Weekly Recap | July - W3

Quiet Macro, Ethereum Frenzy, Meta's Spending, Nvidia Chinese Licenses, Nuclear Sector, Uber's Partnerships, Earnings (ASML, TSM, SLC & NFLX), Weekly Planning & Watchlist & Buying Targets.

We are closing a quiet week in terms of news. So it'll be a short report.

Macro.

For the first time since… Long, I have nothing to say in this portion of the weekly. The situation remains the same, a little bit better for the markets since the Big Beautiful Bill passed, raising the debt ceiling hence giving government the opportunity to print more & strengthen fiscal dominance.

Inflation & unemployment are in line, the data isn't perfect & the uncertainty remains high so the FED is not cutting rates but once more: rates do not matter in a fiscal dominant environment as liquidity comes from fiscal policies.

So we remain in the best possible situation for stocks: other assets are hard to invest due to high interest rates & liquidity is pouring through fiscal dominance.

I continue to believe we will have lots of volatility as one of the government's goals remains to lower the US10Y, which continues to rise as uncertainty is still here and institutions don't really want to buy treasuries, but we know that the administration won't hurt the stock market - can't hurt the stock market, not too much at least.

In brief… Enjoying the volatility to buy red days and trimming the green ones. Until something breaks - which will happen, but it could take really long. Our job here is not to try & know when it'll happen, it is to capitalize on the frenzy as much as possible, until it happens.

And in the best case scenario, we'll have cash aside by then and will also be able to capitalize on the downtrend.

Watched Stocks and Portfolio.

The Ethereum Frenzy.

Bitcoin reached a new ATH last week & the frenzy continues around cryptos, with Ethereum notably as the asset - which is the biggest position in my Buy & Hold portfolio, delivered strong returns these last days.

And institutions continue to pile into it.

This is already massive but we also have companies trying to replicate MicroStrategy’s success with Ethereum as a collateral - instead of Bitcoin, hence increasing the buying pressure, while last week's performance will also attract short term speculators.

It’s hard to know where we’ll go over the next months but if the markets continue to be bullish and the frenzy doesn’t slow down, Ethereum might go to a new ATH & beyond.

Nvidia & AMD in China.

Nvidia released Monday a communiqué saying that the government will allow them to sell their H20 chips in China again - AMD should also be allowed for their GPUs. Altough it remains difficult to trust this administration… This might change in a week once again, but it’s good news for now.

This is probably due to the trade negotiations ongoing with China as GPUs are one of their most important demand, like rare earths for the U.S.

Nevertheless, if they were to receive those licenses, it would open again an estimated $20B market FY25 growing double digit to Nvidia. Significant for the company & its future earnings.

China is Back.

The Nvidia news triggered a bounce in China. You know I am bullish in the region with or without access to GPUs as I believe purchasing power & consumption will grow & boost returns, but the market is more excited about the AI potential in the region - and I also prefer to have that narrative than not.

I have a huge position in the already and it finally seems ready to bounce. As usual, any trade negotiation news or the U.S. administration changing its opinion could stop the train. But not the fundamentals.

Meta's Spending.

Zuck has been spending like there is no tomorrow these last weeks, billions of dollars in talents & shares acquisition for different kinds of AI generative companies.

His objective is clear: give the best opportunity, the best tools & the best environment to the best engineers to develop the best AI services, with has a clear plan on how to get there. More details here.

Nebius Ratings.

I don’t talk about analysts' ratings because I don’t believe them to be valuable. They often follow price action - too late, & try to look good and rarely share real buying opportunities.

Nevertheless, the market looks up to them and & modification moves stocks, so it is interesting to see that Goldman Sachs initiated its coverage on Nebius with a price target at $68.

It doesn’t mean we’re going there, but it certainly shines a light on this small cap which will have more eyes on it now that green light has been given. Many fund managers & large investors use those analysis. A net positive for Nebius.

Uber in China.

Uber announced that they will partner with Baidu to offer mobility services in Asia & the Middle East with Baidu's autonomous vehicles Apollo Go.

The platform continues to prove that AV manufacturers continue to want to work with them as they own distribution, which is what really matters at the end of the day.

Energy Sector & Nuclear - Again.

I’ve talked a lot about the energy sector lately, mostly fossil energies, but we continue to have confirmation that nuclear will be a big deal for the next decade.

I’ll continue to share that the best way - in my opinion, to play this growing demand is through the commodity - uranium, and the companies which enrich it to be used in powerplants as all of them will need it, while it is much harder to have a clear idea on who will be the most used contractor or infrastructure builder.

My personal preferences go towards Centrus Energy (LEU) and Cameco Corporation (CCJ) although both stocks are expensive today. But any depression in the sector might give great opportunities.

To keep an eye on.

Earnings.

We had some great earnings to kick off the season with ASML, TSM, Schlumberger & Netflix. I did not do a specific write-up for the latter as everything was great, so I didn’t think it was necessary to write hundreds of lines to say so.

Here are the recaps.

ASML.

Taiwan Semiconductor.

Netflix.

The stock did not really react to great earnings but it was very extended and already priced for such results. I’ve said earlier it was certainly a good time to trim Netflix & continue to believe so, but the company is so great that I would struggle to sell any shares if I was part of the ride.

Nothing to worry about fundamentally.

Schlumberger.

I did not review the company’s earnings but the market was not happy with them as we are back at the bottom of the range after bouncing on the bearish trendline.

Will have to be more patient.

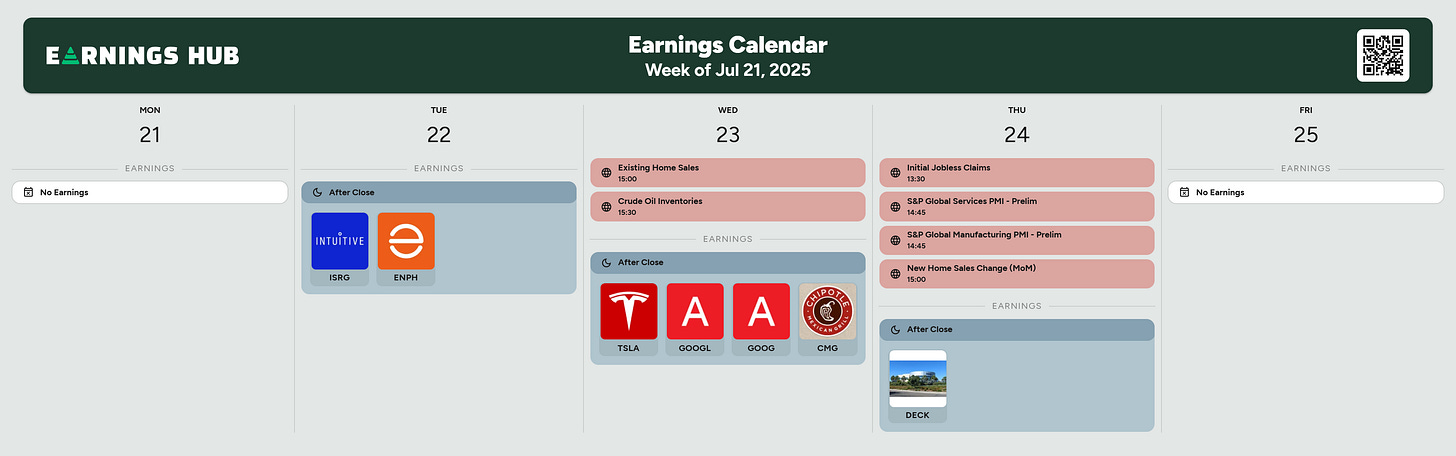

Weekly Planning.

Next week will have a specific write-up for Tesla & Google and some comments on Decker’s Hoka brand, Enphase & Intuitive.

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger, those are only my view of valuation & price action today, I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

“OCB” - Optimized Cost Basis, the optimum average price for a long term position.

“Accumulation Target” - buying target based on price action, to average up.

“DCA” - trading at a proper price to open a position or accumulate.

“Accumulation” - trading at a proper price to average up an already existing position with an average below OCB.

Bold cells are updates compared to last week.