Weekly Recap | September - W1

Palantir grew up, Celsius & Pepsi drama isn't over, Lululemon insider activity, DOJ & Nividia's damp squib, OpenAI nefunding round, Tesla's Uptober, DCA Price Targets & Crypto.

Palantir included in the S&P.

This is this week big new as a Palantir shareholders as the stock has finally been included inside of the S&P500, a big step for the company’s future although it is included in the big guy’s class at a really big valuation.

It still is a great, an awesome new even, for the long term.

Celsius & Pepsi, the Inventory War.

The drama will never end and the market keeps reacting exactly the same way every time management gives the same information. Wednesday was no different when Celsius’ CEO said for the fifth time that revenues will be impacted in Q3-24 by Pepsi’s inventory optimization, estimating a reduction between $100M & $120M compared to Q3-23. This triggered another sell-off, sending the stock 10% lower to the $30s.

A reminder from the last earnings call.

“So unfortunately, I can't predict what our partners will do. That's really up to them to continue to optimize their system. And if it's fully optimized, then we'll be in good shape. But there's still some flexibility within that system for them to further optimize. We'll have to see where that goes.”

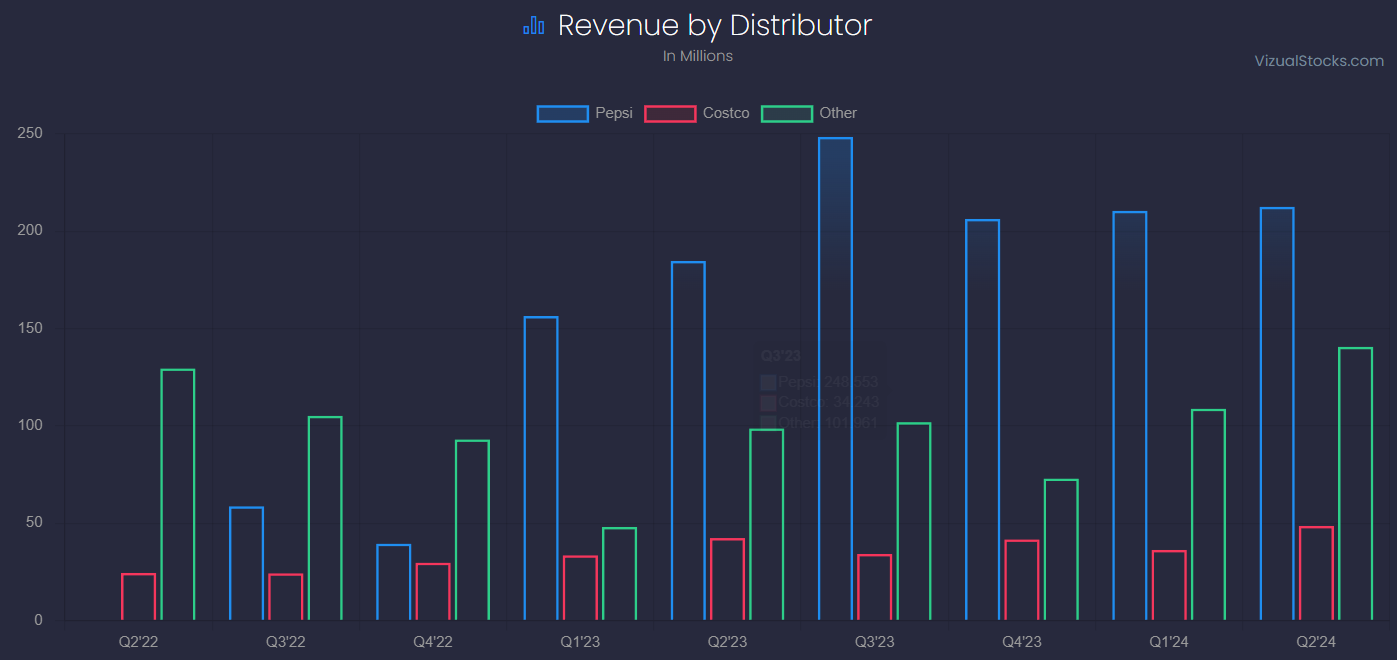

Celsius & Pepsi Relation.

Pepsi is one of the main distributors for Celsius drinks in the U.S., and their relationship is pretty straightforward: Pepsi buys from Celsius, sells to retailers who then sell to consumers. Hence, Celsius revenue is registered when Pepsi buys, not a second later, and this is the reason for the actual problem.

Why? Because Pepsi bought a lot, really a lot, during 2023, much more than the actual demand from the end consumer.

Which means they ended up with lots of inventories during 2024 than they expected and that their stock was enough to satisfy the retailers’ demand - hence no need to buy more.

There’s absolutely nothing new besides the value of the decline in Pepsi’s purchases this quarter and I’d like to add that we still have one full month to go before closing the quarter, enough time for Pepsi to buy a bit more if needed.

Consumers.

Besides this mess, management also gave some color on retail consumption, with a 10% growth in scanner data for the first two months of Q3-24 compared to Q3-23. This data comes directly from the different retailers furnished by Pepsi, which literally means that consumption of Celsius drinks is growing YoY.

But this doesn’t impact Celsius’ revenues today because those sales come from Pepsi’s inventory, and Celsius registers revenues when they sell to Pepsi, not to the consumer directly. Indirectly, it means that Pepsi will need to buy more Celsius going forward as retailers consume more.

The bear viewpoint is that we’re talking about “only” 10% growth in consumption, weaker than many would like to see. Although we’re only talking about Pepsi’s part of the business which excludes Costco in the U.S., all the international & online sales, so there’s more room for growth.

But we might see a weak Q3-24 which would bring more pessimism to the name as reducing Pepsi’s revenue by $120M could mean a Q3-24 revenue in decline YoY - although I’d bet on a flatish more than a decline.

My Take.

Nothing new in Celsius city. We knew growth was slowing & that Pepsi was optimizing its inventory. How long this will take is very hard to know, but management hinted it would take a few quarters early in 2024 so we should reach the end. As to how Pepsi will manage inventory going further, this still is a question mark.

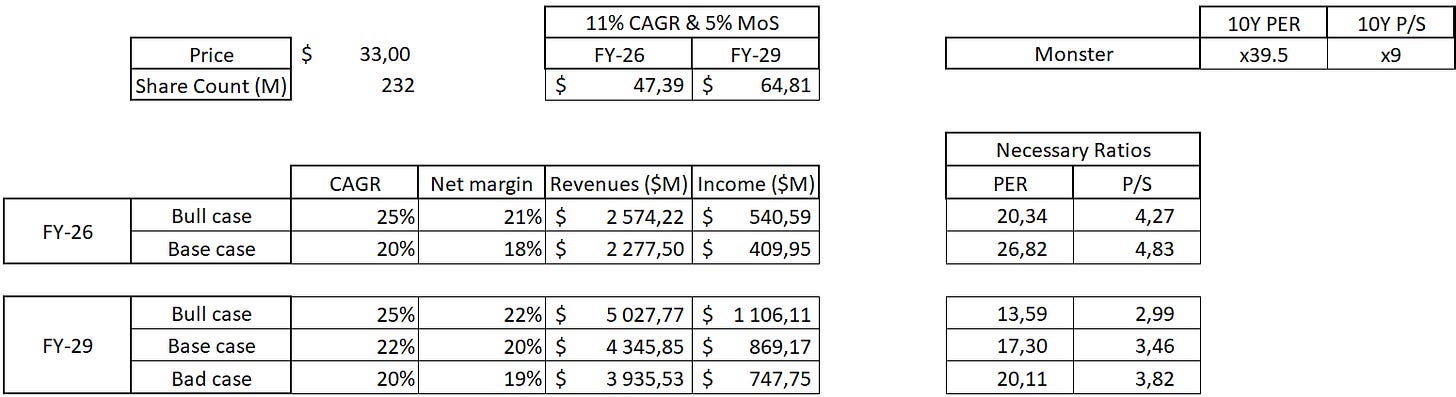

The only change is in terms of valuation with Celsius actually trading at 4.4x EV/Sales while projections didn’t change.

At today’s valuation, we wouldn’t need 20% growth to have proper returns with proper ratios; even 10% CAGR up to FY-26 would give 11% CAGR with lower ratios than Monster’s 10-year average.

I am not saying to buy blindly here because there still are risks around the name, but I am saying it’s more than worth considering it and doing your homeworks to make your own decision.

Lululemon CEO’s buying.

Everything is in the title, I won’t have much to add to this, except to say that insider buying only happens when management has a strong conviction in its business & stock price. Insider selling doesn’t matter, but insider buying tells you everything you want to know.

And when the company’s CEO buys his own shares at the market for more than $1M, at an average of $260, it tells you even more.

Nvidia VS DOJ.

The U.S. Department of Justice has been on Nvidia’s back for some time now & for different reasons, all of them due to Nvidia’s actual monopoly on computing power hardware, which they suspect them to sustain through different means - which would be illegal of course.

The market got a big scare this Tuesday as some news about a subpoena sent to Nvidia’s management which would mean things are moving. But less than 24h later, Nvidia answered that they never received anything… Weird things happen in this neighbourhood.

We won’t know the truth but this might mean that the DOJ didn’t stop looking into Nvidia and that this might blow back to our faces in a few days, weeks, or months - or never. You never know what to expect with governmental institutions…

As for if Nvidia is or isn’t working on keeping its monopoly… C'mon.

OpenAI new Funds Raising.

We talked about Apple potentially investing in OpenAI last week - and fighting with Microsoft to acquire it maybe? More news came as OpenAI is apparently trying to raise more funds, maybe something close to what Altman wished some months ago.

What’s $7T after all?

Jokes aside, more companies than Apple are looking to invest in OpenAI in this new round with names like Nvidia also considering its first investment while Microsoft would reinforce his.

Like it or not, many companies are betting on them.

Tesla FSD v13 & 10/10.

Tesla revealed this week that they’ll release the v13 of FSD in October… The same month that they plan to reveal the “robotaxi”, or so everyone expects.

I do not have much more to say about it, except that they sure know how to tease the world and grow expectations around their brand & products, although this time… They can’t really fail. You cannot hype the world for 15 years without showing results and the EVs are now accepted by all, they need to show results for their other projects.

Tangible results, no more empty promises.

DCA Price Target & Crypto.

I’ll start by talking about Bitcoin, Ethereum & Solana which all retested their early August wicks as I talked about some weeks ago.

“I personally bought the wick on the three assets but crypto has the bad habits of always retesting them… Which doesn’t mean we will without any doubts go back to $50,000 in the next days, weeks, but I personally think we will - and I will buy again if it happens.”

Without much suspense, I bought them all - Bitcoin is trading at $53,000 at writing time, which is enough already for me to start buying although the wik bottom isn’t perfectly retested yet.

There’s toom to go lower for them all.

Back to stocks, here are the ones I follow closely and would like to buy with their buying price target. The color code is about my accumulation priority with the green ones being the first stocks to receive liquidity if under the buying target, the orange ones the second & the red ones last. This is mostly due to my personal appreciation of their reversal potential, hence where returns will be yielded faster - eespecially if a recession does hit.

Here are the stocks actually under my accumulation price target.

Olo still seems strong & very undervalued while Airbnb & Lululemon seem to finally have found a daily range, good enough signs so I continue buying, slowly as we’re still in delicate market conditions. Celsius & Hims are both still falling and while I started my DCA already, I’ll wait to have some daily consolidation before resuming. There’s no rush.

And here is the complete list.