Weekly Recap | September - W4

Watchlist Update, Rate Cuts, Market Situation Overview, PayPal Conference & Partnerships, Nebius Funding & Avride, Alibaba's Dominance.

I joined FiscalAI affiliate program this week and will regularly share my referal link for you guys to have a 15% reduction on all subscription plans.

https://fiscal.ai/?via=wealthyreadings

FiscalAI is the tool I use on my write-ups for any KPIs & honestly the best platform on the market to follow companies. If you’re interested, feel free to use my link!

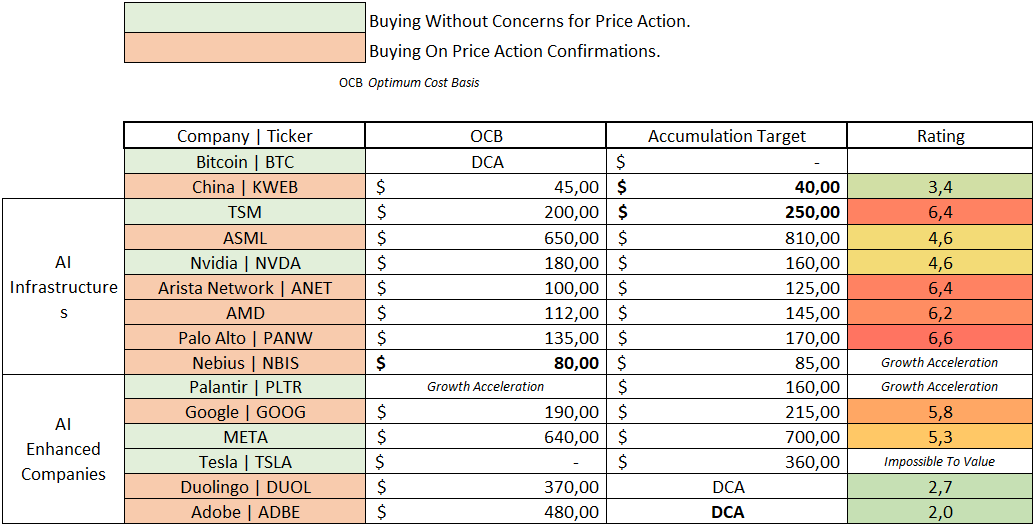

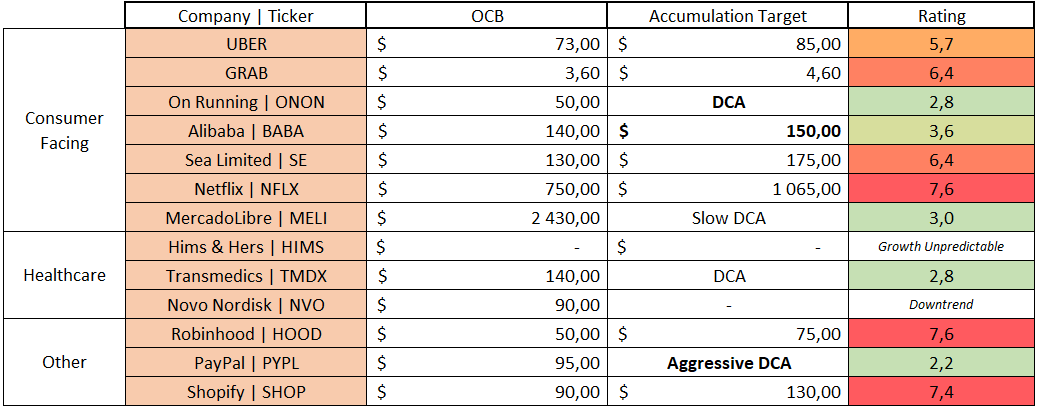

Weekly Buying List Update.

Here is my watchlist & buying plan. Reaching those prices does not mean I always pull the trigger; those are only my view of valuation & price action today. I only pull the triggers on the ones I believe to be the best liquidity attribution at the moment - purchases are shared on my Savvy B&H portfolio.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Optimized Cost Basis (OCB) - optimum average price for a long term position.

Accumulation Target - buying target based on price action, to average up.

Rating - Buy < 3.5 < Hold < 7 < Trim.

“(Slow) DCA” - trading at proper conditions to open a position or accumulate.

Bold cells are updates compared to last week.

Macro.

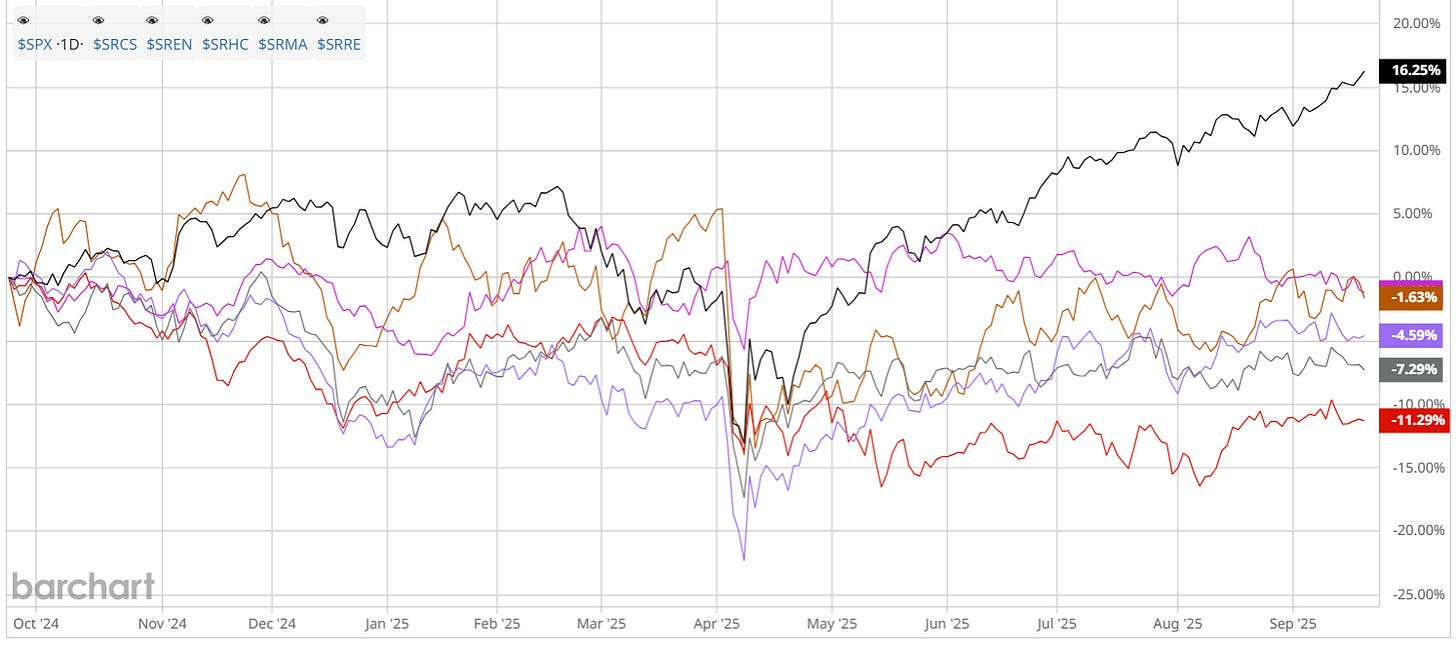

Without surprises, the FED cut rates by 25bps and the market didn’t dislike it, as many expected while I was doubtful. I remain cautious as we still have bearish divergence on the S&P 500 and haven’t had a real breather for more than 5 months.

As I shared in my last portfolio modification, what matters here is cash management. I stick with 20% of my total portfolio in cash and will be ready to buy aggressively when the breather comes, and continue to invest every penny above 20% as I cannot time the market perfectly and need to accept that I might be wrong.

Personal Thoughts.

My view of the market remains the same since long: a blow-off top into a U.S. equities short bear market, and I continue to believe this will happen by 2026 at the latest, which means the blow-off top is yet to come, with its usual massive returns.

Today, 5 sectors are underperforming the S&P with negative yearly results: Healthcare, Real Estate, Materials, Energy, and Consumer Staples. And we have two paths forward short term, in terms of investing:

Remain aggressive and play momentum on unprofitable companies to maximize returns during a potential euphoric period, accepting that we’ll need to time the market perfectly not to lose 90% of our capital.

Shop within underperforming sectors, which will require mental strength as it probably means underperforming most until the market finally balances itself, which could take a long time.

I’ve no answers on the perfect timing or method. And I am part of those who believe that returns justify the means, so I will participate - to some extent, in the speculation game. But my focus will remain on healthy & long-term organic returns through great stock picking, not shift toward complete euphoria. I will share some ideas to maximize returns, like my Ethereum narrative, but only with a small portion of my portfolio and within reason.

I won’t compromise the quality of my assets for short-term performance nor fall into pre-revenue stocks hyped by unrealistic narratives like Oklo or quantums, because a moment will come when they’ll fall faster than ever, and I do not want to rely on timing luck/skills to yield returns.

Organic returns are the most important ones to focus on, they are the ones that will build wealth over years, while speculators usually end up blowing themselves up at one point or another. Few will speculate and win, and those are great traders and once again, I am part of those who believe returns justify the means, but this is not what you will find on my Substack. You will find here a focus on healthy and organic growth, with some reasonable speculation to spice it all.

Many will share screenshots of massive returns over short timeframes. But they won’t share their portfolios anymore when the music stops. Meanwhile, I, and hopefully we, will stand strong even then.

So you will hear over the next months about those sectors as they will certainly be the big winners of the next three years or so. The market already started to anticipate the shift and some names are already picking up, which means it is time to move.

Watched Stocks and Portfolio.

I will start with some clarifications, as I was asked yesterday - indirectly, about some differences in my portfolios between Substack and X - notably in my write-up from Friday linked below, as they seem to be different, but aren't.

I want this to be clear: the information is the same everywhere. But presented differently, and I'll explain why.

On X, I usually share my personal portfolio with all my positions - long-term, options, and swings, without differentiation. If I own both calls and shares of a stock, it will be shown as one position.

On Substack, I dissociate portfolios & their performance as I believe it is important to see performance per strategy, and not only have a global performance. This gives you the opportunity to see where the returns are the best, how I manage my aggressivity and to focus on your own picks and strategies based on my data - feel free to tell me if I am wrong here or if you want something different.

Here is the screenshot shared on X, which represents my portfolio at Friday close.

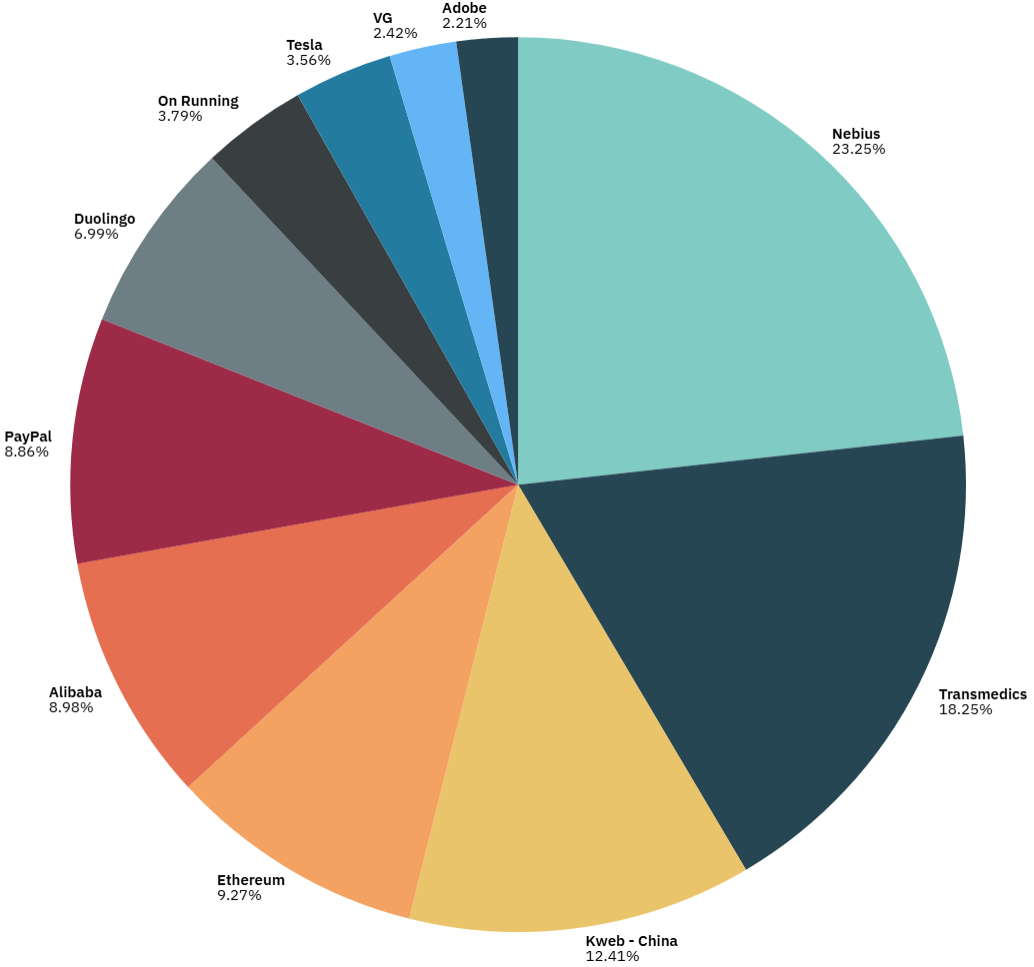

This explains the difference in position sizes. My Nebius position, for example, is very small in my B&H portfolio but is my biggest position in my total portfolio because I own lots of option calls, increasing its total proportion. This is something I haven't shared on Substack and probably should. Having an overview of my global portfolio, all assets included, can be interesting - you tell me.

Secondly, I created my Savvy portfolios in March, but have been investing for longer, so there are some differences in positions or position sizes, as some assets bought in 2024 might not be present in my SavvyTrader or in smaller proportions. This is true for On Running for example, which I own since early 2024 but do not own in my Savvy portfolio. These will smooth out with time.

Thirdly, I never share my Bitcoin position in my personal portfolio because I consider Bitcoin like many consider cash. I DCA every week, and it constitutes a significant portion of my portfolio, a 100% passive investment that I do not intend to trim or comment on; it is an independent investment strategy. The position shared in my B&H portfolio is due to some purchases I do outside of my weekly DCA when I consider that Bitcoin’s price is interesting - real purchases on my personal portfolio.

This should clear any misunderstanding. I always share the same data everywhere. The method is different, and I would listen to your feedback if you’d rather have different methods to share my portfolio/performance. I’ll probably combine both on Substack from today. Share portfolios and performance one by one, followed by my personal portfolio with global positions and performance.

For these things, feedback would be highly appreciated so I know what you prefer and what is most appropriate. It is tough on my shoes to know what most of you expect as some of this data comes from Excel files I maintain, which can rise doubts on their accuracy, and other comes from unmodifiable apps which shouldn’t raise any doubt but have some differences with my real portfolio. So I will let you share your opinion and will try to be more transparent during the next review.

But the data I share is always the same everywhere. Your trust isn’t something I would compromise on, as it is the foundation on which everything here is built.

PayPal Conference & New Partnership.

I shared not long ago that PayPal was very likely going to have a change in narrative sooner than later as it is growing its presence in the AI space with its partnership with Perplexity for example, and a new, pretty massive partnership this week, with a company the market also considered dead: Google.

Alex Chriss was also at a conference this week and shared some very bullish data about the company at large - in my opinion.

I shared that I was being more aggressive on this position; these are the main reasons why, as detailed in my last portfolio modification write-up.

Nebius Funding & Avride is Overlooked.

We talked last week about the Microsoft deal and funraising Nebius started to fund its expansion. Without much surprise, their raise was overfunded with $4.2B on a $3.75B target. Once again, the financing conditions are very advantageous, and the company is only starting its scaling period. More to come.

The market and social media woke up to Nebius’s core business, but not much noise is made about its subsidiaries, notably Avride, which continues to expand its delivery robots, a massive opportunity for the next decade.

In my opinion, this is a much better business than their autonomous vehicle system as this space is a bit crowded with large players like Google and Tesla. While those small delivery robots are largely underestimated; a great high-margin business in time.

Alibaba’s Surge and AI Chips.

China is finally waking up, and I won’t stop telling that it isn’t too late & that this bull run should only be starting, especially for Alibaba, as the bull case remains for the company to become the #1 AI compute and services provider in China.

What I did not have on my bingo card was for Alibaba to also be a hardware provider. Chinese media reported on Wednesday that the company secured a large customer for its AI chips, which would apparently compete with Nvidia’s H20s. I will make the same case as for AMD: many chips can compare with H20, but no chips can compete with Nvidia’s ecosystem - GPUs + CUDA. But I also often made the case that export controls on high-end tech were a mistake with such countries, as it would force them to push innovation further, and China knows how to do this.

Alibaba’s computing power will be used by China Unicom, the country’s second-largest telecommunications company, as part of a big new data center project in China

The Chinese government also shared that it will control GPU imports from Nvidia and potentially forbid them, which means that we might be in a situation where Alibaba also becomes a hardware provider, perhaps one of the biggest in China if it indeed has chips with performance comparable to the H20s.

To be completely accurate, Alibaba doesn’t sell hardware directly but sells compute relying on its hardware, which many companies will rent if they cannot access H20s anymore and scale their own infrastructures.

The situation is still a bit unclear, but the sector is changing, and China is catching up; this cannot be doubted. In my position, this is a triple win: if Chinese companies are indeed catching up on hardware, I will capitalize on it through my KWEB position. If Alibaba were to be the new provider, I would win twice with my KWEB position and my Alibaba shares. And if the Chinese bull market is indeed only starting, with another AI revolution happening in the region, both assets will rocket. As Trump would say.

We’re gonna win so much, you may even get tired of winning.