Portfolio Modifications - 06/17/2025

Devon Energy, Occidental Petroleum, Dollar Tree, Dollar General & Novo Nordisk.

I’ve always said that fundamentals, research & convictions matter, but beating the market comes down to execution. That’s what these write-ups will be about.

I will share through them every change in my active portfolio - stocks & options, reasonings & plans, before I even hit the buttons. I won’t update DCAs, I will only share my plans & new/closed positions in these write-ups. You can follow the rest directly on savvytrader.

https://savvytrader.com/wealthyreadingspro/active

I also recently opened a Buy & Hodl portfolio on which I will DCA $4,000 every month & focus on buying the best assets I can at the best possible price, 100% focused on fundamentals & valuation, without any active management.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Keep in mind that both portfolios have completely different goals and I can behave very differently on both for the same name - accumulating in the buy & hodl while selling in the active portfolio for example. Different rules apply.

My goal is to deliver alpha over the long term, not just six months under easy market conditions. If/when proven this content is valuable, it will be shared behind a paywall. No rush, though; it’ll stay free until proven valuable.

So here’s the deal: you get full transparency on my trades, right when I make them. If - and only in that case, it brings real & long-term alpha, it’ll be accessible only for a fee. I believe that’s fair enough, but feel free to provide feedback!

Active Portfolio - No change.

Option Portfolio - DVN Jan16'26 $37,5 Call & JD Jun18'26 70 Call accumulation.

B&H Portfolio - Accumulation on CAVA, Alibaba, KWEB & new position on PayPal.

Buys.

Today’s write-up is about flying back to more conservative assets as they start to give signs of life after being ignored for long, while tech starts to give some toppish signs & growth continues to go up.

Market continues to give really mixed signals lately as it appears we have different pockets of liquidity growing opposite positions.

Devon Energy | DVT Jan16'26 $37,5 Call @ $3.08.

I already pressed the button on this one.

This is almost a pure price action play although it goes into my bullish narrative on fossil fuels & energy.

It also is a less risky asset with a much lower valuation than growth stocks and bodes well with the conflict in Iran as once again, the market is not concerned about it at all but if things were not to calm, Iran could block major transit route for worldwide oil transport which would rocket oil’s price - and involved stocks.

Nothing of the sort is happening yet.

But price action is juicy as the stock is breaking a two-year downtrend with a clear double bottom & retest in a weekly timeframe.

I kept a reasonable position, not overdoing it on this narrative.

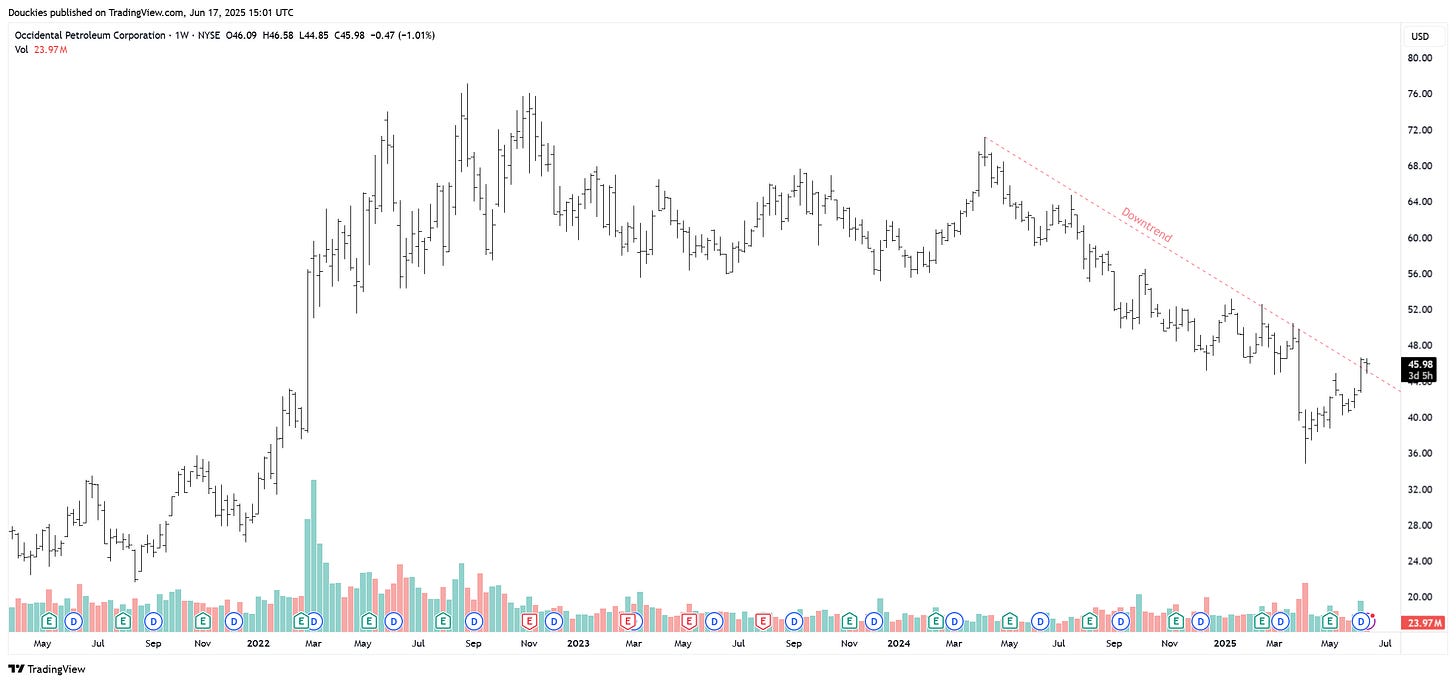

Occidental Petroleum.

I am not in nor intend to as I chose to buy DVN but for those who prefer to follow Warren Buffett, OXY has the same narrative & setup. My choice went to DVN as valuation was even lower than OXY’s.

Dollar General & Dollar Tree.

We leave the oil kingdom to enter the fear of a recession kingdom & one of the most resilient sectors during economic turbulences: consumer discretionary. Both business’ model is based on selling cheap goods for medium & low-income households.

Are their fundamentals really improving? Not really, yet their stocks have bottomed & started to rise not because of fundamentals but because of anticipation. As we worry about buying power in the U.S. with some concerning data on the labour market & retail sales, it could be logical to see a growing demand for cheap stuff.

Even if growth continues to pump, some liquidity is starting to shift & it shows with this kind of PA setup on this kind of companies.

I will buy the retest when they happen - $100s for DG & $90s for DLTR, not yet clear on how but very probably in long-term option calls. I wanted to share the plan before the purchase as those might happen at any moment and it will give you guys some time maybe to figure out if you want to rotate some liquidity into safer assets.

The goal here is not to achieve insane performance but to have chips on safer assets if ever we were to hit a recession - which some liquidity already anticipates.

Novo Nordisk.

I also want to share again the plan on Novo. We had a great trade and apparently sold the local top but I intend to buy back in if given the opportunity - around $70 would be perfect, with the exact same trade.

I start to position my portfolio towards less risky assets. I continue to hold growth calls because they do not yet give signs of troubles, but the global market starts to and if it happens, I want to have some safe assets to balance the risk.