Olo Q1-25 | Earning & Call

The most stable small cap.

If you do not know about Olo, here’s everything you need to understand the company.

Overview.

Revenue. $575.28M | $616.02M | +7.08% beat

EPS. $0.25 | $0.33 | +32.00% beat

Business.

The bull case remains the same: that more & more franchises adopt the flywheel - their module suite, to boost their own efficiency & Olo’s revenue in a triple win situation.

And this is starting as for the first time, one of their customers is going to implement the three modules, including Olo Pay card-present. They did not name it but this is a major step forward for Olo, and the first step towards confirming that their solution can make the difference - even if we already have pointers with the strong demand for their products.

“I'm pleased to announce that one of our existing publicly traded enterprise brands has signed to fully deploy Olo Pay card-present. Once implemented with card-present, this brand will become our first flywheel customer to aggregate full stack payment transaction data alongside digital ordering data into the Engage GDP.”

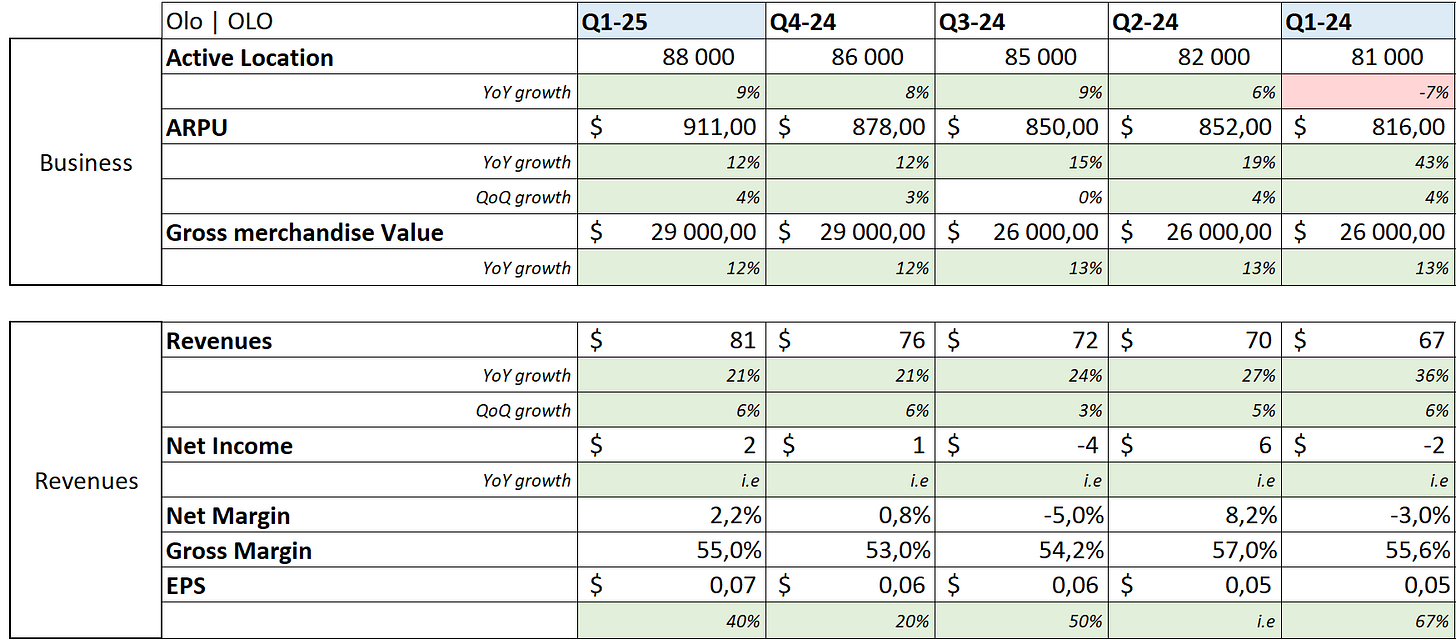

ARPUs are finally starting to show a bit of acceleration or at least stabilization after quarters of slower growth, something I really wanted to see last quarter already. Too early to draw conclusions but it is great to see a pause in the deceleration.

Active location are growing healthily, maybe even a bit ahead of the curve as FY25 guidance is talking about 5,000 new locations & management shared their pipe was pretty full, but let’s see.

Two notable partnerships, one with “an existing publicly-traded enterprise customer” which remained unnamed for OloPay card present. And a pilote with Chipotle for their Catering+ module “with multiple Olo modules across a subset of locations to support their catering channel […] as a complement to their in house tech”. Yes, Chipotle did contact Olo instead of building on top of their own tool. Significant.

They also had expansions from their actual clients with a net retention at 111%.

Borderless is growing well - in house technology which allows payment with the least friction possible, with 16M guests & a healthy usage - note that YoY comparisons are a bit unfair as the tool was at its debut a year ago. Still an important progression & signs that the tool pleases end users.

“For example, more than 2 million Borderless guests have used Borderless at two or more brands, up more than 10x from a year ago.”

Olo released its Guest Intelligence (OGI) a month ago which is a fancy name for guests’ data leveraging tool, allowing franchises to capitalize on guests’ habits.

“OGI has been incredibly well received by our customers. More than 700 of our brands have used it in its first month of availability, and we believe OGI will become even more valuable when we integrate Olo Pay data later this year.”

This remains the bull case, that by using Olo’s entire stack of modules, franchises are able to optimize their workflows, maximize their dollar spent, reaching their best or most promising customers with promotions or marketing while making their experience better.

Some words on macro which management doesn’t consider to an issue as their sector is usually & historically spared from economic slowdown - at large, not talking about individual restaurants obviously.

“And what we've seen in other times of economic uncertainty is that people don't trade out of the restaurant category. They don't magically learn how to cook, go get ingredients from the grocery store and cook for themselves. But what we see, and Peter spoke to as well in his prepared remarks, is that guests opt for more limited service restaurant options instead of maybe the high-end restaurants that they might go to in times of less economic uncertainty. That is actually a good thing for Olo's customer base because two-thirds of them are limited service restaurants. We also see that enterprise chains are in a better financial health position than SMB.”

Financials.

Some encouraging signs here as well.

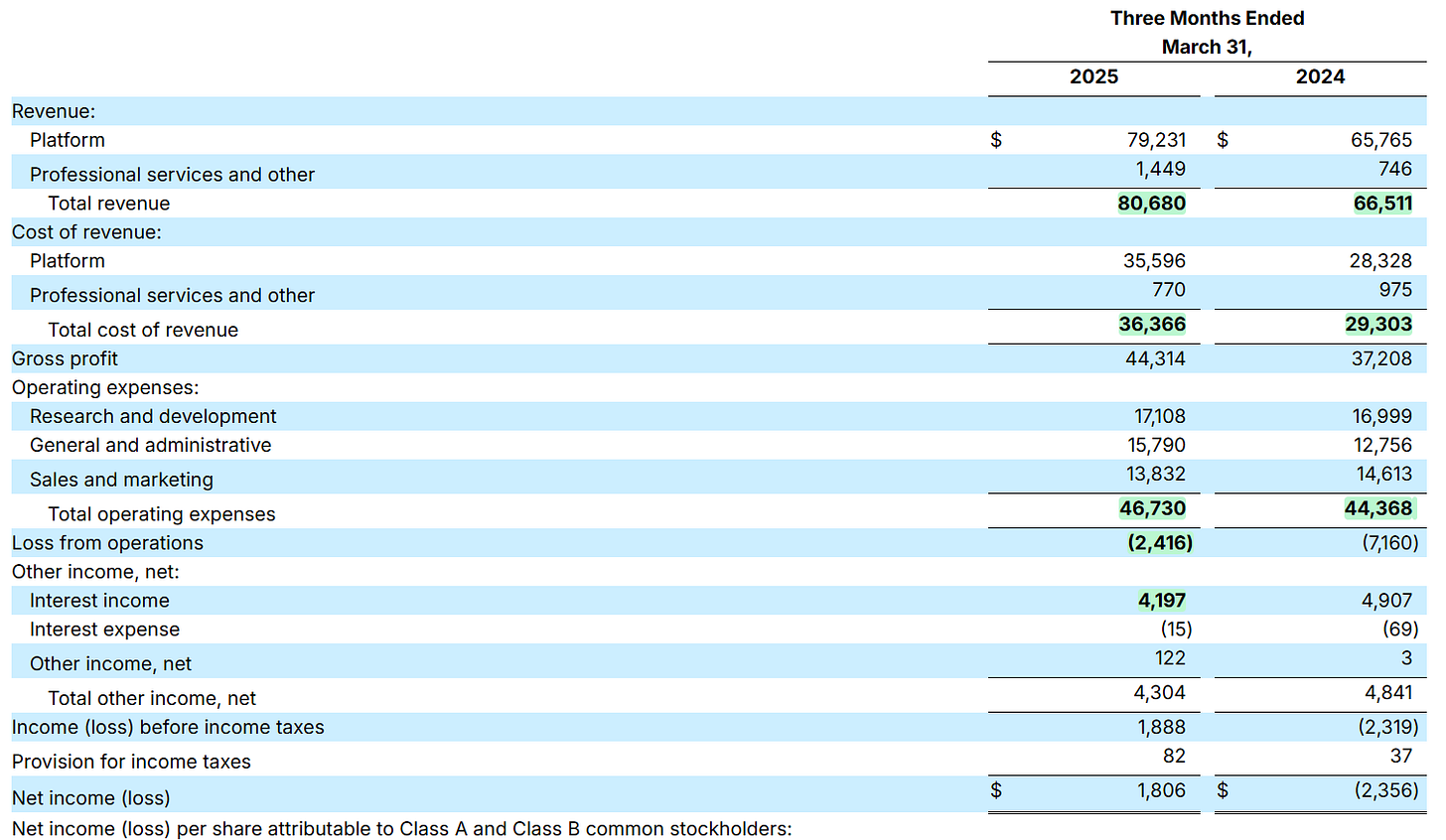

Revenues are up 21% YoY & most importantly growth isn’t decelerating anymore, flat QoQ & YoY compared to the last quarter. This is really encouraging. On another hand, costs have gone up faster than revenues & gross margins have declined, which is to be expected with Olo Pay card-present being deployed and the revenue mix of the quarter, nothing bad. Expenses though are flat YoY which is really great and puts the quarter really close to profitability from its business - interest on cash is enough to have a positive net income this quarter thanks to Olo’s $358M net debt.

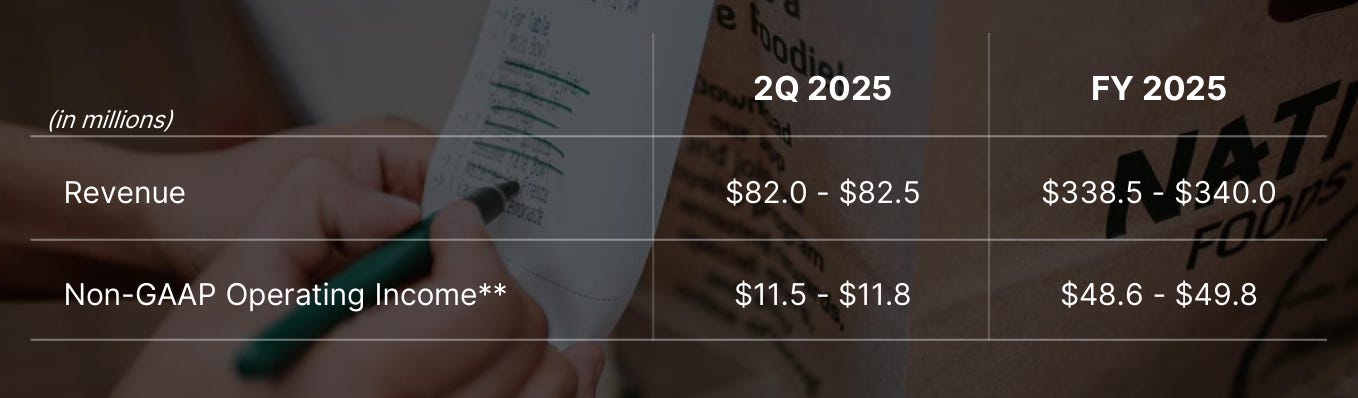

Guidance.

Data is sadly not pointing toward more acceleration, not yet at least.

We’re talking about 18% YoY & 2% QoQ.

My Take & Valuation.

The quarter is good & Olo continues to navigate without much fireworks but with an impressive stability, and it clearly isn’t a bad thing for the company,.I still believe those are coming. Fundamentals remain strong, demand is here, retention is a proof of their modules’ quality & it is a matter of time until the flywheel starts wheeling real fast.

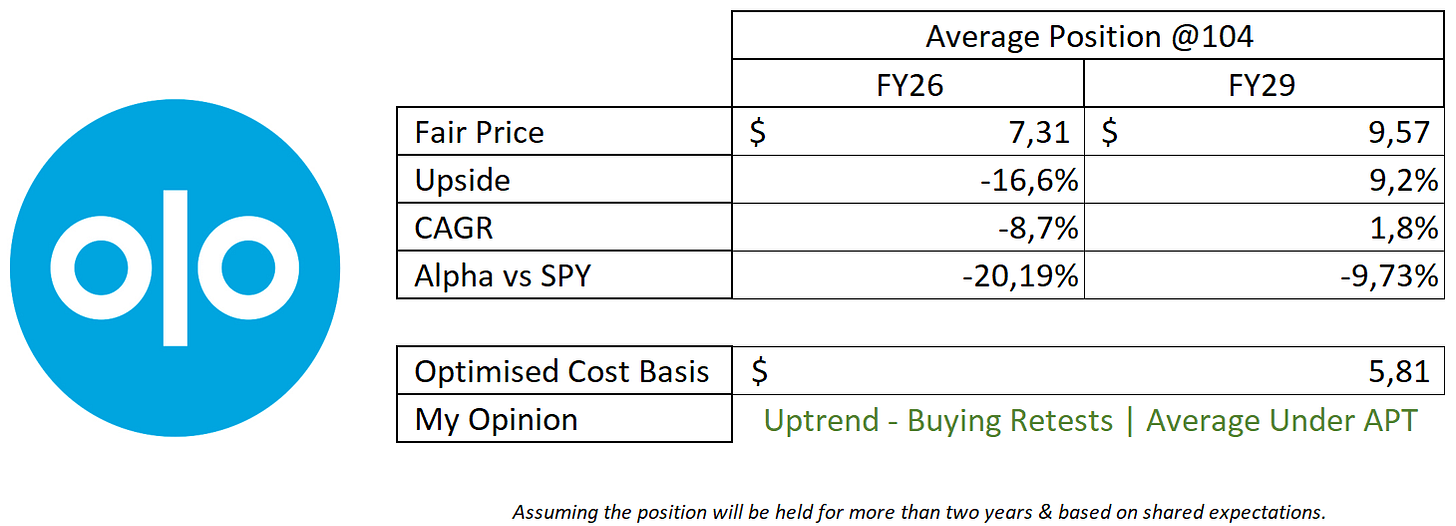

Valuation for this name is also a bit tricky as growth is slowing & hard to predict. I do believe acceleration will come when the flywheel is deployed but I might be wrong or it might take years before doing so. This & the fact that Olo holds 26% of its total capitalization in cash on its balance sheet, without any debt, givign the company lots of control & serenity - not often for a small cap.

This model assumes a 16% & 13% CAGR growth until FY26 & FY29 respectively, 4% net margins, 1.5% dilution, P/S at 5.5.

I’d assume this valuation is very conservative but we need Olo to accelerate growth to really start something. Markets move based on future FCF generation & gives premium multiples to growth, so we’s need strong positive signs there.

Besides that, the quarter was still good & Olo remains a very good & stable company. Without any doubts.

what does it mean when you write in the table 'average position @104'?