Energy | Invesment Thesis

The Forgotten Heart of the World's Economy.

Energy is to the world's economy what our currencies are to our financial system: its heart and lungs. If you've been reading my work for some time, you probably already know what I'll say next.

Value is energy transformed. And growth is the sum of the value created.

Without energy, we wouldn't have growth, nor innovation, and couldn't maintain nor grow our life quality. This probably does a proper introduction, but it seems that the market & many others - including some countries, have forgotten these simple fact: our energy needs are constantly growing in line with our innovations.

We'll start with the energy sector at large, see the bull case and end with some investment thesis.

Energy - What, Why & How.

All Kinds of Energy.

Energy is a big word with lots of different definitions depending on the context. From an economy point of view, it includes the commodities and their outputs used for any kind of activity. We can divide it into three categories:

The fossil fuels. The brut commodities extracted from earth - oil, gas, coal, uranium etc…

The output, refined fossil fuels or gases for end-use, either directly - to power a motor or heat for example, or to produce electricity.

The renewables, systems & infrastructures built to take advantage of nature - wind, sun, water flows, etc… to produce electricity.

So we get the vocabulary straight; I will try to use the word "energy" to mean the outputs, and will use "fossils" to talk about the commodities and "renewables" to discuss the infrastructures to harness natural energy.

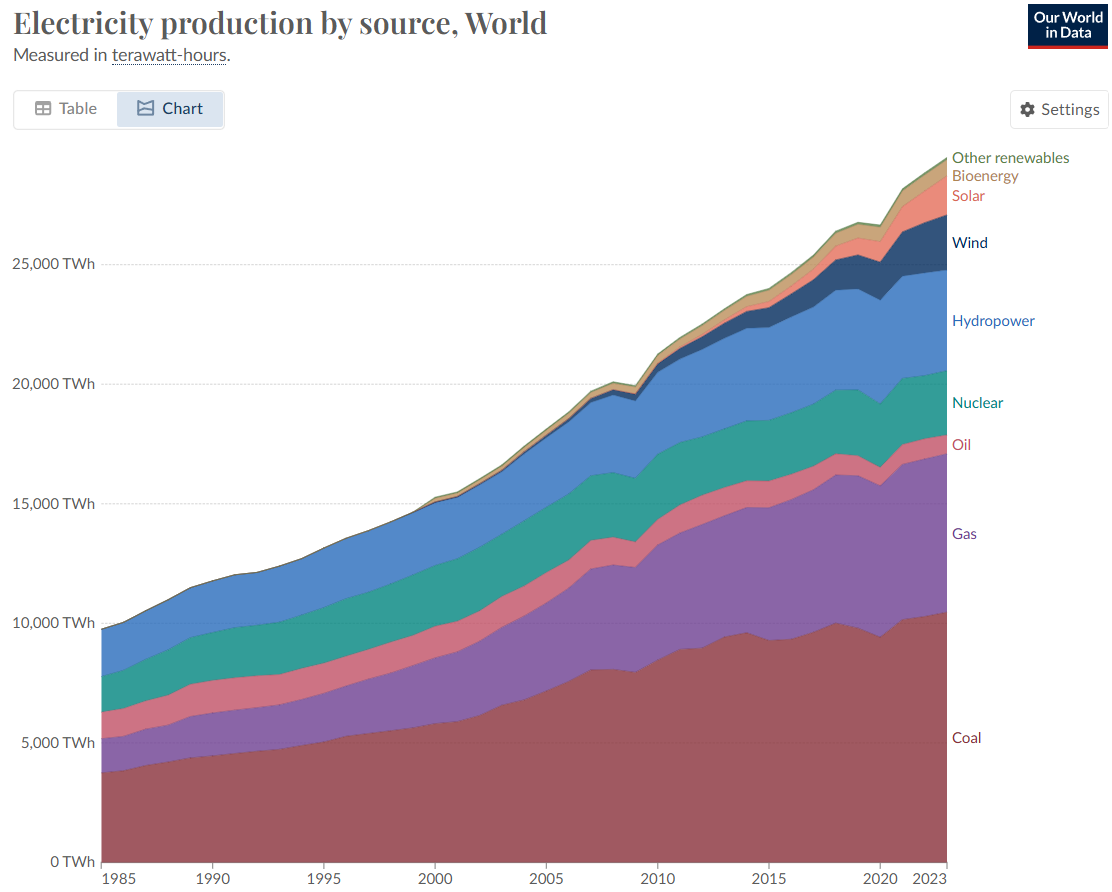

Here’s a rapid overview of the proportions of sources used for electrical production around the world.

Renewable energies are really small compared to fossil fuels, and the trend isn't really changing; everything tends to grow in the same proportions; fossil energies around 60% of the world's electrical production, nuclear responsible for a modest 10%, leaving renewable sources at about 30%, with a significant portion of that from hydropower.

Energy Life Cycle.

There are different life cycles depending on the energy source itself: fossils and renewables.

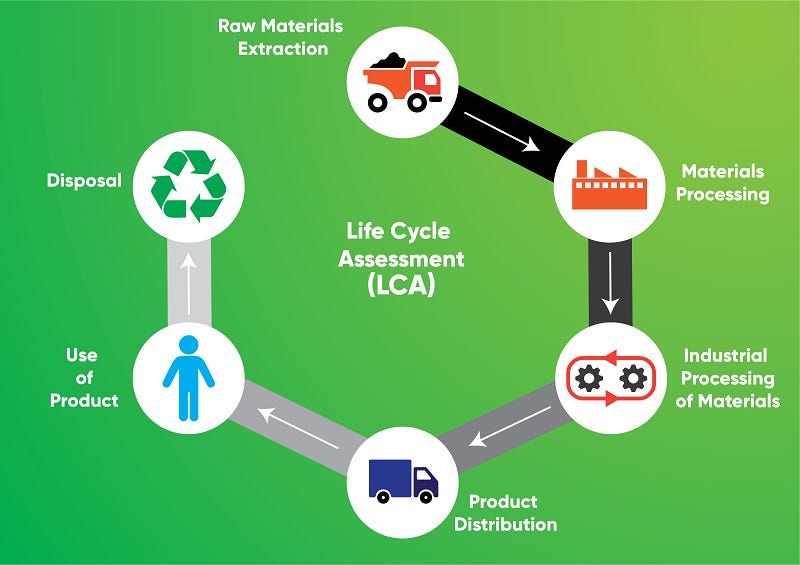

For fossil energies, the life cycle starts “upstream”, with studies to locate the resources, hardware installation, extraction preparation, etc... Once this is done, the cycle follows the steps in the screenshot below. This cycle is applicable to every fossil fuel.

The cycle is different for renewable energies as these "only need" infrastructures to capture natural forces - solar panels for sunlight, water mills or dams for water flow, wind turbines, etc. Electricity is then created through heat, movement or light and forwarded to wherever it's needed.

Those were some basics. Commodities are mined directly from the earth and refined to be used, either directly or to produce electricity. Renewables energy use nature to directly produce electricity.

The Grid.

Going a bit further into electricity now. The grid is the name given to the electrical system of a city or a country, from producers to end-users. It is an incredibly complex piece of engineering, constantly hanging by a thread as its production has to equal consumption at any time. The entire infrastructures could overheat & burn if this wasn’t the case - or at least be damaged.

To be safe, most cities, countries, or anyone who manages the grid, usually slightly overproduce and burn the excess through different means to be sure to answer the demand - which results in wasted energy, hence more expensive electricity as the cost of the wasted fuel will be passed to consumers.

The electrical production follows a constantly changing demand, which isn’t the same at 12 PM or 9 PM, in winter or summer. The illustration below represents the difference in demand at different times during the day.

Answering different loads requires flexibility from producers, requiring them to increase their production rapidely if necessary - even more in case of emergency, which cannot be overlooked by producers as the consequence of not delivering enough electricity during a blizzard for example could be devastating.

This need for flexibility renders the different production means unequal. Some will be very flexible - like coal, and others won’t be - like renewable energies. Some sources are perfect to answer a constant demand - the base load, while other are flexible and turn on/increase or decrease production rapidely - like coal mines or nuclear reactors. There are tons of potential combinations depending on the climate, the resources & the available infrastructures in different geographies.

This, in part, explains why Western countries haven’t entirely migrated to renewables and why most still use gas and oil to generate electricity: for flexibility.

The only country committed to renewables is Germany, and their electricity prices grew by 35% since that decision, three years ago. I have my opinions but am not here to debate whether they are right or not; this is an important note for the rest of this write-up.

Bull Case.

The bull case is pretty straightforward.

The world evolves & our energetic needs constantly grow. Some countries are able to build complex & efficient infrastructures while others will increase their use of fossil fuels to meet their needs. Over the long term, energy consumption is bound to grow exponentially as developed countries enhance their quality of life and developing countries catch up, always growing their base consumption.

Asia is growing rapidly and will continue to improve its infrastructures and the quality of life of its population. The United States will grow their needs to fuel AI computing power & potential reindustrialization infrastructures. I also expressed my view on Latin America, which, if the dollar weakens in the coming months or years, will be able to invest again in its infrastructures and need energy to do so. I also hope that the E.U comes back to its senses & invest in its independance, something which the war in Ukraine should have pushed them to do, but it seems they'd rather become dependent on someone else…

The demand and need for energy around the globe won't slow down. It will at best remain stable, but most likely increase as our new ways of life need more energy. This is the fundamental bull case.

Future.

What makes the sector interesting at the moment - or some part of it, is its valuation, with some giants trading under historical multiples while yielding between 4% & 7% returns to shareholders.

Most of the market is focused on tech, AI & other small capitalizations and has left aside the energy sector. Valuations are clearly extended in the first, and with my view of the current macro environment, it’s certainly not a bad time to turn to energy, the heart of any economy.

My vision remains the same than when I shared this write-up.

My medium-term base case (1-3 years) is constant inflation through fiscal dominance, which means more expensive commodities, hence growing revenues for companies dealing with them. My alternative base case is a provoked U.S. recession, which would mean a drastic reduction in energy consumption. I wouldn’t be surprised if the government then chose to fight this recession with money printing, hence bringing us back to square one - inflation. The recession would hit these stocks as well, but at current valuations, the potential downside is limited & much lower than some small caps or tech stocks.

We’ll review different thesis, with different objectives, scenarios, & timeframes. I am watching all of them and have already made some moves I’ll share below.

Fossil.

Starting with fossil energies, focusing on gas & oil as I am not really interested in coal, which is a thing of the past that most are trying to move away from. We’ve already seen the thesis above: a worldwide constant & growing demand for these commodities for various reasons.

Let’s go back to the life cycle of those fossil commodities.

First step: Upstream. Everything done before extraction, from research to the installation of the drilling hardware, etc. Companies are providing those services to producers & paid by them for it, hence not directly impacted by the price of the fossil fuels.

Second step: Production. This speaks for itself; these are the operations of the pits, extraction, refinement, etc., before reselling the finished products.

Third step: Distribution. The last step, once the commodity is usable, distributors will either consume it to produce & sell electricity or sell it directly for consumption.

All steps: Transportation. This one is somewhat independent but necessary, be it to transport the raw or the refined commodity.

I chose to focus on the need for energy more than on the energy itself and bought two ETFs, one including upstream companies & a second one for oil & gas transports - namely XES & AMLP. I did not chose individual stocks as I want to be exposed to the entire sector & not to a specific product from one company, and also want to be involved in the broader geography possible.

The choice of upstream is also motivated by Trump’s administration, who is focused on growing the U.S. energy potential and focuses on known & efficient methods to do so - hence, fossils. The long-term plan is to drill more, and that’s the upstream's job. Some assume this will lower the price of the commodity - which I disagree with, but either way, it won’t affect the upstream sector, which is impacted by the volume more than by the commodity price.

Both upstream & transport would be impacted by a U.S. recession but aren’t entirely dependent of this geography nor of the commodities’ price directly. It will impact them, but both sectors will continue to work as long as demand remains high, whatever the price of the commodities.

I already started the positions and intend to DCA as I take profits on risky assets, as long as my thesis & macro view doesn't change.

Nuclear.

There is a lot of hype at the moment around some names since Google, Amazon & Co. declared their intent to power their own data centers with nuclear energy. This won’t happen before years and the anticipation on some names seems too early... But the long term prospect of the sector is really bullish.

I intend to play the sector through its commodity: uranium. I have started digging on the mining industry but it rapidly became too complexe & seemed very shaddy, so I gave up on it to set my eyes on its refined product. Everytone will need refined uranium in the future for the powerplants, big or small, and it seems to be the most interesting vertical for now.

I have set my eyes on two names for now.

Cameco Corporation. A giant who does almost everything related to uranium, from mining operations - which is nice to have exposure to with a serious company, to distribution, refining & more, internally or through partnerships or partial ownership of other companies.

Centrus Energy. A very small company, "simple" supplier of enriched uranium with a different kind of clientele, growing rapidly; I’ll need to dig into this one a bit more but it looks promising

As I said, my problem is that valuations ran hot after the Mag 7 announcements, without much fundamental improvement, and I don’t believe they will live up to expectations in the short-term.

I believe in the fundamental bull case & need of nuclear power all around the world during the next decad, but this will take years, not just a few months, and the needs for enriched uranium are going to grow slowly.

My base case remains inflation & potential U.S. recession and I struggle believing those stocks will maintain their valuation under those conditions, so I've made the choice to wait for lower ratios and intend to buy if it happens, as long as my view on nuclear remains the same.

Renewables.

I do not intend to play renewables, not directly. Those are very interesting at the scale of households - especially solar, as end-users are able to consume their production, less so at the scale of cities or countries. They require expensive infrastructure & maintenance, are not flexible, and you can’t sell the produced electricity oversea. Interesting locally but it ends here.

For households, I also believe Trump's plan to cut all subsidies is a blow to the entire sector, making the products even more expensive & potentially not even worth it in America at least, considering the relatively low price of electricity anyway - depending on the state.

An average for solar installation is around $0.09 to $0.11 per kWh installed. This will fluctuate depending on the installation & more, while those prices exclude interest rate expenses for installation, maintenance, potential subscriptions etc... Those could be worth for most, but might not be worth the trouble & upfront payment.

I am still watching some names, Enphase mainly, but won’t touch it without a clear view on Trump’s measures, while I personally do not believe emerging markets are enough - for now, to be significant demand in this domain. It’s worth keeping an eye on it without any doubts though.

Storage.

Much more interesting subject at both levels, States & households, which I believe will become a mandatory topic during the next years. As I said earlier, one of the big problem with electricity is the need to have a constant & perfect balance between production & consumption. Storage changes this by holding on the surplus - to a limit of course, which reduce the need of wasting production.

These technologies are also a proxy for renewable energies as often used togehter. A much more interesting vertical in my opinion, and I am already invested in it through a company that everyone knows, but many underestimate.

Yup: Tesla & their megapack.

More information above.

“You can see the Megapack as boosted Powerwalls, a solution for storing various types of energy on a very large scale. Each unit can store 3MWh – enough to power 3,600 homes for an hour, according to their advertising.”

This could become the backup for cities, companies, factories, residential areas, or entire buildings in the future. A source of cheaper energy as it would be stored during over production and a mean to help the grid. Triple win.

Power Farms.

Batteries are one step, but there are others which can help the grid. I’ll do it again, fast. In a grid production + x = consumption with x being wasted. Grids must be able to accelerate or slow their production rapidely to answer changing demand. This isn’t easy - nor cheap.

What if some actors could consume this wasted energy, which is produced but not used? They’d buy it cheaply, which is a win-win situation and help the grid regulate itself by growing, slowing, or stopping their consumption, using the delta between production & consumption to avoid waste, hence reducing producers’ costs and therefore, the costs passed to customers. My take is that batteries will do this in the future, but they can fulfill and aren’t the answer to everything.

Others exist: HPC & Bitcoin miners.

The gist doesn’t get more complicated than this. Those are actors capable - in some cases, to reduce, grow, or completely stop their consumption. It’s true for AI model training for example, it isn’t for ChatGPT servers which must run fast constantly, so HPC is case-dependent. Bitcoin miners are different; they can consume as much as possible as well as almost nothing, and can change that in a few seconds. They are the perfect schoolboy.

This sector is very interesting, but still very immature. My personal take is that these power farms will be present all around the world at one point, consuming the surplus for some cents while driving lower the global electricity cost & lowering the wates.

The only country that has understood this so far is Texas, and these power farms are one of the reasons why energy prices are lower than average. Things also start to move in Switzerland, who is studying Bitcoin miners as grid controllers.

“1. Show how much unused energy could be utilized in the canton through Bitcoin mining.

2. Examine to what extent the energy from the canton's electricity production could be used for Bitcoin mining, in collaboration with Swiss electricity companies.

3. Assess whether Bitcoin mining can contribute to the stabilization of the electricity network.”

I will keep an eye on these trends; many companies already propose these services - Iris Energy for example, mining Bitcoin themselves while selling the rest of their electricity to HPCs & others who need it, consuming surplus.

Again, the industry isn’t mature enough for now, seen only as a leverage narrative linked to Bitcoin. It’s worth looking at them, not holding for the long term yet, but I believe this will eventually change and I thought it interesting to mention.

Conclusion & Plan.

I’ll conclude with a rapid resume, not on the topic but from an investment perspective.

Fossil Energy. I am very bullish on this sector despite my view of a potential recession in the medium term, mostly thanks to its current valuation & yields. I already bought two ETFs - XES & AMLP, and intend to DCA as long as their valuation remains reasonable.

Nuclear. Strong prospects for the next decade, but the stocks are expensive, based on hype more than fundamentals, in my opinion. I intend to buy but would like to see lower multiples as the nuclear narrative should take years to play out either way.

Renewable Energy. A very interesting narrative but without enough potential, in my opinion, especially with Trump in office. Things could change but the need for massive investment upfront & complicated management makes it less interesting for me. Keeping an eye on it.

Storage. A proxy for renewable energy and a much better play, in my opinion, as storing electricity can be done through renewable or other sources, but is critical for the future for cheaper electricity or emergencies. I am already playing this narrative through Tesla Energy & the Megapacks/Powerwalls.

Power Farms. This is for the future; a system worth knowing but considered as entirely speculative for now. Things will change, and these farms will certainly be used everywhere to help grids in the future, but we’re not there yet.