Performance Review & Buying Plan

Portfolios Performance, Investment Strategy, Buying List & Target for Followed Assets.

I will try to make this kind of post a quarterly habit to update my short term vision of the market & my price targets for each stock I follow once the earning season is over and we have more visibility on our companies’ fundamentals.

It won’t be a long write-up. Fundamentals were detailed here and nothing changed since so I will focus on raw data.

Performances.

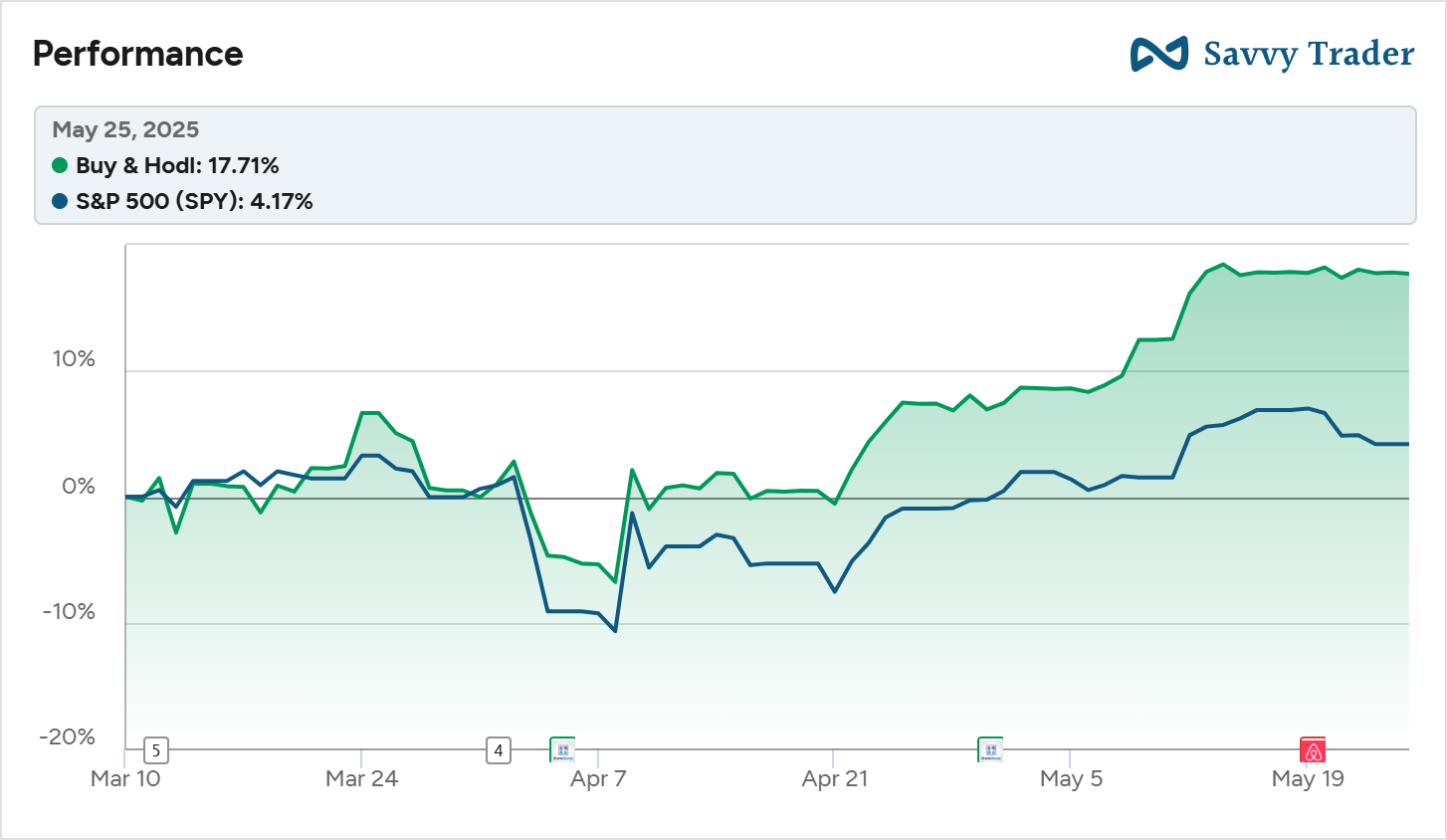

I changed things around lately but am now satisfied with the way things are, with three different portfolios sharing two strategies. All of them delivered alpha since inception.

Buy&Hodl: 13% alpha.

Active: 3% alpha.

Option Account: 39% alpha.

The Buy & Hodl Portfolio.

No headaches, we’re talking about a DCA portfolio with monthly cash injection.

Find the best assets, run my valuation model & wait for price action confirmations to buy. Control the investment thesis each quarter & hold as long as everything is alright with some potential trim if valuation gets crazy, only close a position if the thesis isn’t right anymore.

https://savvytrader.com/wealthyreadingspro/buyandhodl

Sleeping tight & performance is here.

More details below as this will be the subject of this write-up.

Active & Option Portfolio.

Only trading strong fundamentals, less focus on valuation, more on price action with a shorter position timeframe. When convictions are here, it’s important to go big, this is where performance lies. Every trade is shared when the button is pressed, won’t have much to share today as I didn’t do any moves.

Too early to talk about performance but we’re up a good start.

https://savvytrader.com/wealthyreadingspro/active

And this is my personal options account. Once again, everything was shared those last months.

Pretty satisfied with the performance for the first half of this year.

My View of the Market.

Few words on what I am expecting going forward. As I have shared many times over the weeklies, my vision remains the same: the U.S. cannot avoid a recession and they could spend their way out of it but this would bring inflation back. I shared this back in November and since, the situation only got worse with the trade war started by Trump and the many supply chain disruptions, mostly with China, which still aren’t fully reestablished.

The most important data to look at remains the US10Y and as long as this one doesn’t come back around 3%, I will remain worried. I’ll be happy if it happens without a recession or red days in the stock market. But I don’t see how it could...

We started the year in a bad economic situation & the pressure was strengthened by political decisions. I don’t see how this ends well and my timeframe for troubles to finally show up in the data remains the end of this year to 2026 or so.

In brief, I remain cautious. We might see another all-time high in the S&P 500 after Bitcoin led the way, but I don’t see the bull run continue & will use it to deleverage the risky assets if it ever happens.

Active Portfolio.

As said above, I will probably close some trades if we go higher. Nothing is settled yet as this is more of a day-to-day managed portfolio but I will keep you posted on any transactions, as usual.

B&H Portfolio.

On here, my uncertainty will be translated by a huge portion of cash. I do not intend to sell any of my holdings as long as fundamentals are good, even if the market was to crash violently. We have to make the distinction between recession-induced issues & fundamental issues.

I will however keep a good 30% to 40% of cash at any point in time until I feel better about the macro, and will be a bit more selective in how & when I buy each stock - stronger focus on price action. I believe the next year or two will give wonderful opportunities but we need to be able to seize them - have cash available.

Buying List.

Now to the heart of this write-up & what you guys expect from me: my buying list & the prices at which I’d buy each stock. Some explanations first.

You guys should know my methodology by now.

Fundamentals. Only focusing on what I believe to be the strongest assets.

Valuation. Running my model based on expected growth, margins, conservative multiples & minimum expected returns to find a fair buy price.

Price action. To maximize performance & focus most of my liquidity on the assets which go up, as at the end of the day what we want is to make money, not to be right & stubborn on our opinions.

Here’s the color code & some comments.

APT. Average Price Target - the optimum average for a long term position in the stock.

PA. Price Action.

Fundamentals.

Red - None, as I do not follow companies I do not believe in.

Orange - Some doubts but potential is here.

Green - Strong.

Valuation.

Red - Potential trim.

Orange - Hold & potential buy on PA if average remains below APT.

Green - Below APT, potential buy depending on PA.

Price Action.

Red - Downtrend (lower highs & lows in weekly). Not buying.

Orange - Potential downtrend or not enough confirmations.

Green - Healthy range or uptrend.

The perfect buys are triple greens (GGG) and good buys are GGY or GYG/GYY as long as average remains below APT. This is why I share a buy target for every stock except the price action red - no point rushing to buy falling knives, as all others are buyable depending on PA & actual positions.

For a concrete example, assuming I have a position on Uber at an average of $60, I would buy some shares at $80 without much concern as long as my average is not pushed above $73. This is how we ride uptrends, by averaging up our stocks.

In Brief.

Active portfolio is managed as usual but option portfolio will be deleveraged on opportunities as I grow less & less confortable with macro.

B&H portfolio will hold between 30% & 40% of cash & focus on buying the best assets at the right moment, until macro gives me more confidence.

Hello, how do we see your Buy and HODL Portfolio? Do we have to join Savy Trader?

Thank you for clarifying the portfolios!