Portfolio Modifications - 05/30/2025

Novo Nordisk, VG, Fluor Corporation, Bitcoin & Google.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

https://savvytrader.com/wealthyreadingspro/active

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Active Portfolio - Reinforced Bitcoin & Google.

Option Portfolio - Buys for slightly less than 50% of the portfolio’s liquidity.

NVO Dec19'25 $85 Call

VG Jan16'26 $12.5 Call

FLR Mar20'26 $45 Call

Buys.

Google & Bitcoin.

I won’t go over those buys as everything was detailed here.

NVO | Dec19'25 $85 Call @ $5.22.

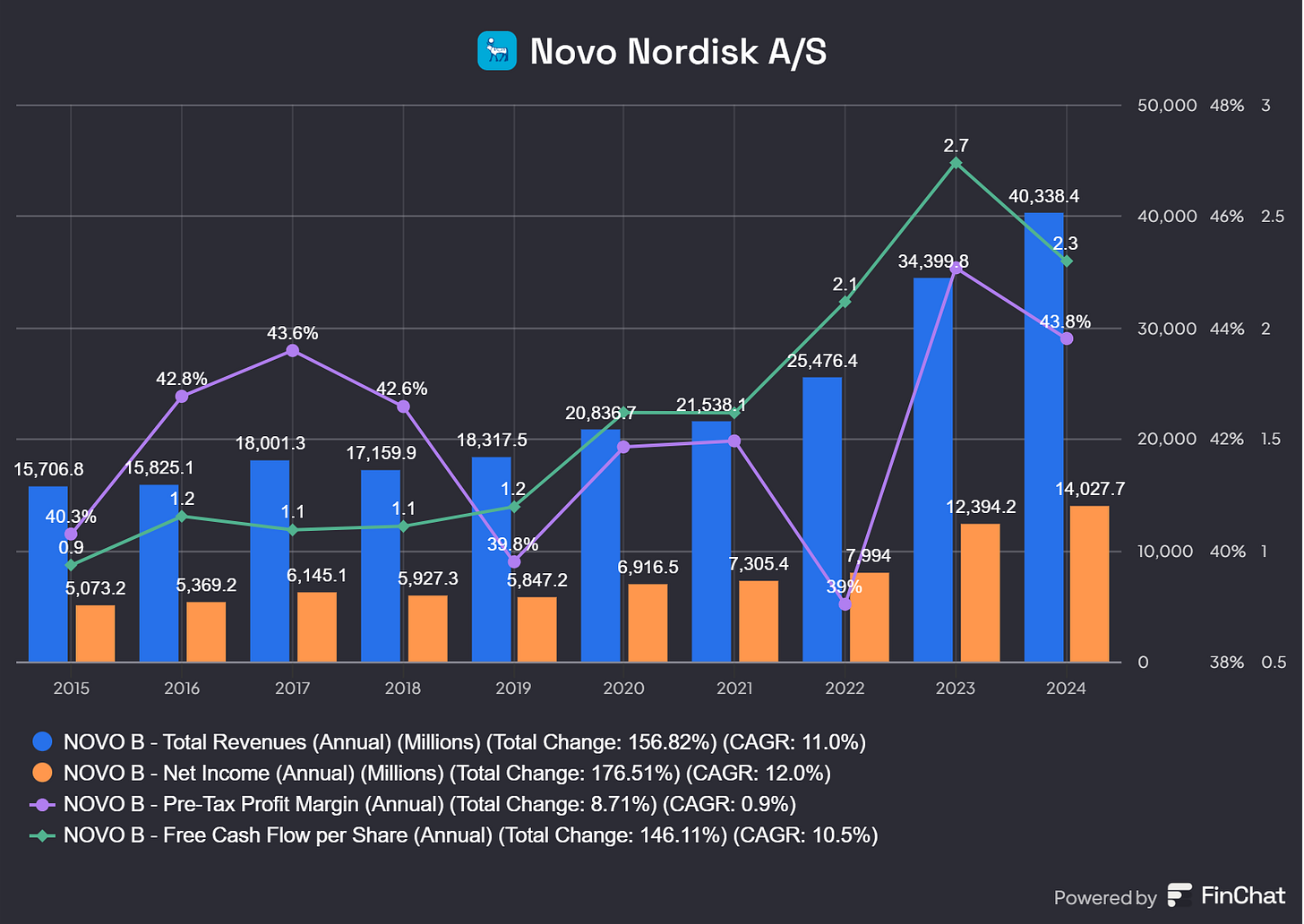

The Danish healthcare giant has taken a beating those last months as the GLP-1 sales have been a bit disappointing, mostly due to the lack of retention of their users as we talked about many times during Hims’ reports, and guidance for those were reduced. But like Hims, Novo is about more than just GLP-1.

The company is really healthy and growing really well, boosted by the GLP-1 in 2024 but not only. Now that the shortage has ended, even with a retention rate below 50% after a trimester, the drug will be sold in volume enough to sustain its part of that growth while the rest of the portfolio continues to behave well.

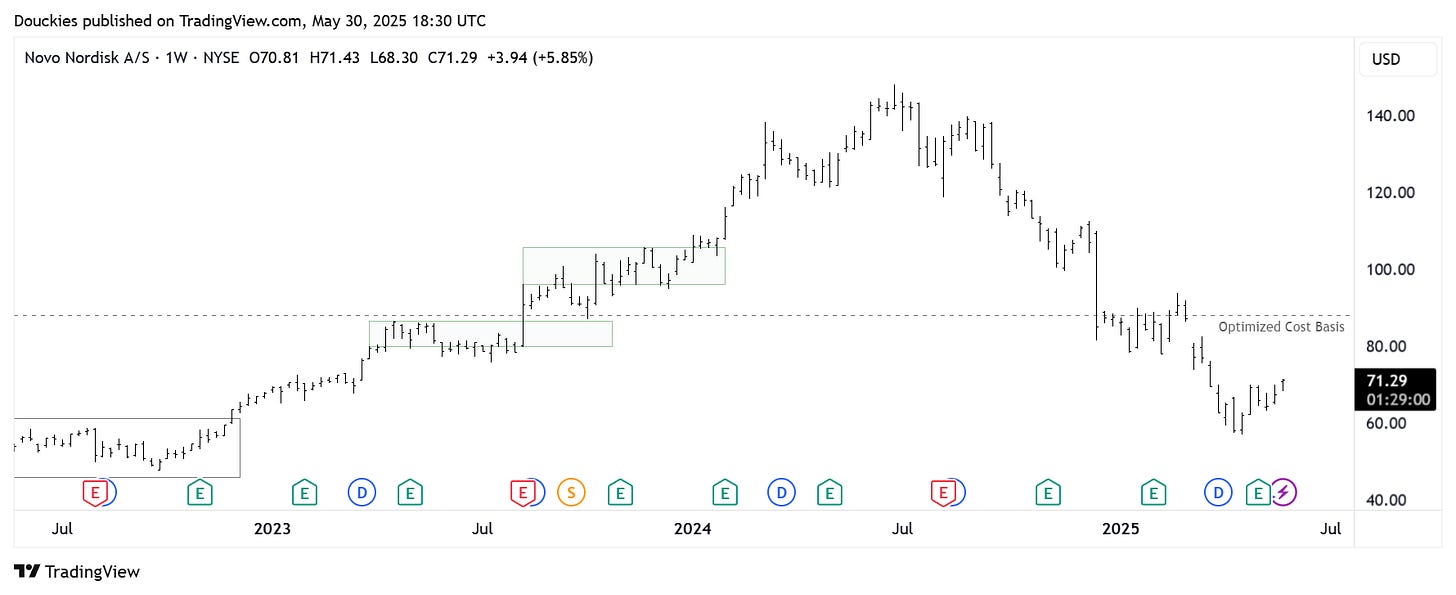

I shared my valuation of the stock not so long ago where I assumed a fair value based on its historical multiples & guidance to be around $90. Useless to say that I consider the stock to be a bargain around $70, and its price action is finally showing some signs of life with higher lows in weekly timeframe, largely below a fair value.

We might go a bit up & down and fail the first breakout but the calls are dated for the end of the year, giving time for the position to play out & potentially buy more as long as the local low around $60 is held.

Last argument as you guys know I am not the most bullish lately, the sector is very interesting as somehow recession-proof & the stock has been behaving really well over the last weeks despite some volatility in stocks.

In brief, a very healthy company in a recession-proof sector, beaten down because of a unique narrative with a price action now stabilizing and behaving pretty well despite volatility.

I’m in.

VG Jan16'26 $12.5 @ $2.49 | FLR Mar20'26 $45 @ $5.68.

I group both of them together because both of them take part on the energy sector, the first one as a LNG (Liquefied Natural Gas) provider & the second focused on construction, mostly for energetic or commodities infrastructures but no only as it also takes part on advanced technologies & manufacturing, nuclear & wastes management… Pretty important theme in the U.S. at the moment.

I shared my view on the energy sector some months ago & on fossil fuels, nothing changed since and I still believe very hardly in up & mid stream.

The situation got even better when it comes to LNG as demand grew for the resource, with Europe & Saudi Arabia committing to buy much more from the U.S & the dollar weakening will give many more opportunities around the world, while we all know by now the focus Trump’s administration has on re industrialising the U.S. Both also have a very interesting price action.

Venture Global had its IPO some months ago and was beaten down after it, as it often happens, before finally finding a bottom & slowly bouncing from there, breaking out and now retesting its base. Perfect entry point.

Fluor is a much older stock with comparable price action. I bought a smaller position on this one as the retest is not perfect & I intend to grow the position if we go lower, with a full position to build if we touch $35 or so.

Like Novo Nordisk & the healthcare sector, the energy sector is somehow recession proof & both stocks are already beaten down. It is always possible to go lower, but risk is much more interesting with those three names than many others.