Portfolio Modifications

Focusing on the best opportunities

I made some portfolio modifications over the past few days - mostly today, which need explanations as some of you might see them as random or indecisive, but I assure you they’re not. Conditions changed, and so did my portfolio.

I’m not attached to my stocks. I have no problem cutting a position in a slump for one with better potential. The market doesn’t care about feelings. Neither should we.

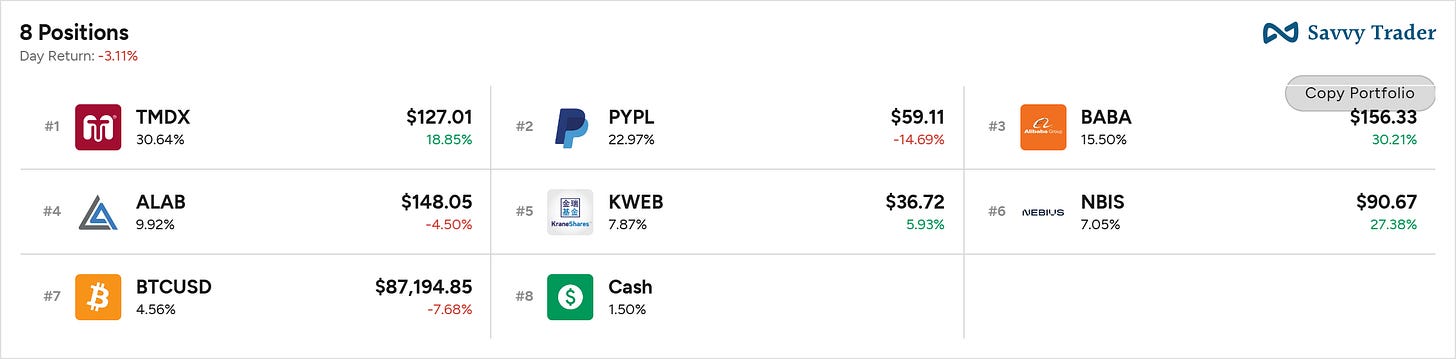

In short: I sold Tesla and Duolingo to buy AsteraLabs and accumulate TransMedics. Going forward, I may trim PayPal to buy more AsteraLabs, Nebius, or TransMedics on opportunities.

I’ll detail each move to clarify my thought process. A reminder first: my investing style is to concentrate liquidity in a handful of names where I have the strongest conviction based on fundamentals, narrative and price action.

Selling Tesla.

Probably the most surprising move given a strong Q3 and positive news lately, not to mention my love for the company.

This is about potential. Tesla was a 3% position & isn’t speculative. It has upside with its robotaxi, energy, chips, AI & more. And it’s one of the rare companies with exposure to multiple sectors. Tesla is an amazing company.

Still, with only 3% allocation and “limited” short-term upside - it’s probably not going to double in a year, its impact on my portfolio would be minimal. It’s a stock to own and hold, and I would love to but with a much bigger position at a much better price.

There are many strategies in the market. Tesla is a great name. But I need liquidity, maybe not for better names but for better opportunities.

Selling Duolingo.

I’ve said everything I needed to say about Duolingo yesterday. My case was clear: I’ll buy back when the market shows love.

Even if the rebound is as aggressive as Meta in 2022, I’ll find liquidity to jump back in. It remains one of my strongest convictions and favorite companies on the market.

But again, liquidity matters. And today, I’d rather reallocate.

Trimming PayPal.

I haven’t done it yet but I might if the market keeps dropping.

I know I sold AsteraLabs a few days ago to buy… PayPal and TransMedics. Now I’m doing the opposite? Yes; because conditions changed.

First, Alex Chriss spoke at Citi’s Fintech conference on Wednesday & I didn’t love what I heard. Not enough to exit the position, I’m still neutral for Q4 with western consumer habits who’d rather use debt than skip Christmas and the potential $2,000 stimulus for low-income households. But enough to trim, as the short-term turnaround I expected will take longer, possibly several more quarters, more than a year.

And since I believe better opportunities exist: liquidity reallocation.

Nvidia’s report.

Second, Nvidia’s Q3 report dropped yesterday and it set the tone: dominant. I’m still writing the full review, but here’s the bottom line: the world’s largest company grew 62.4% YoY and 66% from its datacenter branch, despite tough comps.

Add this quote for those skeptical of AI demand or worried GPUs won’t pay off before being replaced.

The clouds are sold out, and our GPU-installed base, both new and previous generations, including Blackwell, Hopper, and Ampere, is fully utilized.

Ampere is from 2020 and still in use, although in use doesn’t mean profitable, I’ll give the bears that, but it confirms demand. Yes, there are concerns about Nvidia’s rising inventory - which can be explained by shipment delays, and whether buyers can or for how long will they be able to afford GPUs, preferably from organic sources and not continuous debt as we see lately.

There are reasons to worry. Not enough to exit, in my view. I understand others may disagree.

What I see is strong GPU demand, accelerating compute needs & development of AI AI services all around the world. The bubble will come when demand disconnects from reality. That’s not what I see today.

Buying AsteraLabs – Again

Which brings us to AsteraLabs, which I called one of the best buys on the market a few days ago. It looks even better today as Nvidia derisked the investment.

My first concern was a slowdown in hardware demand. Nvidia proved that wrong.

Second, AsteraLabs’ revenue is tied to Nvidia’s custom racks. If Nvidia is selling more hardware than ever and guiding even higher, AsteraLabs’ opportunity is also rising.

Third, I worried about demand for AsteraLabs’ products. I highlighted during their last quarter the conversations they were having with data center owners, and the interest they had for their hardware.

The math does itself from here.

If AsteraLabs is in discussion with multiple clouds to customize Nvidia racks & Nvidia is selling more than ever, it seems to be a logical conclusion that AsteraLabs is in a very good posture to sell its products, and ramp up its X & P series.

Conditions changed in few days. Fundamentally, with proof of sustained demand and interest, and narratively as the AI bubble fears are faced with numbers bears can’t explain - unless they claim fraud & co which some do.

The Plan.

I am aggressive while the S&P continues to fall with assets like Nebius & AsteraLabs but I personally cannot turn bearish with such numbers. It doesn’t mean I am right. But here’s where I stand today:

TransMedics remains the best asset in the market and is over 35% of my portfolio.

Nebius is a close second. I’m patient but plan to buy more.

No change in my China views, holding those names strong.

AsteraLabs should deliver strong returns if my AI thesis holds.

I will hold PayPal through Q4 or use its liquidity to grow others.

I follow my system.

I might end up being wrong thinking that the AI trade is alive, still has legs. I’ll adapt if necessary but as of today, I do believe in those assets. and as usual, I will cut them at a loss if I need to.