On Running Q1-25 | Earning & Call

Nike should be worried.

Everything you need to know about On Running can be found here.

“Within this, it's paramount that we are focused on what we can control and continue to build our company towards our vision to be the most premium global sportswear brand.”

Overview.

Revenue. $680.5M | $807.73M | +18.70% beat

EPS. $0.22 | $0.23 | +4.55% beat

Do not pay attention to the YoY net income & EPS decline which is compared to a tax benefit in Q1-24. On is very healthy.

Business.

Once again, On Running gives us everything we want to see, starting by confirmation that the demand for the brand is growing. Clients go to On to buy shoes & do not buy On because they went to buy shoes - important distinction.

This is confirmed by the stronger growth of the DTC channel but also by its growing proportion in total sales.

And the good news doesn’t stop here as the product mix is also confirming this, with more & more clients purchasing accessories & apparels, reducing the importance of shoes in the company’s revenues.

We are still talking about 90%+ of revenues but it confirms that consumers go to On because they love the brand & end up buying more than just a pair of shoes. We usually try a brand before buying more than their main products so this is a sign of conversion, of loyalty to the brand.

Growth came from all geographies. America growing 28%, Europe 33% & Asia 129%, from a much lower base although considering the actual momentum in the latter, Europe won’t be On’s second biggest market before year ends.

“But if I had to pick one highlight this quarter, it would be the continued strength of our Tokyo store, which even surpassed our Regent Street store in London in terms of net sales. China, Japan, Australia, Korea and our distributor markets in Southeast Asia more than doubled in net sales. Momentum in China continues to accelerate, achieving the strongest growth across the region.”

I also shared a personal story on X this weekend as I went to a shoe store to buy a new pair of On - obviously, and simply couldn’t find my size.

This is anecdotal but interesting. Everyone I saw tried On’s shoes, and management confirmed strong demand from wholesale.

“Strong preorders for the second half of the year from our wholesale partners already reflect the strength of our products.”

Few words on On’s efficiency which is partly driving their margins higher as we talked some quarters ago about their optimizations in their storehouse & production lines, with much more automation & robotics, a theme they’ll push further.

“That's why we're actively building a future facing team, hiring computational engineers, robotics specialists and plant engineers to support this next phase […] And it became apparent that what we are setting up is quite literally the future: clean, efficient and fully automated manufacturing combined with high side flexibility, a step change for the industry and for ON, a major leap toward a more resilient and locally diverse supply chain.“

This will cost but will also give On an advantage over competition as companies like Nike or Adidas have already established infrastructures and it is always much harder to move for a behemoth than for a cricket. This is what On is doing with those initiatives and it is great, long term.

On their LightSpray technology, it still isn’t ready to be wildly commercialized but they are doing more tests. If you don’t know the technology, here’s what I am talking about.

A new way to make shoes, although still very expensive & not ready to produce shoes for everyone - only for high-performance running. But this highlights On’s ambitions pretty well.

Financials.

Excellent.

Strong revenue growth & continuous optimization hence growing margins, slightly, but we are talking about premium retailers, 60% is already pretty high. Expenses are also growing but less fast than revenues which ends up in a 100% operating income growth. As shared above, the rest is compared to Q1-24 which had a tax benefit, net income did not decrease from a business perspective, it would have easily doubled YoY without this benefit.

Important to note that the strength of the Swiss Franc - or maybe the weakness of the dollar, helped the company in its currency mix. I shared many times with On that currency mix would go & come, and so it does.

Balance sheet remains solid with 238M CHF of net debt including leases but with an outflow of 36M CHF of cash due to their investments - again, for future optimization. Nothing to worry about, on the contrary.

Guidance.

“On the back of our strong performance in Q1, the sustained high demand of our products across the globe as well as our premium position and premium offering, we are increasing our constant currency growth rate outlook for 2025 to at least 28%.”

“At least” meaning 28% would be the low end of their guidance, confirmed by a strong beginning of the quarter.

“Entering Q2, we continue to observe strong consumer demand for our products across all global markets and channels. […] We actually just had the strongest month in the history of the company in April, and this is true from a global perspective.”

Management also confirmed that this guidance is taking into consideration actual tariffs and some uncertainty around consumer strength. Confirming that they could do better if the conditions stayed favorable.

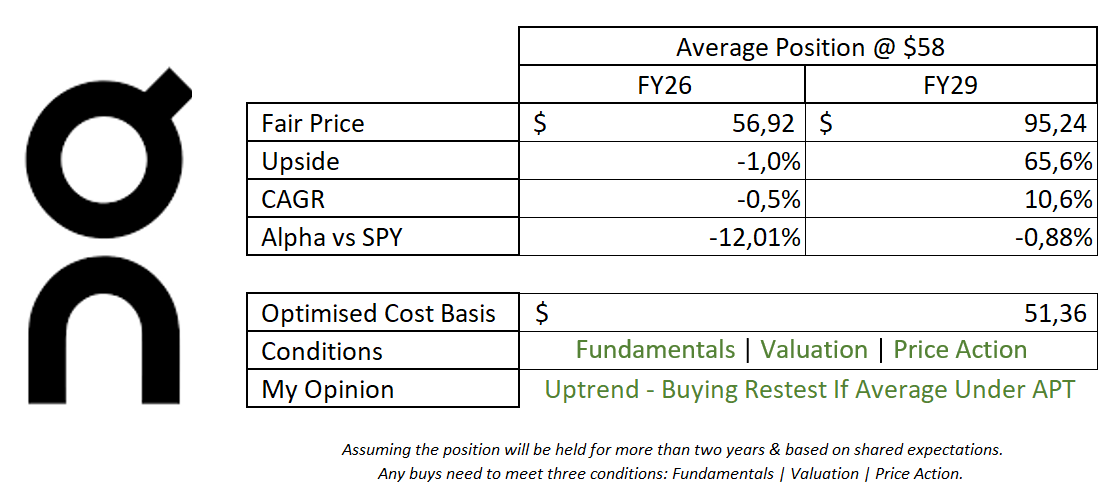

My Take & Valuation.

The quarter is simply excellent and confirms that On has the potential to take Nike’s market shares. I would be worried to see this small runner behind me if I was them, although Nike still is 20x bigger in terms of yearly sales. But if anything, this shows On’s potential, not Nike’s supremacy.

In terms of valuation, I chose to remain conservative in my numbers both in terms of growth & multiples. The first because that’s my usual process, the second because I don’t have clear benchmarks so I used Nike’s 10Y average while Nike grew only 7% during the period while On is planning to grow 25%+ during the next two years, so probably more than Nike during the next decade.

This model assumes a 25% & 20% CAGR growth until FY26 & FY29 respectively, 16% net margins, 1% dilution, P/S & PER at x3.5 & x38 respectively.

I would remain a bit cautious on the actual conditions as you know my mid-term bias - pretty bearish, although premium brand usually do better as they have a different client base.

On sure is a wonderful brand which will continue to make lots of noise in the next year, and which I want to be a shareholder of.

Thanks for the write-up!