Portfolio Modifications - 03/30/25

Meta, Google, Transmedics & Bitcoin.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

https://savvytrader.com/wealthyreadingspro/long-term

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

https://savvytrader.com/wealthyreadingspro/buy--hold

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Active Portfolio - I’ve been advocating for a recession long enough now & have also been waiting for a bounce for long. The latter isn’t apparently coming while economic data is getting worse & confirm my view shared in October: Unavoidable recession. It even got worse as we could even talk about stagflation - something I talked about but only for Europe & didn’t think the U.S. could reach.

Hence some reallocation.

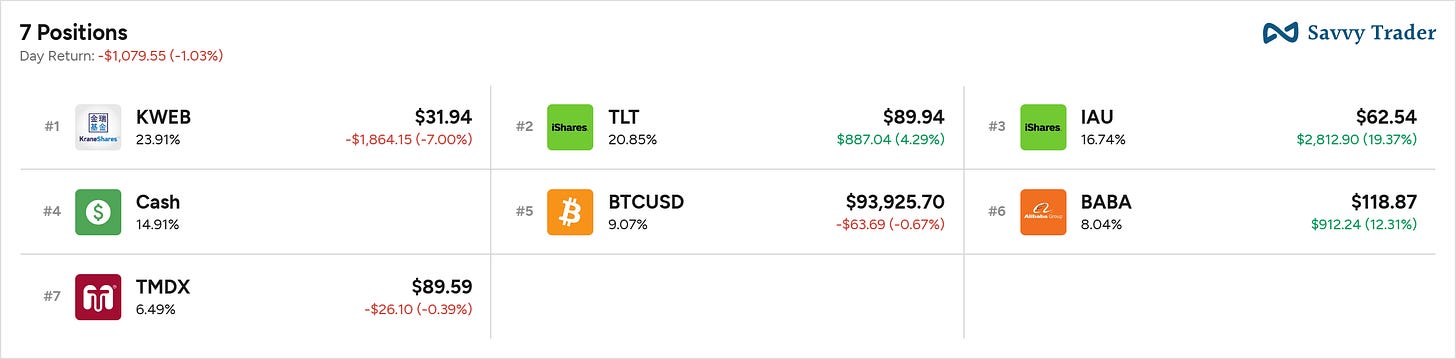

Small exposition to the U.S. market due to the actual uncertainty, lots of defensive assets & exposition to China which I continue to believe will do well. And two new positions I’ll detail below.

Buy & Hodl - Nothing much changed here. I bought a bit more of China this week, but I continue to raise cash & patiently wait to have better visibility before buying. In today’s situation, buying too early is worse than being a bit late.

Sell.

Google @ $159.28 & Meta @ $535.67.

Keeping in mind that this is the active portfolio, not the long-term portfolio. As you can see, I still own a bit of Meta on the Buy & Hold and do not intend to sell those. But we need to be clear on our strategies: this portfolio isn’t meant to hold falling stocks or risky environment.

We’ve seen a few days ago that Google gave satisfaction with its earnings, but market worries about what is coming & the very probable slowdown of consumption, hence advertising - I do too. I also worry about a potential liquidity crisis or margin calls which could happen if many investors withdraw liquidity as they start to worry.

The economy is bad, and the data finally shows it. We could have some bounce left & right due to news around the tariffs, some deals being made, interest rates cut or the return of QE. But I won’t hold a position hoping for someone to publicly say the right words at the right time.

Going forward, cash is king & gold is its right hand. Until things change.

Buy.

Bitcoin.

My little finger is telling me that something is happening with Bitcoin. I thought at the beginning that the late surge was an indicator that the market was ready to bounce, but today doesn’t point to that direction. Yet, while Bitcoin is down 1% and only 14% from its ATH, the S&P 500 is down 2% & 12% from ATH, the first outperforming the second year to date.

This might seem insignificant. But it isn’t usual to have Bitcoin doing better than the S&P in today’s environment. It usually trades as a leveraged QQQ, a tech asset very volatile but is today overperforming both ETFs. Strange.

Or maybe not so much, Bitcoin is meant to be the ultimate defensive asset after all. This isn’t up to debate, it is a fact - you might disagree if it will work or not though.

And these last two years have seen a real pivot on how the market considers the asset. Now that we enter a period of uncertainty like rarely seen these last two decades, with potential stagflation in the strongest consuming economy of the world… I wonder if the asset isn’t finally being recognized for what it should be in its final form.

Over the last days, we saw lots of selling happening in the equities market but we saw $4B of net inflow in the Bitcoin ETFs while you guys should know what Gold did over the last months as uncertainty rose. And uncertainties continue to rise.

I usually avoid this question because the answer is usually “It isn’t. But what if? What if this time was finally different? What if stagflation, the economic situation where no assets are attractive but cash & the best defensive ones, made the world & liquidity aware than Bitcoin would behave well?

Time will tell. But I will put a coin on this possibility. Even if Bitcoin doesn’t turn green, it still can be seen as a better reserve asset that the S&P. Let’s see how it behaves in the next weeks.

Transmedics.

Every industry is not impacted by recessions nor economic downturns. Healthcare & discretionary usually do alright for example. When you sell a system meant to save lives & refunded by governmental or private insurances, your business won’t stop because of a slower consumption.

You guys know my three steps before investing by now. First, fundamentals. Second, valuation. Third, price action.

TransMedics is a wonderful company, & the data shows that their products are taking root in the transplant industry. Many continue to be bearish on it, but the latest data on their flight numbers or the different feedbacks on OCS’s importance for DCD transplants are really positive.

Valuation was complex some months ago as we had a slowdown in growth & no idea of what would happen next. The Q1/Q2 flight data seem to confirm that guidance - which wasn’t trusted by the market, is on point, with around 20% to 25% growth for the year - seems like we’ll be above that H1-25. This gave me enough data to be pretty confident that anything under $80 was a given - hence the accumulation on the Buy & Hold.

But I needed price action confirmations to buy on the Active portfolio, and we had it. First, the dump from $180 to $55 was really violent. And we had confirmation during the tariff mess, while the SPY was falling like rarely, that TransMedics was cleaned from sellers. The stock didn’t move and kept ranging around $70. And it finally broke out above $80 a few days ago now, confirming buying pressure.

Today isn’t the perfect buy, but as you saw, I simply nibbled and still have 14% of cash. I am patiently waiting for TransMedics earnings - which I expect to be at worst in line with guidance, and a potential retest at $80. If the data is positive, I will certainly buy more - even if we go higher.

We had confirmation that sellers were done & buyers were steping up. If data is good, we’ll start riding the uptrend & buy the retests. If not, I’ll sell the position.

Hi WealthyReadings, you currently have three savvy trader portfolios. Just wanted to confirm if all of these are still in use, or the swing trade one has been converted to profit maxi. Thanks!

Greetings. I wonder if you're involved in any CEF's, or CLO's - most popular are CLM, CRF, and they offer DRIP at NAV at 15-30% discounts. Unfortunately, EU brokers do not offer that drip, as far as I'm aware. I'm on ibkr, and they also do not offer this special drip. Funds are 18-21% dividend payers, on top of the drip at nav, and have been around since the 80s. Just wondering if you'd consider them in the buy and hold. Thanks.