Hims & Hers | Q4-24 Earning & Call

I will never understand the market.

If you do not know about Hims & Hers, you can find everything you need to know about the company here.

Overview.

This is going to be a complex quarter to decipher with lots of unknowns. Bear with me, it’s interesting.

Revenue. $470.31M | $481.14M | +2.30% beat

EPS. $0.10 | $0.11 | +10.00% beat

$5M buyback.

I will go over the business by itself & do a very specific write-up for the GLP-1 situation before the revenue part.

Business.

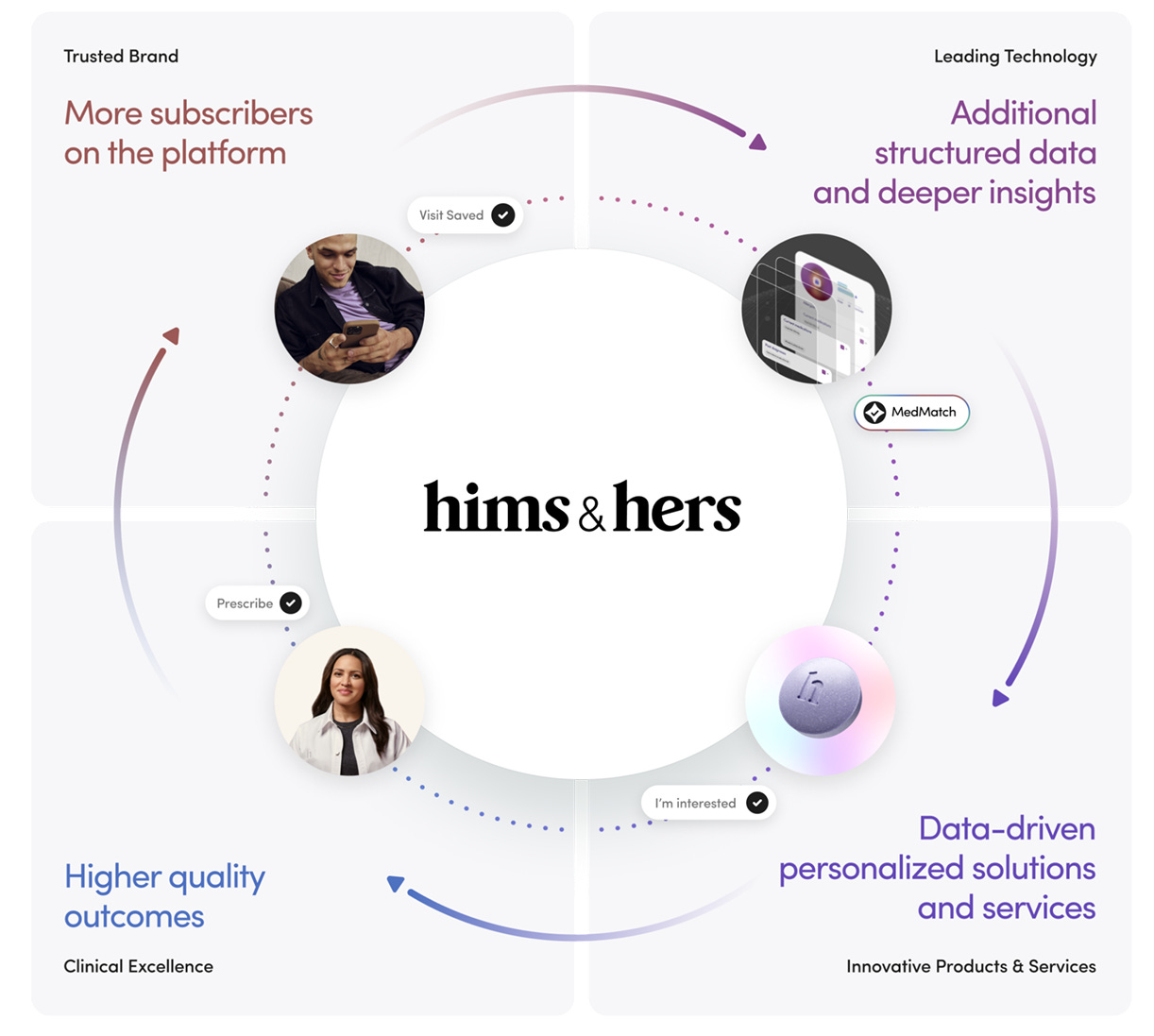

Let’s go over it one more time: Hims & Hers is about personalization & offering its patients the best tailored service they can. The key metrics to monitor the business health are subscriber growth & retention.

One diagram makes a better case than thousands of words.

And their business model seems to work, first with some positive comments.

“We continue to see the benefits of more personalized capabilities enabling us to better attract users and increase their longevity on the platform. As our personalized offerings continue to evolve and gain scale, we expect to see ongoing gains in customer retention.“

And second some positive data as the company added 182,000 new patients on their platform while multi-30-day subscribers grew 10.9% QoQ - 71.5% of their Q3-24 new acquisition ended up being multi-30 days subs, which highlights the demand & satisfaction of their clients.

User base growth is really here & management is pretty confident on what’s coming.

“You know, I think 10,000,000 subs on the platform to me feels, you know, really quite in reach.”

Something they intend to do through expansion plans we talk about just below.

I do not look much at revenue per sub, not that the data isn’t interesting but business will scale on user growth & retention. Growing average revenue should grow as patients’ consumption grows.

On the personalized solution, the company now has 55% of their patients using one or more personalized solutions, meaning a growing user base & a growing usage of this service, which is exactly what we want to see.

Expansion.

Once again, the bull case on Hims is its personalization. And this is done through data, constant expansion of both services & products - like the at-home testing services we talked about on the last Sunday news.

The final goal for Hims & Hers isn’t to be an online drug store but a personalized app helping its patients live a better life, sometimes through simple advice, testings & other drug-free methods, other times with the help of some specific medication tailored to their metabolism - don’t get me wrong, they sure are motivated by revenues & aren’t saints though.

“Whole body testing gives providers even more insights into their patients' health, enabling a more holistic individualized treatment plan inclusive of personalized medication, supplements, workout routines and nutrition.”

&

“we see a world where AI can substantially elevate the subscriber experience by providing resources with greater sophistication such as AI coaches, therapists, nutritionists and trainers available for twenty fourseven on demand support to help our customers make meaningful lifestyle changes in pursuit of their health and wellness goals, trusted and empathetic AI powered care coordinators to help customers navigate their healthcare journey, and greater transparency and visibility into the reasoning that drives each treatment and service recommendation on our platform in a manner not constrained by the availability of provider time on the platform.”

Seems pretty interesting to me. And the company intends to widen its circle of competencies by constantly adding new specialties shortly.

“Integration of lab diagnostic capabilities positions us well to expand into new specialties such as menopausal support, low testosterone, and sleep, amongst other specialties.“

And this is only the beginning as most of their cash & investment capacities went & will continue to go towards fundamental development.

“At the end of twenty twenty four, we also signed an agreement to acquire a California peptide facility. As we work to address chronic conditions and areas of need among Americans, this facility will provide the ability to explore innovative advances in preventative health, metabolic optimization, cognitive performance, recovery science and biological resistances. I'm thrilled with the potential range of treatments and peptide science and we are committed to being at the forefront.”

As I said, personalized experience focused on tailored solutions for the wellness of all their patients.

Them growing in terms of users & prescriptions also helps feed MedMatch, their AI tech that uses user data to propose better & tailored products to their clients or anticipate conditions for others.

GLP-1.

This is all that matters for the market. We have to understand what is left & what will happen once Hims cannot sell compounded semaglutide anymore.

Before even starting, compounder companies filed lawsuits against the FDA for the removal of semaglutide of the shortage list while no checks were done to ensure that patients could find branded drugs. Second, we have Kennedy entering office at the head of the FDA just now. This news shouldn’t be used to confirm our bias but they are worth noting.

Now into the big subject that I’ll try to dissect properly & clearly.

Semaglutide.

In three months, Hims won’t be able to sell mass compounded semaglutide anymore, except for some specific cases regulated by the FDA; this was confirmed by management today.

“And we will continue to primarily focus within our weight loss category on bringing care to individuals that stand to benefit from our oral based offerings, liraglutide later this year and clinically necessary personalized dosages of semaglutide.”

As for the regulation.

“the documentation, the clinical necessity of it, what the actual experience of it looks like, what personalization means from an actual dosing standpoint and a difference from commercially available drug. All of this is very clear and regulated. And so, we play by the rules and the rules are quite clear. And so I don't expect there to be meaningful conflict when it comes to the personalization standpoint”

So yes, Hims will continue to serve some specific cases, the question is about the volume - which will obviously be lower but existent.

The next questions from the market is what alternatives will be proposed & will those drive comparable growth?

Alternatives.

On the fundamental first, Hims has already other options available and will have more in the short term & in the long term. But their approach to the service is healthier than just providing drugs as, as shared earlier, they wish to provide a better lifestyle through change of habits - this is important.

“In order to truly address the epidemic, patients need comprehensive care that extends beyond medicine to making lifestyle changes from nutrition to exercise to mental health and we are dedicated to this approach.”

On the products already available, first of all, the oral-based offerings.

“We do expect to see the oral based offering be quite popular, given the fact that many other platforms will no longer be offering commercially available dosages of semaglutide, we are likely to receive benefits from that across both of our specialties on the oral side”

Demand for it has grown rapidly - although obviously less rapidly than compounded semaglutide. Secondly, on the medium term, Hims is planning to propose liraglutide mid-25 in compounded dosage exactly like they used to do for semaglutide. The first one has less good results but is apparently very efficient as well, especially combined with other available products.

And even later in time, without dates, GLP-1 drugs will have generics & Hims will be able to use them for their entire business.

As noted in the comment above, regulation is hurting Hims but its competition as well which might not have the alternatives Hims has, meaning, some traffic will somehow turn to them.

Numbers.

Second part is obviously the numbers as that is what investors care about: growth. Hims aren’t saints, they do not do this by altruism but for revenues. So let’s try & assume what was & what can be.

“We launched an oral based weight loss offering in the fourth quarter of twenty twenty three, which saw great success as it scaled to a revenue run rate of over $100,000,000 in just over seven months. Our GLP-1 offering, which launched in the second quarter of twenty twenty four, has experienced similar success, delivering north of $225,000,000 of incremental revenue in 2024”

As we said, the oral drug is attracting less than GLP but the run rate is still growing. And we do not have any idea of what the liraglutide demand will be like as it will come only in a few months.

GLP-1 registered $225M in three quarters with Q4 being the bigger one, generating more revenues that the yearly run rate of oral drugs, which highlights a very strong demand & we could expect even higher revenues in Q1-25 as Hims still can compound its product during the period.

The rest comes on the guidance part.

Demand.

Now the question is: will they have demand for their products or are their users only here for GLP-1? I think that’s where Hims’ personalization & user experience matters.

“And so I think that the competitive advantages that have served as a foundation for how we've been able to scale specialties in the past, the trusted brand, the value that we bring to consumers beyond the medication will be a critical component of maintaining our existing ecosystem of subscribers, but then also continuing to draw a broader set of subscribers to the platform.”

&

“We also know that consumers are looking for health and treatments from platforms that they do trust. So those are the elements, being one of the reasons why the oral weight loss was able to scale so quickly.”

We enter the realm of speculation.

Compounded semaglutide is over except for specific cases. Hims will have alternatives with the oral drugs & another compounded GLP-1 drug later this year. We also need to take some branded GLP-1 data into account.

Studies show that around 58% of patients drop their usage of branded GLP-1 drugs within the first 12 weeks while many others confirmed this kind of numbers throughout the first 6 months, mostly due to unbearable side effects.

As you can see, this isn’t the case for Hims which reports 70% of continuation while the other 30% abandons the drug but certainly not the wish to lose weight - meaning they will try to find alternatives, probably within Hims.

Once Hims stops its compounded semaglutide product, users will either go towards other services or towards branded products, the ones with 42% of retention… They’ll first need a prescription & then to find supply because even if the shortage is over, nothing confirms that 100% of patients will find shoes for their feet.

What happens then? They try, have side effects & stop? Or maybe it works, at least for 40% of them. What about the others?

My opinion? They go back to a better service with tailored drugs. Either trying oral products or waiting for compounded liraglutide on Hims. After all, the company will stop its semaglutide product around May for a liraglutide starting mid-25… isn’t it worth the wait? If Hims’ service is so great?

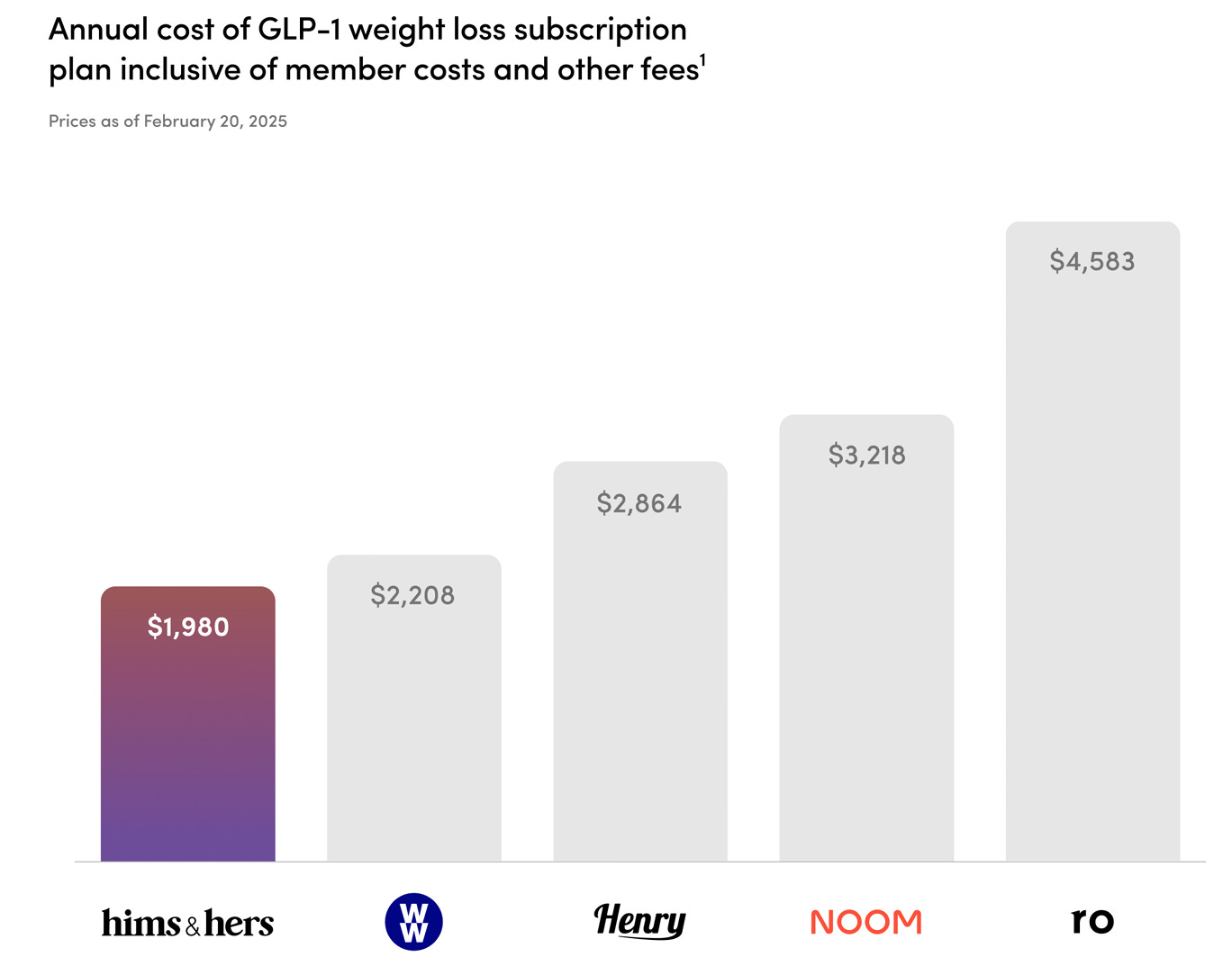

Remains the question of pricing as prescribed branded GLP-1 can be refunded but everyone won’t have access to it & most cannot pay a branded solution, usually worth more than $1,000 per month.

Lots of unanswered questions but the weight loss drug part of Hims isn’t dead nor dying. Dynamics are uncertain, that is for sure but once more: the bull case is about personalization & retention and we’ve seen that both are strong for Hims.

I wouldn’t be surprised to see users coming back to Hims or shifting towards other solutions instead of going to the broad market trying to find branded solutions.

The rest of the business.

The last question from an investor point of view is what is left without compounded semaglutide? Is there still growth? Once again, more in the guidance but some comments before getting there.

“So I think across the year, both on the full year basis as well as within quarters, the vast majority of the revenue is still coming from the non GLP-1 related offering. We still see that the overall tenured specialties remain quite durable. Much of the increase in personalized subscribers that you're seeing, that number drive north of 55% is driven in part by the continued shifting of subscribers to those categories.”

So yeah… GLP-1 is great & would have made the story much better, the growth much faster. But Hims continues to be very healthy without it, while alternatives will possibly scale more rapidly than we think.

Revenues.

Without any doubts, FY24 was a great year in terms of revenues for Hims.

We’re talking about a 69% YoY growth with slightly declining margins but this isn’t important as it comes from the GLP-1 drugs being added to their offering - lower margin product. It’s honestly noise.

The rest is pretty standard for a growth company with more expenses especially in marketing - with the Super Bowl ad & more, to attract users & higher Op. & Support as the usage of their platform grows.

Hims ends the year with $125.8M of net income including a $54.3M benefit on taxes from the last quarter & $9.8M of interest on their cash, meaning $61.9M of income coming directly from the business for a pre-tax margin of 4.8%. Pretty correct.

In terms of cash, balance sheet closed FY24 with $300M of cash for no debt & FCF was $198M FY24 including $92M of SBCs for a 13% shares dilution. Fair enough to my opinion for a growth company yielding as Hims did this year.

Guidance.

To the last big part of this report, the guidance.

Before going further, we need to understand what is factored inside of this guidance.

”This figure excludes contributions from commercially available dosages of semaglutide, which will not be offered on the platform after the first quarter. There may be the potential to offer commercially available dosages of compounded semiglutide throughout the year. However, we see our steady state weight loss offering being primarily composed of our evolving oral based solutions as well as liraglutide later this year. Personalized semiglutide dosages will supplement these core offerings for the subset of consumers for whom it is a clinical necessity.”

Bottom line: No semaglutide included in guidance post Q1-25 which would mean the three last quarters of the year would share $1.76B of revenues, without compounded semaglutide.

Assuming this only product was indeed $150M of revenues in Q4-24 or 30% of total revenues, they’d reach $170M or so Q1-25 which would roughly mean a guidance of $2.13B FY25 without including semaglutide at all, or a growth above 40% YoY FY25. Not sure this is bearish…

Valuation.

So… I’m not sure anything changed here. Hims was trading around $42 post-market & guidance is still way above my original initial expectations, excluding compounded semaglutide…

I am certainly not overshooting with a 40% CAGR up to FY26 as Hims would require a 25.7% YoY growth in FY26 if it reaches its FY25 low-end guidance, which seems largely feasible with all the upgrades the company is working on & the inclusion of liraglutide which could clearly bring back a portion of the GLP-1 demand.

My fair price will remain around $25 with some margin of safety.

My Take.

Very complex quarter, very tough price action as the stock is down 20% or so post-market & I personally don’t think it deserves it. The most important questions were what portion of Hims’ growth comes from compounded semaglutide & will they be able to propose alternatives once this service is closed.

On the first one, GLP-1 was 15% of FY24 revenues & Hims grew 43% YoY excluding it - without distinction between the legal & non-legal product. And guidance is talking about a 56% YoY growth without semaglutide post Q1.

As for the alternatives, we have the oral product & will have the compounded liraglutide in a few months which will time nicely with the suppression of the semaglutide so users could pass from one to the other.

I remain bullish. It is hard for me to understand why this quarter would be bad & why the company wouldn’t succeed as guidance is really strong even without semaglutide & they will propose alternatives. The real question is about retention of those users, will they pivot towards other solutions or will they leave entirely the company? And if they were to try branded products, will they come back or not?

This will be interesting data to control over the next quarters. But for now, I personally see no fundamental reasons to sell my position, on the contrary. I will need to sleep on it but will certainly increase my holdings depending on price action - you guys will have to follow the portfolio for this one, I won’t do a specific post about it & you already have the reasoning!

I’ll let management conclude this lengthy report.

“While most might get lost in the noise of today's realities, the future is where we are focused.”

Thank you again for the quality writeup. Do we know if the FY25 guidance includes alternatives (oral and liraglutide), or is excluding all post-Q1 weight loss drugs completely?

how did you get $25 FV for Hims? also, how did you calculate PES and PS in two tables in your valuation thesis