Transmedics Q1-25 | Earning & Call

Above expectations.

If you do not know about TransMedics, everything you need will be found here.

“We're there to be the next standard of care for organ transplant in the long term.”

Overview.

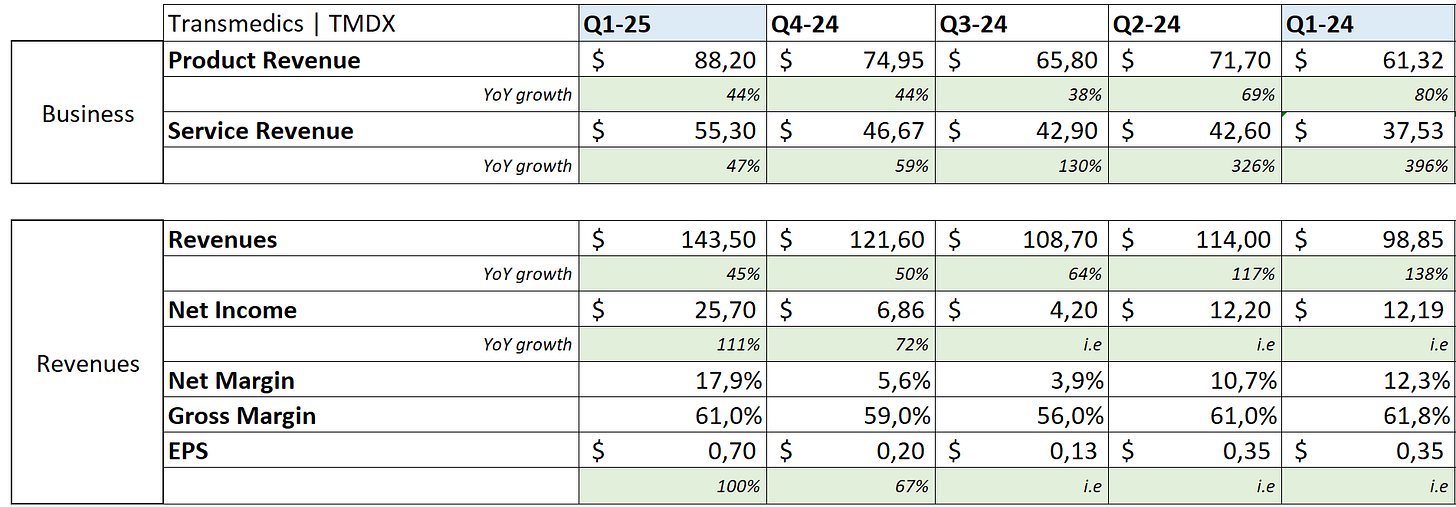

Revenue. $123.39M | $143.54M | 16.33% beat

EPS. $0.24 | $0.70 | 191.67% beat

Business.

Both service & products are growing well & proving that the bull case remains strong, despite some volatility & negativity lately with a strong 17.7% & 18.5% sequential growth for products & services respectively, which attest to the trust of the medical sector towards their products, despite the bearish Scorpion report.

“I think the results speak very loudly that the clinical transplant community voted with their action, not with their word. We reached out to every user of the OCS platform and non user in The United States across all three platforms when this garbage came out in January. And we've made our points clear and the results shows their position. So we look at these results with a high degree of pride and humility, and we are continuing to laser focus on our users, servicing our users' need and making sure that we're there for them as they have been there for us throughout Q1.”

Liver transplants continue to be the main source of growth for the company - 76% of total business, as their OCS is finalized & continues to prove its dominance compared to competition. More importantly, growth is stronger than the market’s growth which means that TransMedics continues to grow its market share in livers.

“We're seeing more utilization of deceased donors across both DBD and DCD. We're gaining share. We're gaining momentum.“

And management’s confidence points towards continuation.

“All the pseudo competitors out there cannot deliver the value that the OCS can deliver in liver transplantation. And the upcoming publications will prove it unequivocally based on data and evidence, not just based on opinions”

Interesting to note that liver is the lowest source of revenues for TransMedics OUS - heart first followed by lungs. This highlights the potential in thos regions while they are asking to have access to TransMedics’ products.

“As you've seen in our symposium, the buzz even OUS is becoming louder and saying why we need access to these innovations in Europe and Australia.”

On heart & lungs, the dynamic is stable but we’ll need time & the next-gen OCS to see significant growth. We know already that those are dependent on the FDA’s approval & clinical tests, which are still planned to start H2-25.

“We filed both OCS Lung and Heart IDEs and are actively discussing the final details with FDA. Based on our interactions, we feel we are on track to initiate both programs in H2-25 as we communicated earlier in the year.”

And to be reinforced.

“In addition, we are planning to launch two new heart and lung clinical programs later in the year to further catalyze our growth in 2026 and beyond.”

On the service vertical, the company now owns 21 planes & had 16 fully operational during the quarter - it won’t ever be 100% due to maintenance. Their fleet grew but “only” operated 78% of total flights - lower than my personal expectations. This points to a too strong demand for their NOP to fulfill entirely. This is a good thing.

The end goal was to own 22 planes & management will look at opportunities without any rush & will focus on growing the usage of their actual fleet before considering growing it further - if necessary.

Growth also came from their clinical services which confirms the bull case that in time, more & more will rely on TransMedics end-to-end service as it is a more efficient & cost-effective solution.

Some comments on competition as the question is always asked. Waleed repeated many times that they will consider competition when other products show valid & stronger results through clinical trials & not rumors - which did not happen yet.

“Anybody could claim that they have a potential competing technology. They need to prove it. We stand by our product. We stand by our data.”

I also would like to comment on the stickiness of the medical sector when they find a product to their fit. It is a complex & regulated environment which works on habits, proof of it being the decades it took to move forward with new transplant methods. If TransMedics’ hardware is being trusted despite bear cases & criticism and earns the sector’s trust - proven by growing market share, it will take long for their solutions to be replaced.

You don’t change transplant equipment like you change shirts. It requires training, courses, habits, etc. You need something significantly better to go through this process again. Sticky industry & high switching costs.

Some words on tariffs & supply chain concerns. TransMedics does manufacture in the U.S. but I did not know where the parts of their OCS were bought & those could have had a big impact on the company.

“TransMedics is & will continue to be a proud U. S. Manufacturer of the OCS technology platform. Importantly, we also are focused on vertically integrating most of the critical technology blocks to minimize supply chain risks on our business. Based on what we know today, we believe that the currently proposed tariffs will have a minimal impact on our business.”

Nice to see confirmations.

On expansion, we know for some time that management is planning to open a NOP in Italy but is also working on adding some of its production there.

“Additionally, we are leaning forward and have announced publicly our strategic plan to open a disposable design center of excellence and a new manufacturing facility in the premier biomedical device district of Mirandola, Italy.”

This will allow TransMedics to be closer to the European market first but also to have a second supply chain for their disposables if needed. They also intend to use the local talent there to internalize a part of their hardware.

Financials.

I did expect strong financials but those are even higher than I thought.

We are talking about a 48.2% YoY growth fueled entirely by fundamentals - products, flights & clinical demand. Gross margins declined slightly due to the revenue mix with higher services - which are lower margin verticals. Expenses grew 27.6% YoY with most of the growth coming from R&D due to their lung & heart trials coming out soon -Net margins expanded as well from 12% to 18% hence a 122% YoY net income increase without external factor. It is all from the business itself, which is very encouraging.

We close the quarter with $250M of net debt.

Guidance.

Management raised its FY25 guidance, which I am not the biggest fan of as we know & saw last year that soft quarters can bring doubt to the market. Raising after one quarter can make sense business-wise but market’s expectations are also going to raise, especially passing from a 23% midpoint to 30% - pretty steep raise.

But management confirmed during the call that they are confident & took into consideration the potential softness & other potential aleas.

“It's still early in the year, and we wanted to make sure that we also are putting guidance that can be achieved and factor in some potential headwinds coming up in Q2 or Q3 or Q4. So we feel very strongly that the momentum we experienced in Q1 will continue for the full year results, but we expect some variability between quarters, potential seasonality as we've seen last year.”

I do trust their capacity to manage & follow guidance, I simply wonder how the market will react when softness happens, not if.

My Take & Valuation.

Nothing to complain about and the market misunderstood the company or trusted too much that Scorpion report, which we talked about & said was mostly bullshit.

As of today, TransMedics is rapidly growing its liver transplant shares on both DCD & DBD which is encouraging, medical institutions are trusting them and the company is on time to bring heart & lung next-gen in trials in a few months, hence a potential source of revenue from FY26. Add to this potential geographical expansion… And you find yourself a very bullish cocktail.

Valuation is hard to do for this name as I have no idea on the multiples the market would give to such a product - meant to disrupt a massive industry around the world. We do not have any history… So I will use slightly higher multiples than the medical industry - which sit around P/S 5x & P/E 30x, as TransMedics deserves a fundamental premium & is growing faster than the industry, but I personally believe the company deserves even higher multiples. So this is very conservative.

This model assumes a 25% & 20% CAGR growth until FY26 & FY29 respectively, 17% net margins, 2% dilution, P/S & P/E at 7x & 35x respectively.

Another potential comparative point would be Intuitive Surgical - a surgical robots company, which has been trading at 16x sales average for the past 8 years. I’ll let you do the math but that would push TransMedics much, much higher…

To conclude valuation, the only thing I would say is that to me, TransMedics is easily a triple-digit stock based on today’s data.

In conclusion, a great quarter which confirms the bull case & TransMedics’ capacity to become a real end-to-end transplant service for liver without any doubts, for heart & lungs soon enough hopefully - depending on their trial results. This is the next step we have to follow which could fuel & accelerate growth in the next years.

Patience paid off! Still remember the day you introduced this name, what a great find!