Weekly Recap | November - W1

China again, precisions on Transmedics' earnings & plan, Hims & GLP-1 again, MicroStrategy & Bitcoin, Lululemon's new data, Olo Pay, weekly earnings, Visa & Mastercard results, ADM vs Nvidia.

Macro.

China’s Stimulus.

The rumors continue to flow in concerning China's stimuli on how, when & how much. The latest news from Reuters, in which they talk about some of their sources, mentions “10 trillion yuan ($1.4 trillion) in extra debt in the next few years”.

It's still a wait & see situation but I stand by my original take: better assume this will happen as it certainly will over the next months and should boost internal value creation & consumption, hence China's market. This announce wouldn’t be enough to satisfy western speculators but it is only the beginning and over the long term, it would be more than enough.

I have write-ups almost ready on this but I will send them only after earnings season peak, there's no rush. I still believe it's better to have an exposure to China's market, be it through Chinese companies, China-exposed ones or index, than not.

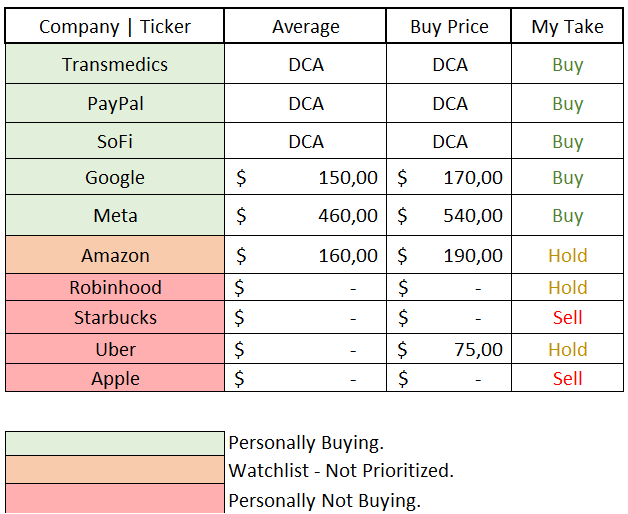

Watched Stocks & Portfolio.

Transmedics Earnings.

I've already commented on TransMedics earnings & seeing the statistics of both the IC & the review, I'd say many here are interested by the stock. So I'll add some information that I found after writing the review & add some info.

Starting with my over-enthusiastic tone & bullishness which I should temper. I've shared my way of investing in a dedicated post and I wrote that I do not excessively buy downtrends, I slowly accumulate & wait for a better price action to buy more aggressively. I also wrote this on my Buying Plan shared in early October.

“The stock has been behaving very well, and I would be surprised to see this bottom lost without any black swan or very bad fundamental news. I'm starting to accumulate slowly at current price but I wouldn’t be shaken out if the stock were to fall to $100 or less as long as fundamentals are intact.”

As I said, I wasn’t shaken out when it happened.

I held my shares bought at $140 & bought more at $88. This kind of price action will certainly take weeks to reverse and it could go much lower as most are worried about the fundamentals. The $90 was a retest zone, we still have a support around $70 and another around $50... There's no saying we won't go there - nor that we will. But prudence is better in this situation.

I am aware that I say nothing in saying this, but I just want to be a bit clearer: the opportunity is great, the opportunity cost isn't. I am building the position but I won't tie up too much liquidity until the market shows me that it wants to go up. Could be next month, could be next year.

Now, about what worries the market and that I personally didn't realize because I do not agree with it. To repeat myself & management's words.

“We did not see any degradation of our market share.”

Analysts & investors expected TransMedics to gain market share even with lower need for transplant & a lower growth, not only stabilize them. The data I could get seemed like the global market share in terms of total transplants was stable but the company seems to win shares in both heart & liver transplants while losing shares in lungs. This was done by comparing revenues per organ with volume of transplants in the U.S. so again, rough comparison. This is a good deal in my opinion as lungs isn't a big part of their business - less than 5% of total revenues, while liver is most of it.

Altogether, I see this situation as a net positive in terms of fundamentals & narrative, hence accumulating the stock. But the market doesn't like the name and we only make money when it does, so there is no point putting all our chips on TransMedics today. Time will come, but we gotta be patient.

Hims & Hers.

GLP-1 still is the main narrative around the stock lately, for two reasons.

Firstly, Ozempic & Wegovy - semaglutide branded products sold by Novo Nordisk, are getting more & more available which might mean that it will get out of the FDA shortage list soon enough. This is speculation but if it were to arrive, it would obviously hurt Hims' potential growth.

Secondly, Lilly's revenues were posted this week, showed a slower growth than expected from their own GLP-1 drugs, blamed on the lack of inventory - which would make sense as the shortage finished just a month ago, not early enough to impact the quarter.

Things are happening and we’ll have answers Monday with Hims' earnings. A rough take would be that they will post a great quarter GLP-1 wise and a potential good guidance as they either way will have a few months of freedom even after the FDA takes semaglutide out of the shortage list.

MicroStrategy, Bitcoin & the Crypto Market.

I am writing about this because what Saylor is doing will stay in the history of financial decisions - even if it doesn't work, as it certainly is one of the most interesting macro decisions I've seen in years. And it deserves a proper write-up to be understood - to come after earning season.

As of today, the new is simple: A $42B leverage to acquire Bitcoin over the next three years with half of it effective already - there are three more 0s but I assume this is a wink to Bitcoin's supply. Assuming a Bitcoin trading at $70,000, this would imply buying 583,333 Bitcoin during three years while the yearly production is roughly around 164,250 per year, or 492,750 for the period. Michael Saylor is telling us that he plans to buy the entire Bitcoin production during the next three years.

As long as Bitcoin trades under $85,000, MicroStrategy will be buying 100% of the new Bitcoins emitted during the next three years, which means the market would have to deal with what's left. Thing is, the rest of the market is pretty big now… And that is confirmed every day with the ETFs inflows now cumulating more than $24B of net inflows since inception.

And many believe - I included, that it will continue growing over the next years as Tesla has always been interested in Bitcoin, Microsoft is voting to add some to its balance sheet and countries like El Salvador or Bhutan have mining installations and certainly won't sell their production…

Spot buying pressure is only starting.

Lululemon’s Strong.

We've had very good weeks lately on Lululemon and we can probably confirm the stock has bottomed. Friday's strength came from a consumer report from YipiData talking about a YoY sales acceleration in the U.S., which was the weak point for the company, and a constant sales growth QoQ in China.

Olo & Olo Pay.

I already talked about Olo Pay and called it the inflection point for Olo to scale & accelerate growth, especially after deploying card-present systems as this will give them a view on 100% of transactions.

We now they partnered with different providers but they finally deployed the infrastructure with Qu-Pos. This is only the start but it is an important milestone for Olo & the entire investment thesis. A good step forward which now has to yield results and should do so rapidly, as soon as early 2025.

Weekly Earnings.

We closed a very busy week and here's my take on the companies' stocks I've covered.

As usual, it only is my opinion and I am aware that there is a case to make to buy some, especially Starbucks with a new management capable of redressing a sinking ship. It just is too early to my opinion.

Other Subjects.

AMD, Nvidia & the Computing Power Industry.

We had AMD's results this week which I do not cover but those who do & the market were not happy with the data… Many commented that it was another quarter proving that AMD can’t compete with Nvidia, there is no other Nvidia.

We've also seen it during the earnings this week with all tech companies talking about their H100s infrastructures and their wish to buy more, not only more GPUs, more of Nvidia's products. The difference came in how much as Tesla & Meta seem to continue their spending or to grow them while Google is slowing down… We've also seen a potential slowdown with ASML while TSM still is ramping. Some contradictions here... but I believe that it is just a bump in ASML's trajectory and that we're not done with the computing power hardware growth.

On another note, it was announced Friday that Nvidia was set to join the Dow Jones instead of Intel.

Visa & Mastercard.

Two of the best businesses in the world, which I do not own but follow to have an idea of the consumer's health. And well… Both companies seem to show a very healthy consumer, with growing local & cross-border volume.

Economy seems to remain strong for now!