Tesla Q3-25 Detailed Review

The end of the tunnel?

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Tesla’s bull thesis is here.

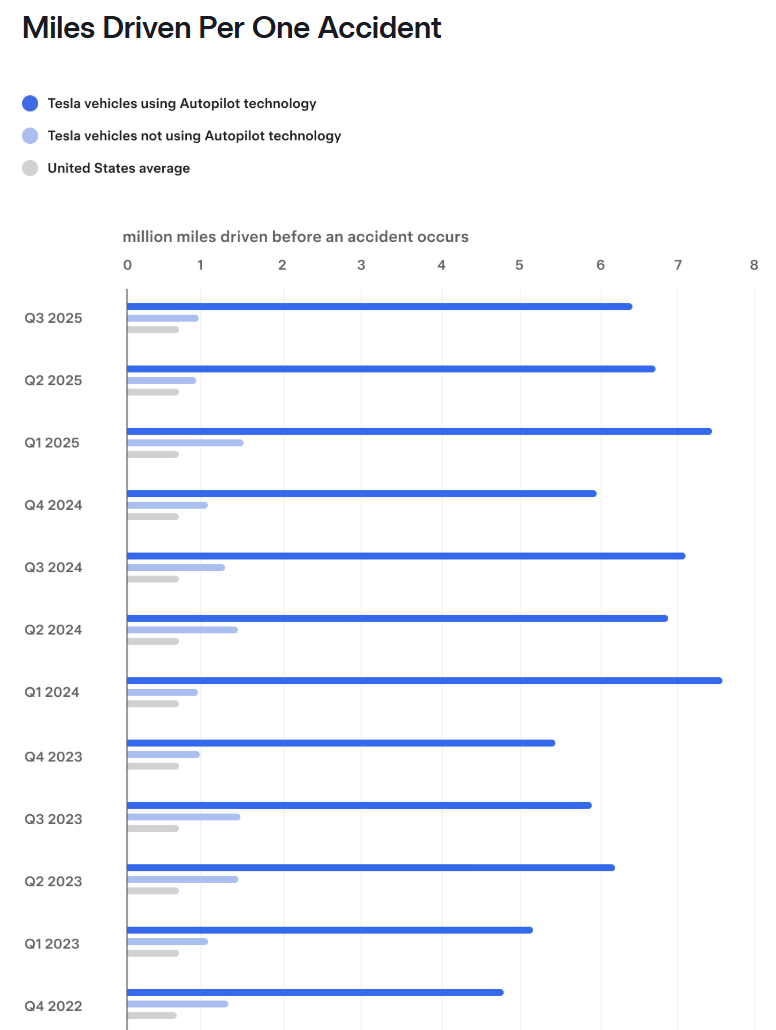

I think it’s important to emphasize that Tesla really is the leader in real-world AI.

Business.

This quarter is the total opposite of the last one. Return to growth across all verticals, stronger margins, solid financials, positive news… Tesla moves quickly, which is exactly why I remain a long-term holder on this name, a perfect buy and forget position.

EVs.

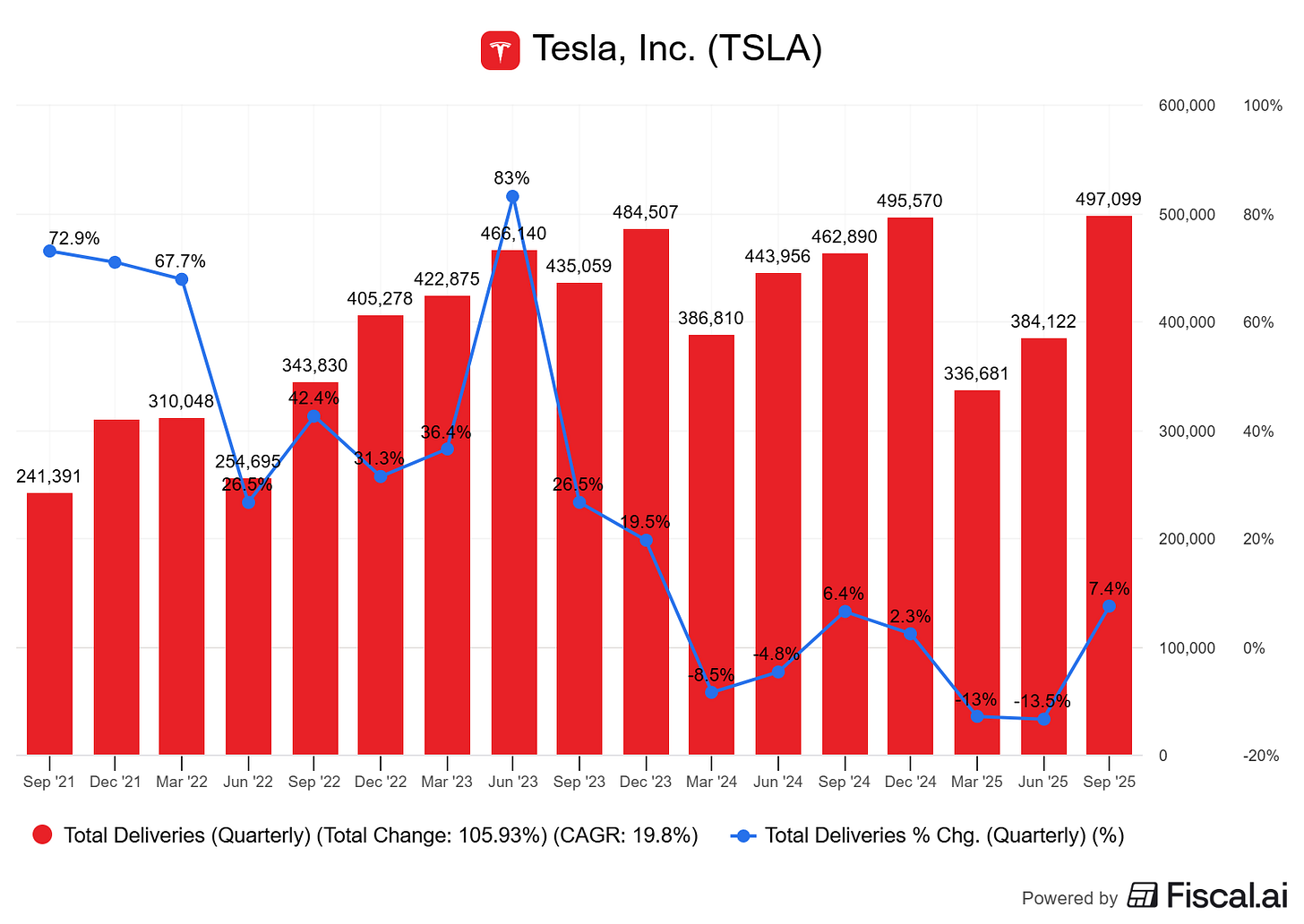

Tesla’s core business returned to growth. Bears will argue that demand was driven by the expiration of EV subsidies at the end of Q3. Bulls will argue the global rollout of the refreshed Model Y is the source of demand. Both points carry some truth.

What matters is the outcome: Tesla delivered a record number of EVs this quarter.

Greater China and APAC were up sequentially 33%, North America was up 28%, while EMEA was up 25%.

The average price per EV continues to decrease and is now below $40,000 which is Tesla’s objective, to be affordable, a tendency which will continue especially with the new lower-cost models now ramping - which could sustain demand even without subsidies. Time will tell.

Hardware 5.

Some updates on Tesla’s next-generation chip which powers the EVs’ AI capabilities.

Tesla describes its cars as “robots on wheels”. Robots need compute to operate; the more or the most efficient it is, the better they do - just like a computer can process more demanding softwares with higher compute. The problem with EVs is the same than with other hardwares: to design a chip small and powerful enough to fit inside the car and operate it safely and efficiently.

Hardware 4 is doing so today and operates a constantly improving FSD. But Tesla is designing its fifth-generation with Samsung & TSMC as manufacturing partners.

By some metrics, the AI five chip will be 40 times better than the AI four chip. Not 40%, 40 times. Because we have a detailed understanding of the entire software and hardware stack, we’re designing the hardware to address all of the pain points in software.

[…] we know what the chip needs to do, and we know just as importantly, we know what the chip doesn’t need to do. To sort of use some examples here, with the AI five, we deleted the legacy GPU or the traditional GPU, which is in AI four. We also deleted the image signal processor. This looks like a long list of deletions that are very important. As a result of these deletions, we can actually fit AI five in a half reticle and with good margin for traces from the memory to the Tesla accelerators, the ARM CPU cores, and the PCI blocks.

Tesla’s vertical integration and deep knowledge of their products allow them to design chips tailored to their vehicles. Better chips means more capacities & an exponentially better FSD as more compute will be available.

FSD.

Adoption of FSD is still modest relative to its potential.

However, note that the total paid FSD customer base is still small, around 12% of our current fleet. We are working with regulators in places like China and EMEA to obtain approvals so that we can deploy FSD in those regions as well.

The real acceleration in adoption will come once regulations are in place and safety is a given. Tesla’s current safety reports indicate we’re close to it - if not already there, but public perception still needs to catch up.

Our goal is to be actually paranoid about deployment because, obviously, even one accident will be front-page headline news worldwide.

In time, the practical benefits of autonomy will drive demand.

What it comes down to is, can you text while you’re in the car? If you tell someone, yes, the car is now so good, you can be on your phone and text the entire time while you’re in the car, anyone who can buy the car will buy the car. End of story.

With reasoning, it’s literally going to think about which parking spot to pick. It’s going to say, this is the entrance, but actually, probably, there’s not a parking spot right at the entrance. If it’s a full, you know, if the parking lot is fairly full, the probability of an open parking spot right at the entrance is very low. But actually, what it’ll simply do is drop you off at the entrance of the store and then go find a parking spot. It’s going to get very smart about figuring out a parking spot. It’s going to spot empty spots better than a human. It’s got 360-degree vision, and it’s going to, yeah.

The one million dollars question is when...

Robotaxi.

Tesla tripled its service area in Austin and is targeting rapid expansion, also planning to remove their safety drivers in some region.

We are expecting to have no safety drivers in at least large parts of Austin by the end of this year.

We do expect to be operating robotaxi in, I think, about eight to ten metro areas by the end of the year. It depends on various regulatory approvals.

Production of the Cyber Cab - with no pedals or steering wheel, is expected to begin ramping in Q2 2026 and to take over the Model Y actually running the service progressively.

Energy.

Earlier this year, Elon warned that energy deployment would be uneven. I complained on last quarter’s numbers, but this quarter saw the strong growth he was expecting, with 12.5 GWh deplyed this quarter.

I talked about the need for energy a lot lately, about nuclear or growing use of fossil resources, but I also shared months ago that batteries where a key technology for the future, and Tesla the best way to play this narrative with its megapack.

[…] if you look at total US energy capability, for example, there’s roughly a terawatt of continuous power available in the US. But the average usage over a twenty-four-hour cycle is only half a terawatt because of the big difference between day and night usage. If you buffer the energy with batteries, you can effectively double the energy output in the United States just with batteries, pulling no incremental power plants.

We see the potential there for Tesla battery packs to greatly improve the energy output per year for any given grid, US or otherwise.

Without much surprises, demand for large-scale batteries from factories, utilities and data centers is accelerating, and Tesla is already deploying solutions at scale.

We’re seeing remarkable growth in the demand for AI and data center applications as hyperscalers and utilities have seen the versatility of the Megapack product. It increases reliability and relieves grid constraints

Optimus.

Some insights into the development of Optimus. No data on how or when but it is still too soon to talk about such things, but Elon shared interesting informations about the process and engineering complexities.

On the supply chain first.

With cars, you’ve got an existing supply chain. With computers, you’ve got an existing supply chain. With a humanoid robot, there is no supply chain. To manufacture that, Tesla actually has to be very vertically integrated and manufacture very deep into the supply chain, manufacture the parts internally because there just is no supply chain.

One of the main challenges is achieving human-like dexterity, especially in the hands.

I don’t want to downplay the difficulty, but it’s an incredibly difficult thing, especially to create a hand that is as dexterous and capable as the human hand, which is incredible. The human hand is an incredible thing. The more you study the human hand, the more incredible you realize it is, and why you need four fingers and a thumb, why the fingers have certain degrees of freedom, why the various muscles are of different strengths, and fingers are of different lengths. It turns out that those are all there for a reason.

And as usual, Tesla’s strength lies in its ability to integrate AI, engineering and scaled manufacturing.

It’s not just an obvious fall of a log thing to make Optimus, but we do have the ingredients of real-world AI and exceptional electrical mechanical engineering capabilities and the ability to scale production, which I don’t think anyone else has all of those ingredients.

Humanois robots require breakthroughs that only a few companies in the world can achieve. One of them is Tesla. The question remains the same: when?

Financials.

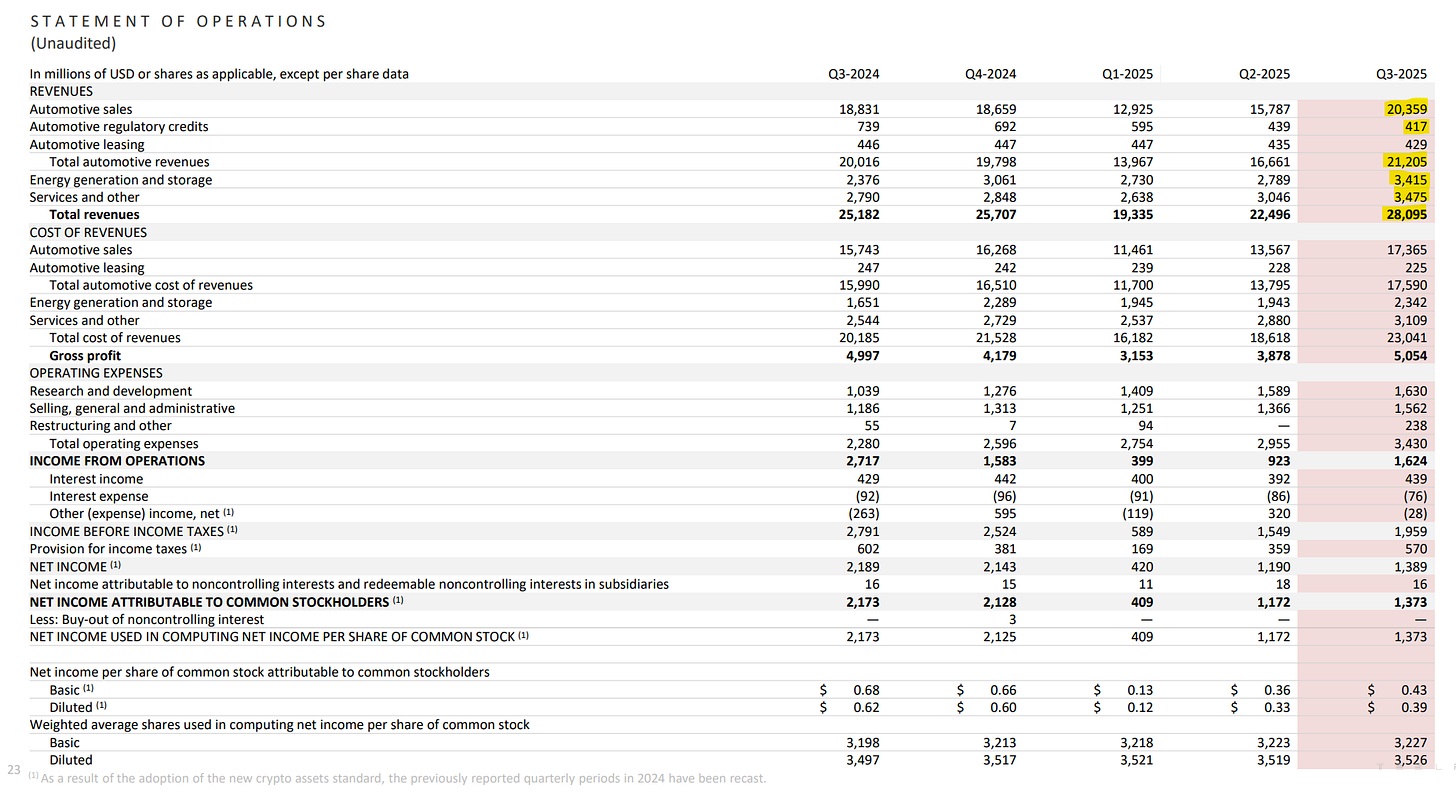

Finally, some positives after a long year.

All Tesla verticals achieved record revenues and the EV segment did so despite a 40% YoY drop in regulatory credits, supporting Elon’s claim that Tesla can produce EVs profitably without them.

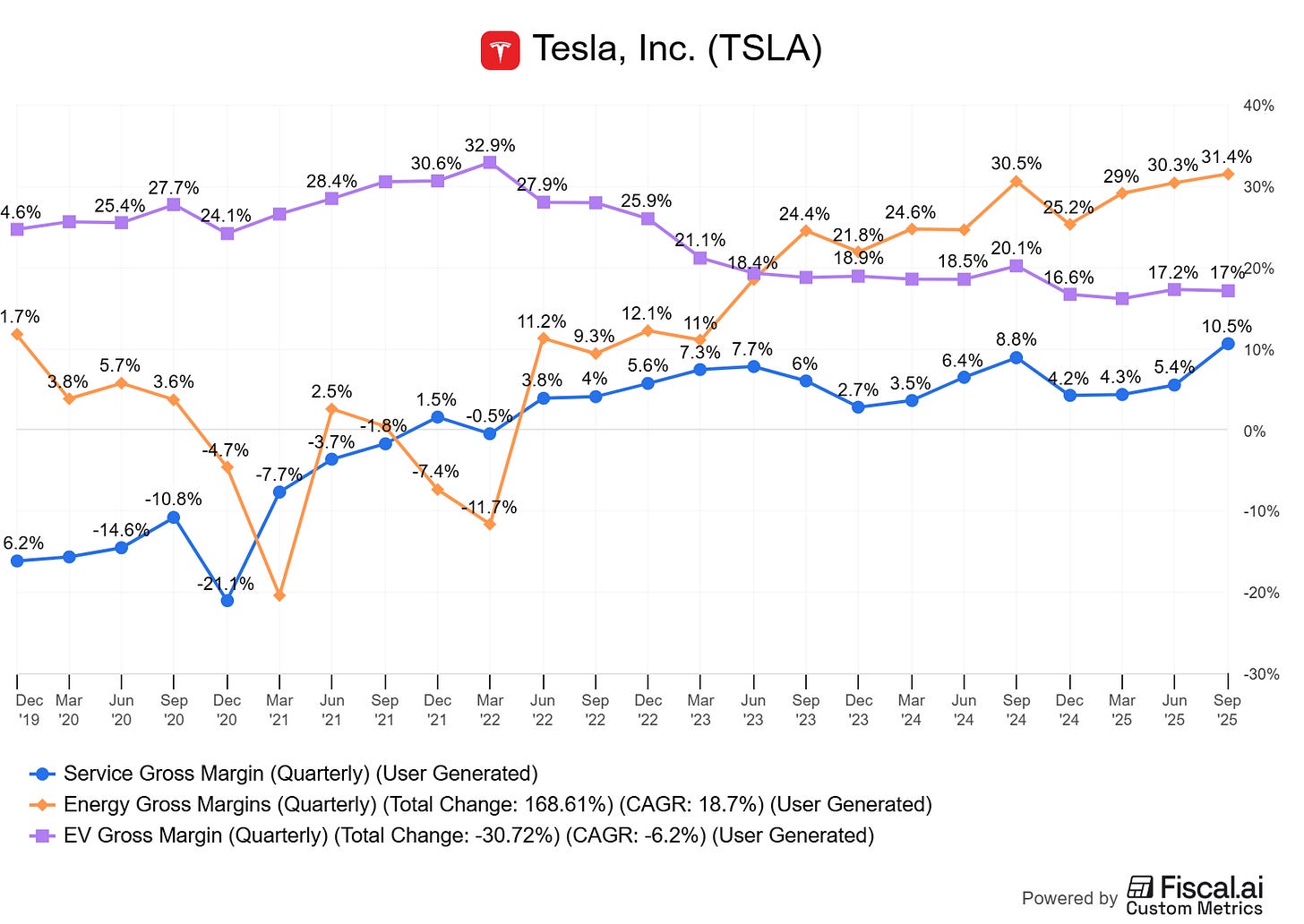

Gross margins remain healthy at 18%, with improving margins in energy and services.

Really positive trends.

Many wish for higher EV margins but Tesla focuses on lower costs, to keep their cars affordable. This is a choice, not a problem, and it comes with lower margins...

For information, the robotaxi service is included in services revenues and costs.

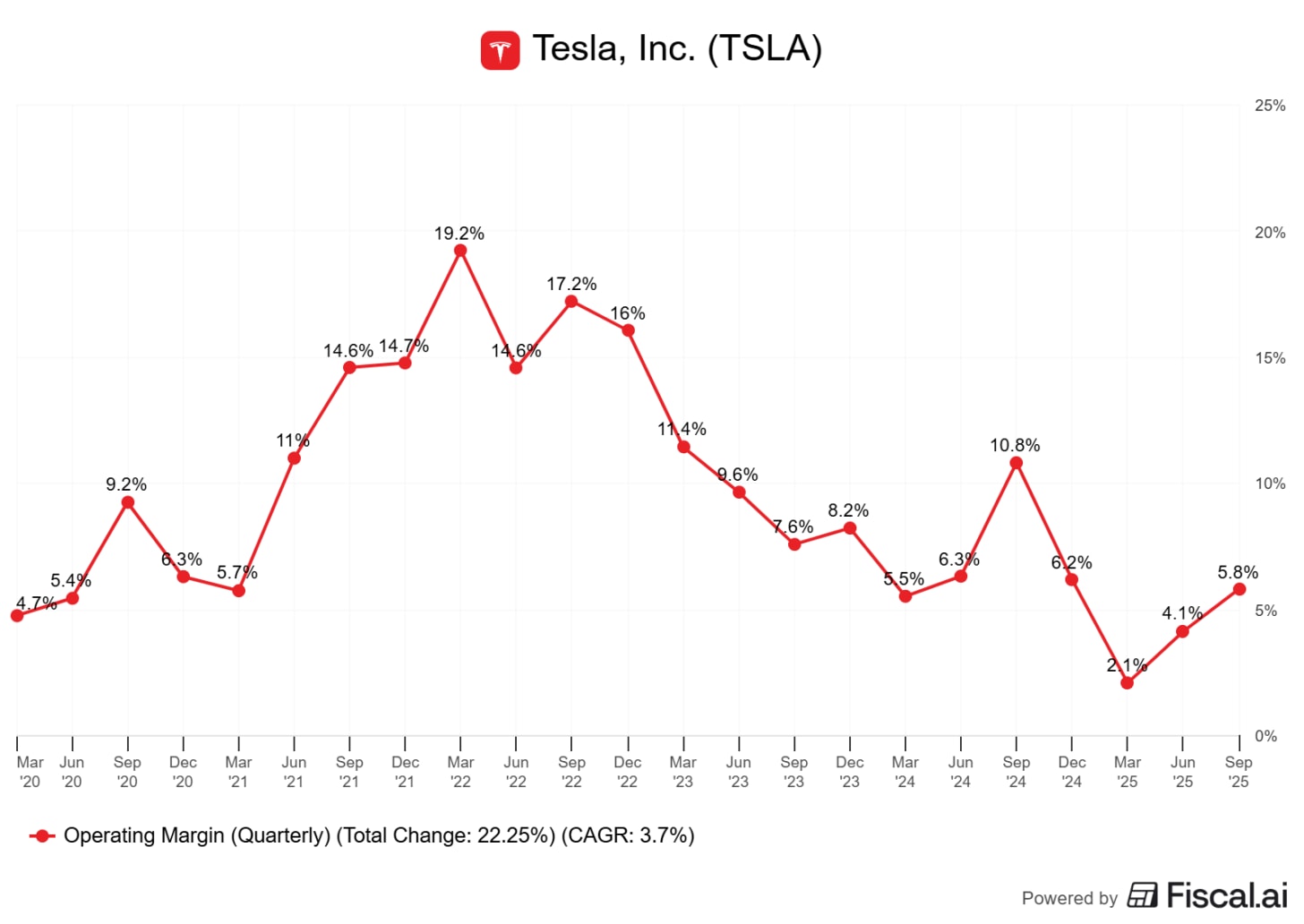

Lower EV margins, which make up 75% of revenue, combined with rising costs from accelerating verticals logically end up with a decline in operating margins, although there was some sequential improvement.

We could/should stabilise around here, depending on the EV vertical next quarters.

I focus on operating margins because Tesla’s net income includes unrealized P&L which is misleading. It means I ignore interest on cash but so be it.

In cash terms, Tesla still holds a $34B net cash treasure chest and generated $3.99B in free cash flow this quarter.

Investing Execution.

A correct quarter with growth in Tesla’s main business, proving demand is still here - something many doubted. Service and energy are healthy and expanding & margins are in line with expectations; the removal of subsidies will continue to pressure EV margins while long-term demand remains uncertain.

This isn’t the final confirmation shareholders need but compared to last quarter, there are clear positives. The long-term narrative remains the same: autonomy will drive demand, and energy will scale. Until then, we wait…

I don’t value Tesla because the market is irrational with this stock. Price-action wise, we are still near all-time highs and the market bought these earnings aggresively.

Reminder that Elon purchased shares on the open market at $350, which should act as a psychological price for many in the future. I would accumulate around that price given this quarter’s data and the weekly 50 there. Until then, I am happy to hold.

As usual; Tesla is not for everyone. It isn’t for dumb investors only. It is an optimism stock riding a clear narrative presented in my investment thesis.

You can adopt it, or not. There’s no in-between.

This piece really made me think, especialy after your last post on Tesla's overall thesis; it's quite something to see the numbers bounce back like this. As a math teacher really into AI, I'm always looking for more detail on their 'real-world AI leader' claim, though the record EV deliveries do make a strong argument.