Weekly Recap | September - W1

Weekly Buying List Update, Tariffs Are Illegal, Transmedics Competition and Flight Data, Duolingo's Situation, PayPal Hiccup, Nebius Service & September Planning.

I joined FiscalAI affiliate program this week and will regularly share my referal link for you guys to have a 15% reduction on all subscription plans.

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs & honestly the best platform on the market to follow companies. If you’re interested, feel free to use my link!

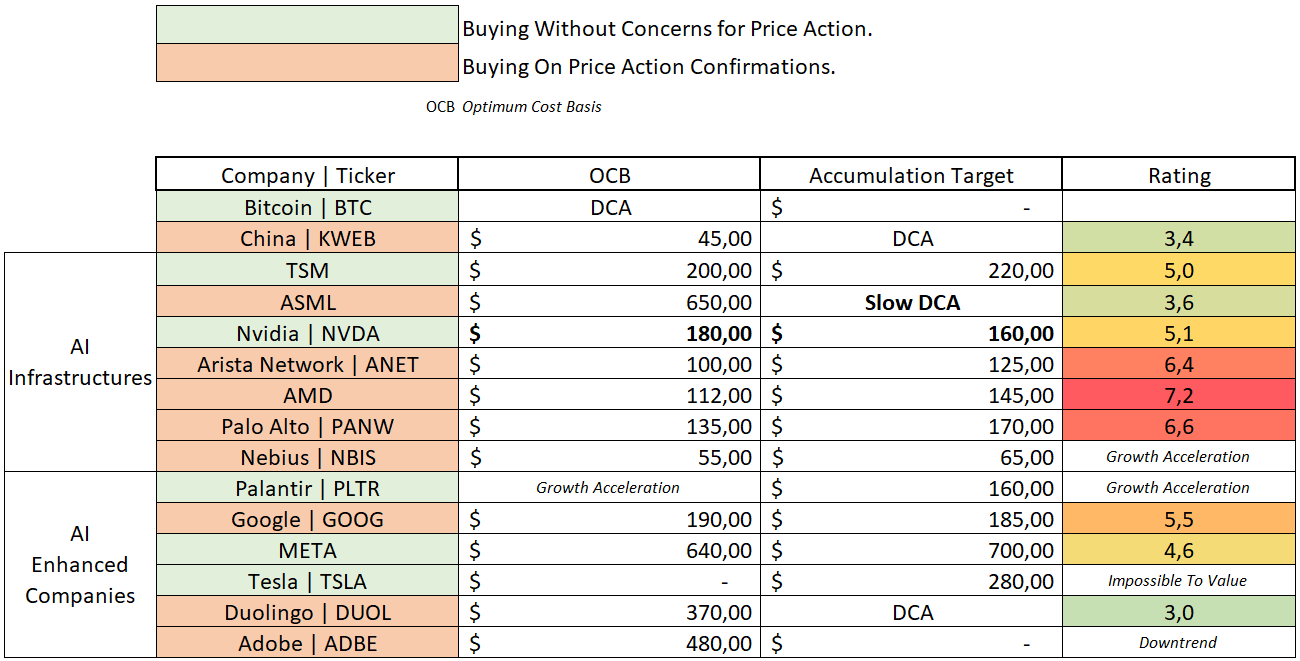

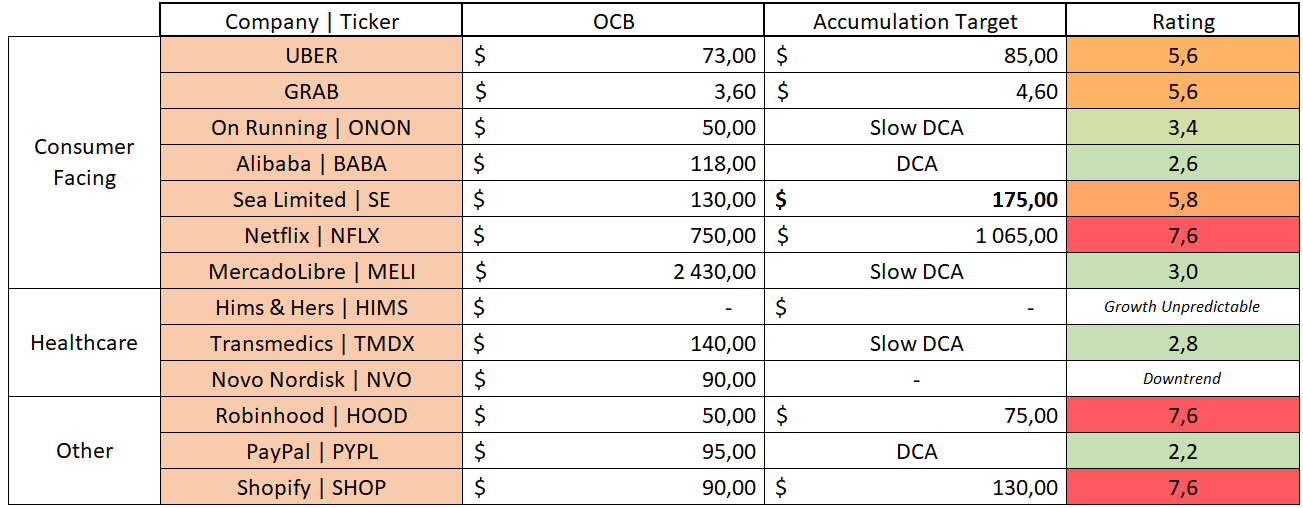

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold cells are updates compared to last week.

Macro.

We did a deep overview of the macro situation last week so I’d advise you to read it if you didn’t.

In terms of news, the only interesting one was the ruling of the U.S. court that Trump’s tariffs were illegal which I do not think is surprising but doesn’t change much neither. The subject should be brought to the Supreme Court for probably some more months of deliberation until reaching a decision.

As usual on this subject, it’s impossible to forecast what will happen but it’s interesting to know that the U.S. justice disagrees with the government. I don’t know if they have the power to cancel them, or else, although I’d assume nothing will happen before next year either way.

Worth following, but without any immediate impact on the economy or the market.

Watched Stocks and Portfolio.

Before starting, I will share once again my investment plan with you guys as I continue to believe we will have a breather, and I continue to say that having plans is important in the market.

I do not want you to follow mine but I advise you to be crystal clear on your portfolio, what you own & want to own, in order to have your emotions checked if the S&P500 were to fall 5% during the next month - not saying it will.

I have cash. I have a plan. For both long term and swings. Have one yourself.

Transmedics Competition & Flight Data.

We talked about OrganOx already some time ago as the company received the FDA clearing for its hardware to fly within the U.S., adding pressure on Transmedics as potential competition. Transmedics management said that it was great to have the authorization, but as the hardware couldn’t fit a jet, it would probably not be economically viable.

The company made more noise this week as it was acquired by the Japanese entity Terumo, for 20x sales give or take - maybe even slightly higher.

At Friday close, Transmedics traded at 7.4x sales, which shows a clear double standard between the public and the private market. OrganOx has only one hardware focused on livers and no equivalent to Transmedics NOP services.

I would attribute the difference of treatments to Transmedics’ transparency as the market can track its flights and project revenues, and flights have been really weak during the quarter, as one could expect due to the summer seasonality.

The stock has been holding on its $110 - $120 price range, which is already positive as the data could seem bearish. I personally believe we’ll see green candles when the flight data is back to growth, as the market will have confirmations this was only due to seasonality, not to fundamental issues.

This is my bias and as usual, my money is where my mouth is.

Alibaba & China.

Rapid news on Alibaba’s expanding social security subsidies to its delivery riders nationwide, certainly due to a global wish from the government to bring more security/stability to its citizens.

More security means fewer worries to manage yourself. There are direct links between this kind of measure, pushed by governmental entities and consumption growth as more stability/security leads to less worries and planning from households.

Once again, China has issues. But they are taking the right measures to resolve them. And it might start to show as Alibaba’s quarter was honestly good, with what I believe to be really positive signs.

Many are against investing in China but I continue to believe the Chinese market is an opportunity, and it seems that many start to realise it as local inflows are growing rapidly. If international inflows follow, the train will leave fast.

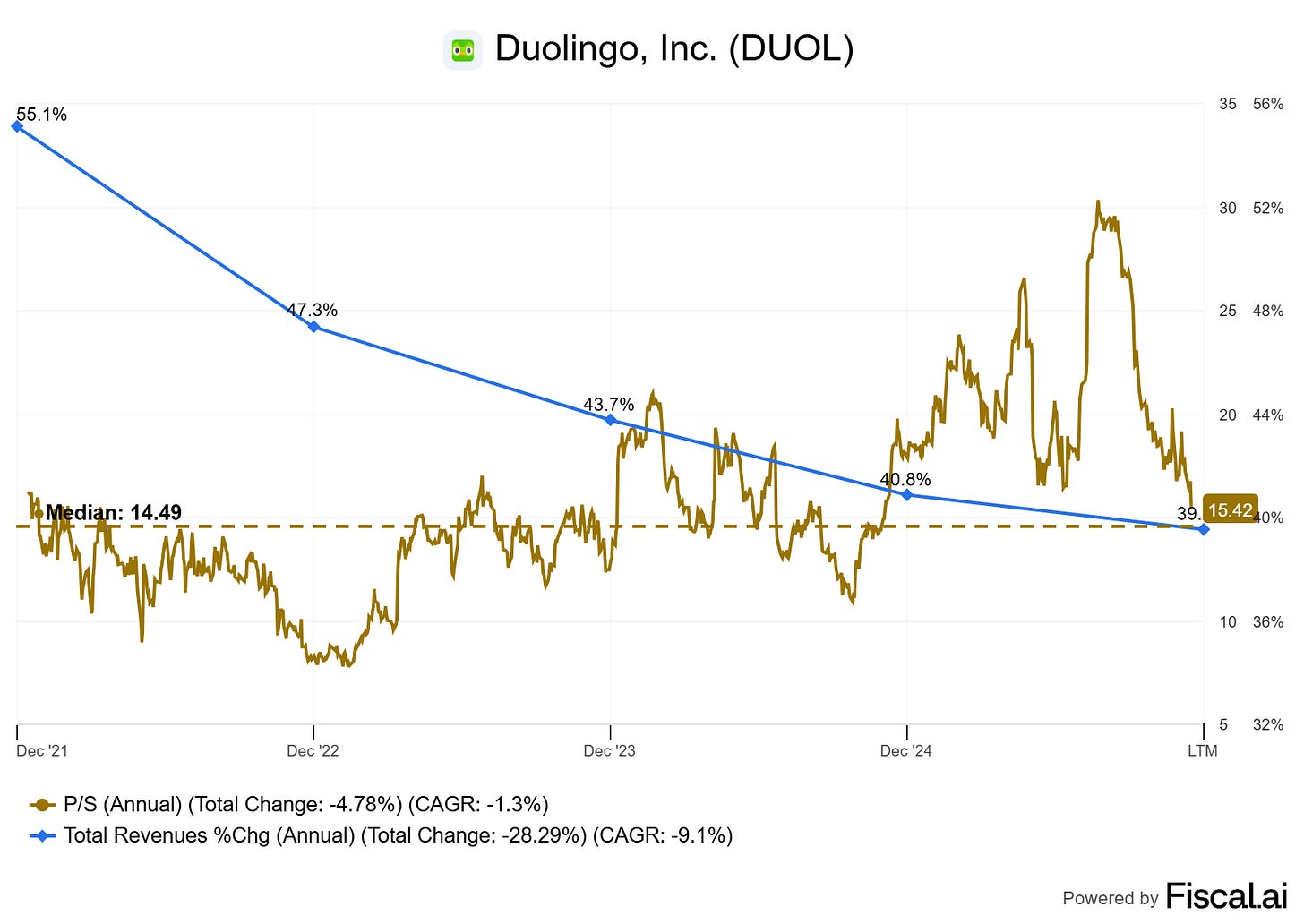

Duolingo Situation.

I have no news on Duolingo but I want to reaffirm my view on the stock, which broke the $300 price yesterday after a sell-off for no apparent reasons on Friday, following another sell off earlier this week as Google released a new AI tool to help you learn languages with some degree of personalisation, but no gamification. A very school like system.

Duolingo has always traded at high multiples justified by a strong growth, with no signs of weakness, and multiples are simply breathing now due to some fear of AI competition.

The market is convinced that AI will replace demand for this kind of app. Just like AI will replace everything apparently, and ChatGPT will be the only app the world relies on. For everything.

My opinion remains the same: Duolingo is a gamified way of learning, which cannot be replicated or won’t be because users would rather open their app on the toilets than generate prompts on their computers when they want to learn “mouse” in Japanese. It is really obvious to me but the market disagrees.

So it sells. And I believe this one will take time, but I own it on my B&H portfolio and will continue to accumulate as long as fundamentals remain strong. I don’t care much about the market’s bias, which are often wrong, I care about what the data says.

And the data doesn’t point to disruption.

PayPal Hiccup.

PayPal had a hiccup on Wednesday with big consequences as around €10B worth of unauthorized debits hit banks from PayPal accounts. The company’s filter system stopped working.

No financials consequences as the banks system took over, and I do not believe one incident rapidly fixed will impact PayPal's reputation, but it sure isn't something we'd like to see again.

The stock fell around 2% following the new, a pretty weak reaction considering the situation, which could also indicate a much weaker selling pressure.

Still holding my shares, still believe it to be a good buy at the moment.

Nebius X Nous.

Some words on Nebius excellent reactivity, deploying new models to all their clients in less than 24h.

Weekly Planning.

The earnings season is mostly over. Lululemon will report next week, I will look at the numbers but won’t cover them. I believe it is too early to jump on apparel names, but important to keep an eye on dominant brands. Might publish a note on it but not write ups.

I will take some days off in September but have some content ready to ship, my Arista Networks investment thesis in the first half of the week and my Astera Labs write up later on. There is no rush as I consider both stocks to be expensive, but I will send them earlier if opportunities arise.

For the next weeks, I am working on Palo Alto and another energy, uranium focused investment thesis plus a detailed write up on the perfect AI datacenter portfolio; a clear recap on the AI infrastructure chain and the best stocks for the next decade, including execution content. This is my in-between earning season plan.

Wishing a great Labor Day to our fellow Americans!