Weekly Recap | May - W2

U.K. deal & China Talks, Google Search, Hims Convertible Notes, Tolaka & ClickHouse, Nvidia H20 & Regulations, Ant Gr., Adobe Contracts, TSM Results, Court Rulling, Weekly Planning & Price Targets.

Macro.

Tariffs Deals.

We had “big news” this week as the U.K. & the U.S. announced a trade deal. A lot of noise for not much to my opinion although the bull interpretation is that deals are possible & talks are happening, so the market expects others to follow. But this one really is insignificant as the U.K. is the only partner in trade deficit with the U.S. & represents less than 2% & 1.5% of U.S. imports & exports respectively.

This was the easiest deal to make with the easiest partner with the least impact on the economy & trade deficit.

On the other hand, the U.S. officially started negotiation with China Saturday. Nothing to comment but discussions are happening. This is more important than the U.K. deal.

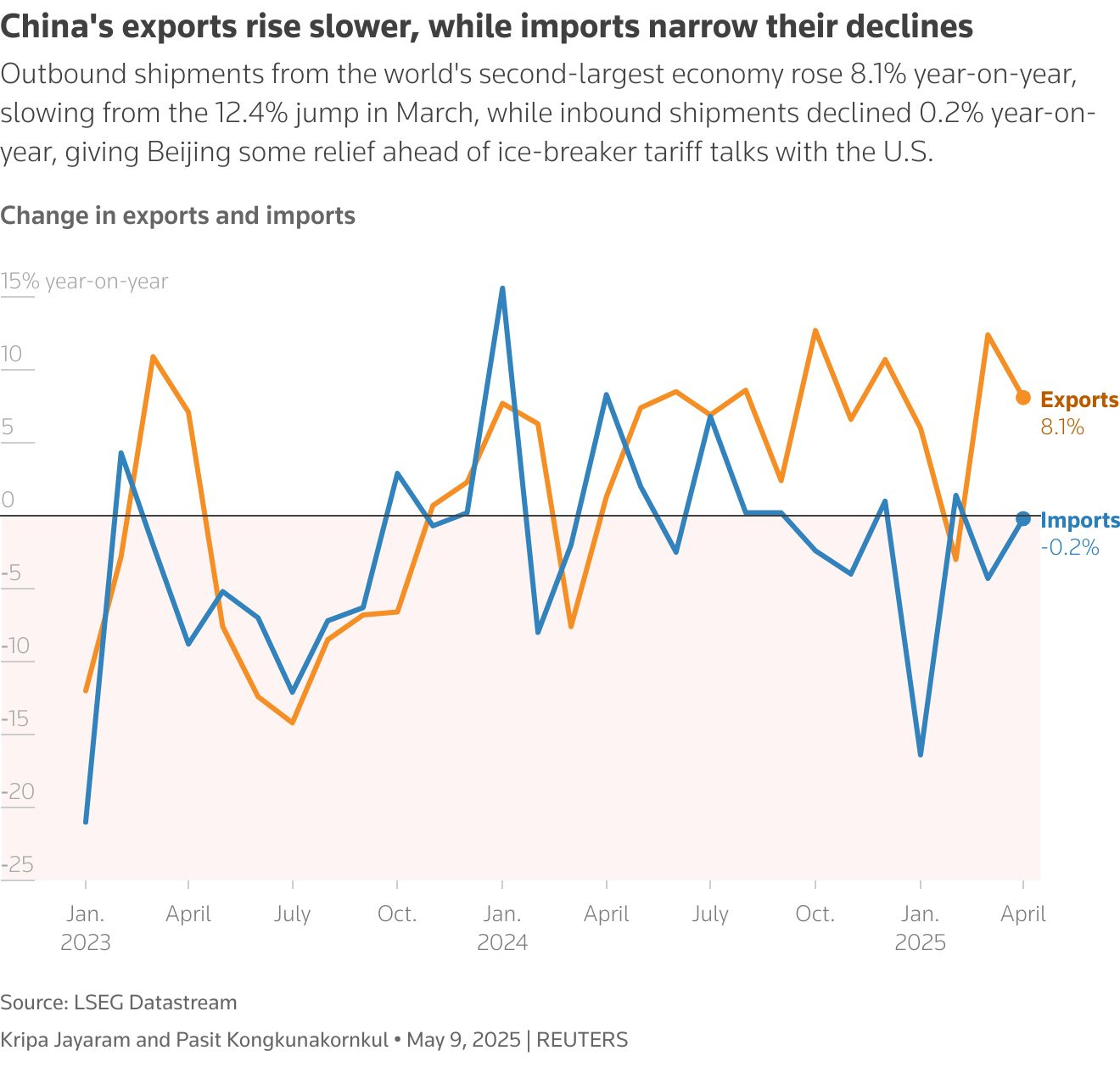

China April Export.

China's April export data rose 8.1% YoY after tariffs were implemented & this is really encouraging for my bull case in Chinese equities as it confirms that there is a world & consumers outside of the U.S.

"China's exports rose 8.1% in April, despite a 21% drop in shipments to the US, as Chinese firms increased sales in other markets such as India, Southeast Asia, and the European Union."

Tariffs were not applied the entire month of April so data might also be a bit biased & we'll need to see the next months. We also have no way of knowing what is rerouted - sent to the U.S. through another country, and what is actually being sold to those partners - there is a bit of both for sure.

But China's exports won’t plummet because of U.S. tariffs alone as the region is "only" 15% of total exports and won’t drop to 0%.

My Alibaba & China bull case relies on growing consumption in China & its neighbors. The data is encouraging even if we aren't talking about retail sales here, it shows that other countries are not entering the trade war & continue to trade with China, even increase their trading, to buy or reroute their products. We’ll see weakness, I am not saying the contrary. But not yet & maybe not as much as we thought.

Watched Stocks and Portfolio.

Google Search Pessimism.

As every quarter, we have news announcing Google’s death. This month's news come from Apple Safari’s VP sharing that volume decreased on Search from Apple devices & that they were looking for AI partners for their browser, without including Google. But the market is interpreting this news wrong in my opinion.

Is Search slowing? Yes. It is normal.

Is AI growing? Yes. This is what matters.

Most users are slowing their usage of Search and attention is shifting toward LLMs. Hence the decrease in search volume.

This doesn't mean a decrease in queries or towards Google. If users leave Search for Gemini or Gemini-powered apps, global usage remains the same even if it doesn’t pass through Search. Google management confirmed during the last call that they were seeing an increase in AI-powered tools' usage.

So let's not be surprised to see global volume slowing on Search, it is how it should be as AI progress. And it doesn't mean Google is dying.

Second preoccupation is valuable queries. One misunderstanding is that all queries are the same. They are not, some are valuable & monetized, others aren't. Valuable queries will move towards AI. What matters by now is not to see Search grow but to see Gemini-powered apps’ usage & valuable queries grow. And guess what.

“Circle to Search is now available on more than two hundred fifty million devices with usage increasing nearly 40% this quarter. And monthly visual searches with Lens have increased by 5,000,000,000 since October […] On the last earnings call, I mentioned the success we're seeing with Lens, where shoppers use their camera or images to quickly find information in ways they couldn't before. In Q1, the number of people shopping on Lens grew by over 10% and the majority of Lens queries are incremental.”

“With the launch of AI Overviews, the volume of commercial queries has increased.”

Our usage to access the internet is changing. Our tools are changing. So yeah... My point being: don't focus on the wrong metrics. You'd miss opportunities, because metrics are also changing.

Hims Notes Offerings.

Management is looking for funding & offered a $450M convertible note offering with an $87M expansion if needed on Thursday. Friday morning, they announced raising it up to $875M. Market reacted badly as often when companies propose notes which are often summarized by “dilution”. But this is bullish for Hims.

"Hims & Hers intends to use proceeds from the offering for general corporate purposes, including accelerating global expansion through both organic growth and strategic acquisitions [...] The funds will also support the technology team, led by newly appointed CTO Mo Elshenawy, to expand the Company’s data pipeline, develop AI tools, and advance personalized treatments to enhance the consumer healthcare experience."

In two days, Hims raised $875M with favorable conditions & the objective to spend this on growing its business. How not to be bullish?

First, it means the first offering was massively subscribed to almost double it in less than 24h, hence a massive interest to loan money to Hims.

Second, those notes pay no interest, which means investors accepted to loan money to Hims in exchange for a premium on their shares in case of success. Otherwise, they’d simply get their money back in 5 years.

Third, the dilution remains minimal as we'd be talking about 6% max, in five years, and under certain conditions. The company grew 80% CAGR over the last 5Y, a 6% dilution seems reasonable to fund future growth.

Last, balance sheet remains immaculate as this is raised through future stock dilution.

Companies need funding to improve. The more, under the best conditions, the better. And Hims just got a lot with better than perfect conditions, and a proven competent management to spend that money.

I’m more than fine with it.

Nebius Tolaka & Clickmouse.

Nebius’ business is healthy but we will talk about its investments today as companies continue to raise funding.

I presented Toloka on the Nebius IC, a branch focused on data & generative data for AI models training - a pretty trendy business right now. The entity which was a part of Nebius is now raising capital, a $72M round led by Bezos' Expedition - an investment branch of Amazon's founder, with investors like Shopify's CTO to participate.

"Toloka founder and CEO Olga Megorskaya said the Bezos-led strategic investment was a milestone that should accelerate the company's growth, particularly in the U.S. market, and support its development of products through human experts collaborating with AI agents."

On the negative side, Nebius will lose its majority vote over Toloka which will become a company led by this new board - Nebius being part of it. On the bright side, they will keep their stake & the company’s value will grow - without precise data on the portion owned by Nebius.

The second one, Clickmouse, is in negotiation to raise hundreds more millions to a valuation estimated around $6B once done. Nebius owns slightly less than 30% of it which would bring its stake’s value up to $1.7B.

Both of those could easily shoot Nebius' equity investment value to $2B or so while its actual valuation sits at $6.6B with $2.2B of cash - hence an EV at $4.26B. Which would mean Nebius' compute business plus Avride are valued at $2B give or take… With this kind of comments during their last quarter.

“Our projected December 2025 annualized run rate revenue of $750,000,000 to $1,000,000,000 is well within reach.“

Seems fair to say that Nebius business is actually trading at 2x EV/FY25ARR, without including Avride. A business focused on AI training, inference & autonomous deliveries - not trendy nor growing at all lately *sarcasm*.

Nvidia H20 & AI Diffusion Rule.

We followed the story over the last weeks & Nvidia finally announced that they will have a new version of their H20 tailored for the new U.S. export controls by summer, featuring “reduced memory capacity and performance.”

Second good news is the suppression of the “AI Diffusion Rule”, a policy set up by the Biden administration classifying countries around the world in three trust circles with different export controls in terms of volume & technology. Revoking this policy will allow high-end hardware constructors to sell more elsewhere, although some export controls remain active for some specific countries - China namely.

Alibaba & Ant Group.

Lots of equities investment this week. Ant Group is also a company majorly owned by Alibaba with a 33% stake. And this company is planning to go public on the Hong Kong exchange, giving us a clear idea of Alibaba's investment value.

Ant Group is the company operating Alipay, one of the most used everything apps in China with more than 650M monthly users & generating more than $25B based on the last estimates. Payment, travel, news, advertising…

A huge & successful business.

Adobe & Government Contracts.

The company signed a deal with the government for their PDF reader software & AI functionalities, which seems to be positive.

"This agreement is part of GSA’s OneGov strategy, which aims to transform government procurement and lower costs. Through this partnership, Adobe will offer a comprehensive Paperless Government Solution at a 70% discount off the current GSA list price through November 30, 2025, helping agencies in eliminating manual processes, reducing paper-related costs, and modernizing service delivery."

I assume Adobe already has business with the government, the question is will this shrink revenues for an already existing business or grow volume. Adobe's management comments seem to point to the second option.

App Store Changes, PayPal & Duolingo.

Following the Epic Games vs Apple case - where the first sued the second on the 30% fee Apple took on every purchase made through the App Store. Court ruled against Apple & forced them to allow app-owners to include direct links to their websites, giving opportunity to users to not pay from the App Store.

Duolingo talked about this on their quarter, saying they will certainly try some things and PayPal already took actions, proposing redirection for subscriptions & purchases to the web directly, avoiding the store fees.

It will be interesting to see how things play out as every company will try this strategy or different methods to bypass the stores’ fees. Will users prefer the convenience of rapid payment through the stores or the few bucks saved on their payments? It'll also be interesting to see if companies keep prices equal on app & on the web, passing the economies to their users or not changing anything & raising their margins…

Lots’ gonna happen. To monitor.

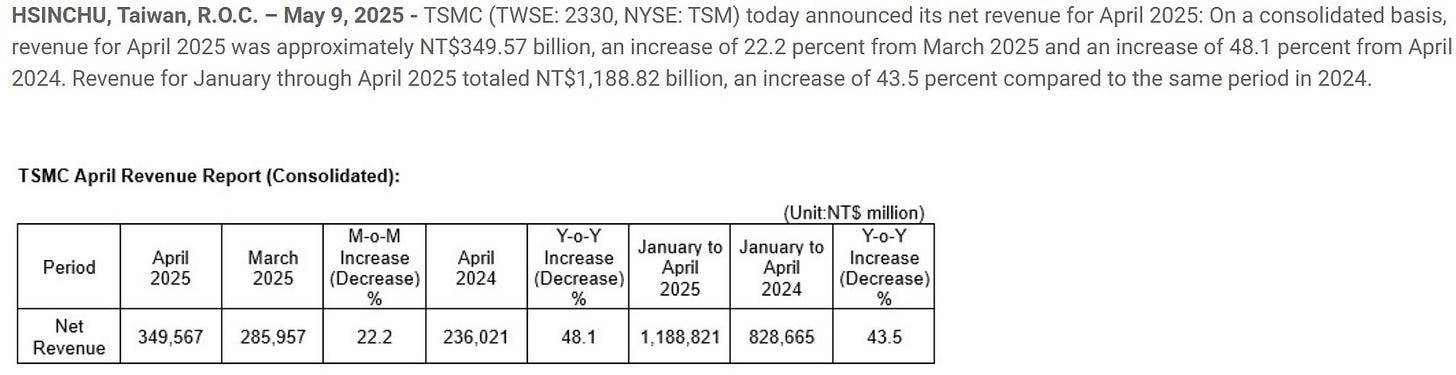

TSM Monthly Results.

April's results are once more incredible & highlight the strong demand for semis with some portion of pricing power I assume as we saw lots of demand was now manufactured in the U.S. at higher prices.

22% MoM, 48% YoY & 43.5% YTD YoY. Nothing short of impressive.

Weekly Planning.

This week’s write ups were not shared as fast as usual as I shared & this week should be the same. You will receive a detailed review on On Running Wednesday without any doubts & one on Alibaba hopefully Thursday but maybe Friday. The Saturday write-up will have comments on JD.com, Cava & more if interesting.

Followed Stock Price Targets.

Here is my opinion on the stocks I follow closely based on the last data & what I’d do with each - buyable doesn’t mean I personally am buying but that in my opinion the stock meets the conditions.

You’ve mentioned for quite some time now that you expect a recession in the US later this year, mainly driven by the consumer impact of tariffs. Now that trade deals are being made, namely the China one announced today, is that thesis not invalided?