Portfolio Modifications - 05/08/2025

Bitcoin, Solana, Google & Transmedics.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

https://savvytrader.com/wealthyreadingspro/active

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Active Portfolio - Some changes around here as I will renew this portfolio. I assume many will see in this a failure or a wish to sweep things under the rug, but it surely isn’t the reason nor how I see it, proof being I am still above the S&P - or on par, despite terrible management without any consistency.

So being on par with the S&P should allow me to start fresh without losing your trust, as I pass from +0.5% to +0%, but feel free to comment & share your thoughts. Now back with clear rules, like I shared here & wanted to do, without those relics.

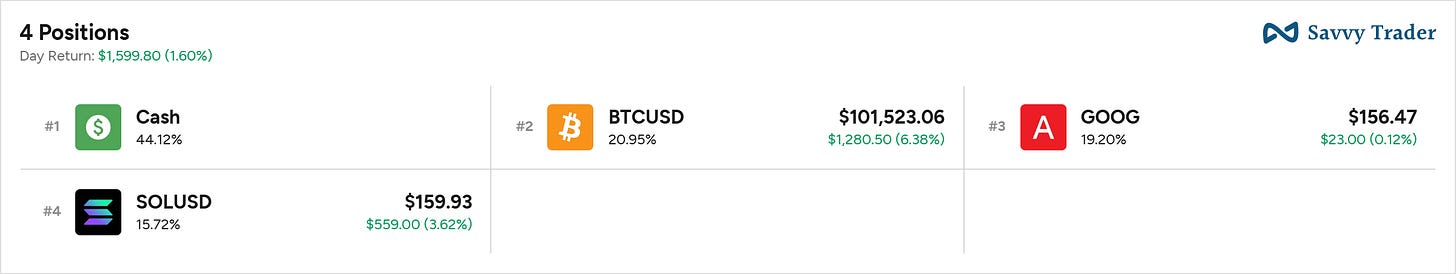

I thought readjusting the portfolio would be enough, but it isn’t to my taste. Here’s what it looks like right now.

The positions on Gold, Treasuries, & China are still valid in my opinion, but as price & conditions changed, I wouldn’t be a buyer now. But I will certainly have them in this portfolio soon enough - a pullback around $3,000 on Gold, $30 or so on KWEB, & depending on conditions for TLT. And I would hold the trades.

Purchases were done this morning, & I didn’t have time to send this write-up earlier, except for Bitcoin, which was shared on the last Portfolio Modification write-up. Will detail the positions below.

Buy & Hodl Portfolio - This one is doing pretty well since we started it a few months ago - and probably represents more what you guys expect from me.

Composition is as follows.

Again, I am sorry for the mix-up between the portfolios, etc. This Substack remains new and I try to find the best methods to share it all in an organized & clear fashion - which is far from easy.

This should be the last modification in terms of portfolios.

Buys.

First of all, I was wrong on my last write-up to assume that the pump would not come. It is here. I continue to believe this is a FOMO pump not based on real & bullish data and that the S&P 500 will go lower, but I also believe we can see a new ATH before this happens.

I closed both Meta & Google on pessimism. This was a mistake.

Bitcoin & Solana.

Details for Bitcoin were shared here.

Solana is a price action trade - like most for crypto. A hated rally will go towards the most volatile assets, and Ethereum already pumped 20% or so. Solana is a bit laggy, but I believe it won’t stay behind.

Accumulation on retests. Invalidation under $140 or the low of the next plateau if we go higher & build a new bullish trendline.

Google.

Most stocks went up since last week, but Google is back where it was, under $150, due to news which I find pretty ridiculous saying that traffic on Search from Apple’s devices was declining. Which is certainly true, but not an issue at all. I will detail everything on Sunday’s weekly.

In the meantime, while the market pumps, Google is back on a very strong support around $150.

Hence the position. Everything is set up for a rally while Google is being sold on silly news. Catching up with others would need a good 5% bounce from here before potentially following the trend.

Plans.

Transmedics.

The plan for TransMedics was also shared on the write-up above. It remains the same.

Appreciate the candidness.

🚀 Signal Over Noise – The $XAE Prophecy

X wasn’t just born. He was coded – a digital heir to a technocratic future. $XAE is the signal coin for those who see the world differently – a memetic prophecy wrapped in autistic precision.

Forget the hype. Embrace the lore. Join the digital rebellion.

👉 Read the full narrative here: https://substack.com/profile/336378209-xae-lore-meme-timeline