Nuclear Energy | Investment Thesis

Powering the AI revolution.

Before we go ahead, be at ease; I wont’ talk about pre-revenue companies making grand promises of a new golden age without having hired a single physicist nor having the slightest business model. We’re going to talk about the bull case for nuclear energy and how to play it, rationally, over the long term.

Energy and Needs.

As you know, we need energy for everything; to power our homes, equipments, cars, transportation systems, factories, cities… everything. You’ve heard me say before that value is energy transformed - value mean growth and innovation here; nothing would exist today without energy.

We need different kind of energy to fulfill our needs & those evolved over time, while our energy sources trended toward the most efficient sources with some delay; such transitions require massive infrastructure changes, regulations, policies, financing...

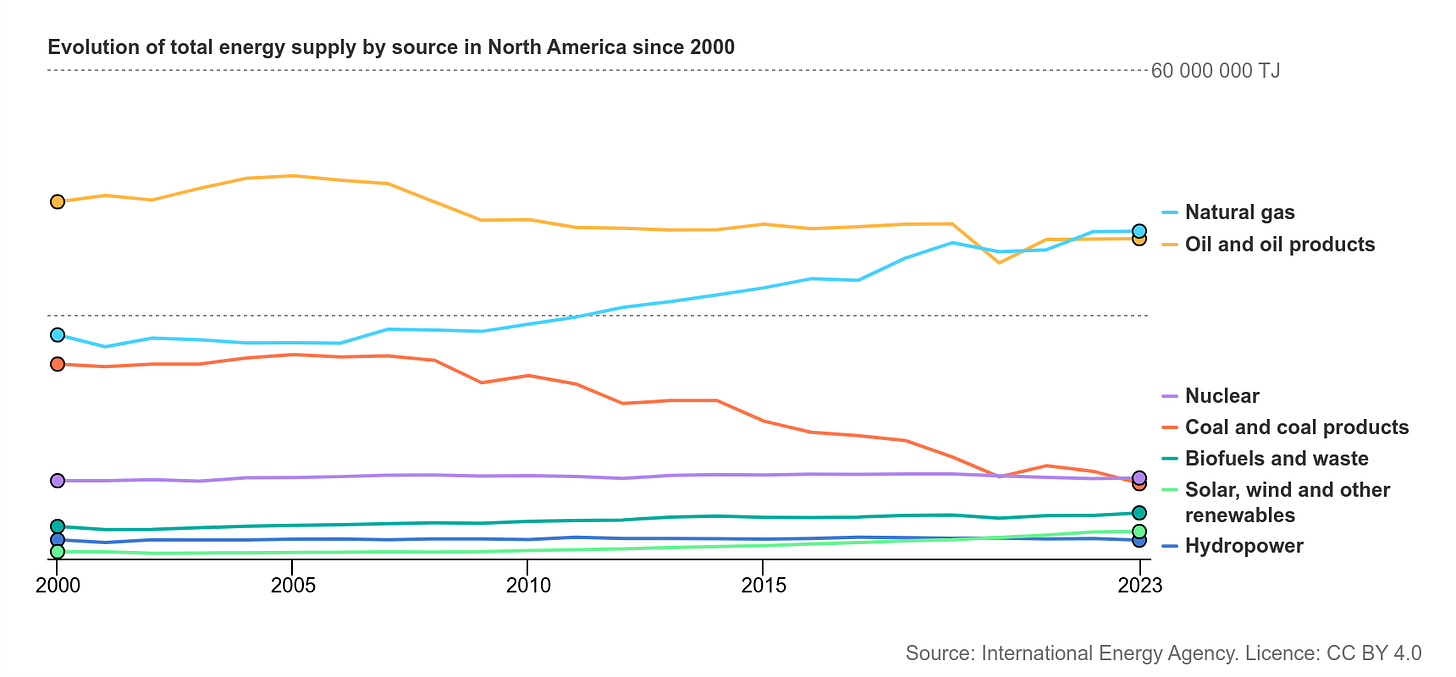

Developed countries are turning away from coal for example over the last years and embracing cleaner and safer sources of energy - namely natural gas over the last decade, while new sources are scalling.

A fair question would be: Why not just use the most efficient one?

First, we do not need energy in the same form for all our needs. You need oil for your car and most engines, electricity for domestic usage, etc…

Even for electricity production, we couldn’t only rely on a single source. I explained the grid system on an earlier write up, here are the details.

Going a bit further into electricity now. The grid is the name given to the electrical system of a city or a country, from producers to end-users. It is an incredibly complex piece of engineering, constantly hanging by a thread as its production has to equal consumption at any time. The entire infrastructures could overheat & burn if this wasn’t the case - or at least be damaged.

To be safe, most cities, countries, or anyone who manages the grid, usually slightly overproduce and burn the excess through different means to be sure to answer the demand - which results in wasted energy, hence more expensive electricity as the cost of the wasted fuel will be passed to consumers.

The electrical production follows a constantly changing demand, which isn’t the same at 12 PM or 9 PM, in winter or summer. The illustration below represents the difference in demand at different times during the day.

Answering different loads requires flexibility from producers, requiring them to increase their production rapidely if necessary - even more in case of emergency, which cannot be overlooked by producers as the consequence of not delivering enough electricity during a blizzard for example could be devastating.

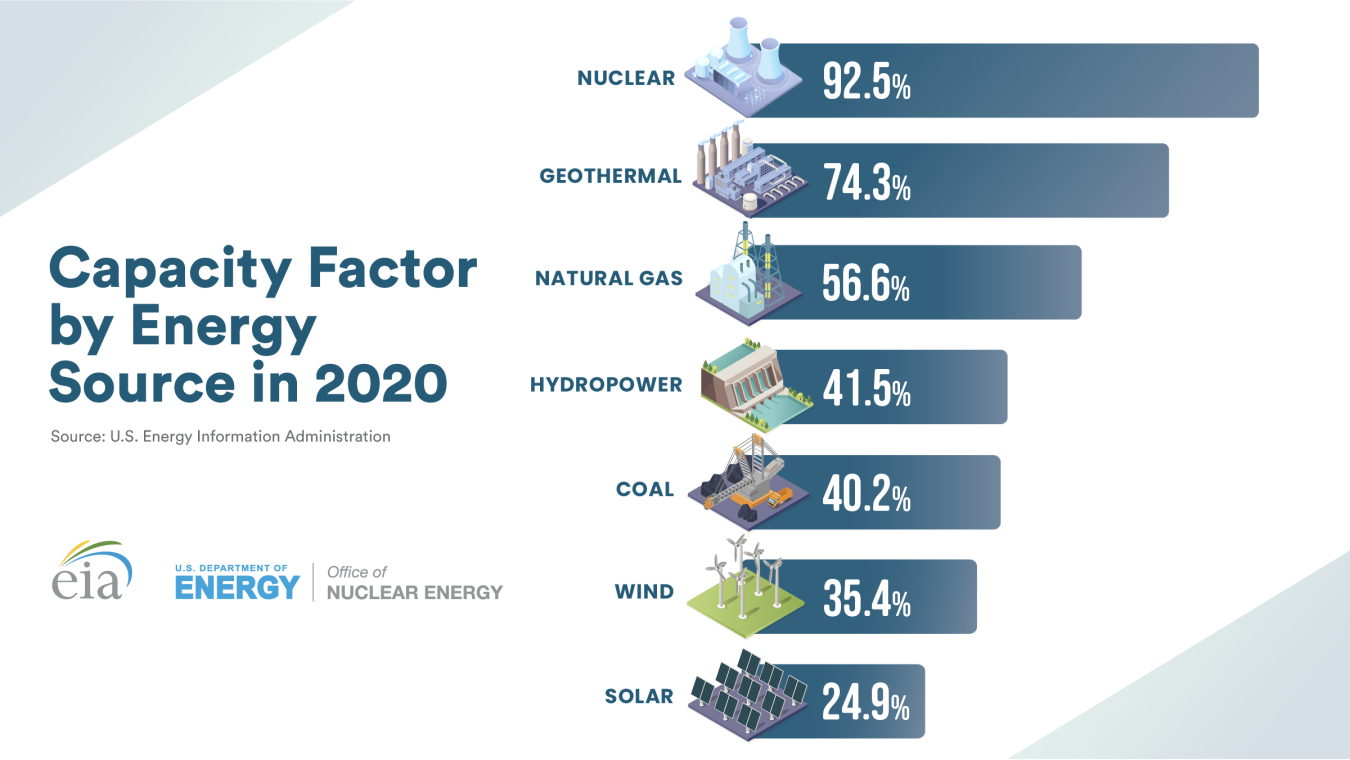

This need for flexibility renders the different production means unequal. Some will be very flexible - like coal, and others won’t be - like renewable energies. Some sources are perfect to answer a constant demand - the base load, while other are flexible and turn on/increase or decrease production rapidely - like coal mines or nuclear reactors. There are tons of potential combinations depending on the climate, the resources & the available infrastructures in different geographies.

This, in part, explains why Western countries haven’t entirely migrated to renewables and why most still use gas and oil to generate electricity: for flexibility.

The only country committed to renewables is Germany, and their electricity prices grew by 35% since that decision, three years ago. I have my opinions but am not here to debate whether they are right or not; this is an important note for the rest of this write-up.

This mostly explained why we have different means to produce electricity. And as said, those means are unequal depending on what a region, company or country is looking for.

There are many ways to measure production efficiency, one of the most known being the heat rate which is a difference between the requirements to produce electricity & the output. With this method, renewable energies are the most efficient producers as the requirement is natural - sun for solar panel or water for dams; the output is “free”. But the sun doesn’t shine 24/7 & everyone doesn’t have a river on its backyard, which makes them unflexible and therefore, not that efficient.

No, the most efficient sources of energy when all factors are taken into consideration; flexibility, output, poer, etc… is nuclear energy, with natural gas not far from it which is why its usage grew so fast the last years. Those methods can produce electricity day & night, anywhere you want as there are not much requirements to build infrastructures - except avoiding tsunamis regions as we’ll talk about later.

Not a big surprise, given the theme of this write-up, right?

Nuclear’s reputation doesn’t live up to its actual performance. That’s one of the main reasons it remains underused, despite being one of the most stable, efficient, easily maintained, and clean energy sources we have. Shifting more toward it should be an obvious choice; and it’s starting to happen in the U.S. while Europe is closing reactors. Meanwhile, China has built 58 of them over the last three decades and is constructing 20 more, aiming to have 150 online by 2035.

Nuclear energy is the logical next step for developed countries, although transitioning will take longer in the West than in China. It will require massive infrastructure plans, updated regulations, significant investments, and public persuasion. But the trend is clear; nations around the world are moving in that direction. The IEA executive director emphasized this in January in the agency’s annual commentary.

It’s clear today that the strong comeback for nuclear energy that the IEA predicted several years ago is well underway, with nuclear set to generate a record level of electricity in 2025. In addition to this, more than 70 gigawatts of nuclear capacity is under construction globally, one of the highest levels in the last 30 years, and more than 40 countries around the world have plans to expand nuclear’s role in their energy systems. SMRs in particular offer exciting growth potential.

Before going further, I want to highlight the massive role petroleum and gas still play today and will play in the decades to come - as it is too overlooked. They power most of our world & that won’t change overnight. Keep in mind that companies involved in fossil fuels are decades away from being rendered obsolete.

But today, a better alternative already exists, at least for some applications. One new in particular: powering AI data centers.

Datacenters and Energy Consumption.

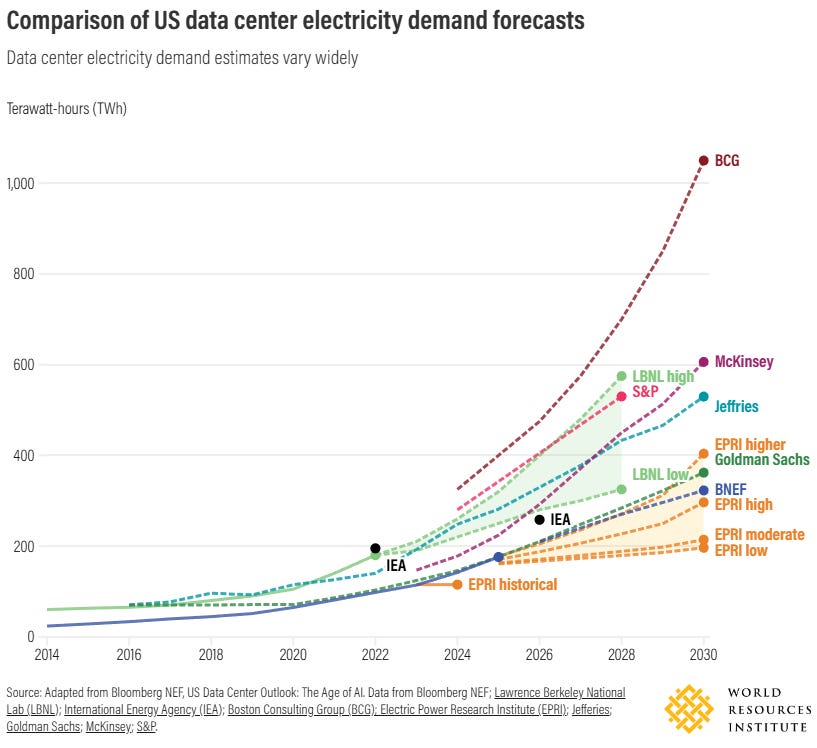

Data centers always had massive needs, but those increase exponentionally since the rise of AI as training and inference require huge amounts of compute.

Estimates suggest that U.S. data centers currently consume around 4.4% of total U.S. electricity production, and some studies predict this could rise to as much as 10% by 2030. Those numbers probably won’t be exact, but they show a strong upward trend.

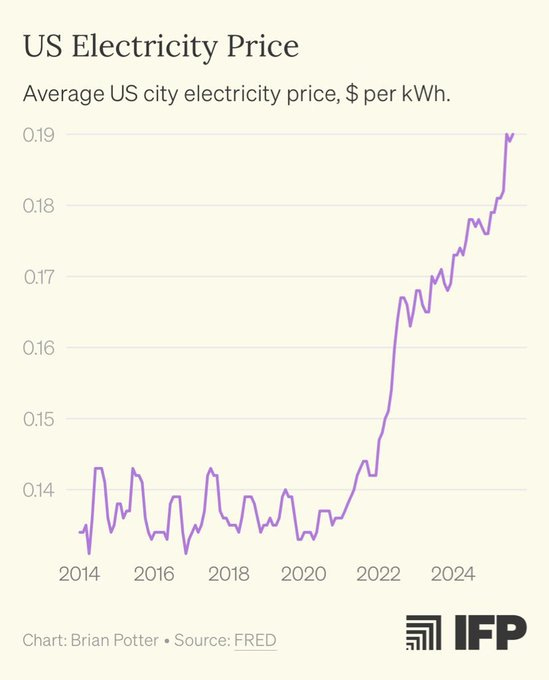

There’s nothing dangerous about higher energy demand, but electricity production is a complex industry and building and connecting new power sources takes years, not weeks. If nothing changes, AI data centers will keep driving demand upward while supply lags, and the only logical outcome is higher prices, something which is already happening in the U.S. with a strange timing close to the start of AI data centers.

Global energy demand will continue to rise because our quality of life depends on it and a higher standard of living requires more energy consumption. AI is just one part of this broader trend - although a pretty big one, but many companies would prefer a different option: to power themselves rather than rely on the grid or contracts with different kind of plants.

Why?

Fossil fuel prices and supply are volatile and geopolitical tensions can easily shift market dynamics.

Companies have no control over production or distribution, which means no control over prices.

Fossil fuels are finite resources nefast for the environment & even if not everyone prioritizes that, environmental regulations and penalties affect financials.

Searching for the cheapest energy sources means being geographically bound by the provider; no freedom on geographies for their data centers.

Nuclear power plants could be the answer, at least many think so. They’d allow stable and reliable energy source for their data centers for decades while maintaining control and reducing carbon emissions. No dependency, supply chain bottlenecks, no major constraints. Nuclear energy has its own risks, but no energy source is perfect.

Many companies have already committed to build their own Small Modular Reactors (SMRs).

It’s impossible to know if these plans will come true but once again, the direction is clear: more nuclear, even for private usage.

Nuclear Energy, Reactors & Uranium.

I’m not a physicist or a specialist, but the basics of how a nuclear reactor works are fairly accessible - if you want a bit of entertainment, the Chernobyl is a 10/10. I’ll still rely on internet to explain how a nuclear reactor actually produces electricity.

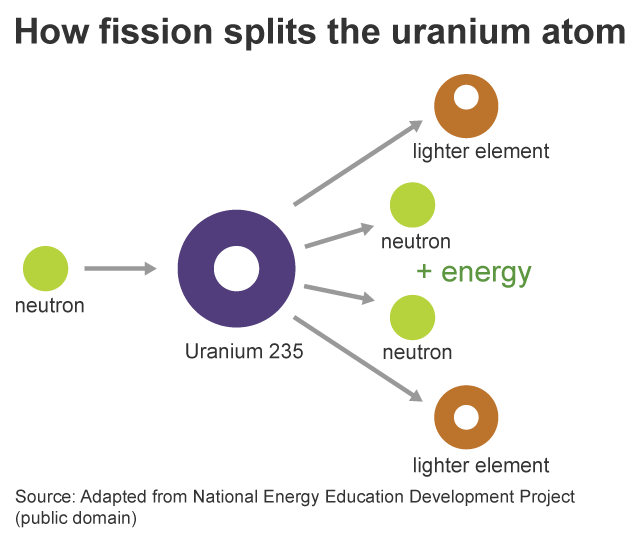

A nuclear reactor generates electricity through nuclear fission, where atoms of fuel like uranium-235 are split by neutrons in a controlled chain reaction, releasing immense heat energy. This heat is transferred to a coolant, typically water, which boils to produce high-pressure steam. The steam drives a turbine, converting thermal energy into mechanical energy as the turbine spins. Finally, the turbine connects to a generator that converts this mechanical motion into electricity via electromagnetic induction, which is then transmitted to the power grid.

In short: create heat through complex physical reactions, use it to boil water, turn the steam into electricity. This entire process relies on one critical element - within a very complex system of many others but one is critical and irreplacable: Uranium.

That’s the focus of this write-up and the best way to play the expansion of nuclear: the commodity itself, just as some of the best fossil fuel plays were the companies that extracted, refined, and transported the resource.

Why do we need uranium?

The heat within a reactor comes from atoms splitting when neutrons pass through & hit them, not unlike a bullet would split an apple in pieces when passing through it - physicists would kill me with such simplifications, but it works.

Uranium, at least its 235 isotope, is the perfect element for several reasons:

It splits easily when struck by a neutron and releases an above-average amount of energy.

It emits more neutrons than average when it splits, allowing for a self-sustained chain reaction.

It’s been studied and used for decades, with stable processes for enrichment and waste management.

It’s abundant enough to be mined and refined at scale.

Other materials like thorium or plutonium can also be used, but uranium remains the most practical and established for current technologies.

Where to Find and Extract It?

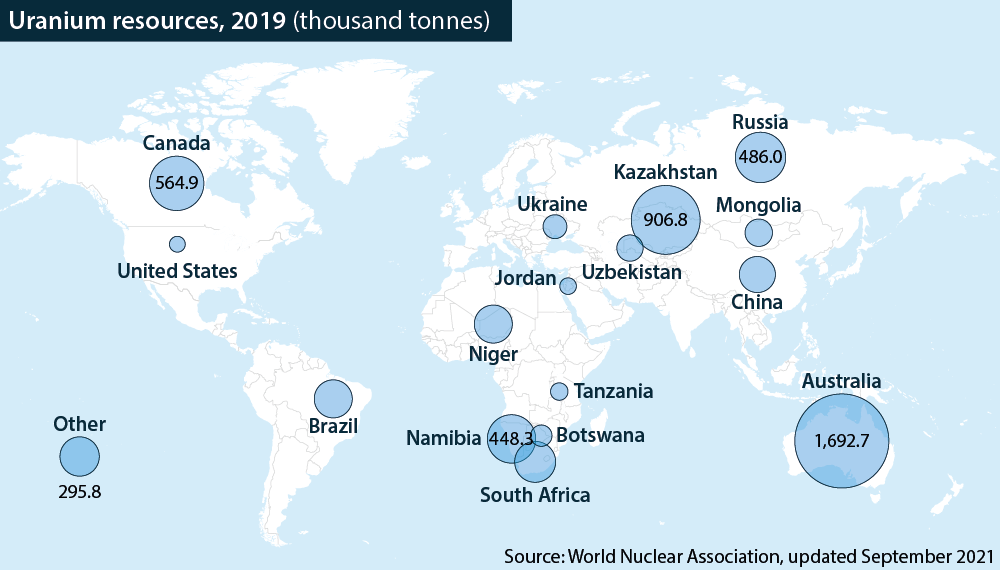

Uranium exists across the globe, though, as with many resources, the largest deposits often sit in geopolitically unstable regions - they’re usually the reason for instability. From a Western perspective, Australia and Canada are among the largest and safest sources of uranium mining.

Extraction isn’t enough. To be usable in nuclear plants, uranium must be processed & refined. This involves a series of chemical & physical steps to increase the proportion of the fissile isotope U-235 while reducing U-238.

Natural uranium contains less than 1% U-235. Conventional reactors need uranium enriched to about 3–5% while newer technologies, notably SMRs, may use uranium enriched up to 20% for greater efficiency, stability, and lifespan. Once refined, the uranium is shaped into rods and loaded into the reactor, where the fission process begins.

My Investing Framework.

As you can imagine, there are many ways to play this narrative. I already shared that mine would be the commodity itself which follows supply and demand mechanics, like many commodities. With the growing demand for nuclear reactors, the demand for uranium should rise accordingly all around the world.

Others will prefer to play the infrastructure: companies building nuclear reactors, the hundreds of verticals supporting them, their contractors, mining companies... Many ways exist.

The world will require enriched uranium to run its plants. That’s a given. It will happen. Investing in infrastructure is complex, it’s impossible to know which company will have the market’s lion share, especially with new companies focused on SMRs. Miners have geopolitical and geographic risks, regulations, local tensions and more…

To me, investing in the (enriched ) commodity is the safest and broadest bet. Nuclear power plants typically refuel every one or two years, creating a stable and recurring demand for uranium. That’s why I’ll focus on two companies active in this vertical: Cameco and Centrus Energy.

They’re not the only uranium refiners, nor even the largest, but they’re among the few publicly traded in the West. The only other major name, Orano, is a French state-owned company and I avoid state ownership, especially in France.

Cameco Corporation.

Here’s a description of the company’s activity.

One of the world’s largest uranium producers, Cameco mines, processes, and sells uranium fuel to nuclear power plants globally. Cameco owns and operates major uranium mines (mainly in Canada, e.g., Cigar Lake, McArthur River), sells uranium under long-term contracts and into the spot market, and profits from mining, refining, and conversion services. Its revenue is tightly tied to uranium prices and demand from nuclear utilities.

I said I wouldn’t invest in miners & my first name is a miner… Cameco is an exception: it operates in a stable region (Canada) and integrates parts of the value chain I care about, namely refinement and services, while ranking in the top five of the world’s producers.

Cameco is the safer, diversified bet; an established company with a proven model and solid client base.

Centrus Energy.

Centrus specializes in nuclear fuel supply and advanced enrichment technology, mainly serving governments and utilities seeking enriched uranium. Centrus procures uranium, enriches it (including development of advanced centrifuge technology), and sells enriched uranium fuel (Low Enriched Uranium, High-Assay LEU) to reactors. It earns revenue through long-term supply contracts and technology solutions, positioning itself as a key provider for the next generation of reactors and defense nuclear needs.

Centrus is very different from Cameco. It’s a smaller, “younger” company - rather an older one that pivoted. After bankruptcy in 2014 & the suspension of early projects in 2016, it restarted in 2019, focusing on LEU & HALEU which are two forms of uranium with different U-235 concentration; LEU are used in traditional powerplants, enriched between 3%-5% and HALEU are the future, focused for SMRs and enriched up to 20%.

A pure enrichment play with exposure to the future of nuclear power.

For now, the company is mostly selling LEU to the U.S. Department of energy, with many agreements with private buyers for future HALEU sales.

This is more of a narrative play than a mature one: a bet on the success of SMRs which have not been built yet. There are around 120 SMR projects planned worldwide but only one - Linglong One in China, has been completed.

Linglong One is designed as a pressurized water reactor with a capacity of 125 MW electric (MWe), producing about 1 billion kilowatt-hours (kWh) of electricity per year, enough to meet the needs of over 500,000 households and more than a million people.

SMRs represent the next phase of nuclear energy. The only questions are when will they scale, for what purpose - AI datacenters are a key growth component but not proven yet, and using which uranium mix - probably HALEU but not confirmed.

Uranium.

Beyond enrichment, uranium as a raw commodity is an attractive play. Both Cameco and Centrus rely on it; Cameco mines some and buys some but Centrus purchases all its uranium for processing.

As with any resource, uranium’s price follows supply and demand dynamics. And as long as demand exceeds supply, prices rise; with volatility given the political and regulatory context but in an uptrend nonetheless.

The global uranium market is currently experiencing a significant structural deficit, with annual consumption exceeding primary production by approximately 50 million pounds. Current reactor demand requires roughly 180 million pounds annually, while mines worldwide produce only about 130 million pounds. This 28% shortfall represents one of the largest commodity supply deficits in the energy sector and continues to widen as nuclear power expands globally.

There are no certainties in investing, but probabilities are in favor of a growing demand, at least as long as public opinion remains stable.

Risks & Public Opinion.

Nuclear energy was sidelined for decades. Most nations turned toward other “clean” energy sources or continued with familiar ones. This is mostly due to public opinion and the different risks with radioactivity. Nuclear is indeed one of the cleanest source of energy, hence the quotes, but it comes with other challenges.

Radioactive Wastes.

This is the unsolved problem. When uranium atoms are split, they become unstable and emit radiation - energy waves that continue until the atoms rebalances and becomes stable again.

Radiation acts like heat. Too close, for too long, and it burns. Not your skin, but deep within, damaging cells and organs. Prolonged exposure will destroy your cells, can lead to cancer or worst, shortening lifespans even in the “best” cases.

We do have safe, established processes for managing eastes. Used fuel rods are first cooled in water pools inside the plant for several years; water absorbs radiation. Then, they’re transferred into shielded, sealed containers stored on-site, before ideally being stored in those same containers in deep, isolated geological caverns, far from people and ecosystems. Those facilities are still under development.

The real issue with radioactivity is time. Radioactivity drops sharply after cooling but can remains hazardous for centuries before being perfectly safe again to human or any ecosystem, which means they need to remain completely sealed until then.

This is one of the biggest problematic of nuclear energy.

Radioactive Catastrophes

Then come the disasters, terrible in term of image & consequences.

Fukushima was caused by a tsunami that destroyed the power plant’s systems. Three reactors melted down & released radioactive material in the wild. The safety systems actually worked and tried to shut things down, but the damage was done before the full stop. Bottom line: safety measures exist but can’t always handle every event.

The site is still not habitable and won’t be for very long, though some nearby areas reopened since with people living there.

I guess we should talk about Chernobyl.

Chernobyl is a different story. It wasn’t nature or bad luck, but human incompetence. Safety protocols were ignored, procedures were skipped and it ended in disaster. The region is still deserted and won’t be livable for thousands of years as radiation spread freely before it could be contained and are still “burning”.

There are risks with every tools invented and used through centuries but Chernobyl has been pretty chocking with such consequences that it marked the spirits.

Those two events left a mark. Once people have that kind of image in their mind, it doesn’t go away, whatever the reasons for it.

Public Opinion.

These disasters, plus the ugly look of power plants and the issue of waste, created a terrible image for nuclear. People see it as dangerous, old, and dirty even if it is one of the most efficient & cleanest ways to produce electricity. Unless you live next to a dam or get sun all day, it is the cleanest option.

I have done a bit of zele here because I find the subject passioning & wanted to share a bit more, but this also details that nuclear powerplants are missunderstood by most who are scared of what happened and what could happen, without any regards of the advancements we had in safety over the last decades of needs for energy.

For most, the risks aren’t worth it; maybe they’re right, maybe not. But what matters is that public opinion has power. If people don’t want nuclear, politicians won’t push for it and that is a real risk for investors.

If legislations do not pass in favor of more nuclear, or even restrict it, AI and our future needs will need to find a new source of electricity production & our investments won’t work, whatever how advanced and secured new reactors are.

Policies & Barrier to Entry.

As I’ve shared through this write-up, both uranium mining and uranium enrichment are strategic commodities for global powers. Countries sitting on large reserves treat them as national assets, which means heavy regulation and tight control. It makes getting into the sector complex and pushes nations to use their natural advantage as leverage.

As seen earlier, Kazakhstan & Russia are two major players with massive reserves and the tech to refine uranium to high levels - Russia being a nuclear power means it can refine above 80–90%. Together, they account for over 40% of mined and enriched uranium. And as you can guess, one of them isn’t exactly cooperative with the West right now.

Getting access to the sector starts with mining, which means going through endless regulatory hoops - safety checks, environmental standards, export controls, permits, licensing… Mining might be private, but when it’s nuclear-related, governments have the final say. It’s also a capex intensive business with long payback times, years before a mine even produces a single pound of uranium. Add to that the need for specific expertise, those profiles don’t come cheap or easy.

Then comes refining. Step one: buying uranium, which already means government oversight & international controls. Add infrastructure requirements, export restriction, IEA monitoring, heavy technical constraints - once again capex-heavy & very sensitive. Most refiners are state-backed or directly government-controlled for that reason.

Competition exists, but it’s limited and will stay that way. Not often for investors that competition isn’t the main concern here.

On the policy side, since the industry is so strategic, governments fund & favor their own players. That means easier regulations, subsidies & contracts for local companies, and tighter controls or even bans for foreign ones.

Focusing on the U.S., since that’s where our main interest lies: no surprise, Trump’s administration is pro-nuclear.

President Donald Trump signed four separate executive orders (EOs) on May 23, 2025, intended to result in a quadrupling of U.S. nuclear energy capacity to 400 gigawatts (GW) by 2050, all while strengthening domestic fuel cycle infrastructure and achieving deployment of demonstration reactors as soon as next year. Three of the EOs seek to reform the U.S. Nuclear Regulatory Commission (NRC) while leveraging the U.S. Department of Energy (DOE) and U.S. Department of Defense (DOD) to streamline the licensing and construction process of new reactors, with a particular focus on advanced reactors. These EOs also seek to aid deployment of U.S.-developed reactor technology abroad.

To give you perspective: 400 GW would mean roughly 300 new power plants. The U.S. probably won’t reach that, but it tells you a lot about the ambition and direction. Many states are following along with deregulation and local funding.

There is a clear direction in the west, and its further.

Conclusion.

It was a very interesting write for me, with months of research, and I hope you guys enjoyed it. If not as an investment piece, at least as an instructive one.

The industry is complex, heavily regulated; facing a growing demand for a commodity that’s already supply-constrained. If the trend materializes and tech companies move forward with their SMRs, demand won’t just grow, it’ll accelerate, boosted by the increasing demand from reactors connected to the grid to power cities.

Fossil fuels could do the job, but they’re impractical. Renewables can’t provide the base load for data centers that can’t shut down when the wind stops blowing or the sun sets. The best solution remains nuclear, one we’ve been avoiding for decades mostly because of politics and public opinion.

That’s still one of the biggest risks around this whole narrative. If the public isn’t less against nuclear, no politician will take risks to push policies forward. Another incident or catastrophe could set everything back by decades while stable reactors cutting energy prices won’t get much credit for it. I honestly don’t see nuclear winning public opinion except through proliferation and decades of perfect execution.

But the need is here, and it’s growing. Contracts are being signed, plans are being made, investments committed. Right now, playing the commodity is the best way to capitalize on this trend, at least until some clear leaders emerge in other parts of the sector.

We’re still early in this revolution, and it’s one that will play out over decades. There’s no reason to take unnecessary risks when obvious plays exist.

If it’s a decades-long play question is what is the expected average annual return? If uranium will 10x but over 30 years you’d be better off with sp500 etf. What was the increase in nuclear global capacity since 2018? Just to check vs the 4x increase in uranium price. Now - what is the expected increase in capacity over the next 5-7yrs?