Weekly Recap | October - W1

Watchlist Update, Quaterly Portfolio Performance & Holdings, Market Thoughts, Government Shutdown, Nebius Acceleration, Alibaba's Buyback, PayPal Narratives.

If you guys are interested by a 15% reduction on all FiscalAI subscription plans, click the link below!

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs and honestly the best platform on the market to follow companies’ fundamentals. If interested, feel free to use my link!

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold cells are updates compared to last week.

I have reduced the list as I try to focus my time and energy on a smaller company list with higher convictions. I have a few names which aren’t there yet and will be in time, just like some will disapear.

Portfolio Performance.

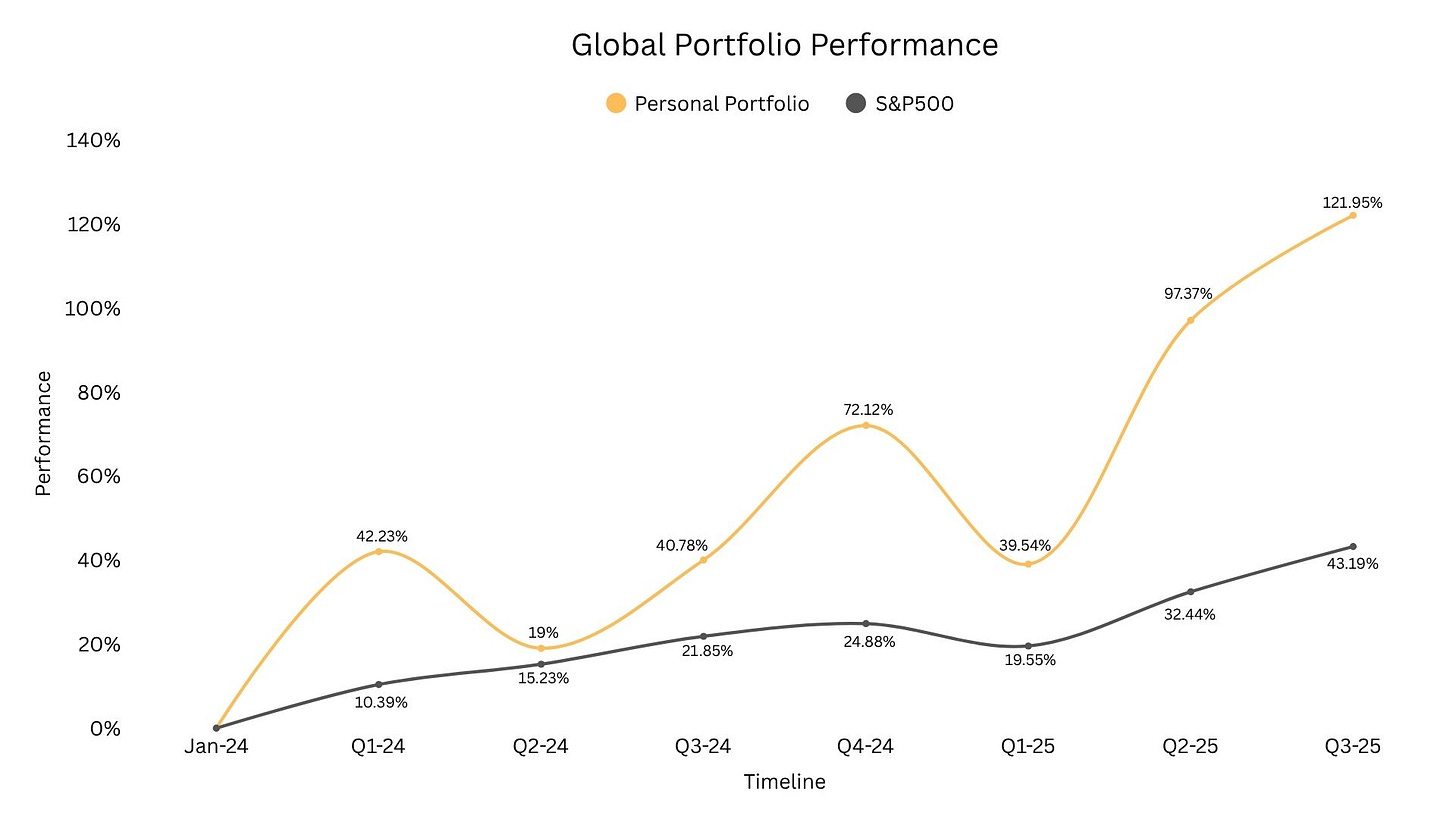

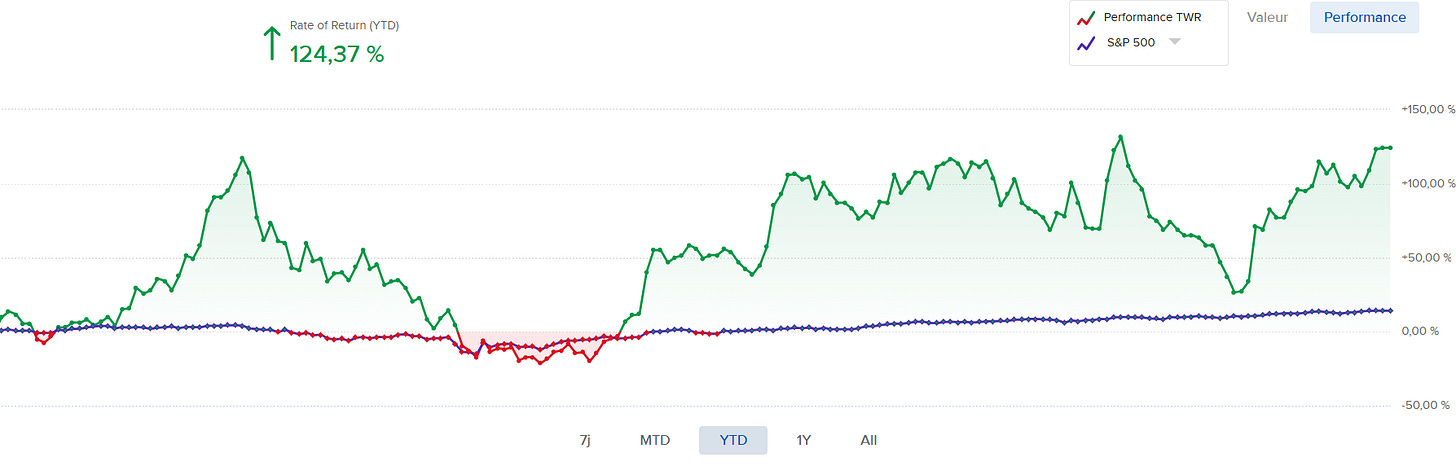

Another quarter closing overperforming the S&P 500 since I started sharing on this platform, with 78% of alpha delivered over a bit less than two years.

This is my personal portfolio’s performance mixing all types of investment. If you want the performance per strategy, I’ll use the data from both SavvyTraders - which you have access to for free, and my personal option account as references.

And here is the actual composition of my portfolio at Friday’s close, including all kinds of investments - my Transmedics position includes both shares and options here for example.

I reduced my cash this week as I reinforced my PayPal position, but would reduce the risk and bring that digit back to 20% if the S&P 500 were to give signs of weakness short term, but only strength is on the menu lately so I see no reasons not to enjoy it as long as it lasts.

The important thing for swing traders is to reduce that risk when needed. There isn’t much to do for investors but focus on buying the best value for your dollars at each point in time.

Some Market Thoughts.

This week has been something… Pushing many portfolios to new highs.

The S&P continues to trade above its bull trends, its EMA21 & there are no reasons to be worried short term for those with speculative/margin positions. But we remain in overbought territory with a massive upward move since April, without any retests on major EMAs. There are no reasons to be bearish as long as the market doesn't give clear signs, but it's important to keep this in the back of our mind and to react when signs arrive for swing traders or to be aware of the possibility of a breather for long term investors. It's all about risk/cash management.

The crypto market is back at full strength with Bitcoin and Ethereum jumping 15% this week, the first being very close to a new all-time high. I didn’t have a precise timing in my plan but am not surprised by this move.

I’ll continue to accumulate Ethereum & BMNR on red days as I expect Q4 to be good for cryptos in general. I also started using leverage again on some altcoins although I don’t share those trades here, the bottom line is that I am confident enough to use leverage - reasonably and as long as the S&P is healthy.

On the government shutdown… I wish I could comment and give some insights but the truth is that it doesn’t matter much. As usual, it will be fixed magically from one day to the other and without much consequence for the market in between. Those events aren’t as bearish as one could think and if the market were to turn red on no rapid resolutions… I’d buy.

Watched Stocks and Portfolio.

Nebius Acceleration & Rising Status.

Nebius announced buying two lands in Alabama for a combined 79 acres for its new greenfield sites supposed to host hundreds of MWs of capacity. This was part of their plan but the market is probably suspecting more deals to come in the near future as management communicated that they wouldn’t accelerate their expansion without a clear demand for compute.

The second news is the Nvidia Exemplar Status which gives Nebius a second stamp of approval after the Microsoft deal and puts it on many companies’ radars. An unknown company doesn’t make money, but a company endorsed by the biggest cloud provider and the #1 GPUs provider is different.

Lastly, for compute demand in general, Meta signed a $14B contract for compute with CoreWeave. Meta & Microsoft spent a combined $114.5B give or take in CapEx, most of it towards AI infrastructures, and are still signing contracts with providers.

The obvious reason for signing such contracts is that they don’t have enough compute themselves to answer the actual demand - more confirmations for the market which enjoys it.

The second could be that they reached a point where they’d rather not oversize their AI infrastructures and let others take the risks to do so. If it works out and demand is as big as expected in the future? Fine, they’ll adapt then. But until clear confirmations that compute demand will grow long term, I believe mega techs reached a point where they are less comfortable with continuous CapEx increase.

That could be the first signs of CapEx slowdown, which wouldn’t bode well with the market. But I am only speculating for now.

Alibaba’s Shares Buyback.

The buyback train has massively slowed down over the last months and the narrative of constant buybacks is now dead… And it is a good thing as all this capital is now going to a much better use: AI and cloud investments.

A great change of narrative which is an important reason - the main reason really, for the change in Alibaba’s stock.

PayPal’s Narrative.

PayPal was in the same situation as Alibaba. A giant who focused on buying back its shares without investing much in the future. I’ve shared many times these last months that it was changing, but it isn’t as clear as Alibaba’s cloud growth trajectory.

The signs are here with many partnerships for PayPal World, agentic e-commerce - Google and Perplexity and any LLMs now with a seamless incorporation of their Honey overlay.

The innovation is here but the market did not react as this isn’t a direct partnership with ChatGPT but a feature accessible for Honey’s users - which aren’t as many as ChatGPT’s. The narrative is not as strong as many wished. But things are moving the right way.

PayPal World is also going live very soon and the company highlighted this with new publicity for Venmo users, educating them that they will now be able to use Venmo like anyone uses PayPal, to pay for anything, anywhere.

PayPal also announced a partnership with DP World, a multinational logistics company based in Dubai, specialized in cargo logistics handling 70 million containers brought in by around 70,000 vessels annually.

The agreement, which could see transactions executed in minutes rather than taking up to a week reflects DP World’s continued commitment to creating a secure and scalable marketplace for digital payments. DP World’s Digital Payments initiative will enable international merchants, shippers, exporters, importers, and marketplaces to complete cross-border payments with greater transparency, lower costs, and faster settlement times.

We don’t have many details on what this deal really is as it seems to be a B2B service, which PayPal doesn’t do much usually, but it is clear enough that the company intends to leverage PayPal services through its stablecoin.

The Emirates are all about efficiency & this wouldn’t be a geopolitical treason as using stablecoins or dollars/treasuries is the same thing.

One thing for sure, if we start to see this kind of deal happening, major players using PayPal’s stablecoins for business usage, the narrative around the asset and those who can safely leverage it within regulatory framework will change. Fast.

As I’ve said for months now, the narrative around PayPal is changing and this could happen from many verticals: PayPal World, Agentic e-commerce, stablecoins and international settlements…

Lots of potential.

Do you feel comfortable buying NBIS on red days or do you think it’s overvalued now?

I honestly don't accumulate anymore. I have a large position at that point and would rather buy other names.

If I didn't have such a position... Maybe I could accumulate yes. But I wouldn't be aggressive after such a run.