Weekly Recap | June - W2

War is Back, China Trade, Inflation, Nebius DCs, Compute Demand (AMD Keynote, TSM Results, Oracle Earnings), Uber U.K., BTC ETFs, Robotaxis, Google Search, Meta Invests, Grab Covertible Notes & More.

Charts & Prices Update. Nebius, TSM & Adobe.

Macro.

We had one week of quiet. And now we’re back at busy.

Israel & Iran.

I only comment on geopolitics when it has or can have an impact on the market. My write-ups are meant to beat the market, not to comment on the actuality with my personal opinion. No one wants to hear it. So let’s please focus on the market & don’t try to find any hidden meaning in my words.

In this case, it is important to talk about it because we are not in 2024 anymore and it seems like the tensions are real this time, compared to last year’s make-believe. Israeli missiles were targeted at nuclear facilities & energy infrastructures, and some Iranian missiles went through the Iron Dome to fall right into Tel Aviv’s residential quarters.

Both countries confirmed they intended to strike harder.

It’s impossible to know what will happen but again, this is a different and more serious situation. And despite the potential risks, the market did not react at all. The S&P 500 fell 1.2% Friday and remains 2.7% below its all-time high.

It’s like nothing is a risk for stocks anymore.

Gold continues to behave normally and is back at its all-time high, oil is starting to rise as usual during any conflict in the Middle East but it remains in the $70 range, which is healthy - the perfect price really, but could go higher if the conflict continues & bring back inflationary fears. On the contrary, the U.S. 10Y continues to rise while the dollar falls, which isn’t normal. Liquidity should rush toward safe assets & leave risk assets right now & it isn’t the case - except for gold.

My interpretation is that most do not take this seriously & believe that this is just a fluke and will pass soon. Like inflation, like the tariffs, like the fear of recession over the last year.

There is no need to be a war-monger or a doomer, but being cautious will not hurt. I personally closed one risk position on Nebius for a loss - my Aug15'25 65 Call, to get more liquidity in case things escalate & reduce downside potential as the expiration is not that far in the future.

My personal portfolio sits on almost 30% of cash and I will be patient to reallocate it even if tons of stocks’ are waiting for a beautiful pullback. The S&P has been rallying big time since April & the tariff fears, and we probably need a breather, with or without an Israel/Iran war.

I am in no rush to buy and will patiently wait to see how the situation evolves. Tech & growth might take a hit, and I’ll keep an eye on my buying prices.

China, U.S. & Trades.

On a “positive” note, the talks continued between the two superpowers in London and have apparently reached an agreement which pleases everyone, with an access to rare earth for the U.S. while China should focus on tech export controls, without any clear new though, only some rumors that the U.S. team could negotiate those if necessary.

Chinese communication has been much more reserved, talking about an agreement on a framework, no specificities. At least, both sides are aligned on the fact they agreed to something, which is new.

This is great news as it means businesses & supply chains can reorganize themselves with bit more clarity, although everything is not finalized so things could still change. This is also great news for Chinese equities as more clarity & trade deals with China should boost confidence for capital to transact between the two superpowers.

But once again. Nothing is certain nor perfectly stable... It just moves in the right direction.

Inflation.

We had the CPI data this week which came cold, aligned with the Fed’s requirements to start cutting rates - around 2%, so the entire social media started buzzing with its famous “it’s time to cut rates, Jerome” narratives.

The thing is inflation is not an issue since some time and the FED knows it. The issue is the uncertainty from tariffs, the debt load, interest rates, and now the actual tensions between Iran & Israel and their impacts on oil prices.

Though FED is supposed to be data-dependent and we have controlled inflation and a weakening labor market, the necessary conditions to cut. But we also have many risks & lowering rates could act like gasoline on a fire.

As usual, perilous situation with no good solutions.

Watched Stocks and Portfolio.

Nebius News.

The company announced, in partnership with Nvidia, the opening of a new datacenter in the U.K. powered by Blackwell stacks, continuing to grow its presence in Europe - a strategic geography.

Most providers are focused in the U.S. as this is where the demand is - and growing rapidly as we’ll see just after. Nebius is also present there but its focus on Europe will allow the provider to build relationships and to take over a forgotten market as Europe is late, as usual, but is getting there with growing compute demand.

Nebius will be deeply rooted before others join the party.

Compute Demand - Again.

I talk about this… Every week, but it is important to monitor the delta between supply & demand.

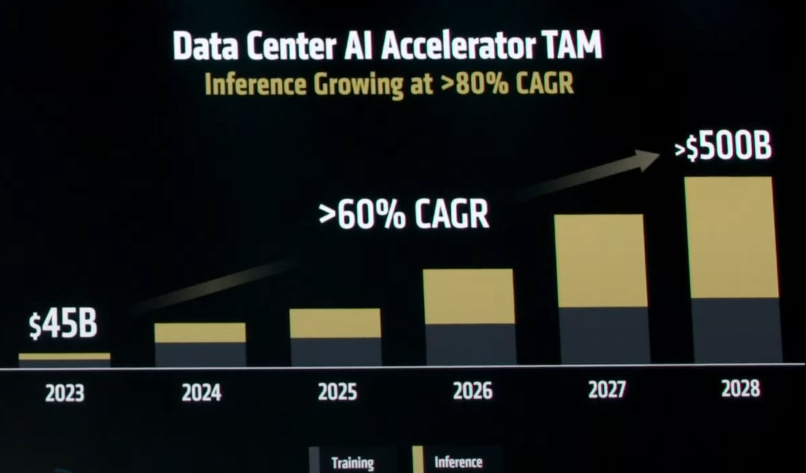

First, the AMD keynote this week confirmed that demand for their GPUs continues to grow & that inference will be bigger than what they first expected - which is exactly what I shared on my Nvidia investment thesis.

Second, Oracle also released its earnings this week and they were nothing short of great, with confirmations that their actual infrastructure wasn’t enough to answer the actual demand.

"And we see the demand. I am still in a position where our supply is not meeting our demands. We actually currently are still waving off customers from, or scheduling them out into the future so that we have enough supply to meet demand."

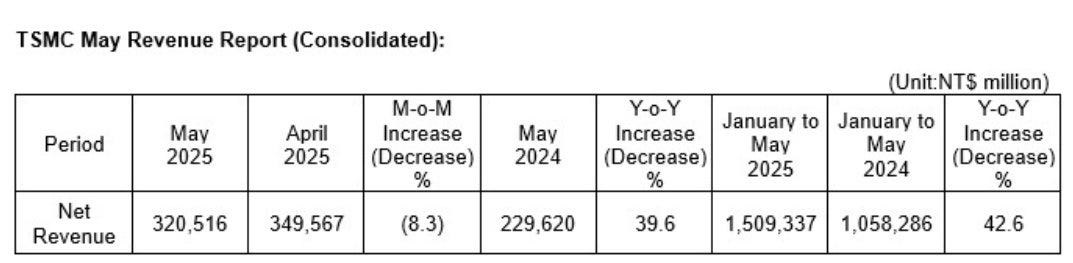

Third, TSM released its monthly financial data with revenues up 42.6% YoY for the first semester, with a sequential decline but nothing worrying with such short timeframes comparison, often affected by order book and timings.

AI is only starting. It will take years to be developed, perfected & used to build real-world use cases - better than image generation & LLMs. We are still very far in terms of time or compute needed from widely spread real-world applications.

Uber & Autonomous Vehicles.

Once more, we talk about Europe & how late they are.

Uber announced that they will partner with Wayve to launch L4 autonomous vehicles trials in the U.K. Those are only trials and regulations aren’t ready yet but things are finally moving in Europe, and it’s great to see.

Bitcoin ETFs.

Long time we did not look at the inflows which are still great & passed largely above the $40B net inflows since inception, and continue to be mostly positive as the world buys Bitcoins.

But more importantly, this ETF is now a historic ETF, beating all records in terms of value locked in its first year.

Bitcoin is not an asset like others. And by 2025, everyone should at least take interest in it and try to understand what the fuss is about.

I did, do, and will fight for it, if not for the adoption of the asset at least for people to look at it and try to understand it. So if you didn’t read it yet, spend some time, you have everything you need just here.

Tesla Robotaxi.

Austin’s streets started to see some Model Ys driving by themselves this week as for once, Tesla is delivering on time. They planned the pilot of their service in June, and here we are.

Nothing else to say, this is just a pilot for now and will take some weeks to months to have better feedback, but it is live.

Google Search.

I’ve said it often & will continue to do so: Search is not dying; attention is shifting and this is normal. We continue to see traffic comparison on X between Search & ChatGPT which is like comparing horses & bus usage.

Here’s a recap of my opinion.

The perfect comparison point would be the number of connections to ChatGPT & requests to Gemini as requests can come from the app but also from other entry points - any services leveraging Gemini like AI Mode, Overview or Lens & more.

This traffic is a better representation of what to look at.

Those are only MoM comparisons hence not really representative, but my point here is that we cannot compare Search with ChatGPT or other LLMs anymore. We need to compare LLM traffic with LLM traffic.

Google will look much healthier that way.

Rapid note as I had a smart comment on X. Google will continue to register revenues in Search even if they come from apps leveraging Gemini because that is how they do. So it is possible to see Search traffic go down & Search revenues go up, as the first one won’t include Gemini usage while the second will.

Meta & ScaleAI.

Meta doubles down on its AI investment with Mark building a high-profile team to work on the most complex issues under his responsibility directly, starting by a $15 billion investment in ScaleAI - almost a majority stake with 49% of it.

This investment is to access the team as much as the product as ScaleAI is focused on data - from its generation to refinement, in order to train AI models - a big subject for the next years as data volume & quality is an important factor to create AI models.

Grab Convertible Notes.

We saw a lot of those lately and it seems like investors still have deep pockets as once more, it was oversubscribed & management had to raise it from $1.25B to $1.5B. The notes have no coupons and will be convertible in 2030 at $6.55 which means investors buying them expect the stock to reach $11 at least by then - convertible price + 10% CAGR returns without any coupons.

There were lots of rumors on a GoTo takeover for a deal around $7B, close from their actual net debt position, after this funding round - around $8.5B. Management said there were no talk on going "at the moment" a few days ago & that their balance sheet will be used to expand the business.

So… Wait & see. A name I really want to buy & will if I am given the opportunity - Investment thesis will be sent in two weeks.

Robinhood Invest America.

Trump’s administration proposed to offer $1,000 to every newborn in America during its mandate under the form of S&P 500 shares in a specific investment account - an idea I personally find really compelling.

And as usual, Robinhood was the first ones to present a product.

Every newborn would have a Robinhood account funded, opened in a few seconds & ready to be used. Useless to say that the bill itself would be very bullish for the market at large & for Robinhood as this means hooked users to their platform before they can even read.

Nothing official nor signed. But once again, Robinhood’s team proved its proactivity & capacities.

Shopify & Circle.

The online store management website is now allowing its merchants to activate USDC payments, proving that stablecoins are going to be an important part of our financial system moving forward.

Circle did its IPO this week & you guys will receive my investment thesis wednesday, to learn everything you need to know about stablecoins and why I personally am really bullish on this sector.

Looks like nowadays wars are bullish. Very prudent to keep a sizable cash level though - have to stand by what you believe.