W3 and the market gave that opportunity few weeks later with its breakout retest, before sending the stock much higher.

This chart reflects perfect fundamentals, financials, and a strong, justified optimism. I would hold and accumulate on retests as TSMC will remain a semiconductors leader for years and our need for it won’t reduce.

This is a perfect buy and hold. No need to complicate things.