Weekly Recap | September - W2

Google will die, Hims acquisition, the Palantir Mania, Bitcoin's liquidity, PayPal continues its partnerships, Macro comment, Tesla in China, Apple's new old.

Earnings season is over, but this week came with so much news that it doesn’t feel like it. September begins.

Google’s Bears are at it (again).

I share monthly the companies I have on my radar & the price at which I’d start buying their stock. This price was reached this week for Google when it fell under $150 for two main reasons - which contradict each other…

AI & LLMs. This is the primary business concern, as there is now undeniable competition for Google’s search engine, while the DoJ is still on their back for their monopoly.

Over the last year, Google’s market share & usage haven't declined while revenues & advertising demand have been growing - we saw that in the last quarters. Nothing suggests a slowdown in the use of their search tool, and to be honest, OpenAI is still a niche tool - not even that good for now. It will be, but it's not like Google is very far behind; they simply offer different AI tools & services.

If you can have equivalent answers with the same speed and fluidity on Google as on LLMs, users probably won't change their habits without a good reason.

Free Cash Flow. This is the second issue, the financial one. A real one that cannot be denied but can be explained. The company's FCF/share is flatish for three years, and margins are decreasing while revenues are growing - more money flowing in, less FCF at the end.

Many see it as a weakness, but it actually is a show of strength.

Google has been able to grow revenues and OpCF, maintain high returns to shareholders, grow CapEx exponentially, and still have flat FCF over the last three years. This is nothing if not excellence.

These two bear cases contradict each other. You can't criticize Google for having strong CapEx and then blame it for not being as good or innovative as the competition. This “competition” consists of private companies on which no one has access to their financials, and their CAPEX are surely as large as Google’s, but without any of its strength.

To finish, each & every public company working on AI has had the same behavior over the past years - we can talk about Meta, Tesla, Amazon… They all increased CAPEX, and sure, it will take time to pay off. But it’s more important to innovate than to become irrelevant.

I don’t see anything concerning on Google except the market’s behaviour & its stock price. So I’m taking advatage on it, slowly because things can go lower, but starting to.

Hims Acquisition.

We have two pieces of news to dissect today about Hims & Hers, both related to the acquisition of MedisourceRx, a 503b compounding pharmacy for which they paid, in part, with shares. This aligns well with what management shared during the last earnings call: their priority is to scale their business & grow their advantage over competition - which is, in part, due to their treatment personalization.

MedisourceRx. A 503b pharmacy is an FDA-regulated outsourcing facility with the rights to manufacture drugs without any medical demand - that is to cmanufacture stock in anticipation of demand.

This will allow Hims to manufacture more drugs in general, mainly personalized drugs for each of their business categories, which is the new source of growth & focus for the company. It also expands their stocking & delivering capacities.

Mixed-Shelf Registration. This is what worried the market earlier this week, as this registration is a legal requirement for any company to finance itself through different means - issuing more common stock, debt, bonds etc...

This meant that Hims needed financing, and those who followed the company knew why as they had already talked about this acquisition, but many investors apparently didn’t.

It took a few hours to have the information that Hims paid for this acquisition in shares - emiting 976,341 of them. A pretty small dilution for what this acquisition will bring to the business in the years to come - knowing that Hims has a buyback plan in place.

A very good news for investors as this will help the business scale.

The Palantir Rocket.

There’s a lot to say about Palantir, and I’ll use this weekly to detail why it’s important not to FOMO and to stick to accumulation prices, as well as talk a bit about what investing is all about.

We discussed Palantir’s inclusion in the S&P 500 last week, which is wonderful news for the stock. And good news rarely come alone; this week, we also saw some price target revisions, notably from Bank of America, which estimates Palantir’s fair value to be around $50 per share.

What is investing about? Maximizing returns, right? The minimum goal when stock picking is to beat the S&P 500's median returns, which are around 11% per year. Palantir currently trades around $35. If you were to buy today, you’d need Palantir to reach $50 before 2027; otherwise, your return would be lower than the SPY, wasting your liquidity on low returns.

Here are the necessary ratios at which Palantir needs to constantly trade until 2027 to reach those returns, based on reasonable assumptions.

Is it possible? Yes.

Would I base my investing on the fact that a company needs to constantly trade above x120 earnings and x21 sales, based on the best-case scenario, to reach proper returns? No.

As a reminder, Palantir raised its FY-24 guidance last quarter to 23% growth YoY. We would need a pretty strong growth acceleration to reach a 24% CAGR up to 2027 - not impossible, but unlikely. Palantir is a wonderful company, and I have no doubt it will trade at $50 one day, but it doesn’t mean today is the perfect buying opportunity. And an analyst price target or an SPY inclusions doesn’t change anything to the company’s financials.

Performance is made when we buy. I give no advice here; each of us make our own decision. I’m simply saying that there’s a time to buy, a time to hold & a time to sell. I’m holding for now and will gladly buy more PLTR when the price is right, but we’re not there today, for me.

Bitcoin’s Pump Origin.

If you still don’t know everything about Bitcoin, I finally wrote my small book on it, and you’ll have it all here. This will help you understand why so many are buying this asset lately.

We had a lot of volatility during the summer, moving from $70,000 to under $50,000 and back up, providing some good opportunities to buy - which I took, as I’ve shared many times here.

What’s interesting is the origin of the inflows. Everyone expected the ETFs to bring tons of volume, and they did, but they are not the source of Bitconi’s actual strength; on the contrary, we are even seeing an outflow of almost $400M the last month while Bitcoin’s price hasn’t moved at all.

There are two takeaways from this.

First, there isn’t much demand from the ETFs’ clients to buy Bitcoin around $60,000.

Second, outflow from the ETFs with a stable price means a comparable buying pressure on the market. And this doesn’t come from leveraged players, as the funding rates are negative on most trading platforms - more selling pressure.

This shows that even if demand at today’s price is slowing from ETFs & shorters actif on exchanges, there still is a strong spot demand for the asset from other participants.

An interesting observation for the long term.

PayPal & Shopify.

I feel like I’m writing the same thing every week when it comes to PayPal but that’s how it is, as they’ve developed a new partnership with… Shopify. I’ve read a lot of “if you can’t beat them, join them” comments when PayPal partnered with Adyen, and it seems that this was true… but not in the way those who said it might have wished.

Many of PayPal’s competitors are now partnering with them to offer transactions & Fastlane, almost as if this new product is becoming the new reference and everyone wants to offer it on their platform. And Alex confirmed this in a conference he gave this week.

“So we're bringing the largest consumer ecosystem to these merchants and enabling them to again raise their conversion rate to an 80% for returning users, which overall creates a double digit lift in conversion. And we think this will ultimately be the default guest checkout experience for any merchant that's looking to have the best highest converting experience anywhere in the world.”

They also talked about their new product & campaign, PayPal everywhere, as you can now use the app physically & enjoy the new rewards. The hope is that users used to pay digitally with PayPal will also take the habits of paying physically, growing the company’s market, exponentially. Available in the U.S now, this should also come in Europe this year, one country at a time.

They even did a pretty cool advertising.

And it seems to work already as feedback says that the two categories the most chosen are for groceries & gas, products you mostly buy physically.

But it isn’t the only good new as Venmo is also starting to fly after the new management started focusing on it and allowing more interations for users - especially with small commerces.

“We've seen 30% monthly active user increase in Q2 with Pay with Venmo.”

And Braintree is confirmed to be monetized at its just-value - being higher than its actual pricing to merchants.

“The reality is we've also started to build some very, very powerful value added services, things like risk as a service or FX. And we've also now put in play really the best guest checkout experience on the market with Fastlane. But we're also having much more intimate conversations about pricing to value. And our customers know that.”

But Alex seemed confident that their merchants understand & accept that fact, while transitions will take some more quarters of course. A good new for margins & growth.

I’ll also talk charting a bit, as PayPal just retested its breakout this week, a retest of a 13 months accumulation box…

I’ve said it many times, but I’ll say it again: things are changing at PayPal, and for the better. We might finally start to have some fun on this ticker after months of buying.

The FED & the Markets.

This week should (finally) see the FED's decision concerning the interest rates - this Wednesday. Consensus is a 25bps rate cut, bringing them down to 5.25%, something most judge not to be enough but only time will tell.

I'm not commenting on macro usually but this time might be important because if the FED makes any decision other than this 0.25% cut, the market could react harshly. It's obvious as to why if the FED decides not to cut interest rates, as many are afraid of a recession and maintaining them as is for longer might prove them right. But cutting 0.5% would certainly be interpreted as the FED hiding some pretty bad data on the actual situation and rushing to lower them. This would mean the recession is already inevitable.

The market is like politics: it doesn't care about truth, only about how things seem. Either way, let's brace ourselves for volatility. Better be ready for something which doesn't happen than not to be ready at all.

Always more Teslas in China.

Time for a small update on Tesla EVs’ deliveries around the world, starting in China where growth is apparently back - but maybe not for long. The company saw 408,387 of its cars insured in China compared to 408,374 at the same period in 2023.

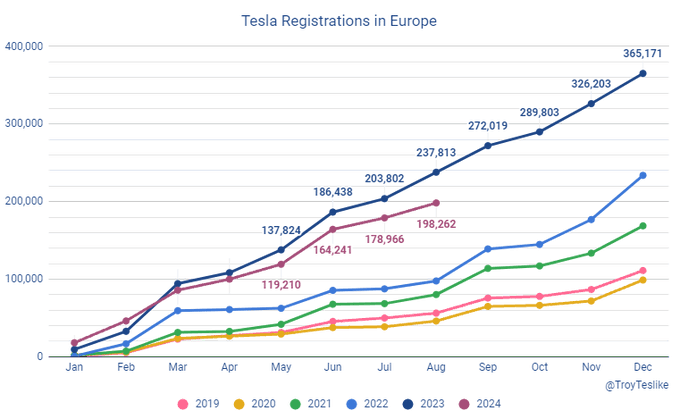

We cannot talk about growth here and the year is far from over so we could end up with a sale decline in the region. But it’s still positive to see that we’re at least flat YoY. It is another story in Europe where we’re still far from 2023’s data.

I still believe this isn’t due to the brand but to the actual economical situation in the continent. But this thesis will only confirm once European get buying power back… Which can be never.

Not very good in term of EVs growth either way this year. But it was to be expected.

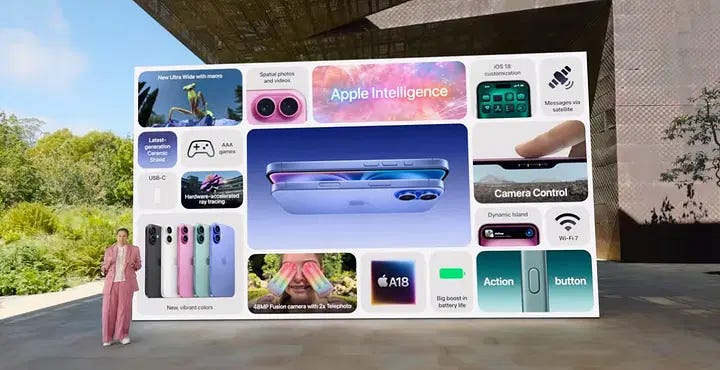

Apple, Nothing New.

Another subject where I feel like I’m repeating myself, but well… is it really my fault if they don’t do anything new?…

Some more customization, an action button, camera control with movements, a battery boost (lol), some new colors… I’m sorry for all the Apple lovers out there. The brand is clearly strong, but their last iPhones has brought absolutely nothing new over the past few years, and it’s starting to show.

The "Apple Intelligence" is good marketing, given that it is nothing more but an integration of ChatGPT, but it only shows a weakness in in-house technology with, again, nothing impressive.

Curious to see how well it sells - and I’m sure it will sell well, but I will say from now on that every iPhone 16 sold is entirely due to the brand, not to the product. But brands can last decades.

Nothing new, starting at $800.

Thanks for doing these weekly updates! Good reminder on what investment is all about.

China is not recovering yet for sure, surprised to see Tesla is selling a tiny bit more than last year, amongst fierce competition from local brands. Maybe their market share is too low to begin with?

Yes iPhone 16 is going to sell well, even they reuse some old colors :)