How Buffett Broke Retails' Critical Thinking

And how an entire generation of investors have twisted his wise words.

This write up might lose me some subscribers. But I’ll share it nonetheless, because I believe some thoughts here are important to evolve as investors; and as the market fell big time - and might continue to, I am seeing things that shouldn’t happen.

Investors holding high beta stocks, complete speculation & quoting Buffett with their portfolio down 50%+ in three weeks, claiming that holding through thick and thin is the investor way, that they will be rewarded because fundamentals are what matters, that this is a normal step everyone has to go through.

It isn’t. And Buffett never said it was. So I wanted to share this. I hope you guys will enjoy it, even if I go against one of the highest regarded opinion of the investing community: that Warren Buffett is the supreme investor and his methods are still today the ones investors should follow.

They aren’t.

Investing is personal. There are no rules on how it should be done, on what tools to use or on what timeframe/objectives one should have. Everything depends of our conditions, assets, knowledge, capacities, objectives, etc… There isn’t anything more dangerous than thinking we “should” do this, or that, because it worked for someone else. That isn’t how we will succeed in investing.

Following Warren Buffet’s method can work. But it won’t for most, here’s why.

Buffett never used social media & yet became the biggest investing guru of the world. With reasons, but most of his teachings are now either misunderstood or quoted by many who have never listened nor read his own words, do not understand what he was preaching and yet act on his quotes like if they were god given.

Warren Buffett is an investing legend. But his status broke retail’s capacity to think by themselves, and their investing capacities.

Be greedy when others are fearful.

Became “let’s buy this stock down 10% and now only valued at 117x sales.”

It’s only when the tide goes out that you discover who’s been swimming naked.

This write-up isn’t about Buffett being wrong or a bad investor. He’s been right more than wrong and deserves his status of legend - his and Munger’s track record speaks for itself. It is about blindly following advices of someone we cannot compare to and why we shouldn’t follow them; about how the world and investing changed, while so many choose not to.

The problem never came from those two legends. It came from the followers.

The Buffett & Berkshire Way

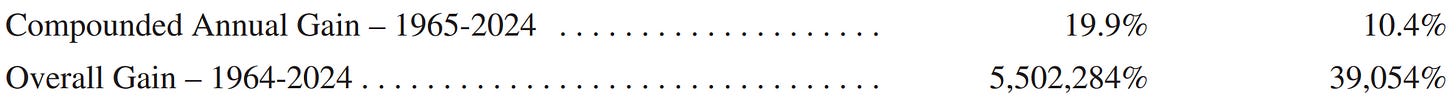

Let’s start by setting up the stage, because many have simply never seen it. Berkshire’s returns are a thing of beauty. They delivered some of the best returns ever seen in the investing community with 5,502,284% gains since 1964, outperforming the S&P 500 by a ridiculous 140x factor.

This doesn’t happen without very skilled persons at the helm. But this doesn’t mean I or you are capable of reproducing this following Buffett’s method. Not because it is impossible - it certainly isn’t. But because we aren’t the same, do not live in the same world nor with the same conditions. Just like you wouldn’t compare the time it would take to travel from Paris to Rome with a horse and a plane, you shouldn’t compare investing in the late 1990s to investing in the 2020s, nor your methods with Buffett’s simply because you aren’t equals.

Because, even if it is never said out loud, Berkshire’s success comes from assets you do not possess, which makes it impossible to replicate.

Berkshire Investing Style

Before talking about where Buffett’s success really comes from, let’s talk about his method and how he invests, purely from a stock picking point of view which comes from Benjamin Graham’s teaching about value investing.

Warren Buffett’s method is Value Investing centered on the concept of a “Moat” - a sustainable competitive advantage that protects a business from rivals. He seeks out high-quality companies with predictable earnings and “honest, able management” when they are trading at a significant discount to their intrinsic value.

Rather than trading stocks, he views himself as a business owner, famously stating his “favorite holding period is forever.” His edge comes from extreme patience and the use of Insurance Float as low-cost leverage to amplify returns without the risk of traditional debt.

Thanks Gemini.

The concept of “Moat” nowadays is misused everywhere, sadly. But when Buffett talks about a moat he doesn’t mean growth stocks with the potential of doing something with their business model. He talks about Apple or Coca-Cola branding, Mastercard and Visa’s monopoly on credit/debit cards, and railway companies in the 60s. He’s talking about established and massive competitive advantages.

And when he’s talking about significant discount, he isn’t talking about 20x sales. He is talking about discount compared to intrinsic value - the terminal value business could be worth years in the future, amplified by its moat.

Quoting Buffett while owning pre-revenue or negative income companies is… missing the point of his teachings entirely. Never having read Graham. Growth investors aren’t value investors and should not really quote Buffett and cite him as their example… It simply doesn’t make any sense to me, or so I believe.

The Insurance Float

Ironically, the following quote came from Munger, Buffett’s right hand who… was using leverage. Made his fortune thanks to it.

There are only three ways a smart person can go broke: liquor, ladies, and leverage

Note that he didn’t say he wasn’t, he said leverage could break you. They also never really used leverage or borrowed money, they used float - which is almost the same.

That float is responsible for Buffett’s success, more than stock picking.

This “float” comes from their insurance business, which is a business of receiving money and potentially owing part of it in the future, which leaves you for a certain time with money to spend even if it doesn’t belong to you.

This is… leverage; except, due to their insurance business model, it came for free as they were paid to keep that money.

Academics estimate Berkshire constantly operated at ~1.5x leverage with this float. Adjusted for that, Berkshire's annualized returns drop from ~20% to ~12-13%. Above the S&P 500, which is impressive. But we're now far from godly returns.

To illustrate, $10,000 invested at 20% CAGR would transform into $563M in 60 years and into $11.7M at 12.5%. The difference between both is illustrating what Berkshire would have been without its float. Still excellent. But not comparable to what was.

Buffett’s stock picking alpha is real. But so far from what the legend says. Financial engineering was the deciding factor for his success. And there is nothing wrong with this - everyone smart enough to do it deserves the reward. But as said at the start, this write-up isn’t about criticizing Buffett but those who believe his investing methods are the ones which should be replicated, the ones which will make them billionaires.

This is the reality check #1.

Do you have access to float? Probably not.

Then you should forget about replicating Buffett’s 20% CAGR.

Acquisition & Activism

This is another part which is inaccessible to mortals like you & I, retail investors.

Buffett acquired many companies, starting with Berkshire which actually was a failed investment transformed into an acquisition and a rebranding which he calls himself, ironically, his “$200B mistake”. That was one of many, notably insurance businesses (GEICO and National Indemnity) which ended up providing Berkshire the float to return such monster gains, See’s Candies which returns billions out of a ~$25M cost, or BNSF Railway which now prints ~$6B in yearly income from a ~$34B acquisition.

All of those contribute to Berkshire’s cash generation, float and returns, and were not generated by buying and passively holding a stock, but by actively owning, managing businesses acquired through different methods.

Do you feel like purchasing a candy store for a few millions? Didn’t think so.

Privileged Information

Last and not least, we simply cannot compare with Buffett’s access to information. He did not always have it, I’ll give you that, but he sure did during his career at Berkshire and this helped - although it wasn’t the main source for returns.

If you disagree with Tim Cook, can you call him? Can you preview the new products? Can you visit General Motors’ factories, talk with employees, management, review the work culture, travel to Japan to analyze the progress, etc.?

I wish for you that you can. But I doubt so. And your 50 shares of Google won’t get you access to Sundar.

Besides this access to information per se, he also has/had people fetching information for him. Sure, Berkshire was known to be a small company with few employees but it hasn’t been the case for long. And rapidly, even if not hired internally, the firm had access to grey matter incomparable to yours or mine - individuals and groups. So this isn’t only about information but also about the brain power to process it with the required knowledge to understand and make assumptions. And not only did this transform into better investing decisions but also privileged access to deals.

I cannot understand healthcare drugs, solar panels, AI GPUs, railways, rocket ships and other. I am limited. My brain, my time, my research are. You are too. They aren’t.

We’ve seen why Buffett’s conditions are different from ours. Now let’s see how today’s global conditions are different from Buffett’s.

The World & The Markets Changed

Besides what you are not and the conditions you do not have, it is forgotten that the world changed since Buffett made his fortune. Compounding did its wonders but the truth is, Buffett’s latest years haven’t been excellent in terms of stock picking; Buffett hasn’t adapted to tech, to growth, to the new liquidity driven market post-2008…

He actually underperformed the S&P 500 since 2008 and that is including the float in his performance. The underperformance would have been heavy without his ~1.5x leverage, mostly because of his strategy of value investing & avoiding tech, avoiding innovation globally in a liquidity driven, speculative world.

One stock allowed Berkshire not to be reduced to ashes the last decade: Apple.

For those who will argue that he did adapt and bought tech by buying Apple, I will answer that Apple is not a tech company but a luxury company and forward you to one of the most iconic interviews of Saylor to explain this clearly - although yes I’m stretching a bit by saying Apple isn’t tech at all but it can be argued.

That said, you do not need to adapt when you have returned like he did pre-2008, as his career and fortunes were made already. But this is exactly my point. Buffett was an amazing stock picker during his prime age - largely helped by his float. Compounding is the only reason his performance kept going in the new, financialized era.

The Post-2008 Financialized World

This is the massive difference with Buffett’s time. His career spanned the U.S. time of industrialization. He saw his country (empire even) being built and played his part in it. It came with drawdowns and crises, of course, but it was a “simpler” and slower time, where company cycles were longer and based on production, output, real goods. Not future potential. Plus, investing wasn’t accessible to everyone.

Technology played its part and we’ll talk about it, but most importantly the subprime crisis played its role and changed the U.S. forever, from an industrializing country to a financialized one, where liquidity flow and financial engineering were kings. Industrial assets were sent overseas - mostly to China. Only tech stayed, combined with the control of the reserve currency. And as liquidity was now the deciding factor of… everything, markets changed.

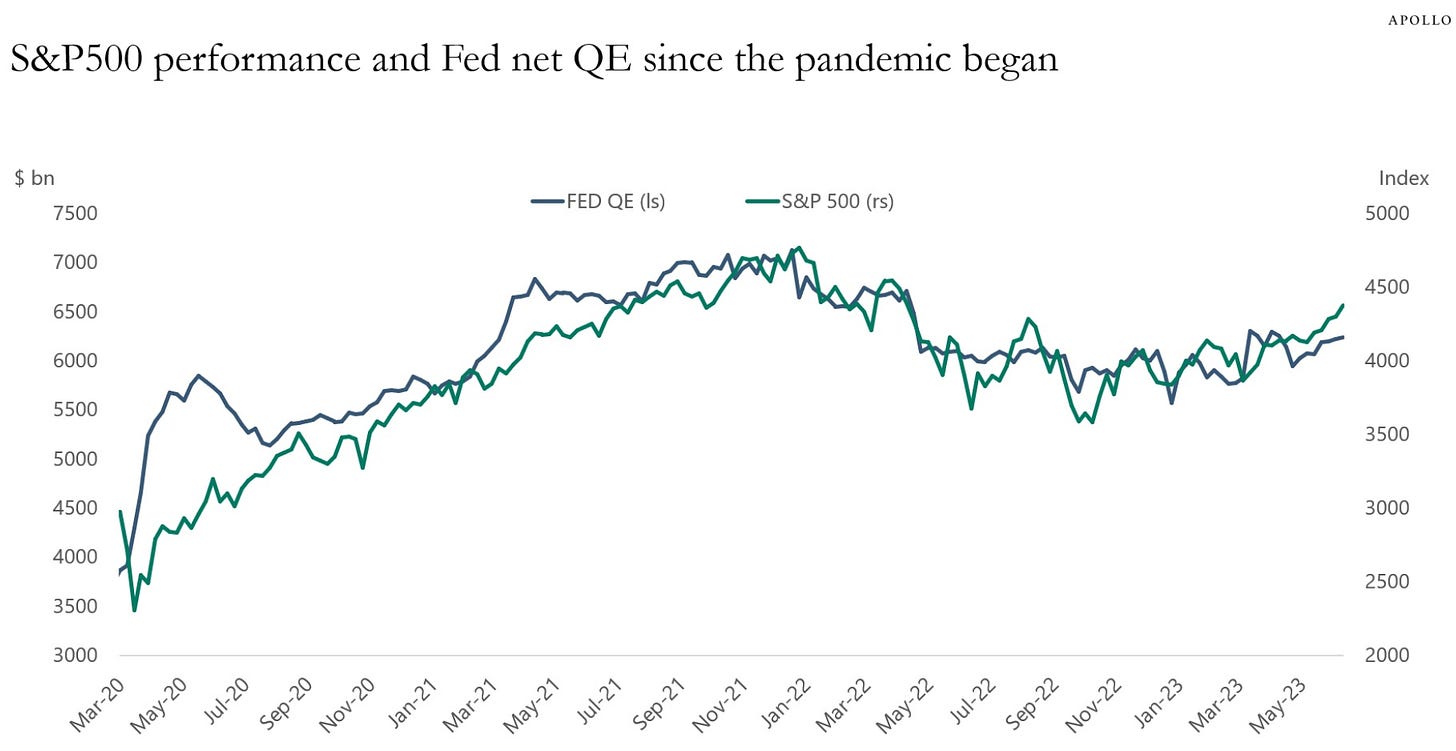

This correlation is crystal clear since 2008 and illustrated here for Covid. And even if some could say this correlation is changing post-2023, they are wrong. We simply passed a new step, from monetary policy ruling the markets to fiscal policy. But the rules remain the same: liquidity dictates everything.

Post-2008, the markets became a liquidity game, not a fundamental one - although of course fundamentals remain important. Assets’ intrinsic value and the market’s vision of it has changed, with shorter cycles, different valuation metrics & expectations. The 1950s criteria could never be met anymore post-2008 for most innovative assets; this is why Buffett never really participated in this sector.

Liquidity now rules.

Technology, Algorithm & Momentum

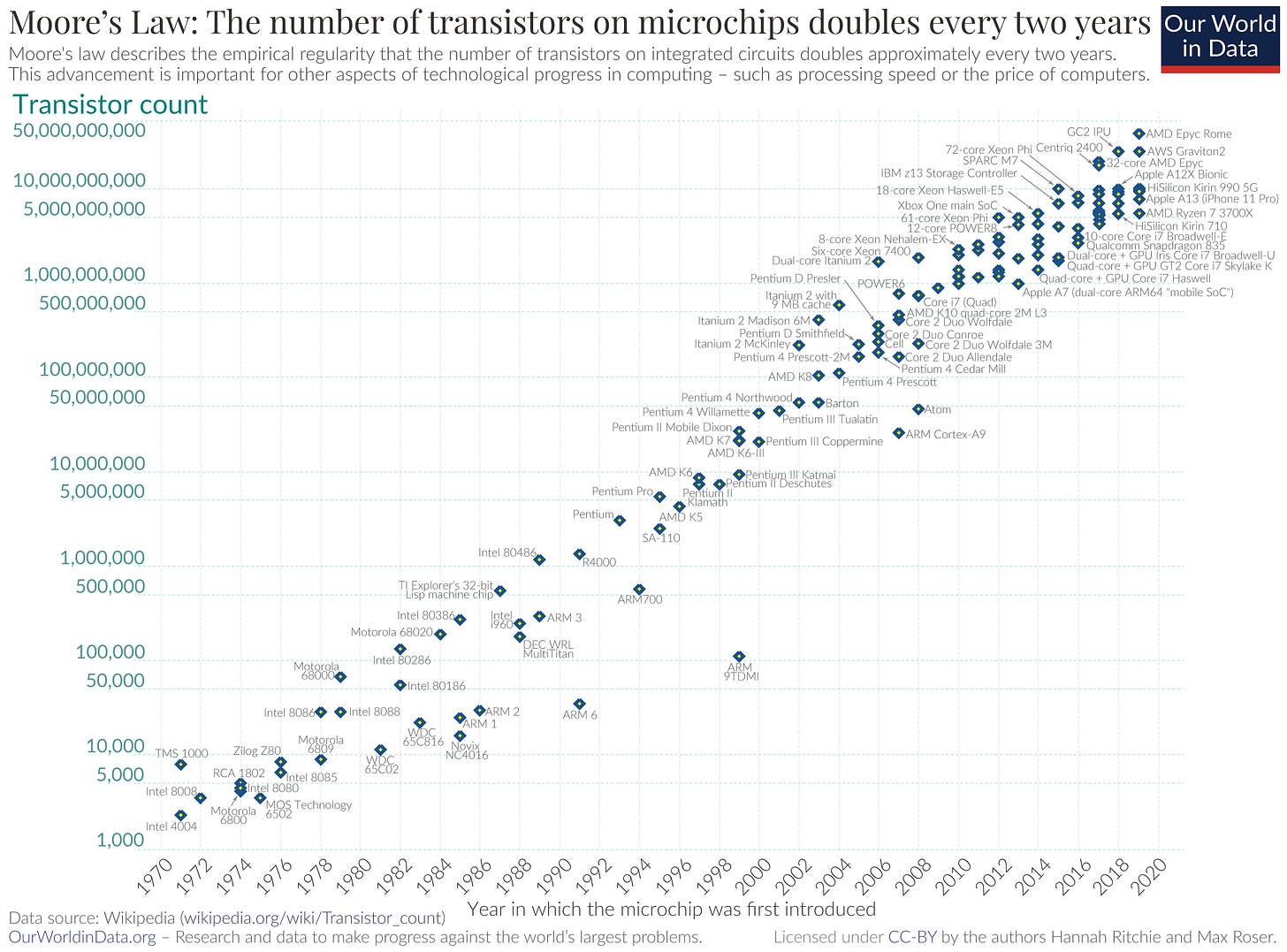

Buffett invested during the industrial revolution. It took ~80 years for the U.S. to reach the golden age of rail - the time where all train tracks were standardized, allowing a car to run from New York to San Francisco without stopping, with peak rail mileage reached in 1910.

By comparison, it took ~50 years to bring electricity to all households, ~30 years to democratize internet, 18 years for smartphones and ~8 years to pass from graphic design hardware to agentic AI and self-driving cars.

Not only is technology accelerating, but more complex topics are being resolved at a pace never imagined before, which is normal. This concept was popularized by Ray Kurzweil and called The Law of Accelerating Returns. Moore’s law also illustrates this perfectly as well and we are even past it now as we now are capable of increasing compute capacities without increasing transistors.

This is about technology itself, which first illustrates why sticking out of tech is a mistake; we cannot escape it.

But more importantly, this evolution and technology was also added to the markets. It did not simply happen in the world - the markets also changed. Technology allowed retail to participate, information to be accessible, algorithms to work 24/7 & represent ~70% of total volume nowadays, cryptos to emerge. Speculation & leverage are more accessible than ever with new products like options. Financing cycles are much faster both due to technology and massive liquidity injection from a financialized economy which privileges financial engineering over manufacturing.

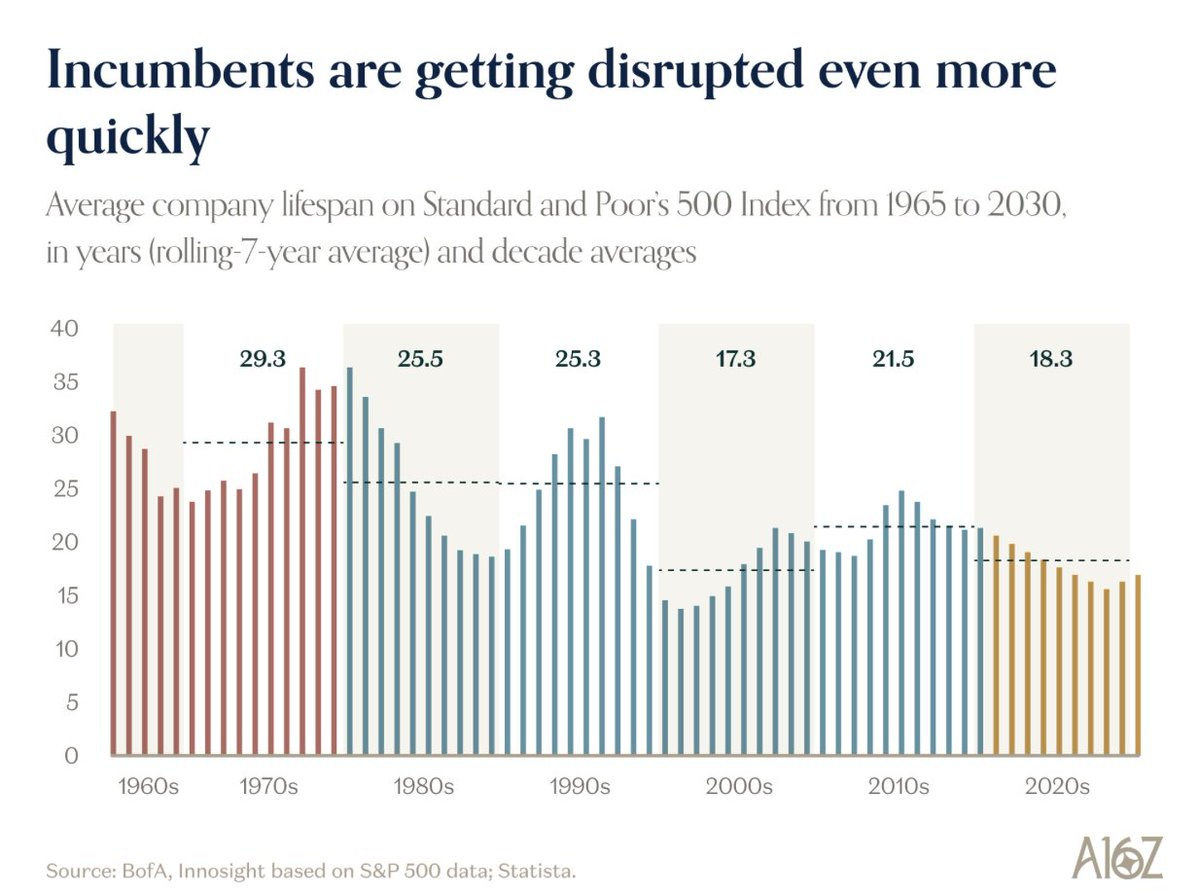

If you were to use Buffett’s strategies today, you wouldn’t find many assets to buy. You wouldn’t find them at a proper valuation. You couldn’t own them for the required timeframe. During his time, companies had 50 years to live. Nowadays, not that many have such a lifespan and most go up and burst in a few years. Those who do have a long and healthy life aren’t cheap, ever. I won’t even talk about IPOs.

I am not sure you would accept if I told you that you should travel from Paris to Rome in 5 days with a horse nowadays, right? So why would you accept to invest as if you didn’t have more than a horse at your disposal?

How to Adapt

I might disappoint you, but I do not have one answer fit all, because there are none in the market. This write up is meant to share that taking the wisdom of someone who had much of it is key to grow. But thinking that following his every word and applying his advices will deliver outsized returns without a doubt is a flawed reflection.

You cannot mimic a Roman emperor nowadays and expect to own Rome.

You aren't Buffett, you aren’t Berkshire, you do not invest within the same framework, your situation, capacities, accesses are different to theirs in every ways and you live in an age which has nothing to do with his.

No, the only way forward is to learn concepts from them, to understand our time and to adapt. The markets are a history of adaptation and too many fail to do so. The only way forward is to know what you want and to find how to get it.

What We Have

There is a lot we do not have as retail investors, namely information, access to cheap debt or float, time, many resources… But there also are things we have and the three most important ones are adaptability, anonymity and speed.

But before everything, what matters is to know what we want. Some are here to hold assets for decades and preserve their net worth. Some are here to become billionaires, some are here to create a small cushion for themselves, others to live off dividends or cash generated by trading. Others are enjoying the game.

Some have the passion to spend ~10h a day working on reading 10-Qs, listening to interviews, trying to find the gems while others will only focus on liquidity flow and follow the money without any regard for fundamentals. Some mix it all.

The danger in investing is not to know what you want.

Because you won’t know how to reach it.

The mistake is to believe there is only one way to achieve your goals; someone else's.

There are hundreds of ways to achieve it but only one which will work for you.

Do not follow someone else's footsteps to reach your own targets.

There are no sins in the market, there are no truths either. There are only options and tools given to millions for them to achieve their dreams. But none will achieve it by using half a decade old methods which worked for one person.

What Can Be Done

Despite not having one truth - as this one truth doesn’t exist compared to what many think, there are universal concepts.

Know yourself, your objectives, your capacities. You won't be able to replicate another investor because you won't have the same strengths and weaknesses - psychologically and logistically. What you have is access to the same tools and the same information - publicly speaking. Use it to your advantage, match your personality to your objectives and capacities . Forcing yourself into something you cannot bear will result in failure.

No tools are off-limits. In a market led by liquidity, liquidity is king. While many will advocate that only fundamentals matter, some liquidity traders became richer than Croesus by finding their own strategy and sticking to it. Investors are known to only look at fundamentals, but this is ridiculous. Being an investor is being capable of extracting value where it lies and according to your objectives. Too many nowadays will not consider you an investor if you do not hold that one stock according to your bias through thick and thin. This is ridiculous.

Ignoring information isn't a sign of wisdom.Avoid your ego. Risk management is the first rule of an investor and the key is to find the safest outsized returns we can. It isn't to buy the last trend, to get excited about that innovative company or to hold onto your original thesis because you simply cannot be wrong. It is about adapting and accepting when we have to move on. The market is always right. Buffett was the one saying this.

Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.

What I am certain of is that a 30-year-old quoting Buffett while owning pre-revenue and high beta stocks, claiming that he will never sell his shares which are down 50% due to fundamentals declining because investing is about fundamentals, convictions, and his holding period is forever, has simply never understood what Buffett talked about and very probably never read Graham’s value investing.

He doesn’t know what he wants, how to achieve his goals nor what he could work on to achieve them. He simply heard a few quotes and believed investing was easy, he only had to buy what he thought would change the world.

Sadly, those are the majority. And sadly, this is plain wrong.

Stop Worshipping. Start Thinking.

Buffett & Munger are legends. I will never said the contrary and will continue to be admirative of what they accomplished and how they did it. I would never have the legitimacy to say they were bad investors of thinkers - they were excellent at both.

But their wisdom was never meant to be followed like commandments, it was meant to be learned from. They had their own objectives, capacities, assets and lived in their own time; their success came from their capacity to leverage each to their advantage.

We live in our time, our world, our markets. Our success will come from our capacity to leverage those, not from our capacity to follow instructions to play a game which disappeared 28+ years ago.

For some, this means following Buffett’s footsteps, adapted to our time. That’s more than fine because they know what they want, need & that their personality fits these methods. But for many, it doesn’t - it is something they follow because everyone told them to, because everyone told them this was how investors should behave.

It doesn’t mean you have to become a momentum day trader full time either. It simply means that you have to find what works for you depending on your psychology, your capacities, logistics, objectives… There are no restrictions in the tools and strategies to use as long as you are able to deliver alpha, sleep well and achieve your goals. If you do not, there is something wrong and it’s time to change vessel.

What works for me won’t work for you, and vice versa. I have said many times that this substrack wasn’t meant for readers to copy my trades but for me to share my opinions and methods on how I deliver my own alpha and for you to leverage that information. Because this is the only thing which can be shared: information. How we use it for our benefit, our alpha, is personal. And there are no wrong ways as long as it works for us.

We can do as well as Buffett and Munger. Hell, we can even do better. But mimicking them is not the way and won’t succeed, because we aren’t playing the same game.

You've added me as a subscriber so hopefully I'll help balance things out!

Excellent post. Hundreds of way to win but only one that will work for you. Hits home.