Weekly Recap | October - W1

Content & feedback, Hims entering kindergarden & Trizepatide shortage, Tesla's deliveries & FSD, Meta AI & Adobe, Nike's quarter, Alibaba's buybacks, My take on OpenAI.

Content & Feedback.

I have been writing for four months now, and while I'm pretty glad with how things are going and my content, I'd love to have some feedback on what could be improved. If you guys have any suggestions for content, I'm all ears. We're going to enter earnings season soon, so I'll gladly upgrade things before or during if I can. This can be about content directly but also about formats or anything really. Feel free to reach out and give your opinion; it's the only way for me to improve.

I usually share my accumulation prices for the companies I follow the first week of the month, but I'll do things differently from now on with another write-up designed to go through the assets' price action and my plans. I won't send a write-up every time I buy something but you'll have my entire plans frequently updated, so you can assume I'll buy when targets are hit.

About next week, a lot is going on and I already have some write-ups ready to be sent. You can expect the detailed investment case on Transmedics, a commentary on the Tesla event happening on 10/10 and this new write-up about stocks' price actions, plus the next weekly on Sunday.

Last week before earnings kicks in and I am back at writing and sending an article for each company I follow, so content will flow. I still am working on the Ethereum & Amazon investment case which will take some time to be finished, and on a write-up on why & how stablecoins could become a new financing weapon for the U.S. I'm trying something new with broader economic opinions and not only stocks. Again, feedback will be appreciated.

Now we can talk about what happened this week, and there was a lot.

Hims Enters the S&P Small Caps 600 & Tirzepatide Shortage is Ending.

Hims is the reason why I want to update more often on charts & my buying plans, as a lot happened for the stock this week. Even if I shared my fair price last month - a price under which the stock stayed for a long time and gave enough opportunities to accumulate, we had a great opportunity on Thursday.

FDA’s Shortage List & GLP-1.

We know Hims will offer GLP-1 drugs; this was announced a few months ago and is the reason why the market went crazy about the stock. GLP-1 is the new trendy drug. As demand grew, production from Lilly or Novo Nordisk didn't follow, so the FDA added both companies' GLP-1 drugs to their shortage list.

When a drug is on the FDA shortage list, other manufacturers can replicate and sell “copycats”. This ensures that global demand is met, which is more important in the short term than protecting companies' patents. But when the original company can finally produce enough to meet the demand itself, the drugs are removed from the list and other pharmaceutical manufacturers can no longer produce nor sell their "copycats."

This is what happened this week when the FDA announced that Zepbound and Mounjaro, two GLP-1 drugs offered by Lilly, would be removed from this list. This doesn't directly impact Hims & Hers because these drugs are based on a molecule called tirzepatide, while their compounded product uses semaglutide which is also used by Novo’s branded drugs - Ozempic and Wegovy. Those are still on the FDA's shortage list.

When the FDA announced the removal of Lilly's drugs from the shortage list, the market got scared that the same could happen to Novo Nordisk's drugs, potentially forbidding Hims from selling its compounded semaglutide which would mean a significant decrease in sales.

I understand the logic but it misses lots of nuances.

First, as said already, Hims sells both generic & branded products. When Ozempic and Wegovy are removed from the shortage list, Hims will also be able to stock and resell them through their platform.

Second, Hims' advantage over the competition lies in the service they offer to customers, as we've seen in the investment case. Clients who want GLP-1 drugs will certainly prefer to buy through their platform rather than going to a pharmacy or through Novo’s website. It's still easier, faster, and more practical, which is what customers want.

With one problem: Him’s products aren’t refunded by national healthcare programs, which means customers have to pay 100% of the treatment themselves, a very expensive treatment when using branded products as you can see above. Those who can’t afford it will go to resellers where they get be refunded.

This will impact Hims’ sales over the long term but there’s not much which can be done about it an nothing new in their situation.

Third, I'd like to remind everyone that last quarter, GLP-1 were less than 5% of Hims' total revenues and Hims still grew by over 50% YoY. It is an important part of the bull case, but GLP-1 isn't Hims' entire business and the market seems to forget that.

Hims fell more than -15% on Thursday on this news, providing a good opportunity which I know many took, though we had seen better prices during the month. But the stock closed Friday with a great new.

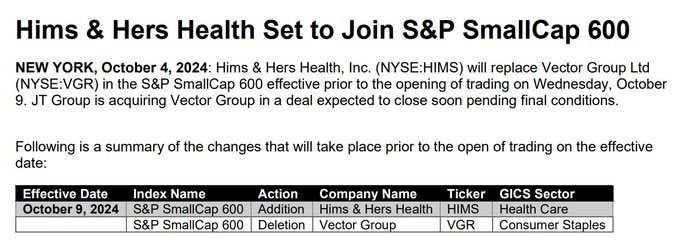

S&P 600 Small Caps.

We’re not talking about the S&P500 here but inclusion this kind of index is a great new for any company.

The modification will happen next week and will bring more liquidity into Hims. This news pumped the stock +5% in after-hours trading on Friday and we can expect an opening on Monday around $19.

Pretty volatile week for hims ranging from $16 to $19ish.

Tesla Deliveries & FSD.

Tesla released its delivery data on Friday which, in my opinion, showed very corrcet numbers with deliveries up +6% YoY. This marks the first quarterly YoY growth for 2024 which is an important signal.

The company also announced a deployment of 6.9 GWh of energy storage, strong YoY growth but flat QoQ. Musk mentioned last quarter that deployment would depend on seasonalities & delays, so no biggy. If anything, it shows a consistent demand for their energy solutions.

There are discussions around the deliveries as most of the growth is expected to come from China, with a much weaker Western market - not surprising givent the interest rates. THings should improve the next months thanks to the stimulus in China and the decreased interest rates in both the E.U and the U.S.

We'll need to wait until the 23rd for more detailed data on the quarter but we also have the Tesla event on October 10th, which needs to be convincing. Big month for Tesla and its future, kind of entering a "do or die" period.

Cybertruck FSD.

On another note, Tesla released this week the Cybertruck FSD. It might seem like a useless new but I think it showsthe quality of the software, how quickly it was adapted to a very different vehicle in terms of structure. There's not much difference between the Model Y & the Model S, but these cars are entirely different from the Cybertruck.

It shows how adaptable the software is and is a pretty important development for potential licensing in the coming years.

Meta AI & Adobe.

I've talked in the Meta investment case about why I believe Meta has more potential to disrupt Google than ChatGPT & co, with its in-app AI tools. But I didn't talk enough about Adobe. Meta publicly released its new AI picture modification tool, which is impressive & comparable to Adobe Firefly.

https://x.com/itsPaulAi/status/1841550882414199243

The case is exactly the same as for Google. The problem isn’t the tool itself because Google's fast queries or Adobe Firefly are better tools than Meta’s AI. The problem comes from Meta’s network effect. For now, most will use Photoshop or Lightroom to edit their pictures before posting them on social media.

But if your social media app can do a comparable job, faster, without much work from you but some text prompt, and for free... Many will use this in-app tool. Meta is becoming a big competition for many tech companies out there because they own their users’ attention. This is underrated.

Nike Q3-24.

I include Nike’s last quarter in this weekly review because it honestly doesn't deserve a separate write-up. The company, and most importantly the brand, is in a lot of trouble lately and things aren't getting better.

Besides offering a terrible overview with double-digit declines in nearly every key metric, there's also a decline in net margin. We’re talking about a sales decline for every product across every geography... even in China, which has been the growth source for most retailers. This speaks volumes about the brand's demand.

There isn't much else to say. A declining stock doesn't automatically is a 'cheap' stock, and currently, Nike is more expensive than... almost ever. I'll continue to monitor the company, especially now it will have a new CEO and some shareholder activism but for now, I wouldn't touch it with a stick. It might become an opportunity but we’re far from there.

Alibaba’s buyback.

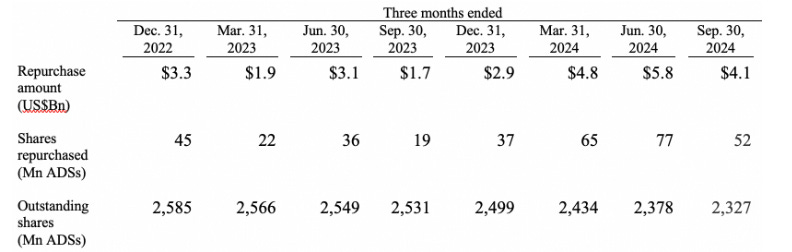

Big topic and a major reason why Alibaba was undervalued a few weeks ago. One aspect of the Chinese stimulus package is designed to facilitate share buybacks. But Alibaba didn't wait for the stimulus to begin its buyback program; they repurchased for $4.1B of shares during the last quarter.

This represents 1.5% of the company at current valuation, acknowledging that they bought most of those shares long before the recent price increase with an average price around $78 according to this data.

And they’re far from done.

OpenAI, again.

It might be the last time I talk about OpenAI because the subject is becoming less & less interesting to me, but I'd like to go over some numbers today, as we've already discussed the management drama.

OpenAI closed another investment round for over $6B, valuing the startup at around $150B. Let's continue with the numbers, as OpenAI apparently reached one million paid users last month for a $20/month subscription each.

Stretching the data and assuming ChatGPT had 1M users for the entire year at $20/month, this means $240M in revenue. I know this is a very rough calculation, but you understand where I'm going with this. We're talking about a company generating a quarter of a billion in revenues, valued at $150B or roughly x625 sales. And I called Palantir overvalued.

And for what? A LLM, while Meta’s Llama probably does more by now, is open source, and can leverage billions of daily users. I'm not here to spit venom but this company is a very big question mark that I can't understand no matter how much I try.

My point here is, is this the heart of the so-called AI bubble, with everyone just throwing cash at them because they have some crazy R&D projects, or is it all just FOMO and wasted money? I guess time will tell, but it's very hard to understand what's happening from the outside.