Weekly Recap | August - W3

Watchlist & Buying Prices Update, Keyu Jin Interview, Inflation & Consumer Data, Duolingo Drawdown Explained, Transmedics Conference, The GPU Taxe, Weekly Planning & Earnings Review.

I joined FiscalAI affiliate program this week and will regularly share my referal link for you guys to have a 15% reduction on all subscription plans.

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs & honestly the best platform on the market to follow companies. If you’re interested, feel free to use my link!

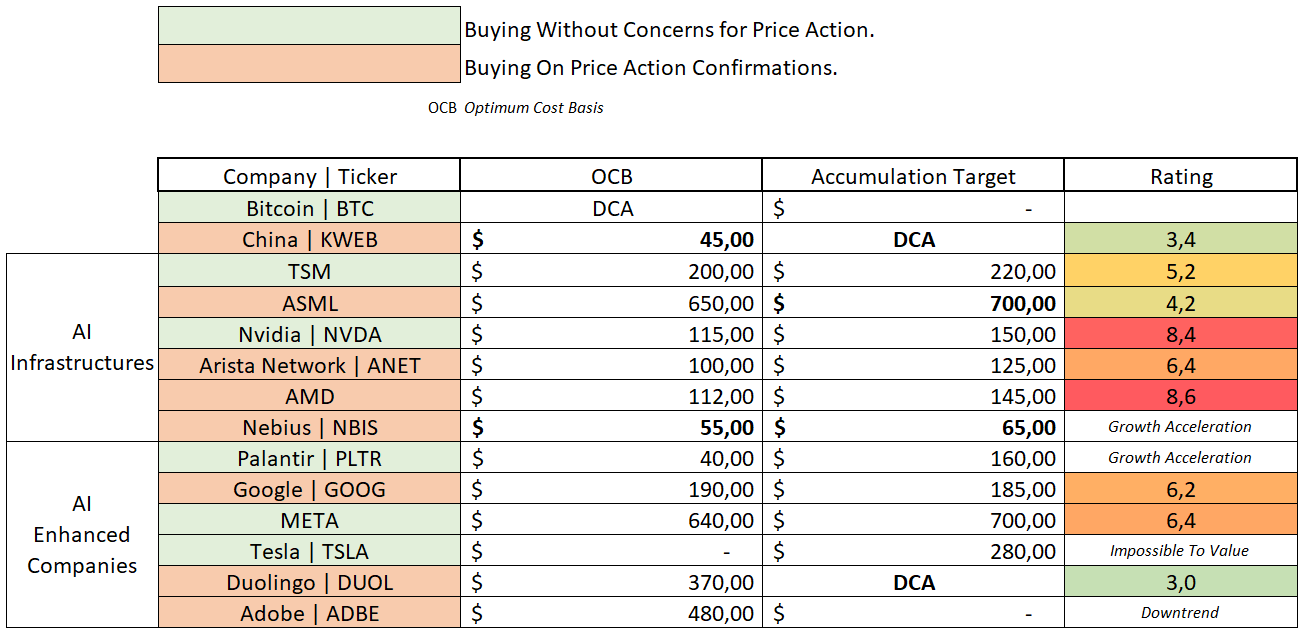

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold cells are updates compared to last week.

I am still upgrading this table & will continue to do so, to make it more readable with time. I also have to update the stocks on the watchlist as some stocks are missing and others I follow less. We’ll find the perfect recipe with time, feel free to comment if you have ideas or to share your opinions.

And if you guys didn’t read my detailed plan for the next month, in case of a market breather, you should.

Always. Have. A. Plan.

On another note, I’d advise the bulls, bears & skeptics on China to watch this video. Lex is one of the best interviewers of our time and Keyu is just the most interesting Chinese economist to listen to, with a clear & unbiased view of her own country.

Bulls and bears all have arguments. But if you are a skeptic or convinced that China is going to collapse, or that Chinese are by definition evil - I have read that many times, or if only for their view of the Taiwan situation, not biased by western medias, take an hour of your time.

Cultural differences can be explained. Hate cannot.

Macro.

CPI, PPI & Consumer Strength.

Let’s get back to some basics with the definition of both metrics.

Consumer Price Index (CPI) - a measure of the average change in prices for a defined cart of goods and services whose price is compared month on month and year on year to show the increase/decrease of price from the final consumer perspective.

Producer Price Index (PPI) - a measure of the average change in prices for domestic producers’ goods and services sold, compared month on month & year on year to show the increase/decrease in prices from the producer's perspective.

PPI is usually the precursor to CPI, or at least gives an indication of inflation’s future. If produced goods & services prices increase, businesses using those will eventually have to sell their final product at a higher price.

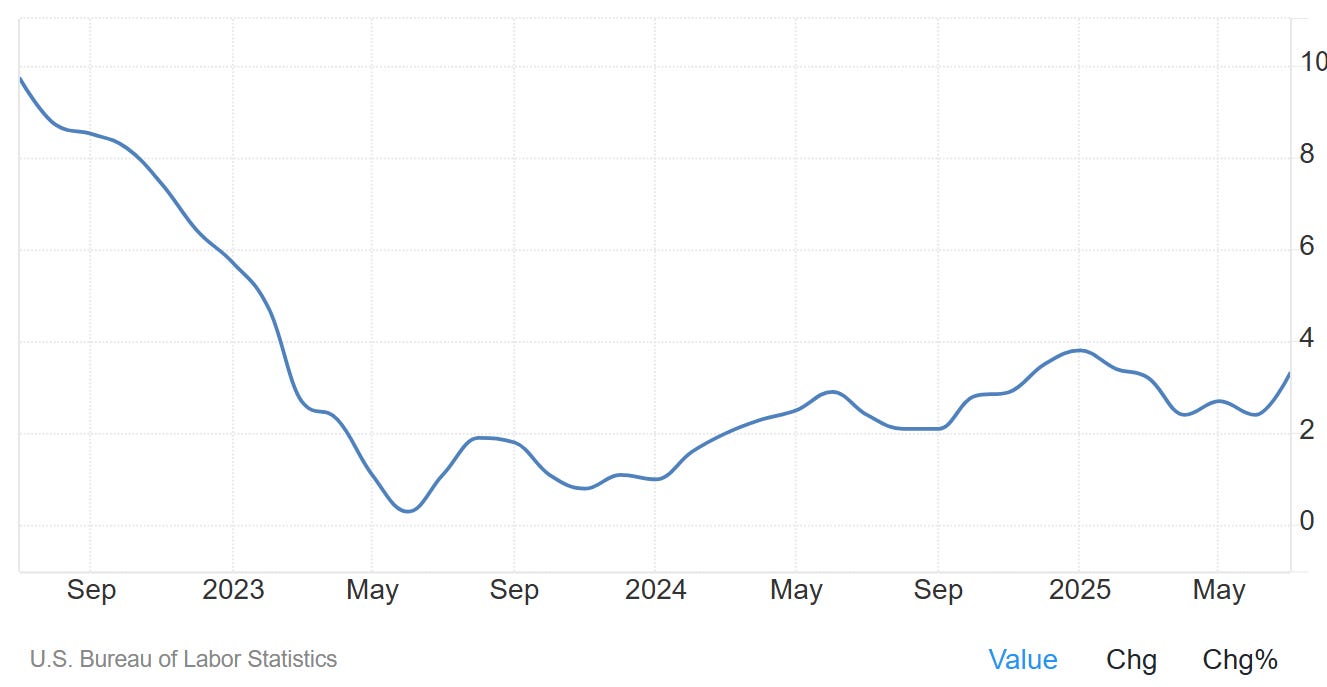

Both metrics were shared this week, with a CPI on expectations but a massive miss on PPI which came at 3.3% for a consensus at 2.5%.

This means that production prices are increasing, and this increase will either have to be passed to consumers or absorbed by U.S. companies, hence shrinking margins. An impossible situation which I talked about for months now as this was the only possible outcome of tariffs. It did not happen earlier because of the inventories built before April. We talked about this earlier as well.

Now that those inventories are emptying and that companies start to import again, at higher prices, the costs of their products rise. It was just a matter of time until this happened, and is just a matter of time to have it transferred to consumers.

Those are getting weaker, slowly but surely, and the market anticipates this with most apparel names being beaten down lately - even On Running despites great earnings.

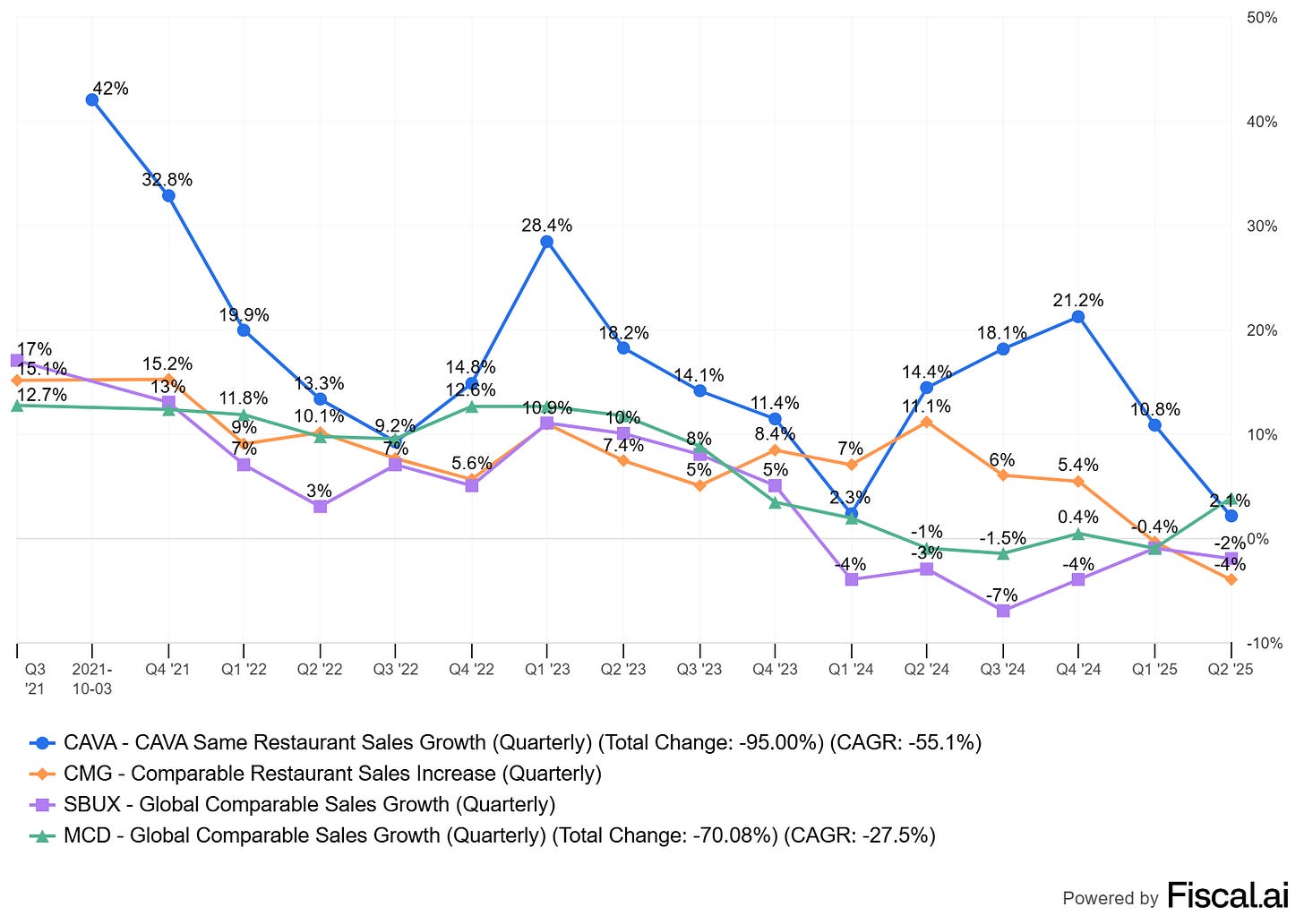

On the data, we had retail sales metrics this week, slightly below expectations at 2.7% instead of 2.8%, still healthy. We also had an earnings season with one specific sector being beaten: restaurants. The most loved places of the last year are now declining in terms of traffic & sales compared to the year prior.

The trend is pretty clear, this is one view of the consumer, but it means something when fewer households eat outside than the previous year. Let’s review after summer’s quarter.

Watched Stocks and Portfolio.

Duolingo & OpenAI.

You probably saw Duolingo’s price action this week, up 30% plus post-earnings to fall 10% lower than its pre-earnings price five days later… Rarely seen something like this in the stock market, especially after a stellar report.

This could be due to OpenAI’s demo about its new ChatGPT version where they asked the LLM to create a game to learn some French vocabulary.

I won’t go over the entire Duolingo investment case but… Here are a few keypoints on why I believe this is a nothing burger.

This version of ChatGPT isn’t free, actually much more expensive than Duolingo.

The last decade proved that users are looking for convenience, even for a few bucks. Is it convenient to recreate a randomly generated game every time you want to learn something?

This won’t give any continuity in progress, knowledge, graphics, or even teaching methods. Every new prompt will generate something different.

It requires knowledge to build a prompt. It’s pretty rare to get exactly what we’re looking for through text-based prompts - at least for complex tasks. It requires skills to create this, and time, which many don’t have or want to spend on this.

And then, I would add the classic arguments. Duolingo is more than just a learning app, it will have many more courses, it is usable for every level, they have a strong acquisition and retention which proves users love their service & they leverage AI themselves. This kind of technology will help them to build even faster.

And more…

That being said, this price action is really tough but I am pretty bullish from here, with a very long-term vision for this stock - more than two years.

The stock had three 40% plus drawdowns in its history, and no 50% plus despite the post-IPO dump but I wouldn’t consider this normal price action.

The stock also never spent long below its 50EMA.

If we base ourselves on this historical technical data, the stock could take some weeks, maybe months to go back up, but we should have seen most of the drawdown, as long as it doesn’t enter a downtrend.

To me, fundamentals are strong, financials are great & improving, valuation is correct, and price action is giving an opportunity due to I consider to be ridiculous concerns.

Transmedics Conference

The company’s management was at the Canaccord Genuity's conference earlier this week, you will find a recap below of what was shared - some pretty bullish data.

My view of the company doesn’t change and I am glad it is the biggest position in my portfolio.

The China GPU Tax.

Something a bit out of this world in my opinion, as the U.S. imposed a 15% tax on revenues for every GPU sold to China. The price for companies to have their export licenses.

Of revenues, which makes this even worse than a tax. Mindblowing for a capitalist country, while many would expect comparable thing from the other side.

In term of investing, it's "better than nothing" as accessing this massive $20B+ market is more important than not for Nvidia and we'd still be talking about $17B or so of revenues.

Weekly Planning.

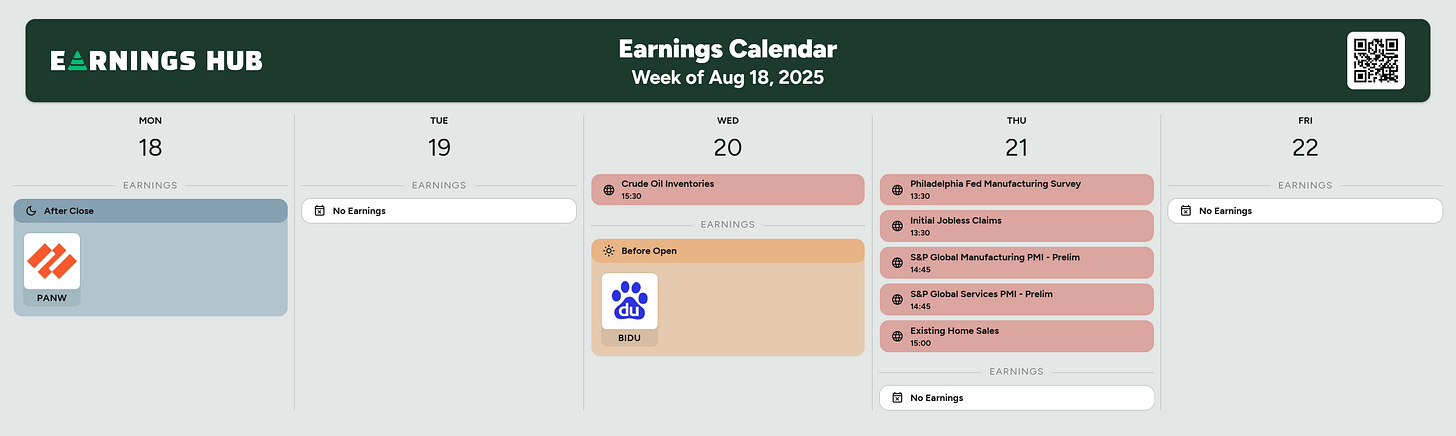

Earnings season peak is now over. But content isn’t. You will receive the ASML & TSM investment thesis this week and I have many more write ups ready to go your way during the next month.

Some companies continue to report though, with Palo Alto & Baidu this week, which I won’t do a detailed review of but will comment, Palo Alto for the company itself and Baidu for its cloud business, to have information on Alibaba’s competition.

Listened to Lex's podcast, thank you for the recommendation. Keyu is more of a balanced view indeed - to me not all of what she says is true but she has a really good understanding of China. The competitiveness is real on a community and even family level, which is driving a lot of people nuts. People are yearning for more healthy competition but it's very challenging due to the vast population. Also a good point on Chinese not really doing 0->1 but it's good at using the technology and bettering it to suit more needs.

Great arguments on Duolingo. It’s worth noting that you need to ask the right questions so AI can give you meaningful answers. Surprised at the news that someone bought air tickets based on some visa requirements insight from chatGPT… but maybe we shouldn’t be surprised.