Arista Network Q3-25 Detailed Review

Still expensive

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Arista’s bull thesis is here.

We are experiencing a golden era in networking with an increasing TAM now of over $100 billion in forthcoming years.

Business.

One of the leaders in data center networking, both on the front end (interconnecting hardware like CPUs, servers, firewalls, storage, etc.) & the back end (interconnecting GPU clusters). There’s no sign of this changing based on this quarter’s results.

One is the bundling strategy with NVIDIA, and the other is the white box. So we have not seen any significant changes in share, up or down, at the moment. It’s stable.

NVIDIA continues to lead on the back end with NVLink, but Arista still holds the upper hand on the front end. That’s reassuring, especially after hearing a few weeks ago that Meta plans to use NVIDIA’s Spectrum-X, though there’s no clarity yet on why, how or whether it’s just a pilot.

It’s early, but management doesn’t see any change in dynamics for now.

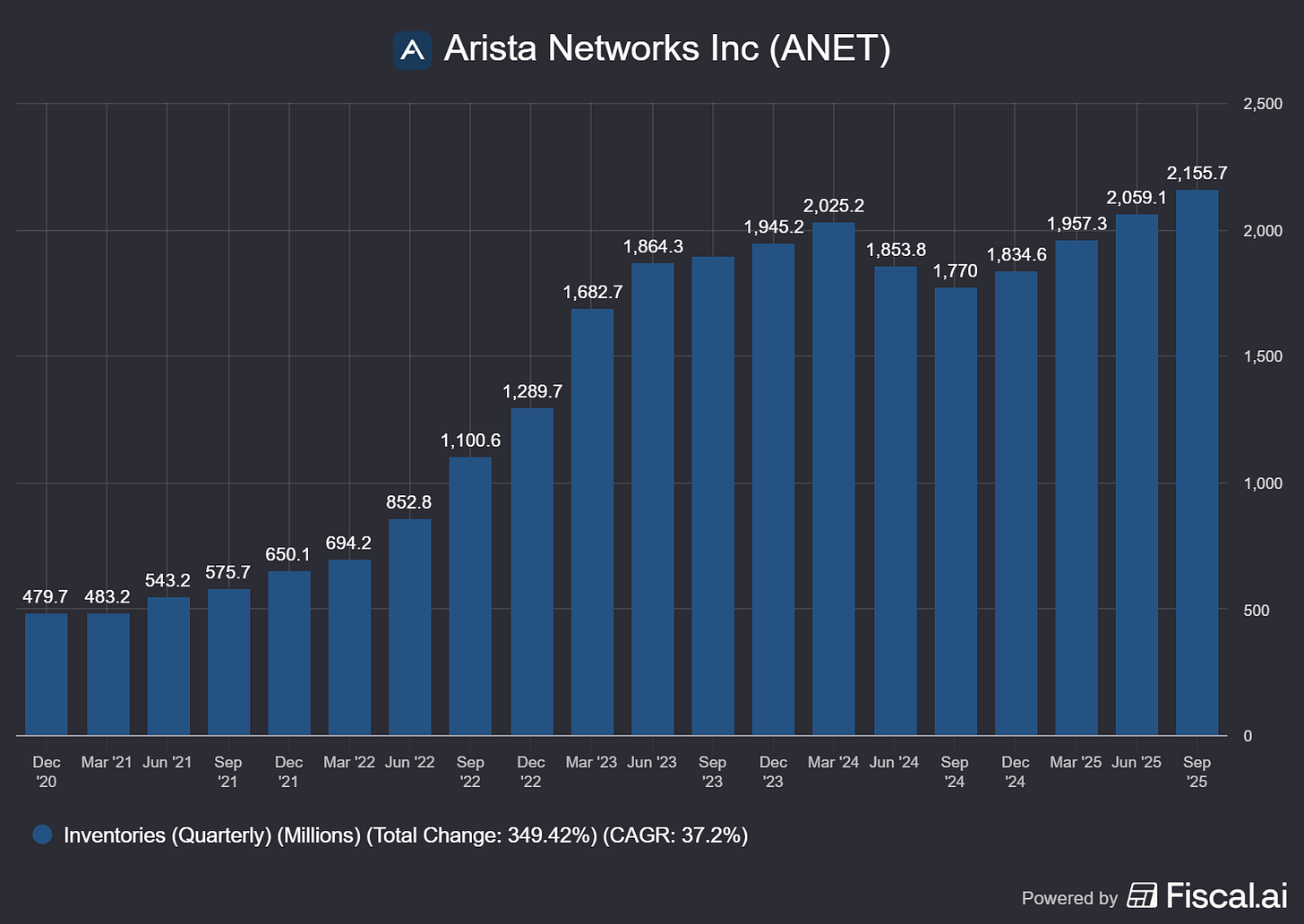

The biggest concern this quarter was the slowdown in sequential growth, which is a non-issue. Arista recognizes revenue on shipment and acceptance not on orders, and is dependent on external factors - mostly suppliers. We know silicon orders are taking longer due to massive demand so these delays are logical.

At the same time, the variability I was stating is demand is greater than our ability to ship. Lead times on many of our components, including standard memory and chips and merchant silicon and everything, are nothing like 2022, but they have very long lead times. Ranging from 38 weeks-52 weeks. So we are coping with that, and you can see Chantelle is leaning in and making greater and greater purchase commitments. We wouldn’t do that without demand.

It shouldn’t be mistaken for a drop in demand.

However, there are times we can’t ship everything despite the demand, and so you’re accordingly seeing that. I wouldn’t read too much into the quarterly variances, but I would say we feel we have never felt more strongly about the demand aspect of this. So no change in demand, some variation in shipments.

That’s also why Arista’s inventory is growing.

As we read 10-Qs and only comment, it’s easy to forget that businesses have real-world implications. Manufacturing takes time. Shipments take time. It’s not as simple as analyzing a revenue sheet.

This happened, and it’ll happen again.

We will continue to have some variability in future quarters as a reflection of the combination of demand for our new products and the lead times from our key suppliers.

But it isn’t a demand issue.

We are experiencing momentum across cloud and AI titans, near cloud providers, and the campus enterprise.

Looking ahead, we need to keep in mind that Arista is GPU-agnostic. Its products are built to support any infrastructure, which means even if NVIDIA’s front or back end competes, Arista remains the go-to hardware for other systems - and for NVIDIA’s.

Obviously, NVIDIA is the gold standard today, but we can see four or five accelerators emerging in the next couple of years. Arista is being sought to bring all aspects, the cabling, the co-packaging, the power, the cooling, as well as the connection to different XPU cartridges, if you may, as the network platform of choice in many of these cases.

Of course, we interoperate with NVIDIA, the worldwide market leader in GPUs, but we also recognize our responsibility to create a broad and open ecosystem, including AMD, Anthropic, Arm, Broadcom, OpenAI, Pure Storage, and Vast Data, to name a few, and build that modern AI stack of the 21st century.

So again, I wouldn’t worry about demand especially given the number of data centers being built. On those, management shared some color into how specifications are decided and by whom

And where the responsibility for procuring the large data centers and the power and the location and the cooling is clearly done by our cloud titans, but the specifications on exactly what’s required on the scale-up, scale-out network is done by the partners like OpenAI and Anthropic. So it’s really a joint decision.

I found that interesting, though it doesn’t necessarily offer more clarity on demand or else since OpenAI or Anthropic could choose any networking system, but this is the dynamic.

Financials.

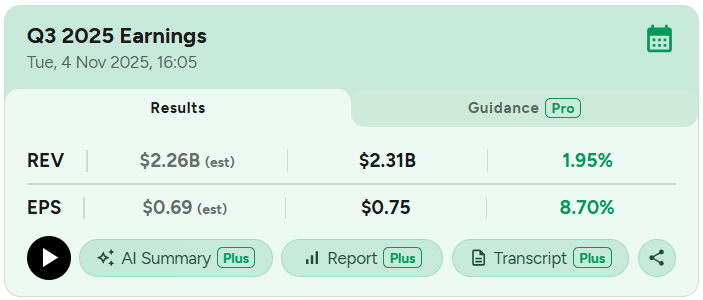

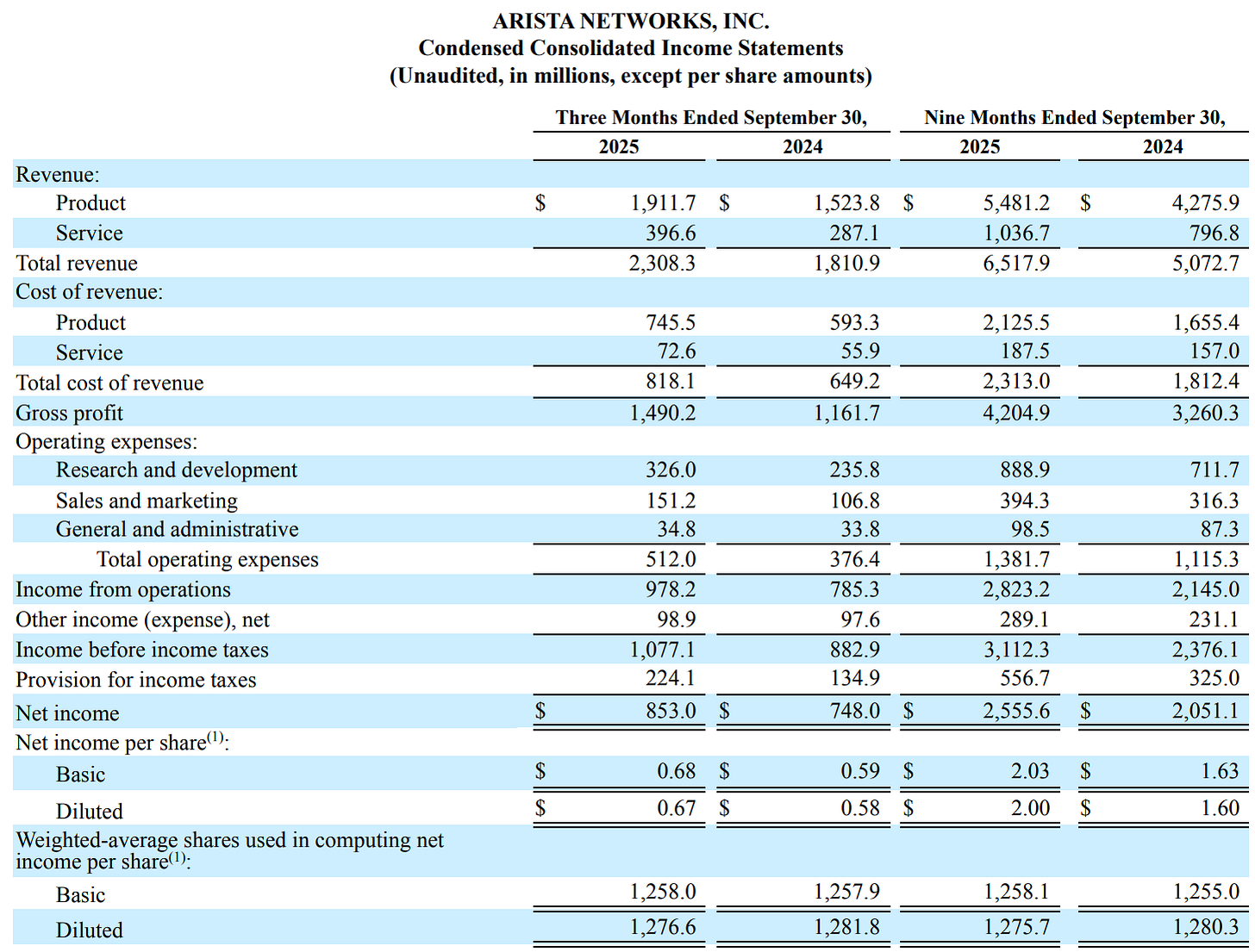

As mentioned, sequential growth was 4.7%, which spooked analysts but YTD growth is 28.2% which is strong especially given the context. Gross and operating margins are relatively flat compared to last year, and net income grew 24.6%.

In terms of cash, the company holds $10.1B in net cash and generated $1.24B in FCF. They didn’t buy back any shares and still have $1.4B left on their repurchase plan

The actual timing and amount of future repurchases will be dependent on market and business conditions, stock price, and other factors.

Translation: management thinks the stock is too expensive to spend cash on it. And we should too.

Guidance.

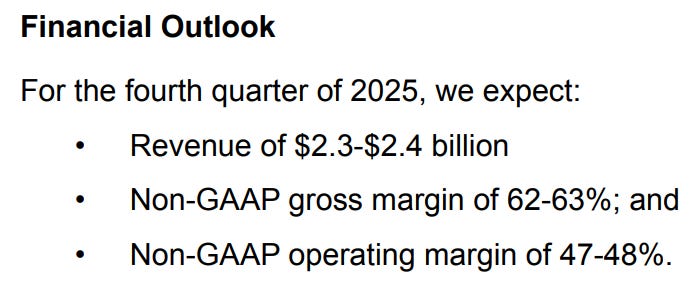

Management expects revenue to grow between 26% and 27% for the year, which again implies slower sequential and YoY growth.

They also reiterated their 20% FY26 revenue growth guidance.

Investment Execution.

In my opinion, this was a good quarter; reassuring in terms of market share and demand, which was important after the recent headlines.

But as always, the market cares about growth and any slowdown is punished, even if percentage growth is structural as the bigger you get, the lower percentage growth but not necessarily dollar growth. Strong growth earns strong multiples and small missteps can wipe out billions in value.

That’s what’s happening to Arista despite no actual misstep. A 20%+ FY26 growth outlook, strong demand and stable market share while competing with NVIDIA’s packaged solutions can’t be called missteaps.

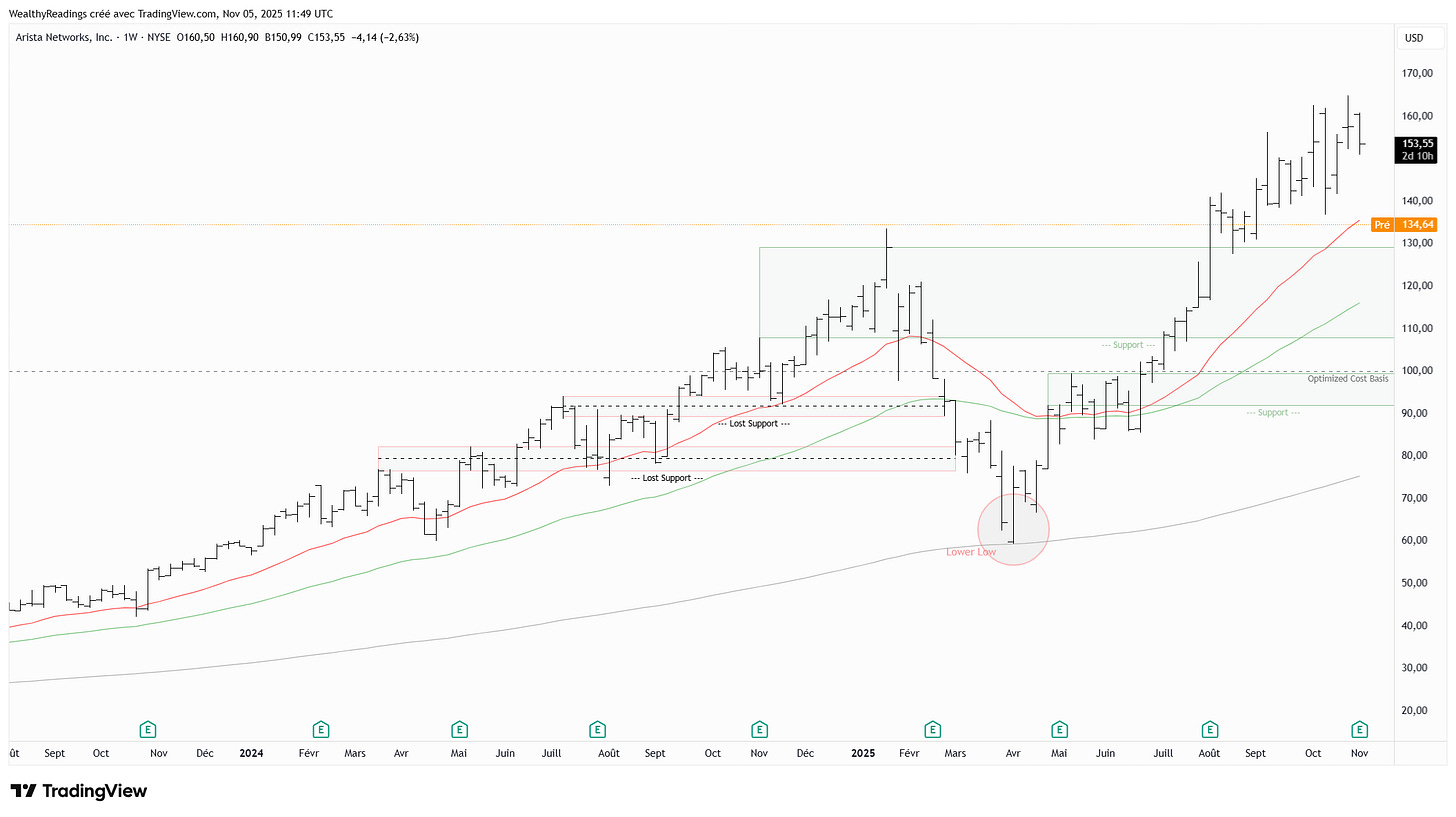

Yet the stock is down 10% plus pre-market, also driven by the short-term bearish sentiment. All that being said, Arista was expensive, even assuming 25% growth.

This breather was necessary, whatever the justification.

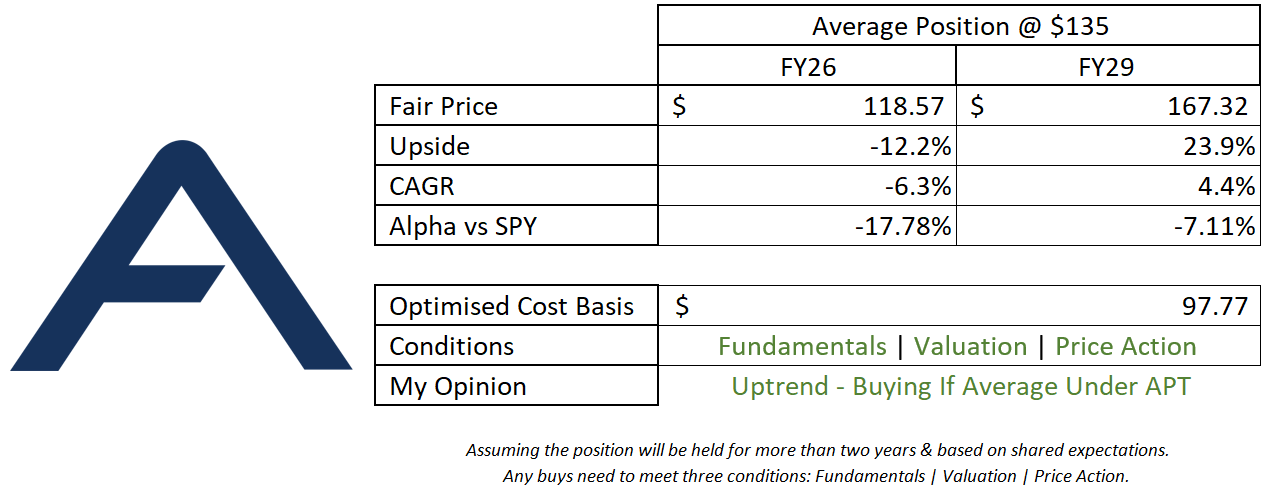

This model assumes a 22% & 16% CAGR growth until FY26 & FY29 respectively, 40% net margins, 0% dilution, P/S & PER at x15 & x38 respectively.

My valuation hasn’t changed, I still consider ~$100 a fair price & management would also probably start spending its cash around this price - maybe earlier.

The stock is set to open on its weekly 21, a potentially strong spot for a bounce but the market is driven by sentiment more than price action, valuation, or fundamentals these days. So who knows…

This could be a solid accumulation price, near the $130 breakout. But I personally won’t touch Arista for now. It’s a correct hold but nothing more.

Everything has a price. And Arista is still expensive even after a 10% drop.