Weekly Recap | May - W3

China deal, Bonds Market, Moody's Rating, Airbnb Expansion, Hims News, Uber Execution, Neoclouds numbers, Nvidia demand, Agentic AI, JD & Cava Earnings, Weekly Planning & Price Targets.

First of all, sorry for the delay!

I did plan most of this write up on Thursday as I had a busy week end planned but too much news dropped on the last days of the week so I thought it better to wait a bit longer & include everything when I finally find time to do so.

Hence the 24-hour delay! But let’s dive in.

Macro.

As we talked about last week, the most important news was the potential China deal. The talks went fast, at least to remedy the actual situation which was untenable for both countries. As for specifics, we still have no idea...

Deescalating was the most important. Tariffs are now down to 10% on U.S. imports & to 30% on Chinese imports for the next 90 days, and both countries will continue to negotiate. So this is a good sign, although Bessent confirmed that 30% was a floor, not a ceiling, but I assume tariffs will be applied to specific products from now on.

Those are the facts. As for my opinion, I still wonder what was the point. We're back to tariffs which seem “healthy”, at least tenable as currencies will fluctuate to attenuate them and the rest will be absorbed by customers as 30% isn't enough to make Chinese products uncompetitive. This could have been the starting point.

Although it still seems that Trump believe companies have to absorb the costs and not pass the price increase to consumers… Which is nothing short of an impossible dream. Not sure what is happening on the White House…

My bearish bias doesn't change with this news. Damage is done, it doesn't show yet because those things take months to affect an economy. Supply chains will take long to be back to normal, the mess is either way far from over and the 10Y continues to be sold as countries & institutions need dollars.

As I shared some weeks ago, confidence will need months to flow back into the U.S. Only retail has the capacity to change sides & buy or sell from one day to another. The mess isn't over.

We are used to looking at a screen, believing that if we have green candles everything is fine. But again, the economy & the markets are two very different things. And damages are done to the first.

This past week was great for the portfolio but we do not buy green candles, we wait for the red ones. We do not FOMO, we plan & we stick to our plan. And data is more important than green candles.

Patience & consistency. That's how we win.

Moody’s Rating.

The rating agency Moody’s downgraded the U.S. debt grade from the highest to the second highest. It isn’t a terrible fall but it does signal broader concerns. I personally do not look at those things because they usually are laggy. They sure trigger some reactions for the market but if grading agencies were good at their jobs we’d know it, they’d have done a better job in the past.

And in the case of the U.S. things are much more complicated as shared here.

The purchase of treasuries by other countries isn’t a means to be paid in exchange for funding but a way to access the safest & largest market of the world to store their liquidity. This won’t change because of Moody’s AA1 grade instead of AAA.

As for the market, while the first news did some relief, this one worried it a bit. I do not believe it to be a serious catalyst to restart the downtrend but it sure is another indication that the world is watching & starts to take note.

On another subject, we should keep an eye on the situation in Japan as the country is struggling to hold its bond market together and are selling everything they can to do so… Which isn’t real cool.

This would deserve a write up by itself, which I will certainly do in time as implications could hurt the entire world.

Watched Stocks and Portfolio.

Airbnb Expansion.

I & many others had high expectations on this announcement and I shared this on my quarterly review of the company few days ago.

“Still no indications on what it will be but a good question was asked during the call as if it will be something entirely different or just a revamp of actual features - as we had a call a few quarters back where they said they’d redo their experiences services. No clear answer was given. Not gonna lie, if it is what this is all about. It will be highly disappointing.”

It wasn’t highly disappointing. But it was disappointing.

Experiences. They did include the revamp of this functionality in the upgrade, which isn’t bad per se. The problem is that I don’t think the issue was with the service itself but more with the lack of habits from users to pass through Airbnb to book anything else than accommodation. This revamp only includes new ones, maybe better ones but that’s about it.

Services. On another hand, you will now be able to book services through Airbnb. This includes many different things from chefs to cook for you to home massages or sports coaches & photographers to follow you as you walk through the city you stay in for some memorable shots.

I believe this to be a good idea as it will bring more possibilities to travelers and all the partnerships are vetted by Airbnb themselves, in order to attest to their quality. This might change in time and become a note system like the hosts. The question remains about demand. It seems to me that most would simply use Uber if possible, while home massages or sports coaches can be cool for certain wallets or travels but not to most. Not to me at least.

Design & workflow. This is the most important part of this upgrade in my opinion, and the one which could change Airbnb from an app to book a bed to an app to organize holidays, which is really what is missing, although once again I am not certain it will be enough.

I personally like the design, many probably won’t but it sure pops enough to your eye to understand that you can do more. The booking workflow will also now propose you to book experiences or services while booking a house, so you can organize everything in advance.

All together, I do not think it is enough. Expanding from the core should not include some design & revamp of already existing services, even if they are now better. This is not an expansion and most importantly hardly justify the months/years in the making. Most expected to be able to book flights, mobility or have an AI leveraging your data to help you create better holidays.

Those will only be used by some very specific travellers. It isn’t about volume and sure, it could change a few users’ opinion on those functionalities & create some habbits. In years, long years, and not in volume. It’ll need time to show if this can work or not. It isn’t enough for me so I decided to sell my shares. I’ll be glad to be proven wrong.

Brian also said more was to come this year. Maybe I’ll be convinced then.

Hims Fundraising & Healthcare Executive Order.

Andrew Dudum confirmed that Hims raised $1B in less than a week after emitting their convertible notes, which I already commented to be bullish.

Lots of things changed for Hims over the last month. The GLP-1 story is cleared up & we do have more visibility, the partnership with Novo is reducing the risks of patent infringement, growth is happening without their weight loss branch, this fundraising confirms a huge demand for the stocks & trust on management... Lots of positive.

Trump also announced that he would sign an executive order to "reduce the price of drugs in the U.S. up to 80%". Pretty surprising & hard to estimate how this will impact Hims or the entire healthcare industry, but I think most of this is noise.

Prices don’t go down just because a president signs a paper. There are costs, markets, infrastructures around the healthcare industry with insurances, etc... Although it sure would help on Medicaid spending but for now, it’s only words and I believe it will stay that way.

Uber Route Share & Ride Out.

The company is going for the buses after taking over taxis by proposing regular drives on specific routes during commute hour, with the minimum detours. Share your drive from point A to point B for the smallest fee.

"Route Share is a new, budget-friendly ride option from Uber designed for everyday commuters. By sharing a ride with up to two other passengers along busy corridors, riders can enjoy a reliable ride at a significantly lower cost than UberX."

A feature which will be used by many as it remains more versatile, comfortable & faster than a bus for probably slightly more than public transports, maybe not even as the company is now partnering with each & every AV company and will certainly leverage those for this kind of ride.

And it’s not all as they are also launching a feature which allows users to order a driver & book their tables at a restaurant in one click.

It seems like nothing but it sure is a functionality which will be used. It won’t generate cash flow but it will generate user retention & make Uber the app for everything, drive habbits. Once again, it’s all about network effect.

Every day convinces me that Uber will be greater than anyone’s expectations.

Nebius & Israel.

The country committed $150M to create its AI infrastructure & partnered with Nebius to do so. This is where geography might be playing an important role. Infrastructures in Europe allows Nebius to propose better latency & client services timetables. Plus a top rated service.

The amount seems small compared to what we usually comment but let's keep in mind that Nebius' guidance was talking about $300M of ARR next quarter & $1B FY25. The entire sum might not go to Nebius but even a quarter of it would be a big step forward. Spending won’t be this year but it confirms the demand. Everything is aligning for the better for the company lately.

CoreWeave Q1-25.

I do not add this on the earning portion of this report as I don’t follow the company but this quarter gave us great information for Nebius, although it is hard to make sense of everything…

My personal conclusion is that this quarter shows that demand for compute is stable at worst with Coreweave now up to $25.9B of backlog, including the $14.7B RPO from where they did their IPO. Using backlog as a metric is a bit shady to me as we cannot know if they will or even can satisfy it, nor have comparison points...

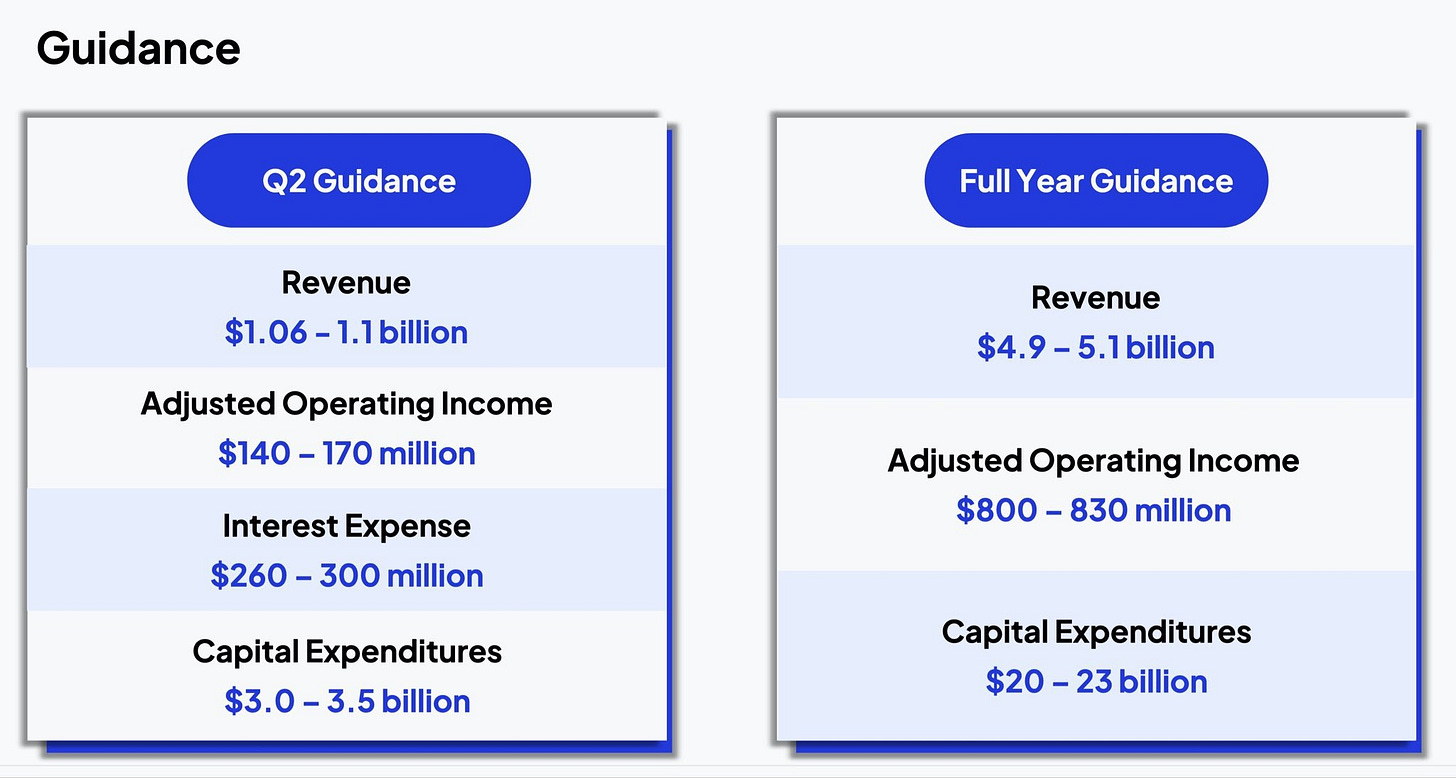

Revenues grew 420% but operating income is still negative mostly due to a massive spending in their infrastructures, a tendency which will apparently not stop as they estimate their CapEx to be between $20B & $23B, more than 4x their estimated revenues...

The question is: where do they find the funding? The company already has -$11B of net debt for a $33B capitalisation, they surely can go further or dilute shareholders even more but without any capacity to generate cash from their business at the moment... I certainly wouldn't trust them.

Neoclouds seem to be a good & growing business. But my money would not be on CoreWeave’s management. Glad it is on the number 2 of the sector.

Nvidia & Saudi Arabia.

Partnerships rained when Trump went to visit the country, mostly for the tech industry as Nvidia received a command for 18,000 Blackwell GPUs. Another sign for the market that AI is real, that spending won't slow down as training & inference are only starting and that the entire world will wake up to it.

The market forgot it during weeks but there's tons of fundamental upside left. Don’t miss it if only in term of understanding.

PayPal & Perplexity.

Lots of partnerships lately for the LLM who is trying to move to the next step for its AI service: payments at large but shopping more importantly. And the biggest platform with the fastest checkout is obviously the go-to to partner with. I have not seen any shopping done through LLMs yet but it will happen and a one click purchase from your Venmo accounts will be very convenient.

"This partnership unlocks new possibilities, where conversations now drive commerce. We're making it easy and secure to shop right in the chat when inspiration strikes. It's a powerful step in making conversational commerce a reality."

Have a conversation with Perplexity, ask to find the best price & market place, and click pay with Venmo. No friction, you pass from casual conversation to your order being shipped.

"Starting this summer in the U.S., consumers can check out instantly with PayPal or Venmo when they ask Perplexity to find products, book travel, or buy tickets."

Agentic AI will do wonders. And fast checkouts will be at its center.

Earnings.

J.D.com Q1-25.

Nothing really special for this quarter, the company continues to execute properly & to invest in its infrastructures for the next decade.

Stable growth, correct margins, demand remains strong. I see nothing to worry about.

Cava Q1-25.

As usual with Cava, there isn’t much to say…

Numbers are excellent, they continue to build their restaurants & customers continue to go there. Growth sure is slowing but the entire sector somehow is and Cava is one of the best in terms of resilience so far compared to fast food brands who are really taking a hard hit.

I certainly would be interested if the price is attractive enough.

Weekly Planning.

Next week is going to be quiet with mostly things to comment on, except for Nebius which reports earnings on Tuesday - it isn’t included in this website yet but we will have the data on Tuesday & a detailed report for you on the day.

As I said, I have write ups ready for the next weeks as things will get quieter, including AST Mobile, Duolingo & Circle investment case. I might also write on the Japanese bond market as I talked about at the beginning of this write up if necessary.

We won’t be bored!

Followed Stock Price Targets.

Here is my opinion on the stocks I follow closely based on the last data & what I’d do with each - buyable doesn’t mean I personally am buying but that in my opinion the stock meets the conditions.

I will try to make a recap of every stock next week with a clearer & uniformed format.

Write-up on Japan bonds would be more than welcome

Thanks the update! no worries about the one day delay.