Weekly Recap | November - W2

Trump's election & assets to watch, Weekly's earnings & my opinion, Crypto update.

Macro.

Trump in the Ovale Office.

Unsurprisingly, I'll start with what we could expect now that we know who will sit in the highest chair of the U.S. We should expect a lot of change as the Republicans not only won the election, they also won the Senate & the House of Representatives, giving them all the latitude they need to implement their policies.

As you know, markets surged after Donald Trump’s election. The SPY touched the long awaited 6,000 points, Bitcoin followed, flirting with the $80,000 mark at the moment of writing while Gold fell - only 3%, the US10 yield spiked and oil kept very quiet. Everything pointing to growth expectations, at least short term.

Which isn't surprising when we see the Republicans' program, a mix of lower taxes, reduced regulation & re-industrialization, boosting the American local labor market & entrepreneurships while cutting governmental expenses and stabilizing the U.S. debt which is ripping higher each passing day. As to whether they will do what they say & how well they will achieve it, that is another question. For now, the market is very optimistic.

Personally, I am even more bullish on the U.S. stock market now. I am not part of those who call it a bubble or anything close to it. Most stocks aren't cheap but not many stocks are valued above reason and with the FED cutting rates, we might have a confluence of very bullish factors.

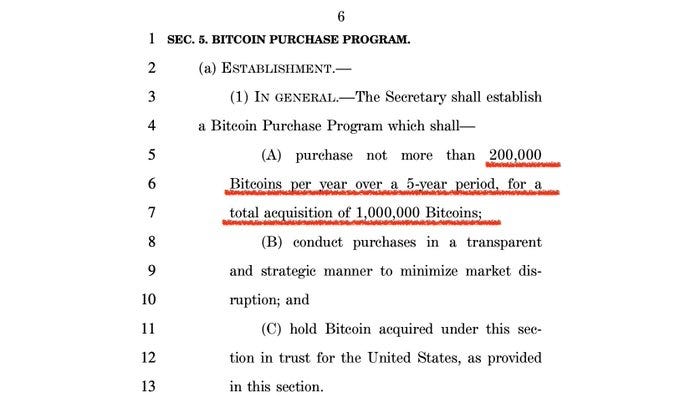

I am even more bullish on Bitcoin & cryptos. For ever for the first one and for at least a few months for the others. Trump is who he is but he's surrounded by individuals who understand the value of the asset & want to capitalize on it before others do. And we already have senators proposing bills to add Bitcoin to the U.S. balance sheet.

I personally believe it is just a matter of time before it happens but even if it were not to, the Republicans will still reduce regulation & very probably fire Gary Gensler from the head of the SEC for, at worst, a crypto neutral. This is where I am the most bullish at least for the next months. We'll reevaluate things later.

This election will also change a lot geopolitically.

Starting with the most important: Energy prices. I believe Trump should be good for the global energy prices. He'll certainly work with Russia & Ukraine to stop that war and maybe re-attract flows of energy to the west. He also was part of the pacification in the Middle-East with the Abraham Accords - which kinda held until a year ago. Hard for me to believe his second mandate will be any different.

I am less bullish on India or LATAM in terms of returns. Those countries will continue to develop wonderfully but as long as the U.S. stock market is attractive, liquidity won't flow to other markets. We'll need to wait a bit longer in my opinion for a rotation to happen.

I remain bullish on China & Alibaba. The country is entirely independent from the dollar & for its energy. I do not believe Trump would hurt China even imposing tariffs on importations. it wouldn't be profitable to the U.S. but more importantly, China's already working on pivoting from being dependent of its exportation to having an internal economy fired up, independently, becoming the hub in the entirety of Asia - more than half of the world population.

I have never been that bearish on Europe. There's not much more to say… There already are lots of noise about a deal with Russia but the first comment I've seen from European politicians could be summed up by "We still won't buy their energy."

Germany is powering its entire electrical grid with coal plants, expensive & pollutive, refuses to use nuclear power while its auto industry is slowly crumbling apart, closing factories & firing workers. The € itself has been crushed after Trump's victory as the U.S. won't babysit those countries anymore - something Europeans will blame on him without any doubts, terrible for a country dependent on importations and with a huge trade deficit - excluding trade between European countries.

This sums up the actual mentality & the wish of self-destruction. Staying far away from any investment linked or dependent on this region.

For the next 6 to 12 months? Long crypto. Long U.S. stocks. Keeping an eye on Latam, China & India. Staying away from Europe.

Watched Stocks & Portfolio.

Earnings.

We're closing a new intense week of earnings, here's my take on the stocks covered, in detail or not, as I'd assume you didn't go through all the write-ups - was a lot of them… Less spamming from now on - until next year.

A few words on Palantir. It's entirely fair to raise its average price as the company is accelerating growth and even if FY-24 is guided around 26% YoY, it will certainly be another story for FY-25, probably above or much closer to 30% & accelerating. We can't be sure of anything, but this is what the tendency shows.

About Celsius, as I said in the report, there is a case to completely ignore the ticker and move on with better names. I detailed the investment thesis in the review but it still has a speculative part to it. I'm personally in.

Those are the only additions I'd make. The rest is detailed in the reviews.

Crypto.

We've all seen the pretty violent reactions after the election of Donald Trump, reaction which comes as no surprise. I hope you, or most of you are on the train and bought the wicks I talked about some weeks ago.

I'm not part of those who believe "the Bull run is just starting" far from it, I believe it's closer to an end than its beginning - in term of time. Bitcoin might be different but it'll go through another bubble cycle and with it all the cryptos, like it did, like it will again. The only difference is how violent those bubbles pump & burst are. I’d love to be wrong on this and I’ll try my best to ride as long as I can. But I’d rather be cautious than trapped in a bear market.

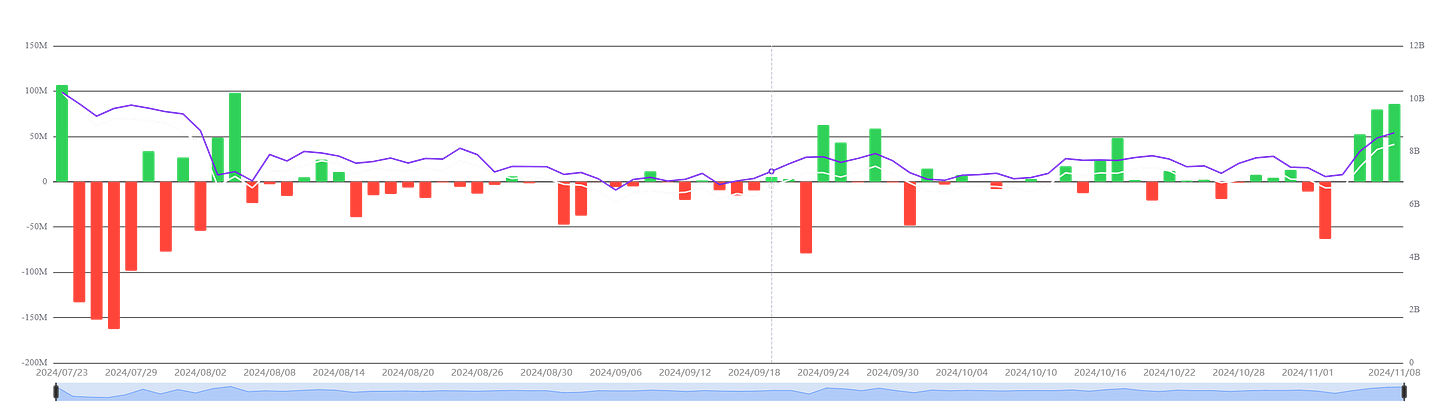

We've seen the highest net inflow in Bitcoin's ETFs on Thursday with more than $1B and I believe it will continue next week. Most importantly, we've seen three days of net inflow on the Ethereum's ETFs and I would bet that this is where the action will come from now on.

FOMO will kick in & attract retail - which has been completely absent up to now. Retail won't focus on quality assets which are up hundreds of percent now, and will certainly pour their money into the next Bitcoin, the next Ethereum and other shitcoins/memecoins…

This is when the folly starts. And I'm entirely focused on extracting the most I can from this but most importantly, on being out before the music stops - and it will, this time is not different. But we're not there yet and I’ll and share transparently when I'm out, why & what I plan to do.

Great times ahead folks.