Weekly Recap | November - W3

CPI & PPI, Trump's staff, Hims & Amazon, Tesla & the EVs subsidy, Earnings & Crypto Update.

Macro.

Inflation Data.

We had both CPI & PPI this week, which came in line with expectations but pretty hot in my opinion if we were to break down the numbers.

Looking at the CPI, the data is dragged down by a strong & continuous decrease in energy prices, which is of course a good thing, but the truth is households are still getting hammered by everything else.

Services continue to get more expensive month-over-month, especially electricity. Most importantly, food, shelter, transportation & healthcare are also impacted by continuous inflation.

Every households’ needs keep getting more & more expensive, so even if the CPI comes around expectations, reality keeps getting harder for most. The PPI shows the exact same story, which isn’t very bullish for the next CPI print.

Markets are very happy lately, but I’m not sure American households, especially the lower-income ones who do not own assets, are feeling the same.

Elon, Vivek & R. F. Kennedy. Jr.

Donald Trump continues to nominate very strong minds at the head of important positions for his government.

Elon & Vivek will indeed be working for the Department of Government Efficiency - yes, the DOGE - to cut government’s “useless” expenses and tear down the walls of regulations which hurt innovation.

As for everything in politics, we have to ponder what is said & what can be done, and even if some smile imagining Elon treating the government like he treated Twitter, he certainly won’t be able to do so.

On another note, let’s keep in mind that “cutting expenses” means firing employees and canceling subsidies, from which tons of private companies live of. Whatever our personal beliefs on the situation, this would be terrible for America if done drastically as we’d have a rocketing unemployment rate. It’s impossible to talk about the outcomes without making lots of assumptions, but it would be terrible for America at large, at least in the short term.

So, again. Let’s see what & how they’ll do things.

The second big topic is Robert F. Kennedy Jr., nominated as The United States Secretary of Health and Human Services (HHS). He has been very vocal for years on how, in his opinion, the FDA & other health institutions have been making billions by ruining Americans’ health on purpose. You can imagine his state of mind now that he has a position of power after having these kinds of words.

The conclusion here is that Donald Trump is letting tornadoes inside of the house; the only question is how loose they will be and how this will impact Americans & America’s economy. Coupled with other of his propositions, America is like a hot pot which could explode at any moment, and there’s no way to know if it will be for the best or for the worst.

It’s a live & watch situation, impossible to predict, but things will be volatile.

Other Markets.

A rapid word on foreign markets & commodities which are almost all tanking since Trump got elected. I believe the narrative is that he is good for the American market & not that good for anything else; hence liquidity is much better in U.S. assets or in the dollar than anywhere else.

As I’ve said last week, I am also very bullish on U.S. equities for the next semester but we’ll have to reevaluate things rapidely depending on how our tornadoes do things. I’m closely watching what gold does and would happily buy a chunk of it if we were to fall a bit more; I’m also watching other markets although for now, high interest rates & a strong dollar is a big weakness for them… until it changes. I’m also starting to dig into the energy sector - including nuclear, but that will take me some weeks at least… Very interesting times & lots to do;

We might take some time to dig into these subjects during the next months, to prepare for what comes after the euphoria on U.S. equities.

Watched Stocks & Portfolio.

Hims & Amazon.

I hope you guys love volatility because holding Hims isn’t an easy drive. The market has focused on GLP-1, selling off on any news coming from Novo or Lilly and is now changing its narrative completely as Amazon announces (again) expanding its offerings of healthcare products.

“Prime members can now quickly and easily treat health, beauty, and lifestyle conditions for as low as $16/month for men’s hair loss, $10/month for anti-aging skin care, and $19/month for ED.”

The narrative is that Amazon's better infrastructure and its Prime member base will lead users to turn to it for convenience instead of going to Hims; hence hurting its business model, stealing its clients & increasing its customer acquisition costs etc… I can understand it but I entirely disagree.

My investment case was based on Hims' simplicity & customization and this was confirmed over these last two quarters with more than half of their clients using a personalized service & more than 60% of last quarter's new subscribers going directly to a personalized service.

This is something Amazon doesn’t offer and didn’t hint at offering anytime soon, and this is Hims’ heart.

My take is just that Amazon is now offering more products than they used to, but they’re nothing more than another online pharmacy; they will capture a few users but I do not believe they are any competition for Hims’ specialised & customized products.

I personally bought more on this dip.

Tesla & the EVs subsidy.

Another complex subject which comes, again, after Donald Trump’s election. For now, Americans might be eligible for a tax reduction if they were to buy an EV, with some criterias - the EV must be assembled in America or buyers must have a gross income under $150,000 etc…

Donald Trump intends to cancel this tax reduction when in power and this of course impacts Tesla and other EV manufacturers. Very hard again to anticipate how things will unfold but here are my two cents from a Tesla shareholder point of view.

This will increase the final price of EVs for many households - those who qualified for the subsidy. Even if it isn’t a direct refund, it still is money that they get to keep for themselves because they bought an EV. This might change the landscape of demand although they also have other advantages so we’ll have to wait & see;

No EV manufacturer is profitable but Tesla; and the end of this subsidy will be a much bigger issue for them than for Tesla. Their prices are usually higher than Tesla’s & still wasn’t enough to reach profitability; with this subsidy gone, demand for their products should slow down even more & have a bigger impact on their financial than for Tesla’s, who has been profitable on each car sold since years now and has other profitable businesses.

This is the bigger narrative as it means fewer competitors long-term for Tesla.

This is a wild take but we can expect a big Q4-24 for Tesla & the EV market at large as many households will probably want to take advantage of the last months where this subsidy exists to finally buy their EV. That’s what I would do if I were hesitating; a $7,500 tax reduction on a $50,000 car makes a big difference. The side effect would be lower deliveries QoQ after this surge in demand.

This doesn’t bode well for Chinese brands because they didn’t qualify for the subsidy either way; and with Trump talking about potential tariffs, I’d assume he won’t make U.S. EVs more expensive without touching Chinese EVs' final price.

As for many things lately, lots of variables. Let’s see how things play out but the bottom line is that it will certainly hurt EVs demand, at least a little bit, meaning less EVs sold by Tesla but also potentially less competition as other manufacturers will struggle.

Earnings.

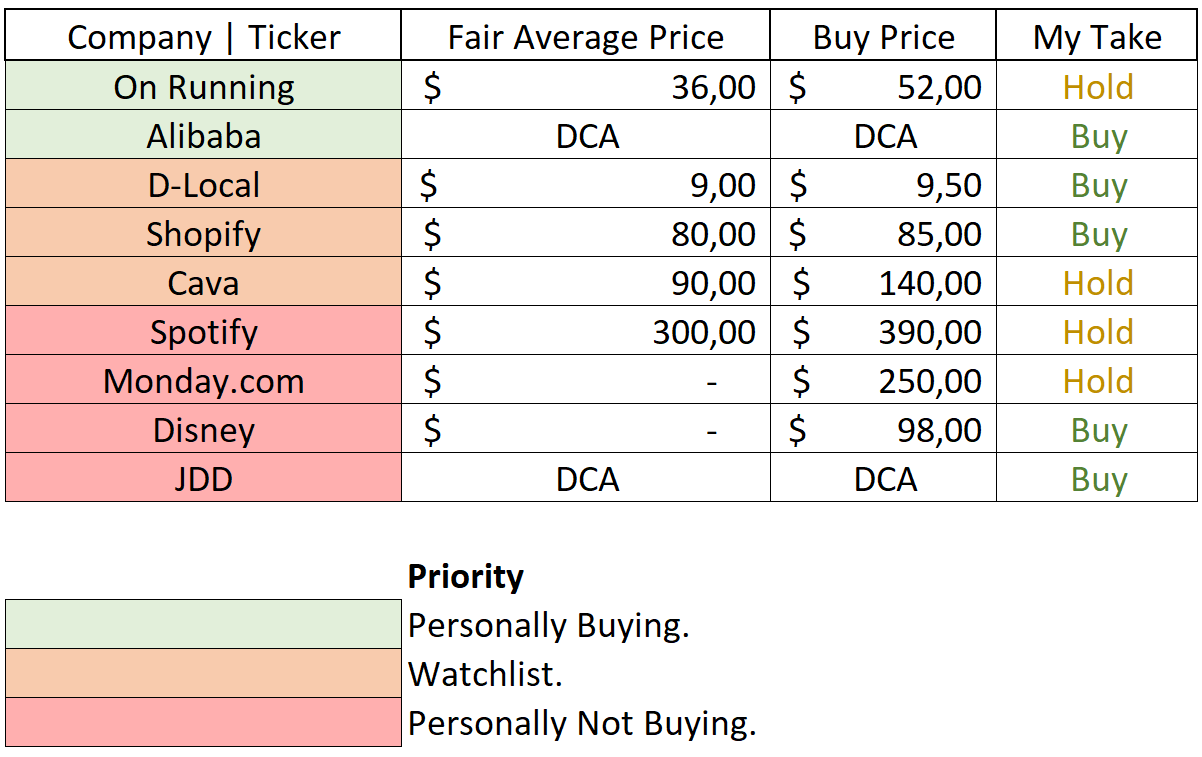

You received yesterday the rest of the earnings I wanted to cover this week; here’s my personal opinion on each with some notes:

On Cava, I wouldn’t give it a buy because the stock is clearly extended and we’ve seen how the market treats small missteps lately with examples like Celsius or Transmedics. The company performs wonders but holding is all I could recommend.

On Disney, there are improvements, and even I have to admit it could potentially be good value for a long-term & not performance-oriented portfolio. Not for me, but there’s surely value there.

On JD, I personally am not buying because I prefer Alibaba & its cloud business which JD.com lacks. I do not want to divide liquidity among many Chinese stocks and would rather concentrate on what I think best.

Lastly, D-Local is a great company but wouldn’t be my number one pick to play Latin America; we’ll probably talk about this later this year when I have time to review & write about energy & commodities.

Crypto Update.

Not much changed since last week except for a continuation of the tendencies I talked about. Both ETFs kept attracting more net inflow despite a pretty quiet week in terms of price action. We need to note that long-term holders are starting to sell a bit of their Bitcoin. This is only a start but the passage from long-term to short-term holders usually indicates a potential top or at least a rotation to riskier assets - which confirms my take from last week.

One indicator was the listing of PEPE on Coinbase which resulted in an +84% increase in 24 hours and funnily enough attracted PEPEBRC with him with a beautiful +98%, confirming that both assets move together like I talked about during a recap a month ago. It gave back most gains but if the frenzy continues, we’ll surely see lots of green.

I am still holding the position; my view of the market remains the same: we’re in for a rotation toward stupidity.

I also shared that I bought SoFi & CLSK calls some weeks ago, I am still holding the first one but have sold 60% of the second one early this week, with some luck in term of timing as it fell the next day.

I’m planning to write another Buying Plan next week to update on my portfolio & its performance and my plans for the next weeks. We’re going to talk more about macro & potential asset rotations/conditions that would lead to it as well during the next months. I’m bullish but I also have some interogations.

I’ll see you then!