Nvidia Q2-25 | Earning & Call

The beggining of the end?

If you guys are interested, you’ll have 15% discount on FiscalAI subscriptions through my referral link. FiscalAI is the tool used for KPIs on all my write-ups, really powerful, valuable data & great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Nvidia's investment thesis is here.

Business.

I’ll start by saying that my title is total clickbait. This quarter is excellent, as usual, has lots of bullish indications on compute demand and gives me some confirmations for other names I am bullish on.

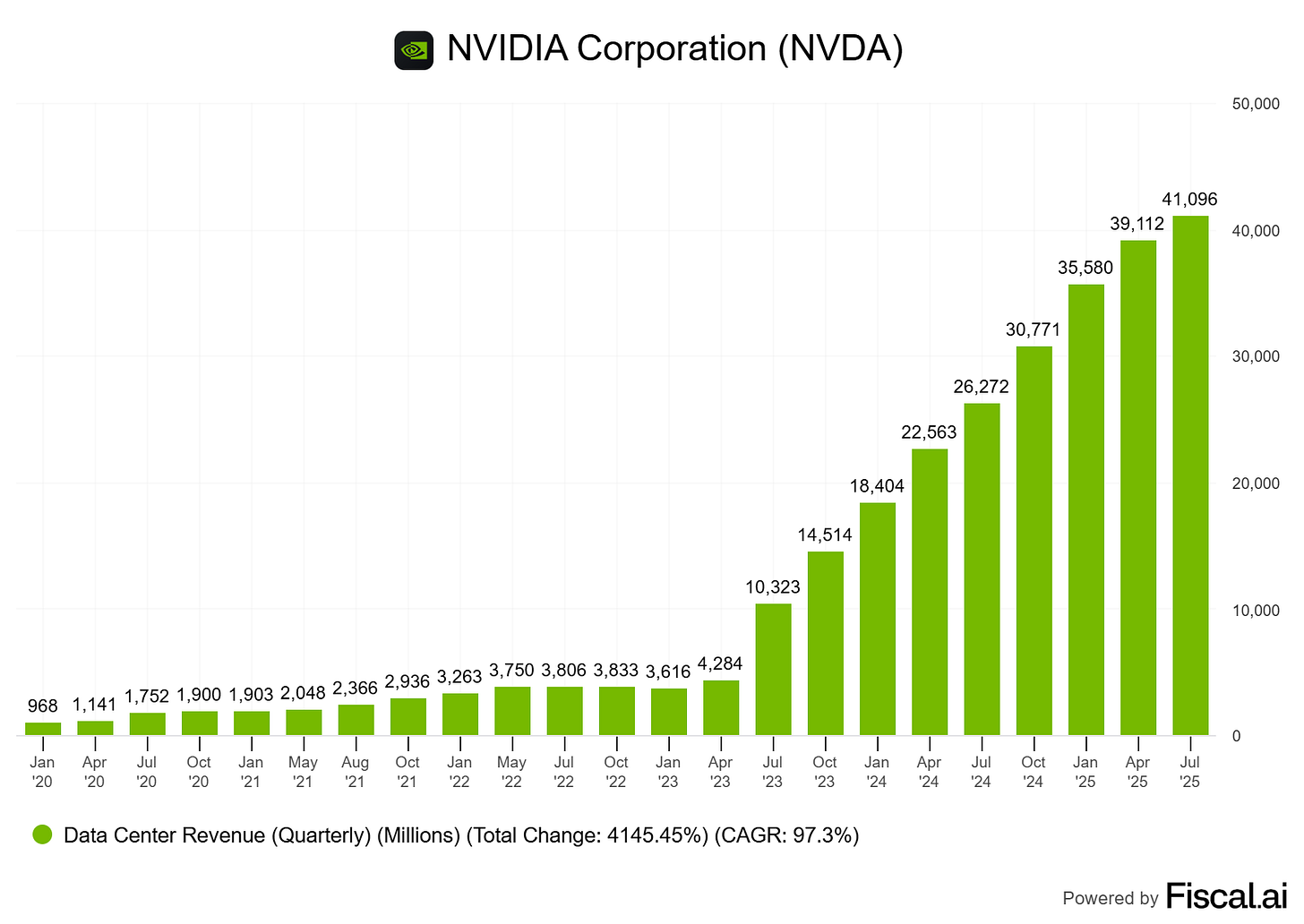

Datacenter.

Starting with the most important metric: datacenters revenues, as strong as usual, up 5% sequentially and 56.4% YoY due to a constant and strong demand for their new hardware.

NVIDIA's Blackwell platform reached record levels, growing sequentially by 17%. We began production shipments of GB300 in Q2. Our full stack AI solutions for cloud service providers, neoclouds, enterprises, and sovereigns are all contributing to our growth.

There are some concerns - noise really, on social media about a potential weakness as sequential growth is slowing and Nvidia missed analysts’ datacenter revenues by 0.46%, which didn’t happen for years.

To me this is sensationalism reporting, made to earn clicks on fear or to grow the bias of those who want to see the stock fall. I’ll address two concerns though.

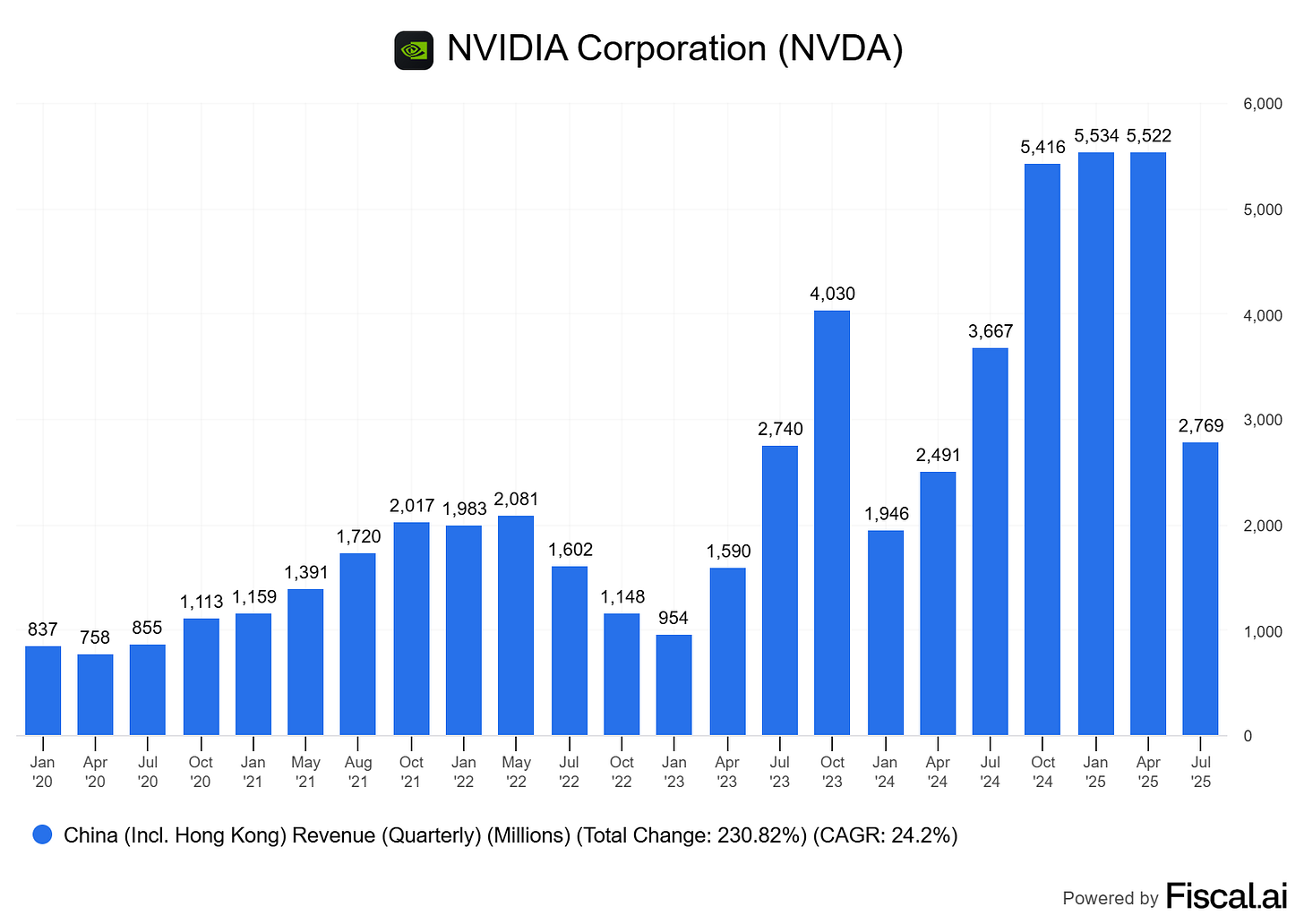

China’s Business.

The first and only reason for a “slower” quarter comes from geopolitics as Nvidia did not sell any H20 for the entire quarter - compared to half of the last quarter with a normal business in the region.

While a select number of our China based customers have received licenses over the past few weeks, we have not shipped any H20 based on those licenses. USG officials have expressed an expectation that the USG will receive 15% of the revenue generated from licensed H20 sales. But to date, the USG has not published a regulation codifying such requirement.

This is due to the U.S. government decision to strengthen export controls months ago. The licenses allowing Nvidia to sell in the region have not been used, meaning there are more negotiations happening between the countries and Nvidia is still being used as leverage. Might take a bit longer to resolve and continue to impact revenues from the region, like it did this quarter.

There are a few more things to say on this, which highlights Nvidia’s dominance, not weakness, despite a 50% sequential decline in revenues from China.

Nvidia generated $4.6B of revenues from its H20 chips in China Q1-25, and $922M from other products. This quarter, without selling any H20, Nvidia generated $2.77B, three times more for “other products” sequentially.

My only explanation is that Chinese companies bought other hardware, lesser one, because they’d still rather buy those than local chips. This is the biggest display of dominance you can find, as China wants - and needs, Nvidia and CUDA.

And China is a massive market.

The China market, I've estimated to be about $50B of opportunity for us this year. If we were able to address it with competitive products, you would expect it to grow, say, 50% per year as as the rest of the world's AI AI market is growing as well. About 50% of the world's AI researchers are in China. The vast majority of the leading open source models are created in China, and so it's fairly important, I think, for the American technology companies to be able to address that market.

We continue to advocate for the US government to approve Blackwell for China. Our products are designed and sold for beneficial commercial use, and every license sale we make will benefit The US economy, The US leadership. In highly competitive markets, we want to win the support of every developer. America's AI technology stack can be the world's standard if we race and compete globally.

I struggle to believe the government would allow Blackwell right now, but they will probably allow less poerful chips as the newest spread in the U.S. We could imagine H200 being sold there now that Blackwell spreads in the west.

For now, nothing happens and Nvidia’s GPUs are held as hostage, but this situation won’t stay true and Nvidia will retrieve access to the Chinese market, the question is for which chips? And therefore for how massive a market?

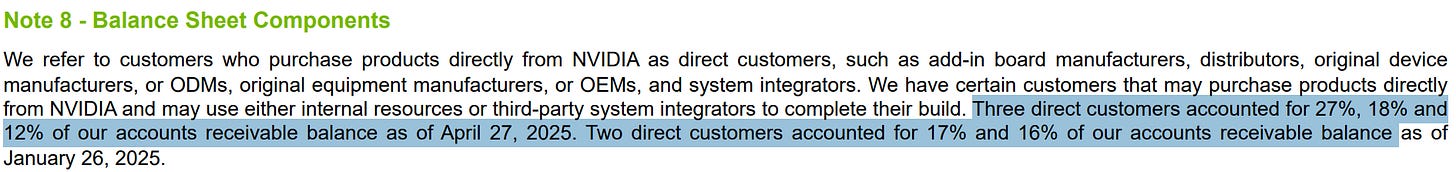

Revenue Concentration.

Second, many on social medias highlighted that 57% of Nvidia’s revenues came from three clients, and saw this as a risk - which is half true.

This has always been true. Nvidia has concentrated revenues because, first, not every company builds massive AI datacenters, only a few do & sell their capacities. Second, Nvidia’s hardware are supply constrained, which means the buyers are those capable of paying the premium which results in a concentrated few, but doesn’t mean global demand is small.

Concentration is an issue when supply is not constrained. A software company relying on two clients is a risk for example.

I illustrated on Twitter that if I can produce 1,000 bottles of water per quarter and sold them in a village in the center of the Sahara once per quarter, the entire supply would be bought by a few households, the richest. But this concentration wouldn’t be a sign of a bad business, just a normal market dynamic.

We tend to forget about logistics when investing, Nvidia doesn’t produce millions of chips per day and it took time for the company to accelerate production.

The current run rate is back at full speed, producing approximately 1,000 racks per week. This output is expected to accelerate even further throughout the third quarter as additional capacity comes online. We expect widespread market availability in the second half of the year.

Global Demand.

As for demand, I don’t think this quarter shows any slowdown and the bears who see it probably had their eyes closed when reading the data. Sequential growth, despite no H20 sold to China, highlights a large local demand due to upgraded performance from Blackwell, worth the investment.

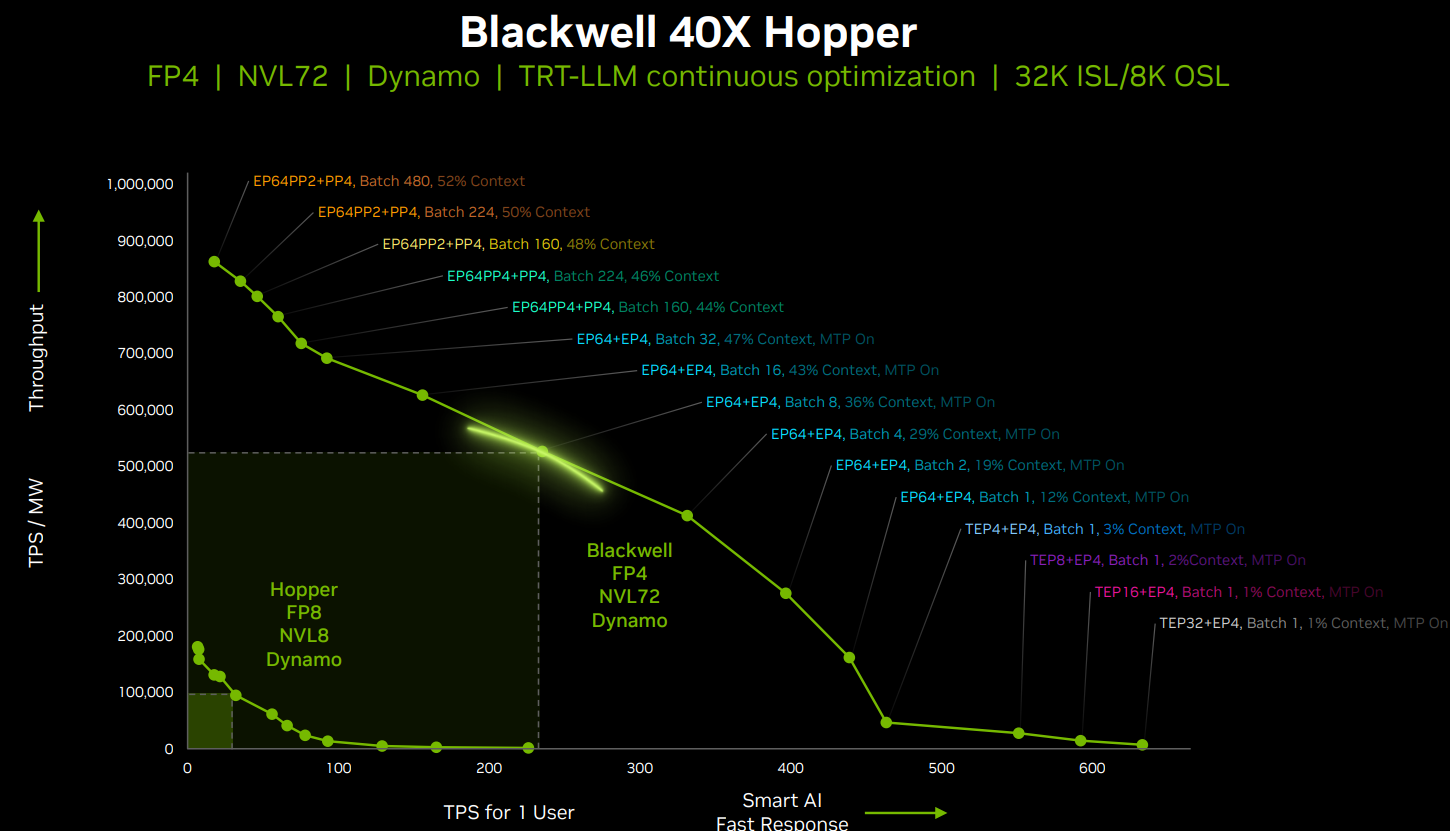

CoreWeave prepares to bring their GB300 instance to market as they are already seeing 10x more inference performance on reasoning models compared to H100. Compared to the previous hopper generation, GB300 and NVL72 AI factories promise a 10 x improvement in token per watt energy efficiency, which translates to revenues as data centers are power limited.

That last sentence is important & I talked about this in my Nebius investment thesis as one of the reason compute will remain limited short term - which is also true for why Nvidia is probably not going to see slowdown in demand.

Compute per unit of energy is the most important metric as long as “datacenters are power limited”. Building more sources take time. meanwhile, the only way to improve compute supply is to upgrade and optimize hardware. This is true as long as the new hardware’s capacities are worth the investment.

As you can see… The difference in TPS per energy unit between blackwell and hopper is just massive, therefore worth the costs. Their new chips are on schedule, and should bring the same kind of improvement according to last year’s presentation.

Rubin remains on schedule for volume production next year.

So I wouldn’t worry for Nvidia’s datacenter branch. Demand is strong locally, stronger even with China limited by geopolitics, their hardware is worth investing and compute demand isn’t slowing and requires hardware improvements as datacenters expansion will take years, as seen in Nebius Investment Thesis.

Jensen has really high expectations for its business - believe them or not.

We expect annual AI infrastructure investments to continue growing driven by the several factors, reasoning agentic AI requiring orders of magnitude more training and inference compute, global build outs for sovereign AI, enterprise AI adoption, and the arrival of physical AI and robotics.

Adoption of NVIDIA's robotics full stack platform is growing at rapid rate. Robotic applications require exponentially more compute on the device and in infrastructure representing a significant long term demand driver for our data center platform.

We see $3B $4B in AI infrastructure spend in the by the end of the decade.

But he has reasons to. Even if the numbers might not be accurate, every sign points to this acceleration.

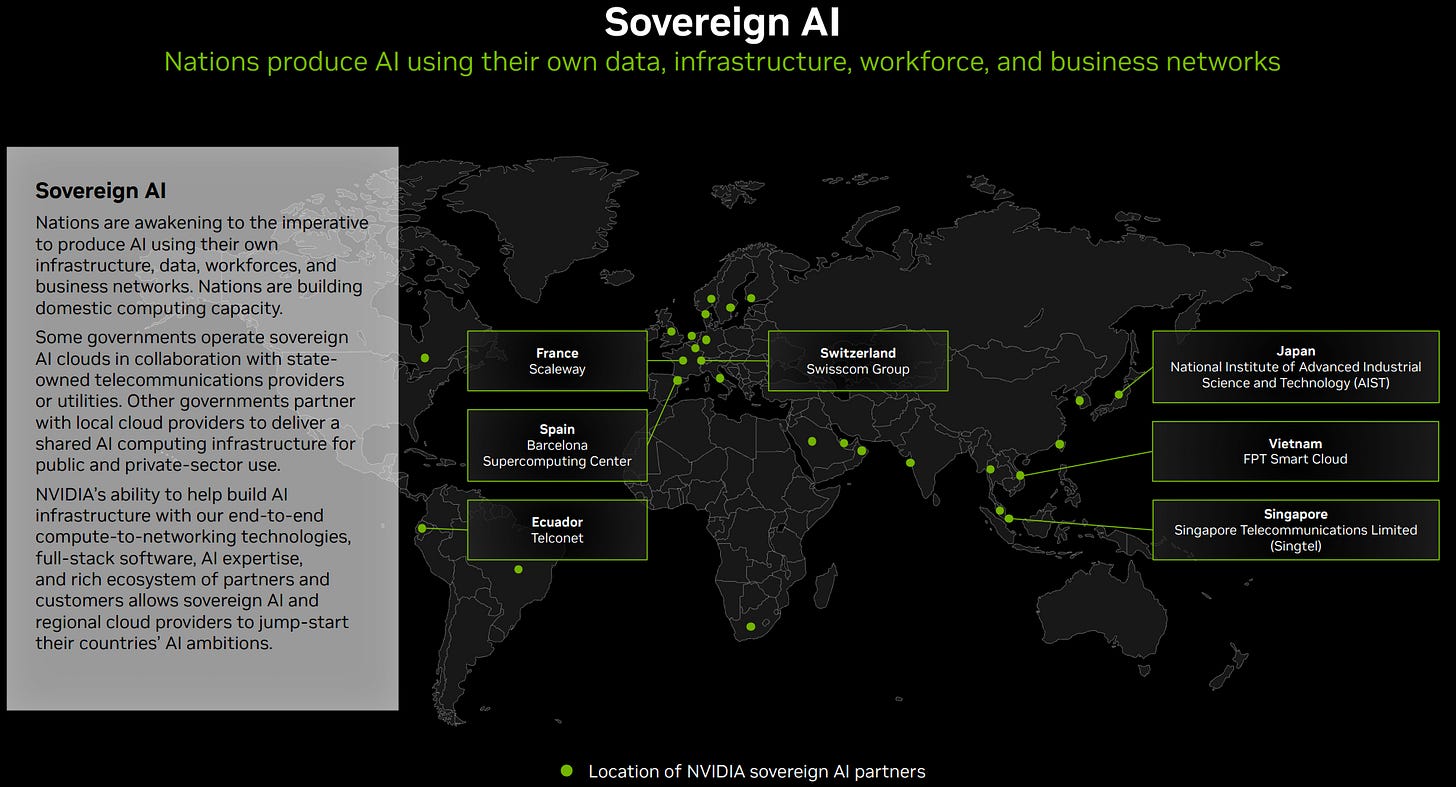

Sovereign Datacenters.

The concept is pretty simple: Countries want to rely on controlled datacenters for their AI models, as they are supposed to treat sensitive data and do not want them to be treated by Google Cloud, Amazon or any other foreign providers - which is ironic considering that most do today.

Sovereign AI is on the rise as the nation's ability to develop its own AI using domestic infrastructure, data, and talent presents a significant opportunity for NVIDIA, which is at the forefront of landmark initiatives across the UK and Europe. The European Union plans to invest €20 billion to establish 20 AI factories across France, Germany, Italy, and Spain, including five gigafactories to increase its AI compute infrastructure tenfold.

If you follow me since some time, you’d know that I am always skeptical of Europe’s capacity to… Make anything work, so AI in all its complexity… I struggle to believe it, but one thing I know about Europe is that they are capable of spending.

The intention is the right one, countries should have locally controlled datacenters. I doubt they all have the capacities to do so - in term of talent, energy and competitivity, but they certainly will try to, and spend for it.

It will certainly result like it did for cloud services, with a few U.S. tech companies with a quasi monopoly. But they’ll spend.

Networking.

I will speak a bit more about networking as I finished writing my Astera Labs thesis, which I’ll send next week, and some bullish comments were made by Jensen.

You’ll learn everything on the write up but in a few words, networking is the new focus to improve compute of actual hardware further.

Networking delivered record revenue of $7.3B and escalating demands of AI compute clusters necessitate high efficiency and low latency networking. This represents a 46% sequential and 98% year on year increase with strong demand across Spectrum X Ethernet, InfiniBand, and NVLink.

The world's fastest switch, NVLink, with 14 x the bandwidth of PCIe Gen five delivered strong growth as customers deployed Brace Blackwell NVLink Rack Scale systems. The positive reception to NVLink Fusion, which allows semi custom AI infrastructure, has been widespread.

The said “semi custom AI infrastructure” can include Astera’s Scorpio P-Series and if demand for this kind of technology grows, demand for Astera’s hardware also will.

Nebius Laïus.

I wanted to add a few words on Nebius as Jensen shared that he also believed one of the core beliefs required to invest in it: that open source AI models are important for the industry and will be fragmented, and that enterprises - Nebius’ business targets, will benefit from it.

They're link great language models, and it and it's it's really fueled the adoption of AI in enterprises around the world because enterprises wanna build their own custom proprietary software software stacks. And so open open source model is really important for enterprise. It's really important for SaaS who also would like to build proprietary systems.

This isn’t bullish Nebius per se, but it means important individuals in the ecosystem has comparable beliefs than the ones Nebius’ business model is built on.

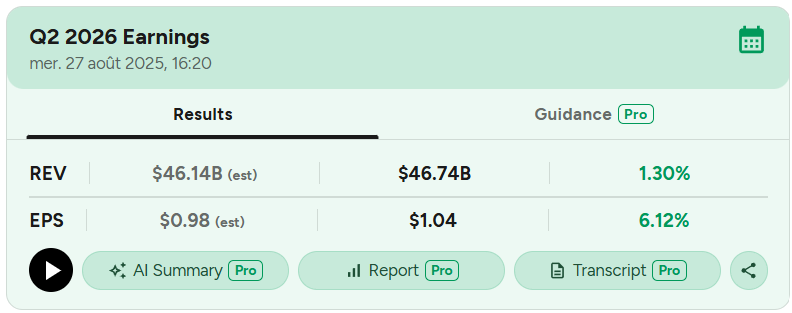

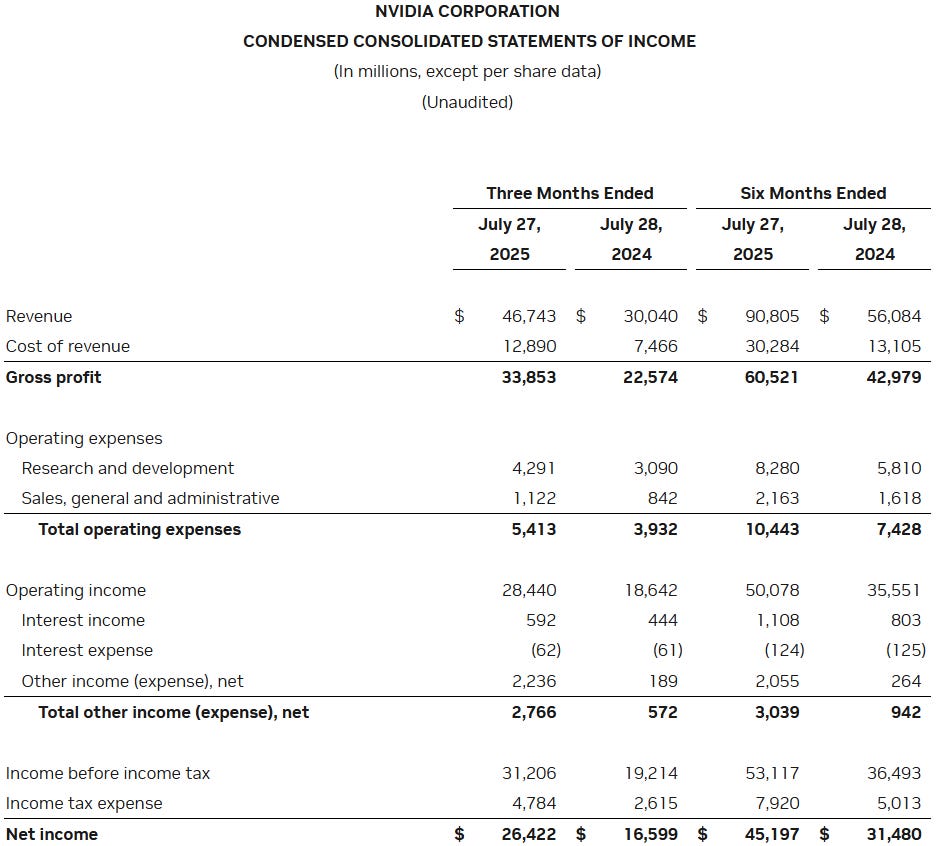

Financials.

There is no need to spend too long here.

A 61.9% YoY growth for the semester, with 66.6% gross margins, a logical growth of R&D spending for a “small” dollar amount compared to Nvidia’s revenues, 49.8% of net margin and therefore a massive cash generation.

$10B returned to shareholders & a new $60B buyback program pushing their buying power to $74.7B which represent… Less than two months of net income. Some said it was bad capital allocation as buying back stocks at all time high is not optimal… It’s not like they have a choice though as they would never have reduced shares without buying their ATH… Rich people problems.

And… What should they use their cash for?

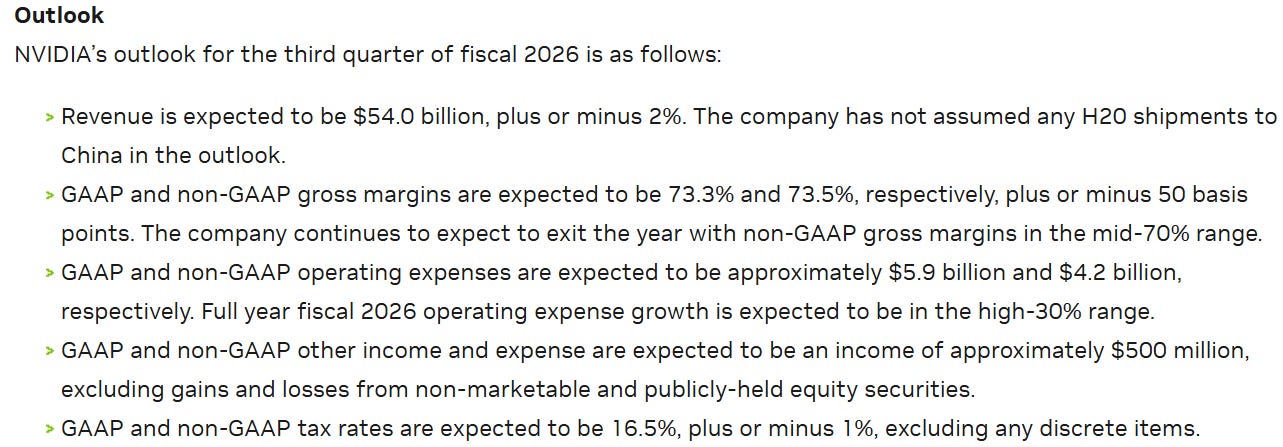

Guidance.

As strong as usual.

A 17.4% sequential growth and 54.3% YoY growth without any H20 shipment. I repeat, WITHOUT ANY H20 SHIPMENT. And bears talk about a slowing demand?

We have not included H20 in our Q3 outlook as we continue to work through geopolitical issues. If geopolitical issues reside, we should ship $2B to $5B in H20 revenue in Q3.

So we could be talking up to $59B of revenues for a 28.2% and 68.5% sequential and YoY growth respectively.

Investment Execution.

I’m not sure I need to write a long conclusion… Need and demand for compute is not slowing and is still supply constrained, for chips, for infrastructures, for energy… This pressure will continue to push companies to invest in better hardware to bypass other constraints. As long as demand for compute is growing, demand for Nvidia’s new hardwares will. And every sign points to growth with many new AI applications.

I still don’t see any bearish data… But I have no doubts that cyclicality will eventually kick in and hurt Nvidia’s stock. AI is here to stay and when it happens, it will give us opportunities.

In term of valuation, it continues to be hard to deal with Nvidia. Many, me included, use conservative assumptions as we struggle to see CapEx growth continue decades. But the AI revolution is not slowing in the U.S. and China didn’t really start it as they don’t have access to Nvidia’s latest chips. Both combined could yield a large growth for years, assuming a continuous demand for more compute - once more. No one has a view on compute ceiling, so assumptions have a large range…

This model assumes a 45% & 30% CAGR growth until FY26 & FY29 respectively, 50% net margins, 1% return to shareholders and a P/S & P/E at x45 & x12.5 respectively.

This model is not conservative, not bullish, it is inline with analysts assumptions. It is probably good enough as long as compute demand ceiling isn’t met, and as long as energy supply and infrastructures are constrained, pushing hyperscalers & neoclouds to more optimized hardware - Blackwell now and Rubin for the next years.

Assuming those conditions remain true for the next two years, this model should hold as multiples remain deserved. But the slightest sign of compute demand slowing will hurt Nvidia big time. Big time.

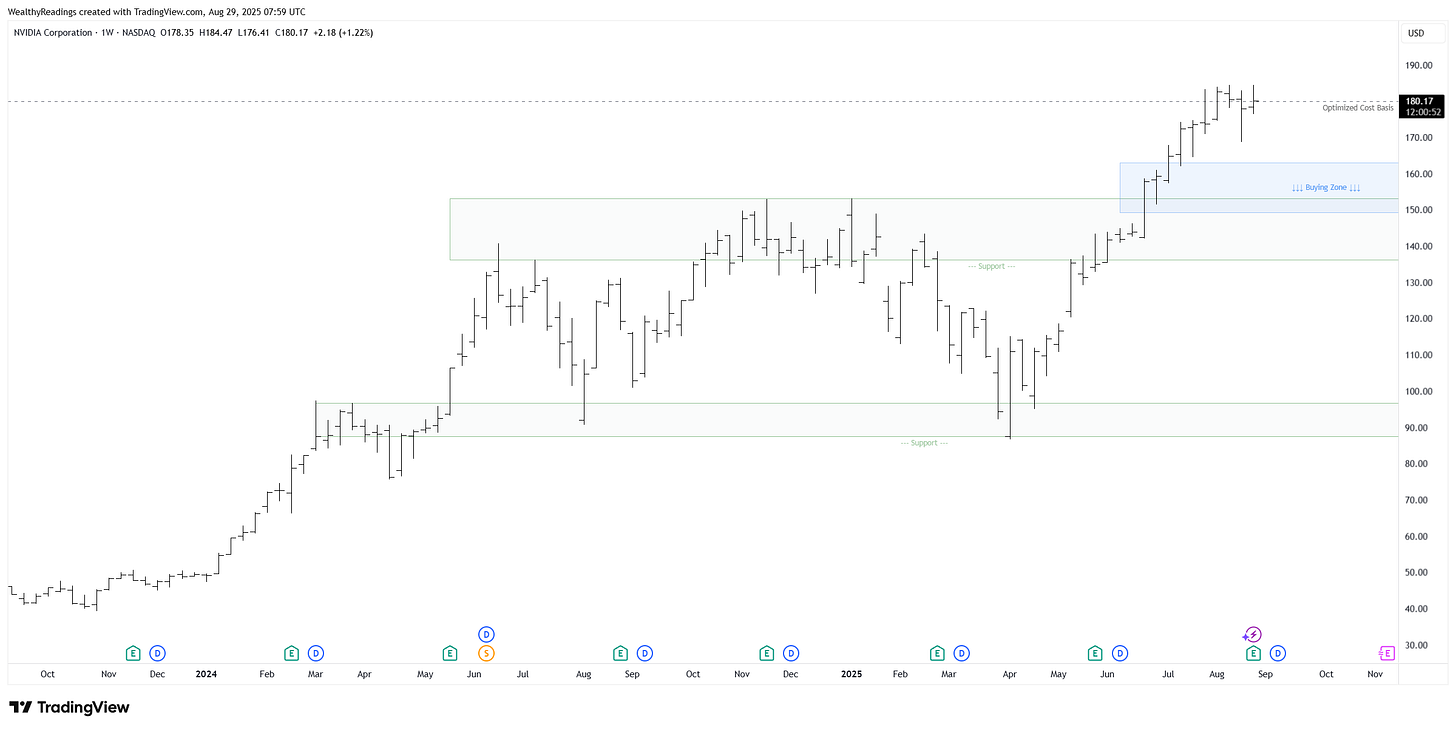

In term of price action, we had a new ATH few weeks ago and any retest seems to be a buying opportunity, depending on your beliefs on compute demand, investment timeframe and risk tolerance.

I probably won’t be a buyer of this retest as seeing Nvidia around $160 without signs of lower compute demand would bring stocks like Nebius or Astera to interesting buying targets, and I’d prefer those higher risks/reward stocks in today’s market.

But Nvidia remains one of the best stocks on the market & most important company of the world, and any long term investor holding shares should hold onto them to my opinion. I see no reasons to close that position and many reasons to grow it.

Great summary! 🙏