Uber Q3-25 Detailed Earning Review

Consumers are weak, but not Uber's consumers

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Uber’s bull thesis is here.

Business.

If there is weakness in the Western consumer, it doesn’t show in Uber’s results.

This can be interpreted in many ways. Maybe the consumer isn’t that weak. Maybe Uber is a service people don’t want to compromise on. Maybe the company is so diversified that all consumers always find an option. Or maybe the “two‑speed economy” I talked about many times explains it, as some households still have significant buying power.

I don’t have a definitive answer, but I tend to believe Uber is such a strong, diversified and important part of its users’ lives that even in weaker consumption cycles, it’ll do well.

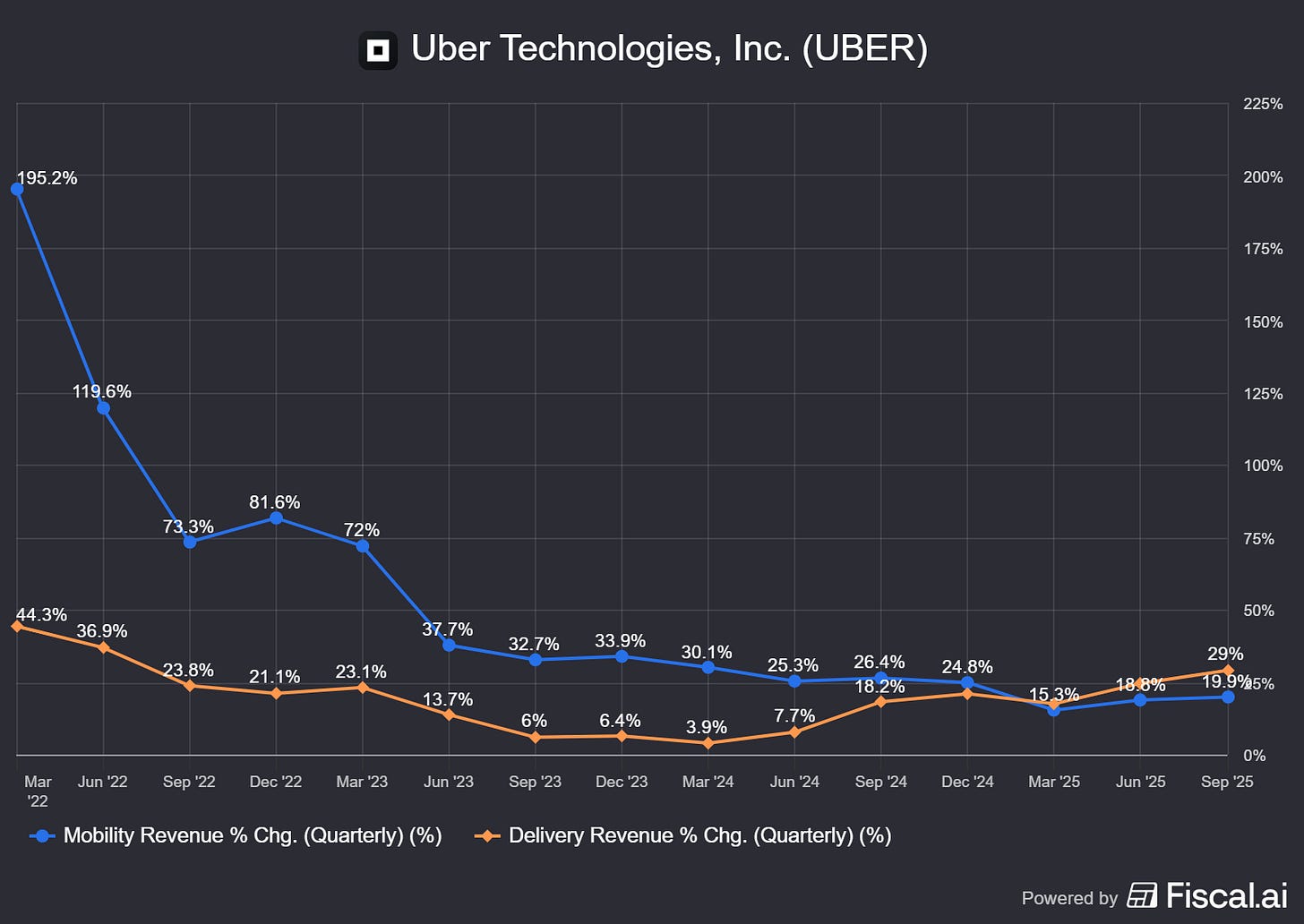

In the meantime, the data is very positive: clear growth acceleration in deliveries and healthy mobility growth, now accelerating for three straight quarters.

This is fueled by both new users and increased usage.

This top-line strength was fueled by record audience and engagement of 17% and 4%, respectively.

In terms of usage, every metric is accelerating. It’s also worth noting that more than 60% of Uber’s delivery business comes from groceries. Both points reinforce my idea that Uber is a diversified business that can thrive in any economy . People will always need to shop or move and Uber often is the easiest option, especially given human natural lazyness.

This quarter showed record gross bookings, users, trips and trips per user per month, with growth accelerating across all metrics.

In fact, we hit a new record over Halloween weekend, this most recent Halloween, with more than 130 million trips across mobility and delivery generating more than $2 billion in gross bookings.

And the potential remains large as most users are still far from their full consumption potential.

For example, 30% of our mobility riders have never tried any Uber Eats offering, and 75% have never tried grocery and retail.

The average cross-platform consumer is spending three times more than kind of monoline consumers.

That’s why management is prioritizing cross‑platform services & working on building habits that encourage use of both apps.

What we have now done, what we are doing now, is to set up specific programs to drive cross-platform behavior. If you are going to work, we will offer you Starbucks on the way to work.

This is the first objective of Uber’s new multi‑year plan. Here are the others.

We’ve defined six strategic areas of focus to guide our next phase.

First, from trip experience to lifetime experience. We’re deepening engagement across our platform, with cross-platform consumers spending three times more and retaining 35% better than single-product users.

Second is building a hybrid future, seamlessly integrating human drivers and autonomous vehicles into a single marketplace, giving us unmatched flexibility and efficiency.

Third, investing in local commerce, expanding rapidly into grocery and retail, now at an approximately $12 billion gross bookings run rate and growing significantly faster than restaurant delivery.

Fourth is multiple gigs. This is broadening earning opportunities for 9.4 million drivers and couriers, including new digital tasks powered by Uber AI Solutions.

Fifth is becoming a growth engine for merchants, helping our over 1.2 million merchant partners drive significant incremental sales through ads, offers, and new demand channels like Uber Direct, as well as new partnerships.

And then finally, generative AI, embedding intelligence across Uber to enhance productivity, optimize our operations, and deliver more personalized consumer experiences.

Plenty of potential left for Uber.

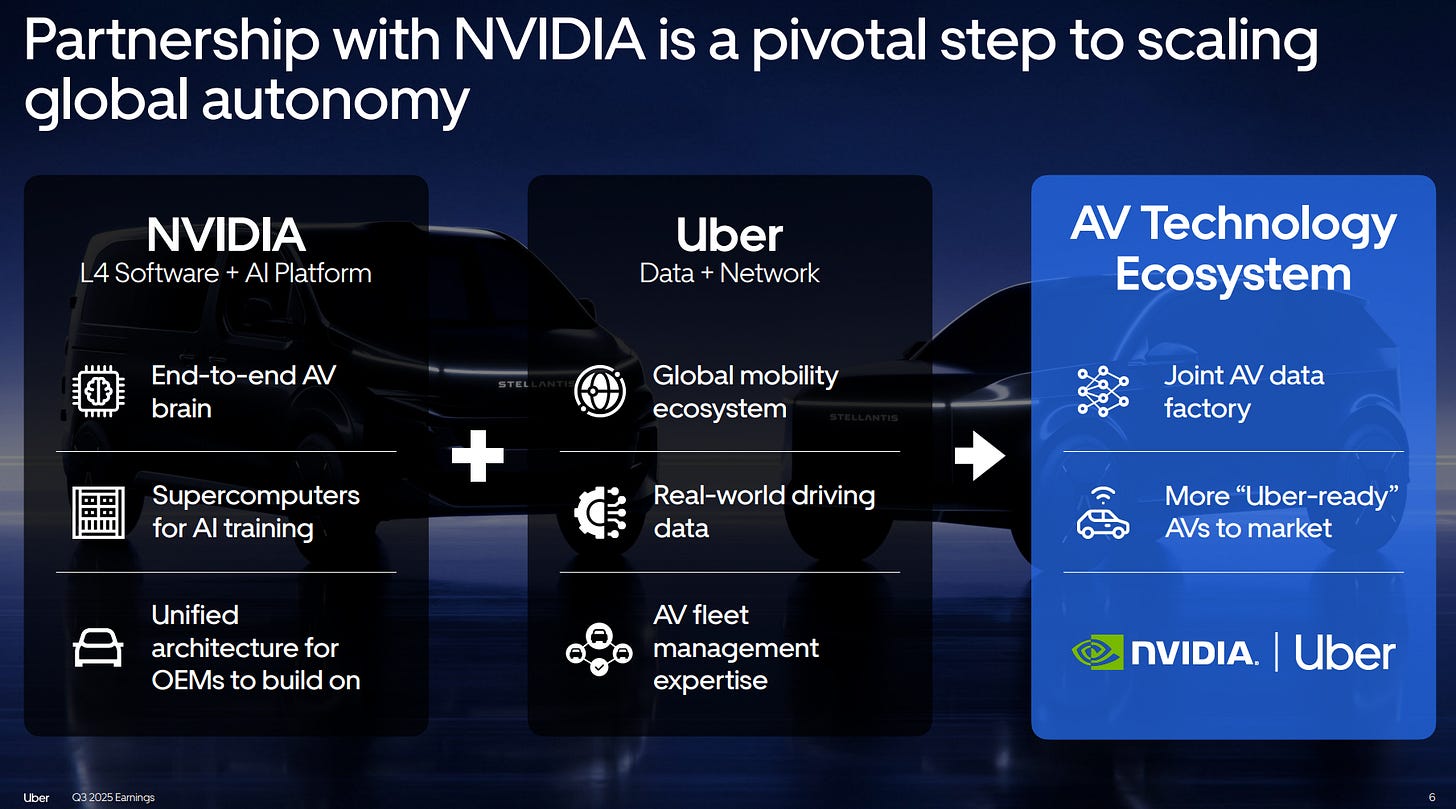

Some more words on autonomous vehicles on which Uber’s strategy is pretty clear: operate its own fleet and accept partners’ fleet within its network. This is the right strategy to my opinion because Uber holds the most important assets: users and distribution. Manufacturer need Uber to monetize their EVs.

Uber already has many partners and continues to add more while developing its own fleet.

We announced the relationship also with Stellantis with an initial 5,000 vehicles that are going to be powered by NVIDIA as well.

The setup is simple: Stellantis manufactures the cars, NVIDIA provides the AI hardware and mode,. Uber operates the fleet within its network.

And obviously, this doesn’t impact other partnership like with Google’s Waymo, with whom everything is going well.

Our partnership with Waymo continues to be excellent from an operational standpoint. Waymo utilization is still very, very high.

Uber’s management shares - or got inspired by, Tesla’s view of the future: networks will be open to anyone who wants to make their EV work.

If you kind of step back and you think about the strategy, a future 10 years from now where every single new car sold is not only L3-ready if it is a personal car, but it is also L4-ready if you want to contribute that car to a ride-sharing platform like ours or fleets might buy those cars as well.

On deliveries, Uber also announced a partnership with Toast, one of Olo’s competitor for those who were there before its acquisition.Toast is a restaurant point‑of‑sale, a software service which allows managers to operate their restaurants, deployed in ~140,000 locations.

What you will see in terms of Toast is that a restaurant that is Toast-enabled essentially will be automatically enabled for Eats as well. The integration between Toast and Eats is going to be seamless. Menu uploads will be seamless. Picture uploads will be seamless.

This will make it easier for restaurants to join Uber’s network with a single point of setup, and it will expand Eats’ inventory.

Financials.

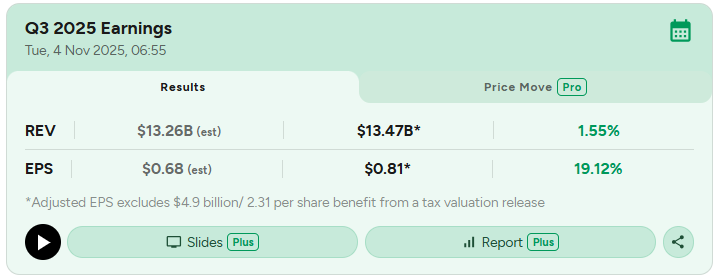

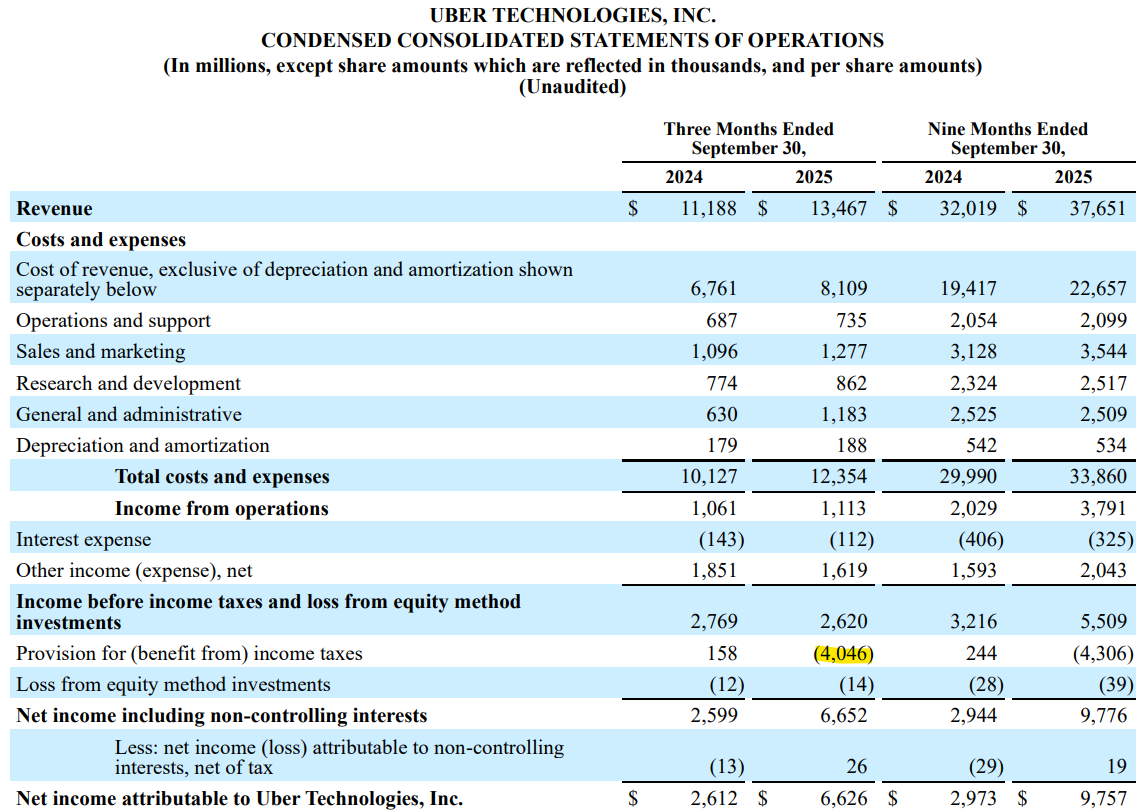

Revenues are up 17.6% YTD with growth accelerating sequentially for the third quarter in a row. Margins remain stable, excluding the tax benefit of the quarter.

In term of cash, Uber holds $3.1B in net debt and generated $2.23B in FCF this quarter.

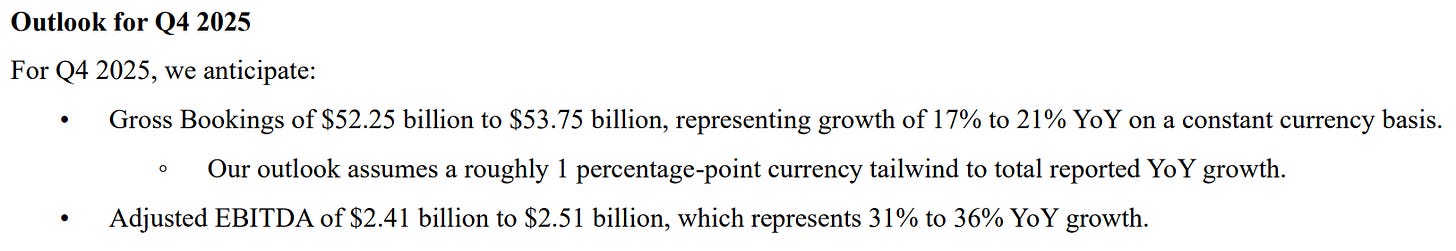

Guidance.

Outlook’s is more of the same, or as management would say, rinse and repeat.

We’re expecting more of the same strong performance in Q4, with another quarter of high teens gross bookings growth and low to mid-30s EBITDA growth.

Investment Execution.

This was a strong quarter for Uber, showcasing both the opportunity and resilience of the platform. Uber has become an essential part of its users’ lives, something they won’t easily give up on while management continues to expand verticals to deepen engagement and usage.

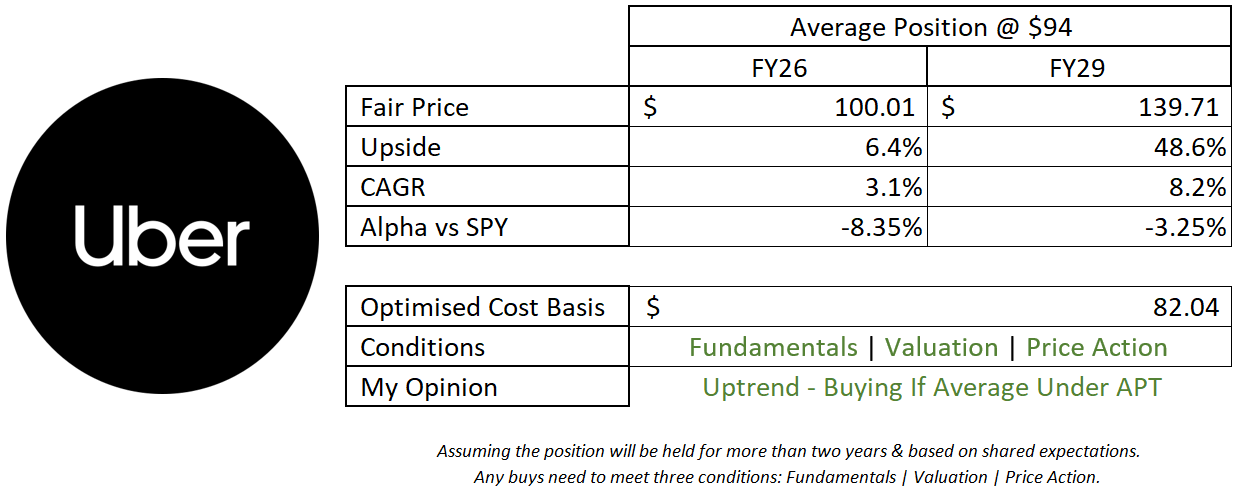

This model assumes a 16% and 12% CAGR growth until FY26 and FY29, respectively, 15% net margins, no dilution, and P/S & P/E at respectively 4x & 25x.

In my view, nothing has changed: Uber remains an excellent company, trading slightly above fair value, not much higher due to the market’s fear is that Tesla could disrupt its business model, but I don’t see that happening soon. Tesla needs to build its EV empire first, secure regulatory approval and then compete for users which Uber already has locked in. But the market will continue to trade with this risk in mind.

Price action is also very healthy, with a clear breakout, retest, and consolidation. The top of the previous range and its daily 21 as fresh supports.

Perfect for those looking to accumulate and sit on their hands. There’s nothing much else to do with this name.