Weekly Recap | October - W4

Bitcoin & Microsoft, Hims hiring & GLP-1, Meta's RayBan, The casino will stay open, TSM is America, Starbucks pre-announce earnings & Buying plan.

Pretty quiet week, the last one as the next will be very, very busy so be ready to be a bit spammed. Earning reviews will fly, almost one per day.

Watched Stocks & Portfolio.

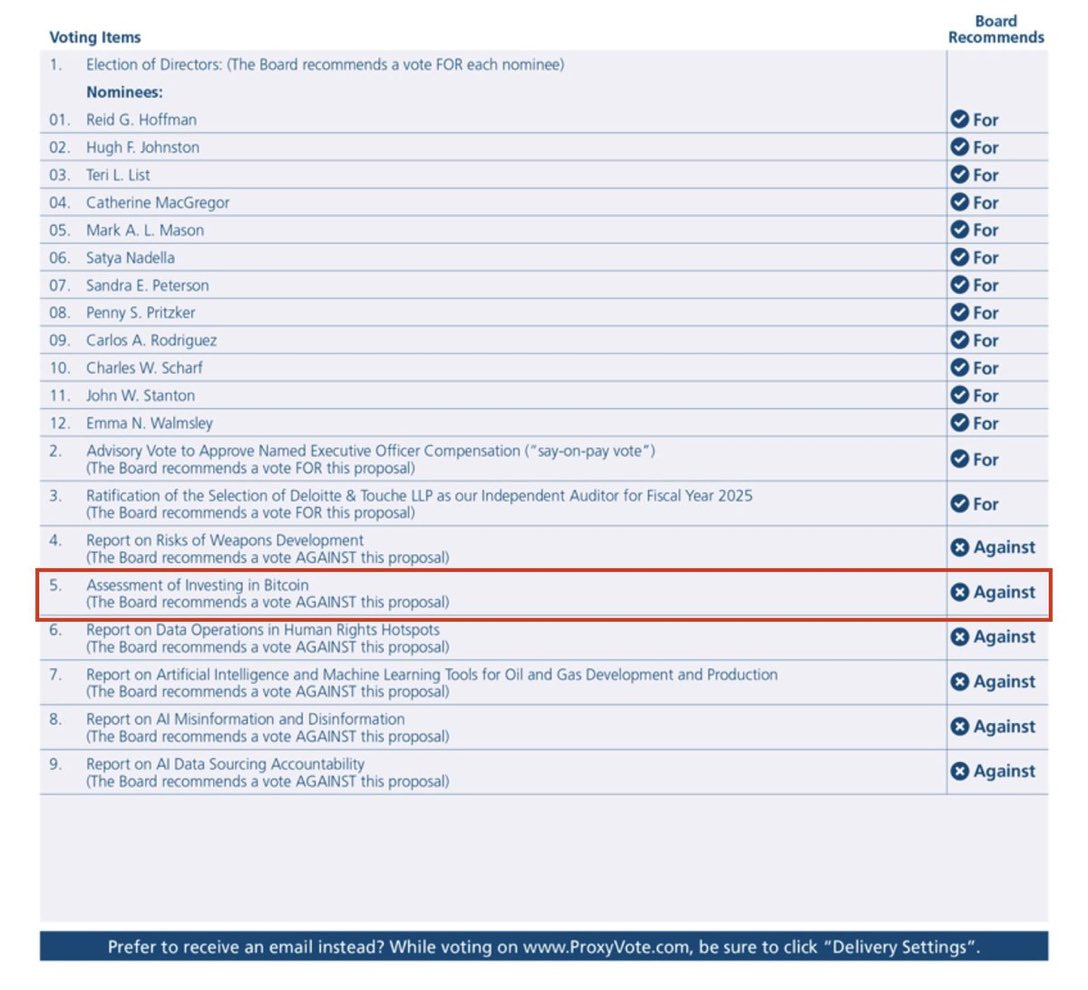

Microsoft & Bitcoin.

This is a big win for the newest asset as the big & mighty Microsoft did include a simple question for its next shareholders' vote.

The board is recommending to vote against which isn't shocking at all and the proposition will probably be rejected. But the 'fact that the question is asked through a shareholder vote is a victory for Bitcoin. It means the asset is considered important enough by enough people to be discussed.

It isn't surprising after Microstrategy and Tesla already own some in their balance sheet but it is nice to see things moving. It wouldn't be surprising to see the asset become the equivalent of what gold is for states.

I know Bitcoin is still a complicated subject for many but if you are here and still have doubts or a disgust for the asset, please take some time to learn about it. Let's not miss opportunities due to prejudice.

Bitcoin is a wonderfully interesting asset and is worth some time.

Hims is Hiring & GLP-1.

Two news for Hims today.

The first one is the hiring of Dr. Jessica Sheperd as Chief Medical Officer of Hers, an OB/GYN & Menopause Expert. The new indirectly says that Hers will soon propose gynecology or/and menopause drugs but Dr. Shepherd also has a large public image, and will be promoting Hims&Hers service using it.

The second new comes with more GLP-1 drama as after Lilly, Novo Nordisk is asking the FDA to ban semaglutide compounders - a cry for help to assert their monopoly. Companies begging institutions to regulate isn't a usually display of strength but this is only an interpretation.

Meta’s smart glasses.

We finally had some data on the Meta x RayBan smart glasses from EssilorLuxottica's CFO - a European optical equipment company, during their earnings earlier this week. Good news.

“Just to give you an idea, in 60% of the Ray-Ban stores in EUrope, in EMEA, Ray-Ban Meta is the best seller in those stores.“

Nothing about the quantity nor the portion of revenues but it shows that there is a market for these. Bright days ahead for Orion.

Other Subjects.

TSM in America.

For the first time, TSM has produced more semis in American than in Taiwan and this is huge for the U.S. A bigger deal in terms of geopolitics than for the market but it will also slowly take away the famous "Taiwan risk" when investing in TSM… Although it will also give a bigger control on semis to America.

It's also worth saying that the Arizona fab is mostly producing 5nms while the most advanced ones are still produced in Taiwan. So until these are produced in the west, the "risk" is still here.

Starbucks pre-disaster.

New CEO, new life. That's the path Brian Niccol chose as the company released a "pre-earnings" - which was basically the company's earnings, this week.

Without any surprise they were bad, but I'll treat them with their official release as we'll certainly have more information then. Brian decided to use this quarter as its trash quarter, starting with the suppression of guidance for FY-25.

“Our fourth quarter performance makes it clear that we need o fundamentally change our strategy so we can get back to growth and that’s exactly what we are doing with our plan.”

Nothing unusual, give all the bad news at once to then be able to move freely. Starbucks is still a wonderful brand in a very competitive landscape, I certainly wish they can bounce back but wouldn't put my money on it just yet, not without concrete positive data.

Keeping a close eye on it, exactly like Nike & others.

MacDonald’s drama.

The company's stock dropped 10% this week as some cases of E.coli were linked to its restaurants. We're talking about less than 100 persons while McDonald's serves dozens of millions of people daily.

I won't try to defend the company but wiping billions of capitalization for this seems like an overreaction and even though I am not interested in the stock, I wouldn't be worried about this new if I were holding or intending to buy/accumulate.

The Casino will now Stay Opened.

This is still a discussion but the New York Stock Exchange is apparently planning to extend equities exchange to 22h per day. Why not 24h is hard to know but I guess traders also need their sleep.

I believe this is meant to happen, whatever our personal opinions. There is no need to have it opened a few hours per day with internet now and this means more fees & more money made for operators. Robinhood paved the way but they were just a bit early, not groundbreaking.

My personal take is that this will bring much more volatility as many will be able to sell or buy whenever, overreacting to any events around the world. It will certainly require more stomach to hold but it seems to be a good thing for long term & patient investors - but this is just a wild take.

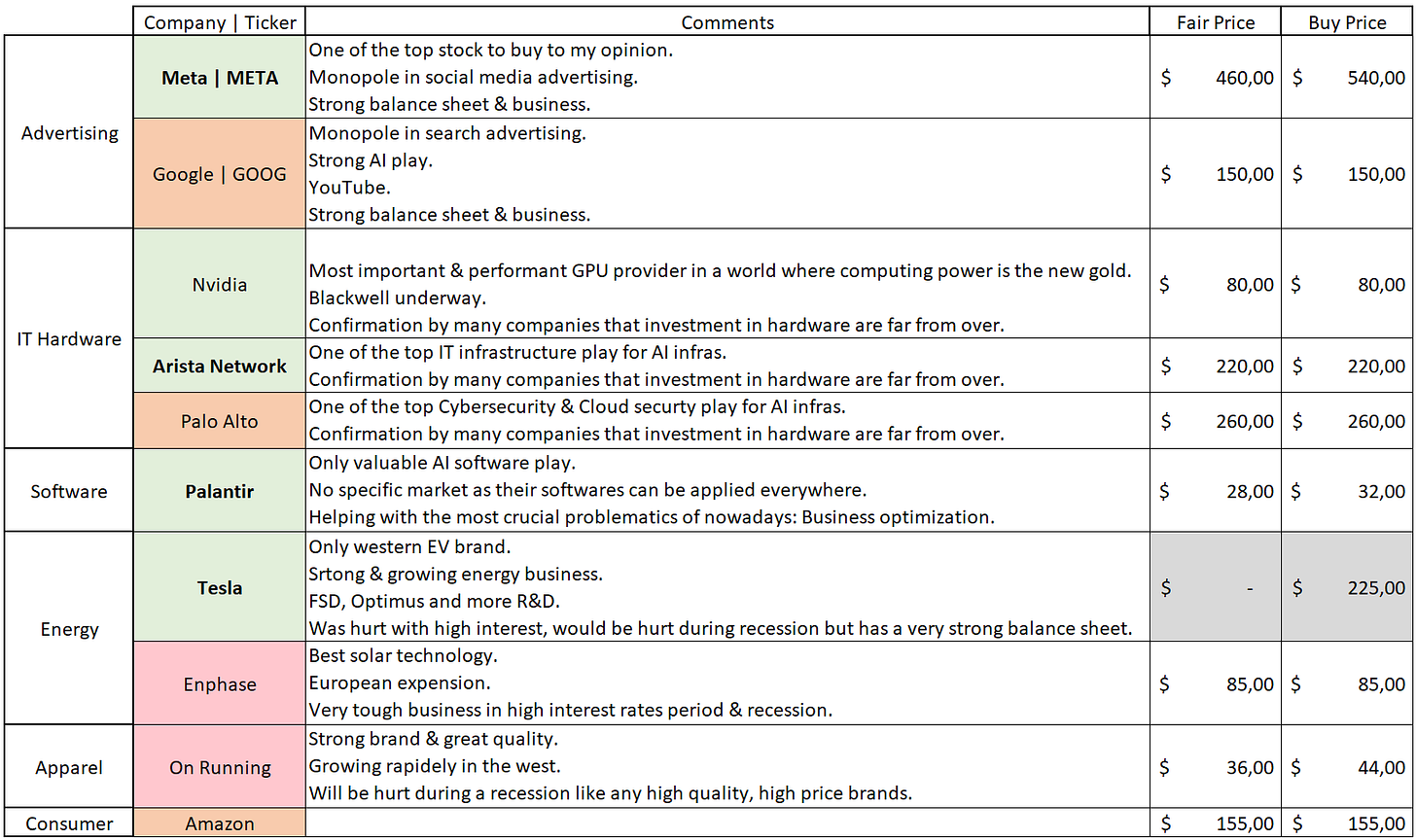

Buying Plan.

I don't want to spam you too much and next week will already be very, very busy so I'll use this weekly to share the updated buying plans.

The only modifications are with Tesla, which already touched $215 early this week & pumped after earnings creating a gap around $225. Hims also had a big week and created a gap around $19.5 so I'll look to buy here. SoFi has also given full satisfaction but might slow down and retest its breakout at $9.

The rest is unchanged and if needed, you can find everything here.

Rapid word on crypto as we've had some volatility and I've bought all wicks. I won't call it "planned" but it was expected and I talked about it last week.

“Heatmap and fundings didn’t change and point north over the medium term; having a retest around $64,000 or even less could shake most out of position but wouldn’t be a worry at all for me.”

It happened and I bought the retest around $65,000 on Bitcoin but also bought Ethereum under $2,400 & Solana at $160. My view on this market hasn't changed, only getting stronger as the ETFs are behaving wonderfully, cumulating $1B of net inflows in a week. Demand for Bitcoin is crazy even above $65,000 and I remain very, very bullish.

I will in the future post these updates in specific posts for you not to miss anything but again, next weeks are going to be very, very busy and I don't want to spam.

NYSE probably wants some daily maintenance window - weird things could happen when processes are not restarted every day!

Alright, fair argument!